Global Hydration Containers Market

Market Size in USD Billion

CAGR :

%

USD

15.13 Billion

USD

25.05 Billion

2024

2032

USD

15.13 Billion

USD

25.05 Billion

2024

2032

| 2025 –2032 | |

| USD 15.13 Billion | |

| USD 25.05 Billion | |

|

|

|

|

Hydration Containers Market Size

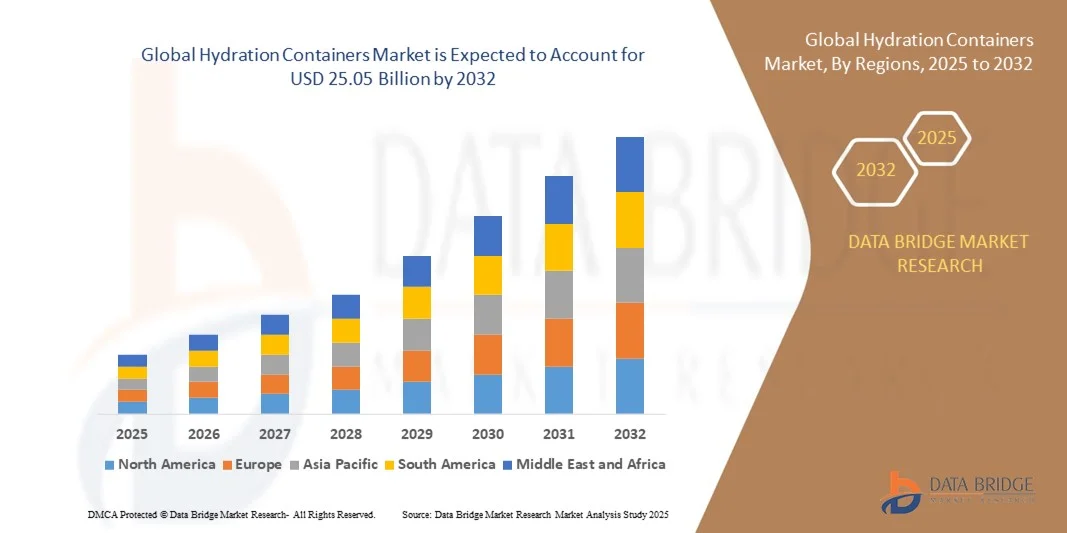

- The global hydration containers market size was valued at USD 15.13 billion in 2024 and is expected to reach USD 25.05 billion by 2032, at a CAGR of 6.51% during the forecast period

- The market growth is largely fuelled by the rising health and fitness awareness among consumers, increasing participation in outdoor sports and adventure activities, and growing demand for portable and reusable hydration solutions

- The shift towards eco-friendly and sustainable products, along with innovations in material technology such as BPA-free plastics, stainless steel, and collapsible containers, is further supporting market expansion

Hydration Containers Market Analysis

- The market is witnessing increasing demand for advanced and multifunctional hydration containers, including those with temperature control, filtration, and smart tracking features

- Consumers are gravitating towards aesthetically designed, durable, and lightweight containers that suit active lifestyles and convenience, driving innovation and differentiation in the market

- North America dominated the hydration containers market with the largest revenue share of 38.5% in 2024, driven by growing health awareness, increasing participation in fitness activities, and rising adoption of reusable and eco-friendly containers

- Asia-Pacific region is expected to witness the highest growth rate in the global hydration containers market, driven by increasing health awareness, expanding urban population, rising adoption of eco-friendly and smart hydration containers, and supportive government initiatives promoting wellness and sustainability

- The Metal segment held the largest market revenue share in 2024, driven by its durability, resistance to corrosion, and suitability for both indoor and outdoor use. Metal containers also offer temperature retention features, making them a preferred choice for premium and everyday hydration solutions

Report Scope and Hydration Containers Market Segmentation

|

Attributes |

Hydration Containers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydration Containers Market Trends

Increasing Demand for Portable and Eco-Friendly Hydration Solutions

- The growing preference for portable hydration containers is transforming the market by enabling on-the-go access to clean drinking water. Lightweight, durable, and easy-to-carry designs allow consumers to maintain hydration during outdoor activities, fitness routines, and travel, enhancing convenience and promoting healthy lifestyles. In addition, innovations in spill-proof lids and ergonomic designs are further increasing usability and consumer adoption across different demographics

- Rising awareness of environmental sustainability is accelerating the adoption of reusable and eco-friendly containers made from materials such as stainless steel, BPA-free plastics, and glass. These solutions reduce single-use plastic consumption and appeal to environmentally conscious consumers across urban and rural settings. Furthermore, government policies and retailer initiatives encouraging sustainable products are stimulating market growth

- The integration of advanced features such as temperature control, smart tracking, and built-in filtration is making modern hydration containers more attractive for everyday use. Consumers benefit from better water quality, temperature maintenance, and usage tracking, leading to increased engagement and frequent usage. These innovations are also helping brands differentiate their offerings and capture premium market segments

- For instance, in 2023, several fitness clubs in North America reported increased member satisfaction and engagement after introducing smart hydration stations with reusable containers, promoting healthier hydration habits and reducing plastic waste. These initiatives have also led to stronger brand loyalty and increased demand for advanced hydration solutions in commercial environments

- While portable and eco-friendly containers are gaining popularity, their adoption depends on continued product innovation, affordability, and consumer awareness. Manufacturers must focus on differentiated designs and sustainable materials to fully capitalize on the growing demand. In addition, marketing efforts emphasizing environmental benefits and lifestyle integration are key to expanding consumer reach

Hydration Containers Market Dynamics

Driver

Increasing Health Consciousness and Active Lifestyle Trends

- Growing health awareness is pushing consumers to prioritize proper hydration, driving demand for convenient and durable hydration containers. This trend is particularly strong among fitness enthusiasts, outdoor adventurers, and corporate wellness programs, fueling market growth. In addition, the rise of social media fitness challenges and wellness campaigns is encouraging consumers to adopt hydration-friendly routines

- Consumers are increasingly seeking containers that support active lifestyles, such as leak-proof, lightweight, and ergonomic designs suitable for sports, travel, and daily routines. This shift is encouraging manufacturers to innovate and expand product offerings. Moreover, premium and customizable options are emerging to cater to fitness-conscious and tech-savvy consumers

- Governments and wellness organizations promoting hydration and healthy living are further boosting adoption, particularly in schools, gyms, and workplaces. Educational campaigns highlighting the benefits of regular water intake are influencing consumer behavior and container usage. In addition, collaborations with health-focused apps and fitness programs are amplifying awareness and engagement

- For instance, in 2022, several corporate wellness programs in Europe encouraged employees to use personal hydration containers, resulting in higher water consumption, better health outcomes, and increased demand for high-quality reusable containers. This has also led to expanded partnerships between hydration container manufacturers and workplace wellness service providers

- While demand is rising, continuous innovation, durability, and convenience remain critical to sustain growth and encourage long-term adoption. Companies focusing on smart, multifunctional, and eco-friendly designs are likely to lead the market in the coming years

Restraint/Challenge

High Product Costs and Limited Consumer Awareness in Emerging Regions

- The higher price of premium hydration containers compared to disposable alternatives limits adoption in price-sensitive markets, especially in developing regions. Cost remains a significant barrier for widespread usage despite long-term benefits. Furthermore, regional economic disparities and fluctuating import tariffs can further restrict access to high-quality containers

- In many regions, a lack of awareness about the health and environmental advantages of reusable hydration containers restricts market penetration. Consumers often continue to rely on single-use bottles, slowing the shift toward sustainable solutions. In addition, limited marketing and distribution channels hinder brand visibility in rural and semi-urban areas

- Supply chain constraints, including availability of high-quality materials and production capacity, can affect product accessibility and pricing stability, particularly during peak demand periods. Fluctuations in raw material costs, shipping delays, and limited local manufacturing capabilities can exacerbate these challenges

- For instance, in 2023, several emerging markets in Southeast Asia reported limited access to premium hydration containers, citing affordability and distribution challenges as key obstacles. This has slowed adoption rates despite growing interest in sustainable and functional products

- While reusable and feature-rich hydration containers continue to gain traction, addressing cost, awareness, and supply chain limitations remains crucial. Market stakeholders must focus on affordable options, educational campaigns, and scalable distribution channels to ensure sustainable growth. In addition, partnerships with local distributors and targeted marketing campaigns can help penetrate underserved markets more effectively

Hydration Containers Market Scope

The market is segmented on the basis of material type, capacity, product type, and distribution network.

- By Material Type

On the basis of material type, the hydration containers market is segmented into Metal, Polymer, Glass, and Silicon. The Metal segment held the largest market revenue share in 2024, driven by its durability, resistance to corrosion, and suitability for both indoor and outdoor use. Metal containers also offer temperature retention features, making them a preferred choice for premium and everyday hydration solutions.

The Polymer segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its lightweight, shatterproof nature, and affordability. Polymer-based containers are particularly popular among fitness enthusiasts, travelers, and students due to their ease of carrying, varied designs, and cost-effective production, making them widely accessible across different consumer segments.

- By Capacity

On the basis of capacity, the market is segmented into Up to 20 Oz., 21-40 Oz., 41-60 Oz., 61-80 Oz., and Above 80 Oz. The 21-40 Oz. segment dominated in 2024 owing to its optimal size for portability and convenience for daily hydration needs. Consumers prefer this capacity for office, gym, and travel purposes, balancing volume with ease of handling.

The 41-60 Oz. segment is expected to witness the fastest growth rate from 2025 to 2032, supported by demand from fitness enthusiasts, outdoor adventurers, and athletes who require larger volumes of water or beverages during activities. This capacity range also caters to family and group usage scenarios, expanding its adoption in recreational settings.

- By Product Type

On the basis of product type, the market is segmented into Water Bottles, Cans, Mugs, Mason Jars, Tumblers, Shakers, and Infusers. The Water Bottles segment captured the largest revenue share in 2024, owing to its versatility, portability, and wide usage across fitness, office, and travel applications. Water bottles are also favored for promotional and branded purposes, increasing their adoption globally.

The Tumblers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for insulated containers that maintain beverage temperature for extended periods. Tumblers are popular in urban markets for coffee, tea, and cold drinks, with designs appealing to both functional and lifestyle-conscious buyers.

- By Distribution Network

On the basis of distribution network, the market is segmented into Direct Sales, Retailers, and E-Retail. The Retailers segment held the largest market share in 2024, fueled by easy accessibility, wide product variety, and the ability to physically examine and select containers. Retail channels remain crucial for consumer trust and adoption, especially in emerging markets.

The E-Retail segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing online shopping penetration, convenience, and availability of customizable and branded hydration containers. E-commerce platforms also enable manufacturers to reach a broader audience, offer promotions, and provide doorstep delivery, boosting market expansion.

Hydration Containers Market Regional Analysis

- North America dominated the hydration containers market with the largest revenue share of 38.5% in 2024, driven by growing health awareness, increasing participation in fitness activities, and rising adoption of reusable and eco-friendly containers

- Consumers in the region highly value portability, durability, and advanced features such as temperature control and smart tracking, which enhance convenience and encourage regular hydration

- This widespread adoption is further supported by high disposable incomes, environmental consciousness, and the increasing availability of premium and innovative products through retail and e-commerce channels, establishing hydration containers as a preferred choice for both individual and corporate use

U.S. Hydration Containers Market Insight

The U.S. hydration containers market captured the largest revenue share in 2024 within North America, fueled by rising health consciousness, active lifestyle trends, and the growing adoption of reusable water bottles and smart hydration products. Consumers are increasingly seeking convenient, high-quality containers for sports, travel, and daily routines. The growing integration of smart features, such as usage tracking and temperature maintenance, along with robust retail and e-commerce infrastructure, is significantly contributing to market expansion.

Europe Hydration Containers Market Insight

The Europe hydration containers market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing awareness of sustainability, the adoption of eco-friendly materials, and supportive government initiatives promoting reusable containers. Urbanization, outdoor recreational activities, and workplace wellness programs are fostering demand for durable, portable, and reusable hydration solutions. The market is expanding across residential, fitness, and institutional applications, with consumers prioritizing convenience and environmental impact.

U.K. Hydration Containers Market Insight

The U.K. hydration containers market is expected to witness significant growth from 2025 to 2032, driven by rising fitness trends, health consciousness, and environmental awareness. Consumers are opting for reusable and smart hydration solutions, including insulated bottles and containers with filtration systems. The robust retail and e-commerce infrastructure, along with government campaigns promoting healthy lifestyles, is expected to further boost market adoption.

Germany Hydration Containers Market Insight

The Germany hydration containers market is expected to witness substantial growth from 2025 to 2032, fueled by strong consumer awareness of health and wellness, demand for sustainable products, and a preference for high-quality reusable containers. The integration of smart features, ergonomic designs, and advanced materials such as stainless steel and BPA-free plastics is promoting adoption across residential, fitness, and outdoor activities. Germany’s emphasis on environmental sustainability and innovative consumer products is further supporting market growth.

Asia-Pacific Hydration Containers Market Insight

The Asia-Pacific hydration containers market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing participation in sports and outdoor activities in countries such as China, Japan, and India. The adoption of reusable and feature-rich hydration containers is supported by government initiatives promoting health and sustainability. Furthermore, APAC’s expanding manufacturing capabilities are making high-quality containers more affordable and accessible to a wider consumer base.

Japan Hydration Containers Market Insight

The Japan hydration containers market is expected to witness significant growth from 2025 to 2032 due to the country’s health-conscious population, active lifestyle culture, and demand for technologically advanced, convenient hydration solutions. Consumers are increasingly adopting smart bottles, insulated containers, and compact portable solutions. Moreover, the growing elderly population is likely to spur demand for user-friendly, safe, and easy-to-use hydration products in both residential and institutional applications.

China Hydration Containers Market Insight

The China hydration containers market accounted for the largest revenue share in Asia Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and increasing health and wellness awareness. Consumers are embracing reusable water bottles, tumblers, and smart hydration containers in households, workplaces, and fitness centers. The government’s focus on sustainability and the presence of strong domestic manufacturers producing affordable and innovative hydration solutions are key factors propelling the market in China.

Hydration Containers Market Share

The Hydration Containers industry is primarily led by well-established companies, including:

- Cascade Designs, Inc. (U.S.)

- Cool Gear International, LLC (U.S.)

- CamelBak (U.S.)

- Brita, LP (U.S.)

- Klean Kanteen (U.S.)

- Hydro Flask (U.S.)

- CAN'T LIVE WITHOUT IT, LLC (U.S.)

- Tupperware (U.S.)

- Thermo Fisher Scientific (U.S.)

- AQUASANA, INC. (U.S.)

- Thermos L.L.C. (U.S.)

- O2COOL, LLC (U.S.)

- Nathan Sports (U.K.)

- Sigg (Switzerland)

- HydraPak, LLC (U.S.)

- Bübi Bottle LLC (U.S.)

- Zhejiang Hals Vacuum Vessel Co., Ltd. (China)

- EMSA GmbH (Germany)

- BKR (U.S.)

- Soma (U.S.)

- HYDAWAY Collapsible Water Bottles (U.S.)

Latest Developments in Global Hydration Containers Market

- In September 2023, NEUE partnered with Berry Global to develop a 100% recycled PET (rPET) bottle, eliminating virgin plastic usage. This innovation reduces carbon emissions compared to conventional mineral water bottles, promoting sustainability and supporting eco-conscious consumer demand in the hydration containers market

- In July 2023, Splendor Water collaborated with Ardagh Glass Packaging to launch 100% recyclable Indigo glass bottles. The new design enhances preservation of taste and natural properties while promoting environmentally friendly packaging, strengthening the brand’s sustainability positioning and appealing to conscious consumers

- In June 2023, ALPLA assisted Coca-Cola in launching India’s first 100% recycled PET bottle for packaged drinking water. By providing rPET preforms, the initiative supports Coca-Cola’s global target of using at least 50% recycled material by 2030, reducing environmental impact and advancing circular economy practices

- In February 2023, Thermos L.L.C. introduced the Icon™ Series, featuring a range of hydration products for cold beverages. The series includes Griptec™ Non-Slip Bases and True-Coat™ Finishes, enhancing usability, durability, and consumer appeal while expanding Thermos’ product offerings in the premium hydration segment

- In September 2022, Ball Corporation partnered with Boomerang Water LLC to provide aluminum bottles for the Boomerang Bottling System. This sustainable packaging solution reduces environmental impact, promotes reusable aluminum bottles, and supports growth in eco-friendly hydration container alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydration Containers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydration Containers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydration Containers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.