Global Hot Melt Adhesive Hma Market

Market Size in USD Billion

CAGR :

%

USD

8.92 Billion

USD

14.31 Billion

2024

2032

USD

8.92 Billion

USD

14.31 Billion

2024

2032

| 2025 –2032 | |

| USD 8.92 Billion | |

| USD 14.31 Billion | |

|

|

|

|

Hot Melt Adhesive (HMA) Market Size

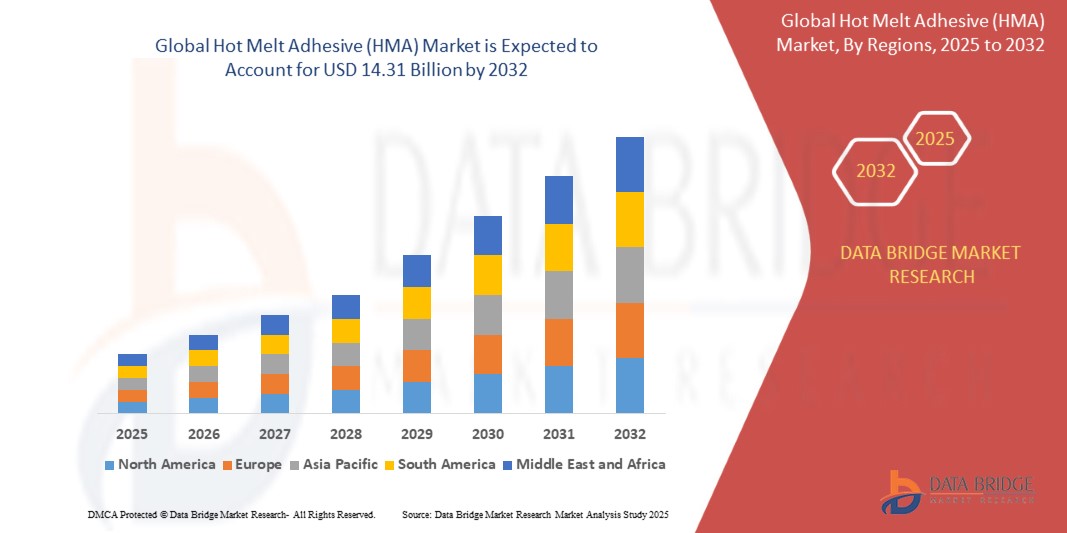

- The global hot melt adhesive (HMA) market size was valued at USD 8.92 billion in 2024 and is expected to reach USD 14.31 billion by 2032, at a CAGR of 7.55% during the forecast period

- The market growth is largely fueled by the rising emphasis on sustainable and bio-based formulations. As environmental regulations tighten and industries pursue greener operations, HMA manufacturers are increasingly developing adhesives that align with eco-friendly standards without compromising performance or bond strength.

- Furthermore, rapidly expanding packaging and e-commerce sectors are also consider major driving forces behind the growth of the global hot melt adhesive (HMA) market. As global consumerism and online retailing continue to rise, there is an increasing need for fast, efficient, and cost-effective packaging solutions, which HMAs fulfill due to their quick setting times, strong bonding capabilities, and minimal curing requirements

Hot Melt Adhesive (HMA) Market Analysis

- Hot Melt Adhesives (HMAs), known for their fast-setting, solvent-free bonding capabilities, are becoming indispensable in various industrial and consumer applications such as packaging, hygiene products, woodworking, and automotive due to their operational efficiency, strong adhesion, and eco-friendly profile

- The rising demand for HMAs is primarily driven by the booming packaging and e-commerce sectors, increasing usage in hygiene products like diapers and sanitary pads, and a growing shift toward sustainable, low-VOC adhesive solutions across manufacturing industries

- Asia-Pacific dominates the global hot melt adhesive market with the largest revenue share in 2024, owing to strong industrial expansion, growing manufacturing activities in China and India, and rising demand across end-use industries. The region also benefits from low production costs and the presence of major adhesive manufacturers driving capacity expansion and innovation in bio-based hot melt products

- North America and Europe continue to witness stable growth driven by automation in packaging lines, advanced infrastructure in hygiene manufacturing, and increasing adoption of hot melt solutions in furniture and woodworking applications

- The Ethylene Vinyl Acetate (EVA) segment holds the dominant share of the HMA market in 2024, favored for its cost efficiency, versatility, and excellent bonding properties in packaging, bookbinding, and nonwoven hygiene applications. Its proven performance and processability continue to make it the adhesive of choice in both established and emerging economies.

Report Scope and Hot Melt Adhesive (HMA) Market Segmentation

|

Attributes |

Hot Melt Adhesive (HMA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hot Melt Adhesive (HMA) Market Trends

Sustainability-Driven Formulation Innovation in Hot Melt Adhesives

- A key and evolving trend in the Global Hot Melt Adhesive (HMA) Market is the rising emphasis on sustainable and bio-based formulations. As environmental regulations tighten and industries pursue greener operations, HMA manufacturers are increasingly developing adhesives that align with eco-friendly standards without compromising performance or bond strength

- For instance, Henkel introduced a series of Technomelt Supra ECO hot melt adhesives that incorporate bio-based content and are designed to reduce carbon footprint in packaging applications. These adhesives are crafted to deliver strong bonding while using renewable raw materials, thereby meeting the rising demand for sustainability from consumer goods and e-commerce sectors

- Another example is Bostik, which launched Born2Bond™, a portfolio including eco-conscious hot melt solutions designed specifically for packaging and product assembly. These adhesives reduce volatile organic compounds (VOCs), support energy efficiency by requiring lower application temperatures, and promote easier recyclability of bonded materials

- In addition to bio-based raw materials, innovations in recycled content incorporation and lower temperature application are further driving sustainability in hot melt adhesives. Products that melt and cure at lower temperatures are increasingly popular, as they reduce energy consumption and minimize heat damage to substrates, especially in temperature-sensitive applications like electronics and food packaging

- Moreover, end-user industries such as hygiene products, automotive, and woodworking are requesting adhesives that meet environmental certifications and compliance standards such as REACH, FDA, and Blue Angel, compelling manufacturers to continually innovate and reformulate

- This push toward eco-friendly, high-performance hot melt adhesive is fundamentally reshaping product development strategies across the industry. As demand grows for circular economy solutions, companies like Jowat, H.B. Fuller, and Sika AG are investing in R&D to deliver next-gen HMAs that align with both environmental responsibility and operational efficiency

- The trend is rapidly gaining traction across regions, particularly in Europe and North America, where both consumer and legislative pressure is driving the adoption of green packaging and sustainable manufacturing. Consequently, bio-based HMAs are becoming a strategic priority in product portfolios, setting a new benchmark for adhesive performance and responsibility

Hot Melt Adhesive (HMA) Market Dynamics

Driver

Surging Demand from Packaging and E-commerce Industries

- The rapidly expanding packaging and e-commerce sectors are major driving forces behind the growth of the global hot melt adhesive (HMA) market. As global consumerism and online retailing continue to rise, there is an increasing need for fast, efficient, and cost-effective packaging solutions, which HMAs fulfill due to their quick setting times, strong bonding capabilities, and minimal curing requirements

- For instance, Amazon and other major e-commerce companies are heavily reliant on automated packaging lines where hot melt adhesives ensure high throughput and reliability. The growing demand for corrugated box packaging and flexible packaging across the food & beverage, personal care, and pharmaceutical sectors is further strengthening this trend

- Moreover, HMAs are widely preferred in carton sealing, labelling, and multi-pack assembly due to their performance versatility and compatibility with various substrates such as cardboard, plastic films, and aluminum. Leading manufacturers like Henkel, 3M, and H.B. Fuller are responding with tailored HMA solutions for high-speed operations and temperature-sensitive applications

- The demand is also bolstered by increased use of customized, sustainable packaging solutions, where HMAs help maintain package integrity without adding excessive weight or environmental burden

- In developing markets across Asia and Latin America, the growing presence of logistics hubs and warehousing infrastructure, along with rising consumer demand for packaged goods, is expected to create robust growth opportunities for HMA providers

Restraint/Challenge

Volatility in Raw Material Prices and Limited Heat Resistance

- One of the key challenges restraining the growth of the hot melt adhesive market is the volatile pricing of raw materials, particularly petroleum-based polymers, resins, and synthetic rubber, which are primary inputs in HMA manufacturing. Fluctuations in crude oil prices directly impact production costs and create pricing instability for adhesive manufacturers

- For instance, in recent years, supply chain disruptions and global energy price spikes have led to increased costs of EVA, polyolefins, and tackifiers, compelling manufacturers to either absorb costs or pass them onto consumers, affecting competitiveness

- Additionally, performance limitations of HMAs under high-temperature environments restrict their applicability in sectors such as automotive under-hood assembly or electronic device bonding, where thermal durability is critical. Traditional HMAs may soften or degrade at elevated temperatures, making them unsuitable for high-heat exposure

- Manufacturers are working to address these concerns through the development of temperature-resistant formulations, such as metallocene-based polyolefin HMAs, but such alternatives often come at a premium cost, limiting accessibility for cost-sensitive end-users

- Moreover, the presence of solvent-based or water-based adhesive alternatives with better thermal resistance and aging properties poses competitive pressure, particularly in industrial settings

- To overcome these challenges, players in the HMA market are increasingly investing in R&D to develop hybrid adhesives, optimizing raw material sourcing, and enhancing supply chain resilience to better manage cost fluctuations and performance expectations

Hot Melt Adhesive (HMA) Market Scope

The market is segmented on the basis of resin type and application.

- By Resin Type

On the basis of resin type, the hot melt adhesive market is segmented into Ethylene Vinyl Acetate (EVA), Styrenic Block Copolymers (SBC), Metallocene Polyolefin, Amorphous Polyalphaolefins (APAO), Polyolefins, Polyamides, Polyurethane, and Others.

The Ethylene Vinyl Acetate (EVA) segment dominated the market revenue share in 2024 due to its versatility, cost-effectiveness, and compatibility with a wide range of substrates. EVA-based HMAs are widely used in packaging, bookbinding, and product assembly applications owing to their quick set times and strong bonding capabilities, making them a preferred choice across diverse industries.

The Metallocene Polyolefin segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by its superior thermal stability, improved adhesion performance, and cleaner processing. These adhesives are gaining popularity in hygiene products and food packaging due to their odorless nature and low VOC emissions, aligning with sustainability goals and stringent regulatory standards.

- By Application

On the basis of application, the hot melt adhesive market is segmented into Packaging Solutions, Nonwoven Hygiene Products, Furniture & Woodwork, Bookbinding, and Others.

The Packaging Solutions segment accounted for the largest market revenue share in 2024, attributed to the booming e-commerce sector and the increasing demand for secure and sustainable packaging formats. HMAs are widely used for carton sealing, labelling, and flexible packaging due to their fast-bonding speed and durability, ensuring efficient production lines and minimal waste. The Nonwoven Hygiene Products segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rising consumer demand for disposable hygiene products such as diapers, feminine care, and adult incontinence products. Hot melt adhesives play a critical role in bonding layers in these products while maintaining comfort and performance. Growing hygiene awareness and population growth in emerging markets are key drivers fueling this segment’s rapid expansion.

Hot Melt Adhesive (HMA) Market Regional Analysis

- Asia-Pacific dominates the hot melt adhesive market with the largest revenue share of approximately 42.7% in 2024, driven by rapid industrialization, expanding packaging and automotive industries, and growing consumer goods manufacturing across countries like China, India, and Southeast Asia

- The region benefits from cost-effective manufacturing environments, rising urbanization, and increasing demand for hygienic and sustainable packaging solutions in food, healthcare, and personal care sectors, which significantly boosts the consumption of HMAs

- Additionally, strong investments in infrastructure development and a thriving e-commerce landscape have accelerated the use of hot melt adhesives in logistics and product assembly applications, making Asia-Pacific the most influential and fastest-growing regional market

U.S. Hot melt adhesive (HMA) Market Insight

The U.S. hot melt adhesive market accounted for the largest revenue share of approximately 63.4% in North America in 2024, driven by a well-established packaging industry, rising demand for sustainable and fast-bonding adhesive solutions, and advancements in product formulation. Increased consumption of packaged goods, e-commerce shipments, and hygiene products are major growth catalysts. Moreover, the growing trend of replacing solvent-based adhesives with environmentally friendly alternatives, particularly in the automotive and construction sectors, continues to fuel market expansion.

Europe Hot melt adhesive (HMA) Market Insight

The Europe hot melt adhesive market is expected to witness robust growth during the forecast period, supported by a strong emphasis on circular economy principles, recyclable packaging solutions, and low-VOC adhesives. Countries like Germany, France, and Italy are investing in sustainable industrial practices, which is fostering the shift towards hot melt adhesives across end-use sectors such as woodworking, nonwovens, and bookbinding. The EU’s regulatory push for reducing carbon footprint and plastic waste is further accelerating the adoption of HMAs in packaging and hygiene applications.

U.K. Hot melt adhesive (HMA) Market Insight

The U.K. remains a key player in the European hot melt adhesive market due to its advanced industrial base and strong automotive and furniture manufacturing sectors. The country’s innovation-driven approach has led to significant R&D in high-performance, temperature-resistant HMAs tailored for demanding applications. Additionally, Germany’s environmental regulations and sustainability goals are encouraging the use of solvent-free adhesives, further propelling the market.

Germany Hot melt adhesive (HMA) Market Insight

The Germany hot melt adhesive market is projected to grow at a healthy CAGR over the forecast period, driven by increasing demand for eco-friendly adhesives in consumer packaging, hygiene products, and electronics. As brands move towards reducing plastic waste and ensuring product recyclability, HMAs are being increasingly preferred for their clean application, minimal curing time, and reduced environmental impact. Government policies promoting sustainable materials and energy-efficient manufacturing are contributing to growing adoption in the region.

Asia-Pacific Hot melt adhesive (HMA) Market Insight

The Asia-Pacific hot melt adhesive market is projected to grow at the fastest CAGR of around 9.6% from 2025 to 2032, fueled by booming e-commerce, rapid urbanization, and expanding packaging, hygiene, and construction sectors. Countries like China, India, South Korea, and Indonesia are witnessing massive demand for consumer goods and infrastructure development, which in turn accelerates adhesive consumption. The availability of cost-effective raw materials and growing manufacturing capabilities also position APAC as a key production hub for HMA.

Japan Hot melt adhesive (HMA) Market Insight

The Japan hot melt adhesive market is steadily expanding due to the country's focus on precision engineering, electronics, and sustainable packaging. Demand is particularly strong in the hygiene and automotive sectors, where high-performance adhesives are required. Japan’s aging population and its emphasis on clean, user-friendly materials in healthcare and personal care products further contribute to market growth.

China Hot melt adhesive (HMA) Market Insight

China accounted for the largest revenue share in the Asia-Pacific hot melt adhesive market in 2024, supported by a dominant manufacturing base, high consumption of packaged consumer goods, and the rising popularity of hygiene products. The government’s focus on green manufacturing and the rise of domestic adhesive producers are also bolstering supply and innovation. With the surge in online retail and fast-moving consumer goods, China remains a key growth engine for the global HMA market.

Hot Melt Adhesive (HMA) Market Share

The hot melt adhesive (HMA) industry is primarily led by well-established companies, including:

- Arkema (France)

- 3M (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Beardow Adams (U.K.)

- Dow (U.S.)

- H.B. Fuller Company (U.S.)

- Henkel Adhesives Technologies India Private Limited (India)

- Jowat SE (Germany)

- Sika AG (Switzerland)

- TEX YEAR INDUSTRIES INC (Taiwan)

- Adhesive Direct UK (U.K.)

- ADTEK Consolidated Sdn Bhd (Malaysia)

- Stage GmbH & Co. KG (Germany)

- CHENG TAI INDUSTRIAL TECHNOLOGY CO., LTD (Taiwan)

- Daubert Chemical Company (U.S.)

- Evans Adhesive Corporation, Ltd (U.S.)

- EVONIK (Germany)

- KLEBCHEMIE M. G. Becker GmbH & Co. KG (Germany)

Latest Developments in Global Hot Melt Adhesive (HMA) Market

- In December 2023, Henkel Adhesive Technologies expanded its hot melt adhesive portfolio for e-commerce packaging with the launch of the Technomelt E-COM range. Designed for right-sized cartons and envelopes, this solution aims to significantly boost the efficiency of on-demand packaging technologies

- In April 2023, Dow Inc. and Avery Dennison Corporation jointly developed an innovative and sustainable hotmelt label adhesive. This breakthrough enables the mechanical recycling of polyolefin filmic labels with polypropylene or polyethylene packaging in a single stream. Approved by Recyclass for recycling in the HDPE colored stream – Class B, it is the first of its kind in the label industry

- In February 2022, H.B. Fuller Company acquired Fourny NV, a Belgium-based specialist in construction adhesives with expertise in commercial roofing and industrial private label solutions. The acquisition enhances H.B. Fuller’s local production capabilities in Europe by reducing reliance on U.S. imports

- In January 2022, H.B. Fuller Company acquired Apollo, a U.K.-based independent producer of liquid adhesives, primers, and coatings for roofing, construction, and industrial applications. This acquisition strengthens the company’s footprint in key construction markets in the U.K. and throughout Europe

- In February 2020, Jowat SE introduced Jowatherm-Reaktant MR 604.90, the first PUR hot melt adhesive with reduced monomer content and hazard-free labeling. It is approved under RAL-GZ 716 for use in wrapping PVC window profiles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hot Melt Adhesive Hma Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hot Melt Adhesive Hma Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hot Melt Adhesive Hma Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.