Global Hydrogen Energy Storage Market

Market Size in USD Billion

CAGR :

%

USD

24.82 Billion

USD

100.56 Billion

2024

2032

USD

24.82 Billion

USD

100.56 Billion

2024

2032

| 2025 –2032 | |

| USD 24.82 Billion | |

| USD 100.56 Billion | |

|

|

|

|

Hydrogen Energy Storage Market Size

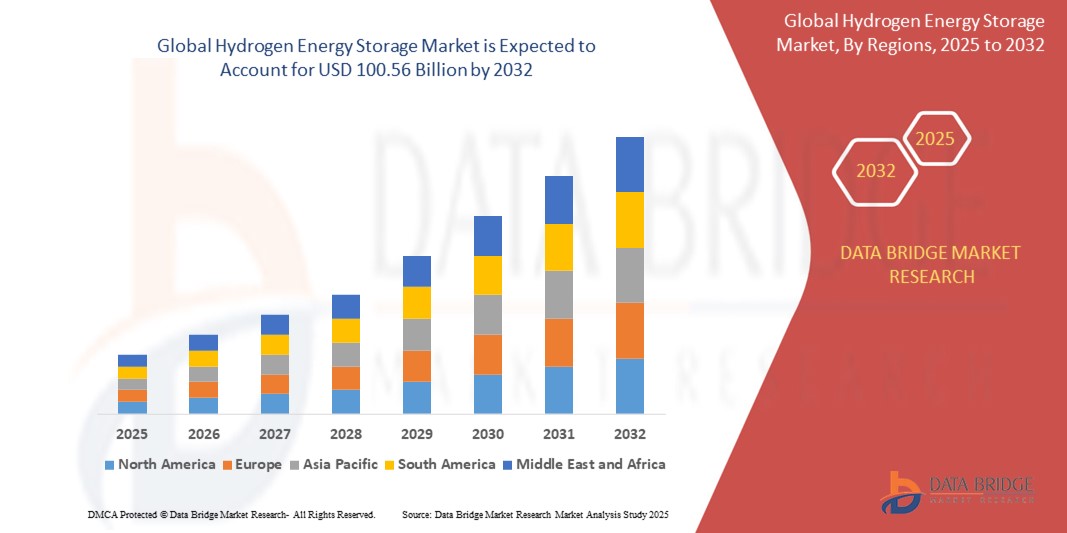

- The global hydrogen energy storage market size was valued at USD 24.82 billion in 2024 and is expected to reach USD 100.56 billion by 2032, at a CAGR of 19.11% during the forecast period

- The market growth is largely fuelled by increasing demand for renewable energy integration, growing investments in green hydrogen infrastructure, and supportive government policies focused on decarbonization and energy transition

- The rising focus on energy resilience and the need for scalable long-duration storage solutions is accelerating the adoption of hydrogen-based energy storage across both developed and emerging economies

Hydrogen Energy Storage Market Analysis

- The hydrogen energy storage market is experiencing rapid expansion due to its critical role in achieving long-term energy security and carbon neutrality goals across major economies

- Rising deployment of intermittent renewable sources such as solar and wind has increased the need for large-scale, long-duration energy storage, where hydrogen plays a key role by converting excess electricity into storable fuel

- Asia-Pacific dominated the hydrogen energy storage market with the largest revenue share of 38.4% in 2024, fuelled by increasing renewable energy investments, supportive government policies, and growing industrial decarbonization efforts

- North America region is expected to witness the highest growth rate in the global hydrogen energy storage market, driven by technological advancements, government incentives under clean energy legislation, and increasing utility-scale storage deployments

- The physical-based segment accounted for the largest market revenue share in 2024, primarily due to its wide adoption in large-scale and commercial hydrogen storage applications. Technologies such as compressed gas storage are well-established, cost-effective, and easily scalable, making them ideal for both stationary and mobile use cases. Their compatibility with existing hydrogen production methods also enhances their practical value in industrial settings

Report Scope and Hydrogen Energy Storage Market Segmentation

|

Attributes |

Hydrogen Energy Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Deployment of Hydrogen Storage in Grid Stabilization • Expansion of Green Hydrogen Infrastructure Across Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrogen Energy Storage Market Trends

“Increasing Investments in Green Hydrogen Projects”

- Hydrogen is increasingly being deployed to store excess electricity from intermittent sources such as solar and wind, enabling grid operators to balance supply and demand more effectively

- It allows for seasonal and long-duration storage that batteries cannot economically provide, positioning hydrogen as a critical component in future energy systems

- The integration of hydrogen with renewables supports the decarbonization of sectors such as transportation, steel, and chemicals by providing clean energy on demand

- Advancements in electrolysis technologies are improving efficiency and reducing cost barriers, allowing green hydrogen to become more commercially viable

- For instance, Germany’s H2 Global initiative is facilitating the large-scale use of hydrogen in renewable-rich regions by funding electrolysis and storage projects to stabilize energy systems

Hydrogen Energy Storage Market Dynamics

Driver

“Government-Led Initiatives and Funding Toward Green Hydrogen”

- Multiple countries are launching national hydrogen strategies and allocating billions in funding to support hydrogen production, infrastructure, and storage development

- Public-private partnerships are being formed to expedite technology deployment and ensure robust supply chain development across the hydrogen ecosystem

- Subsidies, tax breaks, and low-interest loans are reducing investment risks for private players, making large-scale hydrogen storage projects more financially attractive

- Hydrogen is being positioned as a central pillar in many countries’ clean energy and net-zero transition strategies, boosting long-term demand

- For instance, The U.S. Department of Energy’s Hydrogen Shot aims to bring down green hydrogen costs to USD 1 per kilogram within a decade, catalyzing investment in hydrogen production and storage solutions

Restraint/Challenge

“High Infrastructure and Operational Costs”

- Hydrogen storage technologies—such as high-pressure tanks, cryogenic storage, and underground caverns—require significant capital investment and ongoing maintenance, which increases project costs

- Electrolysis, liquefaction, and reconversion of hydrogen are energy-intensive processes, resulting in reduced overall system efficiency and economic feasibility

- Small and medium-sized enterprises face challenges in accessing the capital and technical expertise needed to enter the hydrogen storage market

- The absence of standardized infrastructure—such as refueling stations, pipelines, and storage regulations—adds logistical complexity and slows adoption

- For instance, In India, the high cost of electrolyzers and limited financial incentives have made hydrogen storage less attractive compared to batteries, slowing national deployment despite a growing interest in green energy

Hydrogen Energy Storage Market Scope

The market is segmented on the basis of technology, physical state, application, end use, and storage type.

- By Technology

On the basis of technology, the hydrogen energy storage market is segmented into physical based, material based, liquid hydrogen, metal hydrides, carbon absorption, and underground salt caverns. The physical-based segment accounted for the largest market revenue share in 2024, primarily due to its wide adoption in large-scale and commercial hydrogen storage applications. Technologies such as compressed gas storage are well-established, cost-effective, and easily scalable, making them ideal for both stationary and mobile use cases. Their compatibility with existing hydrogen production methods also enhances their practical value in industrial settings.

The metal hydrides segment is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in material science and its ability to store hydrogen at low pressure and moderate temperatures. These systems are gaining popularity in portable and small-scale applications due to their high volumetric storage capacity and operational safety, particularly in energy-dense environments such as military and aerospace sectors.

- By Physical State

On the basis of physical state, the market is categorized into solid, liquid, and gas. The gas segment held the largest revenue share in 2024, supported by the widespread use of compressed hydrogen in transportation and industrial sectors. Compressed hydrogen is relatively easy to produce and handle using current infrastructure, making it the most commonly adopted form for storage and transport.

The solid segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its potential in offering safer, compact, and more energy-dense storage options. Technologies such as metal hydrides and chemical hydrogen storage fall into this category and are being researched extensively for use in residential and mobile energy systems.

- By Application

Based on application, the market is segmented into stationary power, transportation, portable power, power generation, chemicals, metal workings, utility, and others. The stationary power segment dominated the market in 2024 due to growing demand for long-duration energy storage systems in renewable power integration and off-grid applications. Hydrogen's ability to store excess electricity and provide backup power is proving crucial for grid stability in several regions.

The transportation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by global efforts to decarbonize mobility. Hydrogen-powered fuel cell vehicles and public transport systems are increasingly being deployed, particularly in countries such as Japan and South Korea, supporting the rise of mobile hydrogen storage technologies.

- By End Use

On the basis of end use, the hydrogen energy storage market is divided into commercial, industrial, and residential. The industrial segment held the largest revenue share in 2024, owing to the wide use of hydrogen in refining, chemical production, and metal processing. Industries are increasingly adopting hydrogen storage to reduce emissions and improve energy efficiency across their operations.

The residential segment is expected to witness the fastest growth rate from 2025 to 2032, supported by emerging hydrogen-powered home energy systems and microgrid applications. In areas with limited grid reliability, such as remote or island communities, residential hydrogen systems offer a sustainable and self-sufficient energy alternative.

- By Storage Type

On the basis of storage type, the market is segmented into stationary storage, physical storage, and chemical storage. The stationary storage segment captured the highest market share in 2024, primarily due to its application in grid-scale and backup power systems. Its ability to provide energy continuity and stabilize supply-demand fluctuations is driving widespread deployment across utilities and energy providers.

Chemical storage is expected to witness the fastest growth rate from 2025 to 2032, as it enables high-density, long-term hydrogen retention using compounds such as ammonia or methanol. This method is gaining traction for energy export and international hydrogen trade, especially in regions investing in large-scale hydrogen infrastructure and maritime transport.

Hydrogen Energy Storage Market Regional Analysis

- Asia-Pacific dominated the hydrogen energy storage market with the largest revenue share of 38.4% in 2024, fuelled by increasing renewable energy investments, supportive government policies, and growing industrial decarbonization efforts

- Countries across the region are actively integrating hydrogen into their energy transition roadmaps, with substantial funding directed toward infrastructure, storage, and transportation

- The region’s leadership is further bolstered by advancements in electrolyzer manufacturing, an expanding green hydrogen pipeline, and initiatives promoting clean mobility and power backup solutions in both developed and emerging markets

China Hydrogen Energy Storage Market Insight

The China hydrogen energy storage market held the largest share within the Asia-Pacific region in 2024, driven by aggressive government policies supporting hydrogen development and its role in achieving carbon neutrality by 2060. China is investing heavily in hydrogen production and storage infrastructure, with local governments launching pilot zones and industrial hubs. The presence of a robust manufacturing base, especially for electrolyzers and storage tanks, is accelerating scalability. The rise of hydrogen-powered public transport systems and industrial usage is further propelling the domestic market.

Japan Hydrogen Energy Storage Market Insight

Japan’s hydrogen energy storage market is expected to witness the fastest growth rate from 2025 to 2032, supported by the nation’s long-term commitment to a hydrogen-based economy. Government-led initiatives, such as the Basic Hydrogen Strategy, emphasize the importance of hydrogen for power generation, mobility, and energy storage. Japan's limited domestic fossil fuel resources make hydrogen a strategic alternative, particularly for backup power in disaster-resilient urban planning. Innovation in solid-state storage systems and public-private partnerships are strengthening the market's development.

North America Hydrogen Energy Storage Market Insight

The North America hydrogen energy storage market is expected to witness the fastest growth rate from 2025 to 2032, driven by the United States’ Hydrogen Shot initiative and growing renewable integration across states. Utilities and energy companies are deploying large-scale hydrogen storage systems to support grid reliability and reduce dependence on fossil fuel-based peaker plants. The region is also witnessing increased investment in salt caverns and compressed hydrogen infrastructure to support heavy transport and power sectors.

U.S. Hydrogen Energy Storage Market Insight

The U.S. hydrogen energy storage market is expected to witness the fastest growth rate from 2025 to 2032, supported by federal funding, tax incentives, and innovation in hydrogen storage technologies. Multiple pilot projects across Texas, California, and Utah are demonstrating the feasibility of underground and long-duration storage systems. The growth of clean hydrogen hubs, facilitated by the Bipartisan Infrastructure Law, is expected to further accelerate investment in scalable, commercial-grade storage solutions across industrial and utility-scale applications.

Europe Hydrogen Energy Storage Market Insight

The Europe hydrogen energy storage market is expected to witness the fastest growth rate from 2025 to 2032, propelled by ambitious decarbonization targets and cross-border energy strategies. The European Union’s Green Deal and Hydrogen Strategy emphasize large-scale deployment of electrolyzers, underground salt caverns, and chemical storage solutions to stabilize the grid and power hard-to-decarbonize sectors. EU-funded initiatives and collaborations between energy and gas companies are also advancing hydrogen mobility and storage infrastructure.

Germany Hydrogen Energy Storage Market Insight

Germany remains a key driver within the European hydrogen energy storage landscape, backed by strong R&D capabilities and a national hydrogen strategy focused on green hydrogen. The country is investing in high-capacity salt cavern storage and developing integrated renewable-hydrogen systems to support its Energiewende goals. Germany’s industrial base, particularly in chemicals and steel, is increasingly adopting hydrogen as a decarbonization fuel, creating robust demand for long-duration, cost-efficient storage technologies.

U.K. Hydrogen Energy Storage Market Insight

The U.K. hydrogen energy storage market is expected to witness the fastest growth rate from 2025 to 2032, driven by national decarbonization goals and strong government backing for green hydrogen projects. The U.K.'s Hydrogen Strategy outlines plans to produce up to 10 GW of low-carbon hydrogen by 2030, which is stimulating demand for efficient and scalable storage technologies. Pilot projects across Scotland and Northern England are focusing on salt cavern storage and hydrogen blending into gas grids, supporting the broader energy transition. The country’s industrial and transport sectors are increasingly exploring hydrogen as a viable alternative to fossil fuels, further encouraging the adoption of large-scale storage infrastructure.

Hydrogen Energy Storage Market Share

The Hydrogen Energy Storage industry is primarily led by well-established companies, including:

- Siemens Energy (Germany)

- Linde PLC (Ireland)

- ENGIE (France)

- Air Liquide (France)

- Air Products and Chemicals, Inc. (U.S.)

- Nel ASA (Norway)

- Chart Industries (U.S.)

- GenH2 (U.S.)

- Hexagon Purus (Norway)

- FuelCell Energy, Inc. (U.S.)

- ITM Power PLC (U.K.)

- McPhy Energy S.A. (France)

- Hydrogenious LOHC Technologies (Germany)

- HYGEAR (Netherlands)

- Cockerill Jingli Hydrogen (China)

- Pragma Industries (France)

- Plug Power Inc. (U.S.)

- INOX India Limited (India)

- Home Power Solutions (Germany)

- Hydrogen In Motion Inc. (Canada)

Latest Developments in Global Hydrogen Energy Storage Market

- In August 2024, Linde has announced a long-term agreement to supply clean hydrogen to Dow's Fort Saskatchewan Path2Zero Project. The company plans to invest over USD 2 billion to construct, own, and operate a large-scale integrated facility for clean hydrogen and atmospheric gases in Alberta, Canada

- In November 2021, Iwatani Corporation of America, a subsidiary of Iwatani Corporation, teamed up with ITM Power, a company specializing in energy storage and clean fuel solutions, to implement multi-megawatt electrolyzer-based hydrogen energy systems throughout North America. This collaboration is focused on deploying advanced electrolyzer technology to generate clean hydrogen at scale, addressing the growing demand for sustainable energy sources

- In October 2021, Plug Power Inc. announced the acquisition of Applied Cryo Technologies, Inc. (ACT), a move that significantly enhances its capabilities and expertise in the hydrogen sector. This acquisition enables Plug Power to broaden its technological offerings and strengthen its position within the green hydrogen ecosystem

- In August 2021, Linde plc secured a long-term agreement with Infineon Technologies to facilitate the on-site production and storage of high-purity green hydrogen. This partnership is designed to enhance the supply chain for green hydrogen, ensuring that Infineon has access to the high-quality hydrogen needed for its semiconductor manufacturing processes

- In January 2021, ENGIE and Total formalized a cooperation agreement to collaboratively develop, construct, and operate the Masshylia project, which is set to become France's largest renewable hydrogen production facility located in Châteauneuf-les-Martigues. This ambitious project aims to implement innovative management strategies to oversee the hydrogen production and storage processes effectively

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrogen Energy Storage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrogen Energy Storage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrogen Energy Storage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.