Global Household Cleaning Products Market

Market Size in USD Billion

CAGR :

%

USD

270.69 Billion

USD

368.38 Billion

2024

2032

USD

270.69 Billion

USD

368.38 Billion

2024

2032

| 2025 –2032 | |

| USD 270.69 Billion | |

| USD 368.38 Billion | |

|

|

|

|

Household Cleaning Products Market Size

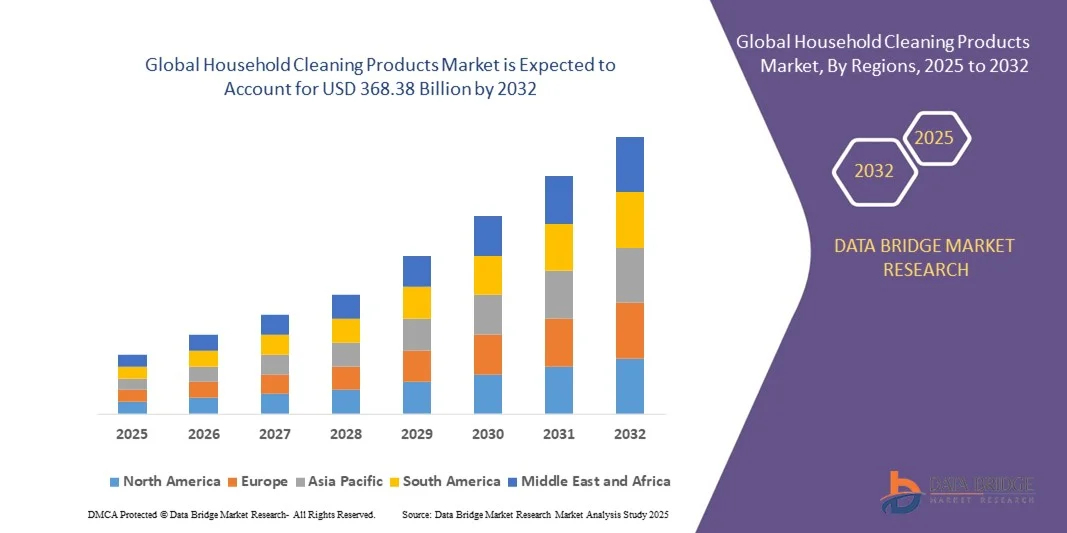

- The global household cleaning products market size was valued at USD 270.69 billion in 2024 and is expected to reach USD 368.38 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by rising consumer awareness of hygiene, increasing disposable income, and urbanization, which are driving the adoption of household cleaning products across residential and commercial settings

- Furthermore, growing demand for eco-friendly, multi-surface, and specialized cleaning solutions is encouraging innovation and product diversification, thereby significantly boosting the industry's growth

Household Cleaning Products Market Analysis

- Household cleaning products, including surface cleaners, specialty cleaners, bleaches, and other formulations, are becoming essential in modern homes and commercial spaces due to their ability to maintain hygiene, improve sanitation, and simplify cleaning tasks

- The escalating demand for household cleaning products is primarily driven by increased health consciousness, the shift toward premium and sustainable products, and the growing influence of organized retail and e-commerce channels that enhance product availability and convenience

- Asia-Pacific dominated household cleaning products market with a share of 49.40% in 2024, due to rising urbanization, increasing household disposable income, and growing awareness of hygiene and sanitation

- North America is expected to be the fastest growing region in the household cleaning products market during the forecast period due to rising hygiene awareness, advanced retail channels, and growing adoption of specialized and eco-friendly cleaning solutions

- Surface cleaners segment dominated the market with a market share of 42% in 2024, due to their versatile application across multiple household surfaces and daily cleaning routines. Consumers prefer surface cleaners for their convenience, ease of use, and ability to deliver quick cleaning results without damaging surfaces. The segment also benefits from innovation in formulations, such as antibacterial, eco-friendly, and multi-surface variants, which enhance consumer trust and adoption. Surface cleaners are highly compatible with modern cleaning habits and increasingly integrated into smart cleaning systems, further consolidating their market dominance

Report Scope and Household Cleaning Products Market Segmentation

|

Attributes |

Household Cleaning Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Household Cleaning Products Market Trends

Growth in Eco-Friendly and Sustainable Cleaning Products

- The household cleaning products market is undergoing rapid transformation as consumers increasingly prefer eco-friendly, plant-based, and biodegradable products that align with sustainable living values. This shift is encouraging manufacturers to reduce chemical intensity and focus on naturally derived ingredients that are safer for both households and the environment

- For instance, Seventh Generation has developed cleaning sprays and detergents made using renewable, bio-based components and packaged in recyclable containers. This approach enhances brand loyalty among environmentally conscious consumers while catalyzing sustainability-driven competition within the industry

- Consumers are actively seeking products that provide effective cleaning without leaving behind hazardous residues, resulting in strong interest in formulations free from compounds such as phosphates, chlorine, and synthetic fragrances. This trend reflects growing awareness about the impact of cleaning agents on human health and water ecosystems

- In addition, companies are taking significant initiatives toward waste reduction through innovations such as concentrated cleaning liquids, refill pouches, and solid-form tablets that reduce packaging requirements and transportation emissions. These developments align with global circular economy objectives, helping to minimize lifecycle environmental impact

- Digital retail platforms are amplifying consumer access to eco-friendly product portfolios, enabling smaller sustainable brands to gain visibility alongside major manufacturers. This expansion through e-commerce facilitates informed purchasing decisions, where sustainability certifications and eco-labels are playing a decisive role in brand selection

- The overall surge in demand for safe and sustainable household cleaning products signifies a fundamental market shift toward environmentally responsible production and consumption. As a result, sustainability has become an indispensable element of product differentiation and long-term corporate strategy for household cleaning product manufacturers

Household Cleaning Products Market Dynamics

Driver

Rising Consumer Hygiene Awareness

- The rise in public awareness regarding hygiene and sanitation has become a central factor driving growth in the global household cleaning products market. Heightened attention to maintaining safe, germ-free environments has elevated cleaning products from basic household necessities to preventive health essentials

- For instance, Procter & Gamble has witnessed increased demand for its disinfectant lines, including Mr. Clean and Lysol-branded products, owing to growing consumer understanding of the importance of surface hygiene. This demand surge underscores a major behavioral shift where consistent cleaning routines are now strongly linked with family wellbeing and disease prevention

- Regular cleaning habits have become an integral part of urban living standards, supported by media campaigns and educational initiatives highlighting the role of surface disinfection against bacteria and viruses. Consumers are increasingly choosing specialized cleaning agents tailored for different surfaces, ensuring comprehensive household protection

- In addition, the influence of digital content and lifestyle promotion has strengthened the culture of cleanliness as a benchmark of personal and domestic care. This attitudinal evolution toward hygiene maintenance is sustaining product demand across all consumer groups, including urban and semi-urban households

- As cleanliness becomes synonymous with health protection, leading companies are expected to expand their product ranges and marketing efforts to further reinforce hygiene awareness. This ongoing emphasis on sanitation and disease prevention forms the foundation for continued growth across global household cleaning markets

Restraint/Challenge

Regulatory Compliance for Chemical Formulations

- Compliance with stringent chemical regulations presents a major challenge for manufacturers developing household cleaning products. Governments across different regions are enforcing extensive monitoring and approval processes to ensure that cleaning agents meet safety, toxicity, and environmental sustainability criteria

- For instance, regulatory authorities such as the U.S. Environmental Protection Agency and the European Chemicals Agency have tightened norms regarding permissible ingredient concentrations and emissions. As a result, global players such as Reckitt Benckiser must invest heavily in reformulation processes and maintain regular certification renewals to remain market compliant

- Product reformulation to comply with volatile organic compound limits and allergen-free requirements often increases operational and development costs. These continuous adjustments demand dedicated R&D resources, especially for multinational manufacturers operating across multiple jurisdictions with varied safety standards

- In addition, inconsistent global regulatory structures pose challenges for scalability, as products that meet compliance in one region may require alterations to enter another market. The complexity associated with varying ingredient restrictions often delays launches and disrupts product supply timelines

- To tackle these barriers, companies are progressively investing in safer alternative ingredients and predictive compliance software to streamline formulation approval. Strengthening collaboration between manufacturers and regulatory bodies will be essential to balance innovation with environmental and human safety, paving the way for smoother compliance and sustainable product development

Household Cleaning Products Market Scope

The market is segmented on the basis of product type, distribution channel, and application.

- By Product Type

On the basis of product type, the household cleaning products market is segmented into surface cleaners, specialty cleaners, and bleaches. The surface cleaners segment dominated the market with the largest market revenue share of 42% in 2024, driven by their versatile application across multiple household surfaces and daily cleaning routines. Consumers prefer surface cleaners for their convenience, ease of use, and ability to deliver quick cleaning results without damaging surfaces. The segment also benefits from innovation in formulations, such as antibacterial, eco-friendly, and multi-surface variants, which enhance consumer trust and adoption. Surface cleaners are highly compatible with modern cleaning habits and increasingly integrated into smart cleaning systems, further consolidating their market dominance.

The specialty cleaners segment is anticipated to witness the fastest growth rate of 19.8% from 2025 to 2032, fueled by rising consumer awareness of targeted cleaning solutions for specific tasks, including glass, metal, and electronic surface cleaning. Specialty cleaners offer tailored benefits such as streak-free shine, odor removal, and germ elimination, making them attractive to households seeking specialized performance. Growing demand from urban households, coupled with increasing interest in premium and eco-conscious cleaning solutions, is expected to accelerate the adoption of specialty cleaners over the forecast period.

- By Distribution Channel

On the basis of distribution channel, the household cleaning products market is segmented into supermarkets/hypermarkets, convenience stores, online retail stores, and others. The supermarkets/hypermarkets segment held the largest market revenue share in 2024, owing to the wide availability of diverse product ranges, promotional offers, and bulk purchase options. Consumers often prefer shopping at these stores for convenience, cost-effectiveness, and the ability to physically compare products before purchase. The strong presence of private-label household cleaning products in these channels further strengthens their market dominance and consumer loyalty.

The online retail stores segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rapid growth of e-commerce platforms, home delivery convenience, and digital marketing initiatives. Online channels enable easy product discovery, price comparison, and access to niche or premium cleaning products, appealing to tech-savvy and urban consumers. The COVID-19 pandemic and evolving consumer behavior toward digital shopping have significantly boosted online adoption, which is projected to continue fueling market growth in the coming years.

- By Application

On the basis of application, the household cleaning products market is segmented into bathroom cleaners, kitchen cleaners, floor cleaners, fabric care, and others. The kitchen cleaners segment dominated the market with the largest revenue share of 38.7% in 2024, driven by increasing consumer focus on hygiene and sanitation in food preparation areas. Kitchen cleaners are preferred for their efficiency in removing grease, food residues, and stains, as well as their compatibility with multiple surfaces such as countertops, sinks, and appliances. Continuous innovation in antibacterial and multi-purpose kitchen cleaners further enhances consumer confidence and supports their dominant position in the market.

The floor cleaners segment is anticipated to witness the fastest growth rate of 18.5% from 2025 to 2032, fueled by rising awareness of household hygiene and the growing adoption of premium and specialized floor care products. Consumers are increasingly seeking products that offer ease of use, streak-free finishes, and long-lasting cleanliness. The expansion of residential and commercial spaces, coupled with innovative formulations such as eco-friendly, scented, and smart-compatible floor cleaners, is expected to drive the segment’s rapid growth over the forecast period.

Household Cleaning Products Market Regional Analysis

- Asia-Pacific dominated the household cleaning products market with the largest revenue share of 49.40% in 2024, driven by rising urbanization, increasing household disposable income, and growing awareness of hygiene and sanitation

- The region’s expanding middle-class population, adoption of modern cleaning habits, and proliferation of organized retail channels are accelerating market growth

- Rapid industrialization, favorable government initiatives promoting domestic manufacturing, and rising penetration of branded household cleaning products are further boosting consumption across residential and commercial sectors

China Household Cleaning Products Market Insight

China held the largest share in the Asia-Pacific household cleaning products market in 2024, owing to its large urban population, rising disposable income, and well-established retail infrastructure. The country’s growing e-commerce penetration, coupled with strong domestic manufacturing of cleaning products, supports consistent supply and competitive pricing. Increasing awareness about hygiene, innovative product launches, and demand for multi-surface and eco-friendly cleaning solutions are key growth drivers.

India Household Cleaning Products Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid urbanization, rising middle-class income, and increasing awareness of hygiene and household sanitation. Government initiatives promoting cleanliness and sanitation, along with growing retail and e-commerce penetration, are strengthening product availability and adoption. Rising demand for specialized cleaning products, eco-friendly formulations, and modern household cleaning solutions is further propelling market expansion.

Europe Household Cleaning Products Market Insight

The Europe household cleaning products market is expanding steadily, supported by high consumer awareness of hygiene, premiumization of products, and strict regulatory standards for chemical safety. The region emphasizes eco-friendly, sustainable, and effective cleaning solutions, particularly in Western European countries. Demand for antibacterial, multi-surface, and specialized cleaning products continues to grow, driven by increased health consciousness and high living standards.

Germany Household Cleaning Products Market Insight

Germany’s household cleaning products market is driven by strong consumer focus on sustainability, quality, and effective cleaning solutions. The country has well-established retail and e-commerce networks, supporting the availability of premium and innovative cleaning products. Demand is particularly strong for environmentally friendly and high-performance surface, kitchen, and floor cleaners.

U.K. Household Cleaning Products Market Insight

The U.K. market is supported by mature retail infrastructure, rising consumer awareness about hygiene and sanitation, and growing demand for sustainable and specialized cleaning products. Innovative product launches, strong e-commerce penetration, and increasing preference for branded household cleaning solutions are contributing to steady market growth.

North America Household Cleaning Products Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising hygiene awareness, advanced retail channels, and growing adoption of specialized and eco-friendly cleaning solutions. Consumers increasingly demand convenience, efficiency, and effective products for surface, kitchen, and bathroom cleaning. Expansion of e-commerce platforms, technological innovation in formulations, and growing household spending are supporting rapid market growth.

U.S. Household Cleaning Products Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by high disposable income, strong retail and e-commerce infrastructure, and rising preference for branded and premium household cleaning products. The country’s focus on hygiene, sustainability, and innovative product development continues to drive demand. Availability of a wide range of surface cleaners, specialty cleaners, and bleaches, along with strong marketing and distribution networks, further solidifies the U.S.'s leading position in the region.

Household Cleaning Products Market Share

The household cleaning products industry is primarily led by well-established companies, including:

- Colgate-Palmolive Company (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Procter & Gamble (U.S.)

- Reckitt Benckiser Group plc. (U.K.)

- S. C. Johnson & Son, Inc. (U.S.)

- The Clorox Company (U.S.)

- Unilever (U.K.)

- Church & Dwight Co., Inc. (U.S.)

- Godrej Consumer Products Limited (India)

- Kao Corporation (Japan)

- Saraya Goodmaid Sdn. Bhd (Malaysia)

- McBride Plc (U.K.)

Latest Developments in Global Household Cleaning Products Market

- In January 2023, Henkel and Shell Chemical LP announced a strategic collaboration aimed at replacing 200,000 tons of crude oil–based feedstock used in surfactant manufacturing with renewable raw materials. This initiative is expected to significantly enhance the sustainability profile of Henkel’s laundry product portfolio while reducing greenhouse gas emissions by up to 120,000 tons over the five-year agreement period. The move underscores growing industry momentum toward eco-friendly formulations and is likely to influence competitors to adopt renewable feedstocks, thereby accelerating the shift toward a greener household cleaning products market

- In March 2022, Henkel entered into a partnership with BASF to substitute fossil-based feedstock with renewable alternatives in its laundry and homecare products. Through this collaboration, 110,000 tons of fossil-based feedstock is projected to be replaced annually, potentially avoiding a cumulative 200,000 tons of CO2 emissions. This initiative reinforces Henkel’s leadership in sustainable product innovation, enhances consumer appeal for environmentally conscious products, and contributes to the broader decarbonization trend in the household cleaning market

- In January 2022, Henkel announced plans to merge its beauty care business with the laundry and homecare segment, aiming to create new consumer brands through a unified platform. This strategic consolidation is expected to optimize operational efficiencies, enable cross-segment innovation, and strengthen Henkel’s competitive positioning in both beauty and household cleaning markets. The integration is likely to foster product development with enhanced sustainability features, responding to increasing consumer demand for multifunctional and eco-friendly solutions

- In December 2021, Unilever launched a new dishwashing liquid formulated entirely from naturally derived ingredients. The product is 99% biodegradable, packaged in bottles made with fully recyclable plastics, and designed to reduce carbon footprint while minimizing reliance on fossil-based ingredients. This innovation highlights Unilever’s commitment to sustainability, strengthens its market positioning in eco-conscious household cleaning products, and aligns with consumer preferences for green and responsibly sourced formulations

- In April 2021, Unilever introduced the world’s first laundry capsule produced using surfactants derived from industrial carbon emissions instead of fossil fuels. This pioneering product was developed through a collaboration with LanzaTech and India Glycols, utilizing biotechnologies and a newly configured supply chain. The initiative represents a significant leap toward carbon-negative product solutions, positions Unilever as an industry innovator, and sets a benchmark for sustainable manufacturing practices in the global household cleaning products market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.