Global Hydrostatic Transmission Market

Market Size in USD Billion

CAGR :

%

USD

5.39 Billion

USD

7.34 Billion

2024

2032

USD

5.39 Billion

USD

7.34 Billion

2024

2032

| 2025 –2032 | |

| USD 5.39 Billion | |

| USD 7.34 Billion | |

|

|

|

|

Hydrostatic Transmission Market Size

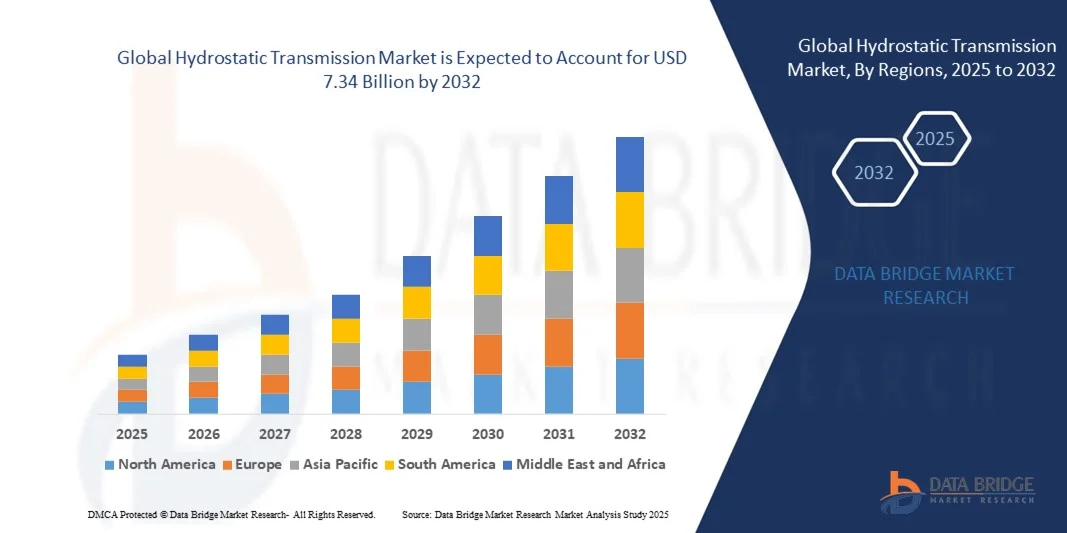

- The global hydrostatic transmission market size was valued at USD 5.39 billion in 2024 and is expected to reach USD 7.34 billion by 2032, at a CAGR of 3.94% during the forecast period

- The market growth is largely fueled by increasing industrialization, mechanization in agriculture and construction, and rising infrastructure development across emerging and developed economies

- Furthermore, the demand for efficient, durable, and high-performance machinery in mining, construction, transportation, and agricultural sectors is driving the adoption of hydrostatic transmission systems. These converging factors are enhancing equipment precision, reducing operational costs, and accelerating the uptake of hydrostatic technology, thereby significantly boosting the industry’s growth

Hydrostatic Transmission Market Analysis

- Hydrostatic transmissions are hydraulic systems that enable smooth, continuous, and precise control of torque and speed in machinery. These systems are widely used in heavy-duty and medium-duty equipment, including tractors, telehandlers, excavators, and loaders, enhancing performance, efficiency, and operator control

- The escalating demand for hydrostatic transmissions is primarily driven by the need for energy-efficient operations, reduced maintenance costs, and improved maneuverability in industrial, construction, and agricultural applications. The integration of advanced technologies, such as variable displacement systems, regenerative braking, and hybrid drivetrains, is further supporting market expansion

- North America dominated the hydrostatic transmission market with a share of 45.9% in 2024, due to extensive industrialization, growing construction activities, and a strong presence of heavy machinery manufacturers

- Asia-Pacific is expected to be the fastest growing region in the hydrostatic transmission market during the forecast period due to rapid industrialization, urbanization, and infrastructure development in countries such as China, Japan, and India

- Heavy duty segment dominated the market with a market share of 47% in 2024, due to its widespread adoption in industrial and construction machinery that require high power output and durability. Heavy-duty hydrostatic transmissions are preferred for their ability to handle extreme loads and harsh operating conditions, making them a reliable choice for large-scale equipment in mining, construction, and agricultural applications. Their robust design ensures long operational life, while advanced features such as pressure-compensated flow control enhance efficiency and performance. The segment also benefits from increasing mechanization in industries and ongoing infrastructure development projects worldwide

Report Scope and Hydrostatic Transmission Market Segmentation

|

Attributes |

Hydrostatic Transmission Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Hydrostatic Transmission Market Trends

Adoption of Hybrid and Electric Machinery

- The hydrostatic transmission market is experiencing a significant transformation with the growing adoption of hybrid and electric machinery across industries such as construction, agriculture, and material handling. As manufacturers focus on improving operational efficiency and reducing carbon emissions, hydrostatic transmission systems are being integrated with hybrid drive technology to optimize energy usage and enhance performance

- For instance, Bosch Rexroth AG and Danfoss Power Solutions have developed hydrostatic systems compatible with electric and hybrid vehicles, enabling smooth torque control and improved fuel economy. These systems combine hydraulic power with electric propulsion, ensuring efficient energy conversion and reduced mechanical losses in off-highway and heavy-duty machinery

- The shift toward electrification has accelerated innovations in variable displacement pumps and compact hydraulic components designed to support hybrid systems’ flexible power management. These advanced hydrostatic transmissions enable precise control of speed and torque while seamlessly integrating with electronic control modules for real-time system monitoring and optimization

- In agricultural and construction machinery, hybrid hydrostatic systems provide operators with low-speed control and high torque output, improving productivity while minimizing fuel consumption. This trend aligns with the broader industry push toward sustainability, emissions compliance, and machine electrification for next-generation mobile equipment

- Furthermore, the adoption of IoT-integrated control systems and smart hydraulics enables continuous monitoring of performance parameters such as pressure, temperature, and load to improve reliability and maintenance efficiency. This integration strengthens the role of hydrostatic transmission systems in connected, energy-efficient machinery ecosystems

- As hybrid and electric platforms continue to gain traction in mobile applications, hydrostatic transmissions will remain central to their evolution. The trend highlights the industry’s shift toward intelligent, low-emission power transmission technologies that enhance both energy efficiency and system responsiveness

Hydrostatic Transmission Market Dynamics

Driver

Demand for Energy-Efficient, High-Performance Equipment

- The rising demand for equipment that delivers high efficiency, reliability, and performance is a major driver for the hydrostatic transmission market. These systems are preferred for applications where variable speed control, precision handling, and energy efficiency are critical, such as construction vehicles, tractors, and forestry machinery

- For instance, Eaton Corporation and Dana Incorporated provide hydrostatic transmission systems optimized for heavy-duty use, allowing fine power modulation and higher mechanical efficiency under variable operating conditions. Their systems deliver smooth acceleration and deceleration, improving equipment productivity while reducing fuel consumption

- Hydrostatic transmissions enable power transfer with minimal energy loss, offering superior torque control compared to mechanical or purely hydraulic systems. Their adaptability allows operators to achieve optimal power distribution across multiple working conditions, enhancing durability and machine lifespan

- In addition, the integration of electronics and sensors in modern hydrostatic systems enables predictive maintenance and automated performance tuning. These advancements contribute to improved energy efficiency metrics and operational flexibility, key priorities for sectors embracing digitalization and sustainability

- As industries place greater emphasis on productivity, fuel efficiency, and precision engineering, hydrostatic transmission systems will continue to gain adoption. Their balance of performance, control, and energy savings makes them an essential component of the next generation of industrial and mobile machinery

Restraint/Challenge

High Cost and Complexity of Systems

- Despite their advantages, hydrostatic transmission systems face growth constraints due to high costs and system complexity. The integration of hydraulic pumps, motors, valves, and control units involves precision manufacturing and high-quality materials, leading to elevated production and maintenance expenses

- For instance, manufacturers such as Parker Hannifin Corporation and Sauer-Danfoss experience high capital costs associated with sophisticated design and testing processes required to ensure system durability under heavy load conditions. These costs often make hydrostatic systems more expensive than conventional mechanical or electric alternatives, limiting adoption in cost-sensitive segments

- The complex design and setup of hydrostatic systems require skilled technicians for assembly, calibration, and maintenance. Any imbalance in system tuning or component compatibility can reduce efficiency and operational lifespan, increasing downtime and repair requirements for end users

- In addition, the high-pressure hydraulic environment demands advanced sealing technologies and regular maintenance to prevent fluid leakage and component wear. These ongoing operational complexities and maintenance costs pose challenges to end users seeking simplified, low-maintenance solutions

- Although technological innovations such as modular design and digitized control units are improving cost efficiency, hydrostatic systems remain capital-intensive. Overcoming these challenges will require continued advancements in materials, automation, and integration techniques to achieve competitive cost-performance balance and broader market adoption

Hydrostatic Transmission Market Scope

The market is segmented on the basis of capacity type, operation type, and end use.

- By Capacity Type

On the basis of capacity type, the hydrostatic transmission market is segmented into light duty, medium duty, and heavy duty. The heavy-duty segment dominated the largest market revenue share of 37% in 2024, driven by its widespread adoption in industrial and construction machinery that require high power output and durability. Heavy-duty hydrostatic transmissions are preferred for their ability to handle extreme loads and harsh operating conditions, making them a reliable choice for large-scale equipment in mining, construction, and agricultural applications. Their robust design ensures long operational life, while advanced features such as pressure-compensated flow control enhance efficiency and performance. The segment also benefits from increasing mechanization in industries and ongoing infrastructure development projects worldwide.

The light-duty segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in small-scale agricultural machinery, utility vehicles, and compact construction equipment. Light-duty hydrostatic transmissions offer easier installation, lower maintenance, and cost-effective operation, making them appealing to small businesses and emerging markets. Their efficiency in maneuverability and energy savings further contributes to their adoption across diverse applications.

- By Operation Type

On the basis of operation type, the hydrostatic transmission market is segmented into variable displacement motor-constant displacement pump, variable displacement pump-constant displacement motor, and variable displacement motor-variable displacement pump. The variable displacement motor-variable displacement pump segment dominated the largest market share in 2024, attributed to its high efficiency, precise control, and adaptability in heavy machinery applications. This configuration allows for optimized torque and speed control, reducing energy losses and improving overall equipment performance. It is extensively used in modern construction and agricultural machines, where variable load handling and fuel efficiency are crucial factors. The segment also benefits from growing automation and smart hydraulic system integration across industrial equipment.

The variable displacement pump-constant displacement motor segment is expected to witness the fastest growth from 2025 to 2032, driven by its cost-effectiveness, ease of design, and suitability for medium-duty machinery. This operation type provides reliable speed regulation and efficient power transmission for a variety of mobile equipment, supporting expanding demand in developing regions and small-to-medium industrial applications.

- By End Use

On the basis of end use, the hydrostatic transmission market is segmented into mining, construction, transportation, agricultural, and others. The construction segment dominated the largest market revenue share in 2024, fueled by extensive infrastructure development projects, urbanization, and the rising need for efficient machinery in earthmoving, material handling, and road construction. Hydrostatic transmissions in construction equipment offer precise control, smooth operation, and high energy efficiency, which are essential for optimizing project timelines and reducing operational costs. The segment is further supported by technological advancements in hydraulic systems and increasing demand for versatile and high-performance machinery.

The agricultural segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of mechanized farming equipment, smart tractors, and automated irrigation machinery. Hydrostatic transmissions provide farmers with smooth variable speed control, improved fuel efficiency, and reduced operator fatigue, making them ideal for modern agricultural operations. Growing emphasis on sustainable farming practices and increased mechanization in emerging economies further accelerates the adoption of hydrostatic transmissions in the agricultural sector.

Hydrostatic Transmission Market Regional Analysis

- North America dominated the hydrostatic transmission market with the largest revenue share of 45.9% in 2024, driven by extensive industrialization, growing construction activities, and a strong presence of heavy machinery manufacturers

- Companies in the region prioritize efficiency, durability, and precise control in equipment, which hydrostatic transmissions provide, supporting their widespread adoption across mining, construction, and agricultural machinery

- The market is further bolstered by high investments in infrastructure, advanced manufacturing technologies, and regulatory standards promoting energy-efficient and reliable machinery solutions

U.S. Hydrostatic Transmission Market Insight

The U.S. hydrostatic transmission market captured the largest revenue share in 2024 within North America, fueled by rapid mechanization, high demand for construction and mining equipment, and the adoption of energy-efficient hydraulic systems. Industrial operators increasingly favor hydrostatic transmissions for their smooth performance, precise speed control, and reduced operational downtime. Rising investments in infrastructure and agricultural mechanization, coupled with advanced manufacturing capabilities, are expected to further propel market growth.

Europe Hydrostatic Transmission Market Insight

The Europe hydrostatic transmission market is projected to expand at a steady CAGR throughout the forecast period, driven by increasing infrastructure projects, urbanization, and stringent emission and efficiency regulations. Demand for construction, mining, and agricultural machinery equipped with durable and efficient hydrostatic transmissions is rising. European manufacturers are also focusing on developing advanced, eco-friendly, and compact transmission systems to meet regional energy efficiency standards and consumer expectations.

U.K. Hydrostatic Transmission Market Insight

The U.K. hydrostatic transmission market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by infrastructure development, mechanization in agriculture, and rising demand for efficient construction machinery. The country’s focus on modernization of equipment, along with high adoption of industrial automation, is encouraging the use of hydrostatic transmission systems. In addition, government initiatives supporting sustainable and energy-efficient machinery contribute to the segment’s expansion.

Germany Hydrostatic Transmission Market Insight

The Germany hydrostatic transmission market is expected to expand at a considerable CAGR during the forecast period, fueled by technological advancements, industrial growth, and emphasis on precision and energy efficiency in machinery. The country’s well-established construction, mining, and agricultural sectors promote demand for high-performance hydrostatic transmissions. Germany’s commitment to sustainability and innovation further encourages adoption of advanced hydraulic systems in both heavy-duty and medium-duty equipment.

Asia-Pacific Hydrostatic Transmission Market Insight

The Asia-Pacific hydrostatic transmission market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and infrastructure development in countries such as China, Japan, and India. Rising mechanization in agriculture, construction, and transportation sectors is boosting demand for hydrostatic transmissions. Government initiatives promoting modern machinery, coupled with cost-effective manufacturing capabilities, are enhancing the region’s accessibility to advanced hydrostatic systems.

Japan Hydrostatic Transmission Market Insight

The Japan hydrostatic transmission market is witnessing growth due to high industrial automation, technological advancements in machinery, and increasing demand for efficient hydraulic systems. Japanese manufacturers emphasize precision, reliability, and compact designs in hydrostatic transmissions, supporting adoption in construction, agricultural, and industrial equipment. The integration of advanced monitoring and control technologies is also contributing to market expansion.

China Hydrostatic Transmission Market Insight

The China hydrostatic transmission market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid industrialization, urbanization, and a growing construction and agricultural machinery base. China’s focus on infrastructure projects and modernized equipment drives strong demand for reliable, efficient hydrostatic transmissions. The presence of domestic manufacturers and cost-effective solutions further accelerates market adoption across residential, commercial, and industrial sectors.

Hydrostatic Transmission Market Share

The hydrostatic transmission industry is primarily led by well-established companies, including:

- KANZAKI KOKYUKOKI MFG. CO., LTD. (Japan)

- Dana Limited (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- Danfoss A/S (Denmark)

- Eaton (U.S.)

- Carraro HQ (Italy)

- Tuff Torq Corporation (Canada)

- Komatsu America Corp. (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Hydro-Gear (U.S.)

- PMC Hydraulics Group AB (Sweden)

- Hydrostatic Transmission Service, LLC (U.S.)

- Sundstrand Hydraulics (U.S.)

- Linde Hydraulics GmbH & Co. KG (Germany)

- POCLAIN HYDRAULICS (France)

- Bosch Rexroth AG (Germany)

- HANSA-TMP (Germany)

- Perea Maritima S.A. (Spain)

- ZF Friedrichshafen AG (Germany)

- Komatsu Ltd. (Japan)

Latest Developments in Global Hydrostatic Transmission Market

- In April 2024, ZF Friedrichshafen AG introduced a next-generation hydrostatic transmission system featuring smart hydraulic controls and AI-based torque optimization. This innovation is set to significantly enhance fuel efficiency and operational precision in heavy-duty commercial vehicles, strengthening ZF’s position in the industrial and commercial machinery segment. The integration of AI-driven torque management supports reduced energy consumption and lower operational costs, encouraging wider adoption of advanced hydrostatic systems in fleets and construction equipment

- In March 2024, Kubota Corporation unveiled an advanced compact hydrostatic transmission tailored for small tractors and utility vehicles. This development improves precision control and reduces maintenance requirements, making modern farming operations more efficient and cost-effective. By addressing the growing demand for mechanized and user-friendly agricultural equipment, Kubota’s innovation is expected to drive adoption in the global agricultural machinery segment

- In February 2024, Allison Transmission announced the launch of a hydrostatic-electric hybrid drivetrain designed for public transportation and logistics vehicles. This system enables improved energy recovery and smoother acceleration, supporting sustainability initiatives and lower fuel consumption in urban transport fleets. The hybrid solution strengthens Allison’s market presence in eco-efficient transit and commercial applications, aligning with increasing global demand for hybrid and electric-powered machinery

- In January 2024, Liebherr Group developed a high-efficiency hydrostatic drive system for mining and construction machinery, incorporating regenerative braking technology. This innovation enhances energy conservation and reduces operational costs, making heavy-duty equipment more sustainable and efficient. Liebherr’s advancement positions the company to capture growing demand in sectors emphasizing performance, durability, and eco-friendly operations

- In January 2023, Dana Incorporated announced plans to launch a hydrostatic driveline for telehandlers in North America. The system’s modular architecture allows for seamless transition to hydrogen or battery-electric vehicle designs, providing flexibility for future-proof machinery. This development addresses evolving market trends toward alternative energy vehicles, enhancing Dana’s competitiveness in the commercial and construction equipment segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.