Global Hydraulic Fracturing Dual Engine Systems Market

Market Size in USD Million

CAGR :

%

USD

553.86 Million

USD

793.69 Million

2024

2032

USD

553.86 Million

USD

793.69 Million

2024

2032

| 2025 –2032 | |

| USD 553.86 Million | |

| USD 793.69 Million | |

|

|

|

|

Hydraulic Fracturing Dual-Engine Systems Market Size

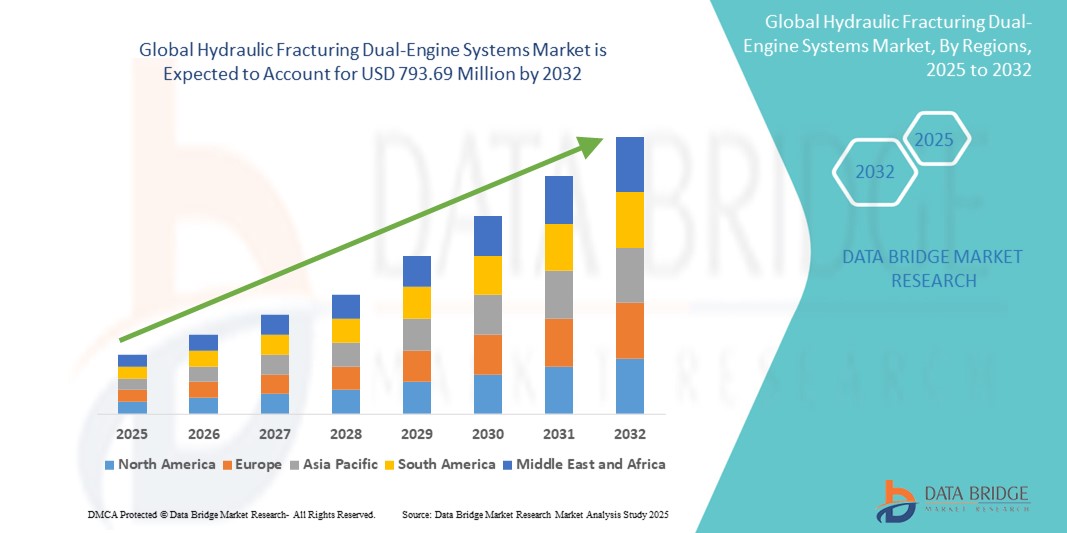

- The global Hydraulic Fracturing dual-engine systems market size was valued at USD 553.86 million in 2024 and is expected to reach USD 793.69 million by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is primarily driven by the increasing demand for efficient and environmentally sustainable oil and gas extraction technologies, coupled with advancements in dual-engine systems that enhance operational efficiency and reduce emissions

- Rising energy demands, particularly in unconventional resource extraction, and supportive government policies in key regions are further propelling the adoption of dual-engine systems in hydraulic fracturing operations

Hydraulic Fracturing Dual-Engine Systems Market Analysis

- Dual-engine systems in hydraulic fracturing, which integrate two power units to optimize performance and reduce environmental impact, are becoming critical in enhancing the efficiency of oil and gas extraction, particularly in shale formations

- The demand for these systems is fueled by the global surge in shale gas and tight oil exploration, growing environmental regulations pushing for lower-emission technologies, and the need for cost-effective solutions in high-pressure fracturing operations

- North America dominated the hydraulic fracturing dual-engine systems market with the largest revenue share of 38.1% in 2024, driven by extensive shale reserves, advanced technological infrastructure, and favourable regulatory frameworks in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing energy demand, and significant investments in shale gas development in countries such as China and India

- The horizontal segment dominated the largest market revenue share of 82.3% in 2024, driven by its widespread adoption in unconventional resource extraction, particularly shale gas and tight oil, due to enhanced production efficiency and greater reservoir contact

Report Scope and Hydraulic Fracturing Dual-Engine Systems Market Segmentation

|

Attributes |

Hydraulic Fracturing Dual-Engine Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydraulic Fracturing Dual-Engine Systems Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global hydraulic fracturing dual-engine systems market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, enabling deeper insights into equipment performance, operational efficiency, and predictive maintenance requirements

- AI-powered solutions in dual-engine systems support proactive issue detection, identifying potential equipment failures before they result in costly downtime or operational disruptions

- For instances, companies are developing AI-driven platforms that analyze real-time operational data to optimize fracturing processes, adjust pump performance dynamically, and reduce fuel consumption based on site conditions

- This trend enhances the efficiency and reliability of dual-engine systems, making them more appealing to operators in both conventional and unconventional resource extraction

- AI algorithms can process extensive data sets, including pump pressure, flow rates, and environmental conditions, to improve decision-making and operational precision

Hydraulic Fracturing Dual-Engine Systems Market Dynamics

Driver

“Rising Demand for Efficient and Sustainable Fracturing Operations”

- The increasing global demand for energy, particularly from unconventional resources such as shale gas and tight oil, is a key driver for the hydraulic fracturing dual-engine systems market

- Dual-engine systems offer enhanced efficiency by combining diesel and natural gas power, reducing fuel costs and emissions compared to traditional single-engine systems

- Government regulations in regions such as North America, promoting lower-emission technologies, are accelerating the adoption of dual-engine systems

- The advancement of IoT and 5G technologies enables real-time monitoring and control of dual-engine systems, supporting more precise and efficient fracturing operations

- Major oilfield service providers are increasingly integrating dual-engine systems into their fleets to meet operator demands for cost-effective and environmentally friendly solutions

Restraint/Challenge

“High Initial Costs and Data Security Concerns”

- The significant upfront investment required for dual-engine system hardware, software, and integration poses a barrier to adoption, particularly for smaller operators in emerging markets

- Retrofitting existing fracturing fleets with dual-engine technology can be complex and expensive, limiting widespread implementation

- Data security and privacy concerns are a major challenge, as dual-engine systems collect and transmit sensitive operational data, raising risks of cyberattacks or unauthorized access

- The lack of standardized global regulations for data management in hydraulic fracturing operations complicates compliance for multinational companies

- These factors may hinder market growth, especially in regions with heightened cost sensitivity or stringent data protection requirements

Hydraulic Fracturing Dual-Engine Systems market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the global hydraulic fracturing dual-engine systems market is segmented into horizontal and vertical. The horizontal segment dominated the largest market revenue share of 82.3% in 2024, driven by its widespread adoption in unconventional resource extraction, particularly shale gas and tight oil, due to enhanced production efficiency and greater reservoir contact.

The vertical segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, propelled by its application in regions with simpler geological formations and smaller-scale operations, where cost-effectiveness and ease of deployment are prioritized.

- By Communication Protocol

On the basis of communication protocol, the global hydraulic fracturing dual-engine systems market is segmented into wired and wireless. The wired segment is expected to hold the largest market revenue share of 68.7% in 2024, owing to its reliability and secure data transmission, critical for real-time monitoring and control in complex fracturing operations.

The wireless segment is expected to experience the fastest growth rate of 12.4% from 2025 to 2032, driven by advancements in IoT and 5G technologies, enabling flexible, cost-efficient, and scalable communication solutions for remote and dynamic fracturing sites.

- By Unlocking Mechanism

On the basis of unlocking mechanism, the global hydraulic fracturing dual-engine systems market is segmented into hydraulic, pneumatic, and electric. The hydraulic segment is expected to hold the largest market revenue share of 59.2% in 2024, attributed to its robust performance, high power output, and compatibility with the demanding operational requirements of fracturing processes.

The electric segment is anticipated to witness the fastest growth rate of 14.1% from 2025 to 2032, fueled by increasing emphasis on sustainability, reduced emissions, and advancements in electric-powered systems, aligning with stricter environmental regulations and industry trends toward greener technologies.

- By Application

On the basis of application, the global hydraulic fracturing dual-engine systems market is segmented into shale gas, tight oil, tight gas, coalbed methane (CBM), and others. The shale gas segment is expected to hold the largest market revenue share of 45.6% in 2024, driven by the global surge in shale gas exploration and production, particularly in North America, due to its vast reserves and favorable regulatory environment.

The tight oil segment is expected to witness the fastest growth rate of 10.3% from 2025 to 2032, propelled by rising global energy demand, technological advancements in extraction techniques, and increasing focus on unconventional oil resources to meet supply gaps.

Hydraulic Fracturing Dual-Engine Systems Market Regional Analysis

- North America dominated the hydraulic fracturing dual-engine systems market with the largest revenue share of 38.1% in 2024, driven by extensive shale reserves, advanced technological infrastructure, and favorable regulatory frameworks in the U.S. and Canada

- Consumers and operators prioritize dual-engine systems for their efficiency, reduced emissions, and ability to handle high-pressure fracturing operations, especially in regions with abundant unconventional resources and stringent environmental regulations

- Growth is supported by innovations in dual-engine system technology, including enhanced fuel efficiency and integration with digital monitoring systems, alongside rising adoption in both onshore and offshore applications

U.S. Hydraulic Fracturing Dual-Engine Systems Market Insight

The U.S. Hydraulic Fracturing dual-engine systems market captured the largest revenue share of 72.3% in 2024 within North America, fueled by robust exploration activities in shale basins such as the Permian and Marcellus. High demand for efficient, eco-friendly systems and growing regulatory focus on reducing emissions drive market expansion. The integration of dual-engine systems in both new rigs and retrofitted equipment supports a diverse ecosystem for shale gas and tight oil production.

Europe Hydraulic Fracturing Dual-Engine Systems Market Insight

The Europe hydraulic fracturing dual-engine systems market is expected to witness steady growth, driven by increasing interest in unconventional gas resources and energy diversification. Countries such as the U.K. and Poland are exploring shale gas, with demand for dual-engine systems that offer operational efficiency and compliance with strict environmental regulations. The market is supported by advancements in automation and emission-reducing technologies.

U.K. Hydraulic Fracturing Dual-Engine Systems Market Insight

The U.K. market for hydraulic fracturing dual-engine systems is anticipated to grow steadily, driven by rising exploration of shale gas reserves and a focus on energy security. Operators prefer systems that balance high performance with environmental compliance, particularly in urban and sensitive areas. Regulatory frameworks encouraging low-emission technologies and growing interest in sustainable fracturing solutions further boost adoption.

Germany Hydraulic Fracturing Dual-Engine Systems Market Insight

Germany’s hydraulic fracturing dual-engine systems market is expected to experience moderate growth, attributed to its advanced industrial base and cautious approach to unconventional energy exploration. Operators prioritize systems with advanced communication protocols and unlocking mechanisms to enhance efficiency and safety. The market benefits from Germany’s focus on energy efficiency and integration of dual-engine systems in pilot fracturing projects.

Asia-Pacific Hydraulic Fracturing Dual-Engine Systems Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global hydraulic fracturing dual-engine systems market, driven by expanding energy demand and exploration of unconventional resources in countries such as China, India, and Australia. Rising investments in shale gas and coalbed methane (CBM), coupled with government initiatives promoting energy security, fuel market growth. Adoption of advanced dual-engine systems with wireless communication and electric unlocking mechanisms is increasing.

Japan Hydraulic Fracturing Dual-Engine Systems Market Insight

Japan’s hydraulic fracturing dual-engine systems market is expected to grow steadily, driven by the country’s focus on energy diversification and limited domestic unconventional resource exploration. Operators favor high-efficiency systems with advanced communication protocols to optimize operations in challenging geological conditions. The integration of dual-engine systems in offshore projects and growing interest in sustainable technologies support market expansion.

China Hydraulic Fracturing Dual-Engine Systems Market Insight

China holds the largest share of the Asia-Pacific hydraulic fracturing dual-engine systems market, propelled by rapid growth in shale gas and tight oil exploration, particularly in the Sichuan Basin. The country’s increasing energy demand, government support for domestic energy production, and advancements in dual-engine system technology drive market growth. Competitive domestic manufacturing and adoption of wireless and electric systems enhance market accessibility.

Hydraulic Fracturing Dual-Engine Systems Market Share

The Hydraulic Fracturing dual-engine systems industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton (U.S.)

- Baker Hughes Company (U.S.)

- NexTier Oilfield Solutions (U.S.)

- Calfrac Well Services Ltd. (Canada)

- Liberty Oilfield Services LLC (U.S.)

- ProPetro Holding Corp. (U.S.)

- FTS International (U.S.)

- U.S. Well Services (U.S.)

- Trican Well Service (Canada)

- Weatherford International (U.S.)

- Basic Energy Services (U.S.)

- Patterson-UTI Energy, Inc. (U.S.)

- RPC, Inc. (U.S.)

- STEP Energy Services (Canada)

What are the Recent Developments in Global Hydraulic Fracturing Dual-Engine Systems Market?

- In June 2025, Chevron U.S.A. Inc. and Halliburton introduced a groundbreaking intelligent hydraulic fracturing process in Colorado. This closed-loop, feedback-driven system integrates automated stage execution with real-time subsurface feedback, optimizing energy delivery into the wellbore without human intervention. The innovation builds upon previous autonomous hydraulic fracturing technology, leveraging digital automation to enhance efficiency and asset performance

- In January 2025, Halliburton and Coterra Energy introduced the first fully automated hydraulic fracturing program in North America. Their Octiv® Auto Frac service, part of the ZEUS platform, enables push-button automation for stage execution, eliminating manual intervention. This breakthrough makes Coterra the first operator to fully automate and control its hydraulic fracturing design and execution. The initial rollout resulted in a 17% increase in stage efficiency, demonstrating significant improvements in operational performance

- In June 2023, NexTier Oilfield Solutions and Patterson-UTI Energy entered into a definitive all-stock merger agreement, creating a leading drilling and completions services provider. The combined company, valued at, operates across major U.S. basins, offering 172 super-spec drilling rigs and 3.3 million hydraulic fracturing horsepower. This merger strengthens its technology-driven portfolio, enhancing efficiency and market reach

- In January 2023, ProFrac Holding Corp. acquired REV Energy Holdings, LLC, a privately owned pressure pumping service provider operating in the Eagle Ford and Rockies. The acquisition strengthens ProFrac’s footprint in South Texas and the Rockies, enhancing its service capabilities. REV operates three premium frac fleets, totaling 204,500 hydraulic horsepower, with opportunities for upgrades through DGB engines and idle reduction systems. This strategic move aligns with ProFrac’s expansion goals in North American unconventional oil and gas resources

- In December 2022, ProPetro Holding Corp. signed an agreement with a leading Permian Basin operator to deploy its first electric-powered hydraulic fracturing fleet. Under this three-year contract, ProPetro will provide committed services following the fleet’s delivery. The e-fleet will initially use Tier IV DGB (Dynamic Gas Blending) dual-fuel equipment, transitioning to full electric operation upon deployment. This move marks a significant step in reducing emissions and optimizing hydraulic fracturing efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.