Global Hospital Operating Room Or Products And Solutions Market

Market Size in USD Billion

CAGR :

%

USD

52.96 Billion

USD

86.86 Billion

2025

2033

USD

52.96 Billion

USD

86.86 Billion

2025

2033

| 2026 –2033 | |

| USD 52.96 Billion | |

| USD 86.86 Billion | |

|

|

|

|

Hospital Operating Room (OR) Products and Solutions Market Size

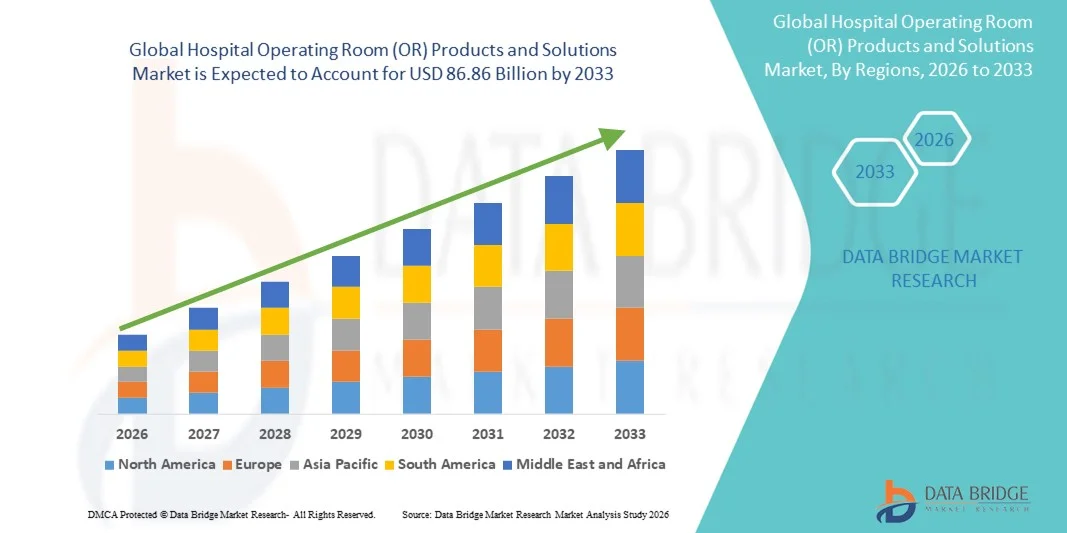

- The global hospital operating room (OR) products and solutions market size was valued at USD 52.96 billion in 2025 and is expected to reach USD 86.86 billion by 2033, at a CAGR of 6.38% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced surgical technologies and automation in hospital operating rooms, driving improvements in patient safety, workflow efficiency, and surgical precision

- Furthermore, rising demand for minimally invasive procedures, enhanced surgical outcomes, and integrated operating room solutions is accelerating the uptake of hospital operating room (OR) products and solutions, thereby significantly boosting the industry's growth

Hospital Operating Room (OR) Products and Solutions Market Analysis

- The hospital operating room (OR) Products and Solutions market, offering advanced surgical technologies, integrated operating room solutions, and automation systems, is increasingly vital for improving surgical precision, patient safety, and workflow efficiency in hospitals and specialty surgical centers

- The escalating demand for hospital OR products and solutions is primarily fueled by the growing adoption of digital surgical tools, increasing hospital modernization initiatives, and a rising preference for integrated, technology-driven operating room environments

- North America dominated the hospital operating room (OR) products and solutions market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of surgical innovations, and the presence of leading OR equipment manufacturers, with the U.S. experiencing substantial growth in installations of imaging systems, surgical tables, and integrated OR platforms

- Asia-Pacific is expected to be the fastest-growing region in the hospital operating room (OR) products and solutions market during the forecast period, registering a CAGR of 25%, driven by rapid hospital modernization, increasing healthcare expenditure, and growing adoption of minimally invasive and technologically advanced surgical procedures

- The surgical equipment segment dominated the largest market revenue share of 28.4% in 2025, driven by its critical role in a wide range of surgical procedures

Report Scope and Hospital Operating Room (OR) Products and Solutions Market Segmentation

|

Attributes |

Hospital Operating Room (OR) Products and Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hospital Operating Room (OR) Products and Solutions Market Trends

Rising Adoption of Advanced OR Equipment and Integration with Digital Systems

- A significant and accelerating trend in the global hospital operating room (OR) products and solutions market is the growing adoption of advanced OR equipment and its integration with digital healthcare management systems. Hospitals are increasingly investing in connected devices, surgical instruments, and OR solutions that enhance workflow efficiency, reduce surgical errors, and improve patient outcomes

- For instance, in March 2024, Stryker Corporation launched its integrated OR solution combining imaging, navigation, and surgical equipment to provide real-time data and enhanced procedural accuracy. This integration is driving operational efficiency and patient safety in modern hospitals

- The trend is fueled by hospitals’ desire for centralized management of OR resources, real-time monitoring of surgical procedures, and integration with electronic medical records (EMR) systems. Advanced OR products now enable automated scheduling, inventory management, and improved interdepartmental communication

- In addition, hospitals are adopting minimally invasive surgical tools, robotic-assisted devices, and high-precision imaging systems, which streamline procedures and reduce patient recovery time. This movement toward digitally connected ORs is transforming hospital infrastructure and elevating expectations for surgical care quality

- The demand for multifunctional and interoperable OR solutions is increasing across both public and private healthcare sectors, creating opportunities for product innovation and expansion of service offerings

Hospital Operating Room (OR) Products and Solutions Market Dynamics

Driver

Growing Need for Enhanced Surgical Efficiency and Patient Safety

- The increasing demand for safer, faster, and more efficient surgical procedures is a key driver for the Hospital OR Products and Solutions market. Hospitals are focusing on reducing procedure times, minimizing complications, and improving postoperative recovery outcomes

- For instance, in February 2025, Medtronic unveiled its next-generation surgical navigation platform designed to enhance precision in neurosurgery and orthopedic procedures. Such innovations provide hospitals with advanced tools to improve procedural accuracy and patient care quality

- Healthcare providers are also prioritizing investments in solutions that reduce human error, optimize surgical workflows, and enhance overall OR efficiency

- The adoption of integrated OR systems is further supported by government initiatives and healthcare accreditation standards that emphasize patient safety, operational efficiency, and quality control in surgical environments

- Hospitals and surgical centers are increasingly implementing digital monitoring, automated instrument tracking, and data-driven performance analytics to enhance surgical outcomes and meet regulatory requirements

Restraint/Challenge

High Capital Expenditure and Maintenance Complexity

- The relatively high cost of advanced OR products and the complexity of installation and maintenance pose challenges for broader adoption, particularly in budget-constrained hospitals or in developing regions. Sophisticated surgical equipment often requires specialized staff training and ongoing technical support

- For instance, the integration of robotic-assisted surgical systems and advanced imaging devices requires not only a significant upfront investment but also routine calibration, software updates, and dedicated technical teams for effective utilization

- Smaller healthcare facilities and clinics may face difficulties in justifying the investment in high-end OR products due to limited procedural volume and budget constraints

- Operational disruptions during installation or maintenance of advanced OR systems can also impact hospital efficiency and patient scheduling, creating additional barriers

- Overcoming these challenges involves strategic planning, flexible financing options, partnerships with technology providers, and training programs to ensure healthcare personnel can fully utilize the potential of advanced OR products

Hospital Operating Room (OR) Products and Solutions Market Scope

The market is segmented on the basis of product type and end-users.

- By Product Type

On the basis of product type, the Hospital Operating Room (OR) Products and Solutions market is segmented into anesthesia and respiratory devices, anesthesia systems, patient warmers, ventilators, patient monitoring, surgical imaging displays, movable imaging displays, vital signs monitoring devices, surgical equipment, electrical surgical units, handheld surgical instruments, operating tables, operating room lights, surgical booms, microscopes, endoscopes, operating room integration systems, and others. The surgical equipment segment dominated the largest market revenue share of 28.4% in 2025, driven by its critical role in a wide range of surgical procedures. Hospitals and surgical centers prioritize surgical instruments such as scalpels, forceps, and retractors for precision and procedural safety. The segment’s demand is further supported by technological advancements in ergonomics, sterilization, and multifunctionality. Continuous replacement cycles and upgrades of surgical kits in hospitals also reinforce the segment’s strong revenue generation. The presence of numerous manufacturers offering high-quality, standardized instruments adds to the market stability. Training programs in hospitals emphasize proper use of advanced surgical equipment, boosting adoption. Ongoing investments in OR modernization across developed and developing regions contribute to sustained dominance. The segment’s integration with other OR systems enhances workflow efficiency and patient outcomes.

The anesthesia and respiratory devices segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, driven by rising surgical volumes, increased ICU procedures, and pandemic-related awareness for respiratory care. Hospitals and ambulatory centers are increasingly investing in modern anesthesia machines, ventilators, and respiratory support devices to ensure patient safety. Integration of smart monitoring, automated delivery, and data logging features makes these devices highly desirable. Growing demand for minimally invasive surgeries also emphasizes precise anesthesia management. Technological upgrades in ventilators, including portability and efficiency, accelerate adoption. The rising geriatric population and chronic respiratory conditions further fuel market expansion. Hospital procurement policies increasingly prioritize devices that improve patient outcomes and reduce procedural risks. Increasing awareness of patient safety standards mandates updated anesthesia and respiratory equipment. Regional expansions and government healthcare programs enhance market penetration. Continuous innovation by leading medical device manufacturers contributes to the rapid growth of this segment.

- By End-Users

On the basis of end-users, the Hospital Operating Room (OR) Products and Solutions market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment accounted for the largest market revenue share of 65.1% in 2025, driven by the high volume of surgeries, availability of funds for advanced OR equipment, and the focus on comprehensive surgical care. Hospitals invest in integrated OR solutions, including surgical equipment, monitoring devices, and imaging systems, to improve workflow efficiency. Large hospitals maintain dedicated surgical teams and specialized ORs, increasing demand for high-quality products. The segment benefits from ongoing training, standardization of equipment, and adoption of advanced technologies. Hospitals in developed regions continue to modernize ORs to maintain competitive healthcare standards. Public and private hospital expansions in developing regions contribute to sustained dominance. Regulatory requirements also ensure hospitals consistently update their OR assets. The growing number of surgical procedures annually supports market stability. Maintenance and servicing contracts with manufacturers further strengthen adoption in hospitals.

The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 14.3% from 2026 to 2033, fueled by the rise of outpatient surgeries, shorter hospital stays, and demand for cost-efficient surgical services. These centers are increasingly equipping ORs with compact, high-performance devices to enhance patient throughput. Advancements in portable surgical and monitoring equipment favor faster adoption. The trend toward minimally invasive procedures in ambulatory settings drives demand for specialized OR products. Ambulatory centers focus on efficiency and patient turnaround, supporting higher investments in essential OR equipment. Rising awareness of outpatient surgery benefits among patients boosts market growth. Technological integration, including digital monitoring and data management, makes adoption more attractive. Expansion of ambulatory surgical networks in urban and semi-urban regions enhances market penetration. Flexible financing and leasing options for equipment further encourage faster adoption.

Hospital Operating Room (OR) Products and Solutions Market Regional Analysis

- North America dominated the hospital operating room (OR) products and solutions market with the largest revenue share of 42.5% in 2025

- Characterized by advanced healthcare infrastructure, high adoption of surgical innovations

- The presence of leading OR equipment manufacturers, with the U.S. experiencing substantial growth in installations of imaging systems, surgical tables, and integrated OR platforms

U.S. Hospital Operating Room (OR) Products and Solutions Market Insight

The U.S. hospital operating room (OR) products and solutions market captured the largest revenue share in 2025 within North America, fueled by the increasing modernization of hospitals, adoption of technologically advanced surgical devices, and growing investment in integrated OR platforms. Hospitals are prioritizing improvements in surgical workflow efficiency, patient monitoring, and operating room safety, which are driving market expansion.

Europe Hospital Operating Room (OR) Products and Solutions Market Insight

The Europe hospital operating room (OR) products and solutions market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government initiatives to modernize healthcare infrastructure and the increasing demand for advanced surgical equipment. Hospitals and surgical centers are adopting OR integration systems, imaging displays, and minimally invasive surgical devices, contributing to regional growth.

U.K. Hospital Operating Room (OR) Products and Solutions Market Insight

The U.K. hospital operating room (OR) products and solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in healthcare facilities, increasing demand for technologically advanced surgical devices, and a focus on patient safety and efficiency in operating rooms.

Germany Hospital Operating Room (OR) Products and Solutions Market Insight

The Germany hospital operating room (OR) products and solutions market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of modern surgical technologies, well-developed hospital infrastructure, and a strong emphasis on innovation and efficiency in operating room operations.

Asia-Pacific Hospital Operating Room (OR) Products and Solutions Market Insight

The Asia-Pacific hospital operating room (OR) products and solutions market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by rapid hospital modernization, increasing healthcare expenditure, and the growing adoption of minimally invasive and technologically advanced surgical procedures.

Japan Hospital Operating Room (OR) Products and Solutions Market Insight

The Japan hospital operating room (OR) products and solutions market is gaining momentum due to the country’s high-tech healthcare ecosystem, rapid hospital modernization, and growing emphasis on efficient and safe surgical procedures. The adoption of advanced surgical imaging systems, operating room integration platforms, and monitoring devices is driving growth.

China Hospital Operating Room (OR) Products and Solutions Market Insight

The China hospital operating room (OR) products and solutions market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid hospital expansion, government support for healthcare infrastructure, high adoption of technologically advanced surgical devices, and strong domestic manufacturing capabilities for OR products.

Hospital Operating Room (OR) Products and Solutions Market Share

The Hospital Operating Room (OR) Products and Solutions industry is primarily led by well-established companies, including:

• Stryker (U.S.)

• Medtronic (Ireland)

• Terumo Corporation (Japan)

• GE Healthcare (U.S.)

• Siemens Healthineers (Germany)

• Baxter International (U.S.)

• Hill-Rom Holdings (U.S.)

• Drägerwerk (Germany)

• Olympus Corporation (Japan)

• Zimmer Biomet Holdings (U.S.)

• Cardinal Health (U.S.)

• Mindray Medical International (China)

• NuVasive (U.S.)

• ConMed Corporation (U.S.)

• Maquet (Germany)

Latest Developments in Global Hospital Operating Room (OR) Products and Solutions Market

- In July 2021, Fujifilm Holdings Corporation unveiled its “Virtual Hospital” platform, an interactive digital OR and hospital environment showcasing its full portfolio of diagnostic, treatment, and surgical solutions — facilitating the adoption of OR‑digital integration

- In February 2022, Getinge AB launched its new modular room system “IN2” to help hospitals create interconnected, sustainable, and efficient operating room environments — the system enables customizable OR layouts and integrated infrastructure solutions

- In March 2023, LeanTaaS introduced its “Perioperative Transformation-as-a-Service (TaaS)” offering, which uses AI and workflow automation to optimize surgical case volume, resource scheduling, and OR efficiency across hospital networks

- In April 2025, Drägerwerk AG & Co. KGaA launched its Atlan A100 anaesthesia workstation, aimed at modernising the anaesthesia delivery environment in the OR with advanced user interface, ventilation support and connectivity features for enhanced procedural control

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.