Global Ice Cream Parlor Market

Market Size in USD Billion

CAGR :

%

USD

14.12 Billion

USD

24.45 Billion

2024

2032

USD

14.12 Billion

USD

24.45 Billion

2024

2032

| 2025 –2032 | |

| USD 14.12 Billion | |

| USD 24.45 Billion | |

|

|

|

|

Ice Cream Parlor Market Size

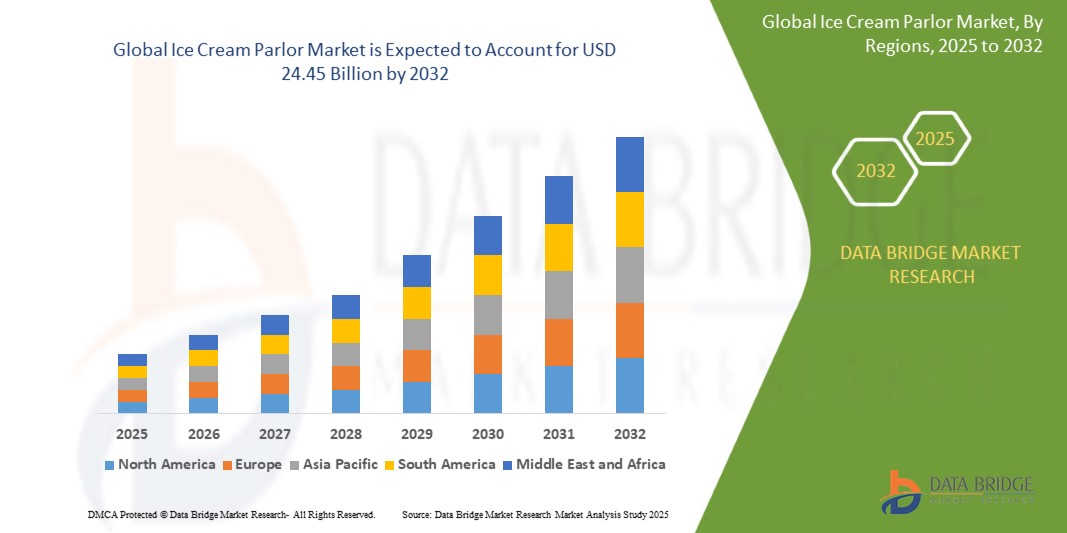

- The global ice cream parlor market size was valued at USD 14.12 billion in 2024 and is expected to reach USD 24.45 billion by 2032, at a CAGR of 7.1% during the forecast period

- The market growth is largely fueled by increasing consumer preference for out-of-home dessert consumption, rising urbanization, and the global trend toward experiential dining, which is boosting footfall in ice cream parlors across key regions

- Furthermore, growing demand for premium, artisanal, and health-conscious ice cream offerings, along with innovation in flavor profiles and store formats, is attracting a broader demographic and driving the expansion of both independent and franchise-based parlors

Ice Cream Parlor Market Analysis

- Ice cream parlors are retail establishments specializing in the sale of frozen desserts, often offering a range of traditional, artisanal, and customizable ice cream products. These outlets serve as experiential destinations where consumers seek indulgence, variety, and social interaction

- The growing appeal of boutique and themed parlors, combined with rising disposable incomes, expanding café culture, and the introduction of health-oriented and plant-based options, is fueling market growth globally, especially in urban centers and tourist hubs

- Asia-Pacific dominated the ice cream parlor market with a share of 40.5% in 2024, due to rising disposable incomes, urbanization, and the growing popularity of out-of-home dessert consumption across emerging economies

- Europe is expected to be the fastest growing region in the ice cream parlor market during the forecast period due to a mature café culture, rising consumer interest in premium and artisanal desserts, and increasing demand for healthier, clean-label products

- Traditional ice cream segment dominated the market with a market share of 80.5% in 2024, due to its widespread consumer acceptance, affordability, and consistent availability across urban and rural locations. Traditional ice cream continues to attract mass-market consumers by offering a variety of classic flavors and formats, including cones, cups, and sundaes. Its production scalability, lower per-unit pricing, and strong brand recognition among established players contribute to its broad appeal. In addition, its compatibility with fast-moving retail and impulse consumption trends reinforces its dominance in both standalone parlors and quick-service settings

Report Scope and Ice Cream Parlor Market Segmentation

|

Attributes |

Ice Cream Parlor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ice Cream Parlor Market Trends

Rising Popularity of Artisanal and Clean-Label Ice Cream Offerings

- Artisanal ice cream parlors are gaining popularity as consumers increasingly seek premium, small-batch frozen treats crafted with natural, high-quality ingredients and free from artificial additives

- For instance, brands such as local boutique creameries in North America and Europe emphasize clean-label, organic components and innovative handcrafted flavors including botanical infusions, exotic spices, and seasonal produce, appealing especially to Millennials and Gen Z

- The trend toward health-conscious indulgence is complemented by offerings of dairy-free, plant-based, and low-sugar ice creams that align with evolving dietary preferences and wellness lifestyles

- Sustainability is prioritized by many artisanal parlors through use of recyclable packaging, locally sourced dairy, and low-impact production methods, which resonates with environmentally aware urban consumers

- Flavor innovation combining cultural and regional influences is expanding with unique taste profiles that range from classic comfort to adventurous blends, further driving consumer interest and differentiation in competitive markets

- Online ordering, direct-to-consumer sales, and pop-up shops are expanding reach beyond traditional storefronts, enabling artisanal ice cream brands to tap new customer segments and urban markets globally

Ice Cream Parlor Market Dynamics

Driver

Growing Consumer Demand

- Increasing consumer preference for high-quality, unique, and natural dessert experiences is a major growth driver for ice cream parlors, pushing demand for premium products beyond mass-market offerings

- For instance, rising disposable incomes and lifestyle trends among urban populations in North America, Europe, and Asia-Pacific fuel in-store visits and take-home sales of artisanal ice creams characterized by authenticity and craftsmanship

- The rise of social media and food influencer culture supports consumer discovery of novel ice cream flavors and brands, enhancing market penetration and brand loyalty

- Expansion of foodservice channels including boutique cafés, experiential dining outlets, and gourmet grocery stores promotes visibility and accessibility of artisanal ice cream

- The increasing focus on indulgence combined with clean eating has created market segments that blend indulgent taste with functional benefits such as probiotic inclusion, protein fortification, and organic certification

Restraint/Challenge

Rising Awareness of Health Issues

- Growing public concern over sugar intake, allergies, and dietary restrictions challenges traditional ice cream consumption patterns and compels parlors to innovate healthier, lower-calorie, or allergen-free options

- For instance, consumers with conditions such as lactose intolerance or diabetes increasingly seek alternatives to conventional dairy-based ice creams, pressuring producers to diversify with plant-based, sugar-free, or keto-friendly variants

- Rising scrutiny by health authorities and consumer watchdogs intensifies demand for transparency in ingredient sourcing, nutritional labelling, and compliance with food safety standards

- Balancing indulgence and health remains complex, as reformulating artisanal recipes to reduce sugar or fat without compromising creaminess and flavor can present challenges in product development and consumer acceptance

- Health-related marketing and educational initiatives by competing snack categories may divert consumer spending from traditional ice cream parlors, influencing market share dynamics

Ice Cream Parlor Market Scope

The market is segmented on the basis of product and type.

• By Product

On the basis of product, the ice cream parlor market is segmented into traditional ice cream and artisanal ice cream. The traditional ice cream segment dominated the largest market revenue share of 80.5% in 2024 due to its widespread consumer acceptance, affordability, and consistent availability across urban and rural locations. Traditional ice cream continues to attract mass-market consumers by offering a variety of classic flavors and formats, including cones, cups, and sundaes. Its production scalability, lower per-unit pricing, and strong brand recognition among established players contribute to its broad appeal. In addition, its compatibility with fast-moving retail and impulse consumption trends reinforces its dominance in both standalone parlors and quick-service settings.

The artisanal ice cream segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for premium, small-batch, and ingredient-conscious offerings. Consumers are increasingly gravitating towards handcrafted ice cream that emphasizes unique flavors, organic ingredients, and reduced artificial additives. Artisanal parlors often offer a personalized customer experience, seasonal menus, and locally sourced components, appealing to health-conscious and experience-driven customers. The growing presence of artisanal brands in urban centers, supported by social media marketing and niche positioning, is fueling their rapid expansion across affluent and younger demographics.

• By Type

On the basis of type, the ice cream parlor market is segmented into independent and branded/franchise. The independent segment dominated the largest market revenue share in 2024, supported by its flexibility in menu offerings, localized customer engagement, and community-driven branding. These parlors often cater to regional tastes and leverage their freedom from corporate constraints to introduce novel and culturally relevant flavors. The personalized service and unique ambiance provided by independent outlets enhance customer loyalty and foot traffic. Moreover, lower entry barriers and entrepreneurial ventures in tier-2 and tier-3 cities are contributing to the continued strength of this segment.

The branded/franchise segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing consumer trust in standardized quality, hygiene, and recognizable brand experiences. Franchises benefit from strong marketing support, established supply chains, and streamlined operations that enable rapid scalability across locations. Their ability to invest in advanced retail formats, tech-enabled ordering systems, and loyalty programs also boosts consumer engagement and retention. The expansion of global and domestic brands into emerging markets, coupled with rising demand for premium, consistent ice cream experiences, is accelerating franchise growth across both metros and smaller towns.

Ice Cream Parlor Market Regional Analysis

- Asia-Pacific dominated the ice cream parlor market with the largest revenue share of 40.5% in 2024, driven by rising disposable incomes, urbanization, and the growing popularity of out-of-home dessert consumption across emerging economies

- Expansion of quick-service restaurants, increasing youth population, and greater exposure to global dessert trends are stimulating market growth across metro and Tier 2 cities

- The availability of a wide range of flavors, growing interest in premium and artisanal offerings, and the integration of ice cream parlors within multiplexes and shopping malls are enhancing consumer footfall

China Ice Cream Parlor Market Insight

China held the largest share in the Asia-Pacific ice cream parlor market in 2024, underpinned by its booming foodservice industry, rising urban middle class, and growing appetite for premium and international dessert concepts. Global and domestic parlor chains are expanding aggressively in metropolitan areas, leveraging digital platforms for promotions and delivery. Consumers show increasing interest in functional and health-oriented flavors, such as matcha, low-sugar, and probiotic-infused ice creams. High-tech innovations, such as AI ordering kiosks and robotic servers, are becoming common in flagship parlors, enhancing customer experience. With ongoing improvements in cold chain logistics and the growth of food delivery services, China is positioned as a leader in both traditional and premium ice cream formats.

India Ice Cream Parlor Market Insight

India is witnessing rapid growth within the Asia-Pacific region, driven by a rising middle class, greater health awareness, and increasing demand for affordable luxury in the form of desserts. The parlor format is thriving in urban and semi-urban settings, especially within entertainment and shopping zones frequented by youth and families. Franchising by domestic and international brands is expanding access to branded ice cream experiences in Tier 2 and Tier 3 cities. Culturally adapted flavors, such as kulfi, mango, or saffron, continue to perform well alongside Western-style offerings. With government support for the food processing industry and increasing cold storage penetration, the market is evolving quickly. India's young, consumption-driven demographic ensures sustained momentum in both volume and variety.

North America Ice Cream Parlor Market Insight

North America remains a prominent and mature market for ice cream parlors, characterized by high per capita consumption, a strong culture of out-of-home dessert eating, and a growing emphasis on wellness-oriented indulgence. Consumer expectations are evolving, with increased demand for clean-label, dairy-free, and functional ice creams that align with dietary trends such as keto, vegan, and high-protein. Both independent parlors and large chains are innovating with seasonal specials, locally inspired flavors, and technology-enabled service models, including self-serve kiosks and app-based ordering. The region also benefits from strong logistics, branding expertise, and franchising networks that support rapid expansion. As consumers increasingly prioritize both taste and nutritional transparency, North America is set to retain its strong market position.

U.S. Ice Cream Parlor Market Insight

The U.S. held the largest share in the North America ice cream parlor market in 2024, driven by a combination of high consumer spending, innovation in product offerings, and a deep-rooted dessert culture. Leading players are consistently refreshing menus with seasonal and limited-edition items to drive traffic and retain customer interest. There is a marked shift toward health-conscious options such as dairy-free, low-glycemic, and probiotic-infused ice creams. The widespread adoption of mobile ordering, delivery partnerships, and data-driven marketing is transforming customer engagement. The franchising model continues to thrive, with both legacy brands and new entrants targeting suburban and urban neighborhoods. With a robust retail and logistics ecosystem, the U.S. continues to shape trends in the global ice cream parlor landscape.

Europe Ice Cream Parlor Market Insight

Europe is projected to grow at the fastest CAGR from 2025 to 2032, supported by a mature café culture, rising consumer interest in premium and artisanal desserts, and increasing demand for healthier, clean-label products. The region is experiencing a strong revival in experiential dining, with ice cream parlors offering ambiance-rich, sit-in experiences combined with handcrafted offerings. A growing focus on sustainability is encouraging the use of organic, plant-based, and locally sourced ingredients. Seasonal menus, unique flavor experimentation, and a preference for vegan and low-sugar options are reshaping the traditional dessert landscape. Innovation in formats, such as ice cream bars, mobile trucks, and hybrid parlors serving coffee and snacks, is also enhancing consumer footfall. Europe’s deep-rooted appreciation for artisanal food and its strong tourism sector are further driving the segment’s upward trajectory.

Germany Ice Cream Parlor Market Insight

Germany’s ice cream parlor market is shaped by its rich tradition of artisanal gelato, a quality-conscious consumer base, and a strong hospitality infrastructure. Small-batch, handcrafted parlors are flourishing in urban and tourist-heavy areas, offering locally inspired flavors and clean-label formulations. The country’s emphasis on health and wellness is prompting increased demand for lactose-free, vegan, and reduced-sugar variants. Many parlors are emphasizing sustainability through biodegradable packaging and organic sourcing. Germany’s commitment to product quality, supported by an experienced workforce and efficient logistics, allows parlors to balance tradition with innovation, making it a key market in the region’s ongoing expansion.

U.K. Ice Cream Parlor Market Insight

The U.K. market is growing steadily, supported by a strong cultural shift toward healthier indulgence, premium dessert experiences, and ethical consumerism. Independent parlors and boutique brands are thriving in urban areas, offering unique experiences through seasonal menus, custom toppings, and plant-based options. Consumers are increasingly seeking high-quality, ethically sourced ingredients, prompting many parlors to adopt eco-friendly practices and clean-label formulations. Post-Brexit retail strategies are encouraging local sourcing and homegrown innovation. The rise of digital ordering, loyalty programs, and visually appealing store designs is helping parlors connect with younger audiences. The U.K. continues to be a promising hub for experiential and sustainable dessert retail formats.

Ice Cream Parlor Market Share

The ice cream parlor industry is primarily led by well-established companies, including:

- 3D Systems, Inc. (U.S.)

- Baskin-Robbins (U.S.)

- D.Q. Corp. (U.S.)

- Cold Stone Creamery (Kahala Franchising, LLC. (U.S.)

- Ben & Jerry's Homemade Inc. (U.S.)

- Häagen-Dazs (U.S.)

- Amorino (France)

- Ghirardelli Chocolate Company (U.S.)

- Marble Slab Creamery (U.S.)

- Cream Stone (India)

- Natural Ice Creams (India)

Latest Developments in Global Ice Cream Parlor Market

- In May 2023, Baskin-Robbins re-opened its ice cream parlor in Bay City, Michigan, following its closure in December 2022 due to a transition in ownership. Since reopening, the outlet has seen a sharp rise in customer traffic, reflecting strong community loyalty and demand for legacy ice cream experiences. This development highlights the enduring appeal of physical parlor locations, especially in suburban markets where consumer nostalgia and brand familiarity drive footfall. The store’s successful relaunch underscores Baskin-Robbins' ability to revitalize local presence and adapt to changing franchise dynamics, contributing to the brand’s broader market stability in North America

- In May 2023, Ben & Jerry’s teamed up with The Entrepreneurial Refugee Network (TERN) to launch Sunny Honey Home, a new flavor created to support refugee entrepreneurship in the U.K. This collaboration aligns with Ben & Jerry’s longstanding commitment to social justice and inclusive business practices. The launch enhances the brand's reputation among socially conscious consumers and also serves as a powerful tool for cause-based engagement in mature European markets. By intertwining product innovation with social impact, Ben & Jerry’s continues to differentiate itself in the premium ice cream segment while building emotional loyalty among ethically driven customer bases

- In April 2023, Milky Mist Dairy, a major Indian dairy manufacturer, expanded into the premium ice cream segment with a new range of products offering both classic and exotic flavors. These ice creams are crafted using high-quality ingredients and offered in diverse packaging formats tailored to urban and family consumption. The launch signals Milky Mist's strategic intent to capitalize on India’s rising demand for indulgent, yet trustworthy branded dessert options. With increasing consumer preference for hygienic, high-quality frozen products and a shift away from unorganized players, this move positions the company to capture a larger share of India’s growing urban middle-class market and strengthen its footprint in the organized foodservice segment

- In February 2023, Cold Stone Creamery, in collaboration with Reese, unveiled a line of co-branded ice creams, including Reese’s Take 5 Peanut Butter Ice Cream, Reese’s Peanut Butter Cup Ice Cream, and a marshmallow-flavored variant. This partnership merges Cold Stone’s expertise in indulgent, handcrafted desserts with the popularity of Reese’s iconic chocolate and peanut butter combinations. The collaboration enhances Cold Stone’s ability to deliver high-impact, flavor-centric promotions that appeal to Gen Z and millennial consumers seeking bold, recognizable flavor profiles. It also reinforces the brand’s experiential value proposition, which remains key to retaining foot traffic in a highly competitive U.S. ice cream parlor market

- In April 2022, Baskin-Robbins underwent a brand refresh by unveiling a redesigned logo and updated employee uniforms as part of its broader repositioning strategy. The new visual identity was crafted to appeal more directly to adult customers, shifting the brand image beyond its traditional focus on children and family audiences. This rebranding effort reflects Baskin-Robbins’ intention to modernize its appeal, align with evolving consumer aesthetics, and attract a broader demographic—including millennials and Gen Z adults seeking premium, nostalgia-driven dessert experiences. By refining its look and feel, the company aims to strengthen brand relevance, enhance in-store engagement, and drive footfall across diverse customer segments in the increasingly competitive ice cream parlor market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ice Cream Parlor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ice Cream Parlor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ice Cream Parlor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.