Global Ilmenite Market

Market Size in USD Billion

CAGR :

%

USD

11.86 Billion

USD

15.14 Billion

2024

2032

USD

11.86 Billion

USD

15.14 Billion

2024

2032

| 2025 –2032 | |

| USD 11.86 Billion | |

| USD 15.14 Billion | |

|

|

|

|

Ilmenite Market Size

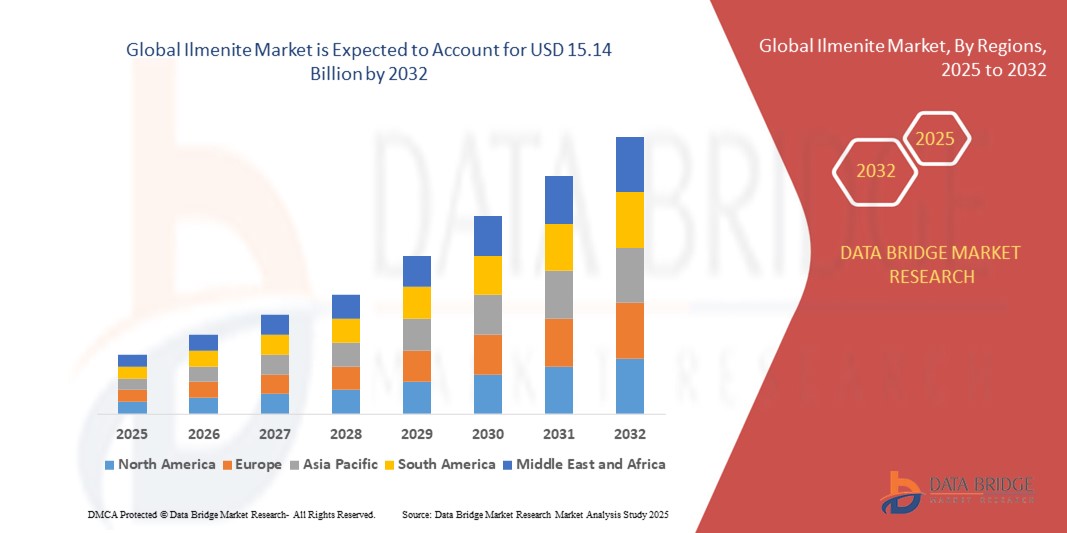

- The global ilmenite market size was valued at USD 11.86 billion in 2024 and is expected to reach USD 15.14 billion by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is growth is primarily driven by increasing demand for titanium dioxide in paints, coatings, and plastics, along with rising applications in cosmetics and paper industries

- Growing awareness of sustainable and high-performance materials in industrial applications is further propelling the demand for ilmenite across various end-use sectors

Ilmenite Market Analysis

- The ilmenite market is experiencing robust growth due to the rising demand for titanium dioxide as a pigment in paints, coatings, and plastics, coupled with its use in titanium metal production for aerospace and industrial applications

- Increasing adoption in cosmetics and paper industries for high-quality pigmentation and durability is encouraging manufacturers to innovate with advanced processing techniques for higher-grade ilmenite

- Asia-Pacific dominates the ilmenite market with the largest revenue share of 38.5% in 2024, driven by a booming industrial sector, rapid urbanization, and high demand for titanium-based products in countries such as China, India, and Japan

- Middle East and Africa is expected to be the fastest-growing region during the forecast period, fueled by increasing mining activities, infrastructure development, and growing demand for titanium dioxide in construction and coatings applications

- The <52% size segment dominated the largest market revenue share of 45% in 2024, driven by its widespread use in titanium dioxide production and metal applications due to its cost-effectiveness and availability

Report Scope and Ilmenite Market Segmentation

|

Attributes |

Ilmenite Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ilmenite Market Trends

Increasing Adoption of Sustainable Mining and Processing Technologies

- The global ilmenite market is experiencing a significant trend toward the adoption of sustainable mining and processing technologies

- These technologies focus on reducing environmental impact through eco-friendly extraction methods, energy-efficient processing, and waste minimization

- Advanced processing techniques, such as the use of artificial intelligence (AI) and automation, are being implemented to optimize resource recovery and enhance operational efficiency

- For instance, companies are leveraging AI-driven analytics to identify high-purity ilmenite reserves, reducing costs and environmental footprint

- This trend is making ilmenite production more sustainable, appealing to environmentally conscious industries and regulators, particularly in applications such as titanium dioxide production for paints and coatings

- Sustainable practices also include recycling titanium materials, which aligns with global sustainability goals and enhances the market's long-term growth potential

Ilmenite Market Dynamics

Driver

Rising Demand for Titanium Dioxide in Construction and Automotive Sectors

- The increasing demand for titanium dioxide (TiO₂), derived from ilmenite, is a major driver for the global ilmenite market, particularly in the paints and coatings, plastics, and automotive industries

- Ilmenite is the primary source of TiO₂, valued for its opacity, brightness, and UV resistance, making it essential for high-performance coatings and plastics used in construction and automotive applications

- Government initiatives and infrastructure development, especially in emerging economies in Asia-Pacific such as China and India, are boosting the demand for TiO₂-based products

- The proliferation of advanced manufacturing and the adoption of 5G technology are enabling faster data processing for supply chain optimization, further supporting market growth

- Manufacturers are increasingly integrating ilmenite-derived TiO₂ into eco-friendly, low-VOC paints and lightweight automotive components to meet consumer and regulatory expectations

Restraint/Challenge

Environmental Concerns and Raw Material Price Volatility

- The high environmental impact of ilmenite mining and processing poses a significant challenge, as it requires substantial energy and water, leading to regulatory scrutiny and potential restrictions

- Integrating sustainable practices into existing operations can be costly and complex, particularly for smaller producers in emerging markets

- In addition, price volatility of raw materials, driven by global supply-demand imbalances and geopolitical uncertainties, creates market instability and affects profitability

- Environmental regulations and varying compliance standards across countries, such as stricter policies in Europe and North America, complicate operations for global manufacturers

- These factors can deter investment and limit market expansion, especially in regions with high environmental awareness or cost sensitivity, such as parts of the Middle East and Africa

Ilmenite market Scope

The market is segmented on the basis of size, type, application, and end-use.

- By Size

On the basis of size, the global ilmenite market is segmented into <52%, 52%-55%, and >55%. The <52% size segment dominated the largest market revenue share of 45% in 2024, driven by its widespread use in titanium dioxide production and metal applications due to its cost-effectiveness and availability. This segment is favored for large-scale industrial applications, particularly in paints, coatings, and plastics.

The >55% size segment is expected to witness the fastest growth rate of 5.8% from 2025 to 2032, fueled by increasing demand for high-purity ilmenite in premium titanium dioxide applications for high-performance coatings and aerospace-grade titanium metal production. Higher titanium content enhances efficiency in advanced manufacturing processes.

- By Type

On the basis of type, the global ilmenite market is segmented into grey and black. The grey segment dominated with a market revenue share of 60% in 2024, attributed to its abundance and suitability as a fluxing agent in blast furnace feeds and sand-blasting abrasives. Its versatility supports widespread use in titanium dioxide production.

The black segment is anticipated to experience the fastest growth rate of 6.2% from 2025 to 2032, driven by its increasing application in high-quality titanium metal production for aerospace and defense industries, where its unique properties, such as corrosion resistance and lightweight strength, are highly valued.

- By Application

On the basis of application, the global ilmenite market is segmented into titanium dioxide application, titanium metal application, and others. The titanium dioxide application segment accounted for the largest market revenue share of 90.2% in 2024, propelled by the rising global demand for titanium dioxide (TiO2) as a white pigment in paints, coatings, plastics, and paper due to its superior opacity, brightness, and UV resistance.

The titanium metal application segment is expected to witness the fastest growth rate of 4.8% from 2025 to 2032, driven by increasing demand in aerospace, defense, and medical industries for titanium’s strength, corrosion resistance, and biocompatibility. The expansion of civil aviation and defense sectors further boosts this segment.

- By End-Use

On the basis of end use, the global ilmenite market is segmented into paints & coatings, plastics, cosmetics, paper & pulp, and others. The paints & coatings segment held the largest market revenue share of 45% in 2024, driven by the growing global construction and automotive industries, which rely on titanium dioxide for high-performance, durable, and eco-friendly coatings.

The plastics segment is anticipated to experience the fastest growth rate of 5.5% from 2025 to 2032, fueled by increasing demand for titanium dioxide as a whitening agent in plastics for packaging, automotive components, and consumer goods. The global plastics industry’s expansion, valued at USD 712 billion in 2023, supports this growth.

Ilmenite Market Regional Analysis

- The Asia-Pacific region dominates the global ilmenite market, accounting for approximately 45-50% of the market share in 2024, driven by expanding industrial production and rising demand for titanium dioxide in China, India, and Japan

- Increasing awareness of TiO2’s benefits in paints, coatings, plastics, and cosmetics boosts demand. Government initiatives promoting sustainable industrial practices and infrastructure development further encourage the use of ilmenite-based products

Japan Ilmenite Market Insight

-

Japan’s ilmenite market is expected to witness significant growth due to strong consumer preference for high-quality titanium dioxide and titanium metal products that enhance industrial and consumer applications. The presence of major manufacturers and the integration of ilmenite in OEM products, such as automotive coatings and electronics, accelerate market penetration. Rising interest in sustainable and high-performance materials also contributes to growth.

China Ilmenite Market Insight

China holds the largest share of the Asia-Pacific ilmenite market, propelled by rapid urbanization, rising industrial output, and increasing demand for titanium dioxide in paints, coatings, and plastics. The country’s growing manufacturing sector and focus on infrastructure development support the adoption of ilmenite-derived products. Strong domestic production capabilities, with China accounting for approximately 35% of global crude ilmenite production, and competitive pricing enhance market accessibility.

Middle East and Africa Market Insight

Middle East and Africa is expected to be the fastest-growing region during the forecast period, fueled by increasing mining activities, infrastructure development, and growing demand for titanium dioxide in construction and coatings applications. Consumers prioritize ilmenite-derived products for their high opacity, UV resistance, and durability, particularly in regions with expanding construction and automotive sectors. Growth is supported by advancements in mining and processing technologies, including sustainable extraction methods, alongside rising demand in titanium dioxide and titanium metal applications across OEM and aftermarket segments.

U.S. Ilmenite Market Insight

The U.S. ilmenite market is expected to witness significant growth, fueled by strong demand for titanium dioxide in paints, coatings, and aerospace industries. The trend towards lightweight materials for automotive and defense applications, coupled with increasing environmental awareness, boosts market expansion. The integration of ilmenite-derived TiO2 in high-performance coatings and plastics supports both industrial and consumer markets.

Europe Ilmenite Market Insight

The Europe ilmenite market is expected to witness steady growth, supported by a focus on sustainable mining practices and increasing demand for titanium dioxide in paints, coatings, and plastics. Consumers seek ilmenite-based products that enhance durability and environmental compliance. Growth is prominent in both titanium dioxide production for industrial applications and titanium metal for aerospace, with countries such as Germany and France showing significant uptake due to advanced manufacturing and regulatory support.

U.K. Ilmenite Market Insight

The U.K. market for ilmenite is expected to witness robust growth, driven by demand for titanium dioxide in paints, coatings, and cosmetics, fueled by urban construction and consumer goods sectors. Increased awareness of TiO2’s UV resistance and aesthetic benefits encourages adoption. Evolving environmental regulations influence market dynamics, balancing performance with sustainability requirements.

Germany Ilmenite Market Insight

Germany is expected to witness strong growth in the ilmenite market, attributed to its advanced manufacturing sector and high consumer focus on high-performance materials. German industries prefer ilmenite-derived titanium dioxide for its opacity and durability in premium paints, coatings, and plastics. The integration of ilmenite in aerospace and automotive applications supports sustained market growth, driven by technological advancements and energy efficiency goals.

Ilmenite Market Share

The ilmenite industry is primarily led by well-established companies, including:

- Iluka Resources Limited (Australia)

- Kenmare Resources plc (Ireland)

- Rio Tinto plc (U.K.)

- Trimex Sands Pvt Ltd (India)

- V.V. Mineral (India)

- Exxaro Resources Limited (South Africa)

- Base Resources Limited (Australia)

- TiZir Limited (Norway)

- Rutile Limited (Sierra Leone)

- Ilmenite Corporation Pty Ltd (Australia)

- KMML (Kerala Minerals and Metals Ltd) (India)

- Beach Energy Ltd (Australia)

- Dundas Titanium A/S (Greenland)

- Richards Bay Minerals (RBM) (South Africa)

- Lomon Billions Group Co., Ltd - (China)

- Tronox Holdings plc – (U.S.)

- Moma Titanium Minerals Mine (Mozambique)

- Titanium Resources Group Ltd (Sierra Leone)

- Bluejay Mining plc (U.K.)

What are the Recent Developments in Global Ilmenite Market?

- In August 2023, Largo Inc., known for its vanadium operations in Brazil, announced the anticipated commissioning of its new ilmenite concentration plant at the Maracás Menchen Mine in Q3 2023. The plant uses feedstock from Largo’s existing vanadium operations and marks a strategic expansion into ilmenite production, a titanium-iron oxide used in pigments and industrial applications. Largo plans to gradually ramp up production starting in Q4 2023, with a target of producing 25,000–35,000 tonnes and selling 20,000–30,000 tonnes of ilmenite concentrate in 2025

- In August 2023, Rio Tinto renewed its fiscal agreement with the Government of Madagascar for its subsidiary QIT Madagascar Minerals (QMM), which extracts ilmenite in Fort Dauphin. The updated deal increases the royalty rate from 2% to 2.5% and includes QMM’s first-ever dividend payment to the government. This amount will be invested in rehabilitating National Road 13, with Rio Tinto contributing an additional US$8 million. The agreement also cancels US$77 million in government advances and grants Madagascar 15% free carry ownership in QMM, reinforcing a long-term partnership for sustainable development.

- In May 2023, Ukraine’s United Mining and Chemical Company (UMCC) announced plans to restore ilmenite production at its Irshansk Mining and Processing Plant to pre-war levels by the end of 2023. This strategic move is expected to significantly impact the global supply and pricing of ilmenite ore, as Ukraine is a key producer of titanium feedstocks. UMCC aims to reach a monthly output of 18,000 tonnes, with existing stockpiles ready for sale and negotiations underway with Western partners. The initiative also supports Ukraine’s broader efforts to modernize its mining sector and attract foreign investment

- In March 2023, Kenmare Resources, a leading producer of titanium minerals, announced plans to expand its ilmenite production capacity to 1.2 million tonnes per annum at its Moma mine in Mozambique. This strategic initiative aims to meet the rising global demand for ilmenite—used primarily in pigments and titanium metal—and promote sustainable production practices. The expansion includes transitioning its wet concentrator plants to the Nataka ore zone, which holds the majority of the mine’s mineral resources, ensuring long-term operational efficiency and growth

- In February 2023, Iluka Resources, a major producer of high-grade titanium feedstocks, announced a strategic partnership with Northern Minerals to become a globally significant supplier of refined rare earths. Under the agreement, Northern Minerals will supply up to 30,500 tonnes of rare earth oxide concentrate from its Browns Range Project in Western Australia to Iluka’s Eneabba Rare Earths Refinery. Iluka also committed up to $78 million in funding to support the development of Browns Range, positioning both companies to strengthen Australia’s domestic supply chain for critical minerals such as dysprosium and terbium

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ilmenite Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ilmenite Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ilmenite Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.