Global Hydrocolloids Market

Market Size in USD Billion

CAGR :

%

USD

10.40 Billion

USD

13.95 Billion

2024

2032

USD

10.40 Billion

USD

13.95 Billion

2024

2032

| 2025 –2032 | |

| USD 10.40 Billion | |

| USD 13.95 Billion | |

|

|

|

|

Hydrocolloids Market Size

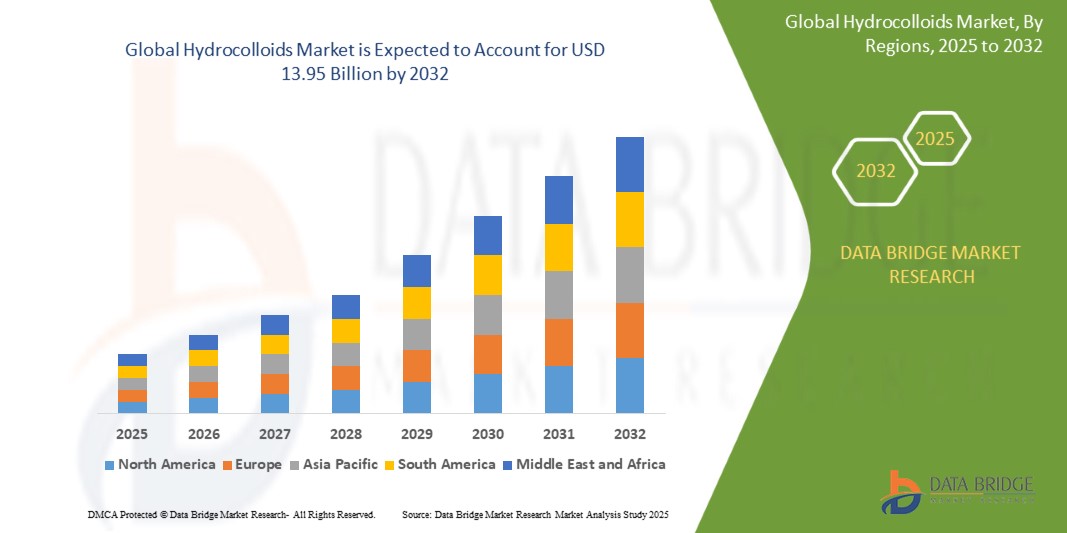

- The global Dairy alternative market was valued at USD 10.4 billion in 2024 and is expected to reach USD 13.95 billion by 2032 During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.40%, growing demand for clean label and natural food ingredients, which is pushing manufacturers to focus on plant-derived, sustainably sourced hydrocolloids.

- This growth is driven by factors such as the expansion of plant-based and vegan food segments and growing demand for functional ingredients in processed foods and beverages

Hydrocolloids Market Analysis

- The global hydrocolloids market is driven by increasing demand for texture-enhancing, stabilizing, and thickening agents in food & beverages, pharmaceuticals, and personal care industries. Consumers are gravitating toward processed yet clean-label and functional products that rely heavily on hydrocolloids for performance.

- Shifts toward plant-based and allergen-free formulations are pushing the demand for natural hydrocolloids such as pectin, guar gum, agar, and carrageenan, aligning with clean-label and sustainability trends.

- North America dominates the market due to robust food processing industries and high demand for functional convenience foods, while Asia-Pacific is projected to exhibit the fastest growth due to expanding processed food sectors and dietary shifts.

- The natural hydrocolloids segment is expected to dominate the market by source in 2025, accounting for approximately 72% of global revenue, supported by rising preference for plant-derived and sustainably sourced ingredients across food, pharma, and cosmetics industries.

Report Scope and Hydrocolloids Market Segmentation

|

Attributes |

Hydrocolloids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrocolloids Market Trends

Clean Label and Natural Ingredient Demand Driving Hydrocolloid Innovation

- A key trend in the hydrocolloids market is the growing demand for clean label and natural food ingredients, which is pushing manufacturers to focus on plant-derived, sustainably sourced hydrocolloids.

- Consumers are increasingly avoiding artificial additives, leading food processors to use hydrocolloids like pectin, guar gum, and agar to maintain texture, stability, and shelf life without synthetic additives.

- Functional clean-label hydrocolloids are also seeing wider adoption in vegan, allergen-free, and organic food products due to their plant-based origin and multifunctionality

- For instance, a Food Navigator article discusses the health claims and labeling considerations for pectin, highlighting its potential prebiotic effects, fiber content, and cardiovascular benefits. The article emphasizes that pectin's natural image and consumer familiarity make it a favorable ingredient in clean-label products. This aligns with the broader industry trend of utilizing plant-based hydrocolloids to meet consumer preferences for natural and recognizable ingredients.

Hydrocolloids Market Dynamics

Driver

Expansion of Plant-Based and Vegan Food Segments

- The global rise in veganism and plant-based diets has accelerated the use of hydrocolloids in dairy and meat alternative products.

- Hydrocolloids like agar, konjac, and methylcellulose are widely used to replicate textures and binding properties in plant-based meat and cheese substitutes.

- These ingredients are essential for maintaining product integrity during processing, cooking, and storage.

- The demand for clean-label, allergen-free, and sustainable food options is further driving the incorporation of hydrocolloids in plant-based formulations.

For instance,

- Beyond Meat has unveiled an expanded line of Beyond Steak R, one of the fastest-growing plant-based meat products, emphasizing improved texture and flavor to meet consumer expectations.

- As plant-based and vegan food segments expand globally, hydrocolloids are becoming vital for replicating the functional properties of animal-based ingredients, thereby reinforcing their role in supporting clean-label and alternative protein innovations.

Opportunity

Increasing Use of Hydrocolloids in Functional and Fortified Beverages

- The functional beverage segment—comprising protein drinks, nutritional supplements, and wellness beverages—is expanding rapidly across global markets.

- Hydrocolloids such as xanthan gum, carrageenan, and acacia gum are essential for ensuring texture consistency, preventing sedimentation, and enhancing mouthfeel in nutrient-dense liquids.

- These ingredients also help stabilize beverages that include plant-based proteins or added micronutrients, which tend to separate over time.

- Consumer preference for clean-label, dairy-free, and plant-based drinks further reinforces demand for natural stabilizers and texture enhancers.

For instance,

- Kerry Group has introduced new hydrocolloid blends designed to improve texture and stability in plant-based and protein-rich beverages, aligning with the trend towards healthier, low-sugar, and clean-label products.

- As the global functional beverage sector grows, hydrocolloids will play an increasingly critical role in formulation, helping manufacturers meet performance, labeling, and shelf-stability demands.

Restraint/Challenge

Volatility in Raw Material Supply Chain

- The production of hydrocolloids relies heavily on agricultural and marine raw materials such as seaweed, guar beans, and locust beans, which are subject to climatic variability, regional harvesting restrictions, and geopolitical risks.

- Seasonal fluctuations and environmental disruptions (e.g., El Niño, floods, or marine ecosystem shifts) can drastically reduce availability and increase prices of core hydrocolloid inputs like carrageenan or agar.

- Global supply disruptions—such as export bans or transportation bottlenecks—particularly from key producing countries like Indonesia, the Philippines, and India, impact continuity and pricing stability.

- Manufacturers are compelled to find alternative sources or reformulate with more available (but potentially less effective or more costly) hydrocolloids, affecting product performance and consistency.

For instance,

- A 2023 report by FoodIngredientsFirst highlighted that hydrocolloids, especially those produced in Europe such as pectin, have been subject to price increases due to soaring energy costs. This has compelled manufacturers to reformulate or validate their ingredient safety data, raising compliance costs and delaying product launches.

Hydrocolloids Market Scope

The market is segmented on the basis of source, type, function and application .

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Function |

|

|

By Application |

|

In 2025, the Bakery segment is projected to dominate the market with the largest share in the application segment.

The Bakery segment is expected to dominate the Global Hydrocolloids Market with the largest share of approximately 33% in 2025. This dominance is attributed to the extensive use of hydrocolloids like guar gum, xanthan gum, and carrageenan in improving dough handling, moisture retention, shelf-life extension, and texture enhancement in baked goods such as breads, cakes, and pastries.

In 2025, the Natural Hydrocolloids segment is expected to account for the largest share during the forecast period in the source segment.

In 2025, the Natural Hydrocolloids segment is projected to lead the market by source, accounting for approximately 72% of global revenue share, driven by growing consumer demand for clean-label, plant-based, and sustainably sourced ingredients used in food, pharmaceuticals, and cosmetics.

Hydrocolloids Market Regional Analysis

Asia-Pacific is the Dominant Region in the Hydrocolloids Market

-

North America leads the global hydrocolloids market due to its robust food and beverage industry, high demand for convenience and clean-label foods, and advanced processing technologies.

- The U.S. drives regional dominance with significant consumption of hydrocolloids in dairy, bakery, beverages, and processed foods to enhance texture, stability, and shelf life.

- Rising health-consciousness among consumers has pushed manufacturers to shift toward natural thickeners and stabilizers like pectin, guar gum, and carrageenan.

- Strong R&D infrastructure and the presence of major food ingredient companies contribute to product innovation and customized hydrocolloid formulations to meet industry-specific needs.

Asia-Pacific is Projected to Register the Highest Growth Rate

-

The region is projected to grow at the fastest pace, driven by expanding applications of hydrocolloids in pharmaceutical, cosmetics, and food & beverage sectors.

- Southeast Asian countries such as Indonesia, Malaysia, and the Philippines are witnessing growing hydrocolloid demand for stabilizers and thickeners in sauces, desserts, and ready-to-drink beverages.

- Japan and South Korea are focusing on innovation in food texture and stability, enhancing hydrocolloid applications in premium food products and health supplements.

- Rising consumer awareness about natural and plant-derived ingredients, combined with supportive government initiatives promoting food innovation, positions Asia-Pacific as a high-growth region for hydrocolloids.

Hydrocolloids Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.)

- Palsgaard (Denmark)

- Nexira (France)

- Ingredion, Incorporated (U.S.)

- Kerry (Ireland)

- BASF (Germany)

- Ashland (U.S.)

- CP Kelco U.S. Inc. (U.S.)

- Glanbia Nutritionals (Ireland)

- Darling Ingredients, Inc. (U.S.)

- Tate & Lyle Plc (U.K.)

- Cargill, Incorporated (U.S.)

- Fuerst Day Lawson (U.K.)

- Koninklijke DSM N.V. (Netherlands)

- ADM (U.S.)

Latest Developments in Global Hydrocolloids Market

- In April 2024, Clariant and Polygal entered into an agreement to develop high-performing, biodegradable solutions for sensory and rheology modification in skin care products.

- In April 2024, Carbonwave entered into a distribution agreement with ChemSpec to distribute an upcycled emulsifier from seaweed, SeaBalance® 2000, in the United States.

- In March 2024, Umaro Foods has raised $3.8 million in funding round lead by AgFunder, to scale up production of its seaweed-based bacon.

- In February 2024, Caldic entered into a partnership with Nitta Gelatin with an aim to advance the distribution of Caldic’s gelatin and collagen in the European Union.

- In 2023: The Kerry Group launched a new range of hydrocolloid blends designed to meet the rising demand for healthier, low-sugar food products. The blend provides improved texture and mouthfeel while maintaining a clean-label status for various applications, including beverages, sauces, and dressings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrocolloids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrocolloids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrocolloids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.