Global Immunofluorescence Market

Market Size in USD Billion

CAGR :

%

USD

3.31 Billion

USD

5.04 Billion

2025

2033

USD

3.31 Billion

USD

5.04 Billion

2025

2033

| 2026 –2033 | |

| USD 3.31 Billion | |

| USD 5.04 Billion | |

|

|

|

|

Immunofluorescence Market Size

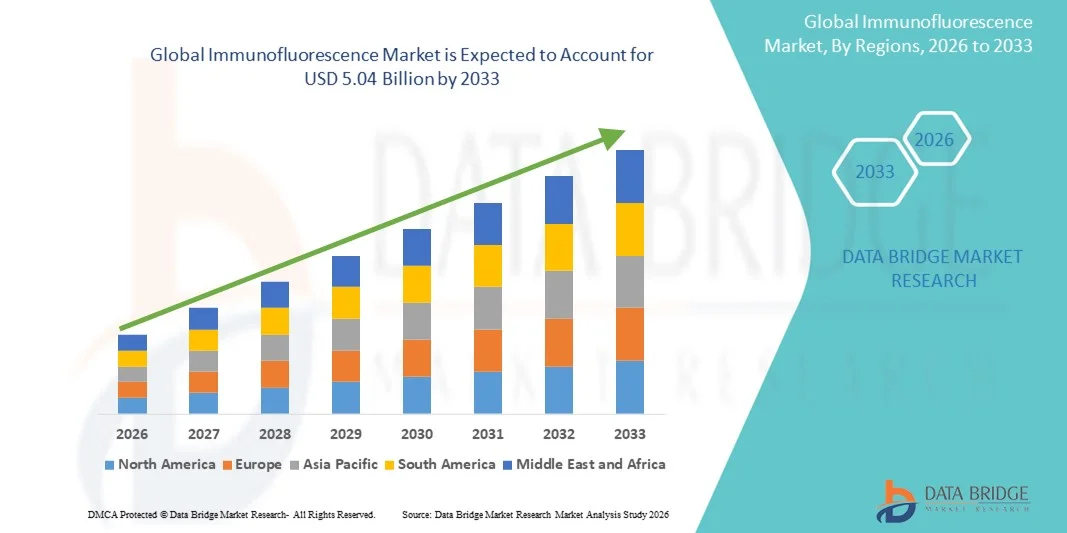

- The global immunofluorescence market size was valued at USD 3.31 billion in 2025 and is expected to reach USD 5.04 billion by 2033, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced diagnostic techniques and continuous technological advancements in fluorescence microscopy, antibodies, and imaging reagents, leading to enhanced accuracy and efficiency in disease detection across research and clinical laboratories

- Furthermore, rising demand for precise, sensitive, and multiplexed diagnostic solutions in oncology, infectious diseases, and autoimmune disorder research is accelerating the uptake of immunofluorescence techniques, thereby significantly boosting the overall growth of the immunofluorescence market

Immunofluorescence Market Analysis

- Immunofluorescence, a critical laboratory technique used for the detection and localization of specific antigens in cells and tissues, plays an increasingly important role in clinical diagnostics, pathology, and biomedical research due to its high sensitivity, specificity, and ability to support multiplex analysis in disease investigation

- The growing demand for immunofluorescence is primarily driven by rising prevalence of cancer, infectious diseases, and autoimmune disorders, along with increasing adoption of advanced diagnostic technologies, expanding research activities, and continuous advancements in fluorescence imaging systems and antibody reagents

- North America dominated the immunofluorescence market with the largest revenue share of approximately 38% in 2025, supported by a well-established healthcare and research infrastructure, high adoption of advanced diagnostic tools, strong presence of key market players, and significant investments in life sciences research. The U.S. leads the region due to extensive use of immunofluorescence in clinical pathology, oncology research, and pharmaceutical R&D

- Asia-Pacific is expected to be the fastest-growing region in the Immunofluorescence market during the forecast period, projected to grow at a CAGR driven by expanding healthcare infrastructure, increasing research funding, rising disease burden, growing biotechnology and pharmaceutical industries, and improving access to advanced diagnostic technologies in countries such as China, India, and Japan

- The laboratory diagnostics segment accounted for the largest revenue share of 56.1% in 2025, driven by routine use in hospitals, diagnostic centers, and pathology labs

Report Scope and Immunofluorescence Market Segmentation

|

Attributes |

Immunofluorescence Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Agilent Technologies (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Immunofluorescence Market Trends

Advancements in Multiplexing and Automation Techniques

- A significant and accelerating trend in the global Immunofluorescence market is the growing adoption of multiplex immunofluorescence techniques and automated imaging platforms, enabling simultaneous detection of multiple biomarkers within a single tissue or cell sample

- For instance, advanced multiplex immunofluorescence assays are increasingly used in oncology research to analyze tumor microenvironments by detecting several immune markers in parallel, improving data depth and analytical efficiency

- The integration of automated staining systems and high-throughput fluorescence imaging platforms is enhancing reproducibility, reducing manual errors, and improving workflow efficiency in research and clinical laboratories

- These advancements allow researchers to obtain more precise spatial and quantitative insights into protein expression, cellular interactions, and disease mechanisms

- In addition, the rising use of digital pathology and image analysis software is supporting better interpretation of immunofluorescence data, particularly in translational and clinical research applications

- This trend toward higher precision, scalability, and workflow automation is reshaping immunofluorescence workflows across academic research institutes, pharmaceutical companies, and diagnostic laboratories worldwide

Immunofluorescence Market Dynamics

Driver

Rising Adoption in Disease Research and Clinical Diagnostics

- The increasing prevalence of chronic diseases, including cancer, neurological disorders, and autoimmune conditions, is a key driver fueling demand for immunofluorescence techniques

- Immunofluorescence is widely used for protein localization, biomarker identification, and validation in both basic research and clinical diagnostics, making it an essential tool in modern biomedical research

- For instance, immunofluorescence assays are extensively employed in oncology research to study tumor heterogeneity and immune cell infiltration, supporting drug discovery and personalized medicine approache

- The expanding application of immunofluorescence in infectious disease research and pathology diagnostics further accelerates market growth

- Growing investments in life sciences research, increased funding for academic and translational research programs, and expanding pharmaceutical R&D pipelines are strengthening market demand

- In addition, the availability of a wide range of fluorescent antibodies, reagents, and advanced imaging systems continues to enhance adoption across research and clinical settings

Restraint/Challenge

High Technical Complexity and Cost of Advanced Systems

- The high cost associated with advanced fluorescence microscopes, automated imaging platforms, and high-quality antibodies and fluorophores poses a significant challenge to broader adoption, particularly for small and mid-sized research laboratories

- For instance, high-end confocal and super-resolution fluorescence microscopes used for advanced immunofluorescence studies can cost several hundred thousand dollars, making them inaccessible to many academic and diagnostic laboratories in cost-sensitive regions

- Immunofluorescence techniques require skilled personnel for precise sample preparation, antibody optimization, and fluorescence signal interpretation, increasing dependency on trained professionals

- Variability in staining protocols, photobleaching of fluorophores, s spectral overlap in multiplex assays can affect data reproducibility and accuracy if protocols are not carefully standardized

- In addition, recurring expenses related to reagent replacement, instrument maintenance, and calibration further increase the overall operational cost for laboratories

- Overcoming these challenges through standardized workflows, affordable reagent development, improved fluorophore stability, and expanded training programs will be critical for the sustained growth of the immunofluorescence market

Immunofluorescence Market Scope

The market is segmented on the basis of product, type, disease, application, and end-user.

- By Product

On the basis of product, the Global Immunofluorescence market is segmented into reagents, instruments, antibodies, kits, consumables, and accessories. The reagents segment dominated the largest market revenue share of 42.6% in 2025, driven by their essential role in every immunofluorescence assay workflow. Reagents, including fluorescent dyes, buffers, mounting media, and blocking solutions, are critical for both clinical diagnostics and research laboratories. Their continuous consumption ensures consistent demand, contributing to dominance. High-quality reagents improve assay sensitivity and specificity, particularly in oncology and infectious disease diagnostics. They are compatible with both primary and secondary immunofluorescence methods, enhancing versatility. Regulatory approvals for clinical-grade reagents further boost adoption. Reagents are extensively used in academic research, pharmaceutical development, and CRO studies. The increasing focus on early disease detection in hospitals also supports market leadership. Technological innovations, such as low-background and high-intensity fluorophores, are enhancing their appeal. Reagents remain integral to high-throughput laboratory workflows. Growth in personalized medicine research adds additional momentum. The segment’s dominance is reinforced by steady global demand and the need for reproducibility in experiments.

The kits segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, fueled by increasing adoption of ready-to-use, pre-packaged solutions for immunofluorescence assays. Kits reduce procedural errors and provide standardized workflows, making them highly attractive for diagnostic laboratories and research institutes. Multiplex immunofluorescence kits are gaining popularity in oncology studies for simultaneous detection of multiple biomarkers. Rising adoption in emerging markets and smaller laboratories accelerates growth. Kits offer time-saving benefits and consistent results, especially in high-throughput research and clinical settings. Manufacturers are focusing on developing kits with enhanced sensitivity and broader antigen coverage. Increasing government and private research funding further supports expansion. Kits simplify workflow for less-experienced staff, broadening their applicability. Standardization reduces assay variability, which is critical for clinical trials. Enhanced shelf-life and ease of storage are additional benefits boosting adoption. Expansion in pharmaceutical R&D for biomarker discovery continues to drive demand. Regulatory approvals for clinical diagnostics kits enhance credibility. Kits are increasingly preferred in disease surveillance and epidemiology studies.

- By Type

On the basis of type, the Immunofluorescence market is segmented into secondary/indirect immunofluorescence, primary/direct immunofluorescence, and micro immunofluorescence. The secondary/indirect immunofluorescence segment held the largest revenue share of 47.3% in 2025, supported by its superior sensitivity due to signal amplification. This type is extensively used in detecting low-abundance antigens in cancer, autoimmune disorders, and infectious disease research. Its wide applicability across clinical laboratories, research institutes, and CROs ensures consistent market demand. Secondary immunofluorescence is preferred in antibody validation and multiplex assays. The technique’s flexibility allows the use of various secondary antibodies for diverse experimental designs. Cost-effectiveness compared to direct methods also drives adoption. It is commonly used for routine diagnostic tests, screening assays, and confirmatory studies. The method provides high reproducibility and reliability, key factors in academic and pharmaceutical research. Ongoing technological enhancements in fluorescent labeling further strengthen market position. Strong regulatory backing for clinical applications enhances usage. Integration with imaging platforms enables high-resolution visualization. Growing awareness of autoimmune and cancer diagnostics supports expansion. Overall, its versatility, reliability, and reproducibility cement dominance.

The micro immunofluorescence segment is expected to grow at the fastest CAGR of 10.2% from 2026 to 2033, driven by increasing applications in infectious disease detection and pathogen identification. Micro immunofluorescence allows high-throughput testing using minimal sample volumes, making it highly suitable for epidemiological studies. The method is increasingly adopted in reference laboratories and hospitals for rapid diagnosis. Technological advancements in automated micro-immunofluorescence imaging systems further accelerate growth. Rising demand for multiplexed assays supports expansion. Adoption is increasing in both academic research and pharmaceutical R&D. Government initiatives for infectious disease monitoring also contribute. Micro immunofluorescence is highly efficient for serological screening during outbreaks. Its high sensitivity and accuracy enhance clinical reliability. Ongoing innovations in reagent miniaturization and assay kits improve usability. Increased funding for global disease surveillance accelerates market adoption. Growing awareness among laboratories in Asia-Pacific supports rapid expansion. The combination of efficiency, sensitivity, and adaptability ensures strong CAGR growth.

- By Disease

On the basis of disease, the Immunofluorescence market is segmented into cancer, infectious diseases, cardiovascular diseases, autoimmune diseases, and others. The cancer segment dominated the market with a revenue share of 39.4% in 2025, driven by widespread use of immunofluorescence for tumor biomarker detection, protein localization, and cancer signaling pathway analysis. Rising global cancer prevalence and increased oncology research funding strengthen demand. Multiplex immunofluorescence for simultaneous detection of multiple cancer markers enhances adoption. Clinical diagnostic laboratories utilize immunofluorescence for tumor profiling and companion diagnostics. The technique aids in early detection and precision medicine initiatives. Academic research applications for cancer biology continue to expand. Availability of high-quality reagents and kits contributes to segment dominance. Integration with high-resolution imaging systems improves assay accuracy. Growing adoption in pharmaceutical R&D supports market leadership. Enhanced sensitivity and specificity of modern immunofluorescence methods boost clinical relevance. Continuous development of novel fluorophores supports ongoing growth. The segment benefits from the rising emphasis on personalized medicine and translational research. Expansion of oncology-focused CROs further reinforces market share.

The infectious diseases segment is expected to register the fastest CAGR of 9.9% from 2026 to 2033, due to increasing global prevalence of viral and bacterial infections and rising testing volumes. Immunofluorescence is widely used for rapid antigen detection in hospitals and diagnostic laboratories. Rising awareness of early diagnosis and outbreak management drives adoption. Technological improvements in assay sensitivity and specificity accelerate growth. Government funding for infectious disease surveillance and pandemic preparedness contributes to expansion. Laboratories in emerging markets increasingly adopt immunofluorescence for infectious disease testing. The method is highly suitable for serological and pathogen identification studies. Multiplex infectious disease kits further support growth. Demand is also driven by rising academic research in microbiology. Collaborations between public health organizations and diagnostic companies accelerate adoption. Workflow efficiency and reproducibility enhance laboratory preference. Expansion of healthcare infrastructure globally supports the CAGR.

- By Application

On the basis of application, the Immunofluorescence market is segmented into clinical research and laboratory diagnostics. The laboratory diagnostics segment accounted for the largest revenue share of 56.1% in 2025, driven by routine use in hospitals, diagnostic centers, and pathology labs. Immunofluorescence plays a vital role in autoimmune disease confirmation, cancer testing, and infectious disease diagnostics. Increasing patient testing volumes globally support dominance. Its reliability, reproducibility, and established clinical utility reinforce adoption. Laboratory diagnostics benefit from high-throughput workflows and standardized protocols. The segment is further strengthened by strong adoption in academic hospital networks and diagnostic chains. Rapid technological advancements in imaging systems enhance diagnostic capabilities. Growing awareness of early disease detection contributes to steady growth. Expansion of clinical laboratories, especially in North America and Europe, reinforces market leadership. Availability of clinical-grade reagents and kits ensures consistent supply. Collaborations with CROs for diagnostic assay validation also enhance usage. Regulatory approvals for clinical tests strengthen the segment’s dominance. Increasing focus on personalized diagnostics continues to drive adoption.

The clinical research segment is projected to grow at the fastest CAGR of 9.4% from 2026 to 2033, supported by expanding biomedical, translational, and pharmaceutical research activities. Rising drug discovery programs and biomarker studies fuel adoption. Government and private research funding, especially in the U.S., Europe, and Asia-Pacific, accelerates growth. Multiplex immunofluorescence for high-content screening enhances applicability. Increasing collaborations between academia and industry further expand the market. Advanced imaging systems improve research efficiency and accuracy. Adoption in preclinical studies and experimental disease modeling drives growth. Expansion of CROs supporting research activities further accelerates adoption. Personalized medicine and genomics research provide additional momentum. Rising awareness about novel targets and disease mechanisms supports increased usage. Technological innovations in reagents, antibodies, and assay kits enhance research capabilities. Academic and pharmaceutical labs increasingly rely on immunofluorescence for data-rich applications.

- By End-User

On the basis of end-user, the Immunofluorescence market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, hospitals and diagnostic centers, and CROs. The academic and research institutes segment dominated with a revenue share of 37.2% in 2025, driven by extensive use in cellular and molecular biology research, basic life science studies, and biomarker discovery. High government and private funding for research supports steady demand. Academic laboratories rely on immunofluorescence for protein localization, pathway analysis, and mechanistic studies. Increasing publication output and global research collaborations reinforce dominance. Adoption is further supported by the availability of trained researchers and established lab infrastructure. Multiplexing capabilities expand assay applications. Research in oncology, infectious diseases, and developmental biology strengthens adoption. Continuous demand for novel reagents and kits sustains growth. Integration with imaging platforms enables high-resolution data generation. Long-term research programs create recurring demand. Academic collaborations with pharmaceutical companies enhance market penetration. Government-supported training programs contribute to growth.

The CROs segment is expected to witness the fastest CAGR of 10.5% from 2026 to 2033, driven by outsourcing of specialized immunofluorescence testing and clinical trial support services. Pharmaceutical and biotechnology companies increasingly rely on CROs for preclinical and clinical studies. Expansion of CRO networks globally accelerates growth. High-throughput assay capabilities and technical expertise make CROs attractive partners. Rising clinical trial volumes for oncology, infectious diseases, and personalized medicine enhance adoption. Regulatory and compliance support offered by CROs strengthens trust. Growth in emerging markets fuels rapid segment expansion. Technological advancements in imaging and multiplex assays improve CRO service offerings. Increasing demand for cost-efficient solutions drives rapid uptake. Collaborations between CROs and academic institutions further support growth. Adoption of kits, reagents, and instruments by CROs boosts market size. CROs increasingly serve as key enablers for diagnostic and translational research programs.

Immunofluorescence Market Regional Analysis

- North America dominated the immunofluorescence market with an approximate revenue share of 38% in 2025

- Supported by a well-established healthcare and research infrastructure, high adoption of advanced diagnostic and imaging technologies, and strong investments in life sciences research

- The region benefits from the extensive use of immunofluorescence techniques across clinical diagnostics, biomedical research, and pharmaceutical development, along with the strong presence of leading market players and research institutions

U.S. Immunofluorescence Market Insight

The U.S. immunofluorescence market accounted for the largest revenue share within North America in 2025, driven by the widespread application of immunofluorescence in clinical pathology, oncology research, autoimmune disease diagnosis, and pharmaceutical R&D. The country’s advanced laboratory infrastructure, high research funding, and growing focus on precision medicine are key contributors to market growth. Additionally, increasing collaborations between academic institutions, diagnostic laboratories, and biotechnology companies continue to strengthen the adoption of immunofluorescence techniques in the U.S.

Europe Immunofluorescence Market Insight

The Europe immunofluorescence market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by strong biomedical research activities, increasing adoption of advanced diagnostic tools, and supportive government funding for life sciences research. The region shows robust demand across academic research institutes, hospitals, and pharmaceutical companies, particularly for disease diagnosis and drug discovery applications.

U.K. Immunofluorescence Market Insight

The U.K. immunofluorescence market is expected to grow at a notable CAGR during the forecast period, supported by a strong academic research base, increasing focus on translational research, and rising use of immunofluorescence techniques in cancer and infectious disease studies. The presence of well-established research institutions and increasing clinical research initiatives further support market expansion in the country.

Germany Immunofluorescence Market Insight

The Germany immunofluorescence market is anticipated to witness considerable growth over the forecast period, driven by advancements in molecular diagnostics, strong pharmaceutical and biotechnology industries, and increasing research activities in oncology and immunology. Germany’s emphasis on innovation, precision diagnostics, and laboratory automation is contributing to the growing adoption of immunofluorescence-based techniques.

Asia-Pacific Immunofluorescence Market Insight

The Asia-Pacific immunofluorescence market is expected to be the fastest-growing region during the forecast period, expanding at a strong CAGR from 2026 to 2033. Growth is driven by rapidly expanding healthcare infrastructure, increasing research funding, rising disease burden, and the growing biotechnology and pharmaceutical industries in countries such as China, India, and Japan. Improved access to advanced diagnostic technologies and increasing awareness of molecular diagnostic methods are further accelerating market growth across the region.

Japan Immunofluorescence Market Insight

The Japan immunofluorescence market is gaining steady traction due to strong investments in biomedical research, advanced healthcare infrastructure, and increasing use of immunofluorescence in oncology and neurological research. The country’s focus on precision diagnostics, aging population, and growing demand for early disease detection are key factors driving adoption in both research and clinical settings.

China Immunofluorescence Market Insight

The China immunofluorescence market held a significant share in the Asia-Pacific region in 2025, supported by rapid expansion of research laboratories, increasing government funding for life sciences, and a growing biotechnology sector. Rising prevalence of chronic and infectious diseases, along with expanding pharmaceutical R&D activities, is driving the adoption of immunofluorescence techniques across academic, clinical, and industrial applications in China.

Immunofluorescence Market Share

The Immunofluorescence industry is primarily led by well-established companies, including:

• Agilent Technologies (U.S.)

• Bio-Rad Laboratories (U.S.)

• Abcam (U.K.)

• Roche Diagnostics (Switzerland)

• PerkinElmer (U.S.)

• B.D. (U.S.)

• ZEISS Group (Germany)

• Olympus Corporation (Japan)

• Nikon Corporation (Japan)

• Cell Signaling Technology (U.S.)

• BioLegend (U.S.)

• Vector Laboratories (U.S.)

• Jackson ImmunoResearch Laboratories (U.S.)

• Proteintech Group (U.S.)

• Miltenyi Biotec (Germany)

• Abnova Corporation (Taiwan)

• Rockland Immunochemicals (U.S.)

Latest Developments in Global Immunofluorescence Market

- In January 2023, Agilent Technologies and Akoya Biosciences partnered to develop chromogenic and multiplex immunofluorescent assay platforms that incorporate spatial analysis for precision cancer therapeutic research, aiming to improve patient stratification and translational outcomes. This initiative expanded immunofluorescence utility in advanced oncology research by combining two powerful imaging modalities

- In June 2023, EUROIMMUN (a Revvity company) launched UNIQO 160, an automated indirect immunofluorescence testing system (IIFT) designed for autoimmune disease diagnostics, enhancing workflow efficiency through integrated sample preparation, incubation, washing, imaging, and interpretation. The system improved automation and consistency in IIFT results for clinical pathology labs

- In July 2023, Anbio introduced the AF‑100S, a handheld fluorescent immunoassay (FIA) device for point‑of‑care diagnostics that delivers rapid, high‑sensitivity results and supports a range of assays including hormones, enzymes, and infectious disease markers, expanding immunofluorescence testing accessibility outside traditional labs

- In November 2024, Bruker Corporation unveiled advancements to its CellScape Precise Spatial Proteomics platform with EpicIF technology, which enhances fluorophore compatibility and imaging throughput while preserving tissue integrity, aiding precise multiplex immunofluorescence assays

- In July 2024, AliveDx launched LumiQ, an automated immunofluorescence assay (IFA) solution for autoimmune diagnostics, streamlining workflows from slide preparation to image capture and improving diagnostic repeatability and interpretation accuracy compared to manual processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.