Global Hydraulic Fluids Market

Market Size in USD Billion

CAGR :

%

USD

8.93 Billion

USD

11.72 Billion

2024

2032

USD

8.93 Billion

USD

11.72 Billion

2024

2032

| 2025 –2032 | |

| USD 8.93 Billion | |

| USD 11.72 Billion | |

|

|

|

|

What is the Global Hydraulic Fluids Market Size and Growth Rate?

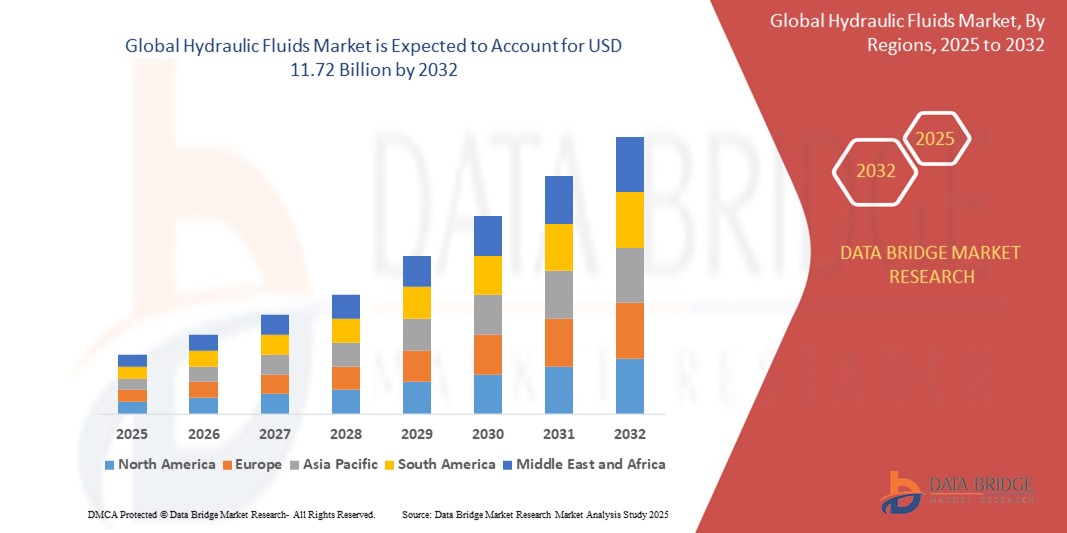

- The global hydraulic fluids market size was valued at USD 8.93 billion in 2024 and is expected to reach USD 11.72 billion by 2032, at a CAGR of 3.45% during the forecast period

- The global hydraulic fluids market is majorly used in the automotive industry, where hydraulic fluids play a crucial role in power steering systems. These fluids transmit force within the power steering system, enabling smooth and responsive vehicle steering

- In addition, hydraulic fluids are utilized in brake systems, ensuring efficient and reliable braking performance. The automotive sector's continuous demand for hydraulic fluids is driven by the need for enhanced safety, precision, and vehicle performance

What are the Major Takeaways of Hydraulic Fluids Market?

- Innovations in hydraulic systems and equipment technology lead to increased performance, reduced downtime, and enhanced overall efficiency in various industrial applications. These advancements often involve the development of high-performance hydraulic fluids that can withstand extreme conditions, providing optimal lubrication and ensuring smooth operation

- As industries continue to invest in modernizing their equipment, the demand for advanced hydraulic fluids rises, propelling the growth of the global market

- Asia-Pacific dominated the hydraulic fluids market with the largest revenue share of 38.4% in 2024, driven by rapid industrialization, rising construction activities, and the robust growth of manufacturing sectors in countries such as China, India, and Japan

- North America is projected to grow at the fastest CAGR of 13.2% from 2025 to 2032, supported by the rising use of advanced hydraulic equipment across oil & gas, aerospace, and industrial manufacturing

- The mineral oil segment dominated the hydraulic fluids market with the largest market revenue share of 46.5% in 2024, owing to its cost-effectiveness and widespread usage across industrial and mobile hydraulic systems

Report Scope and Hydraulic Fluids Market Segmentation

|

Attributes |

Hydraulic Fluids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hydraulic Fluids Market?

“Bio-Based Formulations and Eco-Friendly Performance Additives”

- A significant trend in the global hydraulic fluids market is the rising adoption of bio-based and environmentally friendly formulations. Driven by regulatory pressures and increasing environmental awareness, manufacturers are innovating with biodegradable base oils and low-toxicity additives to minimize ecological impact

- For instance, in February 2024, Shell Lubricants launched a new line of EcoSafe hydraulic fluids for off-highway machinery and industrial equipment, made from renewable sources and optimized for high performance in sensitive environments

- The trend also includes increasing R&D investments into sustainable fluid chemistries that meet or exceed performance benchmarks of conventional fluids while being safer for both equipment and the environment. These fluids often comply with ISO 15380 and OECD biodegradability standards

- Furthermore, manufacturers are offering multi-application bio-fluids that work across industrial, marine, and agricultural settings, reducing the need for multiple products and simplifying inventory

- Companies such as ExxonMobil, Fuchs Petrolub, and TotalEnergies are also developing advanced fluid monitoring technologies to optimize the life cycle and reduce fluid waste, complementing sustainability goals

- This shift toward greener solutions is transforming procurement policies, especially in industries operating in eco-sensitive zones such as forestry, construction, and marine, thereby expanding the adoption of hydraulic fluids with low environmental impact

What are the Key Drivers of Hydraulic Fluids Market?

- Rising industrial automation and growing deployment of hydraulic-powered machinery across sectors such as construction, mining, manufacturing, and aerospace are major drivers fueling demand for high-performance hydraulic fluids

- In April 2024, Castrol expanded its hydraulic fluid portfolio with high-temperature resistant variants designed for next-generation CNC machines and robotic applications, supporting the market's growth through innovation

- Government mandates and global standards requiring fire-resistant and biodegradable fluids in certain operations are also pushing manufacturers to upgrade their product offerings. Industries operating in extreme or high-risk environments increasingly rely on specialty hydraulic fluids for equipment longevity and operational safety

- Infrastructure development initiatives, particularly in Asia-Pacific, Africa, and Latin America, are increasing the fleet of hydraulic equipment, leading to volume growth in fluid consumption

- The rise in predictive maintenance strategies, where fluid analysis is used to prevent machinery breakdown, is also driving the replacement and upgrade cycle for hydraulic fluids across sectors

- Furthermore, the integration of IoT-enabled fluid monitoring systems is enhancing fluid management practices, enabling industries to maintain optimal performance and reduce environmental waste

Which Factor is challenging the Growth of the Hydraulic Fluids Market?

- A major challenge in the hydraulic fluids market is the fluctuating prices of base oils, especially those derived from petroleum. Volatility in crude oil prices can significantly impact production costs and pricing strategies for hydraulic fluid manufacturers.

- In addition, disposal regulations and environmental compliance create a burden for end users, particularly small and medium enterprises, which may face higher costs related to waste handling and fluid recycling.

- For instance, stricter regulations under the REACH framework in the European Union and local mandates in U.S. states such as California are pushing users to switch to low-toxicity or biodegradable alternatives, which are often more expensive.

- Another limiting factor is performance concerns related to bio-based fluids in extreme operating conditions. Some industries still hesitate to transition due to limited temperature stability or shorter fluid life in older formulations.

- While the market is evolving to address these issues, cost-effectiveness and performance parity with traditional fluids remain top concerns for buyers in price-sensitive regions.

- Overcoming these challenges will require increased investments in R&D, user education, and collaboration with equipment OEMs to develop formulations tailored for specific industrial demands

How is the Hydraulic Fluids Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Base Oil

On the basis of base oil, the hydraulic fluids market is segmented into mineral oil, synthetic oil, semi-synthetic oil, and bio-based oil. The mineral oil segment dominated the Hydraulic Fluids market with the largest market revenue share of 46.5% in 2024, owing to its cost-effectiveness and widespread usage across industrial and mobile hydraulic systems. Mineral oil-based fluids are preferred for their ease of availability, good lubrication properties, and compatibility with most hydraulic equipment, making them a staple choice in various sectors.

The synthetic oil segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for high-performance fluids capable of operating under extreme temperature conditions. Synthetic fluids offer enhanced thermal stability, longer service life, and better oxidative resistance, making them suitable for advanced hydraulic applications in aerospace, construction, and manufacturing.

- By Application

On the basis of application, the hydraulic fluids market is segmented into OEM, equipment, construction equipment, transportation, oil and gas, metal production, food and beverage, and others. The construction equipment segment accounted for the largest market revenue share in 2024, owing to the growing global infrastructure development and extensive deployment of hydraulic machinery in the construction industry. Hydraulic fluids are essential for the efficient functioning of excavators, loaders, and other heavy machinery.

The transportation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising adoption of hydraulic systems in commercial vehicles, aircraft, and railways. These fluids are vital for braking systems, steering mechanisms, and landing gear, where reliability and performance are critical.

- By Type

On the basis of type, the hydraulic fluids market is segmented into petroleum-based hydraulic fluid, bio-based hydraulic fluid, and fire-resistant type. The petroleum-based segment held the largest market revenue share in 2024, due to its established use, affordability, and consistent performance across a range of industrial applications.

The bio-based hydraulic fluid segment is anticipated to witness the fastest CAGR from 2025 to 2032, as sustainability becomes a key priority for manufacturers and end-users. Bio-based fluids are biodegradable, low in toxicity, and compliant with environmental regulations, making them increasingly favored for use in agriculture, marine, and forestry industries.

- By Connector Type

On the basis of connector type, the hydraulic fluids market is segmented into mobile hydraulic fluid connectors and stationary hydraulic fluid connectors. The mobile hydraulic fluid connectors segment dominated the market in 2024 with the largest revenue share, driven by the high usage in construction, agricultural, and mining equipment where flexible, quick-disconnect connectors are essential.

The stationary hydraulic fluid connectors segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the steady growth of industrial automation and manufacturing activities. These connectors offer robust and reliable fluid transmission solutions for fixed machinery and production lines, contributing to operational efficiency and system safety.

Which Region Holds the Largest Share of the Hydraulic Fluids Maret?

- Asia-Pacific dominated the hydraulic fluids market with the largest revenue share of 38.4% in 2024, driven by rapid industrialization, rising construction activities, and the robust growth of manufacturing sectors in countries such as China, India, and Japan

- The region’s strong demand for construction machinery, agricultural equipment, and industrial automation has led to a significant consumption of hydraulic fluids for system lubrication, heat transfer, and energy transmission

- In addition, favorable government initiatives focused on infrastructure development, coupled with the emergence of localized production and cost-effective solutions, have boosted the hydraulic fluids market’s growth trajectory across APAC

China Hydraulic Fluids Market Insight

The China hydraulic fluids market held the largest revenue share of over 52% in Asia-Pacific in 2024, propelled by expanding construction and mining operations, as well as heavy manufacturing activities. Strong demand from sectors such as automotive, construction, and steel manufacturing continues to drive fluid consumption. Domestic producers offer affordable, large-scale hydraulic solutions, making China a dominant regional contributor. Environmental reforms are also spurring the shift toward bio-based and fire-resistant hydraulic fluids, creating new opportunities for eco-compliant product variants.

India Hydraulic Fluids Market Insight

The India hydraulic fluids market is expected to grow at the fastest CAGR in the region from 2025 to 2032, driven by expanding agricultural mechanization, smart city projects, and an increase in mobile equipment use across construction and logistics sectors. Local production capacity improvements and the adoption of international performance standards are helping accelerate the use of premium hydraulic fluids. Government initiatives such as ‘Make in India’ and the push for infrastructure modernization are further bolstering demand in both OEM and aftermarket channels.

Which Region Is the Fastest Growing in the Hydraulic Fluids Market?

North America is projected to grow at the fastest CAGR of 13.2% from 2025 to 2032, supported by the rising use of advanced hydraulic equipment across oil & gas, aerospace, and industrial manufacturing. Demand is being fueled by the need for fire-resistant, biodegradable, and synthetic fluids, especially in sectors with high environmental and safety standards. The transition toward energy-efficient systems and digitized fluid monitoring technologies is also reshaping market demand across both mobile and stationary equipment.

U.S. Hydraulic Fluids Market Insight

The U.S. hydraulic fluids market contributed the majority share of 79% within North America in 2024, thanks to widespread industrial adoption and a well-established heavy machinery market. Sectors such as aerospace, mining, and energy continue to drive fluid innovation with demand for high-performance, long-life formulations. In addition, growing focus on sustainability, emission reduction, and equipment efficiency is prompting the adoption of bio-based and synthetic oil variants across end-user industries.

Canada Hydraulic Fluids Market Insight

The Canada hydraulic fluids market is expanding steadily, underpinned by growing mining operations, forestry activities, and cold-weather equipment usage which demands specialized hydraulic formulations. The country’s strong emphasis on eco-friendly practices is creating growth potential for biodegradable and low-toxicity hydraulic fluids in environmentally sensitive zones. With rising investments in renewable energy and construction, demand for hydraulic solutions is increasing in wind turbines, hydro power plants, and green buildings.

Which are the Top Companies in Hydraulic Fluids Market?

The hydraulic fluids industry is primarily led by well-established companies, including:

- Shell group (U.K.)

- Exxon Mobil Corporation (U.S.)

- BP p.l.c.(U.K.)

- Chevron Corporation. (U.S.)

- TotalEnergies(France)

- LUKOIL Marine Lubricants DMCC (U.A.E.)

- Idemitsu Kosan Co.,Ltd. (Japan)

- Indian Oil Corporation Ltd (India)

- Sinopec (China)

- Phillips 66 Company. (U.S.)

- Calumet Specialty Products Partners, L.P., LLC (U.S.)

- Morris Lubricants (U.K.)

- Penrite Oil (Australia)

- Carl Bechem Lubricants India (India)

- Valvoline LLC. (U.S.)

- PEAK LUBRICANTS (U.K.)

- Rock Valley Oil & Chemical Co (U.S.)

- LIQUI MOLY GmbH (Germany)

- ADDINOL. (Germany)

- Amalie Oil Co. (U.S.)

What are the Recent Developments in Global Hydraulic Fluids Market?

- In May 2022, Abu Dhabi’s ADNOC and Masdar agreed to collaborate with bp on its hydrogen projects in the U.K., aiming to accelerate the development of clean energy infrastructure. This move marks a significant step toward global hydrogen economy collaboration

- In May 2022, Chevron, Talos Energy, and Carbonvert completed the expansion of their previously announced joint venture for the Bayou Bend CCS project, located offshore Jefferson County, Texas. This strategic deal enhances large-scale carbon capture and storage capabilities in the U.S

- In May 2022, ExxonMobil and Indonesia’s Pertamina advanced their cooperation in the field of carbon capture and storage (CCS), reinforcing their shared commitment to sustainable energy solutions. This partnership is expected to support Indonesia's decarbonization goals

- In April 2022, Maip Group introduced a new line of sustainable polymers for the European automotive industry by leveraging Eastman’s molecular recycling technologies. This innovation reflects growing efforts in the circular economy and sustainable mobility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydraulic Fluids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydraulic Fluids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydraulic Fluids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.