Global Hybrid Trailers Market

Market Size in USD Billion

CAGR :

%

USD

24.83 Billion

USD

38.11 Billion

2024

2032

USD

24.83 Billion

USD

38.11 Billion

2024

2032

| 2025 –2032 | |

| USD 24.83 Billion | |

| USD 38.11 Billion | |

|

|

|

|

Hybrid Trailers Market Size

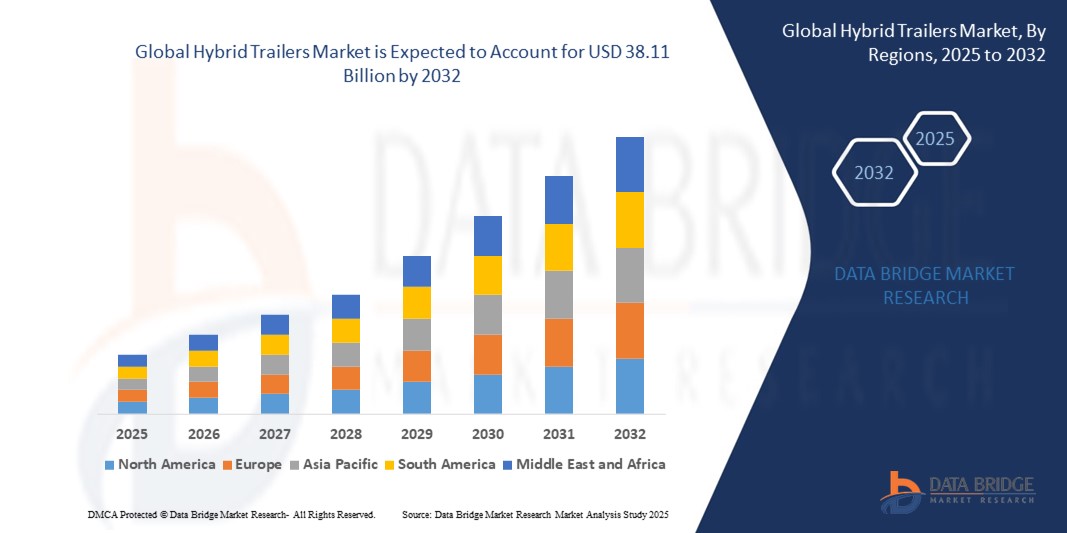

- The global hybrid trailers market size was valued at USD 24.83 billion in 2024 and is expected to reach USD 38.11 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the rising focus on reducing carbon emissions in the transportation sector, alongside the increasing adoption of sustainable logistics solutions by fleet operators

- The growing need for fuel-efficient transportation modes and government incentives promoting clean energy vehicles are further boosting demand for hybrid trailers worldwide

Hybrid Trailers Market Analysis

- The hybrid trailers market is witnessing steady growth as logistics providers and fleet operators increasingly shift towards eco-friendly alternatives to meet stringent emission standards

- Technological advancements in hybrid powertrains, battery storage systems, and lightweight materials are improving trailer performance, thereby enhancing adoption rates

- North America dominated the hybrid trailers market with the largest revenue share of 38.5% in 2024, driven by rising investments in sustainable freight solutions, government incentives for low-emission transport, and the strong presence of leading trailer manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global hybrid trailers market, driven by expanding e-commerce, rising urbanization, supportive policies for green transportation, and large-scale adoption of hybrid trailers across logistics, retail, and construction sectors

- The electric-hybrid trailers segment held the largest market revenue share in 2024, driven by the growing focus on reducing emissions and the integration of battery-electric systems with regenerative braking technologies. Electric-hybrid trailers are increasingly adopted by logistics companies aiming to comply with stricter sustainability mandates

Report Scope and Hybrid Trailers Market Segmentation

|

Attributes |

Hybrid Trailers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Hybrid Trailers Market Trends

Integration of Electrification and Telematics in Hybrid Trailers

- The rising integration of electrification technologies with advanced telematics is shaping the hybrid trailers market by offering improved fuel efficiency, predictive maintenance, and real-time monitoring. These features enable fleet operators to reduce operational costs and enhance logistics efficiency across long-haul and regional transport operations

- Growing adoption of intelligent telematics systems is accelerating fleet connectivity, enabling operators to track energy consumption, optimize routes, and monitor trailer performance remotely. Such digital solutions are especially beneficial for large logistics companies managing diverse fleets

- The increasing affordability and scalability of hybrid power systems, combined with telematics, make them attractive for both small and large fleet operators. This is leading to greater adoption in last-mile delivery and cold chain logistics, where efficiency and reliability are critical

- For instance, in 2023, several logistics firms in Europe introduced hybrid refrigerated trailers integrated with telematics, allowing them to cut fuel usage by up to 20% while ensuring precise temperature control. This reduced operating costs while meeting stricter environmental regulations

- While telematics and hybrid power integration are enhancing trailer performance and sustainability, the full impact relies on ongoing innovation, cost reduction, and wide-scale training for operators. Manufacturers must focus on developing adaptable, region-specific solutions to maximize this growing opportunity

Hybrid Trailers Market Dynamics

Driver

Growing Emphasis on Sustainable Transportation and Regulatory Push

• The rising global focus on reducing greenhouse gas emissions is compelling transport and logistics operators to adopt hybrid trailers as a viable alternative to conventional diesel trailers. Regulations promoting low-emission transport are accelerating investments in hybrid technologies

• Fleet operators are increasingly aware of the financial benefits linked to lower fuel consumption, reduced maintenance costs, and compliance with sustainability targets. This is driving adoption across regional transport and long-haul trucking networks

• Government subsidies and policy initiatives are strengthening adoption by lowering upfront costs. Several countries are implementing green transport frameworks, encouraging logistics firms to replace older fleets with fuel-efficient hybrid trailers

• For instance, in 2022, the European Union announced stricter carbon emission standards for heavy-duty vehicles, pushing logistics and transportation companies to accelerate the adoption of eco-friendly alternatives.The policy encouraged fleet operators to invest in hybrid trailers that reduce fuel consumption, improve operational efficiency, and align with sustainability goals

• While regulatory support and sustainability goals are boosting adoption, wider deployment depends on infrastructure readiness, integration with logistics networks, and continuous product innovation from manufacturers

Restraint/Challenge

High Initial Investment and Infrastructure Limitations

• The high cost of hybrid trailer systems, including advanced battery packs and electrification components, creates a barrier for small and medium-sized fleet operators. These costs limit adoption compared to conventional diesel trailers, especially in cost-sensitive regions

• Limited availability of charging and hybrid-compatible infrastructure further restricts the use of hybrid trailers, particularly for long-haul operations in remote or underdeveloped areas. This makes operators hesitant to switch from traditional fleets

• Technical expertise and maintenance support remain uneven across markets, with many fleet managers lacking access to trained personnel or service networks for hybrid technologies. This can result in higher downtime and limited efficiency gains

• For instance, in 2023, transport associations in Latin America reported that over 60% of regional operators cited high upfront cost and limited charging infrastructure as major barriers to hybrid trailer adoption. This highlighted the financial strain on small and mid-sized fleet owners who struggle to transition toward green technology

• While costs are expected to decline with technological advancements and economies of scale, infrastructure development remains a pressing challenge. Expanding charging networks and integrating renewable energy sources will be vital to support hybrid trailer usage. Financing programs and lease-based models are also being explored to make adoption more affordable

Hybrid Trailers Market Scope

The market is segmented on the basis of product type, trailer type, fuel type, load capacity, and application.

- By Product Type

On the basis of product type, the hybrid trailers market is segmented into electric-hybrid trailers, diesel-hybrid trailers, and others. The electric-hybrid trailers segment held the largest market revenue share in 2024, driven by the growing focus on reducing emissions and the integration of battery-electric systems with regenerative braking technologies. Electric-hybrid trailers are increasingly adopted by logistics companies aiming to comply with stricter sustainability mandates.

The diesel-hybrid trailers segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the balance it offers between conventional diesel power and hybrid efficiency. These trailers provide extended range and reliability, making them suitable for long-haul operations where full electrification remains challenging.

- By Trailer Type

On the basis of trailer type, the market is segmented into flatbed trailers, reefer trailers, tank trailers, and enclosed trailers. Reefer trailers held the dominant share in 2024, driven by the surge in demand for temperature-sensitive goods such as pharmaceuticals, dairy, and frozen food. Hybrid reefer trailers are widely adopted due to their ability to lower fuel consumption and operating costs while maintaining consistent cooling performance.

Flatbed trailers is expected to witness the fastest growth rate from 2025 to 2032, supported by their versatility in transporting heavy equipment, construction materials, and oversized cargo. Hybrid flatbeds offer improved efficiency for industries seeking to optimize long-haul logistics and reduce operational expenses.

- By Fuel Type

On the basis of fuel type, the hybrid trailers market is segmented into diesel, natural gas, electric, and hybrid. The hybrid segment captured the largest share in 2024, driven by its ability to combine energy efficiency with reliability for diverse transport applications. Fleets are increasingly preferring hybrid-powered trailers to meet emission reduction targets without compromising range and performance.

The electric segment is expected to witness the fastest growth rate from 2025 to 2032, supported by advancements in battery technology and the expansion of charging infrastructure. Electric hybrid trailers are being actively promoted by governments through incentives, making them a promising alternative in both developed and emerging economies.

- By Load Capacity

On the basis of load capacity, the market is segmented into light duty, medium duty, and heavy duty. Heavy-duty hybrid trailers held the largest share in 2024, fuelled by their demand in logistics, construction, and cross-border transportation. These trailers are favored for their ability to carry large volumes while reducing fuel dependency and emissions.

The medium-duty segment is expected to witness the fastest growth rate from 2025 to 2032, as they are widely used in regional delivery and urban logistics. Hybrid medium-duty trailers are gaining traction among fleet operators seeking cost-effective and sustainable transport solutions for mid-range distances.

- By Application

On the basis of application, the hybrid trailers market is segmented into long-haul transportation, regional delivery, refrigerated transport, construction support, and others. Long-haul transportation accounted for the largest market share in 2024, driven by the rising adoption of hybrid trailers in global supply chains. Their ability to reduce operational costs while meeting emission standards makes them highly attractive for international freight operators.

Refrigerated transport is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the increasing demand for cold-chain logistics across food, pharmaceuticals, and biotech industries. Hybrid reefer trailers are particularly valued for their efficiency in maintaining low temperatures with lower carbon footprints.

Hybrid Trailers Market Regional Analysis

• North America dominated the hybrid trailers market with the largest revenue share of 38.5% in 2024, driven by rising investments in sustainable freight solutions, government incentives for low-emission transport, and the strong presence of leading trailer manufacturers.

• Fleet operators in the region are prioritizing hybrid trailers to cut fuel costs, comply with stringent emission norms, and enhance operational efficiency, especially in logistics and long-haul trucking.

• The widespread adoption is also supported by a robust logistics sector, technological advancements in electrification, and growing corporate sustainability commitments, making North America a frontrunner in hybrid trailer deployment.

U.S. Hybrid Trailers Market Insight

The U.S. hybrid trailers market captured the largest revenue share in 2024 within North America, fueled by early adoption of electrification technologies, federal tax incentives, and stricter regulatory frameworks. Logistics operators are actively integrating hybrid trailers into fleets to optimize fuel efficiency and reduce carbon footprints. The rapid expansion of charging and alternative fuel infrastructure, combined with increasing demand from e-commerce and last-mile delivery services, is further accelerating market penetration across the country.

Europe Hybrid Trailers Market Insight

The Europe hybrid trailers market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the European Union’s aggressive carbon reduction targets and supportive green transport policies. Rapid urbanization, cross-border logistics growth, and the demand for sustainable fleet operations are fueling hybrid trailer adoption. Moreover, European fleets are integrating hybrid trailers for long-haul and refrigerated transport, with a strong focus on compliance with emission norms and the reduction of diesel dependency.

U.K. Hybrid Trailers Market Insight

The U.K. hybrid trailers market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s decarbonization roadmap and growing demand for sustainable logistics solutions. Rising concerns over urban air quality and stricter fuel economy standards are compelling logistics companies and retailers to adopt hybrid trailers. Furthermore, the U.K.’s well-established logistics industry and growing e-commerce sector are creating significant opportunities for hybrid trailer deployment across both regional and urban freight applications.

Germany Hybrid Trailers Market Insight

The Germany hybrid trailers market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s leadership in automotive innovation, green technology adoption, and strict emission regulations. The German government’s push for clean mobility, coupled with the presence of major trailer manufacturers and component suppliers, is accelerating market growth. Hybrid trailers are increasingly being used in long-haul and construction support applications, aligning with Germany’s strong focus on efficiency, sustainability, and advanced engineering standards.

Asia-Pacific Hybrid Trailers Market Insight

The Asia-Pacific hybrid trailers market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rapid industrialization, expanding logistics networks, and rising environmental concerns in countries such as China, India, and Japan. Government initiatives promoting green transport and the expansion of electric mobility infrastructure are fueling hybrid trailer adoption. In addition, the presence of cost-competitive manufacturing hubs and the rising demand for energy-efficient freight solutions are strengthening the region’s role in driving global market growth.

Japan Hybrid Trailers Market Insight

The Japan hybrid trailers market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on technological innovation, urban sustainability, and energy-efficient logistics. Japanese logistics operators are increasingly investing in hybrid trailers to reduce reliance on conventional fuels while ensuring timely freight delivery. The integration of hybrid trailers with smart fleet management systems, coupled with government-backed clean transport initiatives, is supporting rapid adoption across both regional delivery and long-haul applications.

China Hybrid Trailers Market Insight

The China hybrid trailers market accounted for the largest market revenue share in Asia Pacific in 2024, driven by rapid urbanization, rising logistics demand, and strong government mandates on emission reduction. China’s thriving e-commerce sector, coupled with the push toward smart cities and green transport, is fueling large-scale adoption of hybrid trailers. The availability of affordable locally manufactured hybrid trailer solutions, supported by extensive production capabilities and growing export demand, further solidifies China’s dominant position in the regional and global markets.

Hybrid Trailers Market Share

The Hybrid Trailers industry is primarily led by well-established companies, including:

- Wabash National Corporation (U.S.)

- Hyundai Motor Company (South Korea)

- SAF-Holland (Netherlands)

- Schmitz Cargobull AG (Germany)

- Krone Trailer (Germany)

- Wielton SA (Poland)

- Einride (Sweden)

- Xos Trucks (U.S.)

- TrailerBot (U.S.)

- Nikola Corporation (U.S.)

- Tevva (U.K.)

- Volta Trucks (U.S.)

- REE Automotive (U.K.)

- Daimler Trucks (Germany)

- Volvo Trucks (Sweden)

- PACCAR Inc. (U.S.)

- MAN Truck & Bus (Germany)

- Iveco Group (Italy)

Latest Developments in Global Hybrid Trailers Market

- In October 2023, Einride made a significant stride in the transportation industry by launching the "Gorilla," an autonomous electric trailer specifically engineered for long-haul freight transportation. The standout feature of the Gorilla is its impressive 2,000-mile range, marking a substantial advancement in the electric trailer landscape. This innovation not only addresses concerns about the range limitations of electric vehicles but also positions itself as a game-changer for sustainable, long-distance freight transport. The Gorilla's autonomous capabilities further contribute to efficiency and potentially revolutionize the logistics and trucking sectors by offering a solution that aligns with both environmental and operational demands

- In September 2023, SAF-Holland introduced the "eTrailer" axle system, a pioneering modular hybrid solution designed to cater to various trailer types. This innovative axle system represents a significant step forward in the realm of sustainable transportation. The eTrailer's modular design ensures adaptability across different trailer configurations, providing a versatile solution for the industry. With its hybrid features, the eTrailer system aims to enhance efficiency and reduce environmental impact by optimizing energy usage. SAF-Holland's introduction of the eTrailer aligns with the industry's growing focus on hybrid technologies, offering a scalable and adaptable solution for improved performance and sustainability in trailer systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.