Global Hydrogen Truck Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

9.18 Billion

2024

2032

USD

2.31 Billion

USD

9.18 Billion

2024

2032

| 2025 –2032 | |

| USD 2.31 Billion | |

| USD 9.18 Billion | |

|

|

|

|

Hydrogen Truck Market Size

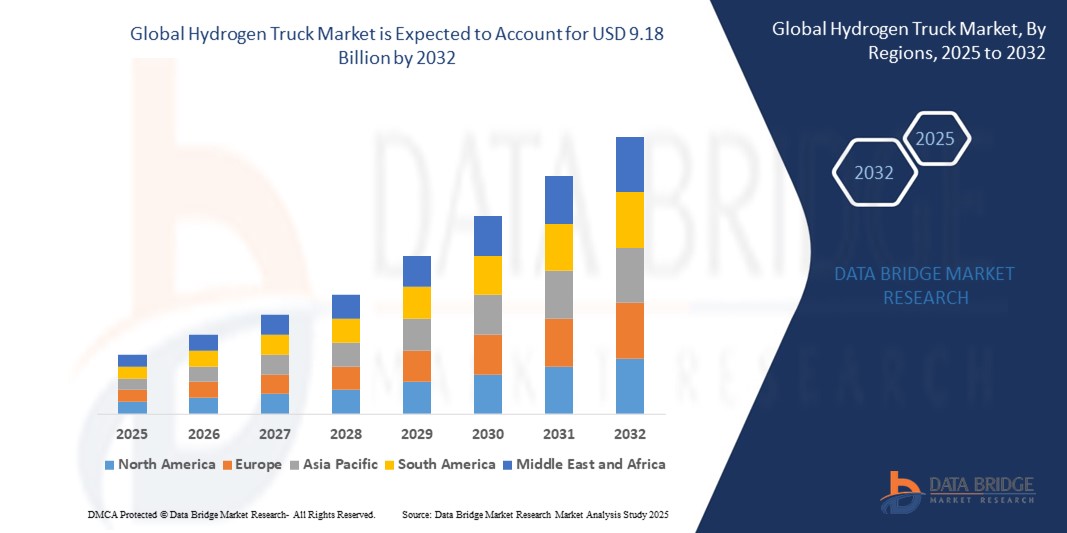

- The global hydrogen truck market size was valued at USD 2.31 billion in 2024 and is expected to reach USD 9.18 billion by 2032, at a CAGR of 18.83% during the forecast period

- The market growth is largely fuelled by the rising demand for zero-emission commercial vehicles, increasing investments in hydrogen infrastructure, and stringent government regulations on carbon emissions

- Expanding logistics and municipal sectors, particularly in North America, Europe, and parts of Asia-Pacific, are further boosting the demand for medium and heavy-duty hydrogen trucks

Hydrogen Truck Market Analysis

- The market is witnessing rapid expansion as manufacturers shift focus from conventional fuels to hydrogen-based alternatives, supported by favorable policies and green energy incentives

- Technological advancements in proton exchange membrane fuel cells (PEMFC) and solid oxide fuel cells (SOFC), along with growing R&D investments, are accelerating the adoption of hydrogen trucks globally

- Asia-Pacific dominated the hydrogen truck market with the largest revenue share of 42.13% in 2024, driven by rapid industrialization, strong governmental policies, and a rising focus on zero-emission transport across nations such as China, Japan, and South Korea

- North America region is expected to witness the highest growth rate in the global hydrogen truck market, driven by the growing shift towards decarbonizing transportation, increasing infrastructure developments for hydrogen fueling stations, and supportive policy frameworks promoting emission-free logistics solutions

- The heavy-duty trucks segment held the largest revenue share of 50.7% in 2024, driven by the growing use of hydrogen fuel cell technology in long-haul transportation and freight operations. These trucks offer the benefit of extended range and high payload capacity, making them suitable for demanding logistics applications across industrialized economies. In addition, government mandates promoting decarbonization in freight movement are accelerating the deployment of zero-emission heavy trucks

Report Scope and Hydrogen Truck Market Segmentation

|

Attributes |

Hydrogen Truck Key Market Insights |

|

Segments Covered |

• By Vehicle Type: Heavy-duty Trucks, Medium-duty Trucks, and Small-duty Trucks • By Fuel Cell Technology: PEMFC and aSOFC • By Range: Upto 300 Miles, 300–500 Miles, and Above 500 Miles • By Motor Power: Upto 200 kW, 200–400 kW, and Above 400 kW • By Application: Logistics and Transport, Municipal, Construction, and Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Hyundai Motor Company (South Korea) • MAN Truck & Bus SE (Germany) |

|

Market Opportunities |

• Expansion of Hydrogen Refueling Infrastructure Globally • Growing Adoption of Hydrogen Trucks in Long-Haul Logistics |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Hydrogen Truck Market Trends

“Surge in Investments Toward Hydrogen Infrastructure Development”

- The global push for decarbonizing transportation is accelerating investments in hydrogen fueling infrastructure, essential for the commercial viability of hydrogen trucks. Governments are offering subsidies and launching hydrogen strategies to establish dense refueling networks. These efforts ensure logistical reliability for hydrogen-powered freight fleets operating across long distances

- Major energy firms and truck manufacturers are co-developing regional hydrogen ecosystems to align vehicle deployment with fueling availability. These ecosystems include dedicated green hydrogen production, transportation corridors, and strategically placed refueling hubs. Such collaborations enhance infrastructure readiness and lower entry barriers for fleet operators

- For instance, Germany's H2 Mobility initiative, supported by companies such as Air Liquide and Shell, aims to establish 400 hydrogen refueling stations nationwide by 2026. This initiative is already transforming the feasibility of hydrogen trucking in Europe and serves as a model for similar projects in Asia and North America

- National policies and zero-emission mandates are reinforcing private sector confidence, leading to scaled infrastructure development. The U.S. Department of Energy, for instance, is investing in hydrogen hubs through its “Hydrogen Shot” initiative, aiming to reduce hydrogen costs and support widespread commercial adoption

- The coordinated buildout of hydrogen infrastructure is laying the groundwork for hydrogen truck expansion. As refueling availability increases and fuel cell technology matures, hydrogen trucks are expected to emerge as a sustainable and scalable solution for decarbonizing long-haul and heavy-duty freight transport

Hydrogen Truck Market Dynamics

Driver

“Rising Demand for Zero-Emission Heavy-Duty Transport Solutions”

• Governments and industries are under growing pressure to curb greenhouse gas emissions, especially from sectors such as freight and logistics. Hydrogen trucks offer a compelling alternative to diesel-powered vehicles by delivering high payload capacity with zero tailpipe emissions. This makes them particularly suitable for decarbonizing heavy-duty, long-haul applications

• Hydrogen fuel cells provide a longer driving range and faster refueling times compared to battery electric alternatives, making them ideal for commercial fleets. These attributes address critical challenges related to operational downtime and limited range in electric trucks. As logistics companies aim to maintain efficiency while reducing carbon output, demand for hydrogen trucks continues to grow

• For instance, Amazon and other global logistics players are actively testing hydrogen fuel cell trucks for their fleets, aiming to meet their corporate carbon neutrality goals. Their adoption signals growing trust in hydrogen technology as a viable clean freight solution

• Moreover, stringent emission standards and clean energy mandates in regions such as the European Union, California, and Japan are accelerating fleet transitions. Incentives, subsidies, and favorable regulatory frameworks are encouraging early adoption, further driving hydrogen truck demand across key economies

• The need for sustainable freight solutions is propelling interest in hydrogen trucks. Their ability to deliver zero emissions without sacrificing range or performance positions them as a critical enabler of next-generation logistics and transport systems

Restraint/Challenge

“Lack of Hydrogen Refueling Infrastructure and High Operational Costs”

• Despite their environmental advantages, hydrogen trucks face major deployment hurdles due to the scarcity of hydrogen refueling stations. The underdeveloped fueling network limits route flexibility and operational reliability, especially for fleet operators covering long-distance or rural routes

• Hydrogen production and distribution remain expensive, particularly when sourced through green hydrogen methods such as electrolysis. These costs translate into higher total cost of ownership (TCO) for hydrogen trucks, making them less competitive than diesel or even battery-electric alternatives in the current market scenario

• For instance, in the U.S., fewer than 100 public hydrogen stations exist—most of them concentrated in California—making nationwide deployment difficult. This fragmented infrastructure discourages widespread fleet investments in hydrogen technologies

• Further, maintenance costs and technical complexity of fuel cell systems add to long-term ownership expenses. In the absence of economies of scale and mature supply chains, operational costs remain a barrier to broader adoption

• In conclusion, while hydrogen trucks offer significant environmental benefits, infrastructure gaps and high costs pose serious challenges. Unless addressed through policy support, private investment, and cost-reduction innovations, these restraints may slow the market’s growth trajectory in the near term

Hydrogen Truck Market Scope

The market is segmented on the basis of vehicle type, fuel cell technology, range, motor power, and application.

- By Vehicle Type

On the basis of vehicle type, the hydrogen truck market is segmented into heavy-duty trucks, medium-duty trucks, and small-duty trucks. The heavy-duty trucks segment held the largest revenue share of 50.7% in 2024, driven by the growing use of hydrogen fuel cell technology in long-haul transportation and freight operations. These trucks offer the benefit of extended range and high payload capacity, making them suitable for demanding logistics applications across industrialized economies. In addition, government mandates promoting decarbonization in freight movement are accelerating the deployment of zero-emission heavy trucks.

The medium-duty trucks segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising urban delivery and municipal service needs. These vehicles offer a balance between efficiency and range, making them ideal for short- to mid-range transport. Their compact size and lower refueling demand compared to heavy-duty variants support growing adoption across intra-city operations.

- By Fuel Cell Technology

On the basis of fuel cell technology, the hydrogen truck market is segmented into proton exchange membrane fuel cells (PEMFC) and solid oxide fuel cells (SOFC). The PEMFC segment dominated the market in 2024 owing to its high efficiency, rapid startup capability, and compatibility with varying temperature ranges. These characteristics make PEMFCs particularly suitable for transportation applications, especially where fast responsiveness and flexible operations are crucial.

The SOFC segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its superior fuel flexibility and high energy efficiency in steady-state operations. These fuel cells are increasingly being considered for specialized applications and long-haul trucks where thermal efficiency and reduced fuel costs are long-term priorities.

- By Range

On the basis of range, the market is segmented into upto 300 miles, 300–500 miles, and above 500 miles. The 300–500 miles segment held the largest revenue share in 2024, owing to its optimal balance between range and fuel storage requirements. This range meets the operational needs of most regional logistics companies and reduces concerns around limited refueling infrastructure.

The above 500 miles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for long-haul transport solutions without the need for frequent stops. Innovations in hydrogen tank storage and fuel cell efficiency are helping manufacturers push the limits of truck range, making them viable alternatives to diesel counterparts on interstate routes.

- By Motor Power

On the basis of motor power, the hydrogen truck market is segmented into upto 200 kW, 200–400 kW, and above 400 kW. The 200–400 kW segment accounted for the largest market share in 2024, as it suits most medium- and heavy-duty truck applications by providing sufficient power for uphill drives, high-speed freight movement, and daily operational consistency.

The above 400 kW segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for high-performance vehicles in heavy industrial transport. These trucks are being adopted for applications that require significant torque and acceleration, such as mining logistics and mountainous terrain delivery routes.

- By Application

On the basis of application, the market is segmented into logistics and transport, municipal, construction, and others. The logistics and transport segment held the dominant share in 2024 due to the global push to decarbonize commercial fleets and reduce reliance on fossil fuels in goods transportation. Hydrogen trucks offer fast refueling and long range, making them ideal for delivery, freight, and fleet services.

The municipal segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing government initiatives to electrify city services such as waste collection, public maintenance, and transit. Hydrogen trucks in this category provide clean, quiet operation with operational readiness in cold climates, making them suitable for all-season municipal use.

Hydrogen Truck Market Regional Analysis

• Asia-Pacific dominated the hydrogen truck market with the largest revenue share of 42.13% in 2024, driven by rapid industrialization, strong governmental policies, and a rising focus on zero-emission transport across nations such as China, Japan, and South Korea

• The region benefits from national hydrogen roadmaps, supportive incentives, and growing investment in hydrogen refueling infrastructure to facilitate fuel cell vehicle deployment

• Leading automakers and technology firms in Asia-Pacific are collaborating to develop advanced hydrogen truck models for commercial and municipal applications, accelerating market momentum

China Hydrogen Truck Market Insight

The China hydrogen truck market captured the largest share in Asia-Pacific in 2024, fueled by robust government funding, the launch of hydrogen demonstration cities, and strong participation from local manufacturers. With goals to achieve peak carbon emissions by 2030, China is scaling hydrogen truck deployment in freight corridors and urban logistics. Companies such as FAW, Dongfeng, and SAIC are heavily investing in hydrogen-powered heavy-duty vehicles, while over 200 hydrogen refueling stations are already in operation across the country.

Japan Hydrogen Truck Market Insight

Japan's hydrogen truck market is expected to witness the fastest growth rate from 2025 to 2032, supported by the government's long-term commitment to building a hydrogen-based economy under its Basic Hydrogen Strategy. Key players such as Toyota and Mitsubishi Fuso are conducting large-scale pilots involving hydrogen trucks in city logistics and construction segments. The development of hydrogen supply chains, public-private partnerships, and local government support in cities such as Tokyo and Yokohama are collectively driving market adoption.

North America Hydrogen Truck Market Insight

The North America hydrogen truck market is expected to witness the fastest growth rate from 2025 to 2032, driven by decarbonization goals, expansion of clean fuel infrastructure, and corporate sustainability mandates. Public and private fleet operators are increasingly turning to hydrogen trucks for long-haul operations due to their fast refueling and extended range capabilities. Government incentives such as the Inflation Reduction Act in the U.S. are supporting fuel cell vehicle deployment and hydrogen production.

U.S. Hydrogen Truck Market Insight

The U.S. is expected to witness the fastest growth rate from 2025 to 2032, driven by active investments in zero-emission freight solutions and growing partnerships between logistics firms and hydrogen technology providers. States such as California, Texas, and New York are leading in hydrogen refueling infrastructure and pilot deployments. Companies such as Nikola Corporation, Hyzon Motors, and Cummins are playing pivotal roles in accelerating hydrogen truck adoption for long-haul and regional transport.

Europe Hydrogen Truck Market Insight

The Europe hydrogen truck market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by stringent carbon emission regulations, funding under the European Green Deal, and growing preference for sustainable logistics. The region is investing heavily in hydrogen corridors across major highways and freight networks. Collaborations among EU member states and OEMs such as Daimler Truck and Volvo are paving the way for commercial hydrogen truck rollouts across logistics, construction, and municipal sectors.

Germany Hydrogen Truck Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, supported by national hydrogen strategies, federal subsidies, and strong industrial collaboration. The German government aims to have hundreds of hydrogen refueling stations operational by 2030, supporting widespread use of hydrogen-powered trucks. With major OEMs such as Daimler and MAN actively developing fuel cell vehicles, Germany is a frontrunner in commercializing hydrogen freight transport across the region.

U.K. Hydrogen Truck Market Insight

The U.K. hydrogen truck market is expected to witness the fastest growth rate from 2025 to 2032, backed by policy initiatives such as the Hydrogen Strategy and Road to Zero emissions targets. Trials involving hydrogen-powered trucks are underway in logistics and waste management fleets, particularly in cities such as London and Birmingham. Public-private partnerships, advancements in green hydrogen production, and investments in transport infrastructure are expected to further drive the market in the coming years.

Hydrogen Truck Market Share

The Hydrogen Truck industry is primarily led by well-established companies, including:

• Hyundai Motor Company (South Korea)

• Nikola Corporation (U.S.)

• Daimler Truck AG (Germany)

• Volvo Group (Sweden)

• TRATON GROUP (Germany)

• MAN Truck & Bus SE (Germany)

• Scania (Sweden)

• PACCAR Holding B.V. (U.S.)

• DAF (Netherlands)

• Dongfeng Motor Corporation (China)

• Foton International (China)

• Yutong International Holding Co., Ltd. (China)

Latest Developments in Global Hydrogen Truck Market

- In June 2024, Xuzhou Construction Machinery Group Co., Ltd. introduced the EHSL552F, a hydrogen fuel cell dump truck aimed at cutting greenhouse gas emissions in heavy-duty sectors such as mining. This launch marks a strategic move to enhance the company’s renewable energy fleet, offering a cleaner alternative for large-scale transportation. The development is expected to boost the adoption of hydrogen-powered vehicles in construction and mining industries, aligning with global sustainability goals and strengthening the brand’s position in the green mobility space

- In April 2024, MAN Truck & Bus SE launched the MAN hTGX, a hydrogen combustion engine truck developed for demanding transport tasks such as hauling timber, heavy goods, and construction materials. Equipped with the H45 engine, it delivers 383 kW of power and a range of up to 600 kilometers, with refueling times under 15 minutes. This innovation supports the European Union’s zero-emission targets and is likely to drive demand for alternative fuel trucks in the heavy-duty vehicle segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.