Global Household Vacuum Cleaners Market

Market Size in USD Billion

CAGR :

%

USD

6.88 Billion

USD

9.95 Billion

2024

2032

USD

6.88 Billion

USD

9.95 Billion

2024

2032

| 2025 –2032 | |

| USD 6.88 Billion | |

| USD 9.95 Billion | |

|

|

|

|

Household Vacuum Cleaners Market Size

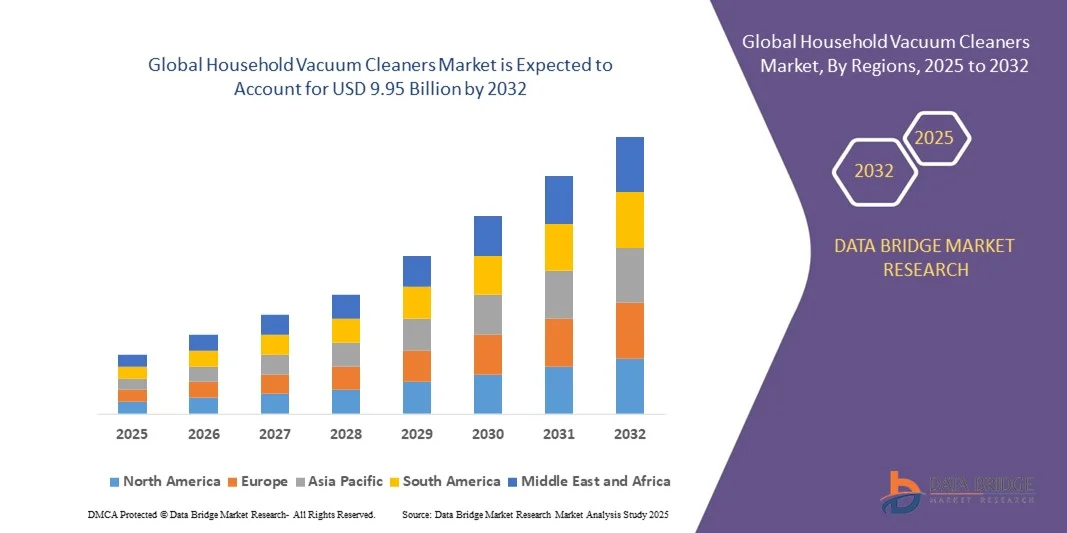

- The global household vacuum cleaners market size was valued at USD 6.88 billion in 2024 and is expected to reach USD 9.95 billion by 2032, at a CAGR of 4.73% during the forecast period

- The market growth is largely fueled by the rising adoption of modern household appliances and the integration of smart technologies in home cleaning devices, leading to increased convenience, efficiency, and automation in both residential and commercial settings

- Furthermore, growing consumer demand for time-saving, user-friendly, and energy-efficient cleaning solutions is driving the development of advanced vacuum cleaners, including cordless, robotic, and AI-enabled models. These converging factors are accelerating the adoption of high-performance vacuum cleaners, thereby significantly boosting the industry's growth

Household Vacuum Cleaners Market Analysis

- Household vacuum cleaners are appliances designed to remove dirt, dust, and debris from floors, carpets, and other surfaces. Modern devices include upright, cordless/stick, canister, robotic, and wet/dry variants, many of which incorporate smart features such as app control, automated navigation, and energy-efficient motors. These innovations enhance cleaning efficiency, convenience, and adaptability for various home environments

- The escalating demand for household vacuum cleaners is primarily fueled by increasing urbanization, rising disposable income, growing awareness of indoor hygiene, and the popularity of smart home ecosystems. Consumers are increasingly seeking versatile, compact, and high-performance cleaning solutions that reduce manual effort and improve home cleanliness standards

- Asia-Pacific dominated household vacuum cleaners market with a share of 33.4% in 2024, due to rising urbanization, expanding middle-class households, and increasing awareness of home hygiene

- North America is expected to be the fastest growing region in the household vacuum cleaners market during the forecast period due to strong consumer demand for advanced vacuum cleaners, including robotic and smart models

- Cordless/ stick segment dominated the market with a market share of 38.5% in 2024, due to its convenience, lightweight design, and ease of maneuverability. Consumers increasingly prefer cordless/stick vacuums for quick cleaning tasks and flexible use across multiple areas without being restricted by power cords. The segment also benefits from technological advancements in battery life, suction power, and compact storage, making it a popular choice for modern households. Integration with smart features such as app control and voice assistance further strengthens its appeal among tech-savvy users

Report Scope and Household Vacuum Cleaners Market Segmentation

|

Attributes |

Household Vacuum Cleaners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Household Vacuum Cleaners Market Trends

Growing Use of Robotic and Smart Vacuum Cleaners

- The household vacuum cleaners market is increasingly shaped by the rising adoption of robotic and smart cleaners as consumers prioritize convenience, automation, and connected living solutions. These devices integrate advanced navigation, AI, and IoT-based controls to deliver efficient hands-free cleaning experiences

- For instance, iRobot’s Roomba series offers AI-driven navigation and app connectivity, while Dyson and Samsung have introduced smart robotic models with voice assistant compatibility and real-time mapping features. These innovations highlight the growing importance of connected cleaning solutions in modern households

- Robotic and smart vacuum cleaners are gaining traction due to their ability to self-operate, detect obstacles, and clean varied surfaces with minimal human intervention. Enhanced features such as app scheduling, allergen detection, and automatic docking further enhance their appeal, particularly for urban households with busy lifestyles

- In addition, integration with smart home ecosystems is a strong driver of product adoption. Voice assistant compatibility via Amazon Alexa or Google Assistant enables seamless operation, aligning with consumer preference for interconnected home appliances

- The surge in smart, AI-enabled robotic solutions signifies a transformative trend in the market, positioning automated cleaning as a household standard. As innovation continues, smart vacuums are redefining convenience, hygiene, and efficiency, solidifying their role in next-generation household cleaning solutions

Household Vacuum Cleaners Market Dynamics

Driver

Demand for Convenient, Cordless Cleaning Solutions

- The increasing consumer demand for convenient, cordless cleaning solutions is a major driver of household vacuum cleaner adoption. Compact designs, lightweight bodies, and wireless operation are redefining vacuum usability by offering flexible cleaning experiences without the constraints of plug-in devices

- For instance, Shark and Dyson have launched cordless stick vacuums that combine powerful suction with ergonomic designs and extended battery performance. These offerings address modern consumer needs for portability, ease of storage, and adaptability across multiple living environments

- Cordless vacuum cleaners allow homeowners to clean hard-to-reach areas, including stairs, corners, and car interiors, improving overall cleaning efficiency. Their rechargeable batteries and interchangeable accessories cater to versatile cleaning requirements across surfaces such as carpets, hardwood, and upholstery

- In addition, rising demand for quick and hassle-free daily cleaning—especially in urban apartments and smaller living spaces—is bolstering adoption of portable cordless models. Convenience and time-saving benefits make them highly attractive to working professionals and families with busy schedules

- The strong preference for cordless cleaning solutions demonstrates a shift toward user-friendly appliances that balance performance, flexibility, and practicality. This trend continues to strengthen the market by driving innovation in compact, ergonomic, and consumer-centric designs

Restraint/Challenge

High Cost Limiting Adoption

- The high cost of advanced vacuum cleaners, particularly robotic and smart models, presents a significant barrier to adoption, especially in price-sensitive regions. Premium products equipped with features such as AI-powered navigation, HEPA filtration, and voice assistant integration often demand higher upfront investments compared to traditional vacuums

- For instance, iRobot’s high-end robotic models and Dyson’s smart cordless vacuums command premium pricing, limiting accessibility for middle-income or budget-conscious consumers. This limits broader penetration despite strong interest in convenience solutions

- The inclusion of advanced sensors, AI modules, and lithium-ion battery technology raises manufacturing costs, which are passed on to consumers. In addition, maintenance and replacement parts for these premium devices further add to long-term costs, reducing affordability

- In emerging markets, where price sensitivity remains high, the high costs of advanced models restrict adoption and create opportunities for low-cost competitors. Budget-conscious buyers often settle for basic models or alternatives such as manual cleaning tools

- To mitigate this challenge, manufacturers are focusing on introducing mid-range robotic and cordless vacuums with essential features at competitive prices. Balancing cost and innovation will be crucial to expand market accessibility and ensure household vacuum cleaners see broader global adoption

Household Vacuum Cleaners Market Scope

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the household vacuum cleaners market is segmented into upright, cordless/stick, canister, drum, central, wet/dry, robotic, and others. The cordless/stick segment dominated the largest market revenue share of 38.5% in 2024, driven by its convenience, lightweight design, and ease of maneuverability. Consumers increasingly prefer cordless/stick vacuums for quick cleaning tasks and flexible use across multiple areas without being restricted by power cords. The segment also benefits from technological advancements in battery life, suction power, and compact storage, making it a popular choice for modern households. Integration with smart features such as app control and voice assistance further strengthens its appeal among tech-savvy users.

The robotic segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by rising adoption in busy urban households and a growing emphasis on automated home cleaning solutions. Robotic vacuum cleaners offer hands-free operation, efficient navigation using sensors, and programmable schedules, catering to consumers’ desire for convenience and time-saving devices. Their increasing compatibility with smart home ecosystems and ability to clean under furniture or hard-to-reach areas enhance their attractiveness. Growing awareness about maintaining hygiene and clean indoor environments is further boosting the adoption of robotic vacuums.

- By Distribution Channel

On the basis of distribution channel, the household vacuum cleaners market is segmented into offline and online channels. The offline segment held the largest market revenue share in 2024, driven by the traditional consumer preference to physically examine and test vacuum cleaners before purchase. Retail stores, specialty electronics outlets, and large-format stores provide the advantage of immediate product availability, in-person guidance, and the ability to compare multiple models side by side. Established brand presence and after-sales support in offline stores continue to attract a significant portion of buyers, especially in emerging markets.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing e-commerce penetration, convenient doorstep delivery, and attractive discounts or promotions offered by online marketplaces. Consumers increasingly value the ability to access detailed product specifications, reviews, and comparisons before purchasing, which enhances confidence in online buying. In addition, the rise of digital marketing, social media influence, and the availability of multiple payment options are accelerating online sales. The ongoing trend of contactless shopping and home delivery is further strengthening the online distribution channel’s growth trajectory.

Household Vacuum Cleaners Market Regional Analysis

- Asia-Pacific dominated the household vacuum cleaners market with the largest revenue share of 33.4% in 2024, driven by rising urbanization, expanding middle-class households, and increasing awareness of home hygiene

- The region’s growing disposable income, rapid adoption of modern appliances, and preference for convenient, time-saving cleaning solutions are accelerating market growth

- In addition, the availability of cost-effective manufacturing, favorable government policies supporting electronics production, and a strong retail and e-commerce infrastructure are contributing to higher consumption of vacuum cleaners across both residential and commercial sectors

China Household Vacuum Cleaners Market Insight

China held the largest share in the Asia-Pacific vacuum cleaners market in 2024, owing to its extensive manufacturing capabilities, rising consumer demand for smart and automated appliances, and strong retail penetration. The country’s increasing focus on urban housing development, e-commerce growth, and domestic brand expansion are major growth drivers. In addition, investments in R&D for energy-efficient and cordless models are boosting demand, while rising awareness of indoor air quality is further supporting market adoption.

India Household Vacuum Cleaners Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid urbanization, growing nuclear families, and increasing disposable income. Rising awareness of cleanliness, expanding e-commerce platforms, and increasing adoption of cordless and robotic vacuum cleaners are key growth factors. Government initiatives promoting smart cities and improving household electrification are strengthening demand, along with a surge in online retail and increasing availability of international and local brands.

Europe Household Vacuum Cleaners Market Insight

The Europe household vacuum cleaners market is expanding steadily, supported by high consumer awareness, a focus on energy-efficient appliances, and growing adoption of smart home devices. Stringent regulatory frameworks for energy consumption and environmental compliance drive manufacturers to innovate in low-power, high-efficiency vacuum cleaners. The increasing demand for premium models with automated and robotic features in developed economies is further enhancing market growth.

Germany Household Vacuum Cleaners Market Insight

Germany’s vacuum cleaners market is driven by a strong consumer preference for premium and energy-efficient appliances, robust retail networks, and significant investments in R&D for smart home integration. Demand is particularly strong for robotic and cordless vacuum cleaners due to lifestyle trends emphasizing convenience and time-saving solutions. The country’s focus on quality, sustainability, and advanced technology adoption underpins its market leadership.

U.K. Household Vacuum Cleaners Market Insight

The U.K. market is supported by rising adoption of robotic and cordless vacuum cleaners, increasing awareness of indoor air quality, and a mature retail and e-commerce landscape. Growing investments by manufacturers in product innovation, energy efficiency, and smart home compatibility are driving demand. Consumer interest in automated cleaning solutions and premium appliance segments further contributes to steady market growth.

North America Household Vacuum Cleaners Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by strong consumer demand for advanced vacuum cleaners, including robotic and smart models. Rising focus on home automation, indoor air quality, and time-saving cleaning solutions are key growth drivers. In addition, increasing disposable income, growing e-commerce penetration, and presence of leading global brands are accelerating market adoption.

U.S. Household Vacuum Cleaners Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by high consumer purchasing power, strong retail and online distribution networks, and increasing demand for premium and robotic vacuum cleaners. Technological innovations, such as AI-enabled navigation, app-based control, and energy-efficient designs, are supporting market growth. Presence of major players and continuous product development are reinforcing the country’s leading position in the region.

Household Vacuum Cleaners Market Share

The household vacuum cleaners industry is primarily led by well-established companies, including:

- Electrolux (Sweden)

- Eureka Forbes (India)

- Haier Inc. (China)

- GENERAL ELECTRIC COMPANY (U.S.)

- SAMSUNG (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- LG Electronics (South Korea)

- Panasonic Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Puresight Systems Private Limited (India)

- BISSELL (U.S.)

- Dyson (Singapore)

- HausVac Inc. (U.S.)

- Miele India Pvt. Ltd. (Miele) (Germany)

- BLACK+DECKER Inc. (U.S.)

- Techtronic Industries Co. Ltd. (Hong Kong)

- BSH Hausgeräte GmbH (Germany)

- Daewoo Electronics (South Korea)

- Groupe SEB (France)

- Midea Group (China)

Latest Developments in Global Household Vacuum Cleaners Market

- In September 2025, Dyson introduced the V16 Piston Animal, a flagship cordless vacuum cleaner featuring advanced floor detection, a wet roller head, and a wipe-clean mechanism. This model enhances cleaning efficiency by automatically adjusting suction power based on floor type and includes a dust compactor to increase bin capacity and simplify emptying. The V16 Piston Animal's integration of wet cleaning capabilities and app-connected interface represents a significant innovation in the cordless vacuum segment, appealing to consumers seeking versatile and intelligent cleaning solutions

- In September 2025, BISSELL launched the PowerClean FurFinder 200W Self-Standing Cordless Vacuum, designed specifically for pet owners. This model features a powerful 200W motor, a tangle-resistant brush roll, and BISSELL’s SmartSeal Allergen System, making it highly effective in removing pet hair and allergens. Its self-standing design and LED lights enhance user convenience and cleaning efficiency. The FurFinder's specialized features cater to the growing demand for pet-focused cleaning solutions, positioning BISSELL as a key player in this niche market segment

- In August 2024, LG Electronics unveiled the CordZero All-in-One Tower Combi at IFA 2024, a revolutionary vacuum cleaner that integrates the CordZero A9X stick vacuum with the CordZero R5 robot vacuum. This innovative design streamlines charging, storage, and aesthetics, offering a comprehensive cleaning solution that enhances daily cleaning efficiency. The dual auto-empty feature and sleek tower design contribute to a clutter-free home environment, appealing to consumers seeking convenience and modern design in their cleaning appliances

- In June 2023, Samsung Electronics Co., Ltd. announced the forthcoming global release of the Bespoke Jet AI, a cordless stick vacuum cleaner boasting up to 280W of suction power. This advanced model features an enhanced and self-emptying All-in-One Clean Station and incorporates AI functionality to optimize cleaning performance. The Bespoke Jet AI's powerful suction and intelligent features position it as a premium option in the market, catering to consumers seeking high-performance and smart cleaning solutions

- In April 2023, The Electrolux Group introduced a new range of stick vacuum cleaners featuring a paint-free surface to minimize environmental impact, available in six colors derived from innovative recycled plastics. This range incorporates between 43% to 49% recycled material, depending on the nozzles and colors. Electrolux's commitment to sustainability and eco-friendly design resonates with environmentally conscious consumers, expanding the brand's appeal in the growing green appliance market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HOUSEHOLD VACUUM CLEANER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL HOUSEHOLD VACUUM CLEANER MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICE INDEX

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, BY PRODUCT, 2022-2031, (USD MILLION) (MILLION UNITS)

11.1 OVERVIEW

11.2 UPRIGHT

11.3 CANISTER

11.4 CENTRAL

11.5 DRUM

11.6 WET/DRY

11.7 HANDHELD

11.8 STICK

11.9 ROBOTIC

11.1 OTHERS

12 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, BY TYPE, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 BAGGED

12.3 BAGLESS

12.4 CORDED

12.5 CORDLESS

13 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, BY POWER SOURCE, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 ELECTRIC

13.3 BATTERY-OPERATED/RECHARGEABLE

14 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 OFFLINE

14.2.1 HYPERMARKET & SUPERMARKETS

14.2.2 SPECIALTY STORES

14.2.3 OTHERS

14.3 ONLINE

14.3.1 3RD PARTY OWNED

14.3.2 COMPANY-0WNED

15 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (MILLION UNITS)

GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 SWITZERLAND

15.2.8 TURKEY

15.2.9 BELGIUM

15.2.10 NETHERLANDS

15.2.11 LUXEMBURG

15.2.12 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA & NEW ZEALAND

15.3.11 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 SAUDI ARABIA

15.5.4 UNITED ARAB EMIRATES

15.5.5 ISRAEL

15.5.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL HOUSEHOLD VACUUM CLEANER MARKET - COMPANY PROFILES

18.1 BISSEL

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 BLACK+DECKER INC

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 DYSON LTD.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 ELECTROLUX GROUP

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 EUREKA FORBES LTD

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 HAIER GROUP

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 IROBOT CORPORATION

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT UPDATES

18.8 LG ELECTRONICS

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT UPDATES

18.9 MIELE

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATES

18.1 ORECK

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 PANASONIC CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT UPDATES

18.12 PHILIPS GROUP

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

18.13 BSH HAUSGERÄTE GMBH

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT UPDATES

18.14 SAMSUNG ELECTRONICS CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT UPDATES

18.15 TECHTRONIC INDUSTRIES CO. LTD.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT UPDATES

18.16 TOSHIBA CORPORATION

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT UPDATES

18.17 KARCHER CLEANING SYSTEMS PRIVATE LIMITED

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHICAL PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 HAFCOVAC

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHICAL PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 SHOP-VAC

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHICAL PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 EMERSON ELECTRIC CO.

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHICAL PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 QUESTIONNAIRE

21 CONCLUSION

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.