Global Hybrid Powertrain Market

Market Size in USD Billion

CAGR :

%

USD

126.04 Billion

USD

364.62 Billion

2024

2032

USD

126.04 Billion

USD

364.62 Billion

2024

2032

| 2025 –2032 | |

| USD 126.04 Billion | |

| USD 364.62 Billion | |

|

|

|

|

Hybrid Powertrain Market Size

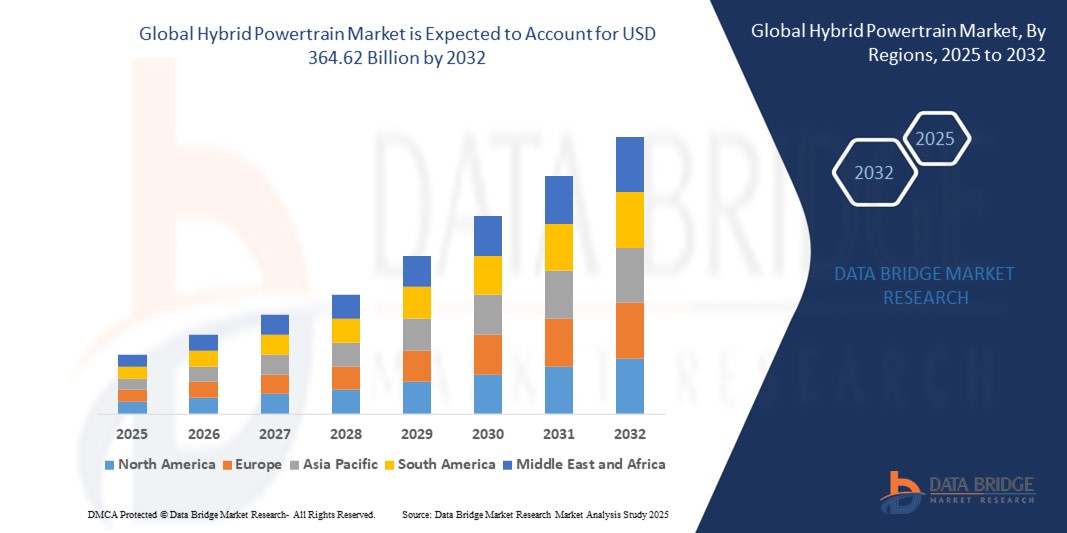

- The global hybrid powertrain market size was valued at USD 126.04 billion in 2024 and is expected to reach USD 364.62 billion by 2032, at a CAGR of 14.2% during the forecast period

- The market growth is primarily driven by increasing demand for fuel-efficient vehicles, stringent emission regulations, and growing consumer preference for eco-friendly transportation solutions

- Rising awareness of environmental sustainability and government incentives for hybrid vehicles are further propelling market demand across OEM and aftermarket channels

Hybrid Powertrain Market Analysis

- The hybrid powertrain market is experiencing robust growth due to rising consumer demand for vehicles that combine fuel efficiency with reduced carbon emissions.

- The adoption of hybrid powertrains in both passenger and commercial vehicle segments is encouraging manufacturers to innovate with advanced, cost-effective, and high-performance hybrid system

- Asia-Pacific dominated the hybrid powertrain market with the largest revenue share of 38.7% in 2024, driven by high vehicle production, government support for green mobility, and increasing consumer demand in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, fueled by rising investments in electric vehicle infrastructure, increasing adoption of hybrid vehicles, and supportive regulatory frameworks in the U.S. and Canada

- The Full Hybrid (HEV) segment dominated the largest market revenue share of 60% in 2024, driven by its seamless integration of electric and internal combustion propulsion, enabling electric-only mode at low speeds without requiring external charging infrastructure. HEVs offer superior fuel efficiency and reduced emissions, making them a practical choice for eco-conscious consumers and automakers aiming to meet stringent emission standards

Report Scope and Hybrid Powertrain Market Segmentation

|

Attributes |

Hybrid Powertrain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Hybrid Powertrain Market Trends

Increasing Integration of AI and Advanced Battery Management Systems

- The global hybrid powertrain market is experiencing a notable trend toward integrating Artificial Intelligence (AI) and advanced battery management systems

- These technologies enable optimized energy distribution, improved fuel efficiency, and enhanced vehicle performance through real-time data analysis

- AI-driven hybrid systems can dynamically adjust powertrain operations, balancing internal combustion engine and electric motor usage based on driving conditions, traffic patterns, and energy demands

- For instances, companies such as Toyota and Ford are developing AI-powered platforms to optimize powertrain configurations for better fuel economy and reduced emissions in hybrid vehicles

- This trend enhances the efficiency and appeal of hybrid powertrains, making them more attractive to both individual consumers and commercial fleet operators

- Advanced battery management systems monitor battery health, predict maintenance needs, and extend battery life, supporting the reliability of hybrid vehicles

Hybrid Powertrain Market Dynamics

Driver

Rising Demand for Fuel-Efficient and Eco-Friendly Vehicles

- Growing consumer demand for fuel-efficient and low-emission vehicles, such as hybrids, is a key driver for the global hybrid powertrain market

- Hybrid powertrains offer improved fuel economy and reduced greenhouse gas emissions through the integration of internal combustion engines with electric motors

- Government incentives, such as tax credits and rebates in regions such as the U.S. and Europe, are encouraging the adoption of hybrid vehicles

- The advancement of 5G connectivity and IoT enables real-time data transmission for hybrid powertrain systems, supporting features such as predictive maintenance and route optimization

- Automakers are increasingly incorporating factory-fitted hybrid powertrains as standard or optional features to meet environmental regulations and consumer expectations

Restraint/Challenge

High Initial Costs and Supply Chain Constraints

- The high upfront costs of hybrid powertrain components, including batteries, electric motors, and control systems, pose a significant barrier to adoption, particularly in price-sensitive markets

- Integrating hybrid powertrains into vehicles requires complex engineering and manufacturing processes, increasing production costs

- Supply chain challenges, such as shortages of critical materials such as nickel and cobalt for batteries, can disrupt production and raise costs

- Concerns over battery lifespan and recycling complexities also challenge market growth, as consumers worry about long-term maintenance and environmental impacts

- The fragmented regulatory landscape across regions regarding emissions standards and material sourcing further complicates operations for global manufacturers

Hybrid Powertrain market Scope

The market is segmented on the basis of type, vehicle type, sales channel, engine type, and powertrain configuration.

- By Type

On the basis of type, the global hybrid powertrain market is segmented into Full Hybrid (HEV), Mild Hybrid (MHEV), and Plug-In Hybrid (PHEV). The Full Hybrid (HEV) segment dominated the largest market revenue share of 60% in 2024, driven by its seamless integration of electric and internal combustion propulsion, enabling electric-only mode at low speeds without requiring external charging infrastructure. HEVs offer superior fuel efficiency and reduced emissions, making them a practical choice for eco-conscious consumers and automakers aiming to meet stringent emission standards. Their self-charging capability via regenerative braking and the internal combustion engine enhances their appeal in markets with limited charging infrastructure.

The Plug-In Hybrid (PHEV) segment is expected to register the fastest growth rate from 2025 to 2032, as advancements in battery technology and increasing consumer demand for extended electric-only ranges drive adoption. PHEVs offer flexibility with external charging capabilities and gasoline backup, appealing to consumers in urban areas with growing charging infrastructure. This segment benefits from government incentives, such as tax credits and subsidies, and is increasingly favored by fleet operators aiming to reduce emissions while maintaining operational versatility.

- By Vehicle Type

On the basis of vehicle type, the global hybrid powertrain market is categorized into passenger vehicles and commercial vehicles. The passenger vehicles segment accounted for the highest revenue share of 78.04% in 2024, driven by surging consumer demand for fuel-efficient and environmentally friendly personal transportation. The widespread availability of hybrid models, such as Toyota’s Prius and RAV4 Hybrid, and increasing regulatory pressures for lower emissions have solidified this segment’s dominance. Passenger vehicles benefit from hybrid powertrains’ ability to optimize fuel consumption in urban stop-and-go traffic, enhancing cost savings and sustainability.

The commercial vehicles segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the increasing adoption of hybrid technology in logistics, public transport, and fleet operations. Hybrid commercial vehicles, such as Ford’s Police Interceptor Utility Hybrid, offer significant fuel savings and reduced emissions in high-use scenarios such as urban delivery and municipal services. Growing environmental regulations and incentives for low-emission fleets further accelerate this segment’s growth, particularly in regions prioritizing sustainable transport solutions.

- By Sales Channel

On the basis of sales channel, the global hybrid powertrain market is segmented into OEM and aftermarket. The OEM segment held the largest revenue share in 2024, attributed to the pivotal role of major automotive manufacturers such as Toyota, Honda, and Hyundai in driving hybrid technology adoption. OEMs leverage extensive R&D, production capabilities, and consumer trust to integrate advanced hybrid powertrains into new vehicle models, supported by strategic marketing and dealership networks. Their ability to offer cutting-edge technology and comprehensive after-sales support reinforces this segment’s dominance.

The aftermarket segment is projected to grow at the fastest rate from 2025 to 2032, fueled by rising demand for retrofitting existing vehicles with hybrid powertrain components. As businesses and consumers seek cost-effective ways to enhance fuel efficiency and comply with emission regulations, aftermarket solutions provide an accessible option. The growth of online sales channels and specialized suppliers further supports this segment’s expansion, particularly for commercial fleets and older vehicle models

- By Engine Type

On the basis of engine type, the global hybrid powertrain market is segmented into gasoline electric and diesel electric. The gasoline electric segment dominated the market in 2024, driven by its widespread use in passenger vehicles and the availability of advanced gasoline-electric hybrid systems from leading manufacturers such as Toyota and Honda. Gasoline electric hybrids offer better fuel efficiency and lower emissions compared to traditional gasoline engines, making them a preferred choice in regions with stringent environmental regulations. Their compatibility with existing refueling infrastructure further enhances their market share.

The diesel electric segment is expected to grow at the fastest CAGR from 2025 to 2032, particularly in commercial vehicle applications such as long-haul trucking and vocational fleets. Diesel electric hybrids provide superior torque and fuel efficiency for heavy-duty operations, supported by advancements in diesel engine technology and increasing adoption in regions such as North America and Europe, where diesel infrastructure remains prevalent.

- By Powertrain Configuration

On the basis of powertrain configuration, the global hybrid powertrain market is segmented into parallel hybrid, series hybrid, and power split hybrid. The parallel hybrid segment held the largest revenue share in 2024, due to its scalability, cost-effectiveness, and suitability for both urban and highway driving. Parallel hybrids, used by manufacturers such as Toyota and Hyundai, allow both the electric motor and internal combustion engine to power the vehicle simultaneously, optimizing fuel efficiency and performance.

The power split hybrid segment is projected to grow at the fastest rate from 2025 to 2032, driven by its intelligent energy management and seamless power delivery. Power split hybrids, such as those in Toyota’s Prius and Ford’s Escape Hybrid, use planetary gear sets to blend engine and motor power, offering superior efficiency and adaptability across driving conditions. Their growing adoption in SUVs and premium vehicles, combined with advancements in control systems, supports rapid growth in this segment, particularly in North America and Europe.

Hybrid Powertrain Market Regional Analysis

- Asia-Pacific dominated the hybrid powertrain market with the largest revenue share of 38.7% in 2024, driven by high vehicle production, government support for green mobility, and increasing consumer demand in countries such as China, Japan, and South Korea

- Consumers prioritize hybrid powertrains for their fuel efficiency, reduced emissions, and enhanced driving performance, particularly in regions with stringent environmental regulations and high fuel costs

- Market growth is supported by advancements in hybrid technology, including improved battery systems and powertrain configurations, alongside rising adoption in both OEM and aftermarket segments

Japan Hybrid Powertrain Market Insight

Japan’s hybrid powertrain market is experiencing rapid growth due to strong consumer preference for high-quality, fuel-efficient hybrid systems that enhance driving comfort and sustainability. The presence of major automotive manufacturers, such as Toyota and Honda, and the integration of hybrid powertrains in OEM vehicles drive market penetration. Rising interest in aftermarket customization also contributes to growth.

China Hybrid Powertrain Market Insight

China holds the largest share of the Asia-Pacific hybrid powertrain market, propelled by rapid urbanization, increasing vehicle ownership, and strong demand for fuel-efficient and eco-friendly vehicles. The country’s growing middle class and focus on smart mobility support the adoption of advanced hybrid powertrains. Robust domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Hybrid Powertrain Market Insight

North America is the fastest-growing region in the global hybrid powertrain market, driven by increasing consumer demand for sustainable vehicles and supportive government policies promoting electrification. The U.S. leads with significant investments in hybrid technology and infrastructure. Growth is further fueled by advancements in full hybrid (HEV), mild hybrid (MHEV), and plug-in hybrid (PHEV) systems, catering to both passenger and commercial vehicle segments.

U.S. Hybrid Powertrain Market Insight

The U.S. hybrid powertrain market is expected to witness significant growth, fueled by strong consumer demand for fuel-efficient vehicles and growing awareness of environmental benefits. The trend toward vehicle electrification and supportive government policies, such as tax incentives for hybrid vehicles, drive market expansion. Automakers’ increasing integration of hybrid powertrains in new models complements aftermarket upgrades, fostering a diverse market ecosystem.

Europe Hybrid Powertrain Market Insight

The Europe hybrid powertrain market is witnessing significant growth, driven by stringent emissions regulations and a strong emphasis on vehicle sustainability. Consumers seek hybrid powertrains that balance performance with fuel efficiency and reduced carbon footprints. Growth is prominent in both OEM installations and aftermarket retrofits, with countries such as Germany and France showing substantial adoption due to environmental concerns and urban mobility demands.

U.K. Hybrid Powertrain Market Insight

The U.K. market for hybrid powertrains is experiencing rapid growth, driven by demand for eco-friendly vehicles and government initiatives promoting low-emission transport. Increased consumer awareness of fuel savings and environmental benefits encourages adoption. Evolving regulations, such as low-emission zones in urban areas, influence consumer preferences, balancing performance with compliance.

Germany Hybrid Powertrain Market Insight

Germany is expected to witness significant growth in the hybrid powertrain market, attributed to its advanced automotive industry and strong consumer focus on sustainability and energy efficiency. German consumers prefer technologically advanced hybrid systems that optimize fuel consumption and enhance driving dynamics. The integration of hybrid powertrains in premium vehicles and aftermarket solutions supports sustained market growth.

Hybrid Powertrain Market Share

The hybrid powertrain industry is primarily led by well-established companies, including:

- Toyota Motor Corporation (Japan)

- Honda Motor Co., Ltd. (Japan)

- Ford Motor Company (U.S.)

- General Motors Company (U.S.)

- Volkswagen AG (Germany)

- Hyundai Motor Company (South Korea)

- Nissan Motor Co., Ltd. (Japan)

- BMW AG (Germany)

- Daimler AG (Germany)

- Fiat Chrysler Automobiles N.V. (Netherlands)

- Subaru Corporation (Japan)

- Porsche AG (Germany)

- Nissan Motor Co. Ltd. (Japan)

- Kia Corporation (South Korea)

- AB Volvo (Sweden)

- Mitsubishi Motors Corporation (Japan)

What are the Recent Developments in Global Hybrid Powertrain Market?

- In September 2024, Toyota issued a safety recall for approximately 103,000 vehicles in the U.S., including 2023–2024 Corolla Cross Hybrid and 2023–2025 Corolla Hybrid models. The issue stems from a software defect in the skid control ECU for the brake actuator, which may cause a hard brake pedal during cornering, potentially increasing stopping distances and crash risk. Toyota will provide a free software update to correct the issue. This recall underscores the growing role of software in hybrid powertrains and the critical need for rigorous quality control in vehicle electronics

- In May 2024, Mitsubishi Electric, Mitsubishi Electric Mobility, and AISIN announced a joint venture to develop and market advanced components for next-generation electric vehicles. The collaboration will focus on traction motors, inverters, and control software tailored for battery EVs and hybrid powertrains. Mitsubishi Electric will hold a 66% stake, while AISIN will own 34%, reflecting a strategic alliance to combine expertise in power electronics, motor technologies, and system integration. This move aims to meet the growing demand for vehicle electrification and contribute to global carbon neutrality by offering innovative, high-performance solutions

- In September 2023, Toyota Motor Corporation launched a new version of its chauffeur-driven Century model in Japan, marking a bold step in blending luxury with hybrid innovation. Built on the Toyota New Global Architecture (TNGA) platform, the new Century SUV features a plug-in hybrid powertrain delivering up to 69 km of electric range and 406 bhp. Fully customizable to meet individual preferences, the model is produced at Toyota’s Tahara Plant, reinforcing the company’s investment in hybrid manufacturing. This launch underscores Toyota’s commitment to sustainability and personalization in the high-end automotive segment

- In April 2023, DENSO Corporation unveiled its first-ever inverter using silicon carbide (SiC) power semiconductors, marking a major leap in hybrid and electric vehicle technology. This high-efficiency inverter was integrated into the eAxle developed by BluE Nexus Corporation and installed in the Lexus RZ, Lexus’s first dedicated battery electric vehicle. SiC semiconductors significantly reduce power loss compared to traditional silicon chips, enabling lighter, more compact, and energy-efficient systems. DENSO’s innovation, branded as REVOSIC®, reflects a broader push toward carbon neutrality and advanced powertrain performance

- In January 2023, General Motors announced a $918 million investment across four U.S. powertrain facilities to support both traditional and electric vehicle production. Of this, $854 million is allocated to retool plants for the sixth-generation small block V8 engines used in full-size pickups and SUVs. The remaining $64 million will fund castings and components for electric vehicles at sites in Rochester, New York, and Defiance, Ohio. This dual-focus investment highlights GM’s commitment to meeting diverse market demands by advancing internal combustion and electrified powertrains, including hybrid

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.