Global Hydrocolloids For Animal Feed Market

Market Size in USD Million

CAGR :

%

USD

3.26 Million

USD

5.24 Million

2024

2032

USD

3.26 Million

USD

5.24 Million

2024

2032

| 2025 –2032 | |

| USD 3.26 Million | |

| USD 5.24 Million | |

|

|

|

|

Hydrocolloids for Animal Feed Market Size

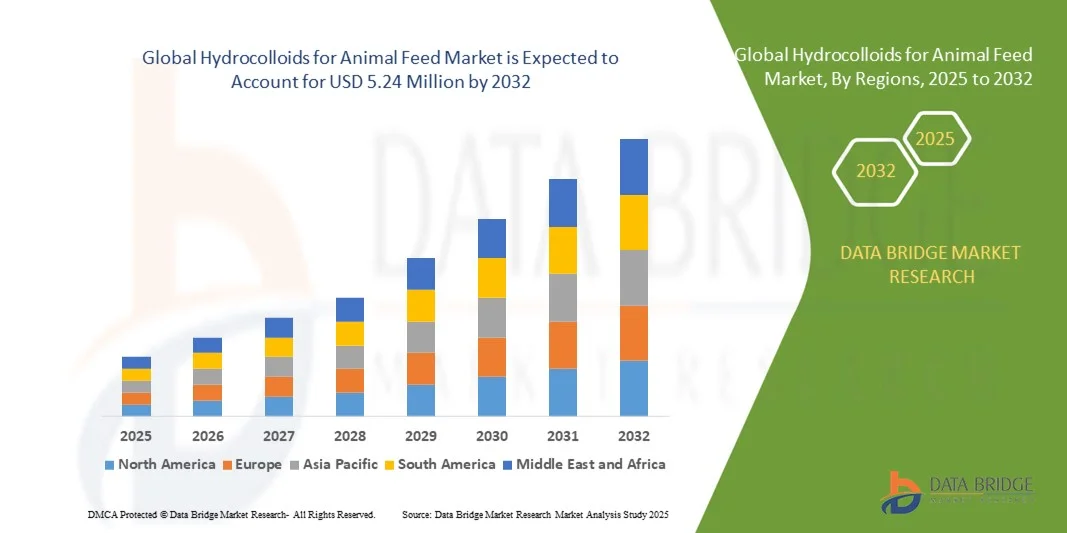

- The global hydrocolloids for animal feed market size was valued at USD 3.26 million in 2024 and is expected to reach USD 5.24 million by 2032, at a CAGR of 6.12% during the forecast period

- The market growth is largely fueled by the increasing demand for functional feed additives that enhance livestock nutrition, improve feed texture, and optimize pellet quality. Rising awareness among farmers and feed manufacturers regarding the benefits of hydrocolloids in improving water retention, nutrient stability, and digestibility is driving widespread adoption in both commercial and small-scale animal feed production

- Furthermore, expanding investments in livestock farming, aquaculture, and poultry production are establishing hydrocolloids as essential feed ingredients for enhancing animal growth performance and feed efficiency. These converging factors are accelerating the uptake of hydrocolloid-based solutions, thereby significantly boosting the market’s growth

Hydrocolloids for Animal Feed Market Analysis

- Hydrocolloids are functional polysaccharides that act as thickeners, stabilizers, gelling agents, and binders in animal feed formulations. They improve feed texture, water-holding capacity, pellet durability, and nutrient delivery, making them critical for optimizing feed performance across livestock, poultry, and aquaculture applications

- The escalating demand for hydrocolloids is primarily fueled by the growing livestock and aquaculture industries, increasing focus on animal nutrition, and rising preference for high-quality, functional feed additives that enhance feed efficiency, product stability, and animal health

- Asia-Pacific dominated the hydrocolloids for animal feed market with a share of over 35% in 2024, due to rapid growth in livestock production, increasing demand for functional feed additives, and a strong presence of feed manufacturing hubs

- North America is expected to be the fastest growing region in the hydrocolloids for animal feed market during the forecast period due to increasing demand for high-quality, functional feed additives in livestock, poultry, and aquaculture sectors

- Carrageenan segment dominated the market with a market share of 29% in 2024, due to its strong functional properties as a thickener and stabilizer in various feed formulations. Carrageenan’s ability to improve feed texture, water retention, and pellet quality makes it highly valued among feed manufacturers. Its compatibility with both wet and dry feed types and ease of incorporation into complex feed matrices further supports its widespread adoption. Livestock producers favor Carrageenan for enhancing digestibility and nutritional efficiency, which reinforces its market dominance in the animal feed sector

Report Scope and Hydrocolloids for Animal Feed Market Segmentation

|

Attributes |

Hydrocolloids for Animal Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrocolloids for Animal Feed Market Trends

Adoption of Natural and Plant-Based Hydrocolloids

- A transformative trend in the hydrocolloids for animal feed market is the rising adoption of natural and plant-based hydrocolloids formulated to meet the demand for cleaner labels, sustainability, and functional performance in livestock nutrition. Plant-derived gums, fibers, and seaweed extracts are increasingly integrated into feed compositions to replace synthetic additives, supporting efficient digestion and nutrient delivery for various animal species

- For instance, manufacturers such as Cargill and CP Kelco have partnered with feed producers to introduce hydrocolloid blends sourced from guar gum, carrageenan, and pectin, aiming to improve feed texture, water retention, and the bioavailability of essential nutrients. These collaborations signify industry commitment to sustainable ingredient sourcing and enhanced animal welfare outcomes

- Plant-based hydrocolloids contribute to improved gut health and immune function by modulating viscosity and supporting beneficial microbiota in animal digestive systems. Their multifunctionality extends the shelf life of compounded feeds and reduces segregation of micronutrients, enabling consistent intake and superior feed conversion ratios

- In addition, ongoing regulatory and market pressures are driving focused research and innovation in hydrocolloid application for antibiotic-free, organic, and specialty animal feed products. Market players are developing customized solutions tailored to species-specific dietary needs and regional sourcing capabilities, further diversifying application opportunities

- Sustainability drivers and heightened consumer awareness regarding animal health standards are compelling producers to emphasize the traceability and reduced environmental impact of natural hydrocolloid ingredients. This transition aligns with global moves toward eco-friendly agriculture and responsible feed manufacturing

- The strong momentum behind plant-based and sustainable hydrocolloid adoption signals a fundamental market shift, positioning these functional additives as critical enablers of advanced nutrition, improved productivity, and compliance with modern feed standards

Hydrocolloids for Animal Feed Market Dynamics

Driver

Rising Demand for Functional Feed Additives

- Increasing demand for functional feed additives is a primary driver accelerating the market for hydrocolloids in animal feed. Producers seek specialized ingredients capable of enhancing feed stability, palatability, and nutrient delivery under diverse livestock production systems

- For instance, in 2025, Ingredion and DuPont expanded their animal nutrition portfolios with new hydrocolloid-based solutions addressing challenges in feed moisture management and micronutrient suspension. Such efforts reflect manufacturer focus on delivering precise performance and health benefits through advanced feed formulation

- Hydrocolloids add value by improving feed consistency, preventing ingredient separation, and enhancing the uptake of vitamins, minerals, and functional bioactives. Their role in stabilizing probiotic inclusion and other sensitive additives is especially important in premium and medicated animal diets

- In addition, the growth of global aquaculture, poultry, and pet food markets is driving innovation in hydrocolloid blends that optimize water stability, texture, and digestibility across diverse feed types and product formats

- Greater attention to animal health, productivity, and welfare, driven by consumer and regulatory pressure, reinforces hydrocolloids’ importance as multifunctional additives in achieving desirable feed performance and compliance

- Rising feed complexity and nutrition requirements for specialized and value-added animal production systems underline the critical role of hydrocolloids in future-oriented feed strategies worldwide

Restraint/Challenge

High Cost and Fluctuating Raw Material Availability

- High costs and variable availability of key raw materials present a leading challenge hampering the widespread adoption and long-term sustainability of hydrocolloids in animal feed manufacturing

- For instance, volatility in guar, seaweed, and locust bean gum supply driven by weather events, regional sourcing issues, or geopolitical tensions has led to price spikes and supply disruptions, impacting Cargill, Ashland, and other key suppliers’ ability to guarantee cost-effective, continuous feed additive supply

- The cost of plant-derived hydrocolloids remains higher relative to synthetic or traditional binders, restricting their use in price-sensitive segments of the animal feed market and causing frequent formulation changes among manufacturers seeking to balance functionality and affordability

- In addition, intense competition for botanical raw materials between the food, pharmaceutical, and animal feed industries further magnifies price pressures and procurement complexity for feed producers

- Efforts to address these challenges through improved supply chain management, contract farming, alternative sourcing strategies, and sustainable cultivation practices are critical to stabilizing hydrocolloid pricing and safeguarding the long-term competitiveness of natural solutions in animal feed

Hydrocolloids for Animal Feed Market Scope

The market is segmented on the basis of type, source, and function.

- By Type

On the basis of type, the Hydrocolloids for Animal Feed market is segmented into Gelatin, Pectin, Carrageenan, Xanthan, Agar, Arabic, Locustbean Gum, Carboxymethyl Cellulose, Alginates, Guar Gum, and Microcrystalline Cellulose. The Carrageenan segment dominated the largest market revenue share of 29% in 2024, driven by its strong functional properties as a thickener and stabilizer in various feed formulations. Carrageenan’s ability to improve feed texture, water retention, and pellet quality makes it highly valued among feed manufacturers. Its compatibility with both wet and dry feed types and ease of incorporation into complex feed matrices further supports its widespread adoption. Livestock producers favor Carrageenan for enhancing digestibility and nutritional efficiency, which reinforces its market dominance in the animal feed sector.

The Guar Gum segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for natural, plant-based additives in animal nutrition. For instance, companies such as Cargill have started incorporating Guar Gum in high-fiber feed formulations to improve feed stability and reduce waste. Guar Gum offers strong water-binding capacity and viscosity-modifying properties, making it suitable for modern feed pellets and extruded feed. Its plant-based origin also aligns with the growing trend toward sustainable and clean-label feed ingredients. Rising awareness about the functional benefits of Guar Gum, including its role in promoting gut health and improving nutrient absorption in livestock, further drives its market growth.

- By Source

On the basis of source, the Hydrocolloids for Animal Feed market is segmented into Botanical, Microbial, Animal, Seaweed, and Synthetic. The Seaweed-derived hydrocolloids segment dominated the largest market revenue share in 2024, attributed to its rich composition of functional polysaccharides such as carrageenan and agar. Seaweed hydrocolloids are highly effective as gelling and stabilizing agents in animal feed, improving texture, water retention, and feed palatability. Livestock producers often prefer seaweed-derived hydrocolloids for their natural origin and ability to enhance feed efficiency and animal health. The segment also benefits from strong availability and processing advancements that ensure consistent quality and performance in large-scale feed production.

The Microbial-derived hydrocolloids segment is expected to witness the fastest growth rate from 2025 to 2032, driven by innovations in fermentation-based production and increasing interest in sustainable feed ingredients. For instance, DSM has focused on microbial hydrocolloids for functional feed applications that support digestive health and nutrient absorption. Microbial hydrocolloids offer controlled viscosity and predictable performance, making them ideal for specialized feed formulations. Their renewable production methods also resonate with the feed industry’s sustainability goals. The rapid scalability and potential for cost-effective production further enhance the segment’s growth prospects in both commercial and high-value feed markets.

- By Function

On the basis of function, the Hydrocolloids for Animal Feed market is segmented into Thickeners, Stabilizers, Gelling Agents, Coating Materials, Fat Replacers, and Others. The Thickeners segment dominated the largest market revenue share in 2024, driven by their critical role in enhancing feed texture, pellet durability, and moisture retention. Thickeners improve the handling and storage properties of feed while preventing nutrient separation, which is essential for maintaining feed quality. Feed manufacturers prefer thickeners to ensure uniform distribution of active ingredients and supplements, optimizing nutritional efficacy. The segment’s dominance is also supported by ongoing innovation in multi-functional thickeners that deliver both viscosity control and enhanced digestibility in livestock feed.

The Gelling Agents segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-quality feed pellets with improved structural integrity. For instance, Ingredion has been developing gelling agent-based formulations that strengthen pellet binding and reduce feed dusting. Gelling agents offer superior water retention and stability under varying storage and feeding conditions, enhancing animal acceptance and feed efficiency. The growth of aquaculture and pet food sectors, which require gel-based and textured feeds, further accelerates demand for gelling agents. Rising awareness of the functional benefits, including nutrient preservation and palatability enhancement, reinforces the segment’s rapid adoption.

Hydrocolloids for Animal Feed Market Regional Analysis

- Asia-Pacific dominated the hydrocolloids for animal feed market with the largest revenue share of over 35% in 2024, driven by rapid growth in livestock production, increasing demand for functional feed additives, and a strong presence of feed manufacturing hubs

- The region’s cost-effective raw material availability, rising investments in feed processing technologies, and expanding exports of animal feed products are accelerating market expansion

- The availability of skilled labor, supportive government policies, and increasing focus on livestock nutrition across developing economies are contributing to higher adoption of hydrocolloids in animal feed formulations

China Hydrocolloids for Animal Feed Market Insight

China held the largest share in the Asia-Pacific hydrocolloids market in 2024, owing to its position as a global leader in livestock farming and animal feed production. The country’s extensive feed industry, government initiatives supporting animal nutrition, and strong export capabilities for feed products are major growth drivers. Rising investments in feed additives and functional ingredients for poultry, swine, and aquaculture are further boosting hydrocolloid consumption.

India Hydrocolloids for Animal Feed Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the rapid expansion of its livestock sector, increasing poultry and dairy production, and rising investments in feed processing infrastructure. Government programs promoting sustainable livestock farming and enhanced animal nutrition are strengthening demand for hydrocolloids. In addition, growing awareness of feed quality, increasing R&D in feed formulations, and rising exports of processed animal feed are contributing to robust market expansion.

Europe Hydrocolloids for Animal Feed Market Insight

The Europe hydrocolloids market is expanding steadily, supported by stringent regulatory frameworks, high demand for natural and functional feed additives, and growing adoption of sustainable feed solutions. The region places strong emphasis on feed safety, quality standards, and innovation in feed formulation, particularly for poultry, dairy, and aquaculture. Increasing use of hydrocolloids in specialty feed products and processed feed enhances market growth.

Germany Hydrocolloids for Animal Feed Market Insight

Germany’s hydrocolloids market is driven by its leadership in advanced animal nutrition, strong feed manufacturing base, and export-oriented production model. The country has well-established R&D facilities and collaboration between academic institutions and feed manufacturers, fostering continuous innovation in hydrocolloid-based feed solutions. Demand is particularly strong for functional feed additives that improve digestibility, pellet quality, and nutrient absorption.

U.K. Hydrocolloids for Animal Feed Market Insight

The U.K. market is supported by a mature livestock industry, increasing focus on high-quality feed production, and growing investments in specialty feed solutions. Rising demand for functional feed additives, enhanced R&D in feed technology, and adoption of sustainable feed practices are driving hydrocolloid consumption. The market is further strengthened by the presence of key feed manufacturers and research collaborations for improving feed efficiency and animal health.

North America Hydrocolloids for Animal Feed Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for high-quality, functional feed additives in livestock, poultry, and aquaculture sectors. A strong focus on animal nutrition, advancements in feed technology, and growing adoption of hydrocolloid-based solutions are boosting market expansion. In addition, rising investments in sustainable feed production, feed fortification programs, and collaborations between feed additive suppliers and livestock producers are supporting market growth.

U.S. Hydrocolloids for Animal Feed Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its extensive livestock industry, advanced feed manufacturing infrastructure, and strong R&D capabilities in animal nutrition. The country’s focus on sustainable and functional feed solutions is encouraging the use of hydrocolloids to enhance feed quality, pellet integrity, and nutrient absorption. Presence of leading feed additive manufacturers and a mature distribution network further solidify the U.S.’s leading position in the region.

Hydrocolloids for Animal Feed Market Share

The hydrocolloids for animal feed industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Ingredion Incorporated (U.S.)

- Cargill, Incorporated (U.S.)

- Kerry Group (Ireland)

- ADM (U.S.)

- Palsgaard (Denmark)

- Darling Ingredients (U.S.)

- CP Kelco U.S., Inc. (U.S.)

- Ashland (U.S.)

- BASF SE (Germany)

- Tate & Lyle (U.K.)

- Glanbia plc (Ireland)

- FDL Ltd (U.K.)

- DSM (Netherlands)

- Nexira (France)

- Deosen (China)

- FMC Corporation (U.S.)

- Fufeng Group (China)

- Exandal (Spain)

- agarpac (India)

- Agramex (Mexico)

- Altrafine Gums (India)

- B&V (Brazil)

Latest Developments in Global Hydrocolloids for Animal Feed Market

- In March 2025, SABO S.p.A. strengthened its partnership with Sevecom S.r.l. to expand its presence in the international animal‑nutrition market. This collaboration allows SABO to leverage Sevecom’s extensive distribution network and technical expertise in hydrocolloid and binder solutions for animal feed. The partnership is expected to significantly enhance SABO’s market reach, accelerate adoption of functional hydrocolloids in feed formulations, and provide customers with more tailored, high-performance feed additives that improve pellet quality, feed stability, and nutrient absorption

- In January 2025, GELITA AG launched a biotech initiative focused on developing animal‑free hydrocolloids as substitutes for traditional gelatins and binders. This initiative is aimed at creating sustainable and ethically sourced hydrocolloid options compatible with animal feed standards. The impact on the market is substantial, as it opens new segments such as halal, kosher, and vegan-friendly feed, while also addressing growing consumer and regulatory demand for clean-label and sustainable feed ingredients, thereby strengthening the company’s leadership in innovation

- In March 2024, ADM Animal Nutrition reported the expansion of its feed-additive portfolio, including hydrocolloid-based solutions designed to improve livestock nutrition and feed processing efficiency. This development reflects the rising global demand for functional feed additives that enhance pellet integrity, water retention, and nutrient delivery. By broadening its hydrocolloid offerings, ADM positions itself to capture a larger share of the fast-growing animal feed market while stimulating competition and innovation among feed additive suppliers

- In August 2023, Mare Austria GmbH expanded its Niklacell CMC product line to include feed-specific hydrocolloids tailored for pelleted animal feed applications. This product line expansion improves feed pellet durability, water-binding capacity, and nutrient preservation, directly addressing key challenges in livestock feed manufacturing. The move strengthens Mare Austria’s position in the animal feed additives market, reinforces its reputation for high-quality functional ingredients, and promotes broader adoption of hydrocolloids in commercial feed production

- In September 2021, Royal DSM N.V. completed the acquisition of First Choice Ingredients, a strategic move to enhance its portfolio of functional ingredients for feed and nutrition applications. This acquisition highlights the trend of consolidation in the hydrocolloids and functional feed additives market, allowing DSM to integrate upstream supply chains, expand product offerings, and deliver more comprehensive solutions for animal nutrition. The deal strengthens DSM’s competitive position, facilitates entry into new feed markets, and encourages innovation in hydrocolloid-based feed solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.