Global Hosted Pbx Market

Market Size in USD Billion

CAGR :

%

USD

8.38 Billion

USD

23.58 Billion

2024

2032

USD

8.38 Billion

USD

23.58 Billion

2024

2032

| 2025 –2032 | |

| USD 8.38 Billion | |

| USD 23.58 Billion | |

|

|

|

|

What is the Global Hosted Private Branch Exchange (PBX) Market Size and Growth Rate?

- The global hosted private branch exchange (PBX) market size was valued at USD 8.38 billion in 2024 and is expected to reach USD 23.58 billion by 2032, at a CAGR of 13.08% during the forecast period

- High requirement for mobility of enterprises and rise in the levels of utilisation for cloud and unified communication services are the major factors that will influence the market growth rate. Furthermore, growing focus on the requirement for upgradation from conventional mode of PBX to cloud based mode, low cost involved with deployment and installation are the factors that will accelerate growth of the hosted private branch exchange (PBX) market

What are the Major Takeaways of Hosted Private Branch Exchange (PBX) Market?

- Innovations and advancement of technologies associated with the infrastructure and components of PBX will boost the beneficial opportunities for the hosted private branch exchange (PBX) market growth

- However, concern about the privacy of data and security with hosted private branch exchange (PBX) services are the factors that will hamper the hosted private branch exchange (PBX) market growth

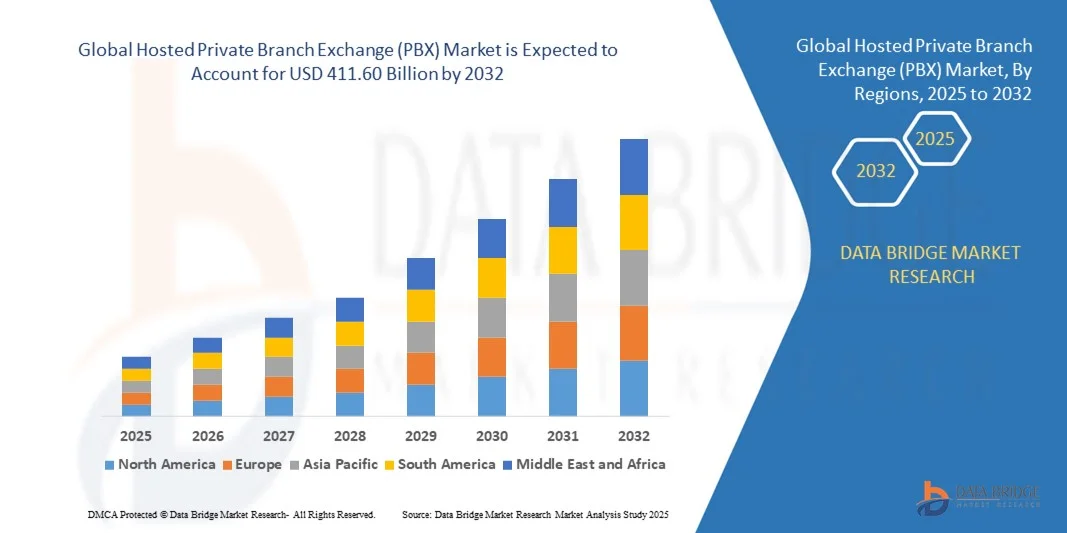

- North America dominated the hosted PBX market with the largest revenue share of 41.05% in 2024, driven by growing demand for business communication solutions, cloud adoption, and increased awareness of unified communication systems

- The Asia-Pacific (APAC) Hosted PBX market is poised to grow at the fastest CAGR of 10.08% from 2025 to 2032, driven by rising urbanization, increasing digital literacy, and rapid adoption of cloud and IoT technologies in countries such as China, Japan, and India

- The solution segment dominated the market with a market share of 61.4% in 2024, driven by the increasing deployment of cloud-based PBX platforms, unified communications solutions, and integrated collaboration tools

Report Scope and Hosted Private Branch Exchange (PBX) Market Segmentation

|

Attributes |

Hosted Private Branch Exchange (PBX) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hosted Private Branch Exchange (PBX) Market?

Cloud-Native and Unified Communications Integration

- A major trend in the Hosted PBX market is the adoption of cloud-native solutions that integrate seamlessly with unified communications platforms, enabling businesses to manage voice, video, and messaging from a single interface. This enhances operational efficiency and collaboration

- For instance, RingCentral’s cloud PBX solution integrates with Microsoft Teams, Zoom, and Slack, allowing users to make calls, schedule meetings, and access messages without switching platforms

- Cloud-native Hosted PBXs also enable advanced features such as AI-powered call routing, voicemail transcription, and analytics dashboards, improving business productivity and customer experience

- Integration with collaboration tools allows centralized management of workflows, reducing IT overhead and improving scalability for businesses of all sizes

- Companies such as 8x8 and Nextiva are enhancing their PBX offerings with cloud-first designs, mobile app capabilities, and omnichannel communication support, reshaping expectations for business communication systems

- The growing preference for scalable, cloud-based, and fully integrated communication solutions is accelerating adoption across small, medium, and enterprise-level organizations globally

What are the Key Drivers of Hosted Private Branch Exchange (PBX) Market?

- The increasing shift toward remote work and hybrid office models is driving demand for Hosted PBX solutions that enable employees to stay connected from any location

- For instance, in March 2025, 8x8 launched its cloud PBX solution optimized for hybrid teams, supporting mobile and desktop applications with real-time analytics, fueling adoption

- Businesses seek cost-effective alternatives to traditional on-premise PBX systems, as hosted solutions reduce maintenance, hardware, and upgrade costs while offering flexible subscription plans

- The need for unified communication solutions that integrate voice, video, and messaging platforms is encouraging enterprises to adopt Hosted PBX systems for improved collaboration and workflow efficiency

- Advanced features such as AI-driven call routing, automated voicemail transcription, and analytics reporting are attracting organizations seeking to enhance customer experience and operational insights

Which Factor is Challenging the Growth of the Hosted Private Branch Exchange (PBX) Market?

- Security and privacy concerns remain a key challenge, as Hosted PBX systems rely on cloud networks, making them susceptible to hacking, data breaches, and unauthorized access

- For instance, vulnerabilities in VoIP systems reported in late 2024 made some businesses cautious about migrating sensitive communications to cloud-based PBX solutions

- Addressing these risks requires robust encryption, secure authentication, and regular system updates; companies such as RingCentral and Mitel emphasize these measures to build user trust

- The relatively high cost of advanced cloud PBX systems for small businesses, particularly those with limited IT budgets, can slow adoption despite long-term savings compared to on-premise systems

- Integration complexity with existing IT infrastructure and legacy telephony systems may also impede deployment, requiring technical expertise and additional resources to ensure smooth migration

How is the Hosted Private Branch Exchange (PBX) Market Segmented?

The market is segmented on the basis of component, organisation size, service category and vertical.

- By Component

The Hosted PBX market is segmented into solution and services. The solution segment dominated the market with a market share of 61.4% in 2024, driven by the increasing deployment of cloud-based PBX platforms, unified communications solutions, and integrated collaboration tools. Businesses prefer complete solutions that combine hardware, software, and cloud connectivity to enhance productivity and reduce infrastructure complexity. Solutions often include VoIP telephony, AI-enabled call management, and mobile applications that enable seamless communication across teams.

The services segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, propelled by rising demand for managed services, installation support, and maintenance contracts. Organizations are increasingly outsourcing PBX management to service providers to reduce operational overhead and ensure optimal performance. The trend reflects a shift toward service-driven adoption, especially among SMEs and enterprises seeking reliable, low-maintenance communication systems.

- By Organization Size

On the basis of organization size, the Hosted PBX market is segmented into SMEs and large enterprises. The large enterprise segment dominated the market in 2024 with a market share of 58.7%, due to the need for advanced communication capabilities, multi-location integration, and centralized control. Enterprises prefer hosted PBX solutions that support complex workflows, extensive call handling, and unified communication platforms.

The SME segment is projected to witness the fastest growth rate of 22.1% from 2025 to 2032, fueled by the increasing adoption of cloud-based PBX systems as cost-effective alternatives to on-premise setups. SMEs benefit from scalable, subscription-based solutions that require minimal IT resources and provide enhanced communication, collaboration, and mobility for small teams.

- By Service Category

The market is categorized into network services, managed services, security services, unified communications cloud, and IT services. The unified communications cloud segment led the market in 2024 with a market share of 45.6%, driven by the demand for integrated communication platforms that combine voice, video, and messaging across cloud infrastructures. This segment allows businesses to streamline workflows, reduce hardware dependencies, and improve collaboration efficiency.

The managed services segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, as organizations increasingly rely on service providers to handle installation, configuration, monitoring, and maintenance of hosted PBX solutions. Growth is particularly strong in sectors where IT expertise is limited, and reliable service support is critical for uninterrupted communication operations.

- By Vertical

The Hosted PBX market is segmented by verticals including IT, BFSI, healthcare, manufacturing, retail, government and public sector, real estate, professional services, education, and others. The IT vertical dominated the market in 2024 with a market share of 32.8%, reflecting early adoption of cloud-based PBX platforms, high IT infrastructure availability, and emphasis on seamless collaboration.

The BFSI vertical is projected to register the fastest CAGR of 23.2% from 2025 to 2032, driven by the need for secure, reliable, and highly scalable communication systems to manage customer interactions, multi-branch connectivity, and regulatory compliance. Other sectors, including healthcare and education, are also increasingly adopting hosted PBX solutions to improve communication efficiency, reduce costs, and integrate with other enterprise applications.

Which Region Holds the Largest Share of the Hosted Private Branch Exchange (PBX) Market?

- North America dominated the hosted PBX market with the largest revenue share of 41.05% in 2024, driven by growing demand for business communication solutions, cloud adoption, and increased awareness of unified communication systems

- Businesses in the region highly value the scalability, reliability, and integration capabilities of Hosted PBX solutions, enabling seamless voice, video, and messaging services across multiple locations

- Widespread adoption is supported by high technological literacy, robust IT infrastructure, and the preference for remote work-friendly communication systems, establishing Hosted PBX as a preferred solution for enterprises of all sizes

U.S. Hosted Private Branch Exchange (PBX) Market Insight

The U.S. Hosted PBX market captured the largest revenue share of 75% in 2024 within North America, fueled by rapid cloud migration, enterprise mobility adoption, and increasing reliance on unified communications platforms. Organizations are increasingly prioritizing cost-efficient, scalable, and flexible communication solutions that enable remote teams and multi-office coordination. The rising integration of Hosted PBX with AI-powered call routing, analytics, and CRM systems is further driving market expansion, making the U.S. a dominant region in global Hosted PBX adoption.

Europe Hosted Private Branch Exchange (PBX) Market Insight

The Europe Hosted PBX market is projected to grow at a substantial CAGR over the forecast period, driven by strict regulatory compliance, data security standards, and the need for advanced business communication solutions. Increased urbanization and digital transformation initiatives across countries such as Germany, France, and Spain are fostering Hosted PBX adoption in both commercial and residential sectors European businesses are attracted to Hosted PBX for its cost-efficiency, remote management capabilities, and integration with cloud-based productivity tools, leading to growing adoption in offices, co-working spaces, and multi-tenant facilities.

U.K. Hosted Private Branch Exchange (PBX) Market Insight

The U.K. Hosted PBX market is expected to grow at a noteworthy CAGR, fueled by the rising demand for smart office communication solutions and remote collaboration platforms. Enterprises and SMEs are increasingly leveraging Hosted PBX systems for secure, scalable, and feature-rich communication, including VoIP, video conferencing, and AI-enabled call analytics. The country’s robust digital infrastructure, coupled with strong e-commerce and tech-driven services, is further accelerating Hosted PBX deployment across commercial and institutional applications.

Germany Hosted Private Branch Exchange (PBX) Market Insight

The Germany Hosted PBX market is projected to expand steadily during the forecast period, driven by growing enterprise adoption, regulatory support for digital communication, and demand for secure, eco-conscious solutions. The integration of Hosted PBX with cloud-based collaboration tools and enterprise IT systems enhances workflow efficiency and scalability for businesses. Germany’s emphasis on innovation, privacy, and technology adoption ensures strong uptake across both corporate offices and multi-residential buildings.

Which Region is the Fastest Growing in the Hosted Private Branch Exchange (PBX) Market?

The Asia-Pacific (APAC) Hosted PBX market is poised to grow at the fastest CAGR of 10.08% from 2025 to 2032, driven by rising urbanization, increasing digital literacy, and rapid adoption of cloud and IoT technologies in countries such as China, Japan, and India. Governments promoting smart city initiatives, combined with the expanding middle class and rising enterprise adoption, are accelerating the market. APAC’s emergence as a manufacturing hub for Hosted PBX components is enhancing affordability and availability, enabling wider adoption among residential, commercial, and industrial users.

Japan Hosted Private Branch Exchange (PBX) Market Insight

The Japan Hosted PBX market is gaining traction due to high technological adoption, increasing urbanization, and demand for secure, easy-to-use communication systems. Hosted PBX adoption is growing across residential, corporate, and hospitality sectors, often integrated with IoT devices, smart office systems, and AI-driven communication tools. The aging population is driving demand for simple, reliable, and secure access and communication solutions across homes and workplaces.

China Hosted Private Branch Exchange (PBX) Market Insight

The China Hosted PBX market accounted for the largest revenue share in APAC in 2024, driven by rapid urbanization, a tech-savvy population, and strong enterprise digitalization. Widespread deployment in residential, commercial, and rental properties is supported by affordable cloud-based solutions and robust domestic manufacturing. Smart city initiatives and government-backed digitalization projects are further accelerating the adoption of Hosted PBX, making China a key growth market in the region.

Which are the Top Companies in Hosted Private Branch Exchange (PBX) Market?

The Hosted Private Branch Exchange (PBX) industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- AT&T Intellectual Property (U.S.)

- BT Group (U.K.)

- 8x8, Inc. (U.S.)

- MegaPath (U.S.)

- CenturyLink / Lumen Technologies (U.S.)

- Mitel Networks Corp. (Canada)

- Plantronics, Inc. / Poly (U.S.)

- RingCentral, Inc. (U.S.)

- Comcast (U.S.)

- Verizon (U.S.)

- Ozonetel (India)

- Nexge Technologies (P) Limited (India)

- BullsEye Telecom (U.S.)

- TPx Communications (U.S.)

- TELESYSTEM (U.S.)

- Interglobe Communications Inc (U.S.)

- 3CX (Cyprus)

- Vonage Holdings Corp. (U.S.)

- Star2Star Communications (U.S.)

- Nextiva (U.S.)

- NovoLink Communications, Inc. (U.S.)

- Datavo (U.S.)

- Digium (U.S.)

- NEC Corporation (Japan)

- Intermedia.net, Inc. (U.S.)

- Atlantech Online, Inc. (U.S.)

- ONEPIPE.IO SERVICES LIMITED (India)

- ClearlyCore (U.S.)

- AVOXI (U.S.)

What are the Recent Developments in Global Hosted Private Branch Exchange (PBX) Market?

- In May 2025, VitalPBX published a whitepaper encouraging companies to retire outdated switches to prevent lost sales and productivity, highlighting the importance of modernizing communication infrastructure to maintain business efficiency

- In April 2025, Cisco introduced an AI-enhanced Webex Calling update featuring real-time transcription and smart call routing, emphasizing the role of AI in improving collaboration and operational effectiveness

- In March 2025, Sangoma expanded its UCaaS suite with new trunking and contact-center services aimed at mid-market clients, underlining the company’s commitment to delivering comprehensive communication solutions

- In February 2025, Allbridge confirmed its continued PBX support following NEC’s exit, focusing on hospitality and senior-living sectors, reinforcing its dedication to serving specialized market niches

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.