Global Hybrid Valve Market

Market Size in USD Billion

CAGR :

%

USD

1.31 Billion

USD

2.16 Billion

2024

2032

USD

1.31 Billion

USD

2.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.31 Billion | |

| USD 2.16 Billion | |

|

|

|

|

Hybrid Valve Market Size

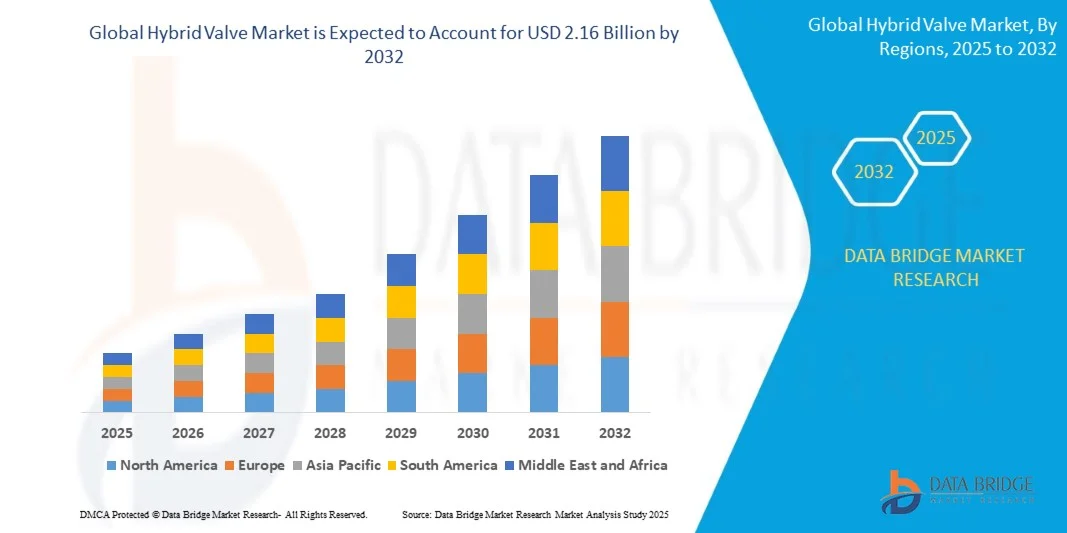

- The global hybrid valve market size was valued at USD 1.31 billion in 2024 and is expected to reach USD 2.16 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by the increasing demand for efficient flow control solutions across industrial sectors such as oil & gas, energy & power, water & wastewater, and chemicals, driving the adoption of hybrid valves for high-pressure, high-temperature, and corrosive applications

- Furthermore, rising industrial automation, infrastructure expansion, and the need for durable, low-maintenance, and high-performance valve solutions are establishing hybrid valves as a preferred choice for critical process control applications. These factors are accelerating the uptake of hybrid valve technologies, thereby significantly boosting the industry’s growth

Hybrid Valve Market Analysis

- Hybrid valves are engineered flow control devices that combine the features of different valve types to offer enhanced durability, precision, and reliability in handling diverse fluids under varying pressure and temperature conditions. They are widely used across oil & gas, power, chemical, and water treatment industries to optimize process efficiency and safety

- The escalating demand for hybrid valves is primarily driven by industrial modernization, stringent safety and environmental regulations, and the growing need for energy-efficient and automated process control systems, making hybrid valves a critical component in contemporary industrial operations

- North America dominated the hybrid valve market with a share of 48.5% in 2024, due to growing industrial modernization, the expansion of oil & gas infrastructure, and increasing energy efficiency initiatives

- Asia-Pacific is expected to be the fastest growing region in the hybrid valve market during the forecast period due to rapid industrialization, urbanization, and the expansion of energy and chemical sectors in countries such as China, Japan, and India

- Steel segment dominated the market with a market share of 42.5% in 2024, due to its widespread availability, cost-effectiveness, and excellent mechanical properties suitable for high-pressure and high-temperature applications. Steel hybrid valves are extensively used across industries such as oil & gas, energy, and water treatment due to their durability, corrosion resistance, and ability to withstand rigorous operational conditions. The established supply chain and ease of fabrication further reinforce steel’s dominance in the market

Report Scope and Hybrid Valve Market Segmentation

|

Attributes |

Hybrid Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Hybrid Valve Market Trends

“Growing Adoption of Automated Industrial Processes”

- The hybrid valve market is expanding significantly due to the increasing adoption of automated industrial processes across multiple sectors such as oil and gas, power generation, chemicals, and water treatment. Hybrid valves combine the functionalities of traditional valves with advanced automation features, making them essential for efficiency and safety in automated operations

- For instance, Emerson Electric has developed hybrid valve solutions designed to meet automation requirements in process industries, enabling optimized flow control and monitoring. Similarly, Flowserve offers digitally integrated valve systems that can support real-time feedback, diagnostics, and predictive maintenance in industrial plants

- The rising preference for smart and automated operations in industries is fueling the demand for valves integrated with sensors and actuators. This integration enhances precision and reliability in fluid and gas handling while reducing downtime and human error in critical applications

- Industries requiring continuous operations such as petrochemicals, pharmaceuticals, and power plants are increasingly implementing hybrid valves to achieve safe and uninterrupted production. Their unique capability to handle severe pressure and temperature conditions while supporting automation makes them highly suitable for demanding environments

- The trend of digitalization, driven by Industrial IoT (IIoT), is further pushing hybrid valve adoption as they enable real-time remote monitoring and integration with automated control systems. This shift to intelligent, connected valves is creating long-term advantages for operational efficiency and cost management

- Overall, the growing reliance on hybrid valves aligns with the global push toward smart manufacturing and energy-efficient industrial operations. By combining durability, automation, and intelligent monitoring, hybrid valves are becoming indispensable assets in the era of Industry 4.0 automation

Hybrid Valve Market Dynamics

Driver

“Rising Demand for Durable, High-Performance Valves”

- The increasing need for reliable and durable fluid control solutions in complex industrial environments is a central driver of the hybrid valve market. Hybrid valves provide long-term resistance against harsh operating conditions while ensuring superior control, making them highly attractive across critical industries

- For instance, Metso has developed hybrid valve systems capable of handling severe service environments in the pulp and paper as well as chemical industries. These durable valves demonstrate the growing preference for solutions that withstand high wear and tear while ensuring optimal process control over extended lifetimes

- Hybrid valves enable industries to achieve consistent output by combining the strength of mechanical valve systems with advanced control technologies. This balance between durability and precision is particularly valuable for industries handling high-pressure steam, abrasive chemicals, or fluctuating thermal conditions

- Their ability to minimize leakage, reduce operational risks, and support preventive maintenance further strengthens their role in industrial safety and efficiency. Businesses are increasingly seeking valves that meet evolving quality and reliability requirements while minimizing unscheduled downtime

- The demand for durable, high-performance valves reflects the critical need for cost-effective and efficient operations across global industries. As companies aim to achieve higher productivity levels while ensuring safety, hybrid valves are positioned as a key enabler of both reliability and modern industrial performance standards

Restraint/Challenge

“High Upfront Costs and Complex Installation”

- The relatively high initial investment required for hybrid valves represents a significant barrier to adoption. Their sophisticated design, high-performance materials, and integration with digital systems substantially increase upfront costs compared to conventional valves, limiting use in cost-sensitive industries or regions

- For instance, advanced hybrid valves from Emerson and Flowserve often demand premium pricing due to the inclusion of automation features, IIoT compatibility, and specialized material construction. Small and mid-sized businesses with constrained budgets find it challenging to invest in such high-cost equipment despite their long-term efficiency gains

- The complex installation process and need for skilled technicians further increase deployment challenges. Integrating hybrid valves into existing industrial systems requires reconfiguration, training, and alignment with digital plant operations, adding both time and expense to adoption phases

- Industries located in developing regions face added hurdles due to lack of infrastructure and expertise required for managing automated systems. This further slows adoption rates compared to advanced economies where automation infrastructure is well established

- Overcoming high upfront costs and installation challenges will require strategies such as modular valve designs, cost-optimized production, and broader training programs for system integration. Addressing these barriers is essential to driving mass adoption of hybrid valves in industries transitioning to automation-driven operations

Hybrid Valve Market Scope

The market is segmented on the basis of material, valve size, and industry.

• By Material

On the basis of material, the hybrid valve market is segmented into steel, tungsten carbide, duplex nickel, titanium, alloy, and others. The steel segment dominated the largest market revenue share of 42.5% in 2024, driven by its widespread availability, cost-effectiveness, and excellent mechanical properties suitable for high-pressure and high-temperature applications. Steel hybrid valves are extensively used across industries such as oil & gas, energy, and water treatment due to their durability, corrosion resistance, and ability to withstand rigorous operational conditions. The established supply chain and ease of fabrication further reinforce steel’s dominance in the market.

The tungsten carbide segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its exceptional hardness and wear resistance, making it ideal for abrasive and erosive fluid handling applications. Industries with high-performance requirements, such as oil & gas and chemical processing, are increasingly adopting tungsten carbide valves to reduce maintenance costs and extend operational life. The growing emphasis on efficiency, durability, and reliability in industrial processes contributes to the rising demand for tungsten carbide hybrid valves.

• By Valve Size

On the basis of valve size, the hybrid valve market is segmented into up to 1”, 1”–6”, 6’’–25’’, 25’’–50’’, and 50’’ & larger. The 1”–6” segment dominated the market in 2024, owing to its versatility and wide adoption across industrial pipelines where moderate flow rates and standard pressure applications are common. This size range is preferred for both retrofitting existing systems and for new installations due to its cost-effectiveness and availability in multiple material options. Its compatibility with diverse industries, including oil & gas, water & wastewater, and building & construction, further strengthens its market position.

The 6’’–25’’ segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increased infrastructure development and large-scale industrial projects requiring higher flow capacities. This segment is favored for applications in power plants, chemical processing, and mining operations, where efficiency and reliability in controlling large fluid volumes are critical. Rising investment in industrial expansion and replacement of outdated valve systems contributes to the accelerated adoption of mid-sized hybrid valves.

• By Industry

On the basis of industry, the hybrid valve market is segmented into oil & gas, energy & power, water & wastewater, building & construction, chemicals, pharmaceuticals, agriculture, metal & mining, paper & pulp, food & beverages, and others. The oil & gas segment dominated the market in 2024, owing to the extensive use of hybrid valves for controlling high-pressure and high-temperature fluids in upstream, midstream, and downstream operations. The industry demands durable, reliable, and low-maintenance valves to optimize production, ensure safety, and minimize operational downtime, which drives the preference for hybrid valve technology.

The energy & power segment is expected to witness the fastest growth from 2025 to 2032, fueled by the expansion of renewable energy infrastructure, thermal power plants, and nuclear facilities. Hybrid valves are increasingly adopted in these applications for precise flow control, corrosion resistance, and enhanced operational efficiency. Government initiatives toward energy efficiency, modernization of power grids, and rising global energy demand further propel the market growth in this sector.

Hybrid Valve Market Regional Analysis

- North America dominated the hybrid valve market with the largest revenue share of 48.5% in 2024, driven by growing industrial modernization, the expansion of oil & gas infrastructure, and increasing energy efficiency initiatives

- Industries in the region prioritize reliable, durable, and low-maintenance valves for high-pressure and high-temperature applications

- The market is further supported by established industrial infrastructure, high technological adoption, and stringent safety regulations, making hybrid valves a preferred choice across oil & gas, power, and water treatment sectors

U.S. Hybrid Valve Market Insight

The U.S. hybrid valve market captured the largest share in North America in 2024, fueled by rapid industrialization, retrofitting of aging infrastructure, and rising demand for advanced flow control solutions. Industries such as oil & gas, chemicals, and power generation are increasingly adopting hybrid valves for enhanced efficiency, durability, and minimal maintenance requirements. The focus on energy conservation and environmental compliance, combined with the country’s strong manufacturing base, further drives the adoption of hybrid valves in both upstream and downstream processes.

Europe Hybrid Valve Market Insight

The Europe hybrid valve market is projected to grow steadily throughout the forecast period, supported by stringent safety and environmental regulations and the modernization of industrial processes. Countries such as Germany, France, and Italy are emphasizing sustainable and energy-efficient solutions, boosting demand for hybrid valves across chemical, energy, and water treatment sectors. The growth of smart industrial infrastructure and automation initiatives also encourages the integration of hybrid valves into existing and new facilities.

U.K. Hybrid Valve Market Insight

The U.K. hybrid valve market is anticipated to grow at a notable CAGR during the forecast period, driven by industrial upgrades, energy sector expansion, and increasing infrastructure projects. The country’s focus on sustainability, coupled with safety standards in oil & gas and power industries, encourages the adoption of high-performance hybrid valves. Growing awareness regarding cost-efficient maintenance and enhanced process control further strengthens market growth.

Germany Hybrid Valve Market Insight

The Germany hybrid valve market is expected to expand significantly during the forecast period, supported by industrial automation, technological advancements, and stringent environmental compliance. Germany’s well-established industrial base, including chemicals, power, and water sectors, promotes demand for hybrid valves that offer reliability, precision, and durability. The integration of advanced valve technologies into process control systems aligns with the country’s emphasis on energy efficiency and operational optimization.

Asia-Pacific Hybrid Valve Market Insight

The Asia-Pacific hybrid valve market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and the expansion of energy and chemical sectors in countries such as China, Japan, and India. Increasing investments in oil & gas, power, and water infrastructure projects, along with government initiatives supporting industrial modernization, are driving demand for hybrid valves. The availability of cost-effective solutions and rising local manufacturing capabilities further enhance market penetration in the region.

Japan Hybrid Valve Market Insight

The Japan hybrid valve market is gaining momentum due to the country’s focus on advanced manufacturing, automation, and process efficiency. Hybrid valves are widely adopted in power plants, chemical facilities, and water treatment plants for precise flow and pressure control. The demand is further boosted by technological innovations, energy conservation initiatives, and the need for durable, low-maintenance industrial solutions.

China Hybrid Valve Market Insight

The China hybrid valve market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid industrial growth, infrastructure development, and strong manufacturing capabilities. High demand from oil & gas, power, and chemical industries, coupled with the government’s push for modernization and efficiency in industrial processes, drives the market. The presence of domestic manufacturers providing affordable and reliable hybrid valves also contributes significantly to market expansion.

Hybrid Valve Market Share

The hybrid valve industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- IMI Plc. (U.K.)

- Trillium Flow Technologies (U.S.)

- Chemtrols EMET Private Limited. (India)

- Dymet Alloys (U.K.)

- Carter Process Control GmbH (Austria)

- Penn United Technologies, Inc. (U.S.)

- MASCOT (India)

- Automat Industries Ltd. (India)

- Flowserve Corporation (U.S.)

- L&T Valves Limited (India)

- BLACOH Fluid Controls, Inc. (U.S.)

- Circor International Inc. (U.S.)

- KOSO INDIA (India)

- Wuxi Smart Auto-Control Engineering Co. LTD. (China)

Latest Developments in Hybrid Valve Market

- In June 2025, Chart Industries and Flowserve agreed to merge, forming a USD 19 billion industrial process technology leader. This strategic consolidation is poised to reshape the global hybrid valve and industrial flow control market by combining extensive product portfolios, advanced engineering capabilities, and a larger geographic reach. The merger enables both companies to leverage synergies in R&D, production, and aftermarket services, strengthening their position to address rising global demand for high-performance, durable, and technologically advanced valve solutions across oil & gas, power, chemical, and water treatment sectors

- In April 2025, Flowserve reported USD 690 million in aftermarket bookings, marking its third consecutive quarter with over USD 100 million in nuclear orders. This consistent performance highlights strong market reliance on Flowserve’s hybrid valve solutions in critical applications requiring precision, safety, and reliability. The robust demand for nuclear-grade valves reflects broader industry trends toward energy security, infrastructure modernization, and long-term operational efficiency, indicating sustained growth potential in high-value industrial valve segments

- In March 2025, Aramco awarded a USD 7.7 billion contract to expand the Fadhili gas plant, specifying the inclusion of advanced hybrid valve packages. This large-scale project underscores the strategic importance of hybrid valves in high-capacity oil and gas operations, where efficiency, safety, and operational continuity are critical. The award also reflects the increasing reliance of major energy players on technologically sophisticated valve solutions to optimize plant performance, reduce maintenance costs, and ensure compliance with stringent safety and environmental standards

- In February 2025, IMI plc launched a GBP 100 million share buyback following 15% growth in its Process Automation segment. This move signals strong investor confidence and robust market demand for IMI’s hybrid valves and automation solutions. The buyback enables IMI to strategically optimize its capital structure while continuing to invest in R&D and market expansion, further strengthening its competitive position in high-growth industrial segments such as oil & gas, energy, chemicals, and water management

- In January 2025, Curtiss-Wright acquired Ultra Energy to broaden its nuclear and industrial valve offerings. This acquisition expands Curtiss-Wright’s product and service portfolio in high-performance hybrid valves, enabling the company to address growing industrial demand for reliable, high-precision flow control solutions. It also strengthens Curtiss-Wright’s position in nuclear and critical industrial sectors, supporting technological innovation, enhanced operational efficiency, and global market penetration in regions with increasing infrastructure and energy investment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hybrid Valve Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hybrid Valve Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hybrid Valve Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.