Global Household Robots Market

Market Size in USD Billion

CAGR :

%

USD

12.23 Billion

USD

48.54 Billion

2024

2032

USD

12.23 Billion

USD

48.54 Billion

2024

2032

| 2025 –2032 | |

| USD 12.23 Billion | |

| USD 48.54 Billion | |

|

|

|

|

Household Robots Market Size

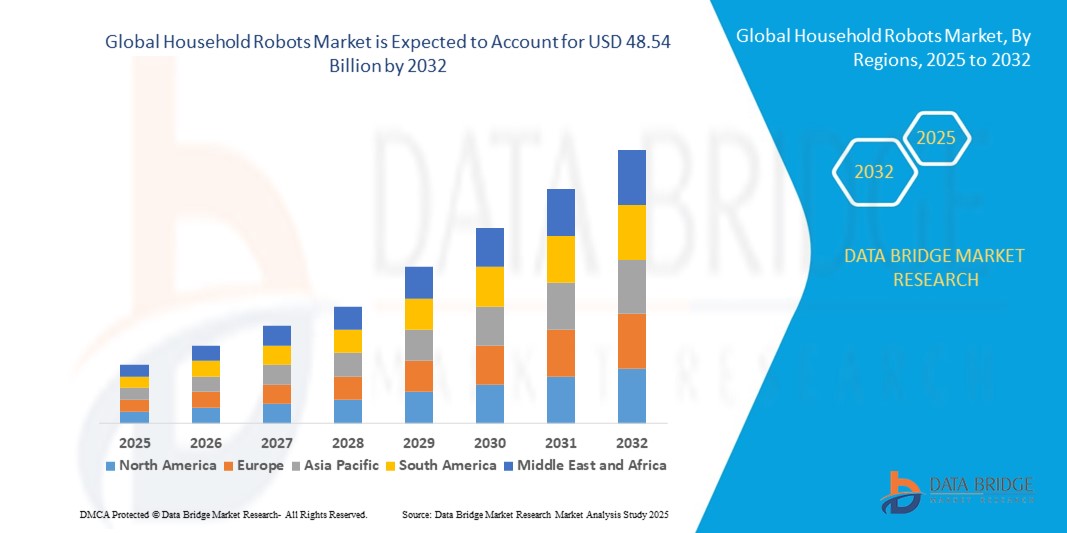

- The global household robots market size was valued at USD 12.23 billion in 2024 and is expected to reach USD 48.54 billion by 2032, at a CAGR of 18.80% during the forecast period

- The market growth is largely fuelled by increasing adoption of smart home technologies, rising demand for convenience and automation in daily household chores, and technological advancements in AI and robotics

- Growing consumer awareness about energy efficiency, improved hygiene, and enhanced home security is further driving the adoption of household robots across residential settings

Household Robots Market Analysis

- Rising investment in research and development by key players is accelerating innovation, enabling smarter, more efficient, and multifunctional household robots

- Partnerships and collaborations between technology providers and consumer electronics companies are boosting market penetration and expanding product offerings

- Asia-Pacific dominates the household robots market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, increasing disposable incomes, and rising adoption of smart home technologies across countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global household robots market, driven by rising investments in home automation, increasing awareness of robotic assistants, and the adoption of advanced domestic technologies

- The robotic vacuum & mopping segment held the largest market revenue share in 2024, driven by the increasing adoption of automated cleaning solutions in residential spaces. These robots offer convenience, time savings, and consistent performance, making them highly popular among busy households

Report Scope and Household Robots Market Segmentation

|

Attributes |

Household Robots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption Of Smart Homes And Connected Devices |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Household Robots Market Trends

Rise of Intelligent and Multi-Functional Household Robots

• The growing adoption of intelligent household robots is transforming home automation by enabling real-time cleaning, security, and assistance. These robots offer convenience, reduce human effort, and optimize household management, particularly in urban and high-density living spaces, enhancing overall productivity and lifestyle quality

• Increasing demand for multifunctional robots capable of vacuuming, mopping, lawn mowing, and elderly assistance is accelerating the market. These devices are particularly valuable in homes with busy professionals or aging populations, allowing simultaneous performance of multiple household tasks with minimal intervention

• The affordability and user-friendly designs of modern household robots are boosting adoption across middle- and high-income households. Frequent usage without complex setup improves overall efficiency, while smart connectivity enables integration with other IoT devices for seamless home automation

• For instance, in 2023, several households in the U.S. and Europe reported enhanced daily convenience and reduced manual labor after implementing robotic vacuum-mop hybrids and AI-assisted personal companion robots, leading to higher consumer satisfaction and repeat purchases

• While intelligent household robots are gaining traction, their market impact depends on continuous innovation, interoperability with smart home ecosystems, and consumer education on functionality. Manufacturers must focus on localized features, energy efficiency, and maintenance support to maximize adoption

Household Robots Market Dynamics

Driver

Increasing Demand for Smart Homes and Automation Solutions

• The rising interest in smart homes and home automation is driving demand for household robots that can perform cleaning, monitoring, and elderly assistance tasks. Consumers are prioritizing devices that offer convenience, efficiency, and energy savings, fueling innovation and product diversification in the market

• Growing urbanization and busy lifestyles are prompting homeowners to invest in automated solutions, reducing time spent on routine chores and enhancing quality of life. Multifunctional robots are particularly appealing in apartments and compact living spaces where efficiency is crucial

• Supportive government initiatives and subsidies for smart home technologies in regions such as North America, Europe, and Asia-Pacific are boosting household robot adoption. Policies encouraging energy-efficient devices and AI-based home solutions further enhance market growth

• For instance, in 2022, the European Union introduced programs supporting energy-efficient home automation, encouraging the purchase of robotic cleaning and assistance systems, which accelerated demand across residential sectors

• While automation demand is a major growth driver, manufacturers must continuously improve AI capabilities, battery efficiency, and affordability to meet evolving consumer expectations and maintain competitive advantage

Restraint/Challenge

High Costs and Limited Awareness in Emerging Markets

• The relatively high price of advanced household robots, including AI-assisted companions and multifunctional cleaning devices, restricts adoption in lower-income and emerging markets. Initial investment costs, coupled with maintenance and software updates, create barriers for widespread usage

• Many consumers in developing regions lack awareness of the benefits and capabilities of household robots. Limited knowledge about product features and interoperability with smart home systems reduces market penetration and slows adoption rates

• Supply chain challenges, including inconsistent availability of spare parts and service networks, further constrain growth. In some regions, consumers face delays in repairs and limited access to technical support, reducing confidence in robotic solutions

• For instance, in 2023, households in parts of Southeast Asia and Sub-Saharan Africa reported slow adoption of robotic vacuum and companion robots due to high costs, limited local service centers, and a lack of awareness about advanced features and benefits, restricting widespread utilization and market growth

• While technological advancements are improving performance and affordability, addressing awareness, distribution, and support challenges is critical to unlocking the full potential of the global household robots market

Household Robots Market Scope

The market is segmented on the basis of application, offering, type, and distribution channel.

- By Application

On the basis of application, the household robots market is segmented into robotic vacuum & mopping, lawn mowing, pool cleaning, companionship, and others. The robotic vacuum & mopping segment held the largest market revenue share in 2024, driven by the increasing adoption of automated cleaning solutions in residential spaces. These robots offer convenience, time savings, and consistent performance, making them highly popular among busy households.

The lawn mowing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing awareness of smart garden maintenance solutions and advancements in autonomous mowing technologies. Lawn mowing robots are increasingly preferred for their efficiency, precision, and ability to maintain large outdoor areas with minimal human intervention.

- By Offering

On the basis of offering, the household robots market is segmented into products and services. The products segment held the largest revenue share in 2024, driven by the high demand for standalone robotic devices for domestic tasks. These products provide automation, convenience, and enhanced home efficiency, attracting tech-savvy and busy consumers.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for maintenance, software updates, and subscription-based features. Service offerings enhance robot performance and extend product life, ensuring customer satisfaction and recurring revenue for manufacturers.

- By Type

On the basis of type, the household robots market is segmented into domestic and entertainment & leisure robots. The domestic segment accounted for the largest share in 2024, fueled by growing adoption of cleaning, lawn care, and pool maintenance robots. Domestic robots save time, reduce manual labor, and improve home hygiene and convenience.

The entertainment & leisure segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing popularity of companion robots, educational robots, and robotic toys. These robots offer interaction, learning opportunities, and recreation, particularly appealing to children and elderly users.

- By Distribution Channel

On the basis of distribution channel, the household robots market is segmented into online and offline channels. The online segment held the largest share in 2024, driven by the convenience of e-commerce platforms, wider product availability, and competitive pricing. Online sales offer easy comparison, doorstep delivery, and access to customer reviews.

The offline segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by consumers preferring in-store demonstrations, expert guidance, and immediate purchase. Physical stores also enable personalized assistance, enhancing customer trust and satisfaction.

Household Robots Market Regional Analysis

• Asia-Pacific dominates the household robots market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, increasing disposable incomes, and rising adoption of smart home technologies across countries such as China, Japan, and India.

• Consumers in the region highly value convenience, automation, and integration of household robots with other smart home devices, including security systems, smart speakers, and lighting solutions.

• This widespread adoption is further supported by favorable government initiatives, technological awareness, and growing demand for labor-saving devices, establishing household robots as a preferred solution for residential and commercial applications.

China Household Robots Market Insight

The China household robots market captured the largest revenue share in Asia-Pacific in 2024, fueled by a rapidly expanding middle class, high technological adoption, and increasing urbanization. The popularity of smart home devices and affordable robotic solutions, along with strong domestic manufacturing capabilities, are driving market growth across residential, commercial, and rental properties.

Japan Household Robots Market Insight

The Japan household robots market is expected to witness the fastest growth rate from 2025 to 2032 due to rapid urbanization, a high-tech culture, and increasing demand for convenient and time-saving home solutions. Companion robots and cleaning devices are particularly favored by the aging population, while integration with IoT devices such as smart cameras, lighting systems, and voice assistants further drives adoption.

Household Robots Market Share

The Household Robots industry is primarily led by well-established companies, including:

- iRobot Corporation (U.S.)

- Ecovacs Robotics Co., Ltd. (China)

- Xiaomi Corporation (China)

- Maytronics, Ltd (Israel)

- Samsung Electronics Co., Ltd. (South Korea)

- Neato Robotics, Inc. (U.S.)

- Dyson Limited (U.K.)

- LG Electronics Inc. (South Korea)

- LEGO A/S (Denmark)

- Hayward Holdings, Inc. (U.S.)

- UBTECH Robotics (China)

- Husqvarna Group (Sweden)

- Miele (Germany)

- Robomow (Israel)

- Cecotec Innovaciones S.L. (Spain)

- Monoprice, Inc. (U.S.)

- temi (U.S.)

- Deere & Company (U.S.)

- BObsweep (Canada)

- ILIFE Innovation (China)

- Sharp Corporation (Japan)

- SharkNinja Operating LLC (U.S.)

- Bissell Inc. (U.S.)

- Blue Frog Robotics (France)

- Beijing Roborock Technology Co. Ltd. (China)

Latest Developments in Global Household Robots Market

- In September 2023, Samsung Electronics Co., Ltd. launched its new Jet Cordless Vacuum range, including models 65, 75E, 85, and 95. The updated models feature lightweight designs, enhanced power, and built-in pet tools, providing efficient and hygienic cleaning solutions for households. This development strengthens Samsung’s position in the home robotics and vacuum market, catering to growing consumer demand for convenient, high-performance cleaning devices

- In March 2023, Dyson Limited expanded into Colombia, introducing its full hair care lineup and high-performing cord-free vacuum cleaners. This market entry increases Dyson’s presence in Latin America, enabling access to new customers and reinforcing the company’s global footprint in home and personal care appliances

- In June 2022, LG Electronics partnered with CJ Logistics to enter the logistics robot market. The collaboration focuses on developing autonomous order-picking robots, optimizing robot operations across logistics centers, and integrating AI and big data for improved efficiency. This initiative positions LG as a key player in smart logistics and industrial automation

- In June 2022, LEGO A/S announced the construction of a new toy brick factory in Chesterfield County, Virginia, with a USD 1 billion investment over 10 years. The facility, employing over 1,760 people, will start production in the second half of 2025, enhancing LEGO’s manufacturing capacity in the Americas and supporting global demand for its colorful bricks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Household Robots Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Household Robots Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Household Robots Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.