Global Immunoassay Food Testing Market

Market Size in USD Billion

CAGR :

%

USD

3.80 Billion

USD

6.82 Billion

2025

2033

USD

3.80 Billion

USD

6.82 Billion

2025

2033

| 2026 –2033 | |

| USD 3.80 Billion | |

| USD 6.82 Billion | |

|

|

|

|

What is the Global Immunoassay Food Testing Market Size and Growth Rate?

- The global immunoassay food testing market size was valued at USD 3.80 billion in 2025 and is expected to reach USD 6.82 billion by 2033, at a CAGR of7.60% during the forecast period

- Rise in the number of research and development activities is the major driver escalating the market growth, also rise in the occurrences to food borne illnesses and rise in the imposition of stringent food safety regulations in emerging economies are the major factors among others driving the immunoassay food testing market growth

What are the Major Takeaways of Immunoassay Food Testing Market?

- Rise in the introduction of multi-containment analysing technology along with rising spending of food safety will further create new opportunities for the immunoassay food testing market manufacturers

- However, unavailability of food control infrastructure and resources along with lack of harmonization acts as a major factor acting as a restraint, and will further challenge the growth of immunoassay food testing market

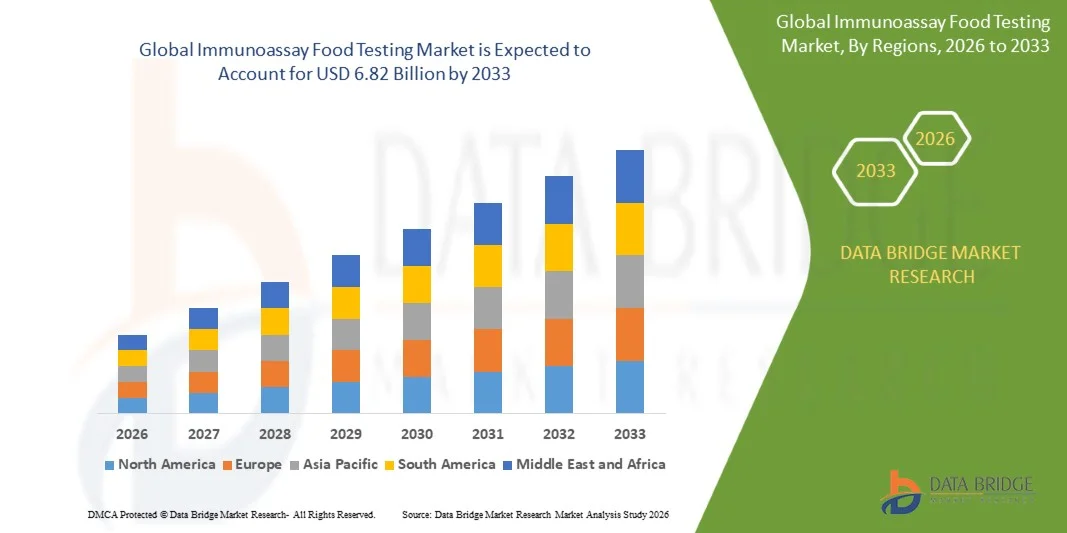

- North America dominated the immunoassay food testing market with a 34.55% revenue share in 2025, driven by strong regulatory frameworks, advanced food safety infrastructure, and widespread adoption of rapid diagnostic technologies across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.49% from 2026 to 2033, fueled by rapid growth in food processing, retail expansion, and heightened focus on food safety across China, Japan, India, South Korea, and Southeast Asia

- The meat, poultry, and seafood products segment dominated the market with a 38.7% share in 2025, driven by stringent regulatory requirements for protein authenticity, pathogen detection, and food safety in perishable protein sources

Report Scope and Immunoassay Food Testing Market Segmentation

|

Attributes |

Immunoassay Food Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Immunoassay Food Testing Market?

Increasing Adoption of Rapid, Portable, and High-Sensitivity Immunoassay Food Testing Solutions

- The immunoassay food testing market is witnessing strong adoption of compact, handheld, and automated testing devices designed to deliver rapid detection of contaminants, allergens, pathogens, and chemical residues in food samples

- Manufacturers are introducing high-throughput, multi-analyte, and software-integrated immunoassay platforms that provide faster results, cloud-enabled data management, and compatibility with laboratory and field applications

- Growing demand for portable, cost-effective, and easy-to-use testing solutions is driving usage across food processing plants, quality control labs, regulatory authorities, and academic research facilities

- For instance, companies such as Thermo Fisher Scientific, Eurofins Scientific, SGS, Merck KGaA, and Bio-Rad Laboratories have enhanced their immunoassay portfolios with multiplex detection, simplified sample prep, and real-time digital reporting

- Increasing need for faster food safety monitoring, high-accuracy testing, and compliance with stringent regulatory standards is accelerating adoption of compact and automated immunoassay devices

- As food supply chains become more complex, Immunoassay Food Testing solutions remain critical for real-time contamination detection, quality assurance, and regulatory compliance

What are the Key Drivers of Immunoassay Food Testing Market?

- Rising demand for rapid, sensitive, and reliable detection of pathogens, allergens, and chemical residues in food is a core driver of market growth

- For instance, in 2025, leading companies such as Thermo Fisher Scientific, Eurofins Scientific, and Merck KGaA launched enhanced immunoassay platforms offering multiplex testing, automation, and cloud-based data management

- Increasing regulatory scrutiny, strict food safety standards, and growing consumer awareness are boosting demand for fast and accurate testing across the U.S., Europe, and Asia-Pacific

- Advancements in enzyme-linked immunosorbent assays (ELISA), lateral flow assays, and fluorescence-based detection technologies have strengthened testing sensitivity, portability, and throughput

- Rising adoption of IoT-enabled testing devices, mobile labs, and digital reporting tools supports efficient food quality monitoring in processing plants and distribution centers

- Supported by ongoing investments in food safety R&D, analytical technology innovation, and regulatory compliance infrastructure, the Immunoassay Food Testing market is poised for long-term growth

Which Factor is Challenging the Growth of the Immunoassay Food Testing Market?

- High costs of advanced immunoassay testing kits and automated analyzers limit adoption among small-scale food processors, SMEs, and emerging market laboratories

- For instance, during 2024–2025, price fluctuations of reagents, specialized detection antibodies, and instrument components increased operational costs for several global providers

- Complexity in sample preparation, calibration, and interpretation of multiplex assays requires skilled personnel and additional training, restricting rapid deployment in some regions

- Limited awareness regarding advanced immunoassay capabilities and digital reporting solutions in developing countries slows adoption of modern testing platforms

- Competition from traditional microbiological tests, rapid test strips, and alternative analytical methods creates pricing pressure and reduces product differentiation

- To overcome these challenges, companies are focusing on cost-efficient, user-friendly designs, cloud-based result analysis, training programs, and compact portable systems to increase adoption globally

How is the Immunoassay Food Testing Market Segmented?

The market is segmented on the basis of sample type and target tested.

- By Sample Type

On the basis of sample type, the Immunoassay Food Testing market is segmented into meat, poultry, and seafood products; dairy products; packaged food; fruits & vegetables; cereals, grains & pulses; nuts, seeds, and spices; and others. The meat, poultry, and seafood products segment dominated the market with a 38.7% share in 2025, driven by stringent regulatory requirements for protein authenticity, pathogen detection, and food safety in perishable protein sources. Immunoassay testing in this segment ensures rapid detection of Salmonella, Listeria, E. coli, and undeclared meat species, making it crucial for manufacturers, distributors, and regulatory authorities.

The fruits & vegetables segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for rapid allergen, pesticide, and pathogen testing in fresh produce, coupled with rising consumer focus on food safety and quality standards.

- By Target Tested

On the basis of target tested, the market is segmented into allergens, mycotoxins, pathogens, GMOs, meat species, and others. The pathogens segment dominated the market with a 41.2% share in 2025, supported by growing incidences of foodborne illnesses, stricter government regulations, and increased testing in processing facilities and laboratories. Immunoassay technologies provide high sensitivity and rapid results for microbial contaminants, ensuring compliance with safety standards across supply chains.

The allergens segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising awareness of food allergies, regulatory mandates for allergen labeling, and the expansion of testing in packaged foods, dairy, and bakery products. Increasing consumer safety concerns and advances in multiplex immunoassay platforms are expected to accelerate adoption globally.

Which Region Holds the Largest Share of the Immunoassay Food Testing Market?

- North America dominated the immunoassay food testing market with a 34.55% revenue share in 2025, driven by strong regulatory frameworks, advanced food safety infrastructure, and widespread adoption of rapid diagnostic technologies across the U.S. and Canada. High demand for pathogen detection, allergen testing, and quality assurance in meat, dairy, and packaged foods continues to fuel the adoption of immunoassay technologies across laboratories, food processing facilities, and retail quality control centers

- Leading companies in North America are introducing automated, high-throughput, and multiplex immunoassay platforms, enhancing accuracy, efficiency, and workflow integration. Continuous investments in food safety R&D, smart food manufacturing, and regulatory compliance strengthen long-term market expansion

- Strong government oversight, established lab networks, and advanced analytical infrastructure further reinforce regional market leadership

U.S. Immunoassay Food Testing Market Insight

The U.S. is the largest contributor in North America, supported by stringent FDA regulations, growing consumer awareness, and extensive food processing and packaging industries. Rising incidences of foodborne illnesses, combined with increasing adoption of rapid pathogen and allergen detection kits, drive high demand for immunoassay testing across meat, dairy, packaged foods, and fresh produce segments. Presence of key testing laboratories, strong innovation ecosystems, and high investment in quality control technologies further accelerate market growth.

Canada Immunoassay Food Testing Market Insight

Canada contributes significantly to regional growth, driven by government-mandated food safety programs, expanding laboratory infrastructure, and increasing adoption of immunoassay-based detection methods in meat, dairy, and produce processing. Focus on sustainable agriculture, pathogen surveillance, and rapid testing solutions supports strong adoption across the country. Continuous R&D investments, skilled workforce, and regulatory alignment with global food safety standards further strengthen market penetration.

Asia-Pacific Immunoassay Food Testing Market

Asia-Pacific is projected to register the fastest CAGR of 9.49% from 2026 to 2033, fueled by rapid growth in food processing, retail expansion, and heightened focus on food safety across China, Japan, India, South Korea, and Southeast Asia. Rising demand for allergen, pathogen, and GMO testing in high-volume meat, seafood, dairy, and packaged food production drives adoption of advanced immunoassay platforms. Investments in modern laboratories, automation, and smart food testing technologies continue to accelerate regional growth.

China Immunoassay Food Testing Market Insight

China is the largest contributor to Asia-Pacific due to large-scale food manufacturing, strong government oversight, and rising consumer demand for safe, high-quality food products. Expanding use of multiplex immunoassay kits, rapid pathogen detection systems, and automated food safety labs drives widespread adoption. Local manufacturing capabilities and cost-effective solutions further enhance domestic and export market penetration.

Japan Immunoassay Food Testing Market Insight

Japan shows steady growth supported by advanced food safety regulations, sophisticated laboratory infrastructure, and a strong emphasis on quality control in packaged and processed foods. High adoption of rapid immunoassay testing systems ensures compliance with safety standards and supports long-term market expansion.

India Immunoassay Food Testing Market Insight

India is emerging as a major growth hub, driven by rising food processing activities, increased government focus on food safety, and growing consumer awareness. Rapid adoption of immunoassay technologies for pathogen, allergen, and GMO testing in meat, dairy, and packaged food sectors is accelerating market penetration.

South Korea Immunoassay Food Testing Market Insight

South Korea contributes significantly due to strong demand for high-quality, safe food products, modern laboratory infrastructure, and increasing regulatory enforcement. Adoption of high-throughput immunoassay testing for meat, seafood, and processed foods, along with government-backed food safety initiatives, supports sustained market growth.

Which are the Top Companies in Immunoassay Food Testing Market?

The immunoassay food testing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Intertek Group plc (U.K.)

- SGS SA (Switzerland)

- Eurofins Scientific (Luxembourg)

- 3M (U.S.)

- Genetic ID NA Inc. (U.S.)

- Microbac Laboratories Inc. (U.S.)

- Mérieux NutriSciences (France)

- Romer Labs Inc. (U.S.)

- AsureQuality Ltd (New Zealand)

- ALS Limited (Australia)

- Bio-Rad Laboratories (U.S.)

- Agilent Technologies, Inc. (U.S.)

- bioMérieux SA (France)

- PerkinElmer Inc. (U.S.)

- QIAGEN (Germany)

- EnviroLogix (U.S.)

- NEOGEN CORPORATION (U.S.)

- Bureau Veritas (France)

- IFP Institut Für Produktqualität (Germany)

- Merck KGaA (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Immunoassay Food Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Immunoassay Food Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Immunoassay Food Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.