Global Id Barcode Reading In Factory Automation Market

Market Size in USD Billion

CAGR :

%

USD

2.73 Billion

USD

4.52 Billion

2024

2032

USD

2.73 Billion

USD

4.52 Billion

2024

2032

| 2025 –2032 | |

| USD 2.73 Billion | |

| USD 4.52 Billion | |

|

|

|

|

Identity Document (ID) Barcode Reading in Factory Automation Market Size

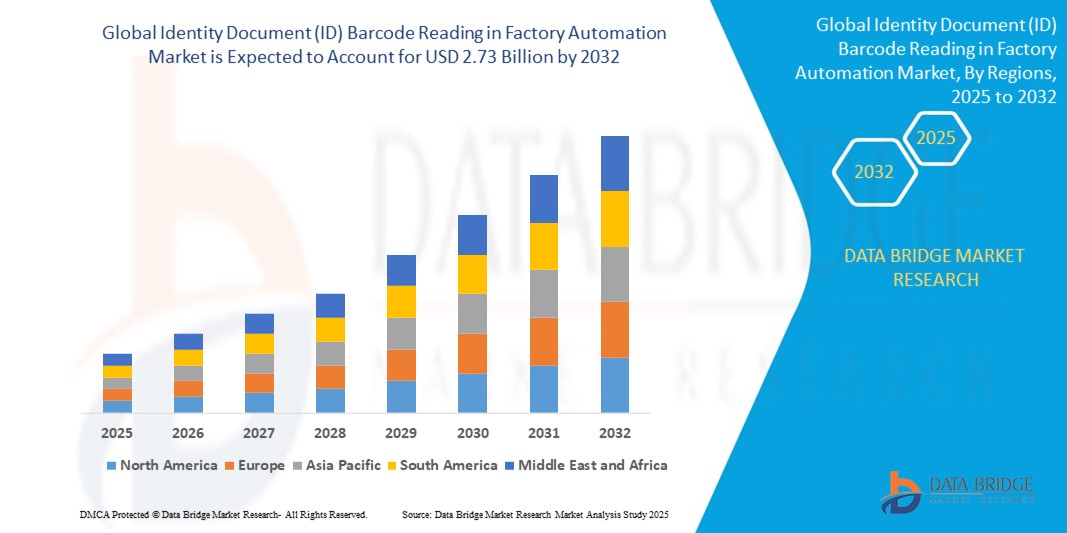

- The global identity document (ID) barcode reading in factory automation market size was valued at USD 2.73 billion in 2024 and is expected to reach USD 4.52 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing demand for automated identification and verification solutions across manufacturing facilities, driven by the need for operational efficiency, accurate traceability, and regulatory compliance

- Furthermore, rising implementation of Industry 4.0 technologies, along with advancements in barcode scanning, RFID, and mobile computing devices, is establishing ID barcode reading as a vital component of modern factory automation systems, thereby significantly boosting the industry's growth

Identity Document (ID) Barcode Reading in Factory Automation Market Analysis

- Identity document (ID) barcode reading solutions, enabling automated identification and verification, are increasingly vital components of modern factory automation systems across industries such as manufacturing, automotive, and logistics due to their ability to enhance operational efficiency, ensure accurate traceability, and support regulatory compliance

- The escalating demand for ID barcode reading in factory automation is primarily fueled by the rapid adoption of Industry 4.0 technologies, the need for secure and real-time identity verification, and the rising preference for integrated, automated systems to streamline production processes

- North America dominated the identity document (ID) barcode reading in factory automation market with a share of 40.51% in 2024, due to the widespread implementation of advanced automation solutions across industries such as manufacturing, automotive, and logistics

- Asia-Pacific is expected to be the fastest growing region in the identity document (ID) barcode reading in factory automation market during the forecast period due to the rapid expansion of manufacturing sectors and government initiatives promoting automation and digital identity verification

- Fixed mount barcode scanner segment dominated the market with a market share of 42.8% in 2024, due to its high-speed scanning capability, continuous operation without manual intervention, and suitability for integration within high-volume production lines. Fixed mount scanners are extensively deployed across factory floors where space efficiency, accuracy, and rapid processing of ID barcodes are critical, particularly in automated packaging, assembly, and inspection stations. Their ability to provide consistent performance under harsh industrial environments also drives widespread adoption in sectors such as automotive, logistics, and electronics manufacturing

Report Scope and Identity Document (ID) Barcode Reading in Factory Automation Market Segmentation

|

Attributes |

Identity Document (ID) Barcode Reading in Factory Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Identity Document (ID) Barcode Reading in Factory Automation Market Trends

“Integration of Identity Document (ID) Barcode Reading in Factory Automation”

- A significant and accelerating trend in the factory automation market is the increased integration of identity document (ID) barcode reading solutions with advanced automation and real-time monitoring systems, improving efficiency, accuracy, and compliance across industrial operations

- For instance, manufacturers are increasingly deploying fixed-mount and handheld barcode scanners on production lines to automate employee identification, access control, and compliance with safety regulations, reducing manual processes and human error

- The integration of ID barcode readers with factory management systems enables real-time tracking of personnel movements, ensuring authorized access to restricted areas and enhancing overall workplace security

- Companies such as Cognex and Zebra Technologies are developing barcode reading solutions with advanced optical performance and connectivity features, supporting seamless integration with Industry 4.0 platforms and factory automation networks

- The demand for ID barcode reading technologies is growing across industries such as automotive, electronics, and pharmaceuticals, as manufacturers prioritize traceability, regulatory compliance, and operational efficiency in line with global automation trends

Identity Document (ID) Barcode Reading in Factory Automation Market Dynamics

Driver

“Enhanced Efficiency in Personnel Identification Processes”

- The growing need for automated personnel identification and access verification within factory environments is a significant driver for the adoption of ID barcode reading solutions

- For instance, companies in sectors such as automotive and food processing are increasingly deploying barcode and RFID-based identification systems to streamline workforce management, track personnel entry points, and ensure compliance with safety and regulatory requirements

- Automated ID barcode reading reduces administrative burdens, minimizes human error, and enhances productivity by providing real-time personnel data and secure access to critical production zones

- This efficiency is particularly valuable in large-scale production environments where workforce management requires real-time, scalable solutions

- Furthermore, as manufacturers integrate these solutions with existing factory automation and security infrastructure, they gain improved visibility, traceability, and control over workforce operations, driving market growth

Restraint/Challenge

“High Initial Investment for Implementation”

- Despite the operational benefits, the high upfront costs associated with implementing ID barcode reading solutions present a significant challenge, particularly for small and medium-sized manufacturers. Expenses related to purchasing advanced hardware, system integration, software licensing, and employee training can create financial barriers to adoption

- For instance, deploying fixed-mount barcode scanners, RFID-enabled readers, and integrated workforce management systems requires substantial capital investment, often beyond the reach of resource-constrained businesses or companies in developing economies

- In addition, the integration of ID barcode reading solutions with existing factory infrastructure may demand technical expertise and system upgrades, further adding to implementation costs and complexity

- While larger manufacturers may justify the investment through improved efficiency, regulatory compliance, and workforce security, smaller businesses often face challenges in demonstrating short-term returns, limiting their willingness to adopt such technologies

- Overcoming this challenge will require industry players to develop more affordable, scalable solutions tailored to varying business sizes and regional needs, as well as increasing awareness of the long-term benefits of enhanced personnel management, operational efficiency, and regulatory compliance

Identity Document (ID) Barcode Reading in Factory Automation Market Scope

The market is segmented on the basis of product type, technology, barcode type, and vertical.

- By Product Type

On the basis of product type, the Identity Document (ID) Barcode Reading in Factory Automation market is segmented into Fixed Mount Barcode Scanner, Handheld Scanner, Mobile Computers Barcode Scanner, and Others. The Fixed Mount Barcode Scanner segment dominated the largest market revenue share of 42.8% in 2024, owing to its high-speed scanning capability, continuous operation without manual intervention, and suitability for integration within high-volume production lines. Fixed mount scanners are extensively deployed across factory floors where space efficiency, accuracy, and rapid processing of ID barcodes are critical, particularly in automated packaging, assembly, and inspection stations. Their ability to provide consistent performance under harsh industrial environments also drives widespread adoption in sectors such as automotive, logistics, and electronics manufacturing.

The Mobile Computers Barcode Scanner segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the growing need for workforce mobility, real-time data capture, and flexible scanning operations across factory floors and warehouses. These devices integrate barcode scanning with mobile computing capabilities, allowing operators to verify ID documents, track materials, and manage assets seamlessly while on the move. The rising trend of digital transformation in factory automation, combined with the need for versatile, ergonomic, and connected scanning solutions, significantly contributes to the expanding demand for mobile computer scanners.

- By Technology

On the basis of technology, the market is segmented into Laser Scanner, Omnidirectional Barcode Scanners, Camera-Based Readers, CCD (Charge Coupled Device) Readers, RFID (Radio Frequency Identification) Technology, Pen-Type Scanners, and Others. The Laser Scanner segment held the largest market revenue share in 2024, primarily attributed to its precision, speed, and cost-effectiveness in reading linear (1D) ID barcodes across production lines. Laser scanners are favored for their durability and reliable performance in industrial settings, where accuracy and fast data capture are essential for verifying worker IDs, tracking components, and ensuring process compliance. Their proven technology, combined with ease of installation and minimal maintenance requirements, makes them a preferred choice for factory automation applications.

The Camera-Based Readers segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising need to capture complex, high-density, and damaged barcodes, especially in harsh factory environments. Camera-based readers offer superior versatility by supporting both 1D and 2D barcode formats, while also providing image capture and optical character recognition (OCR) capabilities for advanced ID verification processes. Their integration with machine vision systems and ability to operate under variable lighting and orientations enhances their adoption in industries such as electronics, pharmaceuticals, and automotive manufacturing.

- By Barcode Type

On the basis of barcode type, the market is segmented into 1D and 2D. The 1D barcode segment dominated the market with the largest revenue share in 2024, due to its long-established use in factory automation for basic identification, tracking, and inventory control tasks. 1D barcodes are simple, widely recognized, and cost-effective, making them prevalent for worker ID badges, raw material labeling, and product identification across diverse manufacturing environments. Their compatibility with traditional laser scanning systems contributes to their continued strong market presence.

The 2D barcode segment is projected to register the fastest growth during 2025 to 2032, driven by its ability to store significantly more information in a compact space, enhanced data security, and high readability even under challenging factory conditions. The demand for advanced ID verification, traceability, and anti-counterfeiting measures across critical industries such as pharmaceuticals, electronics, and automotive is propelling the shift towards 2D barcode adoption in factory automation.

- By Vertical

On the basis of vertical, the market is segmented into Consumer Electronics, Automotive, Logistics, Food and Beverage, Pharmaceutical and Medical, Packaging, Oil and Gas, and Others. The Automotive segment accounted for the largest market revenue share in 2024, driven by the sector's high reliance on automated ID verification, component tracking, and production line efficiency. Factory automation in automotive manufacturing requires robust barcode reading solutions to ensure quality control, regulatory compliance, and seamless material flow, making ID barcode scanning integral to the process. The industry's emphasis on precision, safety, and real-time monitoring further accelerates the demand for reliable scanning technologies.

The Pharmaceutical and Medical segment is anticipated to experience the fastest growth from 2025 to 2032, owing to stringent regulations regarding product authentication, traceability, and personnel identification in manufacturing environments. With increasing focus on preventing counterfeiting, enhancing patient safety, and ensuring compliance with global standards such as GS1 and FDA guidelines, the adoption of advanced barcode reading solutions for ID documents is rapidly growing within pharmaceutical production and medical equipment manufacturing facilities.

Identity Document (ID) Barcode Reading in Factory Automation Market Regional Analysis

- North America dominated the identity document (ID) barcode reading in factory automation market with the largest revenue share of 40.51% in 2024, driven by the widespread implementation of advanced automation solutions across industries such as manufacturing, automotive, and logistics

- The region's strong presence of leading barcode scanner manufacturers, combined with stringent regulations for worker safety and process traceability, further accelerates market growth

- High adoption of Industry 4.0 technologies, coupled with a demand for operational efficiency and real-time data tracking, positions ID barcode reading solutions as a critical component of factory automation systems

U.S. Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, fueled by robust demand for factory automation, regulatory compliance for identity verification, and enhanced production line efficiency. Key industries such as automotive, electronics, and food processing increasingly rely on barcode reading solutions for accurate identification and traceability, with handheld and fixed-mount scanners leading deployments. The rapid advancement of mobile computing devices and integration with cloud platforms also supports market expansion across diverse industrial environments

Europe Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by rising demand for secure identification systems and automated production processes. Strict regulations for data security, coupled with efforts to modernize manufacturing facilities, fuel the adoption of barcode reading solutions across the region. European manufacturers increasingly integrate 2D barcode and RFID technologies to enhance traceability, reduce errors, and meet quality standards in sectors such as automotive, pharmaceuticals, and food production

U.K. Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country's emphasis on smart manufacturing and digital transformation. Heightened focus on worker identity verification, access control, and streamlined supply chain operations is propelling demand for advanced barcode readers. Growing investments in Industry 4.0, along with increased adoption of handheld scanners and mobile computers, support market growth across automotive, logistics, and packaging industries

Germany Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by the country's leadership in industrial automation and precision engineering. Germany's commitment to technological innovation, coupled with stringent regulations for identity management and traceability, drives the integration of ID barcode reading systems in production lines. High demand for 2D barcode readers and RFID-based identification solutions across automotive, electronics, and medical device manufacturing sectors further accelerates market growth

Asia-Pacific Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by the rapid expansion of manufacturing sectors and government initiatives promoting automation and digital identity verification. Countries such as China, Japan, and India lead the regional growth, supported by rising investments in smart factories, increased need for operational efficiency, and the widespread adoption of barcode and RFID technologies

Japan Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The Japan market is gaining momentum due to the country's advanced manufacturing landscape, demand for high-precision identification systems, and strong focus on workplace security. The increasing use of 2D barcode readers, mobile scanning devices, and RFID technologies across industries such as electronics, automotive, and medical manufacturing supports market growth. Japan’s emphasis on quality, traceability, and seamless integration of identity verification solutions within factory automation environments continues to drive adoption

China Identity Document (ID) Barcode Reading in Factory Automation Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid industrialization, expansion of smart factories, and growing enforcement of identity verification protocols in manufacturing environments. The country's large-scale production facilities, coupled with the availability of cost-effective barcode reading solutions and strong domestic manufacturing capabilities, fuel market growth. Demand is particularly strong across automotive, consumer electronics, and logistics sectors, supported by China's leadership in smart manufacturing technologies

Identity Document (ID) Barcode Reading in Factory Automation Market Share

The identity document (ID) barcode reading in factory automation industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- Endress+Hauser Group Services AG (Switzerland)

- Emerson Electric Co. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- Mitsubishi Electric Corporation (Japan)

- Yokogawa India Ltd. (India)

- ABB (Switzerland)

- Jadak (U.S.)

- Balluff Automation India Pvt. Ltd. (India)

- RTscan Technology Limited (China)

- Scandit (Switzerland)

- Wasp Barcode Technologies (U.S.)

- SATO America (U.S.)

- Axicon Auto ID Limited (U.K.)

- Handheld Group (Sweden)

- Cognex Corporation (U.S.)

- Great Eastern (India)

- Data Logic S.p.A (Italy)

- Honeywell International, Inc. (U.S.)

- OMRON Corporation (Japan)

- Zebra Technologies Corp. (U.S.)

- KEYENCE CORPORATION (Japan)

Latest Developments in Global Identity Document (ID) Barcode Reading in Factory Automation Market

- In October 2024, Viziotix showcased its Maxi-Scan technology at Vision 2024 in Stuttgart, Germany. Viziotix introduced its Maxi-Scan algorithm, enabling simultaneous scanning of multiple barcodes in a single image. This advancement allows drones and robots to conduct rapid inventory checks, even in challenging conditions such as low lighting or motion blur. The technology supports real-time processing on edge devices, enhancing automation in logistics and warehouse operations

- In January 2024, Datalogic launched the Blade Series of compact 1D barcode readers. The Blade Series is designed for industrial environments requiring high-performance traceability solutions. Equipped with a 1920x128 pixel camera sensor and advanced lighting, these readers can reliably decode labels even under poor conditions, such as discoloration or damage. This innovation aims to improve efficiency in packaging and intralogistics sectors

- In January 2025, Cognex released the DataMan 290 and 390 AI-powered barcode readers. These new models incorporate advanced AI technology to enhance decoding reliability across various manufacturing applications. The readers feature a user-friendly web interface for easy setup and maintenance, making them accessible even to non-technical users. They are designed to handle a wide range of barcode types, including damaged or low-quality codes

- In August 2024, Scandit acquired MarketLab to enhance its ShelfView capabilities.

- This acquisition enables Scandit to offer improved smart data capture solutions for retailers, enhancing store performance and associate efficiency. The integration aims to provide better monetization of shelf data with consumer packaged goods partners, leveraging advanced barcode scanning technologies

- In May 2024, Pepperl+Fuchs announced plans to open a new U.S. headquarters in late 2025. The new facility will strengthen the company's presence in North America and support its growth in the industrial automation sector. Pepperl+Fuchs specializes in sensor technology and automation solutions, contributing to advancements in barcode reading and factory automation technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Id Barcode Reading In Factory Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Id Barcode Reading In Factory Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Id Barcode Reading In Factory Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.