Global Hosted Telephone Systems Market

Market Size in USD Billion

CAGR :

%

USD

13.38 Billion

USD

45.11 Billion

2024

2032

USD

13.38 Billion

USD

45.11 Billion

2024

2032

| 2025 –2032 | |

| USD 13.38 Billion | |

| USD 45.11 Billion | |

|

|

|

|

What is the Global Hosted Telephone Systems Market Size and Growth Rate?

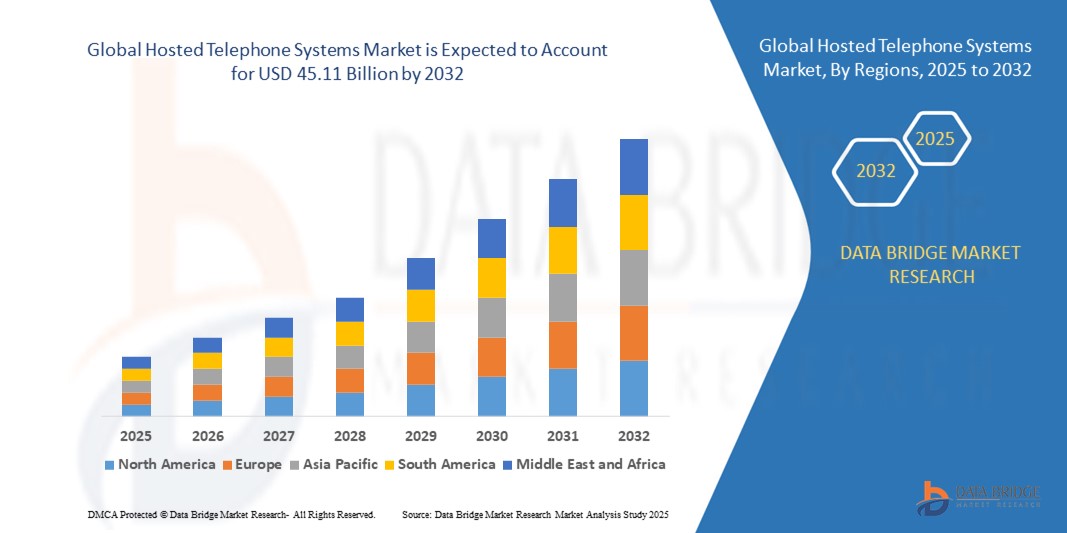

- The global hosted telephone systems market size was valued at USD 13.38 billion in 2024 and is expected to reach USD 45.11 billion by 2032, at a CAGR of 16.40% during the forecast period

- The hosted telecom system market has been growing rapidly in recent years due to the increasing demand for cost-effective and scalable communication solutions. Here are some key insights into the market. The application uses of hosted telecom systems are diverse and cater to various business needs

- Hosted telecom systems often integrate multiple communication channels, such as voice, video, and messaging, into a single platform. This integration enhances collaboration among teams, especially in remote and hybrid work environments. Features such as video conferencing and instant messaging streamline communication and improve workflow efficiency

What are the Major Takeaways of Hosted Telephone Systems Market?

- With the rise of remote work, hosted telecom systems provide flexibility for employees to connect from anywhere using internet-enabled devices. This capability is essential for businesses with distributed teams, allowing seamless communication through mobile apps and softphones. Hosted telecom solutions reduce the need for expensive on-premises hardware and maintenance. Businesses can benefit from lower operational costs, particularly when making long-distance or international calls, as hosted VoIP services typically offer more competitive rates compared to traditional phone lines

- Hosted telecom systems are highly scalable, allowing businesses to easily add or remove users based on their needs. This is particularly beneficial for small and medium enterprises (SMEs) and startups that may experience fluctuating communication requirements. Hosted telecom solutions often provide real-time analytics and reporting tools that help businesses track performance metrics, such as call volume and customer satisfaction scores. This data can be crucial for decision-making and optimizing communication strategies

- North America dominated the hosted telephone systems market with the largest revenue share of 36.47% in 2024, supported by widespread adoption of cloud-based communication platforms and the shift towards remote and hybrid work models

- Asia-Pacific market is forecasted to grow at the fastest CAGR of 9.35% between 2025 and 2032, driven by rapid digital transformation, expanding SME sector, and supportive government initiatives encouraging cloud adoption

- The UCaaS segment dominated the market with the largest revenue share of 57.6% in 2024, driven by the rising demand for integrated voice, video, messaging, and collaboration tools on a single platform

Report Scope and Hosted Telephone Systems Market Segmentation

|

Attributes |

Hosted Telephone Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hosted Telephone Systems Market?

Enhanced Convenience Through AI and Voice Integration

- A notable trend in the global hosted telephone systems market is the integration of artificial intelligence (AI) and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple Siri. This development is enhancing user experience by enabling seamless hands-free communication and management of telephony systems

- For instance, RingCentral and Zoom Phone are embedding AI-driven transcription, smart call routing, and voice command compatibility into their hosted solutions, allowing users to initiate or manage calls via simple verbal prompts

- AI in hosted telephony improves speech recognition, sentiment analysis, and real-time call insights, empowering businesses to enhance customer support and streamline workflows

- Voice integration further enables multitasking and unified communications by connecting hosted telephone systems with CRM, collaboration, and workflow tools through centralized smart platforms

- This shift is transforming business communications, making them more intelligent, flexible, and intuitive. Consequently, providers such as Cisco and Microsoft Teams Phone are pushing innovations in AI-enabled hosted telephone solutions to meet growing enterprise demand

- As enterprises adopt hybrid work models, the demand for AI-powered, voice-integrated hosted telephony is expected to accelerate, driving the next wave of intelligent communication systems

What are the Key Drivers of Hosted Telephone Systems Market?

- The rapid adoption of cloud-based communication and the demand for cost-effective, scalable solutions are driving growth in the hosted telephone systems market

- For instance, in March 2024, 8x8, Inc. expanded its AI-powered XCaaS platform, combining voice, video, chat, and contact center capabilities to deliver secure and integrated hosted telephony for enterprises

- Businesses are increasingly prioritizing remote work enablement, collaboration, and mobility, making hosted telephony a strategic investment compared to legacy on-premise PBX systems

- Enhanced features such as call analytics, auto attendants, virtual numbers, and omnichannel integrations provide superior efficiency and reliability for organizations of all sizes

- In addition, the shift towards unified communications-as-a-service (UCaaS), coupled with the rise of SMBs seeking cost-friendly telephony, is fueling widespread adoption

- The convenience of subscription-based pricing models, remote access, and centralized call management continues to position hosted telephone systems as a preferred choice for modern enterprises

Which Factor is Challenging the Growth of the Hosted Telephone Systems Market?

- One of the major challenges for the hosted telephone systems market is cybersecurity risks associated with VoIP and cloud-based communications. Threats such as call interception, phishing attacks, and DDoS attempts create concerns around reliability and data protection

- For instance, several high-profile VoIP breaches reported in 2023 raised enterprise concerns regarding the security of cloud-based telephony platforms

- Providers are responding with end-to-end encryption, multi-factor authentication, and AI-driven fraud detection to build user trust. However, ensuring continuous protection remains a priority

- Another barrier is the dependency on internet connectivity, as poor bandwidth or outages can significantly affect call quality and reliability, particularly in emerging markets

- In addition, the transition cost and integration complexity for enterprises shifting from legacy PBX to hosted systems can delay adoption among traditional industries

- Overcoming these challenges through robust security frameworks, improved global internet infrastructure, and seamless migration support will be essential for sustained market growth

How is the Hosted Telephone Systems Market Segmented?

The market is segmented on the basis of type, deployment mode, industry vertical, and sales channel.

- By Type

On the basis of type, the hosted telephone systems market is segmented into Hosted PBX and Unified Communications as a Service (UCaaS). The UCaaS segment dominated the market with the largest revenue share of 57.6% in 2024, driven by the rising demand for integrated voice, video, messaging, and collaboration tools on a single platform. Enterprises are increasingly shifting to UCaaS to enhance workforce productivity and reduce operational costs associated with legacy telephony. UCaaS also provides scalability and flexibility, making it suitable for organizations of all sizes.

The Hosted PBX segment, however, is expected to witness the fastest CAGR from 2025 to 2032, supported by the strong adoption among SMEs that seek cost-effective telephony with advanced call management features. Its ease of setup and compatibility with existing infrastructure make it an attractive option for businesses with limited IT resources.

- By Deployment Mode

On the basis of deployment mode, the hosted telephone systems market is segmented into Cloud-Based and On-Premise. The cloud-based segment held the largest market revenue share of 65.4% in 2024, fueled by the accelerating shift of enterprises toward cloud-first strategies, cost efficiency, and enhanced mobility. Cloud deployments eliminate heavy upfront infrastructure investments and offer seamless upgrades and disaster recovery, driving strong adoption across industries. Businesses increasingly prefer cloud-based solutions for their scalability, remote accessibility, and lower maintenance costs, aligning with hybrid and remote work models.

The on-premise segment is projected to witness the fastest CAGR from 2025 to 2032, particularly in highly regulated sectors such as government and BFSI where data sovereignty and strict compliance requirements remain critical. While cloud dominates overall, on-premise deployments continue to serve niche segments where control and customization are key priorities.

- By Industry Vertical

On the basis of industry vertical, the hosted telephone systems market is segmented into IT and Telecommunications, BFSI (Banking, Financial Services, and Insurance), Healthcare, Retail, Government, Education, and Others. The IT and telecommunications segment dominated the market with the largest revenue share of 29.8% in 2024, attributed to the high reliance on communication infrastructure, rapid adoption of remote collaboration tools, and demand for flexible, scalable voice solutions. Enterprises in this sector often require multi-location connectivity and advanced collaboration features, making hosted solutions highly attractive.

The healthcare segment is expected to register the fastest CAGR from 2025 to 2032, driven by the growing need for secure and reliable communication platforms for patient engagement, telehealth, and coordination among healthcare professionals. Enhanced compliance with data security regulations and the push for digital transformation in healthcare delivery models further fuel adoption.

- By Sales Channel

On the basis of sales channel, the hosted telephone systems market is segmented into Direct Sales, Distributors, and Online Sales. The direct sales segment held the largest market revenue share of 46.2% in 2024, as enterprises prefer to purchase solutions directly from providers to ensure tailored offerings, integration support, and service-level agreements. Direct sales channels are particularly dominant in large enterprise deals where customization, consulting, and managed services are crucial.

The online sales segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the growing preference of SMEs and startups for purchasing cost-effective, ready-to-deploy solutions via digital platforms. The convenience of online comparisons, transparent pricing, and instant access to subscription-based models further accelerates this growth. Distributors continue to play a vital role in bridging providers and smaller resellers, especially in emerging markets.

Which Region Holds the Largest Share of the Hosted Telephone Systems Market?

- North America dominated the hosted telephone systems market with the largest revenue share of 36.47% in 2024, supported by widespread adoption of cloud-based communication platforms and the shift towards remote and hybrid work models

- Businesses in the region are increasingly drawn to the cost-efficiency, scalability, and flexibility of hosted solutions compared to traditional on-premise systems

- Strong IT infrastructure, higher enterprise technology budgets, and the presence of global communication providers further solidify North America’s leadership in the market

U.S. Hosted Telephone Systems Market Insight

The U.S. captured the largest revenue share of 81% in 2024 within North America, propelled by rising enterprise demand for seamless collaboration, integration with CRM platforms, and enhanced mobility. The growing shift to cloud-first strategies, alongside the adoption of unified communication platforms by SMEs and large enterprises, is driving growth. Moreover, the strong presence of providers such as RingCentral, Cisco, and Zoom is accelerating adoption across multiple industries.

Europe Hosted Telephone Systems Market Insight

The Europe market is projected to expand at a significant CAGR during the forecast period, driven by digital transformation initiatives and compliance with strict GDPR-related communication standards. Enterprises across the region are adopting hosted solutions to modernize IT infrastructure, reduce capital expenditure, and improve security. The demand is strong across sectors such as BFSI, healthcare, and retail, with increasing preference for flexible, subscription-based models.

U.K. Hosted Telephone Systems Market Insight

The U.K. is expected to grow steadily, fueled by demand for cloud-based collaboration tools and rising adoption among SMEs aiming to cut operational costs. The country’s strong e-commerce, IT, and professional services sectors are key adopters of hosted telephony, while integration with Microsoft Teams and other productivity tools is gaining momentum.

Germany Hosted Telephone Systems Market Insight

The Germany market is projected to witness notable growth, supported by strong digital infrastructure, Industry 4.0 initiatives, and the country’s push toward cloud-native communication solutions. German enterprises are prioritizing hosted systems for their reliability, data privacy compliance, and flexibility, making them a preferred choice for both corporate and public sector applications.

Which Region is the Fastest Growing Region in the Hosted Telephone Systems Market?

Asia-Pacific market is forecasted to grow at the fastest CAGR of 9.35% between 2025 and 2032, driven by rapid digital transformation, expanding SME sector, and supportive government initiatives encouraging cloud adoption. Enterprises in China, India, and Japan are rapidly migrating from traditional systems to hosted platforms for better scalability and cost efficiency.

Japan Hosted Telephone Systems Market Insight

The Japan market is advancing steadily due to strong demand from technology-driven enterprises and government-backed digitalization efforts. Japanese businesses emphasize high-quality communication systems integrated with IoT and AI, boosting adoption of hosted platforms. In addition, the country’s growing remote workforce and focus on data security are contributing significantly to market expansion.

China Hosted Telephone Systems Market Insight

The China market held the largest revenue share in Asia-Pacific in 2024, supported by the country’s large SME base, government-led smart city projects, and strong local vendors. Hosted telephone systems are increasingly preferred for their affordability, integration with collaboration platforms, and ability to support mobile-first workforces. The push toward cloud adoption across industries ensures sustained demand growth.

Which are the Top Companies in Hosted Telephone Systems Market?

The hosted telephone systems industry is primarily led by well-established companies, including:

- RingCentral, Inc. (U.S.)

- 8x8, Inc. (U.S.)

- Vonage Holdings Corp. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Nextiva (U.S.)

- Mitel Networks Corporation (Canada)

- Avaya Inc. (U.S.)

- Zoom Video Communications, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- GoTo (formerly LogMeIn) (U.S.)

- Ooma, Inc. (U.S.)

- Google (U.S.)

- Twilio, Inc. (U.S.)

- Dialpad, Inc. (U.S.)

- Intermedia (U.S.)

- Grasshopper (U.S.)

- Blueface (Ireland)

- Net2Phone (U.S.)

- Broadvoice (U.S.)

- 3CX (Cyprus)

What are the Recent Developments in Global Hosted Telephone Systems Market?

- In May 2024, Avaya and RingCentral expanded their strategic partnership to deliver advanced communications and collaboration solutions with AI integration, offering a hybrid model that combines RingCentral’s AI-powered cloud communications with Avaya Aura telephony. This also introduced RingCentral’s RingSense AI and a new Microsoft Teams integration to enhance functionality and streamline workflows. This collaboration strengthens the unified communication ecosystem, ensuring businesses achieve seamless and efficient connectivity

- In March 2024, Microsoft introduced new unified communication capabilities in Microsoft Teams at Enterprise Connect 2024, featuring a Queues app for improved call management, Private Line for priority callers, a discover feed in channels for personalized updates, and Meet Now in group chats for instant meetings. In addition, Copilot in Teams was launched to assist with drafting messages. These upgrades further position Teams as a comprehensive platform for business communication and collaboration

- In March 2024, Cisco unveiled enhancements to its Webex cloud customer experience portfolio, including Webex Customer Experience Essentials for non-contact center employees and updates to the Cisco AI Assistant for Webex Contact Center. Key features such as quality management tools and built-in CRM integrations were also added. These innovations aim to improve agent performance and elevate customer service, making Webex a stronger choice for organizations of all sizes

- In January 2024, 8x8, Inc. advanced its hosted telephone system offerings by embedding AI-driven capabilities such as intelligent routing and call analytics into its solutions. These enhancements are designed to boost customer service efficiency and business performance. This move underscores 8x8’s focus on empowering enterprises with smarter communication tools

- In July 2023, RingCentral formed a strategic alliance with Vodafone Business to launch “Vodafone Business UC with RingCentral,” a cloud-based platform offering hosted telephone systems and unified communications as a service (UCaaS). The partnership aims to modernize communication infrastructures for Vodafone’s business clients across Europe. This initiative highlights the growing demand for cloud-first communication solutions across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.