Global Hydrocarbon Refrigerants Market

Market Size in USD Billion

CAGR :

%

USD

12.15 Billion

USD

22.92 Billion

2025

2033

USD

12.15 Billion

USD

22.92 Billion

2025

2033

| 2026 –2033 | |

| USD 12.15 Billion | |

| USD 22.92 Billion | |

|

|

|

|

Hydrocarbon Refrigerants Market Size

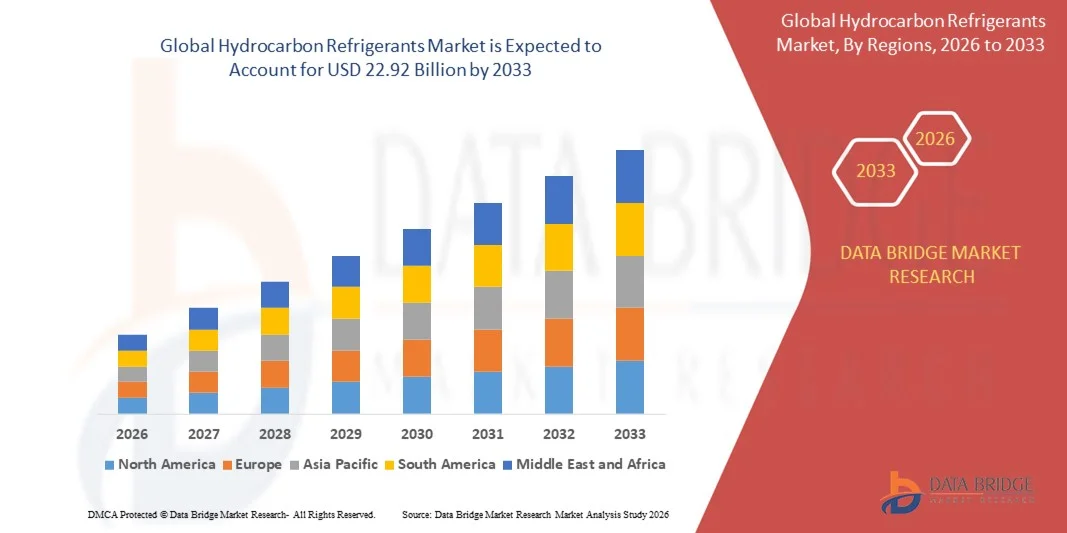

- The global hydrocarbon refrigerants market size was valued at USD 12.15 billion in 2025 and is expected to reach USD 22.92 billion by 2033, at a CAGR of 8.25% during the forecast period

- The market growth is largely driven by the increasing global shift toward low-GWP and environmentally friendly refrigerants, supported by stringent climate regulations and international agreements aimed at reducing greenhouse gas emissions across cooling and refrigeration systems

- Furthermore, rising demand for energy-efficient refrigeration and air conditioning solutions in residential, commercial, and industrial sectors is accelerating the adoption of hydrocarbon refrigerants. These combined factors are strengthening the transition away from conventional HFCs, thereby significantly supporting overall market growth

Hydrocarbon Refrigerants Market Analysis

- Hydrocarbon refrigerants, derived from natural compounds such as propane and isobutane, are becoming critical components of modern refrigeration and cooling systems due to their high energy efficiency, low global warming potential, and favorable thermodynamic performance

- The growing demand for hydrocarbon refrigerants is primarily fueled by tightening environmental regulations, increasing adoption of sustainable cooling technologies, and expanding applications in household refrigeration, commercial cooling, and cold chain infrastructure

- Asia-Pacific dominated the hydrocarbon refrigerants market with a share of around 45% in 2025, due to rapid urbanization, expanding residential and commercial construction, and strong demand for energy-efficient cooling solutions

- North America is expected to be the fastest growing region in the hydrocarbon refrigerants market during the forecast period due to tightening environmental regulations, rising awareness of low-carbon cooling solutions, and increasing adoption in residential refrigeration

- Propane segment dominated the market with a market share of 48% in 2025, due to its excellent thermodynamic properties, widespread availability, and compatibility with various refrigeration and air conditioning systems. Propane is favored for its high energy efficiency and low environmental impact, making it a preferred choice among residential, commercial, and industrial users. For instance, companies such as Chemours and Honeywell utilize propane in their refrigerant formulations to provide eco-friendly cooling solutions. The market also witnesses strong demand for propane due to its versatility in applications ranging from household refrigerators to industrial chillers. In addition, safety regulations and proper handling protocols have further increased confidence in using propane as a reliable refrigerant option

Report Scope and Hydrocarbon Refrigerants Market Segmentation

|

Attributes |

Hydrocarbon Refrigerants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrocarbon Refrigerants Market Trends

Rising Adoption of Low-GWP and Natural Refrigerants

- A major trend in the hydrocarbon refrigerants market is the accelerating shift toward low-GWP and natural refrigerants, driven by global efforts to reduce greenhouse gas emissions and comply with evolving environmental regulations. Hydrocarbon refrigerants such as propane and isobutane are increasingly preferred due to their minimal environmental impact and high energy efficiency across refrigeration and cooling systems

- For instance, companies such as BASF and Arkema have expanded their portfolios of hydrocarbon and natural refrigerants to support manufacturers transitioning away from high-GWP synthetic alternatives. These offerings help appliance and HVAC manufacturers meet regulatory requirements while maintaining system performance and efficiency

- The residential refrigeration segment is witnessing strong uptake of hydrocarbon refrigerants as manufacturers adopt sustainable solutions to align with eco-labeling and energy efficiency standards. This trend is reinforcing hydrocarbons as a mainstream choice in household refrigerators and freezers

- Commercial refrigeration is also embracing hydrocarbon refrigerants, particularly in supermarkets and cold storage facilities, where energy efficiency and emission reduction are critical operational priorities. This is strengthening demand for hydrocarbons in larger-capacity cooling systems

- Heat pump and air conditioning manufacturers are increasingly evaluating hydrocarbons as viable alternatives due to their thermodynamic advantages and regulatory acceptance. This gradual expansion into new applications is broadening the overall scope of hydrocarbon refrigerant usage

- The continued regulatory push and growing environmental awareness among manufacturers and end users are solidifying the role of hydrocarbon refrigerants as key enablers of sustainable cooling, reinforcing long-term market growth

Hydrocarbon Refrigerants Market Dynamics

Driver

Stringent Environmental Regulations on High-GWP Refrigerants

- Stringent environmental regulations targeting the phase-down of high-GWP refrigerants are a primary driver of the hydrocarbon refrigerants market. Policies aligned with the Kigali Amendment and regional F-gas regulations are compelling manufacturers to replace conventional refrigerants with climate-friendly alternatives

- For instance, regulatory frameworks in the European Union have encouraged companies such as Daikin and Bosch to adopt hydrocarbon refrigerants in refrigeration and heat pump systems. Compliance with these regulations is directly influencing product design and refrigerant selection across multiple cooling applications

- The enforcement of emission reduction targets is accelerating investments in natural refrigerant technologies, pushing manufacturers to redesign systems compatible with hydrocarbons. This regulatory pressure is transforming hydrocarbons from niche options into standardized refrigerant choices

- Developing economies are also strengthening their environmental policies, further expanding the addressable market for hydrocarbon refrigerants. This global alignment of regulations is creating consistent demand across residential, commercial, and industrial segments

- The regulatory landscape continues to favor refrigerants with low environmental impact, reinforcing hydrocarbons as compliant and future-ready solutions. This driver is expected to sustain long-term market momentum as policy enforcement intensifies

Restraint/Challenge

Safety Concerns Related to Flammability

- Safety concerns associated with the flammability of hydrocarbon refrigerants remain a key challenge limiting their widespread adoption in certain applications. The need for strict safety standards, system redesign, and controlled charge limits increases complexity for manufacturers and installers

- For instance, organizations such as eurammon e.V. actively promote safety guidelines and best practices for the safe handling and application of hydrocarbon refrigerants. While these efforts support adoption, they also highlight the additional compliance requirements involved

- Manufacturers must invest in advanced system engineering and leak prevention technologies to mitigate safety risks, which can increase production costs and development timelines. This presents barriers, particularly for smaller players and cost-sensitive markets

- Installation and servicing of hydrocarbon-based systems require specialized training to ensure safe operation, creating workforce and skill-related challenges. Limited awareness and technical expertise can slow adoption in some regions

- Despite proven safety records in controlled environments, perception-based concerns continue to influence regulatory approvals and end-user acceptance. Addressing these challenges through education, standardization, and technological innovation remains critical for sustained market expansion

Hydrocarbon Refrigerants Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the hydrocarbon refrigerants market is segmented into propane, isobutene, propylene, and others. The propane segment dominated the market with the largest revenue share of 48% in 2025, driven by its excellent thermodynamic properties, widespread availability, and compatibility with various refrigeration and air conditioning systems. Propane is favored for its high energy efficiency and low environmental impact, making it a preferred choice among residential, commercial, and industrial users. For instance, companies such as Chemours and Honeywell utilize propane in their refrigerant formulations to provide eco-friendly cooling solutions. The market also witnesses strong demand for propane due to its versatility in applications ranging from household refrigerators to industrial chillers. In addition, safety regulations and proper handling protocols have further increased confidence in using propane as a reliable refrigerant option.

The isobutene segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in commercial refrigeration and air conditioning systems. Isobutene offers excellent energy efficiency and low global warming potential, making it suitable for environmentally conscious applications. Its use in commercial chillers and heat pumps is increasing due to its stable performance under varying operating conditions. For instance, Daikin has implemented isobutene-based refrigerants in several commercial HVAC systems to reduce carbon emissions and enhance cooling efficiency. The growing demand for sustainable cooling solutions and regulatory incentives in multiple regions further accelerates its adoption. Isobutene also provides flexibility for retrofitting existing systems, increasing its appeal among manufacturers and end users.

- By Application

On the basis of application, the hydrocarbon refrigerants market is segmented into refrigerators, chillers, air conditioners, heat pumps, and others. The refrigerators segment dominated the market with the largest revenue share in 2025, driven by the growing demand for energy-efficient household appliances and eco-friendly refrigerants. Hydrocarbon refrigerants, particularly propane, are widely used in domestic refrigerators due to their excellent cooling performance and low environmental impact. For instance, LG and Whirlpool have increasingly incorporated hydrocarbon-based refrigerants in their refrigerator models to meet energy efficiency standards and sustainability goals. The market is also supported by the increasing consumer awareness of the environmental benefits of low-GWP refrigerants. In addition, retrofitting opportunities in existing refrigeration units further bolster the demand for hydrocarbon refrigerants in household applications.

The air conditioners segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising temperatures, and increasing adoption of sustainable cooling solutions in commercial and residential spaces. Hydrocarbon refrigerants offer high efficiency and lower environmental impact compared with traditional HFC-based refrigerants, making them increasingly attractive for air conditioning systems. For instance, Panasonic has developed R-290 and R-600a refrigerant-based air conditioners to enhance energy efficiency and reduce carbon emissions. The growing focus on green building certifications and energy-saving regulations across various countries accelerates the adoption of hydrocarbons in air conditioning applications. Their compatibility with modern inverter and variable refrigerant flow systems also contributes to their rising popularity.

Hydrocarbon Refrigerants Market Regional Analysis

- Asia-Pacific dominated the hydrocarbon refrigerants market with the largest revenue share of around 45% in 2025, driven by rapid urbanization, expanding residential and commercial construction, and strong demand for energy-efficient cooling solutions

- The region’s large-scale manufacturing base for refrigerators and air conditioners, rising adoption of low-GWP refrigerants, and cost-effective production capabilities are accelerating market growth

- Supportive environmental regulations, increasing awareness of climate-friendly refrigerants, and rising disposable income across developing economies are contributing to higher consumption of hydrocarbon refrigerants

China Hydrocarbon Refrigerants Market Insight

China held the largest share in the Asia-Pacific hydrocarbon refrigerants market in 2025, supported by its dominance in appliance manufacturing and large domestic demand for refrigerators and air conditioners. Strong government policies promoting low-emission refrigerants, extensive production capacity, and a well-established HVAC supply chain are key growth drivers. Increasing exports of cooling appliances using hydrocarbon refrigerants further strengthen market expansion.

India Hydrocarbon Refrigerants Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid urbanization, rising penetration of household appliances, and increasing demand for affordable cooling solutions. Government initiatives promoting energy efficiency and environmentally friendly refrigerants are encouraging manufacturers to shift toward hydrocarbons. Growth in cold chain infrastructure and rising adoption of air conditioners are further supporting market expansion.

Europe Hydrocarbon Refrigerants Market Insight

The Europe hydrocarbon refrigerants market is growing steadily, driven by stringent environmental regulations, strong emphasis on sustainability, and early adoption of low-GWP refrigerants. The region’s focus on energy-efficient appliances and compliance with F-gas regulations supports increased use of hydrocarbons. Demand is particularly strong in household refrigeration and heat pump applications.

Germany Hydrocarbon Refrigerants Market Insight

Germany’s market is driven by its advanced HVAC manufacturing sector, strong regulatory compliance, and leadership in energy-efficient technologies. The country’s emphasis on sustainable cooling systems and innovation in refrigeration equipment supports widespread adoption of hydrocarbon refrigerants. High demand from residential and commercial refrigeration applications continues to drive steady growth.

U.K. Hydrocarbon Refrigerants Market Insight

The U.K. market benefits from increasing adoption of environmentally friendly refrigerants and rising demand for energy-efficient appliances. Regulatory pressure to phase down high-GWP refrigerants and growing investments in green building solutions are supporting hydrocarbon refrigerant usage. Expansion of cold storage and retail refrigeration further contributes to market demand.

North America Hydrocarbon Refrigerants Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by tightening environmental regulations, rising awareness of low-carbon cooling solutions, and increasing adoption in residential refrigeration. Growth in cold chain logistics and gradual replacement of traditional refrigerants are supporting market expansion. Technological advancements in safe hydrocarbon refrigerant handling are also improving adoption rates.

U.S. Hydrocarbon Refrigerants Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by strong demand for energy-efficient refrigerators and increasing regulatory focus on reducing greenhouse gas emissions. The presence of major appliance manufacturers, rising adoption of sustainable cooling technologies, and expanding cold storage infrastructure strengthen market growth. Continued innovation and compliance with environmental standards reinforce the U.S.’s leading position in the region.

Hydrocarbon Refrigerants Market Share

The hydrocarbon refrigerants industry is primarily led by well-established companies, including:

- Linde (Germany)

- A-Gas (U.K.)

- NIDEC CORPORATION (Japan)

- Beijer Ref AB (Sweden)

- eurammon e.V. (Germany)

- True Manufacturing Co., Inc. (U.S.)

- Air Liquide (France)

- Sinochem (China)

- Harp International Ltd. (U.K.)

- Tazzetti S.p.A. (Italy)

- Oz-Chill Refrigerants (Australia)

- Zhejiang Fotech International Co., Ltd. (China)

- HyChill Australia (Australia)

- GTS S.p.A. (Italy)

- Engas Australasia (Australia)

- Airgas, Inc. (U.S.)

- Arkema (France)

- Honeywell International Inc. (U.S.)

- AGC Inc. (Japan)

Latest Developments in Global Hydrocarbon Refrigerants Market

- In September 2025, BASF launched an advanced hydrocarbon refrigerant with a substantially lower global warming potential, directly responding to tightening environmental regulations across major markets. This launch enhances BASF’s sustainable product portfolio and supports customers transitioning away from high-GWP refrigerants, strengthening long-term demand from commercial refrigeration and HVAC manufacturers. The development reinforces BASF’s competitive position by aligning innovation with regulatory compliance and sustainability-driven purchasing decisions

- In August 2025, Linde formed a strategic partnership with a leading HVAC manufacturer to co-develop hydrocarbon refrigerants for commercial applications, expanding its reach beyond industrial gases into specialized cooling solutions. This collaboration accelerates technology adoption in supermarkets, cold storage, and commercial buildings, enabling Linde to access new revenue streams. The partnership also improves time-to-market for hydrocarbon-based solutions, enhancing Linde’s influence in the fast-evolving sustainable refrigerants landscape

- In July 2025, A-Gas expanded its operations in Australia through the acquisition of a regional refrigerant distributor, significantly strengthening its Asia-Pacific distribution network. This move improves supply chain efficiency and customer proximity in a region experiencing rapid growth in demand for low-GWP refrigerants. The acquisition supports faster market penetration of hydrocarbon refrigerants while reinforcing A-Gas’s competitive positioning in emerging and high-growth economies

- In June 2025, Honeywell announced an expansion of its hydrocarbon refrigerant production capacity to meet rising demand from residential and light commercial refrigeration manufacturers. This investment enhances supply reliability and supports large-scale adoption of environmentally friendly refrigerants amid growing regulatory pressure. The expansion positions Honeywell to capture increased market share while supporting customers’ long-term sustainability goals

- In May 2025, Daikin introduced a new portfolio of air conditioning systems specifically optimized for hydrocarbon refrigerants, signaling a strategic shift toward natural refrigerant technologies. This development accelerates acceptance of hydrocarbons in air conditioning applications, traditionally dominated by synthetic refrigerants. By integrating system design with refrigerant innovation, Daikin strengthens its leadership in sustainable HVAC solutions and drives broader market transition toward low-emission cooling technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrocarbon Refrigerants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrocarbon Refrigerants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrocarbon Refrigerants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.