Global Hygiene Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

2.68 Billion

USD

4.31 Billion

2025

2033

USD

2.68 Billion

USD

4.31 Billion

2025

2033

| 2026 –2033 | |

| USD 2.68 Billion | |

| USD 4.31 Billion | |

|

|

|

|

Global Hygiene Adhesives Market Size

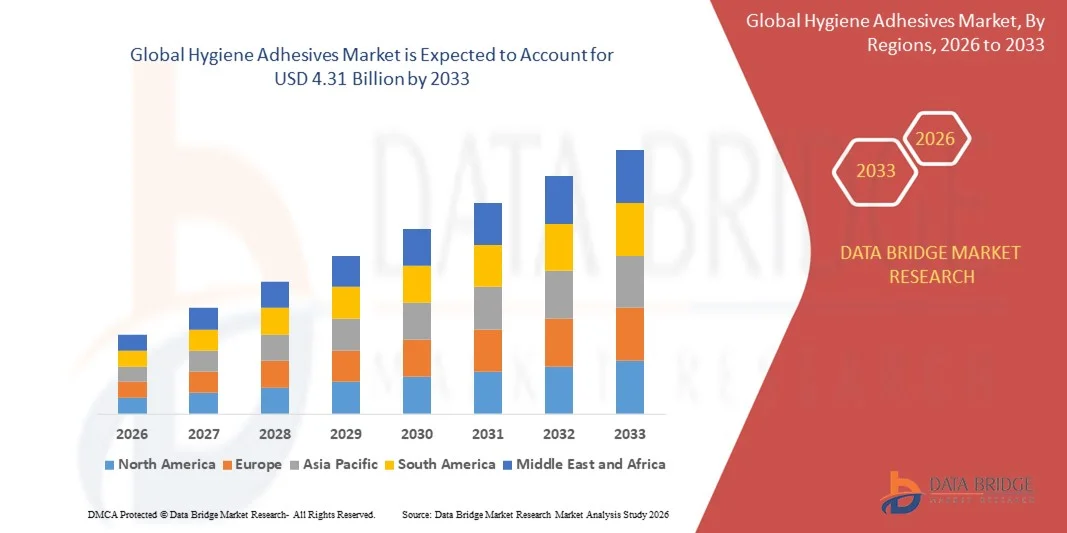

- The global Hygiene Adhesives Market size was valued at USD 2.68 billion in 2025 and is expected to reach USD 4.31 billion by 2033, at a CAGR of 6.10% during the forecast period.

- The market growth is largely driven by increasing demand for high-performance, eco-friendly adhesives in the hygiene industry, including diapers, feminine care products, and adult incontinence products, which require reliable bonding solutions.

- Furthermore, rising consumer awareness regarding product comfort, safety, and sustainability is prompting manufacturers to adopt advanced adhesive technologies. These trends, combined with innovation in biodegradable and skin-friendly formulations, are accelerating the adoption of hygiene adhesives, thereby significantly boosting the industry's growth.

Global Hygiene Adhesives Market Analysis

- Hygiene adhesives, used for bonding materials in products such as diapers, feminine care, and adult incontinence items, are increasingly essential in ensuring product performance, comfort, and skin safety in both consumer and industrial applications due to their strong adhesion, flexibility, and skin-friendly properties.

- The escalating demand for hygiene adhesives is primarily fueled by the growing global population, rising awareness of personal hygiene, and increasing adoption of disposable hygiene products in both developed and emerging markets.

- North America dominated the Global Hygiene Adhesives Market with the largest revenue share of 35% in 2025, characterized by high disposable incomes, advanced manufacturing infrastructure, and a strong presence of key industry players, with the U.S. witnessing significant adoption of advanced adhesive solutions, particularly in baby care and adult hygiene products, driven by innovations in eco-friendly and skin-sensitive formulations.

- Asia-Pacific is expected to be the fastest-growing region in the Global Hygiene Adhesives Market during the forecast period due to rising urbanization, increasing disposable incomes, and expanding awareness of hygiene and wellness products.

- The non-woven segment dominated the market with the largest revenue share of 56.4% in 2025, driven by its extensive use in disposable hygiene products such as diapers, adult incontinence, and feminine care items.

Report Scope and Global Hygiene Adhesives Market Segmentation

|

Attributes |

Hygiene Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Hygiene Adhesives Market Trends

Innovation Through Advanced Formulations and Biodegradable Solutions

- A significant and accelerating trend in the global Hygiene Adhesives Market is the development and adoption of advanced adhesive formulations, including biodegradable, skin-friendly, and eco-conscious solutions. These innovations are enhancing product performance, safety, and sustainability in disposable hygiene products such as diapers, feminine care, and adult incontinence items.

- For instance, Henkel’s Loctite hygiene adhesives are formulated for superior skin compatibility while providing strong adhesion in high-moisture conditions. Similarly, Bostik’s range of hot melt adhesives ensures both comfort and reliability in baby diapers and adult incontinence products.

- Advanced adhesive technologies enable features such as improved elasticity, hypoallergenic properties, and better moisture management, ensuring that products maintain their integrity while remaining safe for sensitive skin. For example, some Arkema and H.B. Fuller adhesives utilize specialized polymers to enhance adhesion while reducing chemical exposure, aligning with consumer preferences for safer, sustainable products.

- The integration of these advanced adhesives into hygiene products facilitates higher-quality performance across multiple product layers, including topsheets, back sheets, and absorbent cores. Through optimized formulations, manufacturers can achieve both functional efficiency and environmental compliance.

- This trend toward innovative, skin-friendly, and eco-conscious adhesive solutions is fundamentally reshaping consumer expectations in the hygiene products sector. Consequently, companies such as 3M, Dow, and Evonik are investing in R&D to develop next-generation adhesives that combine performance, safety, and sustainability.

- The demand for advanced hygiene adhesives is growing rapidly across both developed and emerging markets, as consumers increasingly prioritize comfort, safety, and environmentally responsible products.

Global Hygiene Adhesives Market Dynamics

Driver

Growing Demand Driven by Rising Hygiene Awareness and Disposable Product Adoption

- The increasing focus on personal hygiene, coupled with the expanding adoption of disposable hygiene products, is a significant driver for the heightened demand for hygiene adhesives.

- For instance, in 2025, Henkel AG expanded its portfolio of skin-friendly adhesives for diapers and adult incontinence products, aiming to meet growing consumer expectations for comfort and reliability. Such initiatives by key companies are expected to drive market growth in the forecast period.

- As consumers become more aware of hygiene-related health risks, products incorporating advanced adhesives offer superior performance, including strong bonding in high-moisture conditions, elasticity for better fit, and reduced skin irritation, providing a clear advantage over older adhesive solutions.

- Furthermore, the increasing production of disposable hygiene products in both developed and emerging markets is creating higher demand for adhesives that can ensure product efficiency and durability.

- The convenience of reliable, easy-to-use adhesives that support multi-layer product construction, combined with the demand for skin-safe and eco-friendly formulations, is propelling adoption across baby care, feminine care, and adult incontinence sectors.

Restraint/Challenge

Concerns Regarding Cost and Regulatory Compliance

- High production costs and stringent regulatory requirements for skin safety and environmental compliance pose significant challenges to the broader adoption of advanced hygiene adhesives. Adhesives must meet rigorous standards to ensure they are safe for sensitive skin and environmentally friendly.

- For instance, some consumers and manufacturers are cautious about adhesives containing chemical additives, leading companies to invest in hypoallergenic and biodegradable solutions, which can be more expensive.

- Balancing cost with performance and regulatory compliance is crucial for market growth. Companies such as Bostik, 3M, and H.B. Fuller focus on developing formulations that meet safety standards while remaining commercially viable.

- While innovations are reducing costs over time, the perceived premium for high-performance, eco-friendly adhesives can limit adoption, especially in price-sensitive regions.

- Overcoming these challenges through continued R&D in cost-effective, safe, and sustainable adhesive solutions will be vital for sustained market growth.

Global Hygiene Adhesives Market Scope

The hygiene adhesives market is segmented on the basis of product type, resin type and application.

- By Product Type

On the basis of product type, the Global Hygiene Adhesives Market is segmented into woven and non-woven adhesives. The non-woven segment dominated the market with the largest revenue share of 56.4% in 2025, driven by its extensive use in disposable hygiene products such as diapers, adult incontinence, and feminine care items. Non-woven adhesives offer superior flexibility, conformability, and skin-friendly bonding, making them essential for multi-layered hygiene products that require reliable performance and comfort.

The woven segment is anticipated to witness the fastest CAGR of 18.7% from 2026 to 2033, fueled by rising adoption in specialty hygiene products and applications requiring enhanced mechanical strength. Woven adhesives provide strong, durable bonding for thicker and more robust product layers, and their development in eco-friendly and biodegradable formulations is increasing demand, particularly in regions emphasizing sustainable hygiene solutions.

- By Resin Type

On the basis of resin type, the Global Hygiene Adhesives Market is segmented into APAO, EVA, PSA, SBS, SEBS, SIS, and other resin types. The APAO segment held the largest market share of 39.5% in 2025, owing to its high-performance characteristics such as excellent bonding, heat resistance, and suitability for hot-melt adhesive formulations used in diapers and adult incontinence products.

EVA is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, driven by its versatility, cost-effectiveness, and compatibility with skin-safe, eco-conscious adhesive solutions. EVA adhesives are increasingly adopted in disposable hygiene applications due to their ability to provide strong adhesion while maintaining comfort, conformability, and process efficiency in large-scale manufacturing.

- By Application

On the basis of application, the Global Hygiene Adhesives Market is segmented into baby and infant care, feminine hygiene, adult incontinence, specific or specialty care, medical products, and other applications. The baby and infant care segment dominated the market with a revenue share of 41.8% in 2025, driven by the high global demand for disposable diapers and growing awareness of infant skin safety.

The adult incontinence segment is anticipated to witness the fastest CAGR of 20.5% from 2026 to 2033, propelled by aging populations, rising health awareness, and the increasing prevalence of chronic conditions requiring adult hygiene products. Adhesives in these segments are increasingly formulated for skin-friendliness, eco-consciousness, and high moisture resistance, meeting evolving consumer expectations while ensuring product integrity and comfort.

Global Hygiene Adhesives Market Regional Analysis

- North America dominated the Global Hygiene Adhesives Market with the largest revenue share of 35% in 2025, driven by increasing demand for disposable hygiene products, rising awareness of personal and family hygiene, and the presence of major adhesive manufacturers in the region.

- Consumers in the region prioritize product comfort, skin safety, and high-performance bonding in baby diapers, adult incontinence products, and feminine care items, fueling adoption of advanced hygiene adhesives.

- This widespread demand is further supported by high disposable incomes, well-established manufacturing infrastructure, and strong R&D capabilities among key industry players, enabling innovation in eco-friendly, skin-friendly, and high-strength adhesive solutions. These factors collectively establish hygiene adhesives as a critical component in the production of high-quality disposable hygiene products across both consumer and industrial sectors.

U.S. Hygiene Adhesives Market Insight

The U.S. hygiene adhesives market captured the largest revenue share of 81% in 2025 within North America, fueled by the growing demand for disposable hygiene products such as diapers, adult incontinence items, and feminine care products. Consumers and manufacturers are prioritizing high-performance, skin-friendly, and eco-conscious adhesives to enhance comfort, safety, and product quality. The rising preference for premium hygiene products, combined with robust demand for innovations in hot-melt and PSA adhesives, further propels the market. Additionally, advanced manufacturing infrastructure and strong R&D capabilities among key players are contributing significantly to market expansion.

Europe Hygiene Adhesives Market Insight

The Europe hygiene adhesives market is projected to expand at a substantial CAGR during the forecast period, driven by stringent regulatory standards for skin safety and environmental compliance. Increasing awareness of personal hygiene and rising urbanization are fostering the adoption of disposable hygiene products. European consumers are also drawn to products featuring high comfort, reliability, and eco-friendly adhesives. The market is witnessing growth across residential, commercial, and healthcare applications, with adhesives being incorporated into both new and upgraded hygiene products.

U.K. Hygiene Adhesives Market Insight

The U.K. hygiene adhesives market is expected to grow at a noteworthy CAGR, driven by rising consumer awareness regarding hygiene and the growing demand for premium baby, adult, and feminine care products. Concerns about skin sensitivity and product performance are encouraging manufacturers to adopt advanced, hypoallergenic adhesive solutions. The country’s well-developed retail and e-commerce infrastructure facilitates widespread availability of high-quality hygiene products, further stimulating market growth.

Germany Hygiene Adhesives Market Insight

The Germany hygiene adhesives market is expected to expand at a considerable CAGR, fueled by increasing awareness of personal hygiene, technological advancements in adhesive formulations, and strong regulatory standards for safety and sustainability. German consumers favor high-performance, eco-conscious adhesives that offer comfort and reliability. Growth is observed across baby care, adult incontinence, and feminine hygiene products, with a strong emphasis on sustainable and biodegradable adhesive solutions aligning with local preferences.

Asia-Pacific Hygiene Adhesives Market Insight

The Asia-Pacific hygiene adhesives market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by increasing disposable incomes, rapid urbanization, and expanding awareness of hygiene in countries such as China, Japan, and India. Rising demand for disposable baby diapers, adult incontinence products, and feminine hygiene items, supported by government initiatives promoting health and sanitation, is driving adoption. Additionally, APAC’s manufacturing capacity for adhesive formulations is improving product accessibility and affordability, expanding market reach.

Japan Hygiene Adhesives Market Insight

The Japan hygiene adhesives market is gaining momentum due to rising demand for high-quality, skin-friendly, and eco-conscious hygiene products. The country’s aging population and urbanization are increasing the need for adult incontinence products and medical hygiene applications. Integration of advanced adhesive technologies in baby care and specialty hygiene products is fueling growth, with consumers valuing comfort, safety, and product reliability.

China Hygiene Adhesives Market Insight

The China hygiene adhesives market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, growing disposable incomes, and increasing awareness of personal hygiene. Rising demand for baby diapers, adult incontinence products, and feminine care items is supporting market growth. The availability of cost-effective, high-performance adhesive solutions from domestic manufacturers, coupled with government initiatives promoting sanitation and health, is further propelling market expansion across both residential and commercial applications.

Global Hygiene Adhesives Market Share

The Hygiene Adhesives industry is primarily led by well-established companies, including:

• Henkel AG & Co. KGaA (Germany)

• H.B. Fuller (U.S.)

• 3M Company (U.S.)

• Bostik (France)

• Arkema Group (France)

• Ashland Global Holdings Inc. (U.S.)

• Dow Inc. (U.S.)

• Evonik Industries AG (Germany)

• Wacker Chemie AG (Germany)

• Jowat SE (Germany)

• Scapa Group Plc (U.K.)

• National Adhesives (U.S.)

• Huntsman Corporation (U.S.)

• Pidilite Industries Ltd. (India)

• Henkel Loctite (Germany)

• Changzhou Jiafeng Adhesives Co., Ltd. (China)

• Huitian New Materials (China)

• Guangzhou Yizheng Adhesives Co., Ltd. (China)

• Avery Dennison Corporation (U.S.)

• Clariant AG (Switzerland)

What are the Recent Developments in Global Hygiene Adhesives Market?

- In April 2024, Henkel AG & Co. KGaA, a global leader in adhesive solutions, launched a strategic initiative in South Africa aimed at enhancing the performance and safety of disposable hygiene products through its advanced hygiene adhesive technologies. This initiative underscores the company’s commitment to delivering innovative, skin-friendly, and eco-conscious adhesive solutions tailored to the unique needs of the local hygiene market. By leveraging global expertise and cutting-edge formulations, Henkel is addressing regional challenges while strengthening its position in the rapidly growing global Hygiene Adhesives Market.

- In March 2024, H.B. Fuller, a leading U.S.-based adhesive manufacturer, introduced a new line of hot-melt adhesives specifically engineered for baby diapers and adult incontinence products. The advanced formulations provide superior bonding, flexibility, and skin compatibility, highlighting H.B. Fuller’s commitment to developing high-performance adhesive solutions that enhance product comfort, safety, and reliability in sensitive applications.

- In March 2024, 3M Company successfully deployed a large-scale hygiene adhesive solution for a major Indian diaper manufacturer, aimed at improving product performance and reducing skin irritation for infants. This project demonstrates 3M’s focus on leveraging advanced adhesive technologies to improve quality, comfort, and sustainability in hygiene products, reinforcing its dedication to innovation in the sector.

- In February 2024, Bostik, a leading global adhesive provider, announced a strategic partnership with a European medical hygiene supplier to develop eco-friendly, biodegradable adhesive formulations for adult incontinence and specialty care products. The collaboration is designed to meet growing consumer demand for sustainable hygiene solutions, emphasizing Bostik’s commitment to driving innovation while supporting environmental responsibility.

- In January 2024, Arkema Group unveiled a new line of Ethylene-Vinyl Acetate (EVA) and APAO adhesives at the International Adhesives Expo 2024, designed for high-performance disposable hygiene products. These advanced adhesives enable improved comfort, moisture resistance, and product durability, showcasing Arkema’s focus on integrating cutting-edge technology into hygiene product manufacturing to enhance consumer satisfaction and safety.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hygiene Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hygiene Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hygiene Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.