Global Hydrofluoric Acid Market

Market Size in USD Billion

CAGR :

%

USD

2.24 Billion

USD

3.46 Billion

2024

2032

USD

2.24 Billion

USD

3.46 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 3.46 Billion | |

|

|

|

|

Hydrofluoric Acid Market Size

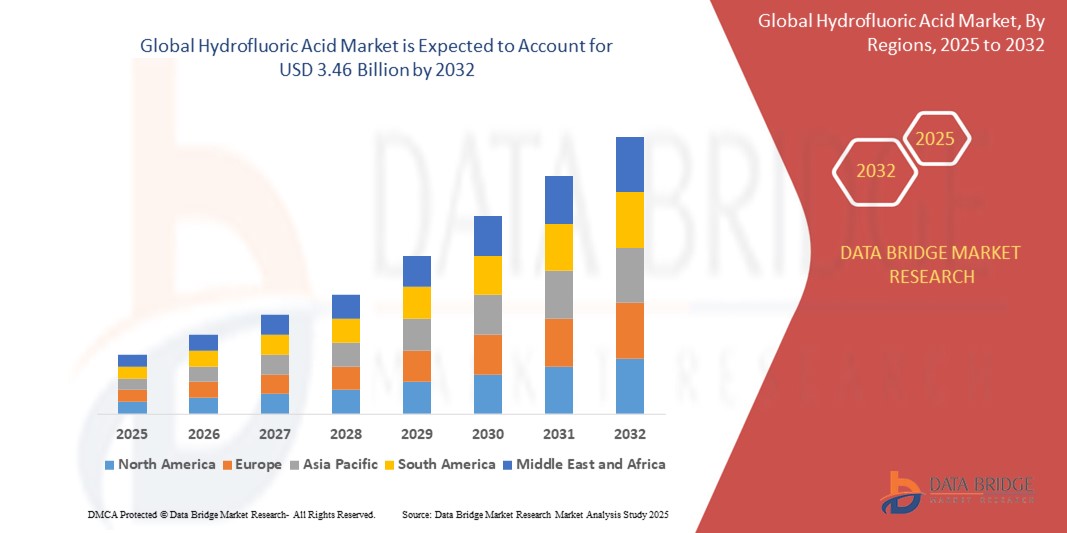

- The global hydrofluoric acid market size was valued at USD 2.24 billion in 2024 and is expected to reach USD 3.46 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by rising demand across fluorochemical production, electronics manufacturing, and metal treatment industries, where hydrofluoric acid serves as a critical raw material for high-performance applications

- Furthermore, advancements in high-purity acid processing and increased adoption in pharmaceuticals, semiconductors, and renewable energy technologies are expanding usage across diverse end-use sectors. These converging factors are accelerating hydrofluoric acid consumption globally, thereby significantly boosting the industry's growth

Hydrofluoric Acid Market Analysis

- Hydrofluoric acid, a highly reactive and versatile compound, plays a crucial role in various industrial processes including fluorocarbon production, semiconductor manufacturing, metal treatment, and petroleum refining due to its unique ability to dissolve oxides and interact with silica-based materials

- The escalating demand for hydrofluoric acid is primarily fueled by the expansion of chemical and electronics industries, increasing production of fluorinated derivatives, and growing need for high-purity acids in pharmaceutical and renewable energy applications

- Asia-Pacific dominated the hydrofluoric acid market with a share of 41.2% in 2024 due to rapid industrialization, expanding chemical and electronics manufacturing, and rising demand for fluorochemicals across emerging economies

- Europe is expected to be the fastest growing region in the hydrofluoric acid market during the forecast period due to strong regulatory frameworks on chemical safety and sustainability, as well as rising demand for high-purity acids in pharmaceutical and electronics manufacturing

- Anhydrous Hydrofluoric Acid segment dominated the market with a market share of 58% in 2024 due to its high purity and extensive use in fluorocarbon production and metal processing. Its superior chemical reactivity makes it the preferred choice for many industrial applications

Report Scope and Hydrofluoric Acid Market Segmentation

|

Attributes |

Hydrofluoric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrofluoric Acid Market Trends

“Increasing Demand for Hydrofluorocarbons (HFCs)”

- A significant and accelerating trend in the global smart lock market is the deepening integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This fusion of technologies is significantly enhancing user convenience and control over their security systems

- For instance, the August Wi-Fi Smart Lock seamlessly integrates with all three major voice assistants, allowing users to lock or unlock their doors with simple voice commands. Similarly, Level Lock+ can be controlled via Siri and Apple HomeKit, offering a discreet smart lock solution

- AI integration in smart locks enables features such as learning user access patterns to potentially suggest security optimizations and providing more intelligent alerts based on activity. For instance, some Ultraloq models utilize AI to improve fingerprint recognition accuracy over time and can send intelligent alerts if unusual door activity is detected. Furthermore, voice control capabilities offer users the ease of hands-free operation, allowing them to lock or unlock doors remotely using simple verbal commands

- The seamless integration of smart locks with digital assistants and broader smart home platforms facilitates centralized control over various aspects of the connected home environment. Through a single interface, users can manage their door locks alongside lighting, climate control, and other security devices, creating a unified and automated living experience

- This trend towards more intelligent, intuitive, and interconnected locking systems is fundamentally reshaping user expectations for home security. Consequently, companies such as WELOCK are developing AI-enabled smart locks with features such as automatic locking/unlocking based on authorized access and voice control compatibility with Google Assistant and Amazon Alexa

- The demand for smart locks that offer seamless AI and voice control integration is growing rapidly across both residential and commercial sectors, as consumers increasingly prioritize convenience and comprehensive smart home functionality

Hydrofluoric Acid Market Dynamics

Driver

“Growing Technological Advancements”

- The growing technological advancements in manufacturing and purification processes are a significant driver for the increased demand for hydrofluoric acid across various industries

- For instance, companies are investing in advanced distillation and refining technologies to produce ultra-pure grades of hydrofluoric acid suitable for high-end applications in semiconductors, pharmaceuticals, and solar cells. In February 2024, Solvay announced the development of a new high-purity HF production line aimed at meeting rising electronic-grade demand

- As end-use industries demand more precision and performance, high-purity hydrofluoric acid becomes critical in etching silicon wafers, cleaning electronic components, and manufacturing specialty fluorinated compounds

- Furthermore, advancements in chemical handling, safety systems, and transportation technologies are enabling safer and more efficient usage of hydrofluoric acid in complex industrial processes

- The constant evolution of processing technologies and the development of customized HF grades are expanding application scope and reinforcing hydrofluoric acid’s role as a key industrial chemical across multiple high-tech and heavy-use domains

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Volatility in the prices of raw materials used in hydrofluoric acid production, particularly fluorspar, poses a significant challenge to market stability and profitability. Fluorspar is a critical input for hydrofluoric acid, and its supply is often influenced by geopolitical factors, mining restrictions, and environmental regulations

- For instance, China, the largest producer of fluorspar, has imposed export controls and stricter environmental policies, creating periodic supply shortages and price spikes that directly affect hydrofluoric acid production costs

- These fluctuations make it difficult for manufacturers to plan long-term production and pricing strategies, impacting downstream sectors such as fluoropolymer production, refrigeration, and semiconductor manufacturing

- The lack of readily available substitutes for fluorspar further exacerbates the challenge, compelling manufacturers to absorb cost increases or pass them on to end-users, which may affect demand elasticity

- Addressing this challenge requires diversification of fluorspar supply sources, investment in recycling technologies, and development of alternative fluorination routes to reduce the market's vulnerability to raw material price volatility

Hydrofluoric Acid Market Scope

The market is segmented on the basis of grade, application, type, and end-user industry.

- By Grade

On the basis of grade, the hydrofluoric acid market is segmented into Anhydrous Hydrofluoric Acid (AHF), Diluted Hydrofluoric Acid (DHF) (Above 50% Concentration), and Diluted Hydrofluoric Acid (DHF) (Below 50% Concentration). The Anhydrous Hydrofluoric Acid segment dominates the largest market revenue share of 58% in 2024, owing to its high purity and extensive use in fluorocarbon production and metal processing. Its superior chemical reactivity makes it the preferred choice for many industrial applications.

The Diluted Hydrofluoric Acid (DHF) (Above 50% Concentration) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing demand in glass etching, cleaning, and oil refining applications, where moderate concentration acids balance performance and safety.

- By Application

On the basis of application, the hydrofluoric acid market is segmented into fluorocarbon production, fluorinated derivative production, metal pickling, glass etching and cleaning, oil refining, uranium fuel production, and others. The fluorocarbon production segment held the largest market revenue share 55% in 2024, driven by rising demand for refrigerants and specialty chemicals, making hydrofluoric acid a critical feedstock.

The glass etching and cleaning segment is projected to witness the fastest CAGR from 2025 to 2032, owing to its increasing use in electronics manufacturing and decorative glass treatments that require precise acid etching.

- By Type

On the basis of type, the hydrofluoric acid market is segmented into UP Grade, UP-S Grade, UP-SS Grade, and EL Grade. The UP Grade segment accounted for the largest market revenue share in 2024, supported by its balanced purity and cost-effectiveness, which makes it widely used in chemical processing and metal pickling.

The EL Grade segment is expected to see the fastest growth from 2025 to 2032, driven by rising demand in high-purity applications such as pharmaceuticals and electronics manufacturing, where stringent quality requirements are critical.

- By End-user Industry

On the basis of end-user industry, the hydrofluoric acid market is segmented into oil and gas, chemical processing, pharmaceuticals, electrical and electronics, and others. The chemical processing segment held the largest market revenue share in 2024, owing to its extensive use in producing fluorinated chemicals and intermediates.

The electrical and electronics segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by the increasing use of hydrofluoric acid in semiconductor manufacturing and glass processing critical to modern electronic devices.

Hydrofluoric Acid Market Regional Analysis

- Asia-Pacific dominated the hydrofluoric acid market with the largest revenue share of 41.2% in 2024, driven by rapid industrialization, expanding chemical and electronics manufacturing, and rising demand for fluorochemicals across emerging economies

- The region’s increasing focus on advanced electronics, growth in oil refining and pharmaceutical sectors, and expanding end-user industries are major contributors to market growth

- In addition, government initiatives supporting chemical safety regulations, investments in local production capacities, and technological advancements in high-purity hydrofluoric acid production are accelerating adoption in both domestic and export markets

China Hydrofluoric Acid Market Insight

The China market holds the largest share in Asia-Pacific in 2024, supported by its strong chemical processing industry and status as a global manufacturing hub. Increasing demand from electronics, pharmaceuticals, and automotive sectors, combined with government policies promoting industrial safety and environmental standards, drive market growth. Chinese producers are investing in sustainable production technologies and higher purity grades to meet domestic and international demand.

Japan Hydrofluoric Acid Market Insight

Japan’s market is growing steadily due to its advanced electronics and semiconductor manufacturing sectors that require high-purity hydrofluoric acid. Continuous R&D investments, stringent quality standards, and the need for reliable supply chains support market expansion. In addition, demand from chemical and pharmaceutical industries further bolsters the market.

Europe Hydrofluoric Acid Market Analysis

Europe is projected to be the fastest-growing region in the hydrofluoric acid market from 2025 to 2032, fueled by strong regulatory frameworks on chemical safety and sustainability, as well as rising demand for high-purity acids in pharmaceutical and electronics manufacturing. The region’s emphasis on environmental compliance, recycling, and green chemistry initiatives contributes to increased adoption of advanced hydrofluoric acid grades. Robust investments in semiconductor fabrication, specialty chemical production, and pharmaceutical sectors are accelerating growth across Western and Northern Europe.

Germany Hydrofluoric Acid Market Insight

Germany is expected to witness significant market growth driven by its strong chemical manufacturing base and innovation in sustainable acid production technologies. The country’s focus on minimizing environmental impact and strict regulatory standards encourages the use of high-quality hydrofluoric acid for metal pickling, pharmaceuticals, and electronics industries.

U.K. Hydrofluoric Acid Market Insight

The U.K. market is poised for steady growth, supported by evolving pharmaceutical and chemical processing sectors with increasing demand for specialty and ultra-pure grades. Government policies promoting chemical safety and sustainability, along with growing electronics manufacturing, contribute to market expansion.

North America Hydrofluoric Acid Market Insight

North America is witnessing stable growth due to demand from oil refining, chemical processing, and pharmaceutical industries. Increasing emphasis on safety regulations, environmental standards, and investments in advanced chemical manufacturing facilities support market development.

U.S. Hydrofluoric Acid Market Insight

U.S. market holds a significant share, driven by large-scale oil refining operations, fluorochemical production, and semiconductor manufacturing. Rising adoption of high-purity hydrofluoric acid and ongoing innovations in production technologies underpin steady demand.

Hydrofluoric Acid Market Share

The hydrofluoric acid industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Solvay (Belgium)

- Daikin (Japan)

- Lanxess (Germany)

- Stella Chemifa Corporation (Japan)

- Fluorchemie Group (Germany)

- DONGYUE GROUP LIMITED (China)

- Formosa Daikin Advanced Chemicals Co., Ltd. (Taiwan)

- Merck KGaA (Germany)

- SINOCHEM GROUP CO., LTD. (China)

- Fujian Shaowu Yongfei Chemical Co., Ltd. (China)

- Gulf Fluor (U.A.E.)

- Morita Chemical Industries Co., Ltd. (Japan)

- Mexichem S.A.B. de C.V. (Mexico)

Latest Developments in Global Hydrofluoric Acid Market

- In November 2021, HMD Kontro launched a specialized pump for hydrofluoric acid (HF) alkylation, developed in collaboration with HF unit operators and UOP. The pump ensures safe HF acid transfer with corrosion-resistant materials, secondary containment, and advanced monitoring, addressing safety and environmental compliance in the HF acid market

- In April 2021, EcoGraf secured a contract for a battery anode materials facility producing spherical graphite outside China. The facility aims to use environmentally safe alternatives to conventional hydrofluoric acid purification processes, aligning with sustainable practices in battery manufacturing

- In April 2021, Renascor Resources explored green finance options for its Siviour Battery Anode Material Project in South Australia. The project aims for vertical integration to produce materials for electric vehicle manufacturing, emphasizing sustainability and environmental responsibility

- In February 2021, Samsung Electronics developed a system to reuse high-concentration liquefied hydrogen fluoride cleaning solutions in semiconductor production. This innovation enhances sustainability by reducing chemical waste and improving efficiency in semiconductor manufacturing processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrofluoric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrofluoric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrofluoric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.