Global Ice Detection System Market

Market Size in USD Billion

CAGR :

%

USD

13.81 Billion

USD

20.63 Billion

2024

2032

USD

13.81 Billion

USD

20.63 Billion

2024

2032

| 2025 –2032 | |

| USD 13.81 Billion | |

| USD 20.63 Billion | |

|

|

|

|

Ice Detection System Market Size

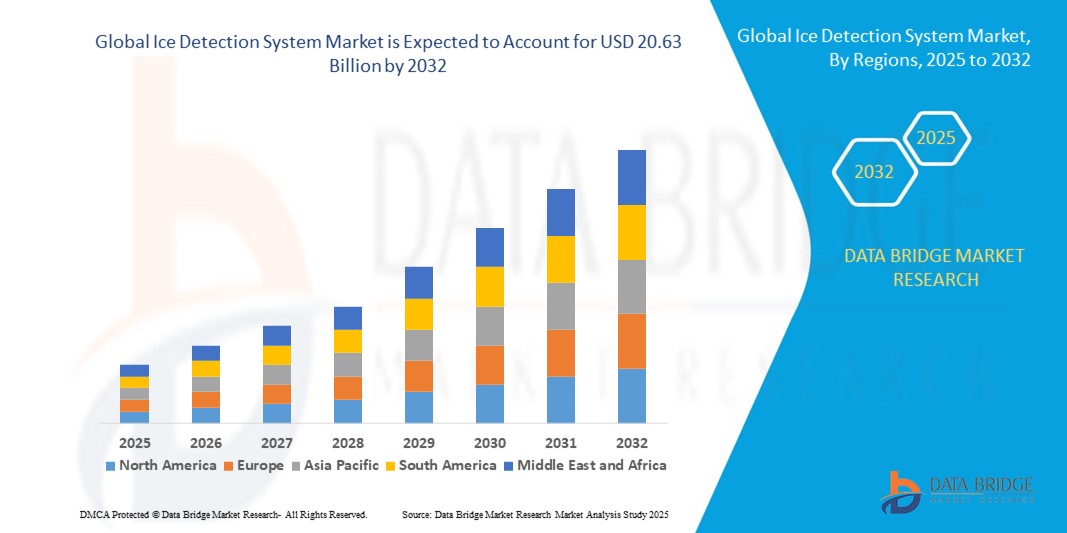

- The global ice detection system market size was valued at USD 13.81 billion in 2024 and is expected to reach USD 20.63 billion by 2032, at a CAGR of 5.14% during the forecast period

- The market growth is primarily driven by increasing demand for enhanced aircraft safety, improved operational efficiency, and the need to mitigate icing-related risks in adverse weather conditions

- Rising awareness of the importance of ice detection systems for ensuring flight safety and compliance with stringent aviation regulations is further propelling market demand across OEM and aftermarket channels

Ice Detection System Market Analysis

- The ice detection system market is experiencing robust growth due to the rising emphasis on aircraft safety and performance in extreme weather conditions

- Growing adoption in both commercial and military aviation, along with advancements in sensor technology, is encouraging manufacturers to develop innovative, reliable, and efficient ice detection solutions

- North America dominates the ice detection system market with the largest revenue share of 33.2% in 2024, driven by a well-established aerospace industry, high adoption of advanced technologies, and stringent regulatory standards for aviation safety

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid expansion of the aviation sector, increasing aircraft deliveries, and growing awareness of icing hazards in countries such as China, India, and Southeast Asian nations

- The anti-icing segment accounted for the largest revenue share of 37.9% in 2024, driven by its preventive approach and deep integration into modern airframes. Continuous protection of critical surfaces (wings, engine inlets, probes, and windshields) reduces operational risk and unscheduled maintenance, making anti-icing solutions the default choice for commercial fleets and high-utilization operators

Report Scope and Ice Detection System Market Segmentation

|

Attributes |

Ice Detection System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Ice Detection System Market Trends

Advancements in Sensor Technology and Integration with Predictive Analytics

- The Global Ice Detection System market is experiencing a strong trend toward integrating advanced sensor technology with predictive analytics to enhance ice detection accuracy and response times

- These systems utilize real-time environmental data, aircraft performance parameters, and advanced algorithms to detect potential icing conditions before they impact safety or operational efficiency

- Predictive analytics enables proactive deicing or anti-icing actions, reducing the risk of in-flight incidents and minimizing maintenance downtime

- For instance, several aerospace manufacturers are adopting ice detection systems capable of automatically adjusting deicing cycles based on weather data and aircraft-specific icing patterns

- This trend is increasing operational reliability for both commercial and military aircraft, while also improving fuel efficiency by avoiding unnecessary deicing operations

- Modern ice detection systems now integrate multiple sensing methods—such as optical, ultrasonic, and electromagnetic detection—to provide comprehensive monitoring across critical aircraft surfaces, including wings, engine inlets, and sensors

Ice Detection System Market Dynamics

Driver

Growing Emphasis on Flight Safety and Regulatory Compliance

- Rising concerns over aviation safety in adverse weather conditions are driving demand for advanced ice detection systems across commercial jets, military jets, and helicopters

- Regulatory bodies in North America and Europe are introducing stringent safety standards mandating reliable ice detection and removal capabilities for aircraft

- Increasing air traffic in cold climate regions, combined with heightened awareness of icing-related accidents, is further boosting market growth

- The integration of ice detection systems into both new aircraft designs and retrofitting programs ensures operational safety and regulatory compliance

- The strong regulatory frameworks and advanced aerospace manufacturing capabilities, while Asia-Pacific is emerging as the fastest-growing market driven by rising aircraft deliveries and infrastructure expansion

Restraint/Challenge

High System Costs and Complexity of Integration

- The high cost associated with the development, installation, and maintenance of ice detection systems is a major barrier for widespread adoption, particularly among smaller operators and in developing regions

- Retrofitting existing aircraft with advanced ice detection and deicing technology requires significant engineering modifications, increasing operational costs and downtime

- Data integration challenges between ice detection systems and aircraft control systems can further complicate deployment

- In addition, the need for compliance with varied international certification requirements increases complexity for manufacturers targeting multiple markets

- These factors, combined with budget constraints in certain regions, may limit adoption despite the clear safety and performance benefits of these systems

Ice Detection System market Scope

The market is segmented on the basis of type, technology, platform, and application.

- By Type

On the basis of type, the global ice detection system market is segmented into anti-icing and deicing. The anti-icing segment accounted for the largest revenue share of 37.9% in 2024, driven by its preventive approach and deep integration into modern airframes. Continuous protection of critical surfaces (wings, engine inlets, probes, and windshields) reduces operational risk and unscheduled maintenance, making anti-icing solutions the default choice for commercial fleets and high-utilization operators. Certification familiarity, proven reliability in mixed weather, and lower life-cycle risk further cement anti-icing as the preferred option in baseline and line-fit programs.

The deicing segment is expected to register the fastest growth rate from 2025 to 2032, as operators pursue retrofit packages for legacy platforms and mission-flexible aircraft. Deicing solutions enable targeted removal strategies that minimize power draw, suit intermittent icing profiles, and complement condition-based maintenance. Increased use in regional, business aviation, and UAV fleets—where retrofit economics and modularity matter—will accelerate adoption over the forecast period.

- By Technology

On the basis of technology, the market is categorized into chemical and electrical. The electrical segment held the highest revenue share in 2024, supported by the widespread use of heated elements, smart probes, and electrically-powered sensing arrays that offer high detection fidelity with rapid response. Electrical architectures integrate readily with avionics, enable health monitoring and data logging, and support incremental upgrades via software and modular LRUs, all of which align with airline reliability and dispatch targets.

The chemical segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by advances in eco-optimized formulations, ice-phobic coatings, and on-aircraft applicators designed to reduce fluid consumption. As airports and operators tighten environmental commitments, next-generation chemistries that deliver effective performance with lower toxicity and runoff will see rising adoption, particularly for aircraft frequently cycling through harsh, mixed-phase winter conditions.

- By Platform

On the basis of platform, the global market is segmented into commercial jets, military jets, and helicopters. The commercial jets segment dominated the market in 2024, underpinned by large active fleets, high flight cycles, and stringent certification and performance requirements across global routes. Line-fit demand from OEM production lines and synchronized MRO schedules sustain scale for detection hardware, controllers, and software analytics in this segment.

The helicopters segment is projected to grow at the fastest rate from 2025 to 2032. Rotorcraft operate extensively at altitudes and weather layers prone to rapid icing onset, supporting greater use of advanced detection and cueing. Growth in civil and parapublic missions (EMS, SAR, offshore energy, and infrastructure support), alongside emerging eVTOL/advanced air mobility platforms that require lightweight, power-efficient detection, will further accelerate uptake.

- By Application

On the basis of application, the market is segmented into engine inlets, nacelle, wings, tail, propellers, windshields, sensors, and air data probes. The wings segment held the largest revenue share in 2024, reflecting the criticality of wing contamination to lift performance, stall margins, and certification envelopes. Broad surface coverage needs and the importance of early-warning cues make wing-focused detection a core procurement priority for both OEMs and operators.

The air data probes segment is expected to witness the fastest growth from 2025 to 2032. Next-generation heated probes and “smart” multi-function sensors offer enhanced ice accretion detection, self-diagnostics, and data fusion with flight control and FMS systems. Their retrofit-friendly form factors, combined with the safety imperative to protect pitot-static integrity in mixed-phase icing, are driving accelerated adoption across commercial, business, and defense fleets.

Ice Detection System Market Regional Analysis

- North America dominates the ice detection system market with the largest revenue share of 33.2% in 2024, driven by a well-established aerospace industry, high adoption of advanced technologies, and stringent regulatory standards for aviation safety

- Operators prioritize ice detection systems for enhancing flight safety, reducing risks from icing conditions, and protecting aircraft components from ice accumulation, especially in regions with harsh winter climates

- Growth is supported by advancements in sensor technology, including LiDAR and AI-integrated systems, alongside rising adoption in both commercial and military aviation segments

U.S. Ice Detection System Market Insight

The U.S. ice detection system market captured the largest revenue share of 82.34% in 2024 within North America, fueled by strong demand from major aircraft manufacturers and growing regulatory emphasis on aviation safety and anti-icing benefits. The trend towards advanced aircraft customization and increasing regulations promoting enhanced ice detection standards further boost market expansion. Aircraft OEMs’ growing incorporation of integrated ice protection systems complements aftermarket sales, creating a diverse product ecosystem.

Europe Ice Detection System Market Insight

The Europe ice detection system market is expected to witness significant growth, supported by regulatory emphasis on aviation safety and operational efficiency. Operators seek systems that improve flight reliability while offering robust ice detection and removal. The growth is prominent in both new aircraft installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and complex weather conditions.

U.K. Ice Detection System Market Insight

The U.K. market for ice detection systems is expected to witness strong growth, driven by demand for improved flight safety and ice mitigation in variable weather settings. Increased interest in aircraft performance optimization and rising awareness of anti-icing benefits encourage adoption. In addition, evolving aviation safety regulations influence operator choices, balancing detection accuracy with compliance.

Germany Ice Detection System Market Insight

Germany is expected to witness strong growth in ice detection systems, attributed to its advanced aviation manufacturing sector and high focus on aircraft safety and energy efficiency. German operators prefer technologically advanced systems that detect and mitigate ice formation and contribute to lower operational risks. The integration of these systems in premium aircraft and aftermarket options supports sustained market growth.

Asia-Pacific Ice Detection System Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding aviation production and rising investments in air travel in countries such as China, India, and Japan. Increasing awareness of ice detection, safety enhancement, and aircraft protection is boosting demand. Government initiatives promoting aviation efficiency and safety further encourage the use of advanced ice detection systems.

Japan Ice Detection System Market Insight

Japan’s ice detection system market is expected to witness strong growth due to strong operator preference for high-quality, technologically advanced systems that enhance flight safety and reliability. The presence of major aviation manufacturers and integration of ice detection in OEM aircraft accelerate market penetration. Rising interest in aftermarket upgrades also contributes to growth.

China Ice Detection System Market Insight

China holds the largest share of the Asia-Pacific ice detection system market, propelled by rapid urbanization, rising aircraft ownership, and increasing demand for ice protection solutions. The country’s growing aviation sector and focus on modern air mobility support the adoption of advanced systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Ice Detection System Market Share

The ice detection system industry is primarily led by well-established companies, including:

- Meggitt PLC (U.K.)

- Collins Aerospace (U.S.)

- Zodiac Aerospace (France)

- ECE Canada Limited (Canada)

- Ametek, Inc. (U.S.)

- Ultra Electronics (U.K.)

- K-Rain (U.S.)

- Radiant Vision Systems (U.S.)

- General Atomics (U.S.)

- Honeywell International Inc. (U.S.)

- Thales Group (France)

- The Marvin Group (U.S.)

- Sensor Systems (U.S.)

- Vaisala (Finland)

- UTC Aerospace Systems (U.S.)

- General Atomics Aeronautical Systems (U.S.)

- Sensor Technologies & Systems, Inc. (U.S.)

- Astronics Corporation (U.S.)

What are the Recent Developments in Global Ice Detection System Market?

- In October 2023, Vaisala launched the IceSense 2 System, an advanced ice detection solution for aircraft that significantly improves accuracy and reliability. This next-generation system employs a multi-sensor approach, integrating LiDAR, radar, and ultrasonic technologies to provide comprehensive coverage and minimize false alarms. By detecting ice formation with greater precision, IceSense 2 enhances flight safety and supports more informed pilot decision-making in challenging weather conditions. The launch underscores Vaisala’s commitment to cutting-edge atmospheric sensing and aviation safety innovation

- In October 2022, Raytheon Technologies launched an advanced ice detection system specifically designed for helicopters, addressing the unique operational challenges faced by rotary-wing aircraft. This specialized system enhances flight safety by using high-tech sensors to detect ice formation in real time, enabling pilots to respond proactively in adverse weather conditions. The technology reflects Raytheon’s commitment to developing platform-specific solutions that improve situational awareness, mission reliability, and aircraft survivability across diverse aviation environments

- In October 2021, Collins Aerospace introduced a new generation of optical ice detection sensors, designed to deliver enhanced accuracy, reliability, and real-time responsiveness for aircraft safety. These Optical Ice Detectors (OID) use laser-based technology to detect and differentiate between supercooled liquid droplets, large droplet icing, and ice crystals, helping pilots respond more effectively to hazardous atmospheric conditions. The sensors offer velocity-independent measurements, continuous monitoring, and flush-mount designs that reduce drag and integration costs. Collins later secured a supply contract with a major aircraft manufacturer, underscoring the market’s demand for advanced sensor innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ice Detection System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ice Detection System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ice Detection System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.