Global Household Cleaning Tools And Supplies Market

Market Size in USD Billion

CAGR :

%

USD

10.82 Billion

USD

12.68 Billion

2024

2032

USD

10.82 Billion

USD

12.68 Billion

2024

2032

| 2025 –2032 | |

| USD 10.82 Billion | |

| USD 12.68 Billion | |

|

|

|

|

Household Cleaning Tools and Supplies Market Size

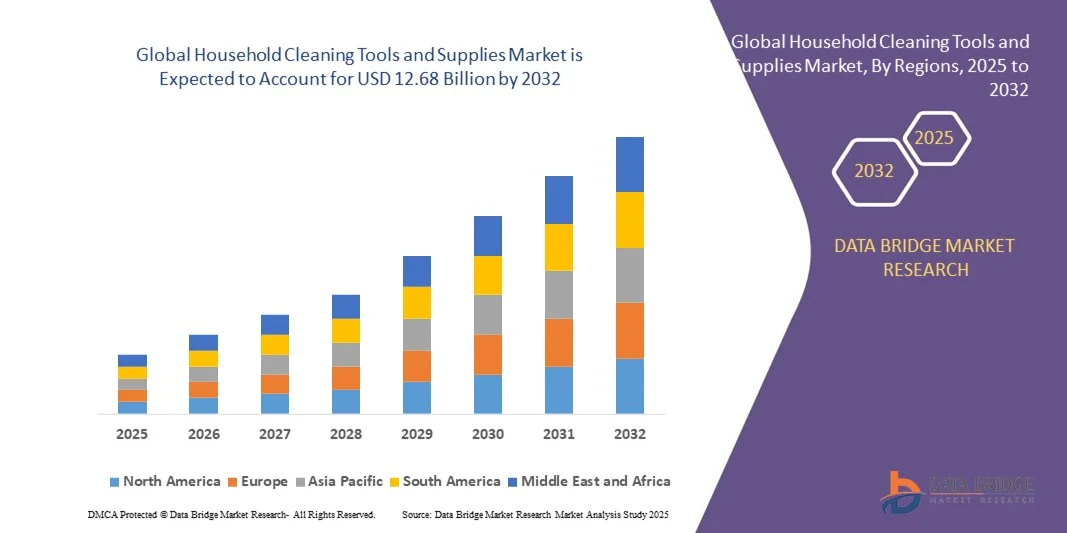

- The global household cleaning tools and supplies market size was valued at USD 10.82 billion in 2024 and is expected to reach USD 12.68 billion by 2032, at a CAGR of 2.00% during the forecast period

- The market growth is largely fuelled by the increasing consumer focus on hygiene and sanitation in residential spaces

- Rising urbanization, expanding working-class population, and growing demand for efficient and easy-to-use cleaning products are further propelling market expansion

Household Cleaning Tools and Supplies Market Analysis

- The household cleaning tools and supplies market is witnessing steady growth driven by changing consumer lifestyles and heightened awareness of cleanliness, particularly post-pandemic

- Manufacturers are focusing on developing sustainable and ergonomic cleaning tools such as reusable mops, eco-friendly brushes, and microfiber cloths to cater to environmentally conscious consumers

- North America dominated the household cleaning tools and supplies market with the largest revenue share of 38.52% in 2024, driven by a strong focus on hygiene, rising awareness of health and wellness, and the widespread adoption of efficient cleaning solutions across residential and commercial sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global household cleaning tools and supplies market, driven by increasing disposable incomes, changing lifestyles, and growing penetration of organized retail and e-commerce channels

- The mops and brooms segment held the largest market revenue share in 2024, driven by their essential role in daily household cleaning routines and the availability of innovative designs such as spin mops and microfiber brooms. These tools offer enhanced cleaning efficiency and convenience, making them indispensable for both residential and commercial application

Report Scope and Household Cleaning Tools and Supplies Market Segmentation

|

Attributes |

Household Cleaning Tools and Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Procter & Gamble (U.S.) |

|

Market Opportunities |

• Rising Adoption Of Eco-Friendly Cleaning Products |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Household Cleaning Tools and Supplies Market Trends

Rising Demand For Sustainable And Eco-Friendly Cleaning Products

- The global shift toward environmental sustainability is driving a growing preference for eco-friendly household cleaning tools and supplies. Consumers are increasingly choosing biodegradable sponges, refillable cleaning solutions, and recyclable packaging to reduce environmental impact and plastic waste. This trend aligns with the global movement toward green and sustainable lifestyles, especially in urban households where awareness of environmental footprints is high

- The heightened awareness of chemical hazards and allergies is also encouraging consumers to switch to plant-based and non-toxic cleaning formulations. Brands are focusing on natural ingredients such as vinegar, citric acid, and essential oils, which offer effective cleaning without harmful residues. These products appeal to health-conscious consumers seeking safe and environmentally responsible options while maintaining high cleaning efficacy and pleasant fragrances

- Retailers and e-commerce platforms are expanding their portfolios to include sustainable cleaning solutions, driving increased market accessibility. The introduction of concentrated refills and subscription-based supply models is further reducing packaging waste while enhancing customer convenience. Many companies are also launching eco-certifications and green labeling to boost consumer trust and brand loyalty in this growing segment

- For instance, in 2024, several leading brands introduced eco-refill stations in major supermarkets across Europe and North America, allowing consumers to refill cleaning liquids using reusable containers, significantly cutting down on single-use plastic waste. This initiative also improved customer retention rates and created new business opportunities for sustainable packaging manufacturers

- While the sustainable cleaning trend is accelerating, affordability and performance parity with traditional products remain critical challenges. Manufacturers must continue innovating to balance cost, quality, and environmental benefits to sustain growth. Strategic partnerships with suppliers and advancements in biodegradable material technology are expected to further expand the market for eco-friendly cleaning tools

Household Cleaning Tools and Supplies Market Dynamics

Driver

Increasing Focus On Hygiene And Sanitation Post-Pandemic

- The COVID-19 pandemic has had a lasting impact on consumer behavior, with heightened awareness of hygiene and sanitation practices. Households are prioritizing frequent cleaning routines to maintain germ-free environments, driving consistent demand for cleaning tools such as mops, brushes, wipes, and disinfectants. This behavioral shift is expected to remain a long-term driver for the industry as hygiene becomes part of everyday lifestyle habits

- Rising urbanization and the expansion of middle-class households are contributing to increased spending on home care and cleaning essentials. Consumers are more inclined to purchase premium and specialized products that offer better performance and convenience, such as microfiber tools and multi-surface cleaning solutions. The trend is also supported by busy lifestyles that prioritize quick, efficient, and easy-to-use cleaning equipment

- The proliferation of online retail and product innovation has improved accessibility, allowing consumers to explore a wide variety of cleaning solutions. The use of antibacterial and antiviral cleaning agents has also become standard in many households, reinforcing long-term demand for disinfecting products. The availability of product reviews and digital marketing campaigns further boosts consumer engagement and brand visibility

- For instance, in 2023, a leading U.S.-based cleaning brand reported a 25% increase in sales of surface disinfectant wipes compared to pre-pandemic levels, demonstrating sustained consumer focus on hygiene and safety. The company also expanded its product line to include multi-surface antibacterial sprays and eco-friendly refills to cater to changing consumer expectations

- While increased awareness continues to drive growth, ensuring consistent product availability and addressing price sensitivity remain vital for capturing demand across emerging markets. Investments in local manufacturing and optimized supply chain logistics are becoming key strategies to meet the growing needs of diverse consumer bases globally

Restraint/Challenge

High Competition And Price Sensitivity Among Consumers

- The household cleaning tools and supplies market is highly competitive, with numerous global and regional brands offering similar products. This intense competition often leads to price wars, reducing profit margins for manufacturers and retailers. Maintaining differentiation through innovation, quality, and branding becomes increasingly challenging as consumer choices expand and brand loyalty weakens

- Consumers, particularly in developing economies, exhibit strong price sensitivity and tend to prefer low-cost alternatives or private-label products. This limits the penetration of premium or eco-friendly solutions that typically carry higher price tags, thereby affecting profitability for major brands. Manufacturers must balance affordability with product innovation to sustain demand across diverse economic segments

- Raw material price fluctuations and supply chain disruptions further impact product pricing and availability, particularly for plastic and metal-based cleaning tools. These variations can increase production costs and create inconsistencies in supply for both retailers and consumers. Furthermore, environmental regulations on plastics and packaging are adding complexity to the sourcing process for manufacturers

- For instance, during 2023, manufacturers in Asia-Pacific faced increased operational costs due to rising plastic resin prices and freight delays, leading to temporary shortages in mop and brush categories. The impact extended to retailers, who faced inventory challenges and were forced to adjust pricing strategies to manage consumer demand effectively

- To mitigate these challenges, manufacturers are focusing on cost-efficient production methods, sustainable material sourcing, and targeted marketing strategies to enhance brand loyalty and maintain market competitiveness. Strategic collaborations, digital transformation, and localized production facilities are emerging as effective approaches to achieve long-term market stability

Household Cleaning Tools and Supplies Market Scope

The market is segmented on the basis of product type, application, and end users.

- By Product Type

On the basis of product type, the household cleaning tools and supplies market is segmented into mops and brooms, cleaning brushes, wipes, gloves, and others. The mops and brooms segment held the largest market revenue share in 2024, driven by their essential role in daily household cleaning routines and the availability of innovative designs such as spin mops and microfiber brooms. These tools offer enhanced cleaning efficiency and convenience, making them indispensable for both residential and commercial applications.

The wipes segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for quick, disposable cleaning solutions that offer convenience and hygiene. The surge in antibacterial and disinfectant wipe usage post-pandemic has further accelerated growth, particularly in urban households seeking time-efficient cleaning alternatives.

- By Application

On the basis of application, the household cleaning tools and supplies market is segmented into bedroom, kitchen, living room, toilet, and others. The kitchen segment dominated the market in 2024 due to the high frequency of cleaning required to maintain hygiene and food safety standards. Consumers increasingly prefer specialized tools such as scrubbing brushes, multi-surface wipes, and grease-removal sprays for kitchen maintenance.

The toilet segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing awareness regarding sanitation and hygiene. Continuous innovation in toilet cleaning products such as ergonomic brushes, disposable wipes, and anti-bacterial cleaners is contributing to segment expansion globally.

- By End Users

On the basis of end users, the household cleaning tools and supplies market is segmented into online retail and offline retail. The offline retail segment accounted for the largest market share in 2024, supported by the wide availability of cleaning products in supermarkets, hypermarkets, and convenience stores. Consumers prefer in-person purchases for household essentials due to ease of product comparison and immediate availability.

The online retail segment is projected to grow at the fastest CAGR from 2025 to 2032, fuelled by the rapid expansion of e-commerce platforms, doorstep delivery convenience, and digital marketing strategies by leading brands. Subscription-based models and bundled offers are further encouraging consumers to purchase cleaning supplies online, enhancing long-term customer engagement.

Household Cleaning Tools and Supplies Market Regional Analysis

- North America dominated the household cleaning tools and supplies market with the largest revenue share of 38.52% in 2024, driven by a strong focus on hygiene, rising awareness of health and wellness, and the widespread adoption of efficient cleaning solutions across residential and commercial sectors

- Consumers in the region prefer innovative and eco-friendly cleaning products such as biodegradable wipes, microfiber mops, and chemical-free cleaning solutions that ensure both safety and sustainability

- This growing inclination toward cleanliness is further supported by high disposable incomes, busy lifestyles, and an increasing preference for convenient, ready-to-use cleaning products, strengthening the market position across the region

U.S. Household Cleaning Tools and Supplies Market Insight

The U.S. household cleaning tools and supplies market captured the largest revenue share in 2024 within North America, driven by strong consumer demand for innovative and time-saving cleaning tools. The increasing adoption of ergonomic and automated cleaning equipment such as electric mops and robotic cleaners reflects the ongoing lifestyle shift toward convenience. The rising influence of e-commerce platforms, combined with heightened awareness of hygiene standards post-pandemic, continues to support market growth in the country

Europe Household Cleaning Tools and Supplies Market Insight

The Europe household cleaning tools and supplies market is expected to witness steady growth from 2025 to 2032, propelled by stringent hygiene regulations and a growing focus on sustainability. European consumers increasingly prefer eco-friendly and reusable cleaning tools to minimize environmental impact. The rising demand for energy-efficient home appliances and green-certified products further boosts market expansion, particularly in countries emphasizing sustainable living and circular economy practices.

U.K. Household Cleaning Tools and Supplies Market Insight

The U.K. household cleaning tools and supplies market is projected to witness significant growth from 2025 to 2032, driven by increased awareness of home hygiene and a growing trend toward sustainable living. Consumers are actively shifting toward organic and biodegradable cleaning products, supported by government regulations encouraging reduced plastic use. The expansion of online retail and home improvement trends are also contributing to higher adoption of advanced cleaning solutions across households.

Germany Household Cleaning Tools and Supplies Market Insight

The Germany household cleaning tools and supplies market is expected to witness strong growth from 2025 to 2032, fuelled by a rising preference for eco-conscious and technologically advanced cleaning products. German consumers emphasize product quality, durability, and environmental sustainability, leading to increased adoption of reusable cleaning tools and high-efficiency equipment. The strong presence of leading manufacturers and innovative product launches is further enhancing the country’s market potential.

Asia-Pacific Household Cleaning Tools and Supplies Market Insight

The Asia-Pacific household cleaning tools and supplies market is anticipated to register the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and heightened hygiene awareness in countries such as China, Japan, and India. Expanding urban households, coupled with lifestyle modernization and government campaigns promoting cleanliness, such as India’s Swachh Bharat Mission, are contributing to strong regional demand. The growth of organized retail and e-commerce is further expanding market accessibility.

Japan Household Cleaning Tools and Supplies Market Insight

The Japan household cleaning tools and supplies market is expected to witness robust growth from 2025 to 2032, supported by the country’s focus on innovation, compact home designs, and high hygiene standards. Consumers are embracing efficient, space-saving, and technologically integrated cleaning tools suitable for urban living. In addition, the cultural emphasis on cleanliness and the popularity of multifunctional home appliances are driving demand across both residential and commercial sectors.

China Household Cleaning Tools and Supplies Market Insight

The China household cleaning tools and supplies market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by a rapidly expanding middle class, increasing consumer spending, and growing awareness of hygiene and wellness. The shift toward modern lifestyles and the expansion of domestic manufacturing capabilities have made high-quality and affordable cleaning tools widely accessible. Furthermore, the strong growth of online shopping platforms and government initiatives promoting healthy living continue to accelerate market expansion in China.

Household Cleaning Tools and Supplies Market Share

The Household Cleaning Tools and Supplies industry is primarily led by well-established companies, including:

• Procter & Gamble (U.S.)

• Bradshaw Home, Inc. (U.S.)

• Libman (U.S.)

• FREUDENBERG (Germany)

• 3M (U.S.)

• Unger Global (U.S.)

• Carlisle FoodService Products (U.S.)

• Tennant Company (U.S.)

• COMAC S.p.A. (Italy)

• Fonzo Equipment Pvt. Ltd. (India)

• Fuller Brush Company (U.S.)

• Newell Brands (U.S.)

• Techtronic Industries Co. Ltd. (Hong Kong)

• Minuteman Intl (U.S.)

• Casabella Holdings, LLC (U.S.)

• Vaibhav Trading Co. (India)

• Kärcher India (India)

• OXO (U.S.)

• Ettore Products Co. (U.S.)

• Emsco Group (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.