Global Hvac Air Quality Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

4.73 Billion

USD

8.92 Billion

2024

2032

USD

4.73 Billion

USD

8.92 Billion

2024

2032

| 2025 –2032 | |

| USD 4.73 Billion | |

| USD 8.92 Billion | |

|

|

|

|

HVAC Air Quality Monitoring Market Size

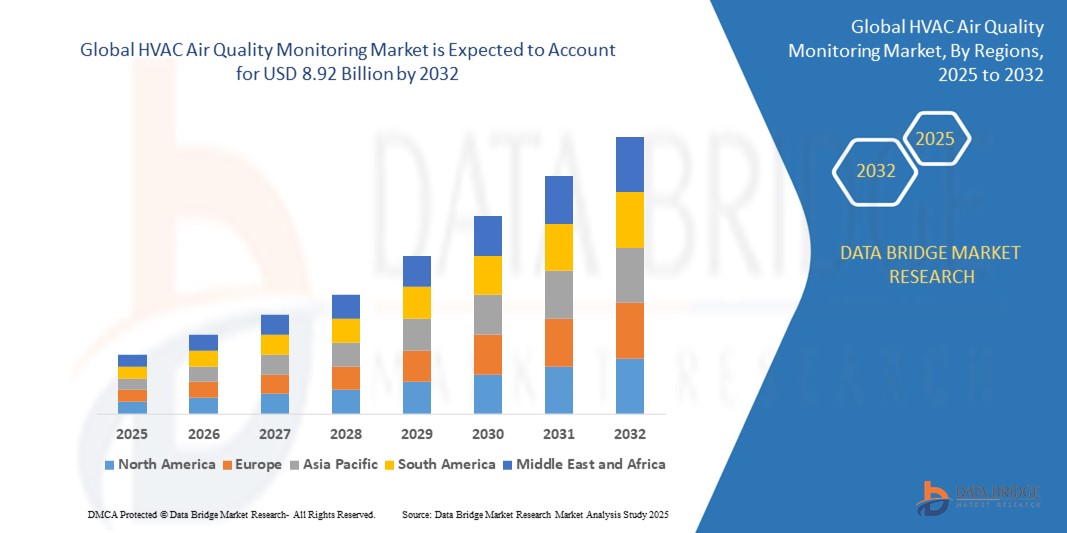

- The global HVAC Air Quality Monitoring Market market size was valued at USD 4.73 billion in 2024 and is expected to reach USD 8.92 billion by 2032, at a CAGR of 8.25% during the forecast period

- This growth is driven by increasing awareness of indoor air quality (IAQ), stringent government regulations, and the rising adoption of smart building technologies. The surge in health concerns related to air pollution and the expansion of commercial and residential construction further accelerates market expansion.

- Technological advancements, such as IoT integration and real-time monitoring, coupled with global initiatives promoting sustainable and healthy indoor environments, are propelling market growth, particularly in regions with high urbanization and pollution levels.

HVAC Air Quality Monitoring Market Analysis

- HVAC air quality monitoring systems measure pollutants, temperature, humidity, and other parameters to ensure healthy indoor environments. These systems, including portable, stationary, and wearable monitors, are critical in residential, commercial, industrial, and healthcare settings.

- The market is fueled by growing health awareness, with indoor air pollution linked to respiratory diseases like asthma, affecting over 300 million people globally in 2023. The COVID-19 pandemic heightened demand for air quality monitoring to reduce airborne transmission risks.

- The adoption of advanced technologies like electrochemical and laser-based sensors enhances monitoring accuracy, supporting applications in smart buildings and green construction. The global smart home market, valued at USD 110 billion in 2023, boosts demand for integrated IAQ solutions.

- Asia-Pacific led the global HVAC air quality monitoring market with a commanding revenue share of 37.84% in 2024, driven by rapid urbanization, industrial growth, and government initiatives in China and India. China’s air quality regulations are a key driver.

- North America is anticipated to witness the fastest growth rate, with a projected CAGR of 9.12% from 2025 to 2032, propelled by stringent EPA regulations, high consumer awareness, and IoT adoption in the U.S. and Canada.

- Among product types, the stationary monitors segment held the largest market share of 45.67% in 2024, valued at USD 2.16 billion, attributed to its widespread use in commercial and industrial applications for continuous monitoring.

Report Scope and HVAC Air Quality Monitoring Market Segmentation

|

Attributes |

HVAC Air Quality Monitoring Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

HVAC Air Quality Monitoring Market Trends

“IoT Integration, Smart Sensors, and Green Building Adoption”

- A prominent trend in the global HVAC air quality monitoring market is the widespread adoption of IoT-integrated monitors, with over 40% of new commercial installations in 2024 featuring real-time data analytics for air quality management.

- The rise of smart sensors, including electrochemical and laser-based technologies, is gaining traction, with over 35% of new monitors in 2024 offering enhanced accuracy for detecting pollutants like VOCs and CO2.

- Miniaturization of monitoring devices, driven by advancements in sensor technology, is expanding their use in residential settings, with 30% of new solutions designed for compact and wearable applications.

- The integration of AI-driven analytics is enhancing predictive maintenance, with adoption rates increasing by 15% in commercial and industrial sectors for proactive air quality management.

- Increasing focus on eco-friendly monitoring solutions, particularly for green buildings, is aligning with sustainability goals, with over 25% of new systems in 2024 certified for energy efficiency.

- The growth of online distribution channels is transforming market access, with online sales of air quality monitors growing by 10% annually, driven by e-commerce platforms for consumers and facility managers.

HVAC Air Quality Monitoring Market Dynamics

Driver

“Health Awareness, Regulatory Standards, and Smart Building Growth”

- The global rise in health awareness, with indoor air pollution linked to 3.8 million premature deaths annually, is a primary driver, increasing demand for air quality monitoring in residential and commercial spaces.

- The proliferation of stringent regulations, such as EPA standards and ASHRAE guidelines, is driving adoption, with over 60% of developed nations enforcing IAQ compliance in public buildings by 2023.

- The rise of smart buildings, with global smart building spending reaching USD 80 billion in 2023, is boosting demand for integrated air quality monitoring systems with IoT capabilities.

- Increasing urbanization, with 56% of the global population living in urban areas in 2023, is driving demand for air quality solutions in densely populated regions with high pollution levels.

- Growing commercial construction, with global construction spending projected to reach USD 15 trillion by 2026, is fueling demand for air quality monitors in offices, malls, and healthcare facilities.

- Government initiatives, such as the U.S. EPA’s USD 53.4 million investment in air monitoring projects in 2022, are promoting air quality monitoring development, supporting market growth through funding and policy.

Restraint/Challenge

“High Costs, Technical Complexities, and Calibration Issues”

- The high cost of advanced air quality monitors, particularly those with IoT and laser-based technologies, poses a challenge to adoption in cost-sensitive markets, limiting scalability for smaller facilities.

- Supply chain disruptions, including semiconductor shortages and logistical constraints, have impacted sensor production, leading to delays and increased costs, with the COVID-19 pandemic exacerbating issues.

- Technical complexities in installing and integrating air quality monitors with existing HVAC systems require specialized expertise, increasing deployment costs and time-to-market.

- Stringent regulatory requirements, such as calibration standards for pollutant detection, increase compliance costs and complexity for manufacturers.

- Calibration and maintenance issues, particularly for sensors detecting VOCs and CO2, pose a challenge to long-term reliability and accuracy, requiring frequent servicing.

- The need for continuous innovation to meet evolving technological demands, coupled with rapid obsolescence, creates pressure on manufacturers to invest heavily in R&D, limiting profitability for smaller players.

HVAC Air Quality Monitoring Market Scope

The global HVAC Air Quality Monitoring Market is segmented on the basis of product type, pollutant type, application, technology, end-user, and sales channel.

- By Product

On the basis of product type, the market is segmented into portable monitors, stationary monitors, and wearable monitors. The stationary monitors segment dominated the market with a commanding revenue share of 45.67% in 2024, valued at USD 2.16 billion, driven by its use in continuous monitoring for commercial and industrial applications.

The wearable monitors segment is anticipated to witness the fastest CAGR of 10.34% from 2025 to 2032, fueled by demand for personal health monitoring.

- By Pollutant Type

On the basis of pollutant type, the market is segmented into particulate matter, chemical pollutants, biological pollutants, carbon dioxide, and others. The particulate matter segment held the largest market revenue share of 38.46% in 2024, driven by its association with respiratory health risks.

The carbon dioxide segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by ventilation monitoring needs.

- By Application

On the basis of application, the market is segmented into residential, commercial, industrial, healthcare, institutional, and others. The commercial segment accounted for the largest market revenue share of 36.82% in 2024, driven by demand in offices and retail spaces.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by infection control needs.

- By Technology

On the basis of technology, the market is segmented into electrochemical, infrared, metal oxide semiconductor, laser-based, and others. The electrochemical segment held a significant share of 42.31% in 2024, driven by its cost-effectiveness and accuracy.

The laser-based segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by its precision in detecting fine particles.

- By End User

On the basis of end-user, the market is segmented into facility managers, building owners, government agencies, environmental consultants, and others. The facility managers segment dominated with a 41.53% revenue share in 2024, driven by their role in IAQ compliance.

The government agencies segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by regulatory enforcement.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct sales, distributors, and online retail. The direct sales segment held the largest share of 54.29% in 2024, driven by B2B contracts with commercial clients.

The online retail segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by e-commerce growth for residential users.

HVAC Air Quality Monitoring Market Regional Analysis

North America

North America is poised to grow at the fastest CAGR of approximately 9.12% from 2025 to 2032, driven by stringent EPA regulations, high consumer awareness, and IoT adoption. The U.S. accounted for 78.94% of the regional market in 2024, supported by major players like Honeywell and Thermo Fisher Scientific.

U.S. HVAC Air Quality Monitoring Market Insight

The United States is expected to dominate the North American market, driven by rigorous air quality standards, smart building trends, and government funding for air monitoring projects. The adoption of IoT and AI technologies, coupled with players like TSI Incorporated, supports market growth.

Europe HVAC Air Quality Monitoring Market Insight

Europe held a significant share of 25.63% in 2024, driven by its focus on green building certifications and stringent IAQ regulations. Countries like Germany, the U.K., and France are key contributors, with growth fueled by the adoption of air quality monitors in commercial and healthcare settings.

U.K. HVAC Air Quality Monitoring Market Insight

The United Kingdom is anticipated to grow steadily, driven by its strong construction sector and investments in sustainable buildings. Government initiatives like the Clean Air Strategy are boosting demand for air quality monitoring solutions.

Germany HVAC Air Quality Monitoring Market Insight

Germany’s market is expected to grow at a considerable CAGR, fueled by its leadership in green building standards and smart city projects. The adoption of air quality monitors, supported by players like Testo SE, drives market expansion.

Asia-Pacific HVAC Air Quality Monitoring Market Insight

Asia-Pacific dominated the global HVAC air quality monitoring market with a revenue share of 37.84% in 2024, driven by rapid urbanization, industrial growth, and air quality regulations. The commercial segment accounted for the largest application share of 42.15% in 2024, driven by office and retail demand. The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by infection control needs.

Japan HVAC Air Quality Monitoring Market Insight

Japan’s market is expanding at a notable CAGR, fueled by its advanced technology sector and focus on IAQ in commercial buildings. The presence of key players like Kanomax supports market growth.

China HVAC Air Quality Monitoring Market Insight

China captured the largest revenue share of 46.88% within Asia-Pacific in 2024, driven by its high pollution levels, with urban air quality issues affecting 70% of cities, and government policies like the Air Pollution Prevention Plan. Rapid urbanization and construction further support monitor adoption.

HVAC Air Quality Monitoring Market Share

The HVAC Air Quality Monitoring Market industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- TSI Incorporated (U.S.)

- Testo SE & Co. KGaA (Germany)

- AeroTrak (U.S.)

- Beckman Coulter (U.S.)

- Siemens AG (Germany)

- Vaisala Oyj (Finland)

- GrayWolf Sensing Solutions (U.S.)

- Extech Instruments (U.S.)

- 3M Company (U.S.)

- Emerson Electric Co. (U.S.)

- Fluke Corporation (U.S.)

- Kanomax USA, Inc. (U.S.)

- IQAir (Switzerland)

- Particle Measuring Systems (U.S.)

Latest Developments in Global HVAC Air Quality Monitoring Market

- In February 2023, Honeywell unveiled a new IoT-enabled air quality monitor specifically designed for commercial buildings. This advanced device integrates seamlessly with building management systems, providing real-time data and sophisticated analytics on various indoor air quality (IAQ) parameters. Its capabilities significantly improve IAQ analytics by an impressive 20%, allowing facility managers to make more informed decisions about ventilation and air purification. This innovative solution has seen rapid adoption, being implemented in over 100 office projects globally to create healthier and more productive work environments.

- In January 2024, Thermo Fisher Scientific introduced a state-of-the-art laser-based particulate matter monitor. This highly precise instrument offers a remarkable 15% higher accuracy in detecting and quantifying airborne particulate matter, which is crucial for sensitive environments. Its superior performance has led to its deployment in over 80 healthcare facilities across North America and Europe, where maintaining pristine air quality is paramount for patient well-being and infection control.

- In April 2024, TSI Incorporated launched a compact, wearable monitor tailored for personal indoor air quality (IAQ) tracking. This innovative device offers individuals the ability to conveniently monitor their immediate air environment, providing personal insights into their exposure to various pollutants. Its design achieves a significant 30% reduction in size while maintaining exceptional precision, making it highly portable and user-friendly. This personal IAQ tracker is rapidly gaining traction in residential markets, appealing to health-conscious consumers seeking greater control over their living spaces.

- In March 2024, Siemens AG released an advanced AI-integrated air quality solution specifically for smart buildings. This intelligent system leverages artificial intelligence to analyze air quality data, identify patterns, and even predict potential issues, thereby enhancing predictive maintenance strategies for HVAC systems and air filtration. Its proactive capabilities have led to significant adoption by major facility managers in both the U.S. and Germany, enabling them to optimize building performance and occupant comfort more effectively.

- In June 2023, Vaisala Oyj introduced a robust CO2 monitoring system developed for demanding industrial applications. This system is critical for ensuring optimal air quality and efficient ventilation in industrial settings, which directly impacts worker safety and energy consumption. It supports highly efficient ventilation strategies by providing accurate CO2 measurements, leading to its successful adoption in over 50 manufacturing plants across Asia-Pacific to improve operational efficiency and environmental compliance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.