Global Hysteroscopes Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.65 Billion

2024

2032

USD

1.70 Billion

USD

2.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.65 Billion | |

|

|

|

|

Hysteroscopes Market Size

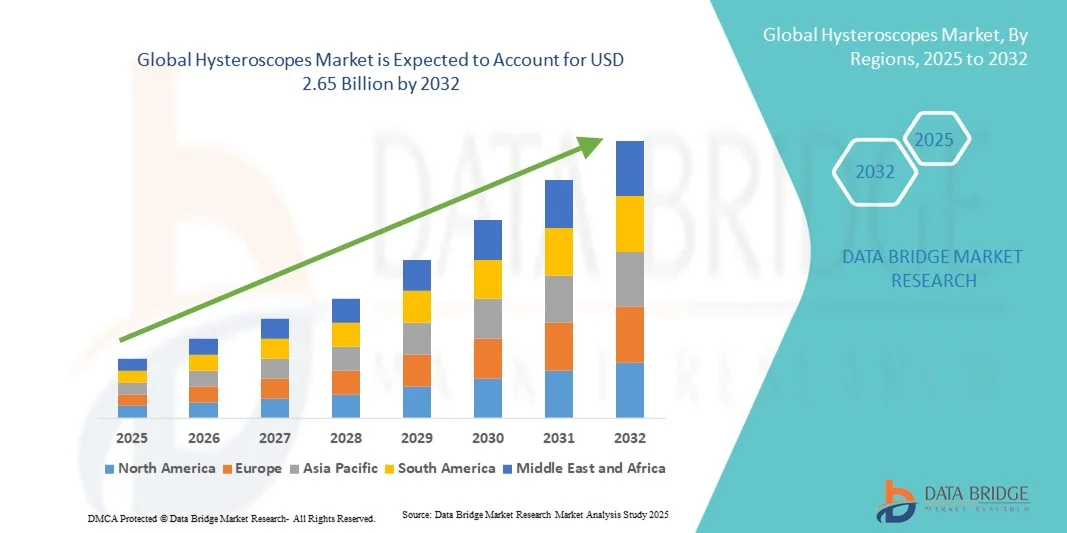

- The global hysteroscopes market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 2.65 billion by 2032, at a CAGR of 5.75% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in minimally invasive gynecological procedures, leading to increased utilization of hysteroscopes in both diagnostic and surgical settings

- Furthermore, rising demand for precise, efficient, and patient-friendly tools in gynecology is driving the adoption of advanced hysteroscopes, thereby significantly boosting the industry's growth

Hysteroscopes Market Analysis

- The Hysteroscopes market, encompassing diagnostic and surgical instruments used for minimally invasive gynecological procedures, is witnessing significant expansion across hospitals, clinics, and surgical centers

- Rising demand for precise, efficient, and patient-friendly instruments is further driving the adoption of advanced hysteroscopes, significantly contributing to industry growth

- North America dominated the hysteroscopes market with the largest revenue share of 35.8% in 2024, characterized by advanced healthcare infrastructure, high investment in women’s health, and a strong presence of key industry players, with the U.S. experiencing substantial growth in hysteroscope installations across hospitals, clinics, and ambulatory surgical centers, driven by innovations from both established medical device companies and specialized startups

- Asia-Pacific is expected to be the fastest-growing region in the hysteroscopes market during the forecast period due to increasing healthcare investments, rising awareness of women’s health issues, and growing adoption of minimally invasive diagnostic and surgical procedures

- The reusable instruments segment held the largest revenue share of 61.2% in 2024, owing to their cost-effectiveness over multiple uses, robust construction, and widespread preference in high-volume healthcare institutions

Report Scope and Hysteroscopes Market Segmentation

|

Attributes |

Hysteroscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Hysteroscopes Market Trends

Advancements in Minimally Invasive Procedures and Imaging Technologies

- A significant and accelerating trend in the global hysteroscopes market is the adoption of advanced minimally invasive hysteroscopy procedures combined with high-definition imaging technologies. This trend is enhancing procedural precision, patient safety, and clinical outcomes

- For instance, the latest hysteroscopes offer improved optics and integrated imaging systems that allow gynecologists to detect abnormalities with greater clarity. Similarly, flexible hysteroscopes provide enhanced maneuverability in complex uterine anatomies, offering more effective treatment options

- Innovations in hysteroscope design, such as the incorporation of ergonomic handles, disposable sheaths, and integrated fluid management systems, are improving procedural efficiency while reducing patient discomfort. These advancements facilitate faster recovery and reduced procedure times

- High-resolution imaging and enhanced optical capabilities allow clinicians to perform both diagnostic and operative procedures with higher accuracy. The integration of camera systems and illumination technologies enables detailed visualization of the uterine cavity and improved identification of lesions or polyps

- This trend towards more precise, patient-friendly, and technologically advanced hysteroscopes is reshaping expectations in gynecological care. Consequently, companies such as Karl Storz, Medtronic, and Stryker are developing next-generation hysteroscopes with features such as enhanced visualization, integrated fluid management, and ergonomic designs

- The demand for advanced hysteroscopes is growing rapidly across hospitals, outpatient clinics, and specialized gynecology centers, as healthcare providers increasingly prioritize safety, procedural efficiency, and improved patient outcomes

Hysteroscopes Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Gynecological Disorders and Minimally Invasive Procedures

- The increasing prevalence of gynecological disorders such as fibroids, endometrial polyps, and abnormal uterine bleeding, coupled with the growing preference for minimally invasive procedures, is a significant driver for the heightened demand for hysteroscopes

- For instance, in April 2024, announced the integration of advanced sensor-based monitoring systems for medical equipment, which reflects the growing emphasis on precision and safety in procedural devices. Such strategies by key companies are expected to drive the hysteroscopes market growth in the forecast period

- As healthcare providers seek to reduce procedure-related risks and improve patient outcomes, advanced hysteroscopes offer features such as enhanced imaging, improved ergonomics, and better fluid management, providing a compelling upgrade over traditional equipment

- Furthermore, the growing adoption of outpatient and ambulatory care facilities is increasing the demand for portable, user-friendly, and efficient hysteroscopes

- The ability to perform both diagnostic and operative procedures with a single device, coupled with reduced procedure time and faster recovery, is a key factor propelling the adoption of hysteroscopes in hospitals and gynecology centers. The trend towards minimally invasive treatments and increasing awareness of advanced options further contributes to market growth

Restraint/Challenge

High Initial Costs and Requirement for Specialized Training

- The relatively high cost of advanced hysteroscopes, including high-definition imaging and disposable components, poses a significant challenge to broader market penetration, particularly in developing regions or budget-conscious healthcare facilities

- Technical complexity and the requirement for specialized training for clinicians limit the widespread adoption of advanced hysteroscopes. Proper handling, maintenance, and procedural expertise are necessary to achieve optimal outcomes

- For instance, in March 2023, Medtronic introduced its latest hysteroscopy system with advanced imaging features, but adoption in smaller clinics remained limited due to high device cost and the need for specialized operator training

- Addressing these challenges through training programs, simulation-based learning, and modular systems that simplify operation is crucial for expanding market adoption. Companies such as Karl Storz, Medtronic, and Stryker are investing in clinician education and customer support to overcome these barriers

- While prices are gradually decreasing, the perceived premium for high-end devices may still hinder adoption, especially in small clinics or low-resource settings

- Overcoming these challenges through cost-effective device options, training support, and workflow optimization will be vital for sustained market growth in the global hysteroscopes sector

Hysteroscopes Market Scope

The market is segmented on the basis of product type, application, end user, and usability.

- By Product Type

On the basis of product type, the Hysteroscopes market is segmented into rigid non-video hysteroscopes, flexible non-video hysteroscopes, and flexible video hysteroscopes. The flexible video hysteroscopes segment dominated the largest market revenue share of 45.3% in 2024, primarily due to its superior visualization, image clarity, and precise diagnostic capabilities. These instruments allow for real-time video-assisted procedures, reducing surgical errors and improving patient safety. Their adoption is increasing in hospitals and specialized gynecology centers where high-definition visualization enhances procedural efficiency. The rising prevalence of uterine disorders, growing patient preference for minimally invasive solutions, and technological advancements in digital optics further strengthen their market dominance. In addition, ongoing R&D activities focusing on lightweight, high-resolution scopes are enhancing usability and patient comfort, making this segment the top revenue contributor.

The flexible non-video hysteroscopes segment is projected to witness the fastest CAGR of 12.8% from 2025 to 2032, driven by growing demand in smaller clinics and ambulatory centers due to their cost-effectiveness and ease of use. These instruments are widely preferred in outpatient and diagnostic procedures requiring flexible navigation and less setup time. Their affordability and lower maintenance requirements make them a practical alternative to high-cost video systems. In addition, growing adoption in emerging markets, coupled with training initiatives for gynecologists on non-video flexible scopes, is further propelling their uptake. The increasing trend toward early and accurate gynecological diagnosis, especially in middle-income economies, continues to support this segment’s rapid expansion.

- By Application

On the basis of application, the Hysteroscopes market is segmented into hysteroscopic polypectomy, hysteroscopic myomectomy, hysteroscopic endometrial ablation, and others. The hysteroscopic myomectomy segment accounted for the largest revenue share of 38.7% in 2024, owing to the rising incidence of uterine fibroids and the widespread shift toward minimally invasive surgeries. These procedures significantly reduce recovery times and hospital stays compared to traditional surgical approaches. The segment benefits from technological innovations that improve visualization and surgical precision, enhancing patient safety and outcomes. Hospitals increasingly adopt hysteroscopic myomectomy as a preferred treatment due to growing awareness of its clinical effectiveness. Moreover, advancements in energy-based devices and operative hysteroscopes are making fibroid removal more efficient, supporting the segment’s sustained dominance globally.

The hysteroscopic endometrial ablation segment is anticipated to register the fastest CAGR of 14.2% from 2025 to 2032, attributed to the rising prevalence of abnormal uterine bleeding and the growing adoption of minimally invasive techniques. Endometrial ablation provides a non-surgical alternative for women seeking symptom relief without hysterectomy. Its growing popularity in outpatient settings and ambulatory surgical centers is driven by short procedure times and high patient satisfaction rates. Continuous improvements in ablation devices, including disposable catheters and thermal balloon systems, enhance procedural safety and effectiveness. In addition, increasing awareness of reproductive health and government programs supporting women’s healthcare are fueling the rapid adoption of this application segment worldwide.

- By End User

On the basis of end user, the Hysteroscopes market is segmented into hospitals, ambulatory surgical centers, and clinics. The hospitals segment dominated the market with the largest revenue share of 52.1% in 2024, supported by advanced healthcare infrastructure, availability of skilled professionals, and higher patient inflow for diagnostic and surgical hysteroscopic procedures. Hospitals serve as key hubs for complex operative hysteroscopy cases due to the presence of high-end equipment and multidisciplinary teams. Rising healthcare expenditure, combined with the increasing integration of digital imaging and video guidance systems, enhances the procedural capabilities of hospitals. Furthermore, collaborations between hospitals and medical device manufacturers for training and product development are further reinforcing this segment’s leadership position in the global market.

The ambulatory surgical centers segment is projected to witness the fastest CAGR of 11.5% from 2025 to 2032, driven by a growing trend toward outpatient care and cost-efficient healthcare delivery. These centers offer reduced waiting times, lower costs, and faster recovery, making them an ideal choice for routine hysteroscopic procedures. The segment is gaining traction as healthcare systems prioritize decentralization and patient convenience. Technological miniaturization of hysteroscopes and improved single-use device options are also supporting adoption in ambulatory environments. In addition, the expansion of private healthcare infrastructure in both developed and developing economies is expected to accelerate the segment’s growth in the forecast period.

- By Usability

On the basis of usability, the Hysteroscopes market is segmented into reusable instruments and disposable instruments. The reusable instruments segment held the largest revenue share of 61.2% in 2024, owing to their cost-effectiveness over multiple uses, robust construction, and widespread preference in high-volume healthcare institutions. Reusable hysteroscopes are ideal for hospitals performing frequent procedures due to their long service life and compatibility with sterilization systems. Their adoption is supported by ongoing advancements in reprocessing technologies ensuring infection control and device longevity. Moreover, reusable models are often preferred in regions where hospital budgets focus on long-term investment efficiency. These factors collectively drive the enduring dominance of reusable hysteroscopes in global revenue generation.

The disposable instruments segment is anticipated to exhibit the fastest CAGR of 13.7% from 2025 to 2032, driven by increasing awareness about infection prevention, cross-contamination control, and convenience in single-use operations. Disposable hysteroscopes eliminate the need for reprocessing, reducing turnaround time and operational costs in smaller facilities. Their lightweight design and plug-and-play integration with visualization systems make them increasingly popular in outpatient and ambulatory surgical centers. Growing manufacturer focus on eco-friendly materials and expanding product portfolios targeting low-cost, high-performance disposable devices further strengthen this trend. Rising demand for patient safety and procedural efficiency continues to fuel the adoption of this segment globally.

Hysteroscopes Market Regional Analysis

- North America dominated the hysteroscopes market with the largest revenue share of 35.8% in 2024

- Characterized by advanced healthcare infrastructure, high investment in women’s health, and a strong presence of key industry players

- The region’s growth is driven by increasing adoption of minimally invasive gynecological procedures and technological innovations in diagnostic and operative hysteroscopy systems

U.S. Hysteroscopes Market Insight

The U.S. hysteroscopes market captured the largest revenue share of the region in 2024, supported by the growing prevalence of uterine disorders, rising awareness regarding women’s reproductive health, and high adoption of advanced endoscopic visualization technologies. The country’s well-established healthcare facilities and favorable reimbursement structure have accelerated the installation of hysteroscopes across hospitals, clinics, and ambulatory surgical centers.

Europe Hysteroscopes Market Insight

The Europe hysteroscopes market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the increasing incidence of gynecological conditions, rising preference for outpatient hysteroscopy, and the presence of leading medical device manufacturers. The region benefits from technological innovations in optics, disposable hysteroscopes, and improved imaging systems that enhance diagnostic precision and patient safety.

U.K. Hysteroscopes Market Insight

The U.K. hysteroscopes market is anticipated to grow at a noteworthy CAGR during the forecast period due to the rising number of gynecological procedures, strong government focus on women’s health, and the integration of advanced imaging systems across healthcare facilities. Moreover, collaborations between public and private hospitals are contributing to the modernization of diagnostic services.

Germany Hysteroscopes Market Insight

The Germany hysteroscopes market is expected to expand at a considerable CAGR during the forecast period, fueled by advancements in optical systems, increased adoption of minimally invasive technologies, and high healthcare spending. Germany’s emphasis on research, development, and sustainability in medical devices continues to attract major global players and drive domestic innovation.

Asia-Pacific Hysteroscopes Market Insight

The Asia-Pacific hysteroscopes market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing healthcare investments, rising awareness of women’s health issues, and growing adoption of minimally invasive diagnostic and surgical procedures. Expanding healthcare infrastructure and favorable government initiatives promoting modern medical technologies further boost regional growth.

Japan Hysteroscopes Market Insight

The Japan hysteroscopes market is gaining momentum due to the country’s advanced medical technology landscape, growing emphasis on early diagnosis, and strong preference for precision-based, minimally invasive procedures. Japan’s aging female population and well-established healthcare facilities continue to support consistent growth in demand for hysteroscopic systems.

China Hysteroscopes Market Insight

The China hysteroscopes market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the expansion of hospital infrastructure, government initiatives supporting women’s health programs, and the presence of key domestic manufacturers offering cost-effective hysteroscopic solutions. Increasing focus on digital healthcare and adoption of modern diagnostic devices in both urban and rural regions are further contributing to market expansion.

Hysteroscopes Market Share

The Hysteroscopes industry is primarily led by well-established companies, including:

• Olympus Corporation (Japan)

• Karl Storz SE & Co. KG (Germany)

• Medtronic (Ireland )

• Richard Wolf GmbH (Germany)

• Stryker (U.S.)

• B. Braun SE (Germany)

• Smith & Nephew plc (U.K.)

• CooperSurgical, Inc. (U.S.)

• Ambu A/S (Denmark)

• Boston Scientific Corporation (U.S.)

Latest Developments in Global Hysteroscopes Market

- In May 2024, Minerva Surgical announced the launch of the HERizon Disposable Hysteroscope, a single-use device designed to enhance convenience and reduce infection risks during hysteroscopic procedures. The product aims to simplify workflow and improve diagnostic efficiency in outpatient and hospital settings

- In August 2024, Minerva Surgical introduced the Symphion Fluid Deficit Readout, an advanced accessory that provides real-time fluid deficit monitoring during operative hysteroscopy. This innovation enhances surgical safety and accuracy, supporting better outcomes in uterine treatment procedures

- In May 2023, Olympus received FDA clearance for its EVIS X1 endoscopy system and compatible scopes (GIF-1100 and CF-HQ1100DL/I). The system integrates enhanced visualization and AI-assisted features, strengthening Olympus’s position in the global minimally invasive surgical device market

- In October 2023, Olympus officially launched the EVIS X1 endoscopy platform in the U.S. market, showcasing it at the American College of Gastroenterology meeting. The system’s advanced imaging and user-friendly interface are expected to drive adoption across gynecological and endoscopic applications worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.