Global Imaging Tracers Market

Market Size in USD Billion

CAGR :

%

USD

4.00 Billion

USD

5.75 Billion

2024

2032

USD

4.00 Billion

USD

5.75 Billion

2024

2032

| 2025 –2032 | |

| USD 4.00 Billion | |

| USD 5.75 Billion | |

|

|

|

|

Imaging Tracers Market Size

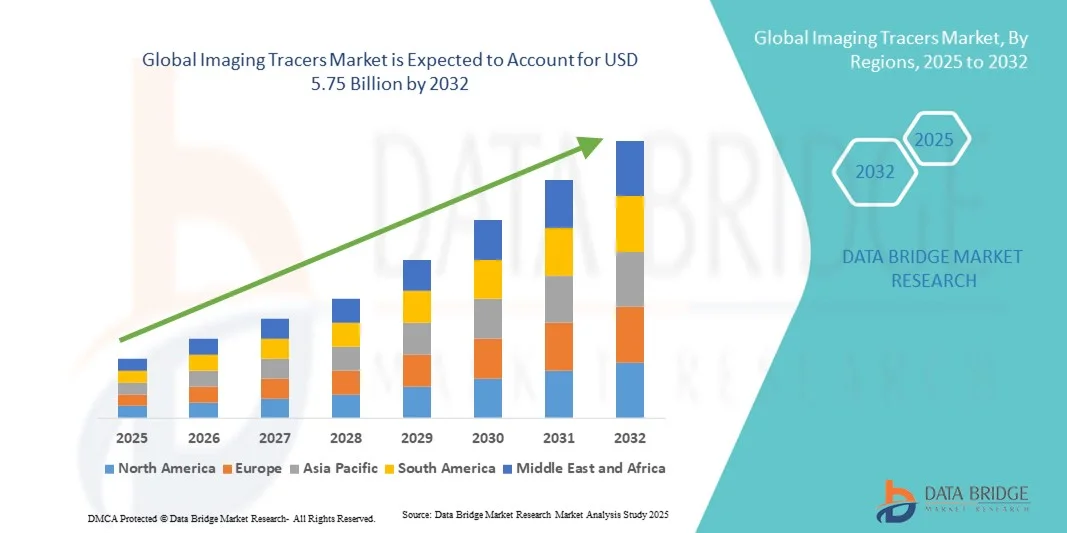

- The global imaging tracers market size was valued at USD 4.00 billion in 2024 and is expected to reach USD 5.75 billion by 2032, at a CAGR of 4.65% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced diagnostic imaging technologies and the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which are driving the demand for accurate and efficient imaging tracers across healthcare facilities globally

- Furthermore, continuous advancements in radiopharmaceutical development, coupled with growing investments in nuclear medicine and molecular imaging, are establishing imaging tracers as critical tools for early disease detection and personalized treatment planning. These converging factors are accelerating the uptake of Imaging Tracers solutions, thereby significantly boosting the industry's growth

Imaging Tracers Market Analysis

- Imaging tracers, which play a crucial role in enhancing the accuracy of diagnostic imaging modalities such as PET, SPECT, and MRI, are increasingly vital in the detection and monitoring of various diseases including cancer, neurological disorders, and cardiovascular conditions, due to their ability to visualize biological processes at the molecular level

- The escalating demand for imaging tracers is primarily fueled by the rising prevalence of chronic diseases, growing investments in molecular imaging research, and technological advancements in radiopharmaceutical development that enable more precise and personalized diagnosis

- North America dominated the imaging tracers market with the largest revenue share of 41.8% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and the strong presence of key industry players. The U.S. experienced substantial growth in imaging tracer utilization, particularly across oncology and neurology applications, driven by innovations from both established pharmaceutical companies and emerging biotechnology firms

- Asia-Pacific is expected to be the fastest-growing region in the imaging tracers market during the forecast period, projected to record a CAGR of 8.7%, owing to rising healthcare investments, expanding diagnostic imaging facilities, and increasing awareness of early disease detection

- The PET segment held the largest market revenue share of 58.4% in 2024, attributed to its superior sensitivity, accuracy, and quantitative capabilities in identifying physiological and biochemical changes at the molecular level

Report Scope and Imaging Tracers Market Segmentation

|

Attributes |

Imaging Tracers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Imaging Tracers Market Trends

Advancements in AI-Powered and Targeted Molecular Imaging Solutions

- A significant and accelerating trend in the global imaging tracers market is the increasing integration of artificial intelligence (AI) and precision medicine technologies for more accurate disease detection, diagnosis, and therapy monitoring. The use of AI in radiopharmaceutical imaging is enhancing tracer quantification, image reconstruction, and pattern recognition, allowing clinicians to identify abnormalities at earlier stages and with greater accuracy

- For instance, in May 2024, GE HealthCare announced the integration of AI-based image analysis tools with its PET tracers to enhance the accuracy of neurological and oncology scans, helping physicians interpret images more efficiently and confidently. Similarly, Siemens Healthineers is investing in AI-assisted molecular imaging workflows that support real-time quantification and visualization of tracer uptake in various disease pathways

- AI integration also facilitates personalized imaging by helping to predict optimal tracer dosing and reducing scanning times, thereby improving patient comfort and workflow efficiency. Companies are increasingly focusing on developing machine learning algorithms capable of identifying specific biomarkers that correlate with disease progression, which strengthens the diagnostic utility of imaging tracers in oncology, cardiology, and neurology applications

- Furthermore, the growing adoption of hybrid imaging modalities such as PET/CT and PET/MRI is boosting demand for next-generation tracers designed to target multiple biological processes simultaneously. Advanced tracers for Alzheimer’s disease, prostate cancer, and cardiovascular disorders are being developed to improve diagnostic precision and treatment outcomes

- This trend toward AI-enhanced and highly specific molecular imaging is fundamentally reshaping diagnostic capabilities and accelerating the shift toward precision healthcare. Companies such as GE HealthCare, Siemens Healthineers, and Novartis are actively investing in digital platforms and smart imaging tracer solutions to enhance diagnostic accuracy and clinical decision-making

- The demand for AI-driven, disease-specific imaging tracers is rapidly growing across healthcare institutions, as clinicians and researchers increasingly prioritize early detection, personalized treatment planning, and improved patient outcomes

Imaging Tracers Market Dynamics

Driver

Rising Demand for Early and Accurate Disease Diagnosis Across Oncology and Neurology Applications

- The growing global burden of chronic and life-threatening diseases, particularly cancer and neurological disorders, is a key driver of the Imaging Tracers market. Imaging tracers are essential in PET and SPECT scans for visualizing biological processes at the molecular level, enabling earlier and more precise diagnosis than conventional imaging methods

- For instance, in February 2024, Eli Lilly and Company announced FDA approval for Tauvid, an advanced PET imaging tracer designed for detecting tau pathology in Alzheimer’s disease, marking a significant milestone in neurological diagnostics. Similarly, in October 2023, Novartis introduced a new PSMA-targeted tracer for prostate cancer imaging in Europe, improving the accuracy of cancer staging and monitoring

- The increasing use of PET/CT and PET/MRI hybrid imaging systems across hospitals and diagnostic centers is also fueling the need for novel radiotracers that offer superior image clarity and quantitative accuracy. These innovations are being driven by the rising emphasis on precision medicine, where treatment plans are tailored to individual patient biology

- In addition, the growing investments by public and private healthcare sectors in molecular imaging infrastructure and research are promoting the adoption of advanced tracers. The development of fluorine-18 and gallium-68–based radiopharmaceuticals, known for their high sensitivity and short half-life, is further enhancing clinical utility and operational efficiency

- As patient awareness and physician preference shift toward minimally invasive diagnostic methods, the adoption of next-generation imaging tracers is expected to accelerate significantly during the forecast period. The demand for accurate, safe, and targeted imaging agents is propelling continuous innovation and expansion of product portfolios among leading market players

Restraint/Challenge

High Production Costs, Short Half-Life, and Stringent Regulatory Frameworks

- One of the major challenges restraining the Imaging Tracers market is the high production and operational cost associated with radiopharmaceuticals. The short half-life of most tracers necessitates on-site or nearby cyclotron facilities, increasing infrastructure investments and limiting accessibility in smaller diagnostic centers or developing regions

- For instance, gallium-68 and fluorine-18 tracers require specialized handling and rapid distribution networks to maintain radiochemical purity, significantly increasing logistical complexity and cost per dose. This limits widespread adoption, particularly in low- and middle-income countries where advanced nuclear imaging infrastructure is scarce

- In addition, the stringent regulatory environment governing radiopharmaceutical approvals adds to development timelines and compliance burdens for manufacturers. The need for extensive clinical validation, radiological safety measures, and Good Manufacturing Practice (GMP) certifications creates barriers for new entrants and slows innovation cycles

- Another key restraint is the limited availability of skilled nuclear medicine professionals capable of handling, administering, and interpreting tracer-based imaging procedures. This workforce shortage is particularly acute in emerging markets and poses a long-term challenge to scaling adoption

- Furthermore, reimbursement limitations and cost-containment policies in several healthcare systems restrict the use of newer, higher-priced tracers despite their superior diagnostic capabilities. Patients and healthcare providers often face out-of-pocket costs, reducing demand in price-sensitive markets

- Overcoming these challenges will require continuous investment in radiopharmaceutical production facilities, streamlined regulatory pathways, and increased awareness among healthcare providers about the clinical and economic benefits of early, accurate diagnosis using advanced imaging tracers

Imaging Tracers Market Scope

The market is segmented on the basis of application and modality.

- By Application

On the basis of application, the Imaging Tracers market is segmented into oncology, cardiology, gastrointestinal disorders, neurology disorders, cancer, musculoskeletal disorders, and others. The oncology segment dominated the largest market revenue share of 42.6% in 2024, driven by the growing global incidence of cancer and the widespread use of PET and SPECT tracers in tumor detection, staging, and therapy monitoring. The adoption of targeted tracers such as fluorodeoxyglucose (FDG), gallium-68 PSMA, and fluorine-18–based radiopharmaceuticals has become standard in oncology imaging. The rising demand for personalized medicine and precision diagnostics further strengthens the oncology tracer segment, as these agents enable physicians to visualize cancer cell metabolism and receptor expression in real time. In addition, advancements in hybrid imaging modalities such as PET/CT and PET/MRI are expanding diagnostic accuracy in oncology, allowing for earlier and more precise disease assessment. Continuous innovation by companies like GE HealthCare, Novartis, and Siemens Healthineers in developing tumor-specific tracers is also contributing to this segment’s strong dominance in the global market.

The neurology disorders segment is anticipated to witness the fastest growth rate of 21.3% from 2025 to 2032, fueled by the rising prevalence of neurodegenerative diseases such as Alzheimer’s and Parkinson’s, coupled with increasing research on brain metabolism and receptor mapping. Neurological imaging tracers, including amyloid and tau-specific agents, are transforming early diagnosis and monitoring of disease progression in dementia-related conditions. The surge in regulatory approvals, such as Eli Lilly’s Tauvid and GE HealthCare’s Vizamyl, highlights expanding clinical utility and commercial adoption in neurology applications. In addition, growing investments in brain imaging research and the incorporation of AI-driven image analysis tools enhance precision and efficiency in detecting subtle neurological changes. The rising geriatric population and higher awareness of early intervention therapies are also boosting demand for tracer-based neuroimaging across hospitals and research centers globally.

- By Modality

On the basis of modality, the Imaging Tracers market is segmented into CT and PET. The PET segment held the largest market revenue share of 58.4% in 2024, attributed to its superior sensitivity, accuracy, and quantitative capabilities in identifying physiological and biochemical changes at the molecular level. PET imaging tracers such as fluorine-18 FDG, gallium-68 DOTATATE, and zirconium-89 are widely utilized for oncology, cardiology, and neurology diagnostics. The modality’s ability to offer high-resolution, real-time metabolic imaging makes it indispensable for precision medicine and therapy monitoring. PET’s growing integration with advanced software for data reconstruction and AI-based image quantification further enhances its diagnostic performance. In addition, the increasing adoption of hybrid imaging systems such as PET/CT and PET/MRI across hospitals and diagnostic centers is driving tracer demand, particularly in developed markets with robust radiopharmaceutical infrastructure and cyclotron availability.

The CT segment is projected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by technological advancements in hybrid imaging, rising utilization of contrast-enhanced CT tracers, and growing applications in cardiovascular and gastrointestinal diagnostics. CT imaging tracers provide detailed anatomical and structural information that complements functional data from PET or SPECT scans. The growing preference for low-dose and high-speed CT technologies, coupled with AI-based reconstruction algorithms, is enhancing diagnostic precision while reducing patient exposure to radiation. In addition, expanding applications of CT tracers in detecting vascular anomalies, tumors, and inflammatory conditions are increasing their clinical importance. The development of novel contrast agents with improved biocompatibility and image clarity, along with the cost-effectiveness of CT imaging, is expected to sustain the segment’s rapid growth throughout the forecast period

Imaging Tracers Market Regional Analysis

- North America dominated the imaging tracers market with the largest revenue share of 41.8% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and the strong presence of key industry players

- The region’s leadership is further reinforced by rapid adoption of molecular imaging technologies, ongoing clinical research, and significant investments in oncology and neurology imaging. Favorable reimbursement policies and continuous product innovation from pharmaceutical and biotechnology firms contribute to market expansion

- Furthermore, rising demand for personalized medicine and increasing emphasis on early disease detection through PET and SPECT tracers continue to drive regional growth. The market also benefits from collaborations between academic institutions and radiopharmaceutical developers aimed at advancing next-generation imaging tracers for cancer and neurodegenerative diseases

U.S. Imaging Tracers Market Insight

The U.S. imaging tracers market captured the largest revenue share of 82% in 2024 within North America, primarily driven by strong R&D investment, an expanding network of diagnostic imaging centers, and growing use of PET and CT tracers for oncology, cardiology, and neurology applications. The U.S. market benefits from the robust presence of key players such as GE HealthCare, Cardinal Health, and Curium, who are continuously developing advanced tracers for clinical and research purposes. Moreover, the country’s emphasis on early diagnosis and the integration of AI and hybrid imaging platforms further accelerate demand. Increasing FDA approvals for novel tracers targeting Alzheimer’s and various cancers are also contributing significantly to market growth, ensuring the U.S. remains a global leader in imaging tracer innovation.

Europe Imaging Tracers Market Insight

The Europe imaging tracers market is projected to expand at a substantial CAGR throughout the forecast period, supported by advanced diagnostic imaging infrastructure, rising government initiatives for cancer screening, and growing preference for precision diagnostics. The increasing adoption of PET and SPECT imaging tracers for oncology and neurological disorders, coupled with a growing focus on nuclear medicine research, fuels market growth. European regulatory agencies are actively encouraging innovation and quality assurance in tracer production, facilitating broader clinical usage across hospitals and research institutions. Key countries such as the U.K., Germany, and France are leading contributors, with substantial investments in molecular imaging centers and radiopharmaceutical manufacturing capacity.

U.K. Imaging Tracers Market Insight

The U.K. imaging tracers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding NHS-backed diagnostic programs and rising adoption of molecular imaging in cancer and dementia diagnosis. The country’s focus on early disease detection and increasing participation in clinical research trials for novel tracers are accelerating growth. Collaborations between public healthcare providers and private imaging companies are also helping improve tracer accessibility and affordability. Furthermore, growing investments in PET/CT infrastructure and partnerships with global radiopharmaceutical suppliers are expected to strengthen the market outlook for the U.K.

Germany Imaging Tracers Market Insight

The Germany imaging tracers market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare expenditure, the country’s emphasis on technological innovation, and its strong presence in medical imaging manufacturing. Germany’s active support for radiopharmaceutical development and its commitment to sustainability in medical isotope production are key growth factors. The presence of well-established research facilities and partnerships with academic institutions are accelerating the commercialization of new imaging tracers. In addition, the increasing adoption of PET/MRI hybrid systems and clinical trials focusing on Alzheimer’s and prostate cancer tracers continue to enhance market penetration across hospitals and diagnostic centers.

Asia-Pacific Imaging Tracers Market Insight

The Asia-Pacific imaging tracers market is poised to grow at the fastest CAGR of 8.7% during 2025–2032, driven by rising healthcare investments, expanding diagnostic imaging facilities, and increasing awareness of early disease detection. Governments across the region are promoting nuclear medicine and diagnostic imaging infrastructure to improve healthcare outcomes. Countries such as China, Japan, and India are witnessing a surge in demand for PET and SPECT imaging tracers, especially for oncology and cardiovascular applications. The growing number of cyclotron facilities, coupled with public-private collaborations for radiopharmaceutical production, is further driving market expansion. The increasing availability of cost-effective imaging solutions and training programs for nuclear medicine professionals also enhances accessibility and adoption across emerging economies.

Japan Imaging Tracers Market Insight

The imaging tracers market is gaining strong momentum due to the nation’s advanced medical imaging technology, aging population, and growing focus on cancer and neurological diagnostics. Japan’s commitment to early disease detection, combined with its leadership in radiopharmaceutical innovation, is fostering significant market expansion. PET and SPECT imaging are increasingly utilized for clinical applications, with ongoing research into novel tracers for Alzheimer’s and cardiac imaging. Furthermore, the government’s investment in healthcare modernization and favorable regulatory pathways for radiopharmaceutical approvals continue to strengthen Japan’s role as a key regional market for imaging tracers.

China Imaging Tracers Market Insight

The China imaging tracers market accounted for the largest market revenue share in the Asia-Pacific region in 2024, attributed to rapid urbanization, an expanding middle class, and increasing adoption of advanced diagnostic imaging technologies. China’s strong domestic manufacturing base for radiopharmaceuticals and its strategic push toward healthcare innovation are key growth drivers. The nation’s investment in nuclear medicine facilities, growing cancer screening programs, and partnerships between hospitals and technology providers are accelerating market growth. In addition, supportive government policies promoting precision medicine and expanding PET/CT installations across major cities are strengthening China’s position as a leading regional hub for imaging tracers.

Imaging Tracers Market Share

The Imaging Tracers industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Bayer AG (Germany)

- Bracco Imaging S.p.A. (Italy)

- Cardinal Health, Inc. (U.S.)

- Novartis AG (Switzerland)

- Curium Pharma (France)

- Lantheus Holdings, Inc. (U.S.)

- Nihon Medi-Physics Co., Ltd. (Japan)

- Advanced Accelerator Applications (France)

- ITM Isotope Technologies Munich SE (Germany)

- Norgine B.V. (Netherlands)

- Blue Earth Diagnostics (U.K.)

- Sofie Biosciences, Inc. (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

Latest Developments in Global Imaging Tracers Market

- In June 2025, Telix Pharmaceuticals announced the approval of its PSMA-PET imaging agent, Illuccix, in Italy for prostate cancer diagnostics. This approval marked a significant step forward in improving the precision of prostate-specific membrane antigen (PSMA) detection, enabling clinicians to identify metastases with higher accuracy and optimize treatment planning for prostate cancer patients across Europe

- In October 2024, GE HealthCare received FDA approval for Flurpiridaz F-18 (Flyrcado), a novel PET imaging tracer developed for assessing myocardial ischemia and infarction. This was the first cardiac PET tracer approval in decades, providing physicians with a highly sensitive tool to evaluate blood flow and detect coronary artery disease, thus strengthening GE HealthCare’s position in the cardiovascular diagnostics sector

- In August 2024, Life Molecular Imaging (LMI) achieved a major milestone as its tau PET tracer 18F-PI-2620 received FDA Fast Track designation. The agent is designed for imaging tau protein deposits associated with neurodegenerative diseases such as Alzheimer’s disease and progressive supranuclear palsy (PSP). This designation accelerates development and review processes, highlighting growing interest in early-stage brain imaging diagnostics

- In September 2023, the Centers for Medicare and Medicaid Services (CMS) in the United States implemented significant policy reforms, lifting the one-scan-per-patient limit and unbundling payments for high-cost diagnostic radiopharmaceuticals. This policy shift expanded access to advanced PET tracers for hospitals and imaging centers, supporting wider clinical adoption and encouraging innovation in the imaging tracers market

- In May 2023, Lantheus Holdings secured FDA approval for its PSMA-targeted PET imaging agent Piflufolastat F-18 (Pylarify), intended for the detection of PSMA-positive lesions in men with prostate cancer. The approval represented a major leap in prostate cancer imaging, offering improved lesion visualization and enabling clinicians to tailor therapy decisions based on more accurate staging and recurrence assessments

- In September 2023, Sinotau Pharmaceutical Group received regulatory approval from China’s National Medical Products Administration (NMPA) for Florbetaben F-18, branded as Ouweining. This became China’s first amyloid PET imaging radiotracer for diagnosing Alzheimer’s disease, significantly advancing the nation’s neuroimaging capabilities and providing physicians with a much-needed diagnostic tool for early detection of cognitive decline

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.