Global Humic Based Biostimulants Market

Market Size in USD Million

CAGR :

%

USD

763.68 Million

USD

1,613.36 Million

2024

2032

USD

763.68 Million

USD

1,613.36 Million

2024

2032

| 2025 –2032 | |

| USD 763.68 Million | |

| USD 1,613.36 Million | |

|

|

|

|

Humic-based Biostimulants Market Size

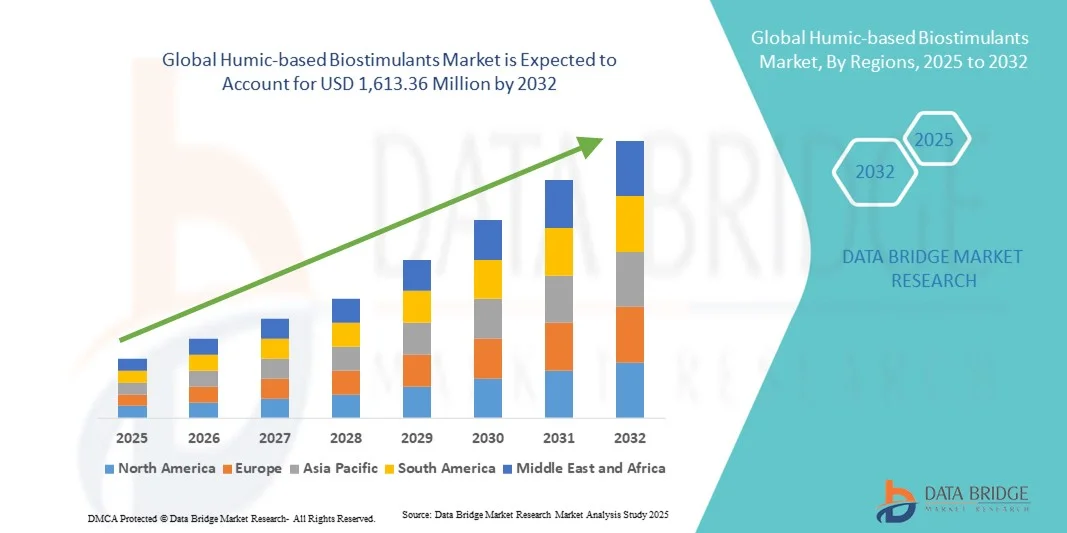

- The global humic-based biostimulants market size was valued at USD 763.68 million in 2024 and is expected to reach USD 1,613.36 million by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fuelled by the increasing adoption of sustainable agricultural practices, rising demand for organic food products, and growing awareness regarding soil health improvement

- In addition, advancements in biostimulant formulation technologies and increasing investments in agricultural biotechnology are further supporting the market expansion across major crop-producing regions

Humic-based Biostimulants Market Analysis

- The humic-based biostimulants market is witnessing significant growth owing to the rising emphasis on enhancing crop yield and quality through natural inputs. Humic substances, such as humic acid, fulvic acid, and potassium humate, are increasingly used to improve soil fertility, enhance nutrient uptake, and stimulate plant growth

- Increasing environmental concerns and restrictions on chemical fertilizers have prompted farmers to shift towards bio-based alternatives, boosting the demand for humic-based products. Furthermore, supportive government initiatives promoting sustainable farming and growing awareness among farmers regarding soil regeneration are further propelling market expansion

- Asia-Pacific dominated the humic-based biostimulants market with the largest revenue share of 41.32% in 2024, driven by the growing emphasis on sustainable farming practices and the rising adoption of organic agricultural inputs across major economies such as China and India

- North America region is expected to witness the highest growth rate in the global humic-based biostimulants market, driven by technological advancements in biostimulant formulations, expanding organic acreage, and supportive regulatory frameworks promoting sustainable agriculture

- The humic acid segment held the largest market revenue share in 2024, driven by its extensive use in improving soil fertility, enhancing nutrient absorption, and promoting root development across a wide range of crops. Its proven effectiveness in both organic and conventional farming systems has made it a preferred choice for farmers seeking sustainable soil enhancement solutions

Report Scope and Humic-based Biostimulants Market Segmentation

|

Attributes |

Humic-based Biostimulants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Humic-based Biostimulants Market Trends

Rising Adoption of Sustainable and Organic Farming Practices

The increasing global shift toward sustainable and organic agriculture is significantly boosting the adoption of humic-based biostimulants. Farmers are moving away from synthetic fertilizers and chemicals to eco-friendly soil enhancers that improve productivity while maintaining environmental balance. This trend is strongly supported by the growing consumer demand for residue-free food and sustainable farming systems. The use of humic substances is increasingly being recognized as a vital component of circular agriculture, where nutrient recycling and soil restoration are prioritized to ensure long-term productivity. Moreover, the movement toward carbon-neutral farming is encouraging farmers to adopt biologically derived inputs such as humic acids to reduce chemical dependency and soil contamination. This evolution aligns with the global push toward environmentally responsible and low-emission farming practices

Humic-based products play a crucial role in improving soil fertility, water retention, and nutrient uptake efficiency, making them a preferred choice among environmentally conscious farmers. The move toward regenerative agriculture is further driving the integration of humic substances into long-term soil management strategies. These products help in improving the cation exchange capacity of soil, allowing better nutrient availability and retention during crop growth. Furthermore, humic-based inputs enhance root development and seed germination, resulting in improved plant resilience against drought and nutrient stress. Their ability to promote beneficial soil microbes also contributes to overall soil biodiversity, reinforcing long-term soil structure and sustainability

Governments and international agricultural organizations are promoting biostimulants through subsidy programs and certification frameworks. This policy support is encouraging large-scale adoption, especially in developing economies where soil degradation and declining yields have become major concerns. Many nations have started including humic-based biostimulants in organic certification schemes and integrated nutrient management policies. In addition, collaborations between research institutes and biostimulant manufacturers are focusing on developing region-specific formulations suited for various soil and crop types. This institutional backing is creating a favorable environment for manufacturers and distributors to expand their reach and educate farmers on product efficacy

For instance, in 2024, the European Union launched initiatives to promote sustainable soil management practices under its Green Deal, leading to a surge in demand for humic-based soil conditioners among organic farms. The initiative emphasized the importance of organic carbon restoration and nutrient efficiency improvement across agricultural lands. Similar policies are being implemented in other regions such as North America and Asia-Pacific, supporting the adoption of natural soil enhancement products. This has encouraged private and public sector partnerships aimed at scaling production and ensuring consistent supply chains for humic-based materials. These developments indicate a long-term structural shift toward more sustainable soil management systems globally

While the trend toward sustainability continues to strengthen, ongoing R&D and product standardization are essential to enhance product consistency, efficacy, and awareness among smallholder farmers for broader market penetration. The growing number of local and international players entering the market necessitates stricter quality control and certification mechanisms. Continued scientific research is also required to demonstrate the measurable benefits of humic-based biostimulants under different climatic and soil conditions. Expanding farmer education programs and demonstration trials will help bridge the knowledge gap and drive consistent product usage

Humic-based Biostimulants Market Dynamics

Driver

Increasing Focus on Soil Health and Fertility Enhancement

The rising concern over soil degradation and loss of fertility is one of the primary factors driving the humic-based biostimulants market. Intensive agricultural practices, excessive chemical fertilizer use, and climate change have adversely impacted soil structure, creating a growing need for organic soil rejuvenation products. Farmers are now recognizing the importance of long-term soil health in sustaining crop productivity and profitability. Humic-based solutions help restore vital soil components that are often depleted by conventional agriculture. This shift marks a transition from short-term yield optimization to holistic soil regeneration strategies

Humic substances improve nutrient absorption and stimulate microbial activity, enabling healthier crop growth and higher yields. This has led to widespread acceptance among both organic and conventional farmers seeking to enhance soil vitality and reduce dependency on chemical inputs. These substances improve the availability of macronutrients such as nitrogen and phosphorus while promoting soil aeration and moisture retention. As a result, crops grown in humic-enriched soil demonstrate enhanced resistance to environmental stress factors such as drought and salinity. The proven agronomic benefits of humic acids are helping bridge the gap between sustainable farming goals and economic viability

The increasing emphasis on sustainable agriculture by global organizations and governments has further reinforced the use of humic-based products in crop management programs. Many countries are promoting soil restoration initiatives that include biostimulant usage as part of integrated nutrient management systems. The Food and Agriculture Organization (FAO) and other international bodies have highlighted humic-based inputs as essential tools for achieving the UN’s Sustainable Development Goals (SDGs) related to soil health. These global endorsements are strengthening farmer confidence and attracting investment from agritech firms into humic-based product innovation. Such policy alignment ensures long-term stability and predictable growth for the sector

For instance, in 2023, the U.S. Department of Agriculture expanded funding for sustainable soil amendment projects, which included the application of humic-based products to restore carbon content and improve soil health. This initiative supported farmers through technical training and subsidies to integrate humic materials into their nutrient management practices. Similar programs across Latin America and Asia are also encouraging the use of organic soil conditioners to combat desertification and fertility decline. These region-specific initiatives demonstrate the universal applicability of humic-based biostimulants in addressing soil health challenges

While awareness of soil health is driving the market forward, continuous education and scientific validation of product benefits remain essential to strengthen farmer confidence and ensure long-term adoption. Demonstration farms and community-based learning platforms are crucial for building trust among farmers, especially in developing economies. Ongoing research collaborations between agricultural universities and private companies are also necessary to expand the scientific evidence base. As more data becomes available, farmers are likely to adopt humic-based biostimulants as core components of their crop input strategies

Restraint/Challenge

Lack of Product Standardization and Low Awareness in Developing Regions

The absence of uniform regulatory frameworks and product quality standards remains a major restraint in the humic-based biostimulants market. Variability in composition, purity, and performance across different manufacturers often leads to inconsistent results and limits market credibility. Without standardized labeling and testing protocols, farmers face challenges in differentiating between high-quality and low-quality products. This inconsistency can undermine confidence in the category and slow market expansion. A coordinated global effort is needed to develop harmonized quality benchmarks and approval systems

In developing regions, low farmer awareness regarding the benefits and correct usage of humic-based products hampers adoption. Many growers continue to rely heavily on traditional chemical fertilizers due to familiarity and immediate visible results, slowing the shift toward biostimulants. Lack of targeted training programs and insufficient technical support exacerbate this challenge. Agricultural extension services and cooperatives often lack the resources to educate farmers on modern soil management techniques. Addressing these informational barriers will be crucial for driving adoption among smallholder farmers who represent a large share of global agricultural output

Limited access to reliable distribution networks and technical support further restricts the market’s reach, particularly in rural agricultural areas. This lack of infrastructure makes it challenging for manufacturers to educate end-users and ensure product availability year-round. Distributors often prioritize chemical inputs with established demand, leaving biostimulants underrepresented in retail channels. To overcome this, manufacturers must develop robust supply chains and collaborate with local agribusinesses to improve product reach. Establishing mobile training units and digital education tools can also support wider accessibility and awareness

For instance, in 2024, agricultural cooperatives in parts of Southeast Asia reported that over 60% of smallholder farmers had little to no awareness of humic-based biostimulants, citing lack of extension services and product information as key obstacles. This highlights the urgent need for government-backed awareness campaigns and demonstration projects that showcase real-world benefits. Successful case studies can play a pivotal role in shifting farmer perceptions and building trust in humic-based technologies. The involvement of local NGOs and international development agencies could further accelerate outreach in underserved regions

While the market holds immense potential, overcoming awareness and standardization challenges through education programs, demonstration projects, and harmonized regulations will be vital for ensuring sustainable growth and widespread acceptance. Collaborative efforts between policymakers, industry players, and research institutions can help establish a clear regulatory structure that boosts credibility. Integrating biostimulants into government-supported agricultural input schemes will also enhance their visibility and affordability. Ultimately, addressing these challenges will unlock the full potential of humic-based biostimulants in global sustainable farming systems

Humic-based Biostimulants Market Scope

The global humic-based biostimulants market is segmented on the basis of type, application method, end-user, and origin.

- By Type

On the basis of type, the humic-based biostimulants market is segmented into humic acid, fulvic acid, and potassium humate. The humic acid segment held the largest market revenue share in 2024, driven by its extensive use in improving soil fertility, enhancing nutrient absorption, and promoting root development across a wide range of crops. Its proven effectiveness in both organic and conventional farming systems has made it a preferred choice for farmers seeking sustainable soil enhancement solutions.

The fulvic acid segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its superior solubility and bioavailability, which allow for faster nutrient transport within plants. Its ability to boost crop resilience against environmental stress and support microbial activity in soil is increasing its adoption in precision and regenerative agriculture practices globally.

- By Application Method

On the basis of application method, the humic-based biostimulants market is segmented into foliar treatment, soil treatment, and seed treatment. The soil treatment segment dominated the market in 2024, attributed to the rising focus on soil rejuvenation and fertility restoration. Soil-applied humic substances are widely recognized for their ability to enhance cation exchange capacity, improve structure, and increase water retention, resulting in improved crop yield and soil health.

The foliar treatment segment is expected to record the fastest growth rate from 2025 to 2032, as farmers increasingly prefer direct nutrient absorption methods for quick plant recovery and stress resistance. The growing use of humic foliar sprays in high-value crops such as fruits and vegetables is accelerating demand, especially among modern greenhouse and horticulture growers.

- By End-User

On the basis of end-user, the humic-based biostimulants market is segmented into farmers, related industries, and research institutes. The farmers segment accounted for the largest market share in 2024, driven by the increasing adoption of organic and sustainable farming practices worldwide. Farmers are leveraging humic-based inputs to restore degraded soils, improve nutrient efficiency, and reduce dependence on chemical fertilizers, aligning with global trends toward green agriculture.

The research institutes segment is projected to grow at the highest rate from 2025 to 2032, supported by rising investments in agricultural biotechnology and soil microbiome studies. These institutions are focusing on exploring the synergistic effects of humic substances with microbial inoculants and fertilizers to develop more efficient, crop-specific formulations.

- By Origin

On the basis of origin, the humic-based biostimulants market is segmented into natural biostimulants and synthetic biostimulants. The natural biostimulants segment dominated the market in 2024, supported by increasing global preference for organic farming inputs and eco-friendly agricultural solutions. Derived primarily from leonardite, peat, and lignite, natural humic substances are valued for their purity and environmental safety, making them the first choice among sustainable growers.

The synthetic biostimulants segment is expected to witness notable growth from 2025 to 2032, as technological advancements enable the development of cost-effective, high-performance formulations. The growing use of synthetic humates in large-scale farming operations, where consistency and rapid results are essential, is expected to expand this segment’s market presence over the forecast period.

Humic-based Biostimulants Market Regional Analysis

- Asia-Pacific dominated the humic-based biostimulants market with the largest revenue share of 41.32% in 2024, driven by the growing emphasis on sustainable farming practices and the rising adoption of organic agricultural inputs across major economies such as China and India

- Farmers in the region are increasingly adopting humic-based products to enhance soil fertility, improve water retention, and boost crop yields while reducing dependency on chemical fertilizers

- Supportive government policies promoting organic farming, coupled with increasing awareness regarding soil health and long-term productivity, are further fueling market growth across the region

China Humic-Based Biostimulants Market Insight

The China humic-based biostimulants market captured the largest revenue share in 2024 within Asia-Pacific, driven by the country’s expanding organic farming sector and strong focus on soil restoration. Government initiatives encouraging the use of eco-friendly inputs have significantly boosted the demand for humic substances. Furthermore, the growing preference for sustainable food production and the presence of numerous domestic manufacturers are contributing to market expansion.

Japan Humic-Based Biostimulants Market Insight

The Japan humic-based biostimulants market is expected to witness a strong growth rate from 2025 to 2032, driven by the country’s focus on high-efficiency, sustainable agriculture and soil improvement practices. Farmers are increasingly adopting humic substances to enhance soil organic matter, water retention, and nutrient absorption efficiency. The integration of biostimulants into precision farming and eco-friendly crop systems, supported by government initiatives promoting sustainable food production, is further propelling market expansion in Japan.

North America Humic-Based Biostimulants Market Insight

The North America humic-based biostimulants market is expected to witness steady growth from 2025 to 2032, fueled by the expanding organic farming industry and the rising focus on regenerative agriculture practices. Farmers across the region are integrating humic substances into crop management programs to restore soil health and boost productivity. Increasing consumer demand for chemical-free produce and strong R&D investments by biostimulant manufacturers are also supporting market expansion.

U.S. Humic-Based Biostimulants Market Insight

The U.S. humic-based biostimulants market accounted for the largest share within North America in 2024, supported by advanced agricultural practices and growing adoption of organic fertilizers. Government-backed sustainability initiatives and farmer awareness programs promoting soil enrichment through biostimulants are accelerating market growth. Furthermore, continuous product innovation and the presence of major biostimulant producers are reinforcing the U.S. market position.

Europe Humic-Based Biostimulants Market Insight

The Europe humic-based biostimulants market is expected to witness significant growth from 2025 to 2032, driven by stringent environmental regulations and a rising shift toward organic and regenerative farming. The European Union’s Green Deal and Common Agricultural Policy (CAP) are encouraging sustainable soil management and biostimulant adoption. Increasing collaboration between research institutes and agricultural cooperatives is further boosting the regional market outlook.

Germany Humic-Based Biostimulants Market Insight

The Germany humic-based biostimulants market is expected to grow rapidly from 2025 to 2032, supported by the country’s strong focus on sustainable agriculture and organic food production. Farmers are increasingly incorporating humic-based products into crop management systems to enhance soil fertility and nutrient availability. Furthermore, advancements in biostimulant formulation and distribution networks are expanding product accessibility across Germany’s agricultural sector.

U.K. Humic-Based Biostimulants Market Insight

The U.K. humic-based biostimulants market is projected to grow rapidly from 2025 to 2032, fuelled by the rising adoption of organic farming practices and government-led sustainability goals. Increasing demand for chemical-free, residue-free produce is driving farmers to incorporate humic-based products into their soil management routines. Furthermore, advancements in research, strong regulatory support for biostimulant use, and the U.K.’s focus on carbon-neutral agriculture are significantly contributing to market growth.

Humic-based Biostimulants Market Share

The Humic-based Biostimulants industry is primarily led by well-established companies, including:

• Eastman Chemical Company (U.S.)

• OMEX (U.K.)

• Lallemand Inc. (Canada)

• Agrinos (U.S.)

• Brandt Consolidated, Inc. (U.S.)

• FMC Corporation (U.S.)

• Valagro SpA (Italy)

• Biolchim S.p.A. (Italy)

• Isagro (Italy)

• Italpollina S.p.A. (Italy)

• ADAMA Ltd (Israel)

• Koppert Biological Systems (Netherlands)

• Haifa Group (Israel)

• Novozymes (Denmark)

• Acadian Seaplants Limited (Canada)

• Atlántica Agrícola (Spain)

• Biostadt India Limited (India)

• Trade Corporation International (Spain)

• Agroenzymas (Mexico)

• Micromix (U.K.)

• Syngenta (Switzerland)

• Bayer AG (Germany)

• UPL (India)

Latest Developments in Global Humic-based Biostimulants Market

- In April 2022, UPL Ltd. entered into a strategic collaboration with Koppert to promote sustainable agricultural practices across Spain and Portugal. Through this technical and commercial partnership, the companies aim to enhance farmers’ access to advanced biological solutions designed to improve crop health and reduce reliance on chemical inputs. The collaboration focuses on integrating biocontrol and biostimulant technologies to support environmentally responsible farming. This initiative is expected to strengthen UPL’s position in the European biologicals market while driving the regional shift toward sustainable crop management practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.