Global Human Combination Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

10.80 Billion

USD

21.36 Billion

2024

2032

USD

10.80 Billion

USD

21.36 Billion

2024

2032

| 2025 –2032 | |

| USD 10.80 Billion | |

| USD 21.36 Billion | |

|

|

|

|

Human Combination Vaccines Market Size

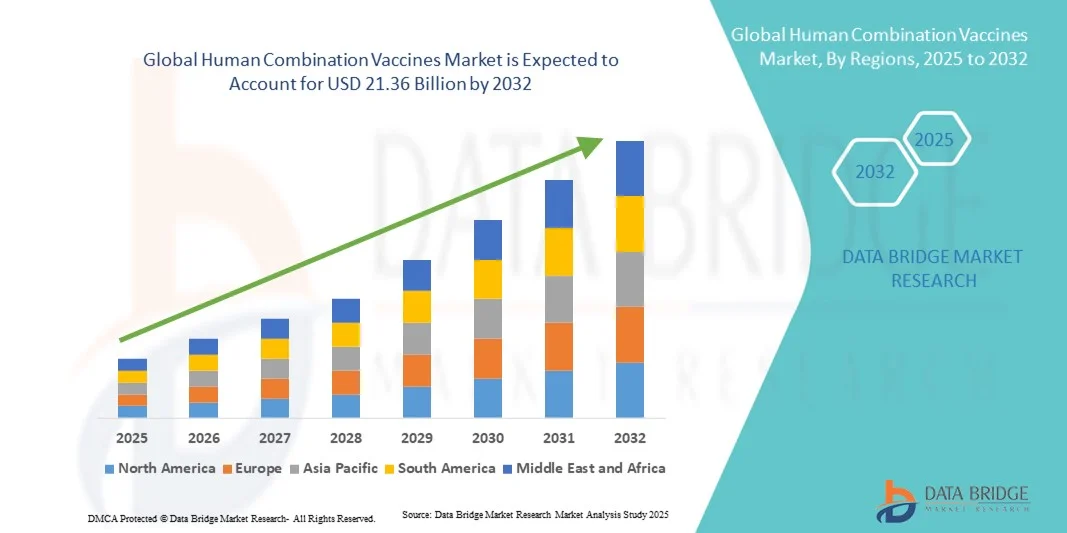

- The global human combination vaccines market size was valued at USD 10.80 billion in 2024 and is expected to reach USD 21.36 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of infectious diseases, rising pediatric population, and growing adoption of combination vaccines that reduce the number of injections while ensuring broader immunization coverage

- Furthermore, advancements in vaccine technologies, strong government immunization programs, and increasing awareness about preventive healthcare are driving the demand for human combination vaccines across all age groups, establishing them as a preferred choice in modern healthcare, thereby significantly boosting the industry’s growth

Human Combination Vaccines Market Analysis

- Human combination vaccines, offering immunization against multiple infectious diseases in a single dose, are increasingly vital components of pediatric and adult healthcare programs worldwide due to their enhanced efficiency, reduced number of injections, and broader protection coverage

- The escalating demand for combination vaccines is primarily fueled by rising incidence of infectious diseases, growing pediatric populations, and increasing awareness of the benefits of immunization in reducing hospital visits and healthcare costs

- North America dominated the human combination vaccines market with the largest revenue share of 40.7% in 2024, characterized by strong healthcare infrastructure, high immunization coverage, and a significant presence of key pharmaceutical players, with the U.S. witnessing substantial adoption of combination vaccines such as Pediarix and Pentacle, driven by innovations in vaccine formulations and government immunization programs

- Asia-Pacific is expected to be the fastest-growing region in the human combination vaccines market during the forecast period due to increasing birth rates, government-led vaccination initiatives, and rising investments in vaccine research and development

- Inactivated vaccine segment dominated the human combination vaccines market with a market share of 58.5% in 2024, driven by their stability, wide adoption, and suitability for pediatric immunization programs

Report Scope and Human Combination Vaccines Market Segmentation

|

Attributes |

Human Combination Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Human Combination Vaccines Market Trends

Advancements in Vaccine Formulations and Delivery Technologies

- A significant and accelerating trend in the global human combination vaccines market is the development of next-generation vaccine formulations, including inactivated, live attenuated, and conjugate platforms, which enhance efficacy and reduce adverse reactions

- For instance, Pediarix has been reformulated to improve stability and provide broader immunization coverage in a single dose, simplifying vaccination schedules for pediatric populations

- Innovative delivery technologies such as needle-free injectors, microneedle patches, and oral vaccine formulations are improving patient compliance and expanding accessibility in both developed and developing regions

- Combination vaccines are increasingly integrated into national immunization programs, enabling streamlined administration alongside other routine vaccines, thereby reducing healthcare visits and logistical challenges

- This trend towards safer, more efficient, and patient-friendly vaccines is reshaping expectations for immunization programs. Consequently, companies such as GlaxoSmithKline are investing in advanced combination vaccines with improved immune response and simplified dosing regimens

- The adoption of advanced vaccine formulations and delivery methods is growing rapidly across both pediatric and adult populations, as governments and healthcare providers prioritize efficient, comprehensive immunization strategies

Human Combination Vaccines Market Dynamics

Driver

Increasing Demand Due to Rising Infectious Disease Burden and Immunization Awareness

- The increasing prevalence of infectious diseases among children and adults, coupled with heightened awareness of vaccination benefits, is a significant driver for the growing demand for human combination vaccines

- For instance, rising cases of diphtheria, pertussis, and tetanus in certain regions have prompted public health authorities to adopt pentavalent and hexavalent vaccines in routine immunization schedules

- Combination vaccines offer multiple protections in a single dose, reducing the number of injections and enhancing patient compliance, making them a preferred choice for healthcare systems worldwide

- Furthermore, government vaccination campaigns and global health initiatives are promoting the widespread adoption of combination vaccines, ensuring coverage in both urban and rural populations

- The convenience of fewer injections, reduced healthcare visits, and broader disease coverage are key factors propelling the adoption of combination vaccines in pediatric and adult populations globally

Restraint/Challenge

Cold Chain Management and Regulatory Compliance Hurdles

- Challenges related to maintaining stringent cold chain conditions during storage and transportation pose significant hurdles for broader market penetration, as vaccines must remain within precise temperature ranges to retain efficacy

- For instance, inadequate cold chain infrastructure in some developing regions has led to vaccine spoilage and reduced immunization coverage, limiting market growth

- Compliance with stringent regulatory requirements across different countries increases the complexity and cost of vaccine production, approval, and distribution, affecting market expansion

- In addition, concerns about potential side effects, vaccine hesitancy among certain populations, and misinformation can negatively impact acceptance of combination vaccines

- Overcoming these challenges through robust cold chain logistics, streamlined regulatory processes, public awareness campaigns, and ongoing research into safer formulations is crucial for sustained market growth

Human Combination Vaccines Market Scope

The market is segmented on the basis of type, age, combination, and distribution channel.

- By Type

On the basis of type, the human combination vaccines market is segmented into inactivated and live attenuated vaccines. The inactivated vaccine segment dominated the market with the largest revenue share of 58.5% in 2024, driven by its established safety profile, stability, and wide adoption in pediatric immunization programs. Inactivated vaccines are often preferred in national immunization schedules due to their ability to provide reliable immunity with minimal side effects. Healthcare providers prioritize inactivated vaccines for both children and adults to ensure broad coverage against multiple infectious diseases. The market also benefits from government programs and international health initiatives that emphasize the use of inactivated combination vaccines for routine immunization. Furthermore, their compatibility with existing cold chain logistics and storage practices enhances accessibility, particularly in developing regions. Inactivated vaccines such as Pentacle and Kinrix are widely adopted, reflecting strong trust and familiarity among healthcare providers and caregivers.

The live attenuated vaccine segment is expected to witness the fastest growth rate of 12.8% from 2025 to 2034, fueled by increasing research and development in vaccines that provide long-lasting immunity. Live attenuated vaccines stimulate robust immune responses, often requiring fewer booster doses, making them attractive for large-scale immunization campaigns. They are increasingly being incorporated into combination formulations to reduce injection numbers and improve patient compliance. Technological advances are enabling better stability and safety of live attenuated vaccines, which is encouraging adoption in both children and adults. Companies are also focusing on expanding these vaccines’ presence in emerging markets where immunization coverage is improving rapidly. The growing awareness of the advantages of live attenuated vaccines in providing durable protection is expected to drive adoption over the forecast period.

- By Age

On the basis of age, the market is segmented into children and adults. The children segment dominated the market with a share of 62% in 2024, driven by high birth rates, routine immunization schedules, and the prevalence of pediatric-targeted combination vaccines such as Pediarix and Proquad. Parents and healthcare providers prioritize early-life immunization to prevent multiple infectious diseases efficiently, reducing the number of injections. National immunization programs and global health initiatives strongly support pediatric vaccination, reinforcing consistent demand for combination vaccines. Pediatric-focused combination vaccines offer simplified schedules, improved compliance, and reduced clinic visits, which are key factors in their widespread adoption. In addition, awareness campaigns by governments and NGOs promote vaccination in children, further boosting market penetration. The availability of vaccines suitable for various age milestones in children ensures continuity of protection throughout early development.

The adult segment is expected to witness the fastest growth at a CAGR of 11.5% from 2025 to 2034, driven by rising awareness of booster vaccinations, travel-related immunizations, and occupational health requirements. Adults increasingly seek combination vaccines that protect against multiple diseases in a single dose, reducing inconvenience and improving compliance. Growing government initiatives to expand adult immunization coverage and private healthcare programs offering combination vaccines are driving adoption. The rise of chronic disease management programs also encourages adult vaccination as part of preventative care. Companies are launching adult-specific formulations to cater to immunization gaps in older populations. Increasing awareness and accessibility are expected to fuel steady growth in adult vaccine uptake.

- By Combination

On the basis of combination, the market is segmented into Pediarix, Pentacle, Proquad, Kinrix, and others. The Pediarix segment dominated the market in 2024, accounting for the largest revenue share due to its broad coverage of DTP, hepatitis B, and polio vaccines in a single injection. Pediarix simplifies pediatric immunization schedules, reduces healthcare visits, and enhances compliance among caregivers. Governments and healthcare providers prefer Pediarix for routine immunization programs due to its proven efficacy and safety profile. The extensive clinical data supporting Pediarix and its global availability contribute to its market leadership. Pediatric healthcare institutions often stock Pediarix as a preferred combination vaccine, reinforcing its widespread use. Its strong brand recognition and adoption in developed and emerging markets ensure continued dominance.

The Proquad segment is expected to witness the fastest growth from 2025 to 2034, driven by its effective coverage of measles, mumps, rubella, and varicella in a single dose. Proquad reduces the number of injections required in pediatric immunization programs and improves compliance with vaccination schedules. Increasing government support for measles and varicella vaccination programs and rising awareness of preventable infectious diseases in children are accelerating adoption. Technological improvements in vaccine stability and safety are further encouraging its uptake. Emerging markets are increasingly adopting Proquad to optimize immunization coverage efficiently. The convenience, efficacy, and alignment with public health goals make Proquad a fast-growing segment in combination vaccines.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retailer pharmacies, and others. The hospital pharmacies segment dominated the market with the largest revenue share in 2024, driven by their critical role in administering pediatric and adult vaccines within structured healthcare systems. Hospitals often serve as the primary point of vaccination due to the presence of trained medical staff, cold chain facilities, and adherence to immunization schedules. Hospital pharmacies ensure reliable supply, proper storage, and controlled administration of combination vaccines. Partnerships between vaccine manufacturers and hospital networks strengthen distribution efficiency and accessibility. The segment benefits from institutional procurement policies and government vaccination programs implemented through hospitals. The availability of comprehensive vaccination services in hospitals reinforces this channel’s dominance.

The retailer pharmacies segment is expected to witness the fastest growth from 2025 to 2034, fueled by increasing accessibility, convenience, and rising demand for adult vaccination programs. Retail pharmacies provide walk-in services, extended operating hours, and easy access to vaccines without appointment requirements. Growing awareness campaigns and private healthcare initiatives encourage adults to receive vaccinations through retail pharmacies. Expansion of pharmacy chains in urban and semi-urban areas enhances the reach of combination vaccines. Retail pharmacies also offer counseling services and immunization reminders, promoting adherence to vaccination schedules. The convenience, widespread presence, and growing trust in pharmacy-based vaccination are driving rapid adoption in this segment.

Human Combination Vaccines Market Regional Analysis

- North America dominated the human combination vaccines market with the largest revenue share of 40.7% in 2024, characterized by strong healthcare infrastructure, high immunization coverage, and a significant presence of key pharmaceutical players

- Consumers and healthcare providers in the region highly value the efficiency, broad disease coverage, and safety offered by combination vaccines such as Pediarix and Pentacle, which simplify immunization schedules and reduce the number of injections for children and adults

- This widespread adoption is further supported by high healthcare spending, advanced cold chain logistics, and strong presence of major pharmaceutical companies, establishing combination vaccines as a preferred choice for both routine pediatric and adult immunization programs

U.S. Human Combination Vaccines Market Insight

The U.S. human combination vaccines market captured the largest revenue share of 78% in 2024 within North America, fueled by well-established pediatric and adult immunization programs and increasing awareness of vaccine-preventable diseases. Healthcare providers and parents are prioritizing combination vaccines such as Pediarix and Pentacle for their ability to reduce the number of injections and simplify vaccination schedules. The growing focus on preventive healthcare, along with robust government support for routine immunizations, further propels market adoption. Moreover, the integration of combination vaccines into school and community health programs is significantly contributing to widespread coverage and higher uptake rates.

Europe Human Combination Vaccines Market Insight

The Europe human combination vaccines market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong government immunization policies and the increasing demand for comprehensive pediatric vaccination programs. Rising urbanization, higher healthcare spending, and growing awareness of vaccine-preventable diseases are fostering market adoption. European healthcare providers are also drawn to combination vaccines for their efficiency and ability to improve compliance with immunization schedules. The region is witnessing significant growth across hospitals, clinics, and community health centers, with combination vaccines being integrated into both routine and catch-up immunization programs.

U.K. Human Combination Vaccines Market Insight

The U.K. human combination vaccines market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of pediatric vaccination and the need for streamlined immunization schedules. Concerns regarding preventable infectious diseases are encouraging both caregivers and healthcare providers to prefer combination vaccines. The U.K.’s advanced healthcare infrastructure, along with strong awareness campaigns and school-based immunization programs, is expected to continue stimulating market growth. The adoption of vaccines such as Proquad and Kinrix in routine programs ensures broad coverage and improved compliance, further supporting market expansion.

Germany Human Combination Vaccines Market Insight

The Germany human combination vaccines market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of infectious diseases and the preference for efficient immunization strategies. Germany’s well-developed healthcare infrastructure, combined with emphasis on innovation and preventative care, promotes the adoption of combination vaccines in both children and adults. Integration of combination vaccines into routine immunization schedules, along with public health campaigns and private healthcare initiatives, is driving consistent demand. The strong focus on vaccine safety and efficacy aligns with local regulatory standards, further encouraging adoption.

Asia-Pacific Human Combination Vaccines Market Insight

The Asia-Pacific human combination vaccines market is poised to grow at the fastest CAGR of 14% during the forecast period of 2025 to 2034, driven by rising birth rates, expanding pediatric populations, and increasing awareness of immunization benefits. Countries such as China, India, and Japan are witnessing higher adoption of combination vaccines due to government-led immunization programs and improving healthcare infrastructure. Furthermore, as APAC emerges as a hub for vaccine production and distribution, affordability and accessibility of combination vaccines are expanding to a wider population, boosting overall market growth.

Japan Human Combination Vaccines Market Insight

The Japan human combination vaccines market is gaining momentum due to the country’s advanced healthcare infrastructure, high immunization awareness, and focus on preventive care. The Japanese market places significant emphasis on pediatric vaccination programs, and the adoption of combination vaccines is driven by their convenience and efficacy. Integration of vaccines such as Pentacle and Proquad into routine immunization schedules, along with government support and public health initiatives, is fueling market expansion. In addition, the aging population encourages broader adult vaccination coverage, including booster doses, contributing to steady growth.

India Human Combination Vaccines Market Insight

The India human combination vaccines market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s growing birth rate, increasing pediatric population, and expanding healthcare access. India stands as one of the largest emerging markets for combination vaccines, with rising adoption in hospitals, clinics, and public health programs. Government initiatives for immunization, increasing awareness among parents, and availability of affordable vaccines are key factors propelling the market in India. The presence of strong domestic manufacturers further supports widespread distribution and accessibility across urban and rural areas.

Human Combination Vaccines Market Share

The Human Combination Vaccines industry is primarily led by well-established companies, including:

- Sanofi (France)

- GSK plc (U.K.)

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson and its affiliates. (U.S.)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Moderna, Inc. (U.S.)

- Serum Institute of India Pvt. Ltd. (India)

- Sinovac Biotech Ltd. (China)

- Hualan Biological Engineering Inc. (China)

- VBI Vaccines Inc. (Canada)

- Vaxart, Inc. (U.S.)

- Valneva SE (France)

- Inovio Pharmaceuticals, Inc. (U.S.)

What are the Recent Developments in Global Human Combination Vaccines Market?

- In August 2025, the U.S. Department of Health and Human Services (HHS) announced it would cease mRNA vaccine development through its Biomedical Advanced Research and Development Authority (BARDA). This decision includes the cancellation of a contract with Moderna for a late-stage bird flu vaccine and the rejection of proposals from major firms such as Pfizer, Sanofi Pasteur, CSL Seqirus, and Gritstone

- In July 2025, Sanofi announced its agreement to acquire Vicebio Ltd, a privately held biotechnology company headquartered in London, UK. The acquisition brings an early-stage combination vaccine candidate for respiratory syncytial virus (RSV) and human metapneumovirus (hMPV), both respiratory viruses, and expands Sanofi's capabilities in vaccine design and development with Vicebio’s 'Molecular Clamp' technology

- In February 2025, the U.S. Food and Drug Administration approved GSK's combination vaccine, Penmenvy, designed to protect against meningococcal infections in individuals aged 10 to 25. Penmenvy combines components from two existing GSK vaccines, Bexsero and Menveo, to defend against the five most common strains of the bacteria. The approval was based on a late-stage study with around 3,650 participants, demonstrating that the combination vaccine was as effective as its component vaccines

- In August 2024, Pfizer and BioNTech provided an update on their mRNA-based combination vaccine program targeting both influenza and COVID-19. The companies announced top-line results from their Phase 3 clinical trial evaluating the combined mRNA vaccine candidate in healthy individuals aged 18-64. The combination candidate consists of Pfizer’s mRNA-based influenza vaccine and the companies’ licensed COVID-19 vaccine

- In December 2023, AstraZeneca announced its acquisition of Icosavax, a biotechnology company specializing in vaccine development. Icosavax's lead program is a combination vaccine candidate targeting respiratory syncytial virus (RSV) and human metapneumovirus (hMPV). This acquisition aims to enhance AstraZeneca's respiratory vaccine pipeline and expand its capabilities in vaccine design and development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.