Global Hydrocarbon Fire Intumescent Coating Services Market

Market Size in USD Billion

CAGR :

%

USD

7.07 Billion

USD

10.86 Billion

2024

2032

USD

7.07 Billion

USD

10.86 Billion

2024

2032

| 2025 –2032 | |

| USD 7.07 Billion | |

| USD 10.86 Billion | |

|

|

|

|

Hydrocarbon Fire Intumescent Coating Services Market Size

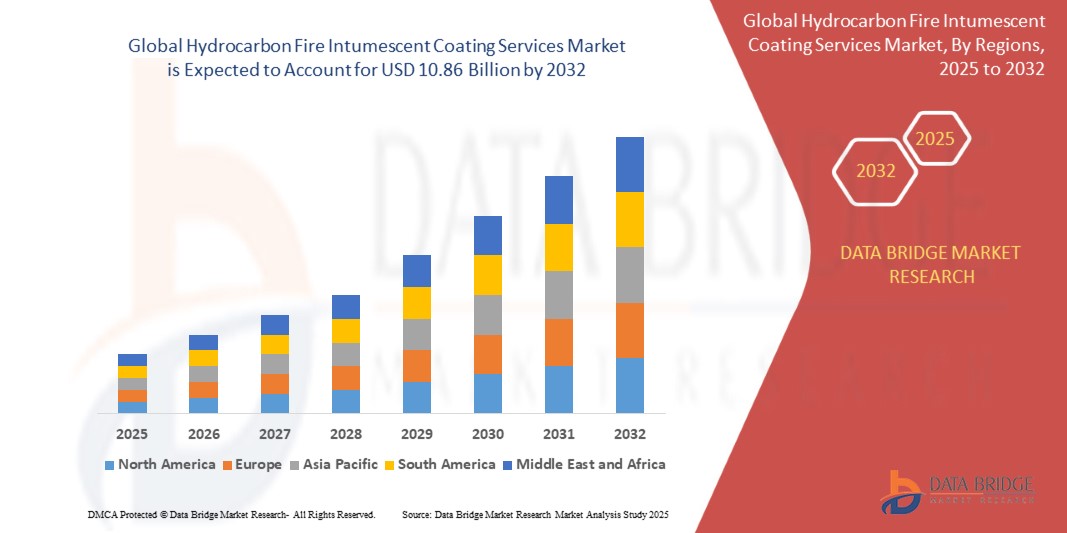

- The global hydrocarbon fire intumescent coating services market size was valued at USD 7.07 billion in 2024 and is expected to reach USD 10.86 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by rising safety regulations across high-risk industries such as oil & gas, petrochemicals, and energy infrastructure, which mandate the use of passive fire protection systems, including hydrocarbon fire intumescent coatings

- Furthermore, increased investments in offshore drilling, LNG terminals, and refinery expansions—particularly in Asia-Pacific and the Middle East—are accelerating demand for high-performance, UL 1709-compliant coatings. These converging factors are driving the widespread adoption of fireproofing services, significantly boosting market expansion

Hydrocarbon Fire Intumescent Coating Services Market Analysis

- Hydrocarbon fire intumescent coatings are advanced passive fire protection solutions applied to structural steel to delay collapse during intense hydrocarbon fires, typically caused by fuel explosions or industrial accidents. These coatings swell upon exposure to extreme heat, forming an insulating char layer that protects the substrate

- The growing demand for these coatings is driven by increasing awareness of industrial safety, the implementation of stricter fireproofing regulations, and the need to safeguard critical infrastructure in oil & gas and petrochemical sectors, where fire hazards are severe and rapid heat rise is common

- Asia-Pacific dominated the hydrocarbon fire intumescent coating services market with a share of over 30% in 2024, due to rapid expansion of industrial infrastructure, particularly in oil and gas, petrochemicals, and heavy manufacturing sectors

- North America is expected to be the fastest growing region in the hydrocarbon fire intumescent coating services market during the forecast period due to region’s expansive oil & gas infrastructure, including shale gas operations, pipelines, and petrochemical hubs which creates a consistent need for high-performance fire protection solutions

- Solvent type segment dominated the market with a market share of 57.8% in 2024, due to its superior performance in extreme environments and its proven efficacy in providing thick, durable fire protection on structural steel. Solvent-based coatings are highly preferred in offshore platforms, refineries, and petrochemical installations where high humidity, salt spray, and temperature fluctuations are common. Their compatibility with a broad range of substrates and longer shelf life further strengthen their adoption across complex industrial applications

Report Scope and Hydrocarbon Fire Intumescent Coating Services Market Segmentation

|

Attributes |

Hydrocarbon Fire Intumescent Coating Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrocarbon Fire Intumescent Coating Services Market Trends

“Increasing Safety Regulations”

- Growing global emphasis on industrial safety and risk mitigation is driving the increased adoption of hydrocarbon fire intumescent coating services, particularly in high-risk sectors such as oil & gas, petrochemicals, marine, and infrastructure. Governments and regulatory bodies are mandating stricter fire protection compliance in both new constructions and retrofit projects

- For instance, companies such as AkzoNobel, PPG Industries, and Jotun are seeing an uptick in orders for certified hydrocarbon fire protection coatings, especially in markets such as the U.S., Middle East, and Europe, where policies aligned with API, ASTM, and local fire codes are becoming more stringent

- There is a sharp rise in demand for fire protection solutions in offshore platforms, LNG terminals, and large refineries, where hydrocarbon explosion risks are high, and passive fire protection is critical to ensure structural integrity during emergencies

- Technological advancements are allowing manufacturers to develop thinner coatings with longer fire protection ratings (up to 4 hours), faster curing times, and improved weather resistance—reducing downtime and labor costs for end-users

- The market is also experiencing growth in low-VOC, solvent-free, and water-based formulations, aligning with corporate ESG commitments and environmental regulations focusing on reducing emissions and improving worker safety during application

- Insurance providers and EPC (Engineering, Procurement, and Construction) contractors are increasingly specifying third-party-tested, globally certified products in project tenders, reinforcing trust in high-performance passive fire protection solutions and encouraging standardization

Hydrocarbon Fire Intumescent Coating Services Market Dynamics

Driver

“Rise in the Product Demand in the Oil and Gas Sector”

- The oil and gas industry is a primary driver of hydrocarbon fire intumescent coating services, owing to its exposure to high fire risk, flammable materials, and harsh operating environments. Fire protection is critical for safeguarding personnel, structural steel, pipelines, storage tanks, and processing equipment during potential hydrocarbon fire outbreaks

- For instance, oil and gas majors—including global operators and service providers—are increasingly contracting specialized coating services as projects expand in both greenfield (new exploration and production sites) and brownfield (existing sites undergoing upgrades) settings. The adoption rate is especially high in regions undertaking capacity expansions or modernization, such as North America and the Middle East

- These coatings offer life-saving thermal protection and also contribute to the structural integrity and operational continuity of offshore rigs and refineries, where fire incidents can be catastrophic and regulatory penalties severe

- Demand is further driven by the energy sector’s move into harsher exploration environments, such as deepwater drilling and LNG terminals, where fire safety measures are paramount for compliance and insurance purposes

- The trend is reinforced as energy and utilities firms increasingly prioritize ESG (environmental, social, and governance) standards, making advanced, compliant fire protection a necessity rather than an option

Restraint/Challenge

“Volatility of Raw Material Prices”

- The market faces significant headwinds due to volatility in raw material prices—particularly for key inputs such as resins, flame retardant additives, and binders. This volatility undermines cost planning, compresses margins, and complicates long-term service or supply contracts

- For instance, sharp price swings in specialty chemicals and base materials have forced some service providers to adjust pricing mid-project, impacting competitiveness and customer relationships. These disruptions are especially acute for global companies exposed to currency fluctuations and regional supply chain bottlenecks

- Manufacturers are challenged to balance quality, performance, and cost, as cheaper raw materials may not meet the increasingly stringent performance and regulatory standards required for oil and gas or critical infrastructure projects

- The unpredictable nature of feedstock costs has prompted a shift toward greater use of recycled or alternative materials and has triggered more backward integration by service providers to manage supply risk and cost more effectively

- The issue is compounded by global events—such as trade disruptions, health crises, or geopolitical tensions—that can further restrict raw material availability and destabilize supplier relationships

Hydrocarbon Fire Intumescent Coating Services Market Scope

The market is segmented on the basis of type and end user.

• By Type

On the basis of type, the hydrocarbon fire intumescent coating services market is segmented into emulsion type, solvent type, and others. The solvent type segment dominated the largest market revenue share of 57.8% in 2024, primarily due to its superior performance in extreme environments and its proven efficacy in providing thick, durable fire protection on structural steel. Solvent-based coatings are highly preferred in offshore platforms, refineries, and petrochemical installations where high humidity, salt spray, and temperature fluctuations are common. Their compatibility with a broad range of substrates and longer shelf life further strengthen their adoption across complex industrial applications.

The emulsion type segment is projected to witness the fastest growth rate from 2025 to 2032, supported by increasing environmental regulations and a growing preference for low-VOC (volatile organic compound) alternatives. Emulsion-based coatings offer safer handling, lower emissions, and ease of application, making them attractive for onshore facilities and enclosed environments. As sustainable practices gain prominence, demand for water-based fire protection solutions such as emulsions is accelerating across new infrastructure developments.

• By End User

On the basis of end user, the market is segmented into chemicals, oil and gas, metals and mining, lime and cement, pulp and paper, and others. The oil and gas segment held the largest market revenue share in 2024, driven by stringent fire safety norms and the high-risk nature of hydrocarbon-based facilities. These environments demand advanced passive fire protection systems, and hydrocarbon intumescent coatings are integral to mitigating fire spread and protecting structural integrity during prolonged exposure to intense flames. Continuous investments in offshore drilling, LNG terminals, and refineries are fueling demand for these specialized services in the sector.

The chemicals segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by growing chemical production capacities and the rising importance of regulatory compliance in hazardous processing environments. The need to safeguard chemical plants from catastrophic fire incidents has made intumescent coatings a key component of industrial fireproofing strategies. In addition, modernization of aging chemical infrastructure and construction of new plants, particularly in Asia-Pacific and the Middle East, are contributing to the robust growth of this segment.

Hydrocarbon Fire Intumescent Coating Services Market Regional Analysis

- Asia-Pacific dominated the hydrocarbon fire intumescent coating services market with the largest revenue share of over 30% in 2024, driven by rapid expansion of industrial infrastructure, particularly in oil and gas, petrochemicals, and heavy manufacturing sectors

- The region’s increasing focus on worker safety, stricter fire protection codes, and ongoing investments in energy infrastructure are key contributors to market growth

- Government-backed infrastructure projects, combined with the presence of major steel fabricators and local applicators, are strengthening adoption of hydrocarbon fire protection solutions across refineries, chemical plants, and offshore platforms

China Market Insight

China held the largest share in the Asia-Pacific region in 2024, supported by large-scale investments in downstream oil and gas infrastructure and chemical production. As a major player in global refinery and petrochemical expansion, China is enforcing tighter safety regulations and quality control for fireproofing services. The country's focus on industrial safety, combined with initiatives such as the Belt and Road infrastructure push, is creating sustained demand for hydrocarbon fire protection. Local manufacturers are scaling up solvent-based coating production and deploying high-efficiency application systems to meet evolving safety and performance standards.

India Market Insight

India is emerging as one of the fastest-growing markets in Asia-Pacific due to the expansion of its refining capacity, construction of new petrochemical complexes, and development of LNG regasification terminals. Increasing regulatory oversight by agencies such as the Petroleum and Explosives Safety Organisation (PESO) is propelling the need for certified and reliable fireproofing services. The market is also witnessing strong demand from pipeline construction and offshore exploration. Growing collaboration between global fire protection suppliers and local service providers is ensuring customized solutions adapted to India’s climatic and operational requirements.

Europe Hydrocarbon Fire Intumescent Coating Services Market

Europe is projected to grow steadily in the hydrocarbon fire intumescent coating services market, supported by stringent regulatory frameworks such as the EU Construction Products Regulation, EN 13381-4, and UL 1709 standards. The region’s mature oil and gas infrastructure, particularly in the North Sea, is undergoing extensive refurbishment and modernization, prompting increased demand for passive fire protection services. Environmental awareness and energy transition goals are also driving innovation in low-VOC, durable, and sustainable coating technologies. Countries including the U.K., Germany, and the Netherlands are at the forefront, with high adoption rates across refineries, LNG facilities, and offshore rigs. Europe’s well-developed safety culture and insurance-driven compliance requirements further enhance market penetration.

U.K. Market Insight

The U.K. market is expanding due to retrofitting needs across aging oil platforms, petrochemical installations, and hazardous material processing plants. Rising emphasis on ISO and EU safety compliance is pushing stakeholders to adopt third-party tested and performance-rated fire protection systems. The demand is further strengthened by regulatory pressure and insurance mandates requiring advanced fireproofing solutions for critical infrastructure. Local contractors are increasingly utilizing automated spray systems and solvent-based coatings to meet demanding site conditions and reduce downtime during application.

Germany Market Insight

Germany's market is supported by a strong commitment to industrial safety, innovation in coating technologies, and the presence of major chemical parks and process industries. The country has been investing in hybrid coating systems that combine fire resistance with corrosion protection, aligning with its dual focus on operational safety and equipment longevity. As recycling, circular economy practices, and low-emission materials gain prominence, German firms are integrating eco-friendly and highly durable fire protection solutions into industrial construction and maintenance practices. Strict adherence to national and European safety codes continues to drive steady demand in this market.

North America Hydrocarbon Fire Intumescent Coating Services Market

North America market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by region’s expansive oil & gas infrastructure, including shale gas operations, pipelines, and petrochemical hubs which creates a consistent need for high-performance fire protection solutions. Compliance with OSHA, NFPA, and API standards necessitates rigorous passive fireproofing across upstream, midstream, and downstream operations. Technological advancements in mobile application units, offsite prefabrication, and third-party certified coating systems are boosting service efficiency. The Gulf Coast and Alberta oil sands remain key hotspots for continued investment in this market.

U.S. Market Insight

The U.S. leads the North American region, driven by its extensive network of refineries, LNG facilities, and petrochemical complexes. The adoption of hydrocarbon fire intumescent coatings is strongly supported by federal and state-level regulations requiring certified fire protection in high-risk environments. Key players in the U.S. are leveraging advanced application technologies and mobile deployment units to ensure compliance and reduce installation timelines. The market also benefits from a mature safety culture, well-established inspection protocols, and strong demand from both new constructions and maintenance of legacy energy infrastructure. The presence of major oil & gas companies and third-party testing laboratories ensures continued innovation and regulatory alignment in this segment.

Hydrocarbon Fire Intumescent Coating Services Market Share

The hydrocarbon fire intumescent coating services industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- PPG Industries, Inc (U.S.)

- Jotun (Norway)

- The Sherwin-Williams Company (U.S.)

- Hempel A/S (Denmark)

- Etex Group (Belgium)

- Kansai Paint Co., Ltd. (Japan)

- 3M (U.S.)

- Carboline Company (U.S.)

- BASF SE (Germany)

- Contego International Inc. (U.S.)

- Isolatek International (U.S.)

- GCP Applied Technologies Inc. (U.S.)

- Demilec (USA) Inc. (U.S.)

Latest Developments in Global Hydrocarbon Fire Intumescent Coating Services Market

- In November 2024, Clariant introduced its next-generation melamine-free flame retardant, positioning it as a safer and more sustainable alternative for fire protection applications. This innovation is expected to make a significant impact on the hydrocarbon fire intumescent coating services market by addressing increasing regulatory pressure to eliminate toxic components while maintaining high-performance fire resistance. By offering an environmentally responsible solution that aligns with evolving industry safety standards, Clariant is likely to influence formulation trends across coating manufacturers, especially in regions enforcing stricter chemical safety laws and green building codes

- In February 2023, PPG launched the PPG STEELGUARD 951, an epoxy-based intumescent fire protection coating engineered to provide up to three hours of cellulosic fire resistance for structural steel. Although tailored primarily for architectural applications, the advanced formulation showcases the company's growing focus on high-performance protective solutions. This development has reinforced PPG’s presence in the fire protection segment and demonstrates the technological crossover potential for hydrocarbon-related infrastructure, especially in hybrid projects where both hydrocarbon and cellulosic risks coexist. It also sets a new benchmark for epoxy-based coatings in terms of durability and aesthetic integration

- In October 2022, Hempel's Hempafire Pro 400 passive fire protection coating received certification under the EN 13381-8 standard and was awarded the CE mark. This milestone underscores the product’s compliance with stringent European fire safety regulations and also enhances its credibility for global deployment. By securing a broad range of certifications—including BS 476 and ApplusFire—Hempel has strengthened its foothold in both new construction and retrofit markets, particularly across Europe. The recognition is expected to increase specification rates among engineering consultants and contractors seeking reliable, certified coatings for large-scale infrastructure and industrial assets

- In June 2022, Hempel expanded its fire protection portfolio with the launch of Hempafire XTR 100, its first intumescent coating designed specifically for hydrocarbon passive fire protection (PFP). UL 1709-certified, this lightweight solution delivers robust fire resistance at reduced dry film thicknesses, resulting in lower material use, faster application, and reduced structural load. This product is a key advancement in the hydrocarbon PFP segment, offering project efficiencies and enhanced safety for applications in offshore platforms, refineries, and LNG terminals. The launch of Hempafire XTR 100 marked Hempel’s strategic entry into the hydrocarbon fire protection domain, intensifying competition and innovation in the global services market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrocarbon Fire Intumescent Coating Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrocarbon Fire Intumescent Coating Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrocarbon Fire Intumescent Coating Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.