Global Human Papilloma Virus Hpv Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

4.57 Billion

2025

2033

USD

2.00 Billion

USD

4.57 Billion

2025

2033

| 2026 –2033 | |

| USD 2.00 Billion | |

| USD 4.57 Billion | |

|

|

|

|

Human Papilloma Virus Testing Market Size

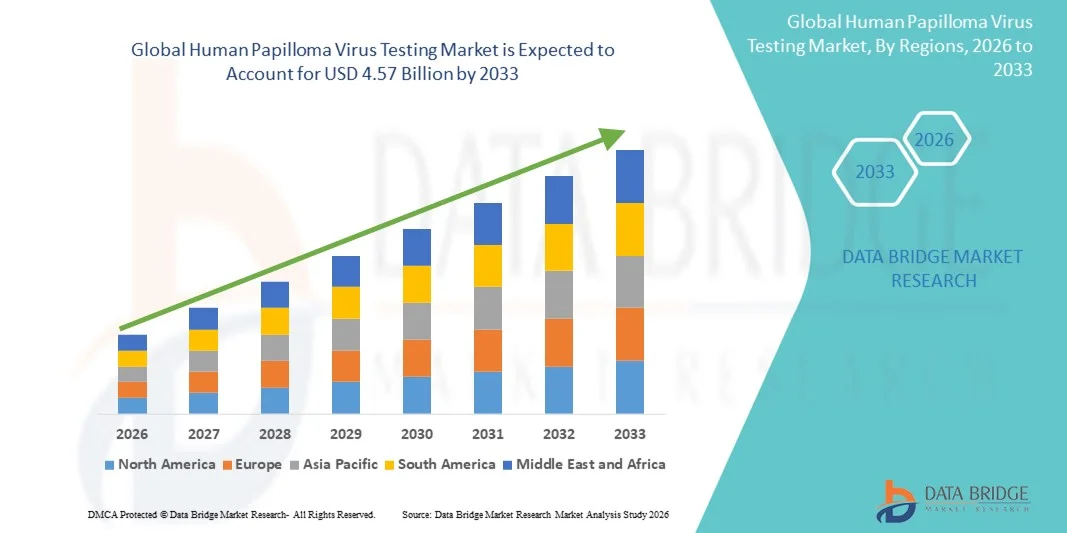

- The global Human Papilloma Virus Testing market size was valued at USD 2.00 billion in 2025 and is expected to reach USD 4.57 billion by 2033, at a CAGR of 10.90% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced molecular diagnostics and technological advancements in screening tools, leading to increased accuracy and efficiency in both clinical and laboratory settings

- Furthermore, rising awareness among healthcare providers and patients about early detection of cervical cancer and related conditions is driving the demand for Human Papilloma Virus (HPV) Testing solutions. These factors are accelerating the uptake of HPV testing platforms, thereby significantly boosting the industry's growth

Human Papilloma Virus Testing Market Analysis

- Human Papilloma Virus (HPV) testing, used for the detection of high-risk and low-risk HPV strains associated with cervical cancer and other HPV-related diseases, plays a critical role in early diagnosis, routine screening programs, and preventive healthcare strategies, especially among women aged 30 and above

- The escalating demand for HPV testing is primarily driven by the rising global prevalence of cervical cancer, increasing awareness regarding sexually transmitted infections, expanding government-led screening initiatives, and growing adoption of molecular diagnostic techniques across developed and developing regions

- North America dominated the human papilloma virus testing market with the largest revenue share of 43.5% in 2025, characterized by widespread adoption of routine cervical cancer screening programs, strong presence of leading diagnostic companies, advanced laboratory infrastructure, and high public awareness levels. The U.S. contributed the majority of the regional share, supported by favorable reimbursement policies and inclusion of HPV testing in standard clinical guidelines

- Asia-Pacific is expected to be the fastest growing region in the Human Papilloma Virus Testing market during the forecast period, registering a CAGR from 2026 to 2033, due to increasing healthcare investments, rising awareness about cervical cancer prevention, improving access to diagnostic services, and large population bases in countries such as China and India

- The Consumables segment dominated the largest market revenue share of 58.6% in 2025. This dominance is driven by the recurring and continuous demand for test kits, reagents, assay buffers, primers, probes, and sample collection materials required in HPV screening programs

Report Scope and Human Papilloma Virus Testing Market Segmentation

|

Attributes |

Human Papilloma Virus Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Roche (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Human Papilloma Virus Testing Market Trends

Enhanced Convenience Through Advanced HPV Testing Technologies

- A significant and accelerating trend in the global Human Papilloma Virus (HPV) Testing market is the increasing adoption of high-sensitivity molecular and immunoassay-based platforms. These advanced technologies are significantly enhancing the accuracy, speed, and reliability of HPV detection, enabling more effective screening and early diagnosis

- For instance, the implementation of high-throughput PCR-based HPV tests allows clinical laboratories to process large volumes of samples with reduced turnaround time, improving patient management and workflow efficiency. Similarly, self-sampling HPV kits are offering a discreet and convenient option for patients, enhancing compliance and outreach in screening programs

- Next-generation HPV testing platforms enable multiplex detection of high-risk HPV strains and co-infections, allowing clinicians to make more informed decisions regarding patient care. Innovations in point-of-care HPV testing also provide rapid results without the need for centralized laboratory infrastructure, particularly beneficial in remote or resource-limited settings

- The integration of automated sample processing and digital reporting systems facilitates seamless laboratory workflows, reducing human error and standardizing test outcomes. Through these technologies, laboratories can manage large-scale screening programs while ensuring consistent quality and reproducibility

- This trend towards faster, more sensitive, and user-friendly HPV testing is fundamentally reshaping expectations for cervical cancer screening and preventive healthcare. Consequently, companies such as Roche Diagnostics and Hologic are developing next-generation HPV assays with enhanced throughput, sensitivity, and ease-of-use

- The demand for reliable, rapid, and accurate HPV testing solutions is growing rapidly across both clinical laboratories and community health programs, as patients and healthcare providers increasingly prioritize effective early detection and streamlined diagnostic processes

Human Papilloma Virus Testing Market Dynamics

Driver

Growing Need Due to Rising Awareness and Screening Programs

- The increasing prevalence of cervical cancer and awareness about the importance of early detection are significant drivers for the heightened demand for HPV testing

- For instance, in March 2024, Roche Diagnostics launched its cobas HPV Test 2.0, which is designed to provide high-throughput, automated screening of high-risk HPV strains, supporting large-scale national screening programs. Such strategies by key companies are expected to drive the Human Papilloma Virus Testing industry growth in the forecast period

- As healthcare systems focus on reducing cervical cancer incidence, HPV testing offers reliable risk stratification and early intervention options, providing a compelling upgrade over traditional cytology-based screening

- Furthermore, the increasing implementation of national HPV vaccination and screening programs is fostering adoption of more accurate testing solutions

- The convenience of self-sampling kits, integration with laboratory information management systems, and rapid test results are key factors propelling adoption across clinical laboratories, hospitals, and community health centers. The trend toward proactive preventive care and patient-centric testing further contributes to market growth

Restraint/Challenge

Concerns Regarding Cost and Limited Infrastructure

- Cost constraints associated with high-sensitivity HPV tests and molecular platforms pose a significant challenge to broader market penetration, particularly in developing countries

- For instance, the high initial investment required for automated HPV testing platforms and laboratory infrastructure has made some healthcare providers hesitant to adopt these advanced solutions

- Addressing these cost barriers through affordable testing kits, government subsidies, and partnerships with diagnostic companies is crucial for expanding market access. Additionally, limited availability of trained personnel and laboratory facilities can restrict adoption in rural or resource-limited areas

- While prices are gradually decreasing, the perceived premium for advanced HPV tests can hinder widespread adoption, especially in regions with constrained healthcare budgets

- Overcoming these challenges through capacity building, training programs, and the development of cost-effective, portable, and easy-to-use HPV testing solutions will be vital for sustained market growth

Human Papilloma Virus Testing Market Scope

The market is segmented on the basis of product, valence, indication, distribution channel, and end user.

- By Product

On the basis of product, the Human Papilloma Virus Testing market is segmented into Consumables and Systems. The Consumables segment dominated the largest market revenue share of 58.6% in 2025. This dominance is driven by the recurring and continuous demand for test kits, reagents, assay buffers, primers, probes, and sample collection materials required in HPV screening programs. Every test conducted requires fresh consumables, which creates a steady and repetitive revenue flow for manufacturers. The growing number of cervical cancer screening initiatives and expansion of HPV testing in routine women’s health checkups have significantly increased the demand for consumables. In addition, consumables are required in high volumes by hospitals, diagnostic centers, and public health programs. Their relatively lower cost per unit compared to systems also encourages bulk procurement. Technological improvements in reagents enhancing test accuracy and shelf life further support high adoption. Large-scale government-funded screening projects in emerging markets have also fueled consumption. Partnerships between diagnostic companies and healthcare providers ensure consistent supply. Rising awareness about early HPV detection has widened the end-user base, thereby increasing consumable usage. Overall, the repeat-purchase nature of this segment ensures its sustained market dominance.

The Systems segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033. This rapid growth is driven by increasing investments in advanced diagnostic infrastructure, especially in hospitals and specialized laboratories. Automated HPV testing systems reduce human error and improve throughput, making them attractive for high-volume testing environments. Many healthcare facilities are upgrading their diagnostic equipment to support molecular and PCR-based testing. Innovations such as compact, portable, and point-of-care HPV testing machines are also driving adoption in remote and rural areas. Integration of digital reporting and cloud-based data management features is further enhancing system demand. Private diagnostic chains are increasingly investing in advanced platforms to strengthen their service offerings. Rising focus on early disease detection and precision medicine is also accelerating the procurement of modern diagnostic systems. Although the initial cost is higher, long-term operational efficiency makes it a favorable investment. These factors collectively contribute to the strong growth outlook of the Systems segment.

- By Valence

On the basis of valence, the Human Papilloma Virus Testing market is segmented into Bivalent, Quadrivalent, and Nonavalent. The Quadrivalent segment dominated the market with a revenue share of 41.3% in 2025. This segment’s dominance is supported by its widespread clinical acceptance and broad usage in multiple national immunization and screening programs. Quadrivalent solutions are designed to detect or target multiple common HPV strains associated with cervical and genital cancers. Healthcare providers favor them due to their balanced cost-to-coverage ratio and proven effectiveness. Extensive clinical data and long-term real-world evidence have strengthened confidence in this category. Governments and NGOs often prefer quadrivalent tests for mass screening as they provide wider population coverage compared to bivalent options. Strong manufacturing capacity and well-established distribution networks also enhance their availability. Additionally, high awareness among clinicians regarding their benefits boosts consistent demand. Accessibility in both developed and developing countries further reinforces its leading position. The lower cost than nonavalent alternatives also contributes to its widespread adoption. Continuous integration into routine screening programs ensures steady demand. These combined advantages maintain the strong dominance of the quadrivalent segment.

The Nonavalent segment is projected to be the fastest growing, registering a CAGR of 13.7% from 2026 to 2033. This accelerated growth is attributed to its broader coverage of additional high-risk HPV strains, offering more comprehensive detection capability. Increasing incidence of multiple HPV strain infections has created a strong demand for more advanced and inclusive testing solutions. Healthcare institutions are shifting toward higher-valence products for better clinical outcomes. Rising funding for advanced diagnostic technologies is supporting the uptake of nonavalent products. Moreover, ongoing research and improved affordability over time are making nonavalent solutions more accessible. The segment is also benefiting from growing recommendations by international health organizations to adopt broader-spectrum testing. As awareness of multi-strain HPV risk increases, demand for nonavalent options will continue to surge. Technological advancements have reduced production costs, further encouraging adoption. This strong clinical advantage is expected to significantly boost its penetration in the coming years.

- By Indication

On the basis of indication, the Human Papilloma Virus Testing market is segmented into Cervical Cancer, Anal Cancer, Vaginal Cancer, Penile Cancer, Vulvar Cancer, Oropharyngeal Cancer, and Genital Warts. The Cervical Cancer segment held the largest market share of 52.4% in 2025. This dominance is primarily due to the strong link between HPV infection and cervical cancer, which has made HPV testing a standard component of cervical cancer screening worldwide. Extensive awareness programs for women’s health have significantly driven testing rates. Governments and healthcare organizations prioritize cervical cancer prevention due to its high mortality rate if left undiagnosed. Routine Pap smear and HPV co-testing have become common in hospitals and diagnostic labs. Non-government organizations actively promote regular screening in both urban and rural areas. Technological advancements have made testing faster and more reliable, increasing patient participation. Increased funding for women’s healthcare initiatives has further strengthened this segment. Early detection significantly improves survival rates, reinforcing the importance of HPV testing. Rising female population in reproductive age also adds to the high testing volume. These factors together make cervical cancer the dominant indication in the market.

The Oropharyngeal Cancer segment is expected to grow at the fastest CAGR of 12.5% from 2026 to 2033. This growth is driven by the increasing recognition of HPV as a major risk factor for oropharyngeal cancers, especially in younger populations. Rising incidence of throat and mouth cancers linked to HPV has intensified the need for early detection. Improved diagnostic awareness among ENT specialists and oncologists is fueling the demand. The availability of more accurate molecular tests specific to oral HPV strains is also supporting growth. Public health campaigns are expanding their focus beyond cervical cancer to include head and neck cancers. Increased tobacco alternatives and lifestyle changes have altered disease patterns, increasing HPV-related oral cancer cases. Research advancements are contributing to better testing accuracy and adoption. Expansion of screening programs to include high-risk populations is also aiding growth. These trends indicate strong future expansion for this segment.

- By Distribution Channel

On the basis of distribution channel, the Human Papilloma Virus Testing market is segmented into Wholesalers, Physician Distributors, Government Entities, and Public and Private Alliances. The Government Entities segment dominated with a revenue share of 39.7% in 2025. This is due to large-scale procurement of HPV testing solutions for national screening and immunization programs. Governments play a crucial role in funding and implementing population-wide screening initiatives, especially in developing countries. Bulk purchasing through tenders ensures consistent and high-volume demand. Many public hospitals and clinics receive HPV testing materials directly from government sources. Strong involvement of ministries of health ensures stable supply chains. International collaborations with WHO and other agencies further strengthen government-led distribution. Free and subsidized testing programs also increase overall test volume. This channel ensures wide geographic reach, including rural and underserved populations. Government-backed awareness campaigns further increase testing participation. All these factors contribute to the dominant position of this channel.

The Public and Private Alliances segment is expected to grow the fastest at a CAGR of 14.2% from 2026 to 2033. Increasing partnerships between private diagnostic companies and public health bodies are driving this rapid growth. These alliances aim to improve accessibility, affordability, and efficiency of HPV testing services. Many private players are collaborating with NGOs and international health organizations to expand testing coverage. These collaborations focus on innovative testing models and mobile screening units in remote regions. Shared funding models make advanced testing more accessible. Increasing emphasis on public-private partnerships to address global health challenges supports this expansion. Digital health platforms integrated into these alliances further accelerate growth. The flexibility and scalability of such collaborations make them highly effective. This model is expected to play a major role in expanding global HPV testing coverage in the future.

- By End User

On the basis of end user, the Human Papilloma Virus Testing market is segmented into Hospitals, Physicians' Office Laboratories, Clinical Diagnostic Laboratories, and Others. The Clinical Diagnostic Laboratories segment dominated the market with a 46.8% revenue share in 2025. These facilities have advanced infrastructure and specialized equipment necessary for high-throughput HPV testing. They handle a large volume of samples from hospitals and clinics on a daily basis. Their expertise in molecular diagnostics ensures accurate and reliable results. Centralized lab networks allow easier access and faster turnaround times. Many governments and healthcare providers outsource testing to these labs. Technological upgrades and automation in diagnostic labs improve efficiency and reduce errors. Growing preference for specialized testing centers further boosts this segment. Increased investment in laboratory expansion in urban areas also supports growth. Their ability to manage large-scale screening programs strengthens their dominance. This makes them the most preferred end-user segment globally.

The Physicians’ Office Laboratories segment is expected to register the fastest CAGR of 10.8% from 2026 to 2033. This growth is driven by the rising trend of point-of-care and decentralized testing. Many physicians are incorporating in-house testing capabilities to provide faster diagnosis and treatment. Increasing adoption of compact and easy-to-use HPV testing kits supports this expansion. Patients prefer on-site testing due to convenience and reduced waiting time. Technological advancements have simplified testing procedures for use in smaller settings. Growing healthcare infrastructure in semi-urban areas is also contributing to this surge. These offices play a crucial role in early detection and routine screening. Increasing awareness among general practitioners about HPV risks supports adoption. Overall, this segment is expected to grow significantly over the forecast period.

Human Papilloma Virus Testing Market Regional Analysis

- North America dominated the human papilloma virus testing market with the largest revenue share of 43.5% in 2025, characterized by widespread adoption of routine cervical cancer screening programs, a strong presence of leading diagnostic companies, advanced laboratory infrastructure, and high public awareness regarding early detection and prevention of HPV-related diseases

- Extensive government-led screening initiatives, favorable reimbursement policies, and the integration of HPV testing into standard clinical guidelines have significantly strengthened testing rates across hospitals, diagnostic laboratories, and public health centers in the region

- This strong regional position is further supported by continuous investments in molecular diagnostics, increased focus on women’s health, and regular updates to national screening recommendations, driving consistent demand for HPV testing solutions in both public and private healthcare sectors

U.S. Human Papilloma Virus Testing Market Insight

The U.S. human papilloma virus testing market captured the majority share within North America in 2025, supported by well-established cervical cancer screening programs, high test adoption rates, and the presence of major diagnostic players such as Roche, Abbott, and Hologic. The inclusion of HPV testing in routine women’s health check-ups, combined with strong awareness campaigns and insurance coverage, continues to drive widespread utilization of advanced HPV diagnostic assays. In addition, the growing use of primary HPV testing as a preferred screening method over traditional cytology is further accelerating market growth in the country.

Europe Human Papilloma Virus Testing Market Insight

The Europe human papilloma virus testing market is projected to expand at a notable CAGR during the forecast period due to the increasing implementation of organized national screening programs and the rising burden of cervical and other HPV-related cancers. Governments across the region are actively promoting early detection and prevention strategies, which is boosting the uptake of HPV molecular diagnostic tests. Continuous advancements in laboratory capabilities and a strong emphasis on preventive healthcare are also supporting sustained market expansion.

U.K. Human Papilloma Virus Testing Market Insight

The U.K. human papilloma virus testing market is anticipated to grow significantly over the forecast period, driven by the National Health Service (NHS) cervical screening program and the country’s transition toward primary HPV testing. Increased public participation in screening initiatives, combined with improved access to diagnostic services and awareness campaigns, is strengthening demand for HPV test kits and systems. Ongoing efforts to eliminate cervical cancer as a public health concern are expected to further accelerate market growth.

Germany Human Papilloma Virus Testing Market Insight

The Germany human papilloma virus testing market is expected to register steady growth, supported by a robust healthcare system, high screening compliance, and a strong focus on preventive medicine. The country’s advanced diagnostic infrastructure and increasing adoption of molecular testing technologies are facilitating early and accurate detection of HPV infections. Rising investments in research and public health programs aimed at reducing cancer incidence are further contributing to market expansion.

Asia-Pacific Human Papilloma Virus Testing Market Insight

The Asia-Pacific human papilloma virus testing market is expected to be the fastest-growing region during the forecast period, registering a CAGR from 2026 to 2033, due to increasing healthcare investments, growing awareness of cervical cancer prevention, improving access to diagnostic services, and large population bases in countries such as China and India. Expanding government initiatives, the introduction of national screening programs, and the rising availability of affordable testing options are key factors driving strong regional demand.

Japan Human Papilloma Virus Testing Market Insight

The Japan human papilloma virus testing market is witnessing gradual growth, supported by rising awareness of HPV-related health risks and increasing emphasis on early cancer detection. The country’s advanced healthcare infrastructure, availability of high-precision diagnostic technologies, and growing focus on women’s health screening programs are encouraging the adoption of HPV testing. Strategic efforts to strengthen preventive healthcare and improve screening participation are expected to positively impact the market.

China Human Papilloma Virus Testing Market Insight

The China human papilloma virus testing market accounted for the largest share in Asia-Pacific in 2025, driven by rapid healthcare modernization, large-scale public health initiatives, and increasing awareness of cervical cancer risks. The expansion of diagnostic networks, rising government funding for women’s health programs, and the presence of leading domestic and international diagnostic companies are boosting the availability and affordability of HPV tests. Furthermore, nationwide screening campaigns and growing urban healthcare access are significantly contributing to the market’s continued expansion.

Human Papilloma Virus Testing Market Share

The Human Papilloma Virus Testing industry is primarily led by well-established companies, including:

• Roche (Switzerland)

• Hologic, Inc. (U.S.)

• bioMérieux (France)

• QIAGEN (Netherlands)

• Abbott (U.S.)

• Danaher Corporation (U.S.)

• BD (U.S.)

• Seegene Inc. (South Korea)

• Agilent Technologies (U.S.)

• Thermo Fisher Scientific (U.S.)

• Illumina, Inc. (U.S.)

• Meridian Bioscience (U.S.)

• Eurofins Scientific (Luxembourg)

• HTG Molecular Diagnostics (U.S.)

• GenMark Diagnostics (U.S.)

• Luminex Corporation (U.S.)

• Cepheid (U.S.)

• Zymo Research (U.S.)

• Mylab Discovery Solutions (India)

• PathoDetect Systems (India)

Latest Developments in Global Human Papilloma Virus Testing Market

- In October 2021, Abbott’s RealTime High-Risk HPV test gained wider international recognition after being validated for large-scale cervical cancer screening programs, particularly in low- and middle-income countries. This development strengthened global efforts toward standardizing HPV molecular diagnostics and increasing access to reliable, high-sensitivity testing solutions in under-screened regions

- In June 2022, Roche introduced a clinical HPV self-sampling solution designed to allow women to collect vaginal samples themselves in supervised healthcare environments. This innovation was aimed at improving screening participation rates among women who avoid traditional pelvic examinations, helping healthcare systems reach underserved and reluctant populations

- In April 2023, the World Health Organization officially endorsed HPV self-sampling as a recommended alternative to clinician-collected sampling for cervical cancer screening. This decision marked a major turning point for the HPV testing field, as it removed policy-level barriers and encouraged countries to incorporate self-collection in national screening programs to expand test coverage

- In June 2023, the WHO expanded its list of prequalified HPV diagnostic tests by approving additional molecular HPV assays. This increased the number of trusted, validated HPV testing options available for global public health programs, particularly benefiting national cervical cancer screening initiatives in developing economies

- In November 2023, several large clinical studies published positive outcomes for point-of-care HPV molecular tests, demonstrating that rapid, on-site HPV detection could be effectively used in “screen-and-treat” programs. This supported the adoption of portable HPV testing platforms in rural and resource-limited healthcare settings

- In May 2024, Roche received regulatory authorization in the United States for its HPV self-collection method used in clinical settings. This approval allowed patients to collect their own samples in healthcare facilities for HPV testing, representing a major advancement in patient-centered screening and improving access for women hesitant about traditional exams

- In August 2024, further regulatory expansions in North America permitted healthcare institutions to use multiple HPV molecular assays with patient-collected samples in clinical environments. These developments accelerated the integration of self-sampling into routine cervical cancer screening workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.