Global Immune Modulating Oncology Biologic Drugs Market

Market Size in USD Billion

CAGR :

%

USD

10.10 Billion

USD

28.54 Billion

2025

2033

USD

10.10 Billion

USD

28.54 Billion

2025

2033

| 2026 –2033 | |

| USD 10.10 Billion | |

| USD 28.54 Billion | |

|

|

|

|

Immune-Modulating Oncology Biologic Drugs Market Size

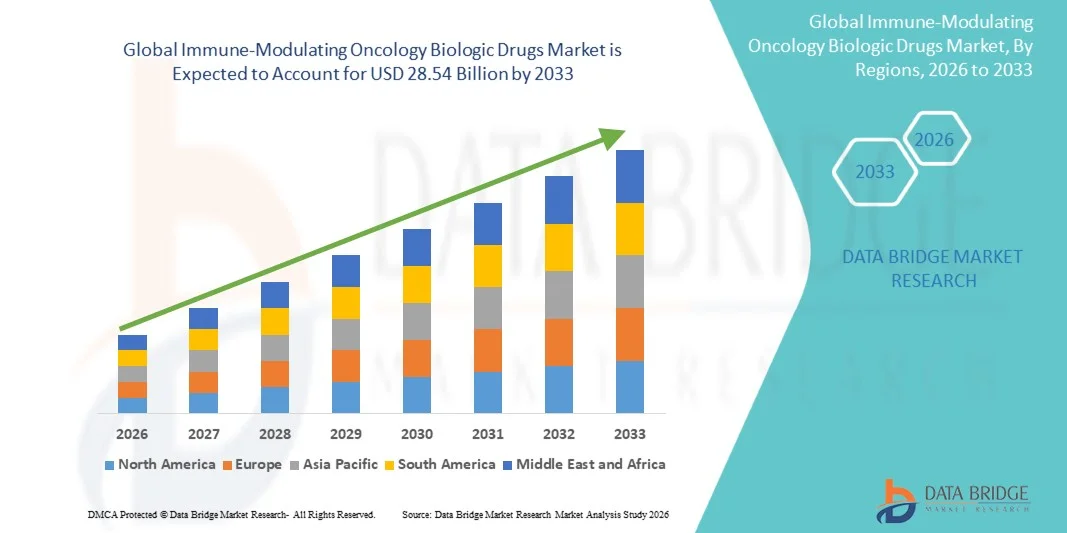

- The global immune-modulating oncology biologic drugs market size was valued at USD 10.10 billion in 2025 and is expected to reach USD 28.54 billion by 2033, at a CAGR of13.87% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cancer globally, rising investments in immunotherapy research, and rapid advancements in biologic drug development technologies

- Furthermore, growing demand for targeted and personalized cancer treatments, coupled with favorable regulatory support and collaborations between biopharma companies and research institutions, is accelerating the uptake of Immune-Modulating Oncology Biologic Drugs solutions, thereby significantly boosting the industry's growth

Immune-Modulating Oncology Biologic Drugs Market Analysis

- Immune-modulating oncology biologic drugs, offering targeted immune therapy for cancer treatment, are increasingly vital components of modern oncology care in both hospitals and specialty clinics due to their enhanced efficacy, reduced side effects, and ability to stimulate the patient’s immune system against tumors

- The escalating demand for immune-modulating oncology biologic drugs is primarily fueled by the rising prevalence of cancer, increasing adoption of immuno-oncology therapies, and growing preference for personalized and precision treatment approaches

- North America dominated the immune-modulating oncology biologic drugs market with the largest revenue share of 41.2% in 2025, characterized by advanced healthcare infrastructure, strong biopharma R&D capabilities, and high adoption of innovative biologic therapies in hospitals and specialty clinics

- Asia-Pacific is expected to be the fastest-growing region in the immune-modulating oncology biologic drugs market during the forecast period due to increasing healthcare investments, rising cancer awareness, and expanding access to immuno-oncology therapies in emerging economies

- The Monoclonal Antibodies segment dominated the largest market revenue share of 45.3% in 2025, driven by their extensive adoption in targeted cancer therapies

Report Scope and Immune-Modulating Oncology Biologic Drugs Market Segmentation

|

Attributes |

Immune-Modulating Oncology Biologic Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Immune-Modulating Oncology Biologic Drugs Market Trends

“Expansion of Targeted and Personalized Immunotherapies”

- One of the most notable trends shaping the global immune-modulating oncology biologic drugs market is the shift toward highly targeted and personalized immunotherapies

- Biopharmaceutical companies are increasingly developing therapies that harness the patient’s immune system to identify and destroy cancer cells, while minimizing damage to healthy tissue. This includes immune checkpoint inhibitors (such as PD-1, PD-L1, and CTLA-4 inhibitors), cytokine-based therapies, CAR-T cell therapies, and bispecific antibodies

- The trend reflects a move away from traditional chemotherapy and radiation toward therapies that offer precision, improved efficacy, and potentially better safety profiles

- For instance, in 2025, Bristol Myers Squibb expanded its clinical trials portfolio for Opdivo (nivolumab) to include combination treatments with anti-CTLA-4 antibodies for advanced melanoma and non-small cell lung cancer, showing enhanced tumor response rates in patients with previously limited treatment options

- Similarly, Roche’s Tecentriq (atezolizumab) has been combined with targeted chemotherapies and monoclonal antibodies in trials for triple-negative breast cancer, reflecting the growing interest in combination immunotherapy strategies

- This trend is further supported by advances in companion diagnostics, molecular profiling, and biomarker identification, enabling clinicians to stratify patients and optimize therapy selection

- With the emergence of precision medicine, the market is witnessing an increased adoption of therapies tailored to individual genetic and tumor profiles, driving both clinical outcomes and commercial growth

Immune-Modulating Oncology Biologic Drugs Market Dynamics

Driver

“Rising Cancer Incidence and Growing Immunotherapy Adoption”

- The rising global burden of cancer is a primary driver of growth in the immune-modulating oncology biologic drugs market

- According to the World Health Organization, the prevalence of cancers such as lung, breast, colorectal, and hematologic malignancies continues to rise across both developed and emerging economies, creating a substantial unmet need for effective treatment options. Immunotherapy has emerged as a preferred option due to its potential for durable responses and ability to treat advanced-stage cancers that are resistant to conventional therapies

- For instance, the global uptake of immune checkpoint inhibitors has been accelerated by their approval across multiple indications. In 2024, Roche reported a significant increase in Tecentriq adoption in both North America and Europe, largely due to expanded indications in metastatic urothelial carcinoma and non-small cell lung cancer

- Similarly, the launch of CAR-T therapies like Gilead’s Yescarta and Novartis’ Kymriah has driven adoption for hematological malignancies, with clinical studies demonstrating high remission rates in relapsed or refractory patients

- In addition, increasing investment in R&D by pharmaceutical companies, supportive government policies, and favorable reimbursement frameworks in major markets are further enabling rapid adoption

- The rising number of combination therapy trials, collaborations between biotech and academic institutions, and strategic partnerships for global commercialization are expanding access to immune-modulating biologics, accelerating the overall market growth

Restraint/Challenge

“High Costs and Safety Concerns”

- Despite their promising clinical outcomes, high costs and safety concerns continue to challenge broader adoption of immune-modulating oncology biologic drugs

- The complex manufacturing processes for biologics, stringent quality control requirements, and lengthy clinical development phases contribute to their high price, often exceeding several hundred thousand dollars per patient per treatment cycle

- Such costs limit access in developing countries and among underinsured populations, posing a significant barrier to market expansion

- Moreover, immune-related adverse events (irAEs) associated with these therapies—such as cytokine release syndrome, autoimmune reactions, and organ-specific toxicities—require careful clinical management, frequent monitoring, and specialized healthcare infrastructure

- For instance, in 2024, a clinical report highlighted severe cytokine release syndrome in a subset of patients receiving Novartis’ Kymriah (CAR-T therapy), requiring intensive care interventions and close hospital monitoring

- Patients receiving CAR-T therapy must often be hospitalized in specialized centers for close observation during the first few weeks post-infusion, increasing the overall treatment cost and logistical complexity

- Companies are addressing these challenges through the development of optimized dosing regimens, improved patient selection using predictive biomarkers, and post-marketing safety studies

- However, until cost-reduction strategies and broader healthcare access are achieved, these factors remain significant restraints on the widespread adoption of immune-modulating oncology biologic drugs

Immune-Modulating Oncology Biologic Drugs Market Scope

The market is segmented on the basis of type, mechanism of action, and application.

• By Type

On the basis of type, the Immune-Modulating Oncology Biologic Drugs market is segmented into Monoclonal Antibodies, Cytokines, Immune Checkpoint Inhibitors, Cancer Vaccines, and Others. The Monoclonal Antibodies segment dominated the largest market revenue share of 45.3% in 2025, driven by their extensive adoption in targeted cancer therapies. Monoclonal antibodies offer high specificity toward tumor antigens, minimizing off-target effects and improving patient outcomes. Hospitals and oncology centers prefer these biologics for solid and hematological cancers. Continuous approvals by regulatory authorities support steady uptake. Integration into combination therapies further fuels demand. Widespread clinical familiarity ensures physician confidence. Technological advances in antibody engineering enhance efficacy. Biopharmaceutical companies maintain robust R&D pipelines, strengthening supply. Global reimbursement policies favor monoclonal antibody-based therapies. Growing cancer prevalence drives patient volumes. Availability in both branded and biosimilar formats supports penetration. Long-term contracts with healthcare systems secure revenue stability. These factors collectively sustain market dominance.

The Immune Checkpoint Inhibitors segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, fueled by rising adoption of PD-1, PD-L1, and CTLA-4 inhibitors across multiple cancers. Increasing clinical trial successes and regulatory approvals accelerate usage. High efficacy in lung cancer, melanoma, and hematological malignancies drives uptake. Expanding immunotherapy awareness among oncologists supports adoption. Rising investments in personalized oncology care enhance market penetration. Combination therapies with chemotherapy and targeted drugs increase versatility. Growing patient preference for immunotherapy due to reduced side effects bolsters growth. Healthcare infrastructure improvements in emerging regions enable access. Government initiatives and public funding for cancer immunotherapy further support CAGR. Increasing insurance coverage improves affordability. Oncology treatment centers are expanding to meet patient demand. Continuous R&D enhances next-generation checkpoint inhibitors. These factors collectively propel rapid market growth.

• By Mechanism of Action

On the basis of mechanism of action, the Immune-Modulating Oncology Biologic Drugs market is segmented into T-Cell Modulators, B-Cell Modulators, Natural Killer Cell Modulators, Tumor-Associated Antigen Targeting, and Others. The T-Cell Modulators segment accounted for the largest revenue share of 39.7% in 2025, driven by the pivotal role of T-cells in immune surveillance and cancer destruction. Therapies targeting T-cell activation or checkpoint inhibition are widely used across melanoma, lung, and colorectal cancers. High efficacy in clinical trials supports adoption. T-cell modulators are incorporated in combination regimens for enhanced outcomes. Hospitals and oncology centers favor these drugs due to predictable safety profiles. Robust R&D investments continuously improve efficacy. Strong presence of leading pharmaceutical companies ensures supply consistency. Growing global prevalence of solid tumors drives demand. Positive reimbursement policies accelerate patient access. Physician familiarity supports sustained usage. Regulatory approvals for novel indications further expand the patient pool. Continuous scientific validation strengthens clinical confidence. These factors collectively maintain dominance.

The Natural Killer (NK) Cell Modulators segment is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, fueled by the growing recognition of NK cells in immuno-oncology. Emerging therapies targeting NK cell activation or adoptive NK cell transfer are gaining traction. Clinical trials demonstrate efficacy in hematologic malignancies and solid tumors. Rising investment in cellular immunotherapy supports market growth. Expanding manufacturing capabilities for NK cell therapies improve accessibility. Combination with monoclonal antibodies enhances therapeutic potential. Government and private funding for immunotherapy R&D drives pipeline expansion. Awareness programs by oncology associations support adoption. Adoption in personalized medicine strategies fuels growth. Increasing oncology center capacity in Asia-Pacific and Latin America enables market penetration. Favorable regulatory landscape facilitates faster approvals. Growing clinical evidence validates safety and effectiveness. These factors collectively propel rapid CAGR growth.

• By Application

On the basis of application, the Immune-Modulating Oncology Biologic Drugs market is segmented into Lung Cancer, Melanoma, Breast Cancer, Colorectal Cancer, Hematological Malignancies, and Others. The Lung Cancer segment dominated the market with a revenue share of 31.8% in 2025, driven by high global incidence and mortality rates. Immune-modulating biologics such as PD-1/PD-L1 inhibitors and monoclonal antibodies are widely prescribed in first-line and second-line treatment regimens. Increasing awareness of immunotherapy options among patients supports adoption. Hospitals and oncology centers prioritize lung cancer immunotherapy due to improved survival outcomes. Strong clinical trial pipelines ensure continuous product availability. Combination therapies with chemotherapy and targeted drugs enhance efficacy. Regulatory approvals for multiple indications boost physician confidence. Public and private reimbursement coverage increases patient access. Rising geriatric population and smoking-related cancers expand the patient base. Oncology networks promote guideline-based treatment. Integration into hospital protocols supports consistent utilization. Ongoing innovations in drug formulations improve tolerability. These factors collectively maintain segment dominance.

The Hematological Malignancies segment is projected to grow at the fastest CAGR of 10.5% from 2026 to 2033, driven by increasing use of CAR-T therapies, bispecific antibodies, and NK cell modulators. Expansion of blood cancer treatment centers accelerates adoption. Strong efficacy in leukemia, lymphoma, and myeloma drives clinical demand. Rising investment in immunotherapy R&D supports pipeline growth. Technological advancements improve safety and treatment precision. Regulatory approvals and accelerated pathways enhance patient access. Integration of biologics in combination therapy strategies boosts adoption. Increasing insurance coverage improves affordability in key markets. Growing awareness of personalized medicine strengthens uptake. Hospital-based and outpatient hematology programs facilitate distribution. Academic collaborations promote clinical adoption. Patient advocacy groups support education and treatment access. These factors collectively drive strong CAGR growth.

Immune-Modulating Oncology Biologic Drugs Market Regional Analysis

- North America dominated the immune-modulating oncology biologic drugs market with the largest revenue share of 41.2% in 2025, driven by the region’s advanced healthcare infrastructure, strong biopharma R&D capabilities, and high adoption of innovative biologic therapies in hospitals and specialty clinics. The U.S. represents the largest market within the region, accounting for over 78% of North America’s revenue, supported by regulatory approvals for novel immunotherapies and rapid clinical adoption. Hospitals and oncology centers are increasingly incorporating monoclonal antibodies, checkpoint inhibitors, and cellular therapies into standard treatment protocols

- High healthcare spending and favorable reimbursement policies further enhance market penetration. Continuous pipeline expansion and approvals for multiple indications sustain growth. Physicians and patients are increasingly aware of immuno-oncology benefits, leading to robust uptake

- Strong presence of major pharmaceutical companies ensures consistent supply. Investment in clinical trials accelerates innovation. The rising prevalence of lung cancer, melanoma, and hematological malignancies fuels demand. North American oncologists are early adopters of combination therapies, integrating immune-modulating biologics with targeted treatments. These factors collectively maintain dominance in the global market

U.S. Immune-Modulating Oncology Biologic Drugs Market Insight

The U.S. immune-modulating oncology biologic drugs market captured the largest revenue share of North America’s market in 2025, reflecting the country’s advanced healthcare infrastructure, strong biopharma R&D capabilities, and rapid adoption of innovative immuno-oncology therapies. Hospitals, specialty cancer clinics, and academic medical centers are the primary end users, incorporating monoclonal antibodies, checkpoint inhibitors, cytokines, and cellular therapies into standard treatment protocols. Rising incidence of lung cancer, breast cancer, melanoma, and hematological malignancies fuels demand. Regulatory approvals and accelerated FDA pathways enable faster adoption of novel biologics. High patient awareness, physician familiarity with immunotherapies, and favorable reimbursement policies strengthen market uptake. Combination therapies, integrating immune-modulating biologics with conventional treatments, are increasingly common. Clinical trials and robust pipeline developments from major pharmaceutical companies ensure continuous innovation. Investments in advanced treatment centers and oncology-focused infrastructure further support growth. Patient preference for therapies with improved efficacy and manageable side effects boosts adoption. Government initiatives and private partnerships enhance access to cutting-edge therapies across urban and semi-urban regions. The market benefits from extensive healthcare coverage and insurance frameworks. Digital health integration and telemedicine services improve patient engagement and adherence. The U.S. market is projected to grow at a CAGR of 10.8% from 2026 to 2033, maintaining its position as the global leader in immune-modulating oncology biologic drug adoption.

Europe Immune-Modulating Oncology Biologic Drugs Market Insight

The Europe immune-modulating oncology biologic drugs market accounted for a substantial share of 28.7% in 2025, with strong demand for immunotherapies across Western European countries. Rising cancer incidence, particularly in lung, breast, and colorectal cancers, drives adoption of immune-modulating biologics. Germany, the UK, and France are key contributors due to advanced healthcare systems and government support for oncology treatments. Increasing clinical trials and approval of novel biologics expand treatment options. Hospitals and specialty clinics prioritize therapies with proven efficacy and manageable safety profiles. Growing awareness of immunotherapy benefits among patients supports uptake. Insurance coverage and reimbursement policies improve accessibility. Research collaborations and academic partnerships foster adoption. Regulatory frameworks are favorable, enabling rapid market entry for new biologics. Focus on precision medicine strengthens targeted therapy usage. Public-private initiatives support clinical infrastructure improvements. High physician confidence in monoclonal antibodies and checkpoint inhibitors sustains dominance. Europe’s strategic position in pharmaceutical R&D pipelines enhances market competitiveness. The market is projected to grow at a CAGR of 9.2% from 2026 to 2033.

U.K. Immune-Modulating Oncology Biologic Drugs Market Insight

The U.K. immune-modulating oncology biologic drugs market contributed approximately 8.5% of Europe’s revenue in 2025, driven by rising adoption of immuno-oncology therapies and integration into NHS cancer treatment protocols. The focus on early diagnosis and immunotherapy for lung, melanoma, and hematological cancers accelerates market growth. Hospitals and oncology centers are expanding infrastructure for cellular therapies and monoclonal antibodies. Robust regulatory support and access to clinical trials ensure timely adoption. The increasing awareness of immunotherapy efficacy among physicians and patients enhances treatment penetration. Reimbursement policies under the NHS facilitate access to advanced biologics. Combination therapies with standard chemotherapy further encourage uptake. Research collaborations with biotech firms strengthen innovation. E-commerce and telemedicine services improve patient engagement and adherence. Aging population and rising cancer prevalence contribute to consistent demand. Ongoing pipeline approvals and novel indications sustain growth. The segment is projected to grow at a CAGR of 9.5% from 2026 to 2033.

Germany Immune-Modulating Oncology Biologic Drugs Market Insight

Germany immune-modulating oncology biologic drugs market accounted for around 9.8% of Europe’s market share in 2025, reflecting the country’s advanced healthcare system, strong oncology network, and significant biopharma presence. Hospitals and cancer centers are early adopters of monoclonal antibodies, checkpoint inhibitors, and CAR-T therapies. Increasing prevalence of breast, colorectal, and hematological cancers drives demand for immune-modulating biologics. Clinical trial activity is robust, enabling rapid introduction of novel therapies. Government funding supports immunotherapy adoption. High patient awareness and physician familiarity with biologics increase utilization rates. Expansion of oncology treatment centers in urban areas strengthens access. The market benefits from structured reimbursement and pricing policies. Continuous R&D and partnerships with biotech firms ensure a steady pipeline. German healthcare providers prioritize combination therapies and personalized treatment plans. The market is projected to grow at a CAGR of 8.9% from 2026 to 2033, reflecting steady but sustainable growth.

Asia-Pacific Immune-Modulating Oncology Biologic Drugs Market Insight

Asia-Pacific immune-modulating oncology biologic drugs market is expected to be the fastest-growing region with a CAGR of 11.8% from 2026 to 2033, driven by increasing healthcare investments, rising cancer awareness, and expanding access to immuno-oncology therapies in emerging economies such as China, India, and Japan. Growing prevalence of lung, breast, and hematological malignancies accelerates demand. Hospitals and specialty oncology centers are rapidly adopting monoclonal antibodies, checkpoint inhibitors, and cell-based therapies. Rising government support, increasing clinical trial infrastructure, and private investments enhance market expansion. Growing awareness among physicians and patients supports immunotherapy penetration. Increasing insurance coverage and reimbursement schemes improve accessibility. Urbanization and rising disposable incomes drive hospital utilization. Expansion of pharmaceutical manufacturing and biotechnology sectors improves drug availability. Adoption of combination therapies enhances therapeutic outcomes. Patient preference for advanced biologics due to fewer side effects supports uptake. Regional healthcare modernization initiatives further propel growth. Strong pipeline development and approvals of novel biologics sustain momentum.

Japan Immune-Modulating Oncology Biologic Drugs Market Insight

Japan’s immune-modulating oncology biologic drugs market accounted for approximately 6.3% of the Asia-Pacific share in 2025, driven by high healthcare standards, aging population, and increasing adoption of immunotherapies in oncology. Hospitals and specialty clinics actively integrate monoclonal antibodies and checkpoint inhibitors into cancer treatment protocols. Government initiatives to promote innovative therapies facilitate adoption. Rising incidence of lung cancer, melanoma, and hematological malignancies contributes to steady demand. Strong R&D collaborations between pharma companies and academic institutions drive pipeline growth. Patient awareness campaigns and physician training improve clinical uptake. Advanced clinical trial infrastructure ensures timely access to new biologics. Reimbursement policies support affordability. Hospital expansion in urban areas strengthens therapy access. Adoption of personalized medicine encourages targeted immunotherapies. Combination therapy strategies enhance treatment efficacy. Market growth is projected at a CAGR of 11.2% from 2026 to 2033, reflecting strong regional momentum.

China Immune-Modulating Oncology Biologic Drugs Market Insight

China immune-modulating oncology biologic drugs market accounted for the largest market revenue share in Asia-Pacific, approximately 41% in 2025, driven by increasing cancer prevalence, expanding hospital networks, and government initiatives promoting immunotherapy access. Adoption of monoclonal antibodies, checkpoint inhibitors, and emerging cell therapies is growing rapidly. Hospitals and oncology centers are investing in advanced biologics to meet rising patient demand. Strong pipeline development and domestic manufacturing improve affordability. Rapid urbanization and rising disposable incomes expand the patient base. Increasing regulatory approvals for novel biologics accelerate market penetration. Awareness campaigns by healthcare authorities support physician and patient education. Expansion of insurance coverage facilitates therapy access. Clinical collaborations with biotech and pharmaceutical companies improve innovation. Emphasis on personalized treatment plans boosts adoption. The market is projected to grow at a CAGR of 12.4% from 2026 to 2033, establishing China as a key driver of regional growth.

Immune-Modulating Oncology Biologic Drugs Market Share

The Immune-Modulating Oncology Biologic Drugs industry is primarily led by well-established companies, including:

- Roche (Switzerland)

- Bristol-Myers Squibb (U.S.)

- Merck & Co. (U.S.)

- Pfizer (U.S.)

- AstraZeneca (U.K.)

- Novartis (Switzerland)

- Amgen (U.S.)

- Sanofi (France)

- Regeneron Pharmaceuticals (U.S.)

- Gilead Sciences (U.S.)

- Eli Lilly (U.S.)

- Takeda Pharmaceutical (Japan)

- Moderna (U.S.)

- CureVac (Germany)

- BioNTech (Germany)

- BeiGene (China)

- Seagen (U.S.)

- Incyte (U.S.)

- Celgene (U.S.)

- AbbVie (U.S.)

Latest Developments in Global Immune-Modulating Oncology Biologic Drugs Market

- In November 2021, the U.S. Food and Drug Administration (FDA) approved pembrolizumab (Keytruda) for adjuvant treatment of renal cell carcinoma, marking a significant expansion of this immune‑modulating biologic into earlier‑stage disease settings for patients at high risk of recurrence after surgery. This approval helped solidify Keytruda’s position as a leading PD‑1 inhibitor across multiple cancer types and demonstrated the growing reliance on immunotherapies in curative‑intent oncology care

- In January 2023, the FDA granted approval to pembrolizumab for the perioperative treatment of non‑small cell lung cancer (NSCLC), allowing its use not only in advanced disease but also in earlier, resectable stages. This trend underscored the shift toward immune modulation earlier in the treatment continuum, offering improved survival outcomes when combined with surgery

- In November 2023, the FDA approved pembrolizumab in combination with chemotherapy for the treatment of advanced biliary tract cancer, an area with historically limited therapeutic options. This regulatory milestone represented a meaningful expansion of immune‑modulating oncology biologics into traditionally difficult‑to‑treat gastrointestinal cancers, broadening patient access to immunotherapy benefits

- In March 2025, the FDA expanded pembrolizumab’s indications to include HER2‑positive gastric or gastroesophageal junction adenocarcinoma expressing PD‑L1, offering a targeted immune‑modulating approach for a subset of patients with poor prognosis and limited effective treatments. This development highlighted precision immunotherapy’s evolving role in gastric cancers

- In June 2025, the FDA approved pembrolizumab for perioperative use in resectable, locally advanced head and neck squamous cell carcinoma, making it one of the first immune‑modulating biologic agents to be routinely used in this earlier surgical setting. By enabling immunotherapy before and after surgery, this approval aimed to reduce recurrence and improve long‑term outcomes

- In May 2025, Akeso, Inc.’s penpulimab, an anti‑PD‑1 antibody with a modified Fc region, received approval in the U.S. for non‑keratinizing nasopharyngeal carcinoma, introducing a novel PD‑1 biologic designed for enhanced immune activation and potentially reduced side effects. This marked a notable entry of next‑generation immune modulators into the American market

- In May 2025, camrelizumab, a PD‑1 inhibitor developed in China, received conditional approval for use in combination with famitinib for recurrent or metastatic cervical cancer, expanding the reach of immune‑modulating biologics into critical women’s health indications and reinforcing the importance of combination approaches in oncology

- In June 2025, Teva Pharmaceutical Industries and Shanghai Fosun entered a strategic collaboration to co‑develop an innovative anti‑PD‑1‑IL‑2 ATTENUKINE therapy (TEV‑56278), aimed at enhancing antitumor immune responses while reducing toxicity. This deal reflected growing interest in next‑generation biologics that move beyond checkpoint blockade toward multifaceted immune modulation

- In June 2025, Bristol Myers Squibb (BMS) and BioNTech announced an up‑to USD 11.1 billion partnership to co‑develop a bispecific antibody targeting PD‑1 and VEGF‑A (BNT327), emphasizing industry confidence in multi‑targeted immune‑modulating strategies. By combining checkpoint inhibition with angiogenesis blockade, this collaboration aimed to enhance efficacy in solid tumors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.