Global Immunofluorescence In Autoimmune Diseases Market

Market Size in USD Billion

CAGR :

%

USD

5.02 Billion

USD

7.82 Billion

2024

2032

USD

5.02 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 5.02 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Immunofluorescence in Autoimmune Diseases Market Size

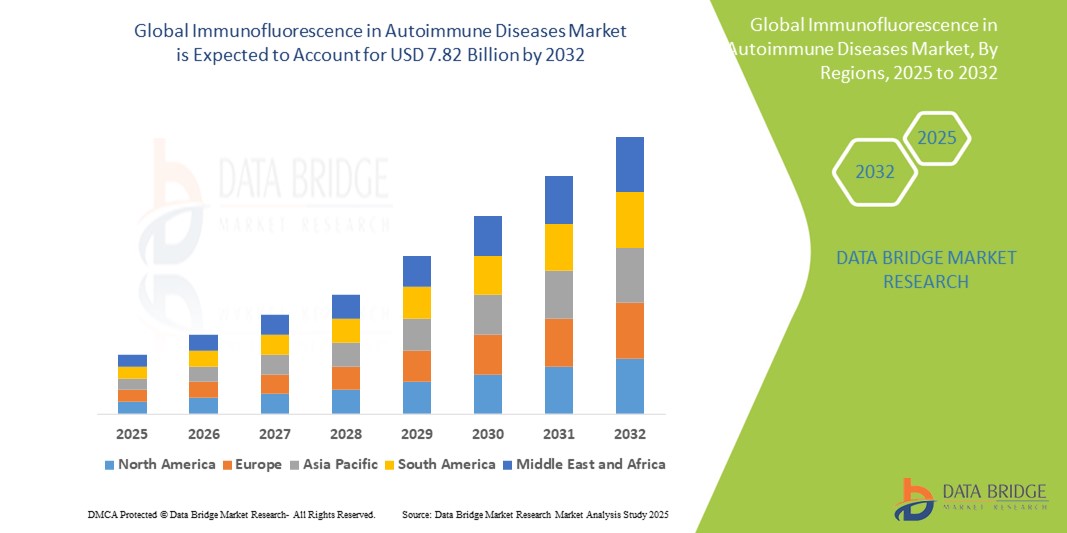

- The global immunofluorescence in autoimmune diseases market size was valued at USD 5.02 billion in 2024 and is expected to reach USD 7.82 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of autoimmune disorders, along with the growing need for accurate, sensitive, and early-stage diagnostic techniques in clinical settings. As autoimmune conditions such as systemic lupus erythematosus, rheumatoid arthritis, and autoimmune hepatitis become more commonly diagnosed, the demand for reliable immunofluorescence assays continues to rise

- Furthermore, advancements in fluorescence microscopy, digital pathology, and diagnostic automation are contributing to higher throughput and precision in testing workflows. These converging factors are accelerating the uptake of immunofluorescence-based diagnostic solutions, thereby significantly boosting the industry's growth

Immunofluorescence in Autoimmune Diseases Market Analysis

- Immunofluorescence in Immunofluorescence, a critical technique utilizing fluorescent-labeled antibodies to detect autoantibodies in patient samples, is becoming an essential diagnostic tool in identifying and monitoring autoimmune disorders across both clinical laboratories and research settings due to its high specificity, sensitivity, and ability to visualize complex antigen-antibody interactions

- The escalating demand for immunofluorescence assays is primarily fueled by the rising global prevalence of autoimmune diseases, increasing awareness regarding early diagnosis, and the growing emphasis on precision medicine in autoimmune disease management

- North America dominated the immunofluorescence in autoimmune diseases market with the largest revenue share of 41.7% in 2024, supported by advanced healthcare infrastructure, strong research funding, and the widespread adoption of technologically sophisticated diagnostic platforms, particularly in the U.S. where major hospitals and diagnostic labs are deploying immunofluorescence-based assays to improve diagnostic efficiency

- Asia-Pacific is expected to be the fastest growing region in the immunofluorescence market during the forecast period, attributed to rising healthcare expenditure, expanding laboratory networks, and increasing government initiatives focused on early disease detection and chronic disease management

- The indirect immunofluorescence segment dominated the market with a share of 65.7% in 2024, driven by its widespread use in detecting a wide array of autoantibodies and its established role in the diagnosis of systemic autoimmune diseases such as lupus erythematosus and autoimmune hepatitis

Report Scope and Immunofluorescence in Autoimmune Diseases Market Segmentation

|

Attributes |

Immunofluorescence in Autoimmune Diseases Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Immunofluorescence in Autoimmune Diseases Market Trends

“Advancements in Digital Imaging and AI-Enhanced Diagnostic Platforms”

- A significant and accelerating trend in the global immunofluorescence in autoimmune diseases market is the integration of digital imaging technologies and AI-driven diagnostic platforms. These innovations are significantly improving the accuracy, speed, and reproducibility of autoimmune disease diagnoses across clinical laboratories and research facilities

- For instance, companies such as Thermo Fisher Scientific and EUROIMMUN have developed automated immunofluorescence analyzers that incorporate high-resolution digital microscopy, enabling clinicians to perform precise pattern recognition for autoantibody detection, even with large sample volumes

- AI-enhanced software can now assist in identifying specific fluorescence patterns that correspond to distinct autoimmune diseases such as systemic lupus erythematosus (SLE) or scleroderma, reducing the variability introduced by human interpretation

- Furthermore, the integration of immunofluorescence assays into laboratory information management systems (LIMS) allows seamless data capture, storage, and analysis, streamlining lab workflows and improving decision-making

- The shift toward automation and intelligent image analysis is also enhancing laboratory efficiency by minimizing manual labor and error rates. Instruments such as the EUROLabWorkstation ELISA and IFA platforms can process hundreds of samples with minimal human intervention

- This trend towards smart, automated, and AI-supported immunodiagnostics is reshaping expectations in autoimmune disease testing, encouraging healthcare systems and laboratories to invest in cutting-edge solutions that support early detection and long-term disease monitoring

- Consequently, companies such as Inova Diagnostics and Bio-Rad Laboratories are focusing on developing next-generation immunofluorescence technologies with AI-driven image interpretation, integration with electronic medical records (EMRs), and cloud-based reporting features to meet rising diagnostic demands

Immunofluorescence in Autoimmune Diseases Market Dynamics

“Increasing Prevalence of Autoimmune Disorders and Demand for Early Diagnostic Tools”

- The rising global burden of autoimmune diseases, including conditions such as lupus, rheumatoid arthritis, and autoimmune hepatitis, is a major driver for the growing demand for immunofluorescence-based diagnostics

- For instance, according to the National Institutes of Health (NIH), over 80 autoimmune diseases have been identified, with millions of individuals affected worldwide—creating urgent demand for early, sensitive, and disease-specific diagnostic methods

- Immunofluorescence assays are regarded as the gold standard for detecting antinuclear antibodies (ANA), which are critical for diagnosing various autoimmune conditions

- In addition, increasing awareness about the importance of early detection and personalized treatment planning, especially in developed healthcare markets, is propelling the uptake of these tests

- The expansion of clinical laboratory infrastructure in emerging economies and supportive government initiatives toward chronic disease diagnostics are further fueling market growth

- Moreover, the availability of fully automated platforms, remote sample processing, and compatibility with multiplexed testing are making immunofluorescence more attractive for both centralized laboratories and point-of-care diagnostics

Restraint/Challenge

“Interpretation Complexity, Cost, and Regulatory Compliance Barriers”

- One of the major challenges facing the immunofluorescence market is the subjectivity and technical complexity involved in interpreting fluorescence patterns, which often require trained personnel and manual microscopy

- In resource-limited settings, lack of skilled professionals and inadequate access to modern imaging systems can limit the reliability and scalability of immunofluorescence testing.

- Moreover, the high cost of immunofluorescence reagents, fluorescent microscopes, and automated analyzers can act as a deterrent, particularly for small diagnostic labs or healthcare providers in cost-sensitive markets

- Regulatory hurdles related to test validation, reproducibility, and compliance with international standards can delay product approvals and restrict market entry for smaller manufacturers.

- For instance, inconsistent regulatory frameworks across regions may require companies to customize assay validations, increasing both time and cost to market

- To address these challenges, leading players are investing in user-friendly diagnostic kits, cloud-based pattern recognition software, and partnerships with hospitals and labs for training and standardization

- Tackling these barriers through enhanced automation, regulatory harmonization, and AI-based pattern recognition will be essential to drive broader adoption and unlock the full potential of immunofluorescence in autoimmune disease diagnostics

Immunofluorescence in Autoimmune Diseases Market Scope

The market is segmented on the basis of product, type, and end user.

- By Product

On the basis of product, the immunofluorescence in autoimmune diseases market is segmented into reagents, instruments, antibodies, kits, consumables, and accessories. The reagents segment dominated the market with the largest market revenue share in 2024, driven by their essential role in performing immunofluorescence assays with high specificity and accuracy. Reagents such as fluorochrome-labeled secondary antibodies and mounting media are regularly consumed in indirect and direct immunofluorescence techniques, ensuring steady demand. Their critical function in ensuring consistent and reproducible diagnostic outcomes makes them indispensable in both clinical and research settings.

The antibodies segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising incidence of autoimmune diseases and the demand for disease-specific antibody markers. Innovations in antibody engineering and the development of monoclonal antibodies targeting unique autoantigens are expanding the application of immunofluorescence in precise and early-stage autoimmune diagnostics.

- By Type

On the basis of type, the immunofluorescence in autoimmune diseases market is segmented into indirect immunofluorescence and direct immunofluorescence. The indirect immunofluorescence (IIF) segment held the largest market revenue share of 65.7% in 2024, driven by its superior sensitivity and signal amplification capabilities. IIF remains the gold standard for detecting circulating autoantibodies in serum samples, especially in systemic autoimmune diseases such as lupus and vasculitis. Its ability to test against multiple substrates in a single assay and detect a wide spectrum of autoantibodies positions it as a preferred diagnostic approach across laboratories.

The direct immunofluorescence (DIF) segment is expected to witness robust growth from 2025 to 2032, particularly due to its vital role in diagnosing autoimmune blistering skin diseases and vasculitides. DIF involves applying labeled antibodies directly to patient tissue to detect in situ deposits of immunoglobulins or complement, offering rapid diagnosis in dermatological and renal pathology applications.

- By End User

On the basis of end user, the immunofluorescence in autoimmune diseases market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, hospitals and diagnostic centers, and contract research organizations (CROs). The hospitals and diagnostic centers segment dominated the market with the largest market revenue share in 2024, attributed to their central role in autoimmune disease diagnosis and patient care. These institutions conduct large volumes of immunofluorescence-based testing for conditions such as pemphigus vulgaris, dermatomyositis, and systemic lupus erythematosus, enabling early and accurate diagnosis and treatment planning.

The pharmaceutical and biotechnology companies segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by increasing R&D activities targeting autoimmune disease therapeutics. These entities utilize immunofluorescence in drug discovery, biomarker validation, and mechanism-of-action studies, leveraging the technique's precision and ability to visualize cellular and molecular interactions within tissue samples.

Immunofluorescence in Autoimmune Diseases Market Regional Analysis

- North America dominated the immunofluorescence in autoimmune diseases market with the largest revenue share of approximately 41.7% in 2024, supported by advanced healthcare infrastructure, strong research funding, and the widespread adoption of technologically sophisticated diagnostic platforms

- The widespread implementation of indirect immunofluorescence techniques in specialized diagnostic laboratories, along with substantial investments in autoimmune research and development, further strengthens the region’s market leadership

- In addition, favorable reimbursement policies, the availability of well-established healthcare facilities, and a high concentration of key market players contribute to the sustained dominance of North America in this segment

U.S. Immunofluorescence in Autoimmune Diseases Market Insight

The U.S. immunofluorescence market captured the largest revenue share of 78% in 2024 within North America, fueled by the high prevalence of autoimmune diseases such as systemic lupus erythematosus (SLE), multiple sclerosis, and rheumatoid arthritis. The presence of advanced diagnostic laboratories and specialized autoimmune research centers has accelerated the use of both direct and indirect immunofluorescence methods. Furthermore, significant investments in life sciences research, the availability of FDA-approved diagnostic kits, and collaborations between academic institutions and diagnostic companies are fostering market expansion. Increased awareness and adoption of personalized medicine are also contributing to the market’s robust growth trajectory.

Europe Immunofluorescence in Autoimmune Diseases Market Insight

The Europe immunofluorescence market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing healthcare expenditure and emphasis on early disease detection. Countries such as Germany, the U.K., and France are at the forefront of deploying immunofluorescence-based diagnostics due to their strong medical research infrastructures. A rise in autoimmune disease incidence, aging populations, and advancements in imaging technologies are further supporting market growth. European Union support for research initiatives and harmonized regulatory policies are streamlining the clinical adoption of immunofluorescence techniques across hospitals and diagnostic labs.

U.K. Immunofluorescence in Autoimmune Diseases Market Insight

The U.K. immunofluorescence market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a strong healthcare system, government-supported research, and increasing awareness of autoimmune conditions. National initiatives to advance precision medicine and partnerships between public institutions and private diagnostics firms are driving the adoption of immunofluorescence assays. The growing preference for high-sensitivity diagnostic methods in university hospitals and the expanding base of trained pathologists and immunologists are supporting sustained growth in the U.K. market.

Germany Immunofluorescence in Autoimmune Diseases Market Insight

The Germany immunofluorescence market is expected to expand at a considerable CAGR during the forecast period, fueled by an increase in autoimmune disease diagnoses and a technologically advanced healthcare infrastructure. Germany’s focus on innovation in clinical diagnostics and its emphasis on sustainability are driving the use of eco-conscious, automated immunofluorescence instruments. Academic research institutions and pharmaceutical companies are actively adopting immunofluorescence methods to explore disease mechanisms and treatment pathways. In addition, government funding for rare disease research is indirectly supporting the demand for sensitive diagnostic platforms such as immunofluorescence.

Asia-Pacific Immunofluorescence in Autoimmune Diseases Market Insight

The Asia-Pacific immunofluorescence market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising autoimmune disease prevalence, increasing healthcare spending, and rapid modernization of laboratory infrastructure. Countries such as China, Japan, and India are leading regional growth, backed by expanding diagnostic networks and favorable government initiatives for health system upgrades. The increasing number of clinical laboratories, along with improved access to healthcare and specialized diagnostics in urban areas, is accelerating the adoption of immunofluorescence-based testing in APAC.

Japan Immunofluorescence in Autoimmune Diseases Market Insight

The Japan immunofluorescence market is gaining momentum due to its well-established biotechnology sector, advanced diagnostic capabilities, and rising aging population. The prevalence of age-related autoimmune conditions and Japan’s national focus on early disease detection are key drivers of market demand. Integration of immunofluorescence with digital pathology and image analysis systems is becoming widespread in academic hospitals. Moreover, Japan's leadership in automation and AI-assisted diagnostics is enhancing the throughput and accuracy of immunofluorescence applications across both research and clinical domains.

India Immunofluorescence in Autoimmune Diseases Market Insight

The India immunofluorescence market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s increasing focus on improving diagnostic capabilities and a growing patient base for autoimmune disorders. The rapid expansion of diagnostic laboratories, the proliferation of multispecialty hospitals, and the support of government health programs are enhancing access to advanced diagnostics such as immunofluorescence. India’s emerging biotech ecosystem, combined with the availability of cost-effective antibody reagents and domestic manufacturing capacity, positions the country as a key growth driver in the regional market.

Immunofluorescence in Autoimmune Diseases Market Share

The immunofluorescence in autoimmune diseases industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bio-Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- Inova Diagnostics, Inc. (U.S.)

- EUROIMMUN Medizinische Labordiagnostika AG (Germany)

- Abcam Limited (U.K.)

- Bio-Techne Corporation (U.S.)

- Zeus Scientific, Inc. (U.S.)

- Werfen S.A. (Spain)

- Danaher Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- DiagnoCure Inc. (Canada)

- Cell Signaling Technology, Inc. (U.S.)

- BD (U.S.)

- Abbexa Ltd (U.K.)

- Creative Diagnostics (U.S.)

- RayBiotech, Inc. (U.S.)

- Genway Biotech Inc. (U.S.)

- Antibodies-online GmbH (Germany)

What are the Recent Developments in Global Immunofluorescence in Autoimmune Diseases Market?

- In July 2024, AliveDx (Switzerland) introduced LumiQ, a fully automated immunofluorescence assay (IFA) solution designed for high-throughput autoimmune diagnostics, complemented by its MosaiQ planar microarray platform. This integrated "sample-to-answer" system streamlines the workflow by combining initial screening with confirmatory testing, enhancing both diagnostic speed and accuracy. It represents a significant move toward fully automated, end-to-end immunofluorescence testing in clinical labs

- In June 2023, EUROIMMUN (Revvity, Inc.) launched the UNIQO 160, an advanced automated indirect immunofluorescence testing (IIFT) system. Designed to handle up to 160 samples per run, it integrates sample preparation, incubation, washing, slide mounting, image acquisition, and analysis into a single benchtop unit—reducing hands-on time and streamlining workflows

- In June 2023, EUROIMMUN expanded compatibility for its EUROPattern Microscope Live, enabling 89 new IIFT assays covering vasculitis, hepatology, gastroenterology, neurology, endocrinology, nephrology, and dermatology. The update triples the system's throughput and diagnostic coverage

- In May 2023, Thermo Fisher Scientific introduced a new Autoimmune Assay Kit, engineered to deliver faster and more accurate detection of autoantibodies across a spectrum of conditions. This offering underscores Thermo Fisher’s investment in precision diagnostics for autoimmune disorders

- In March 2023, Trinity Biotech rolled out the Autoimmune Panel Plus, a diagnostic multiplex assay designed to streamline laboratory workflows by enabling simultaneous detection of multiple autoantibodies, thereby enhancing diagnostic efficiency and throughput

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.