Global Hydrolyzed Proteins Market

Market Size in USD Billion

CAGR :

%

USD

22.12 Billion

USD

34.21 Billion

2024

2032

USD

22.12 Billion

USD

34.21 Billion

2024

2032

| 2025 –2032 | |

| USD 22.12 Billion | |

| USD 34.21 Billion | |

|

|

|

|

Hydrolyzed Proteins Market Size

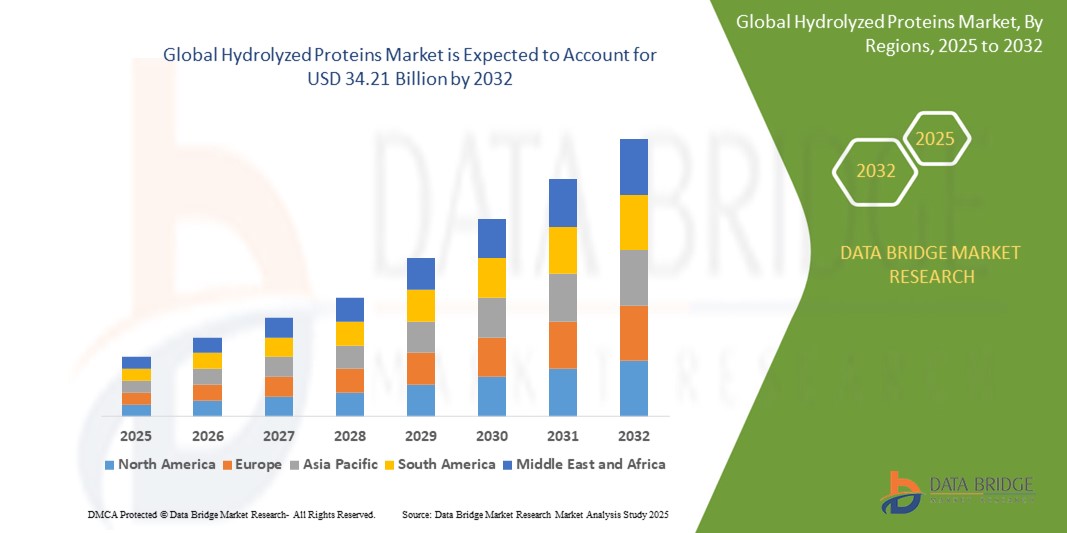

- The global hydrolyzed proteins market size was valued at USD 22.12 billion in 2024 and is expected to reach USD 34.21 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by the increasing demand for functional, easily digestible, and hypoallergenic protein sources across infant nutrition, medical nutrition, and sports supplements, driven by rising health consciousness and personalized dietary preferences

- Furthermore, advancements in enzymatic hydrolysis and clean-label processing technologies are enabling the development of high-quality protein hydrolysates with improved taste, solubility, and bioavailability, thereby accelerating their adoption across food, beverage, and pharmaceutical sectors

Hydrolyzed Proteins Market Analysis

- Hydrolyzed proteins are proteins that have been broken down into smaller peptides or amino acids through chemical or enzymatic hydrolysis, enhancing their digestibility and absorption. These proteins are widely used in infant formulas, clinical nutrition, sports supplements, and functional foods

- The growing use of hydrolyzed proteins is primarily driven by increasing demand for allergen-reduced and fast-absorbing protein ingredients, along with expanding applications in clean-label and high-performance nutrition products across global markets

- North America dominated the hydrolyzed proteins market with a share of 25.6% in 2024, due to the rising demand for high-quality nutritional products in medical, infant, and sports nutrition sectors

- Asia-Pacific is expected to be the fastest growing region in the hydrolyzed proteins market during the forecast period due to rapid population growth, urbanization, and increasing protein consumption across China, India, and Japan

- Enzymatic hydrolysis segment dominated the market with a market share of 54.5% in 2024, due to its precision, better control over peptide profiles, and preservation of nutritional integrity. This method is widely preferred for food and pharmaceutical applications as it minimizes the formation of undesirable by-products and supports clean-label claims

Report Scope and Hydrolyzed Proteins Market Segmentation

|

Attributes |

Hydrolyzed Proteins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hydrolyzed Proteins Market Trends

“Rising Demand in Sports Nutrition”

- The hydrolyzed proteins market is experiencing significant growth driven by increasing consumer focus on fitness, muscle recovery, and quick protein absorption, making hydrolyzed proteins ideal ingredients in sports nutrition products

- For instance, Glanbia plc, a major player, has enhanced its hydrolyzed whey protein portfolio to cater to athletes and fitness enthusiasts seeking fast-acting, highly digestible protein supplements for improved muscle synthesis and recovery

- Advances in enzymatic hydrolysis processes allow production of hydrolyzed proteins with tailored peptide profiles that enhance bioavailability and reduce allergenicity, broadening applications in functional foods and dietary supplements

- The trend toward clean-label, minimally processed, and naturally sourced proteins is encouraging manufacturers to develop hydrolyzed protein products free from artificial additives, targeting health-conscious consumers

- Expansion of product formats such as protein bars, ready-to-drink beverages, and nutritional snacks incorporating hydrolyzed proteins is facilitating convenience and on-the-go consumption in sports and wellness markets

- Growing application of hydrolyzed proteins in clinical and elder nutrition markets reflects their benefits for improved digestibility and nutrient uptake in sensitive populations, further broadening market demand

Hydrolyzed Proteins Market Dynamics

Driver

“Rising Demand for Protein-Rich Diets”

- Increasing global consumer awareness about the importance of high-quality protein intake for overall health, weight management, and chronic disease prevention is significantly propelling hydrolyzed protein market growth

- For instance, Kerry Group has expanded its hydrolyzed protein ingredient offerings to address diverse dietary needs across sports nutrition, medical nutrition, and fortified food applications, capitalizing on this rising demand

- Accelerated adoption of protein-rich diets in emerging markets, fueled by urbanization and increasing disposable incomes, is boosting demand for versatile hydrolyzed protein ingredients with superior functional properties

- Growing elderly and clinical populations create sustained demand for hydrolyzed proteins that support muscle maintenance, improve absorption, and offer hypoallergenic properties in specialized nutrition products

- Regulatory encouragement for enhanced nutritional labeling and protein fortification in foods is motivating food manufacturers to incorporate hydrolyzed proteins to meet both compliance and consumer expectations

Restraint/Challenge

“Availability of Alternatives”

- The presence of alternative protein sources such as plant-based proteins, collagen peptides, and synthetic protein blends presents competitive challenges to the hydrolyzed proteins market, affecting adoption and pricing strategies

- For instance, DuPont Nutrition & Health actively promotes its plant-based hydrolyzed protein solutions as environmentally friendly and cost-effective alternatives to traditional animal-derived hydrolysates, increasing competition

- Price fluctuations and supply constraints in key raw materials such as dairy, soy, and meat proteins may prompt manufacturers to seek cheaper or more sustainable protein options, challenging hydrolyzed protein market share

- Consumer shifts toward vegan and allergen-free diet preferences reduce demand for some hydrolyzed animal proteins, requiring companies to diversify offerings and emphasize hypoallergenic plant-based hydrolysates

- Complex manufacturing and purification processes for hydrolyzed proteins also increase production costs compared to simpler protein concentrates or isolates, limiting penetration in cost-sensitive segments

Hydrolyzed Proteins Market Scope

The market is segmented on the basis of type, source, process, application, and end users.

- By Type

On the basis of type, the hydrolyzed proteins market is segmented into milk protein, meat protein, marine protein, egg protein, plant protein, and yeast protein. The milk protein segment dominated the largest market revenue share in 2024 due to its high digestibility, amino acid profile, and proven benefits in clinical and infant nutrition. Widely used in specialized dietary formulations, hydrolyzed milk proteins are especially valued for their reduced allergenic potential, making them a preferred choice for infant formula and medical applications. The extensive research backing and regulatory acceptance further strengthen the dominance of this segment in both developed and emerging markets.

The plant protein segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for sustainable and allergen-free alternatives. Growing veganism, lactose intolerance, and clean-label trends are propelling interest in hydrolyzed plant proteins across functional beverages, sports nutrition, and food supplements. Their versatility, ease of formulation, and environmental appeal are expanding their footprint in mainstream product development across health-conscious demographics.

- By Source

On the basis of source, the market is categorized into animal, plant, and microbes. The animal source segment held the largest market revenue share in 2024, primarily due to the long-standing usage of milk, meat, and egg-derived hydrolysates in nutritional and therapeutic products. Animal-derived hydrolyzed proteins are extensively used in infant and clinical nutrition due to their high bioavailability and complete amino acid profile, meeting specific health requirements efficiently.

The plant source segment is projected to record the fastest CAGR through 2032, fueled by the accelerating adoption of plant-based diets and growing demand for allergen-free, non-GMO ingredients. Innovations in enzymatic hydrolysis technologies have improved the taste, solubility, and nutritional value of plant-based hydrolysates, boosting their application in sports and functional nutrition.

- By Process

On the basis of process, the market is segmented into acid and alkaline hydrolysis and enzymatic hydrolysis. The enzymatic hydrolysis segment accounted for the largest revenue share of 54.5% in 2024, owing to its precision, better control over peptide profiles, and preservation of nutritional integrity. This method is widely preferred for food and pharmaceutical applications as it minimizes the formation of undesirable by-products and supports clean-label claims.

The acid and alkaline hydrolysis segment is expected to grow at a steady pace, driven by its cost-effectiveness and rapid processing advantages, especially in industrial applications where flavor and nutrient retention are not as critical. However, regulatory constraints and consumer preference for milder, natural processing methods are limiting its share in high-value nutritional segments.

- By Application

On the basis of application, the market is segmented into infant nutrition, medical nutrition, sports nutrition, cell nutrition, and others. The infant nutrition segment led the market in terms of revenue in 2024, driven by increased demand for hypoallergenic and easily digestible protein sources in infant formula. Hydrolyzed proteins from milk and whey are commonly used to reduce allergic responses and improve gastrointestinal tolerance in infants, particularly in early life or preterm scenarios.

The sports nutrition segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising health consciousness, increased participation in fitness and bodybuilding, and the growing appeal of high-protein, fast-absorbing supplements. Hydrolyzed proteins are favored by athletes and active consumers due to their rapid absorption and muscle recovery benefits.

- By End Users

On the basis of end users, the market is bifurcated into food and beverages and cosmetics. The food and beverages segment dominated the market in 2024 due to broad incorporation of hydrolyzed proteins in nutritional drinks, bars, and dietary supplements. These proteins enhance texture, taste, and nutritional value, making them integral to clean-label and functional food trends.

The cosmetics segment is anticipated to grow rapidly through 2032, as hydrolyzed proteins gain traction in skincare and haircare formulations for their moisturizing, film-forming, and strengthening properties. Increased consumer focus on bioactive and protein-rich ingredients in personal care products is supporting this growth trajectory.

Hydrolyzed Proteins Market Regional Analysis

- North America dominated the hydrolyzed proteins market with the largest revenue share of 25.6% in 2024, driven by the rising demand for high-quality nutritional products in medical, infant, and sports nutrition sectors

- The region benefits from a well-established health and wellness culture, growing preference for functional foods, and significant investments in protein-based R&D

- The increasing prevalence of lifestyle-related disorders and the expanding aging population further support demand for hydrolyzed proteins in dietary and clinical formulations across the region

U.S. Hydrolyzed Proteins Market Insight

The U.S. hydrolyzed proteins market captured the largest revenue share in 2024 within North America, fueled by robust consumption of protein-enriched products and expanding applications in medical nutrition and sports supplements. The growing consumer focus on gut health, allergen-free products, and clean-label protein ingredients is boosting demand. In addition, strong innovation in enzymatic hydrolysis processes and the presence of key market players contribute to the market's growth across food, beverage, and personal care sectors.

Europe Hydrolyzed Proteins Market Insight

The Europe hydrolyzed proteins market is projected to grow at a steady CAGR throughout the forecast period, supported by stringent food safety standards and increasing demand for bioactive ingredients in functional and fortified foods. The region’s focus on sustainable protein sources, particularly plant and marine-based hydrolysates, is accelerating product development. Demand is also rising across medical and infant nutrition sectors, driven by aging demographics and heightened health awareness.

U.K. Hydrolyzed Proteins Market Insight

The U.K. hydrolyzed proteins market is expected to register a notable CAGR over the forecast period due to the country’s growing appetite for sports nutrition and plant-based dietary solutions. Increasing consumer preference for hypoallergenic and easily digestible proteins, along with a strong emphasis on ethical sourcing, is influencing product innovation. Expanding interest in nutraceuticals and personalized nutrition also underpins market expansion in the U.K.

Germany Hydrolyzed Proteins Market Insight

The Germany hydrolyzed proteins market is projected to expand consistently, driven by the country’s leadership in sustainable food innovation and its mature pharmaceutical and personal care sectors. With consumers seeking clean-label, high-performance protein ingredients, hydrolyzed proteins are gaining ground in functional foods and clinical nutrition. Regulatory support for protein fortification and continued R&D investments are also enhancing the domestic market landscape.

Asia-Pacific Hydrolyzed Proteins Market Insight

The Asia-Pacific hydrolyzed proteins market is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by rapid population growth, urbanization, and increasing protein consumption across China, India, and Japan. Rising awareness of health and nutrition, combined with government initiatives to improve child and elderly nutrition, is fostering market expansion. The presence of cost-effective production facilities and strong demand for infant and sports nutrition products further accelerates growth in the region.

Japan Hydrolyzed Proteins Market Insight

The Japan hydrolyzed proteins market is steadily growing due to a health-conscious aging population and high demand for functional and easy-to-digest foods. Japanese consumers favor hydrolyzed proteins in clinical and elderly nutrition owing to their superior digestibility and low allergenicity. The market is also benefitting from domestic innovations in enzymatic processing and the integration of protein hydrolysates into skincare and personal care formulations.

China Hydrolyzed Proteins Market Insight

The China hydrolyzed proteins market accounted for the largest revenue share within Asia-Pacific in 2024, supported by growing urban middle-class populations and a shift toward high-protein diets. The increasing adoption of hydrolyzed milk and plant proteins in infant formulas, dietary supplements, and functional foods is driving demand. Government initiatives supporting child nutrition and protein fortification, along with strong local manufacturing capabilities, are strengthening China’s position in the global hydrolyzed proteins market.

Hydrolyzed Proteins Market Share

The hydrolyzed proteins industry is primarily led by well-established companies, including:

- Koninklijke DSM N.V. (Netherlands)

- Abbott (U.S.)

- Kerry Group PLC (Ireland)

- Tate & Lyle PLC (U.K.)

- Arla Foods (Denmark)

- ADM (U.S.)

- Danone Nutricia (France)

- Nestlé S.A. (Switzerland)

- Glanbia PLC (Ireland)

- FrieslandCampina (Netherlands)

- Agrilife (U.S.)

- SunOpta (Canada)

- Darling Ingredients (U.S.)

- Omega Protein Corporation (U.S.)

- BRISK BIO (U.S.)

Latest Developments in Global Hydrolyzed Proteins Market

- In May 2022, Kerry Group announced the opening of a state-of-the-art manufacturing plant in KwaZulu-Natal, South Africa, with an investment of EUR 38 million. Spanning 10,000 square meters, this facility is dedicated to producing nutrition products tailored for consumption across the African continent. This strategic investment aims to meet the growing demand for nutritional solutions, enhancing Kerry Group's footprint in the African market

- In November 2021, Groupe Lactalis celebrated the inauguration of its new whey drying tower at its Verdun, France facility. This cutting-edge tower, equipped with advanced drying technologies, significantly boosts production capacity, enabling the output of 30,000 tons of high-quality whey powder annually. This expansion reinforces Lactalis's commitment to serving the food industry and enhances its product offerings to meet diverse market needs

- In June 2021, Arla Foods Ingredients launched a new whey protein hydrolysate, branded as WPH Lacprodan DI-3091, designed specifically for individuals facing maldigestion or malabsorption issues. This innovative ingredient aims to overcome taste challenges often associated with dietary restrictions. By enhancing palatability and nutritional value, Arla provides a solution that supports health and wellness, making it easier for patients to meet their dietary needs

- In October 2020, Glanbia Nutritionals commenced operations at its new facility located on a sprawling 120-acre site. The commissioning phase, set to span the next eight months, focuses on optimizing processes within the 375,000-square-foot plant. Once fully operational, this facility will process approximately 3.6 million liters of milk per day, producing high-quality block cheese and value-added whey products for both U.S. and international markets

- In March 2020, Arla Foods introduced a new line of plant-based drinks, focusing on oat-based options made solely from natural ingredients. This initiative reflects the growing consumer preference for healthier and sustainable beverage alternatives. By expanding into the plant-based sector, Arla aims to cater to the increasing demand for dairy-free products, enhancing its portfolio and commitment to innovative nutrition solutions

- In February 2020, Kerry Group announced its strategic acquisition of Pevesa Biotech, a Spanish firm specializing in organic and non-allergenic plant protein ingredients. This acquisition is part of Kerry’s broader strategy to strengthen its position in the high-value protein (HVP) market. By incorporating Pevesa's expertise, Kerry aims to enhance its product offerings in general, infant, and clinical nutrition, focusing on organic and allergen-free options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hydrolyzed Proteins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hydrolyzed Proteins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hydrolyzed Proteins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.