Global Image Guided Therapy Market

Market Size in USD Billion

CAGR :

%

USD

5.39 Billion

USD

8.75 Billion

2025

2033

USD

5.39 Billion

USD

8.75 Billion

2025

2033

| 2026 –2033 | |

| USD 5.39 Billion | |

| USD 8.75 Billion | |

|

|

|

|

Image Guided Therapy Market Size

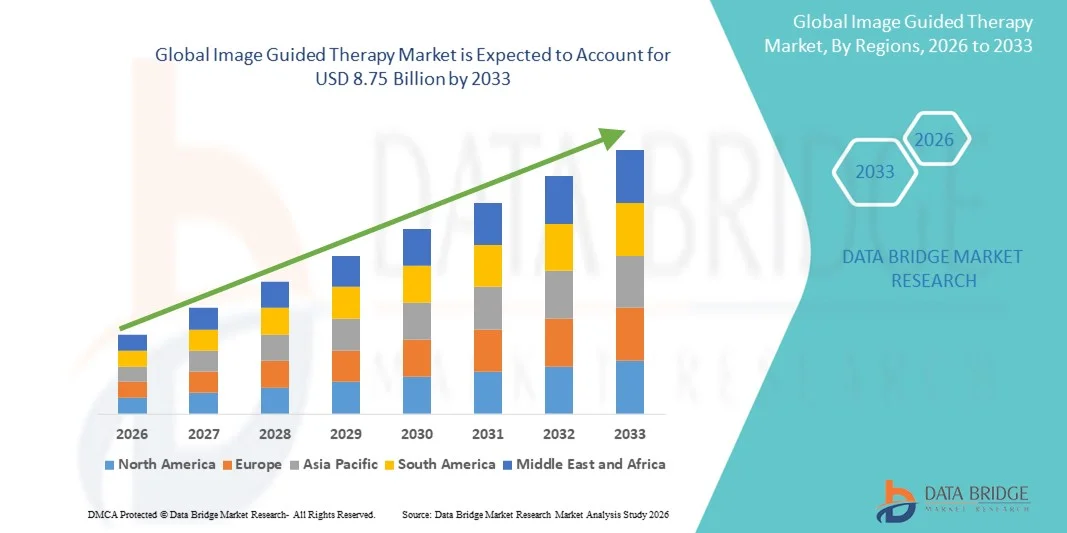

- The global image guided therapy market size was valued at USD 5.39 billion in 2025 and is expected to reach USD 8.75 billion by 2033, at a CAGR of 6.25% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive procedures and technological advancements in imaging modalities, enabling precise and real-time guidance during complex surgeries

- Furthermore, rising demand for improved patient outcomes, reduced procedural risks, and faster recovery times is establishing image-guided therapy as a preferred solution in both hospital and outpatient care settings. These converging factors are accelerating the uptake of advanced imaging-assisted interventions, thereby significantly boosting the industry's growth

Image Guided Therapy Market Analysis

- Image-guided therapy systems, enabling real-time visualization and precision during minimally invasive procedures, are increasingly vital components in modern surgical and interventional practices across hospitals and ambulatory care centers due to their ability to improve procedural accuracy, reduce complications, and shorten recovery times

- The escalating demand for image-guided therapy is primarily fueled by technological advancements in imaging modalities, rising adoption of minimally invasive surgeries, and the growing focus on patient safety and improved clinical outcomes

- North America dominated the image-guided therapy market with the largest revenue share of 40.9% in 2025, characterized by well-established healthcare infrastructure, high adoption of advanced medical technologies, and the presence of key industry players, with the U.S. experiencing substantial growth in image-guided procedures, driven by innovations in MRI and PET-based guidance systems

- Asia-Pacific is expected to be the fastest-growing region in the image-guided therapy market during the forecast period due to increasing healthcare expenditure, expanding hospital infrastructure, and rising awareness of minimally invasive treatment options

- Magnetic Resonance Imaging (MRI) segment dominated the image-guided therapy market with a market share of 41.7% in 2025, driven by its wide applicability across oncology, cardiology, and neurosurgery procedures, combined with the growing demand for high-precision diagnostic and therapeutic interventions

Report Scope and Image Guided Therapy Market Segmentation

|

Attributes |

Image Guided Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Image Guided Therapy Market Trends

Advancements Through AI and Real-Time Imaging Integration

- A significant and accelerating trend in the global image-guided therapy market is the integration of artificial intelligence (AI) with advanced imaging modalities such as MRI, PET, and hybrid systems, enhancing procedural accuracy and clinical decision-making

- For instance, the Siemens Healthineers AI-Rad Companion can assist radiologists and surgeons in real-time image analysis, helping identify critical structures and suggest optimal intervention strategies during complex procedures

- AI integration in image-guided therapy enables predictive analytics, anomaly detection, and adaptive imaging protocols, improving outcomes while reducing risks; for instance, some Philips systems use AI to optimize radiation dose and enhance tumor visualization

- The seamless integration of imaging systems with hospital PACS and robotic-assisted platforms facilitates coordinated workflows, allowing clinicians to monitor, plan, and execute interventions efficiently through a centralized interface

- This trend towards intelligent, adaptive, and integrated image-guided therapy systems is fundamentally reshaping surgical expectations, with companies such as Medtronic developing AI-enhanced guidance solutions that offer predictive insights and workflow automation

- The demand for AI-enabled, real-time imaging guidance is growing rapidly across both hospitals and ambulatory surgical centers, as clinicians increasingly prioritize precision, efficiency, and improved patient outcomes

- The development of cloud-connected platforms for image storage and remote consultation is expanding the reach of image-guided therapy, allowing specialists to provide guidance across multiple facilities and improve clinical collaboration

Image Guided Therapy Market Dynamics

Driver

Rising Adoption of Minimally Invasive Procedures and Advanced Imaging

- The increasing prevalence of minimally invasive procedures, combined with the adoption of advanced imaging technologies, is a significant driver for the heightened demand for image-guided therapy systems

- For instance, in March 2025, GE Healthcare announced the launch of its new Discovery MI DR PET/CT system with AI-enabled workflow, aiming to enhance accuracy in oncological interventions and reduce procedural times

- As hospitals and clinics focus on improving patient safety and clinical outcomes, image-guided therapy systems provide high-precision navigation, real-time monitoring, and reduced complication rates, offering a compelling advantage over conventional procedures

- Furthermore, the growing adoption of robotic-assisted surgery and hybrid operating rooms is making image-guided therapy systems an integral part of modern surgical workflows, offering seamless integration with other advanced devices

- The combination of faster recovery, lower procedural risk, and improved visualization during interventions is driving the uptake of image-guided therapy in both surgical and interventional cardiology, neurosurgery, and oncology, with clinicians increasingly prioritizing these systems for enhanced procedural efficiency

- The rising prevalence of chronic diseases such as cancer and cardiovascular disorders is creating sustained demand for precise, image-guided interventions that improve treatment outcomes

- Government initiatives promoting advanced healthcare infrastructure and reimbursement schemes for minimally invasive procedures are further driving market growth in developed and emerging regions

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high acquisition costs and complex installation requirements of advanced image-guided therapy systems pose significant barriers to broader market penetration, particularly in developing regions or smaller clinics

- For instance, the cost of fully integrated hybrid ORs with AI-enabled imaging guidance can exceed several million USD, limiting accessibility for mid-tier hospitals and healthcare providers

- Regulatory approvals and stringent clinical validation requirements further restrict market growth, as systems must comply with FDA, CE, and other country-specific medical device regulations, which can prolong time-to-market

- Addressing these challenges through cost optimization, modular solutions, and regulatory strategy is crucial for wider adoption; for instance, Philips offers scalable image-guided therapy solutions for mid-sized hospitals to reduce upfront costs

- While prices are gradually decreasing, the perceived premium of high-end image-guided therapy systems still limits adoption in price-sensitive markets, particularly for clinics that prioritize capital allocation to other healthcare infrastructure

- Overcoming these barriers through affordable solutions, flexible financing, and robust regulatory support will be vital for sustained growth of the global image-guided therapy market. Limited technical expertise among clinical staff in emerging markets can slow adoption, as image-guided therapy systems require specialized training and experience for optimal utilization

- Integration challenges with existing hospital IT infrastructure, including compatibility with legacy PACS and EMR systems, can delay deployment and increase operational complexity, restraining market expansion

Image Guided Therapy Market Scope

The market is segmented on the basis of product, application, and end-user.

- By Product

On the basis of product, the image-guided therapy market is segmented into Positron Emission Tomography (PET), Magnetic Resonance Imaging (MRI), and Others. Magnetic Resonance Imaging (MRI) segment dominated the market with the largest market revenue share of 41.7% in 2025, driven by its high-resolution imaging capability, non-invasive nature, and broad applicability across multiple clinical specialties. MRI is widely used for guiding oncological, neurological, and cardiology procedures due to its superior soft tissue contrast and real-time imaging potential. Hospitals and ambulatory surgery centers favor MRI-guided therapy for its precision, which reduces procedural risks and enhances treatment outcomes. MRI systems are increasingly integrated with AI-driven platforms that optimize imaging sequences and assist in surgical planning, further enhancing their adoption. The segment also benefits from ongoing technological innovations, such as faster acquisition times, hybrid imaging solutions, and compatibility with robotic-assisted interventions. Overall, MRI remains the preferred modality for complex, high-precision interventions, maintaining its dominant market position.

Positron Emission Tomography (PET) segment is anticipated to witness the fastest growth rate of 18.5% from 2026 to 2033, fueled by rising demand for precision oncology interventions and personalized treatment planning. PET provides functional imaging that enables clinicians to detect metabolic activity, tumor localization, and early treatment response, which is critical for cancer therapy. The integration of PET with CT and MRI systems allows multi-modality imaging, enhancing procedural accuracy. Increasing availability of PET tracers and AI-assisted interpretation is expanding its clinical applications beyond oncology, including cardiology and neurology. Emerging markets are seeing rapid adoption of PET-guided therapy due to improving healthcare infrastructure and growing awareness among specialists. Continuous technological enhancements, such as digital PET scanners, are further driving adoption and market growth globally.

- By Application

On the basis of application, the image-guided therapy market is segmented into oncology, cardiology and electrophysiology, neurosurgery, urology, and others. Oncology segment dominated the market with the largest revenue share of 39.8% in 2025, due to the increasing prevalence of cancer and the critical need for precise tumor localization and targeted treatment. Image-guided therapy in oncology allows minimally invasive biopsies, ablation procedures, and radiation therapy with enhanced accuracy. Hospitals and cancer centers prioritize advanced imaging modalities such as MRI and PET for real-time tumor tracking. AI-assisted imaging in oncology helps in treatment planning, dose optimization, and early response assessment, reducing complications. Continuous advancements in interventional oncology techniques, such as image-guided brachytherapy and robotic-assisted tumor ablation, are driving market demand. The segment also benefits from favorable reimbursement policies in developed markets, supporting the adoption of sophisticated oncology-guided therapy solutions.

Cardiology and Electrophysiology segment is expected to witness the fastest CAGR of 17.9% from 2026 to 2033, driven by growing incidences of cardiovascular diseases and the adoption of minimally invasive cardiac interventions. Procedures such as catheter ablation, stent placement, and cardiac mapping increasingly rely on real-time image guidance. Advanced modalities such as MRI and hybrid PET-CT systems help visualize cardiac structures and electrophysiological activity, improving procedural success rates. The integration of image-guided therapy with robotic navigation systems enhances precision in complex cardiac procedures. Emerging economies are increasingly investing in cardiac imaging infrastructure, expanding the market. Continuous innovation in AI-assisted cardiac imaging and remote monitoring is further accelerating adoption in both hospitals and specialized cardiac centers.

- By End-User

On the basis of end-user, the image-guided therapy market is segmented into ambulatory surgery centres, hospitals, and clinics. Hospitals segment dominated the market with the largest market revenue share of 45.6% in 2025, due to the presence of advanced imaging infrastructure, high patient volumes, and specialized surgical departments. Hospitals are equipped to handle complex procedures requiring real-time imaging guidance across oncology, cardiology, neurosurgery, and urology. Large hospitals benefit from hybrid operating rooms integrating multiple imaging modalities, enhancing procedural efficiency and outcomes. The availability of trained radiologists, surgeons, and technical staff supports optimal utilization of sophisticated image-guided therapy systems. Hospitals also receive higher reimbursement coverage for advanced procedures, encouraging adoption. Continuous capital investment in modern surgical technologies ensures that hospitals remain the dominant end-users of image-guided therapy globally.

Ambulatory Surgery Centres segment is expected to witness the fastest CAGR of 16.8% from 2026 to 2033, fueled by the growing preference for minimally invasive, outpatient procedures and shorter hospital stays. ASC adoption of image-guided therapy is supported by technological innovations such as compact MRI, PET, and hybrid imaging systems suitable for smaller facilities. The cost-efficiency, quick patient turnaround, and enhanced safety associated with image-guided interventions attract patients seeking outpatient care. Increasing collaboration between ASCs and specialized hospitals allows access to advanced imaging platforms. Rising awareness of the benefits of real-time guidance in reducing procedural risks drives adoption in these centers. Continuous expansion of ASC infrastructure, particularly in North America and Asia-Pacific, contributes to the rapid growth of this end-user segment.

Image Guided Therapy Market Regional Analysis

- North America dominated the image-guided therapy market with the largest revenue share of 40.9% in 2025, characterized by well-established healthcare infrastructure, high adoption of advanced medical technologies, and the presence of key industry players

- Healthcare providers in the region highly value the precision, improved patient outcomes, and reduced procedural risks offered by image-guided therapy systems, particularly in oncology, cardiology, and neurosurgery

- This widespread adoption is further supported by strong government healthcare initiatives, favorable reimbursement policies, a well-trained medical workforce, and the growing integration of AI and robotic-assisted surgical platforms, establishing image-guided therapy as a preferred solution across hospitals and ambulatory care centers

U.S. Image Guided Therapy Market Insight

The U.S. image-guided therapy market captured the largest revenue share of 79% in 2025 within North America, fueled by the early adoption of advanced imaging modalities and minimally invasive procedures. Hospitals and ambulatory surgical centers increasingly prioritize precision-guided interventions in oncology, cardiology, and neurosurgery. The rising integration of AI-enabled MRI, PET, and hybrid imaging systems enhances procedural accuracy and workflow efficiency. Moreover, strong government healthcare initiatives and favorable reimbursement policies further drive market expansion. Growing patient preference for less invasive procedures and faster recovery is also supporting adoption. The widespread availability of trained clinical specialists ensures optimal utilization of these advanced systems.

Europe Image-Guided Therapy Market Insight

The Europe image-guided therapy market is projected to expand at a substantial CAGR throughout the forecast period, driven by advanced healthcare infrastructure and the rising prevalence of chronic diseases. Increasing investment in hospitals and surgical centers is fostering the adoption of MRI, PET, and hybrid systems. European clinicians prioritize accuracy, reduced procedural risks, and improved patient outcomes, driving demand for real-time image guidance. Technological advancements, such as AI-assisted imaging and robotic integration, are further stimulating growth. The region sees significant uptake across oncology, neurosurgery, and cardiology applications. In addition, supportive reimbursement frameworks in key countries enhance affordability and adoption rates.

U.K. Image-Guided Therapy Market Insight

The U.K. image-guided therapy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the focus on minimally invasive procedures and advanced surgical interventions. Rising patient awareness regarding safety, faster recovery, and treatment precision is encouraging hospitals to adopt image-guided therapy systems. The country’s healthcare infrastructure, combined with technological integration and e-health initiatives, supports market expansion. Real-time imaging guidance is becoming increasingly utilized in oncology and neurology procedures. In addition, government and private investments in advanced imaging technologies are expected to continue stimulating market growth.

Germany Image-Guided Therapy Market Insight

The Germany image-guided therapy market is expected to expand at a considerable CAGR during the forecast period, fueled by the adoption of AI-assisted imaging, robotic interventions, and hybrid operating rooms. The country’s well-developed healthcare infrastructure and emphasis on technological innovation drive high uptake across hospitals and surgical centers. Increased prevalence of cardiovascular, oncological, and neurological disorders further supports market growth. German clinicians favor precision-guided therapies to reduce procedural complications and optimize patient outcomes. Integration with hospital IT systems and emphasis on minimally invasive procedures are accelerating adoption. In addition, strong local manufacturers and service providers enhance accessibility and support for advanced imaging systems.

Asia-Pacific Image-Guided Therapy Market Insight

The Asia-Pacific image-guided therapy market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by expanding hospital infrastructure, rising healthcare expenditure, and technological advancements in countries such as China, Japan, and India. Increasing awareness of minimally invasive procedures and improved patient outcomes is boosting adoption. Government initiatives to upgrade medical facilities and promote advanced surgical technologies support market growth. Emerging markets in APAC are investing in AI-enabled MRI, PET, and hybrid imaging platforms. The region’s expanding middle class and rising demand for advanced healthcare solutions are also significant growth drivers. Continuous development of local imaging technology suppliers is enhancing accessibility and affordability.

Japan Image-Guided Therapy Market Insight

The Japan image-guided therapy market is gaining momentum due to the country’s advanced healthcare system, high adoption of medical technology, and focus on precision-guided procedures. Hospitals and surgical centers emphasize minimally invasive interventions, particularly in oncology, cardiology, and neurosurgery. Integration with AI-driven imaging and robotic-assisted platforms enhances procedural accuracy. Japan’s aging population is increasing demand for safer, efficient, and less invasive treatment options. The country’s strong R&D capabilities and technological culture further accelerate adoption. In addition, real-time image guidance in outpatient and specialized facilities is becoming increasingly prevalent.

India Image-Guided Therapy Market Insight

The India image-guided therapy market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid hospital infrastructure expansion, growing middle-class population, and rising awareness of advanced healthcare procedures. Increasing demand for minimally invasive surgeries and early disease detection is driving adoption in oncology, cardiology, and neurosurgery. Government initiatives supporting smart hospitals and healthcare digitization further enhance market growth. The availability of cost-effective, locally manufactured imaging systems improves accessibility. Hospitals and ambulatory centers are increasingly investing in MRI, PET, and hybrid imaging technologies. Strong collaborations with international technology providers are also propelling adoption across major Indian cities.

Image Guided Therapy Market Share

The Image Guided Therapy industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- Brainlab AG (Germany)

- Stryker (U.S.)

- Zimmer Biomet. (U.S.)

- Varian Medical Systems, Inc. (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hitachi, Ltd. (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Accuray Incorporated (U.S.)

- Analogic Corporation (U.S.)

- Karl Storz GmbH & Co. KG (Germany)

- Smith & Nephew (U.K.)

- Elekta AB (Sweden)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Shimadzu Corporation (Japan)

What are the Recent Developments in Global Image Guided Therapy Market?

- In July 2025, Philips announced FDA 510(k) clearance for the latest version of its UroNav image‑guided navigation system enhancing precision for minimally invasive prostate‑cancer therapy by enabling advanced annotation workflows that support focal therapy procedures

- In June 2025, Medtronic received FDA 510(k) clearance for the updated Visualase V2 MRI-Guided Laser Ablation System, offering enhanced hardware and software workflow improvements for minimally invasive neurosurgical procedures such as laser ablation of brain tumors and focal epilepsy under real‑time MRI guidance

- In March 2025, a market‑analysis firm highlighted increasing integration of AI and machine‑learning into image-guided surgery systems citing that these “intelligent surgery devices” are contributing to improved surgical precision and real-time image analysis in operating rooms, reflecting broader adoption and technological maturation in IGT

- In June 2024, Siemens Healthineers received U.S. FDA clearance for its new Biograph Trinion PET/CT Scanner, a high‑performance, energy‑efficient PET/CT system with air-cooled digital detectors and ultrafast time‑of‑flight capabilities — enabling more precise oncologic, cardiologic and neurologic imaging at lower radiation doses, while simplifying installation compared to legacy PET/CT scanners

- In September 2023, Insight Medbotics announced that its IGAR MRI‑compatible Robot became the world’s first robotic guidance and placement system cleared by the FDA to operate inside an MRI bore marking a milestone in integrating robotics directly within MRI‑guided interventions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.