Global Imo Compliant Marine Fuel Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

5.20 Billion

2025

2033

USD

2.81 Billion

USD

5.20 Billion

2025

2033

| 2026 –2033 | |

| USD 2.81 Billion | |

| USD 5.20 Billion | |

|

|

|

|

IMO Compliant Marine Fuel Market Size

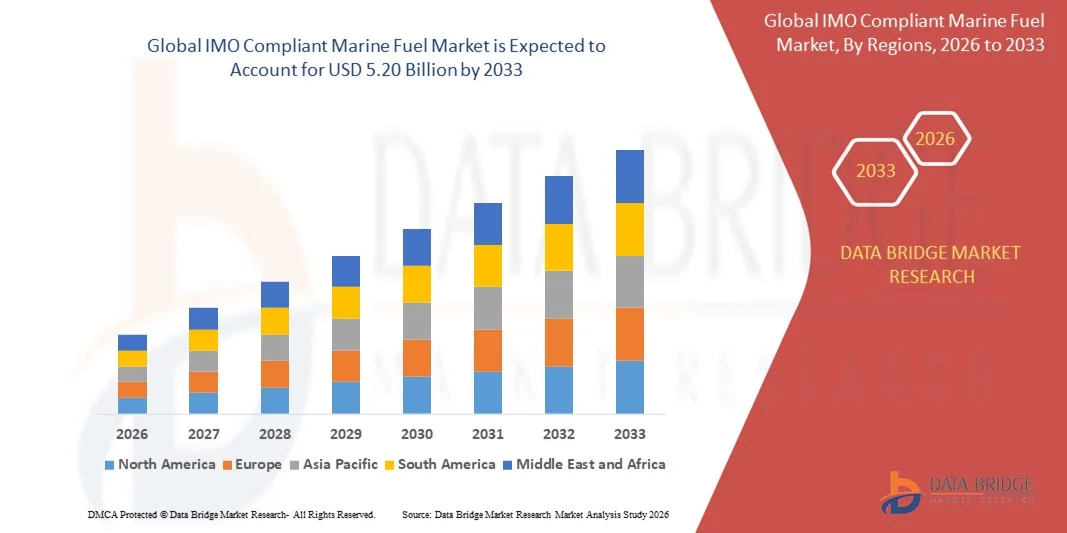

- The global IMO compliant marine fuel market size was valued at USD 2.81 billion in 2025 and is expected to reach USD 5.20 billion by 2033, at a CAGR of 8.00% during the forecast period

- The market growth is largely fuelled by the rising enforcement of emission regulations such as IMO 2020, which mandates reduced sulfur content in marine fuels

- Increasing adoption of cleaner fuel alternatives by shipping operators to improve fleet efficiency and reduce environmental impact

IMO Compliant Marine Fuel Market Analysis

- The market is witnessing a strong shift toward low-sulfur fuel oil (LSFO), marine gas oil (MGO), and new compliant blends as shipping companies prioritize regulatory compliance and sustainability

- Fuel suppliers and refiners are expanding production capabilities, supported by advancements in desulfurization technologies and increasing maritime traffic across major trade routes

- North America dominated the IMO compliant marine fuel market with the largest revenue share in 2025, driven by early enforcement of IMO 2020 regulations and strong availability of low-sulfur marine fuels across major ports

- Asia-Pacific region is expected to witness the highest growth rate in the global IMO compliant marine fuel market, driven by increasing maritime trade volumes, expanding shipbuilding activities, and growing demand for low-sulfur and alternative marine fuels across major ports

- The VLSFO segment held the largest market revenue share in 2025 driven by its widespread adoption among commercial fleets seeking cost-efficient compliance with IMO 2020 sulfur limits. VLSFO offers lower sulfur content, operational reliability, and broad availability across major bunkering hubs, making it the preferred choice for large ocean-going vessels

Report Scope and IMO Compliant Marine Fuel Market Segmentation

|

Attributes |

IMO Compliant Marine Fuel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

IMO Compliant Marine Fuel Market Trends

Rise Of Low-Sulfur And Alternative Marine Fuels

- The global shift toward IMO 2020 regulations is accelerating the adoption of low-sulfur marine fuels, enabling vessels to significantly reduce sulfur oxide emissions. Shipping operators are increasingly transitioning to very low sulfur fuel oil (VLSFO) and marine gas oil (MGO) to ensure compliance while maintaining operational reliability. This transition is also improving engine efficiency and reducing operational risks associated with non-compliance

- The rising emphasis on sustainability is supporting the demand for alternative fuels such as LNG, biofuels, and methanol. These fuels offer cleaner combustion and help shipping companies lower overall greenhouse gas emissions, aligning with long-term decarbonization goals. The growing push for net-zero emissions is further encouraging large fleet owners to invest in multi-fuel compatible engines

- Cost-efficient fuel blending technologies are gaining traction, allowing refiners to produce IMO-compliant fuels without compromising on engine performance. This trend is further supported by strategic refiner–shipowner collaborations focused on optimizing fuel formulations for efficiency. Blended fuels are also helping stabilize pricing, making compliance more feasible for medium-size operators

- For instance, in 2023, multiple refineries across Asia-Pacific announced expanded VLSFO production capacity, helping stabilize supply and reduce price volatility for shipping operators adopting cleaner fuels. This expansion enabled wider accessibility of compliant fuels across key trade routes. It also improved regional competitiveness in the global marine fuel supply chain

- While compliance fuels are witnessing rapid adoption, continued advancements in refining processes, supply chain optimization, and cleaner alternative fuels will be essential to meeting evolving maritime environmental standards. Refiners are exploring new formulations to reduce particulate emissions and improve engine compatibility. These innovations will play a pivotal role in supporting long-term regulatory alignment

IMO Compliant Marine Fuel Market Dynamics

Driver

Rising Enforcement Of IMO 2020 Regulations And Emission Standards

- The strict enforcement of global sulfur caps by the International Maritime Organization has significantly increased demand for compliant marine fuels, pushing shipowners to transition quickly from traditional high-sulfur fuel oil. This shift is strengthening market growth as fleets modernize fuel strategies. Strong penalties for non-compliance are further accelerating the adoption curve

- Increasing environmental awareness among shipping companies is further encouraging investments in cleaner fuels and efficient engines. Operators recognize the long-term financial and regulatory risks of non-compliance, leading to higher adoption of VLSFO, MGO, and LNG-based fuels. The growing involvement of sustainability-focused investors is also influencing fleet modernization decisions

- Governments and port authorities are implementing rigorous monitoring systems and incentivizing cleaner fuel usage, ensuring smooth adoption of IMO-compliant fuels across global trade routes. Enhanced inspection frameworks and emissions-tracking systems are streamlining compliance. These initiatives are collectively reducing the operational uncertainty associated with regulatory shifts

- For instance, in 2023, several European ports enhanced sulfur emission monitoring mechanisms, resulting in increased compliance rates and higher demand for low-sulfur marine fuels. The upgrades also facilitated early detection of non-compliant vessels, improving enforcement transparency. This strengthened the region’s leadership in global maritime emission control

- While regulatory pressure continues to fuel market expansion, maintaining consistent supply, controlling costs, and supporting infrastructure upgrades remain critical for sustained compliance. Industry collaboration will be needed to overcome regional supply disparities. Investments in storage, refining, and bunkering systems will shape long-term market resilience

Restraint/Challenge

High Cost Of IMO-Compliant Fuels And Limited Alternative Fuel Infrastructure

- The significantly higher price of low-sulfur and alternative marine fuels poses a major financial challenge for shipowners, particularly smaller fleet operators. Elevated fuel costs directly affect shipping profitability and hinder widespread adoption in cost-sensitive markets. This pricing gap continues to influence fleet routing and operational planning

- Many developing regions lack adequate bunkering infrastructure for alternative fuels such as LNG, methanol, and biofuels. The absence of supporting facilities restricts fuel availability and limits the ability of vessels to transition to advanced, cleaner fuel options. As a result, shipping companies often delay investment in dual-fuel or alternative-fuel vessels

- Supply chain constraints, such as inconsistent refining capacity and uneven regional distribution of compliant fuels, further impact market penetration. Operators often face delays or route adjustments to access compliant fuel sources. These disruptions raise operational costs and reduce scheduling reliability for global shipping networks

- For instance, in 2023, several African and Latin American ports reported limited availability of VLSFO and LNG bunkering services, resulting in operational disruptions for international carriers. This shortage also increased dependence on long-distance fuel sourcing. Consequently, the regions remain less competitive in supporting modern fuel standards

- While the industry continues to move toward cleaner fuel adoption, addressing cost pressures, expanding infrastructure, and improving global fuel availability will be essential for long-term market stability. Strategic public-private partnerships will be necessary to bridge regional gaps. Investments in large-scale alternative fuel hubs will also influence future shipping routes

IMO Compliant Marine Fuel Market Scope

The market is segmented on the basis of type and application

- By Type

On the basis of type, the global IMO compliant marine fuel market is segmented into Distillate/Marine Gas Oil (MGO), Ultra-Low Sulfur Marine Oil (ULSFO), and Very-Low Sulfur Fuel Oil (VLSFO). The VLSFO segment held the largest market revenue share in 2025 driven by its widespread adoption among commercial fleets seeking cost-efficient compliance with IMO 2020 sulfur limits. VLSFO offers lower sulfur content, operational reliability, and broad availability across major bunkering hubs, making it the preferred choice for large ocean-going vessels.

The MGO segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by its cleaner burn properties, suitability for auxiliary engines, and rapid uptake among operators prioritizing reduced emissions. MGO’s compatibility with existing engine systems and increasing use in emission control areas makes it an attractive option for operators seeking operational flexibility.

- By Application

On the basis of application, the global IMO compliant marine fuel market is segmented into Oil Tankers, Bulk Carriers, General Cargo, Container Ships, and Others. The Container Ships segment held the largest market revenue share in 2025 due to high global trade volumes, frequent long-haul operations, and the sector’s strong inclination toward reliable low-sulfur fuel options to ensure uninterrupted compliance. The segment benefits from large fleet modernization programs and consistent demand for clean marine fuel.

The Oil Tankers segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising crude and refined product transportation activities and the growing shift toward low-sulfur fuels to meet regulatory demands. Increasing voyages across emission-sensitive routes and heightened focus on environmental performance among tanker operators are further accelerating the segment’s adoption of IMO compliant fuels.

IMO Compliant Marine Fuel Market Regional Analysis

- North America dominated the IMO compliant marine fuel market with the largest revenue share in 2025, driven by early enforcement of IMO 2020 regulations and strong availability of low-sulfur marine fuels across major ports

- Ship operators in the region prioritize reliable access to VLSFO, MGO, and emerging alternative fuels to ensure seamless compliance with emission standards during international voyages

- This dominance is further supported by advanced refining capabilities, stringent environmental policies, and a high concentration of international shipping traffic requiring consistent access to compliant fuel options

North America IMO Compliant Marine Fuel Market Insight

The U.S. IMO compliant marine fuel market captured the largest revenue share in 2025 within North America, fuelled by expansive coastal trade routes and rapid adoption of low-sulfur fuel grades. Increasing regulatory oversight and the modernization of refining operations have enhanced the supply of cleaner marine fuels nationwide. Ports such as those along the Gulf Coast have expanded bunkering capabilities, enabling shipping companies to transition efficiently from high-sulfur options to compliant fuels. The growing emphasis on sustainability and the integration of LNG-based bunkering infrastructure are further accelerating market growth in the U.S.

Europe IMO Compliant Marine Fuel Market Insight

The Europe IMO compliant marine fuel market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict environmental regulations and the region’s strong commitment to maritime decarbonization. Key ports across countries such as the Netherlands, Germany, and Spain are expanding VLSFO and LNG bunkering capacities to support compliance-based fuel transitions. The rise in sustainable shipping initiatives, combined with the region’s emphasis on reducing SOx and CO₂ emissions, is fostering large-scale adoption of low-sulfur and alternative marine fuels across commercial fleets.

U.K. IMO Compliant Marine Fuel Market Insight

The U.K. IMO compliant marine fuel market is expected to witness significant growth from 2026 to 2033, supported by tightened maritime emission standards and rising investments in cleaner port infrastructure. Shipping companies are increasingly shifting toward MGO, VLSFO, and LNG as part of long-term decarbonization strategies. Moreover, heightened concerns regarding environmental compliance and operational efficiency are encouraging operators to adopt fuels that minimize emission-related regulatory risks in both domestic and international shipping routes.

Germany IMO Compliant Marine Fuel Market Insight

The Germany IMO compliant marine fuel market is expected to experience substantial growth between 2026 to 2033, fuelled by the country’s advanced refining sector and strong regulatory frameworks promoting clean marine operations. German ports are enhancing their supply networks for low-sulfur fuels and investing in LNG and methanol bunkering solutions to support evolving sustainability targets. The nation’s focus on green shipping initiatives, combined with its high standards for environmental protection, is accelerating the adoption of IMO-compliant fuel types across a wide range of vessel categories.

Asia-Pacific IMO Compliant Marine Fuel Market Insight

The Asia-Pacific IMO compliant marine fuel market is expected to witness rapid growth from 2026 to 2033, driven by expanding maritime trade, surging fuel demand across major shipping hubs, and ongoing port infrastructure upgrades. Countries such as China, Singapore, Japan, and India are leading the transition toward compliant fuels by increasing refining output and bolstering bunkering capabilities. Government-led initiatives to strengthen environmental compliance and the region’s role as a global shipping powerhouse are accelerating market penetration for VLSFO, MGO, LNG, and emerging alternative marine fuels.

Japan IMO Compliant Marine Fuel Market Insight

The Japan IMO compliant marine fuel market is expected to witness strong growth from 2026 to 2033 due to the country’s advanced maritime sector, emphasis on low-emission shipping, and high adoption of cleaner fuel technologies. Japan’s major ports are actively expanding their supply of VLSFO and LNG bunkering services, supporting fleets seeking reliable compliance solutions. The integration of sustainable fuel alternatives into port operations, combined with Japan’s leadership in energy-efficient marine technologies, is further contributing to market expansion nationwide.

China IMO Compliant Marine Fuel Market Insight

The China IMO compliant marine fuel market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by strong refining capacity, a robust maritime trade ecosystem, and large-scale adoption of low-sulfur fuel grades. China’s major ports, such as Shanghai, Shenzhen, and Qingdao, are rapidly upgrading bunkering infrastructure to support compliant fuels and LNG-powered vessels. The country’s significant investments in green shipping corridors and its rapidly growing fleet of international carriers are key factors accelerating the demand for IMO-compliant marine fuels across the region.

IMO Compliant Marine Fuel Market Share

The IMO Compliant Marine Fuel industry is primarily led by well-established companies, including:

Here are the companies in bullets, without the © symbol, and with headquarters in brackets exactly as requested:

• Exxon Mobil Corporation (U.S.)

• Shell (U.K.)

• bp p.l.c. (U.K.)

• Chevron Corporation (U.S.)

• China Petrochemical Corporation (China)

• Gazprom Neft PJSC (Russia)

• Indian Oil Corporation Ltd (India)

• PetroChina Company Limited (China)

• Petrobras (Brazil)

• TotalEnergies SE (France)

• CHINA COSCO (China)

• Clipper Oil, Inc. (U.S.)

• Marquard & Bahls (Germany)

• Peninsula Petroleum Limited (Gibraltar/U.K.)

• SK SHIPPING (South Korea)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Imo Compliant Marine Fuel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Imo Compliant Marine Fuel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Imo Compliant Marine Fuel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.