Global Hydraulics Market

Market Size in USD Billion

CAGR :

%

USD

44.08 Billion

USD

57.61 Billion

2024

2032

USD

44.08 Billion

USD

57.61 Billion

2024

2032

| 2025 –2032 | |

| USD 44.08 Billion | |

| USD 57.61 Billion | |

|

|

|

|

Hydraulics Market Size

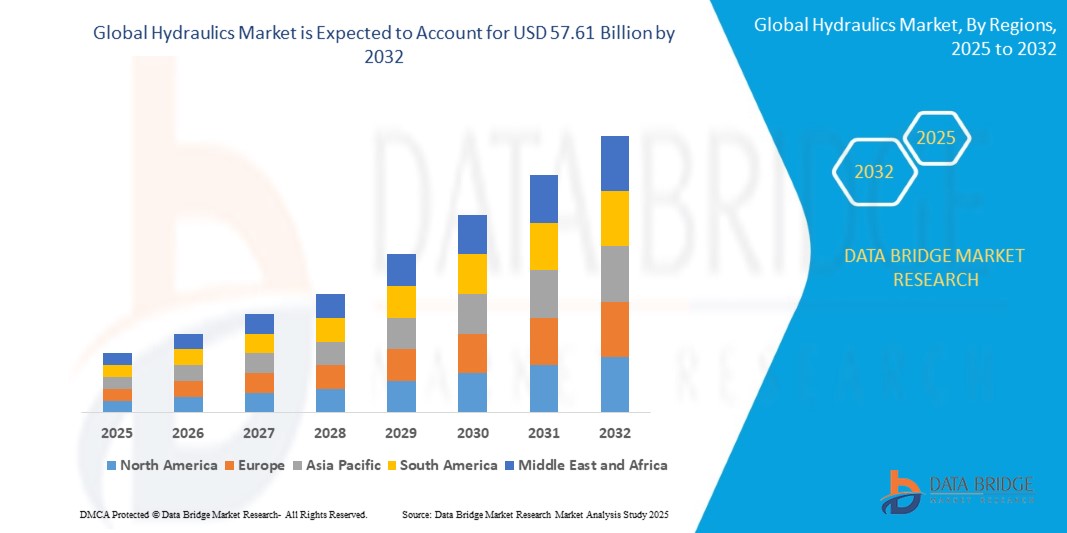

- The global ophthalmic operational microscope market was valued at USD 44.08 billion in 2024 and is expected to reach USD 57.61 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.4%, primarily driven by the rising demand across construction, agriculture, and industrial automation sectors

- This growth is driven by factors such as infrastructure modernization, increasing use of hydraulic equipment in mining and material handling, and advancements in electro-hydraulic systems

Hydraulics Market Analysis

- Hydraulic systems are essential components used across various sectors including construction, manufacturing, agriculture, aerospace, and automotive. These systems provide power transmission, precise control, and high force output, making them indispensable for heavy-duty operations and automation

- The demand for hydraulics is significantly driven by the expansion of infrastructure projects, industrial automation, and the rising adoption of hydraulic machinery in agriculture and mining. Over half of the global demand is fueled by the construction sector, especially in developing economies undergoing rapid urbanization and industrialization

- The Asia Pacific region stands out as one of the dominant markets for hydraulics, driven by massive infrastructure development, booming construction industries, and increased government spending on transportation and smart cities

- For instance, China’s “Belt and Road Initiative” and India’s smart city projects are significantly boosting the demand for hydraulic excavators, loaders, and cranes. Additionally, Japan and South Korea are investing in advanced electro-hydraulic systems for enhanced precision and energy efficiency in manufacturing

- Globally, hydraulics rank as one of the most crucial technologies in heavy machinery and industrial automation, following electric drive systems. They play a pivotal role in ensuring reliable, high-force motion control and energy transmission in diverse engineering applications

Report Scope and Hydraulics Market Segmentation

|

Attributes |

Hydraulics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydraulics Market Trends

“Integration of Smart Hydraulics and IoT-Based Monitoring”

- One prominent trend in the global hydraulics market is the increasing integration of smart hydraulics systems with IoT-based sensors and digital monitoring solutions

- These advancements enable real-time diagnostics, predictive maintenance, and remote system control, enhancing operational efficiency and reducing downtime in industrial and mobile hydraulic applications

- For instance, IoT-enabled hydraulic pumps and actuators can now transmit data on temperature, pressure, and fluid condition, allowing operators to predict failures before they occur and optimize performance dynamically

- Digital control units also allow seamless integration with broader industrial automation systems (Industry 4.0), providing intelligent feedback loops and enabling more precise control of hydraulic functions

- This trend is transforming traditional hydraulic systems into connected, data-driven solutions, increasing their appeal across smart factories, automated agricultural equipment, and modern construction machinery, and significantly driving demand for next-gen hydraulic components

Hydraulics Market Dynamics

Driver

“Growing Demand for Hydraulic Systems in Construction and Infrastructure Development”

- The accelerating pace of urbanization and infrastructure development, particularly in emerging economies, is significantly contributing to the increased demand for hydraulic systems across construction, mining, and transportation sectors

- As governments and private sectors invest in large-scale projects such as highways, railways, airports, and smart cities, the need for heavy-duty machinery powered by efficient hydraulic components has grown substantially

- Hydraulic systems offer essential capabilities like high-force output, precision control, and reliability, making them indispensable for tasks such as lifting, excavation, and material handling

- The ongoing advancements in hydraulic technology—such as energy-efficient pumps, electro-hydraulic actuators, and compact power units—further support their widespread adoption in modern construction equipment

- As more construction firms seek to improve productivity and reduce equipment downtime, the demand for robust and intelligent hydraulic solutions continues to grow, driving market expansion

For instance,

- In March 2024, India’s Ministry of Road Transport & Highways announced a target of constructing 12,000 km of national highways by March 2025, boosting the demand for hydraulic road rollers, graders, and excavators

- In August 2023, the European Union launched the “Green Construction Initiative,” focusing on sustainable urban development, where energy-efficient hydraulic systems play a pivotal role in reducing emissions from heavy equipment

- As a result of the rising need for modern infrastructure and mechanized operations, the global hydraulics market is seeing strong growth, particularly in segments requiring powerful and reliable motion control solutions

Opportunity

“Digital Transformation and Smart Hydraulics for Industry 4.0”

- The growing integration of digital technologies and smart sensors in hydraulic systems presents a major opportunity for market growth, particularly as industries shift toward Industry 4.0 and intelligent automation

- Smart hydraulic systems, embedded with IoT sensors, cloud connectivity, and AI-based analytics, can offer real-time monitoring, predictive maintenance, and enhanced system diagnostics—improving uptime and operational efficiency across sectors

- These technologies allow manufacturers and operators to remotely monitor equipment health, detect early signs of failure, and optimize performance based on real-time data

For instance,

- In October 2024, Bosch Rexroth launched its new generation of cyber-physical hydraulic actuators equipped with built-in diagnostics and real-time feedback capabilities, tailored for use in smart factories and mobile machinery

- In June 2023, Eaton introduced a cloud-based predictive maintenance platform for its industrial hydraulic systems, helping customers reduce unscheduled downtime by up to 40% through early fault detection and automated alerts

- Smart hydraulics are increasingly being deployed in automated production lines, agricultural machinery, and energy-efficient construction equipment, enabling seamless integration with digital ecosystems and boosting sustainability

- As industries move toward connected and autonomous systems, digitally enhanced hydraulic solutions offer a competitive edge—opening new revenue streams and driving innovation across traditional hydraulic markets

Restraint/Challenge

“High Initial Investment and Maintenance Costs Limiting Adoption”

- The high initial cost associated with acquiring advanced hydraulic systems and components remains a significant challenge for market penetration, particularly among small and mid-sized enterprises (SMEs) and contractors in developing regions

- Sophisticated hydraulic equipment—such as precision pumps, valves, actuators, and smart control units—often comes with a substantial price tag. In addition, ongoing maintenance, energy consumption, and specialized servicing requirements contribute to the total cost of ownership

- This financial barrier can discourage businesses with limited capital from upgrading to modern hydraulic systems or adopting newer, more efficient technologies

For instance,

- In May 2023, the European Fluid Power Committee noted that maintenance costs for aging hydraulic machinery can be 20% higher than newer systems due to increased downtime and the scarcity of replacement parts

- As a result, many companies continue relying on legacy systems, which may not offer the same efficiency, precision, or environmental compliance as modern hydraulic solutions

- These limitations can slow market adoption, especially in regions lacking access to financing or technical expertise, ultimately restraining the broader growth potential of the global hydraulics market

Hydraulics Market Scope

The market is segmented on the basis of component, application, end user, and type.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Application |

|

|

By End User |

|

|

By Type

|

|

Hydraulics Market Regional Analysis

“Asia Pacific is the Dominant Region in the Hydraulics Market”

- Asia Pacific dominates the global hydraulics market, driven by rapid industrialization, significant infrastructure development, and increasing adoption of construction and agricultural machinery

- China holds a leading share due to its large-scale investments in transport and energy infrastructure, massive construction activities, and its role as a global manufacturing hub

- The region benefits from growing demand for mining equipment, agricultural mechanization, and smart manufacturing initiatives, particularly in countries like India, Japan, and South Korea

- Government-led infrastructure programs—such as India’s Bharatmala and Smart Cities Mission and China’s Belt and Road Initiative—are significantly increasing the need for hydraulic-powered machines like excavators, cranes, and loaders

- In addition, the presence of key hydraulic component manufacturers and rising R&D investment in next-generation electro-hydraulic and energy-efficient systems are accelerating innovation in the region

- With a large base of end-user industries and an expanding export market, Asia Pacific continues to lead global growth in hydraulic applications, making it the most influential region for the foreseeable future

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global hydraulics market, fueled by massive infrastructure projects, growing manufacturing output, and rising mechanization in agriculture and construction

- China, India, and Southeast Asian countries are emerging as key growth markets due to increased urbanization, population growth, and government-backed industrial development programs

- China continues to lead the region with its expansive construction sector, high demand for heavy-duty equipment, and strong presence of domestic hydraulic component manufacturers

- India is also experiencing a surge in demand for hydraulic systems driven by road and railway expansion, smart city initiatives, and a push toward agricultural modernization through mechanized tools

- Meanwhile, Japan and South Korea remain strongholds for technologically advanced hydraulic equipment, with emphasis on precision, energy efficiency, and smart system integration

- The region's improving access to capital, skilled labor, and R&D facilities, along with the increasing presence of global players and OEM partnerships, is expected to accelerate the adoption of innovative hydraulic technologies

- As a result, Asia-Pacific is poised to be the fastest-growing region, playing a pivotal role in shaping the future of the hydraulics industry across applications like construction, industrial automation, and mobile machinery

Hydraulics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Parker Hannifin Corporation (U.S.)

- Palfinger AG (Austria)

- Sulzer Ltd. (Switzerland)

- Questas Group (Australia)

- Bosch Rexroth AG (Germany)

- Eaton Corporation plc (Ireland)

- Danfoss Power Solutions (Denmark)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Yuken Kogyo Co., Ltd. (Japan)

- HYDAC International GmbH (Germany)

- Liebherr Group (Switzerland)

- HAWE Hydraulik SE (Germany)

- Bucher Hydraulics GmbH (Germany)

- Wipro Infrastructure Engineering (India)

- Husco International (U.S.)

Latest Developments in Global Hydraulics Market

- In March 2023, DEF Hydraulics introduced its groundbreaking innovation, the NextGen Hydraulic System, aimed at transforming fluid power applications in the construction industry. The system features cutting-edge technology, including advanced sensors, predictive analytics, and smart control algorithms, to enhance performance, efficiency, and reliability. This development highlights DEF Hydraulics' dedication to innovation and its efforts to meet the evolving demands of the construction sector with state-of-the-art hydraulic solutions

- In February 2023, Bosch Rexroth AG launched a state-of-the-art Hydraulics Training Center to meet the growing educational demands within the fluid power industry. This advanced facility is designed to support skill development for both newcomers and experienced professionals, addressing the diverse training needs of individuals at various stages of their careers in the industry

- In November 2023, at Agritechnica 2023, Danfoss Power Solutions showcased a range of hydraulic components and innovations aimed at enhancing autonomy and electrification in agriculture. The company highlighted its comprehensive suite of hydraulic, electric, and fluid conveyance components, alongside electronic controls, to support sustainable farming practices. Notably, Danfoss presented its Autonomous Custom Engineering Services (ACES), designed to assist in developing autonomous and semi-autonomous machinery, addressing labor challenges in agriculture. Additionally, the company introduced the H1F fixed displacement bent axis hydraulic motor, offering up to 95% overall efficiency, underscoring its commitment to efficiency and sustainability in agricultural machinery

- In September 2022, Parker Aerospace, a division of Parker Hannifin Corporation and a leader in motion and control technologies, was selected by Boeing to supply the AP15V engine-driven pump (EDP) for the hydraulic system of the B-52H Stratofortress. As part of the U.S. Air Force's Commercial Engine Replacement Program (CERP), the Parker AP15V EDP, also known as the "World Pump," will continue to serve the aircraft’s hydraulic system until the 2050s

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydraulics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydraulics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydraulics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.