Global Implantable Cardiac Rhythm Management Market

Market Size in USD Billion

CAGR :

%

USD

19.48 Billion

USD

27.95 Billion

2024

2032

USD

19.48 Billion

USD

27.95 Billion

2024

2032

| 2025 –2032 | |

| USD 19.48 Billion | |

| USD 27.95 Billion | |

|

|

|

|

Implantable Cardiac Rhythm Management Market Size

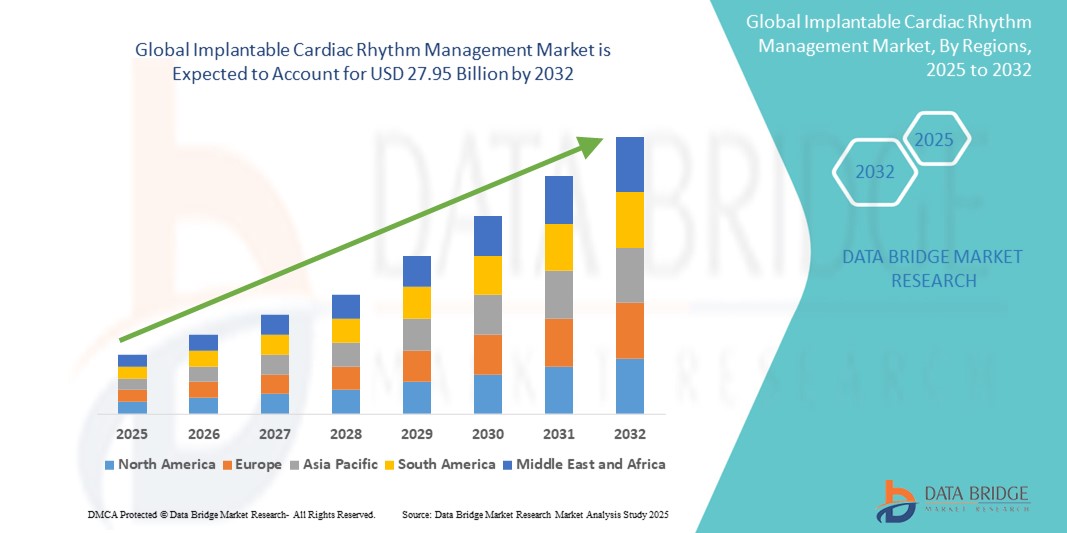

- The global implantable cardiac rhythm management market size was valued at USD 19.48 billion in 2024 and is expected to reach USD 27.95 billion by 2032, at a CAGR of 4.62% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, such as arrhythmias and heart failure, driven by factors including the aging global population and rising lifestyle-related risk factors. This has led to a growing demand for advanced diagnostic and therapeutic solutions in cardiac care

- Furthermore, rising technological advancements, including the development of miniaturized devices, leadless pacemakers, and remote monitoring capabilities, are establishing implantable cardiac rhythm management solutions as the modern standard of care for patients with heart rhythm disorders. These converging factors are accelerating the uptake of implantable cardiac rhythm management solutions, thereby significantly boosting the industry's growth

Implantable Cardiac Rhythm Management Market Analysis

- Implantable cardiac rhythm management (CRM) refers to the use of implanted medical devices to monitor, regulate, and correct abnormal heart rhythms (arrhythmias). These devices help manage conditions such as bradycardia (slow heart rate), tachycardia (fast heart rate), and heart failure

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, such as arrhythmias, heart failure, and sudden cardiac arrest, driven by factors including the aging global population and rising lifestyle-related risk factors. This has led to a growing demand for advanced diagnostic and therapeutic solutions in cardiac care

- North America dominates the implantable cardiac rhythm management market with the largest revenue share of 42.23% in 2024, characterized by a highly developed healthcare infrastructure, high awareness and adoption of advanced medical technologies, and significant investments in research and development by key industry players

- Asia-Pacific is expected to be the fastest growing region in the Implantable cardiac rhythm management market during the forecast period with a CAGR of 7.4% from 2025 to 2032, due to increasing urbanization, rising disposable incomes, and the growing incidence of cardiovascular diseases, alongside improving healthcare infrastructure and increasing awareness in countries such as China and India

- Defibrillators segment dominates the implantable cardiac rhythm management market with a market share of 45.9%, driven by the high demand for life-saving devices such as Implantable Cardioverter Defibrillators (ICDs) and external defibrillators for treating cardiac arrhythmias and sudden cardiac arrest

Report Scope and Implantable Cardiac Rhythm Management Market Segmentation

|

Attributes |

Implantable Cardiac Rhythm Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Implantable Cardiac Rhythm Management Market Trends

“Advancing Diagnostics Through Technological Innovation”

- A significant and accelerating trend in the global implantable cardiac rhythm management market is the deepening integration of advanced sensor technologies and sophisticated data analytics within implantable devices and their associated monitoring systems. This leads to increased diagnostic precision and personalized patient management in healthcare settings

- Furthermore, rising clinician demand for highly accurate, user-friendly, and integrated solutions for managing complex cardiac arrhythmias is establishing technologically advanced ICRM devices as the modern standard for cardiac care. These converging factors are accelerating the uptake of implantable cardiac rhythm management solutions, thereby significantly boosting the industry's growth

- For instance, advanced sensors are being increasingly integrated into ICRM devices and remote monitoring platforms to continuously analyze vast physiological datasets, identify even subtle cardiac anomalies, and provide real-time alerts for patient risk stratification. This allows clinicians to be alerted rapidly so they can intervene before issues escalate into serious conditions or emergency cardiac events

- Technological advancements in ICRM devices enable features such as learning individual patient rhythm patterns to potentially suggest optimized therapy adjustments and providing more intelligent alerts based on physiological changes. For instance, some advanced ICRM systems improve the accuracy of arrhythmia detection over time and can send intelligent alerts if unusual heart activity or device performance is detected. Furthermore, enhanced digital connectivity capabilities offer clinicians the ease of remote access to patient data, allowing them to monitor and adjust device settings from a distance

- The seamless integration of ICRM devices with digital health platforms and broader hospital information systems facilitates centralized control over various aspects of patient cardiac health management. Through a single interface, clinicians can manage device performance alongside other patient vitals, medication adherence, and electronic health records, creating a unified and automated patient care experience

- The demand for implantable cardiac rhythm management solutions that offer seamless technological integration and advanced remote monitoring capabilities is growing rapidly across hospitals, clinics, and home care settings, as healthcare providers increasingly prioritize enhanced patient outcomes and efficient resource utilization

Implantable Cardiac Rhythm Management Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Cardiovascular Diseases and Technological Advancements”

- The increasing prevalence of cardiovascular diseases (CVDs) globally, such as arrhythmias, heart failure, and sudden cardiac arrest, coupled with the accelerating pace of technological advancements in medical devices, is a significant driver for the heightened demand for implantable cardiac rhythm management (ICRM) devices

- For instance, the aging global population and rising lifestyle-related risk factors contribute to a higher incidence of cardiac disorders requiring intervention. Strategic advancements by key companies, such as Abbott's introduction of the AVEIR DR leadless pacemaker system in November 2023, are expected to drive the implantable cardiac rhythm management industry growth in the forecast period

- As healthcare providers become more aware of the long-term benefits and life-saving potential of ICRM devices, they seek advanced features such as improved battery longevity, miniaturization, and enhanced diagnostic capabilities, providing a compelling upgrade over traditional treatment approaches for rhythm disorders

- Furthermore, the growing focus on precision medicine and the desire for improved patient outcomes are making ICRM devices an integral component of modern cardiac care, offering seamless integration with patient management systems and remote monitoring platforms

- The effectiveness of these devices in preventing sudden cardiac death, improving quality of life, and offering long-term rhythm management are key factors propelling the adoption of ICRM solutions in hospitals, specialty cardiac centers, and ambulatory surgical centers. The trend towards less invasive implantation procedures and the increasing availability of technologically advanced ICRM options further contribute to market growth

Restraint/Challenge

“Concerns Regarding High Initial Costs and Stringent Regulatory Hurdles”

- Concerns surrounding the high initial cost of implantable cardiac rhythm management devices and associated procedures pose a significant challenge to broader market penetration, particularly in developing regions or for patients with limited insurance coverage. While these devices are life-saving, their premium pricing can limit accessibility

- For instance, the estimated cost of a pacemaker can range from USD 2,500 to USD 8,000, and for an ICD from USD 10,000 to USD 18,000, often exceeding the annual income of a significant portion of the population in low-to-medium-income countries

- Addressing these cost concerns through favourable reimbursement policies, local manufacturing incentives, and exploring more affordable models is crucial for expanding patient access.

- In addition, the stringent regulatory framework and lengthy approval processes for new medical devices can be a significant barrier to market entry and innovation. Companies must invest substantial resources and time to navigate complex regulatory pathways (such as FDA's rigorous PMA process or EU MDR's stringent controls), which can delay the availability of the newest, most advanced devices

- While regulatory rigor is essential for patient safety, the perceived burden can still hinder widespread adoption, especially for smaller manufacturers or for technologies that require extensive clinical validation.

Implantable Cardiac Rhythm Management Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the implantable cardiac rhythm management market is segmented into pacemakers, defibrillators, cardiac resynchronization therapy (CRT), and implantable loop recorder. The defibrillators segment dominates the largest market revenue share of 45.9% in 2024, driven by its crucial role in preventing sudden cardiac arrest and managing life-threatening arrhythmias. This segment includes various types such as implantable cardioverter defibrillators (ICDs) and external defibrillators, which are essential for treating severe cardiac conditions.

The cardiac resynchronization therapy (CRT) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its effectiveness in treating heart failure and advancements in minimally invasive implantation procedures.

- By End User

On the basis of end user, the implantable cardiac rhythm management market is segmented into hospitals, specialty cardiac centers, ambulatory surgical centers, and others. The hospitals segment accounted for the largest market revenue share, of 44.3% in 2024, driven by their comprehensive infrastructure, ability to handle complex procedures, and high volume of patient admissions for cardiac care. Hospitals serve as primary centers for implantation surgeries and post-operative management of ICRM devices.

The specialty cardiac centers segment is expected to witness the fastest CAGR from 2025 to 2032, as these centers are specifically equipped with advanced facilities and specialized expertise for dedicated cardiac care, offering focused treatment and follow-up for patients with heart rhythm disorders.

Implantable Cardiac Rhythm Management Market Regional Analysis

- North America dominates the implantable cardiac rhythm management market with the largest revenue share of 42.23% in 2024, driven by a highly developed healthcare system, a high prevalence of cardiovascular diseases, and increasing patient awareness regarding advanced cardiac therapies

- Consumers in the region, alongside healthcare providers, highly value the life-saving capabilities, advanced diagnostic features, and seamless integration offered by ICRM devices with remote monitoring systems and electronic health records.

- This widespread adoption is further supported by high disposable incomes, a technologically advanced population, and the growing preference for remote monitoring and personalized cardiac care, establishing ICRM devices as a favored solution for managing complex heart rhythm disorders in both clinical and home settings

U.S. Implantable Cardiac Rhythm Management Market Insight

The U.S. implantable cardiac rhythm management market captured the largest revenue share of 73.4% within North America in 2024. This is fueled by the swift uptake of advanced cardiac devices and the expanding trend of personalized cardiac care. Consumers, along with healthcare providers, are increasingly prioritizing the enhancement of patient outcomes through intelligent, less invasive rhythm management systems. The growing preference for remote patient monitoring setups, combined with robust demand for advanced diagnostic and therapeutic device integration, further propels the implantable cardiac rhythm management industry. Moreover, the increasing integration of digital health technologies, such as sophisticated data analytics and telehealth platforms, is significantly contributing to the market's expansion.

Europe Implantable Cardiac Rhythm Management Market Insight

The Europe implantable cardiac rhythm management market is projected to expand at a substantial CAGR from 2025 to 2032. This growth is primarily driven by the increasing prevalence of cardiovascular disorders and the escalating need for advanced cardiac care in an aging population. The increase in urbanization, coupled with the demand for advanced medical devices, is fostering the adoption of implantable cardiac rhythm management solutions. European healthcare systems are also drawn to the long-term benefits and improved patient quality of life these devices offer. The region is experiencing significant growth across various healthcare settings, with ICRM devices being incorporated into both established cardiac centers and new healthcare initiatives.

U.K. Implantable Cardiac Rhythm Management Market Insight

The U.K. implantable cardiac rhythm management market is anticipated to grow at a noteworthy CAGR from 2025 to 2032 for pacemakers alone. This growth is driven by the escalating burden of arrhythmias and heart failure and a desire for heightened patient management and outcomes. In addition, concerns regarding cardiac events and patient safety are encouraging both clinicians and healthcare systems to choose advanced rhythm management solutions. The U.K.’s embrace of technological advancements, alongside its robust healthcare infrastructure and rising awareness of cardiac health, is expected to continue to stimulate market growth.

Germany Implantable Cardiac Rhythm Management Market Insight

The Germany implantable cardiac rhythm management market is expected to expand at a considerable CAGR from 2025 to 2032. This growth is fueled by increasing awareness of cardiovascular disease management and the demand for technologically advanced, patient-centric solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and robust reimbursement policies, promotes the adoption of implantable cardiac rhythm management devices, particularly in hospitals and specialized cardiac centers. The integration of ICRM devices with digital health solutions and remote monitoring systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local patient and clinician expectations.

Asia-Pacific Implantable Cardiac Rhythm Management Market Insight

The Asia-Pacific implantable cardiac rhythm management market is poised to grow at the fastest CAGR of 7.4% from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards advanced medical technologies, supported by government initiatives promoting healthcare infrastructure development, is driving the adoption of implantable cardiac rhythm management devices. Furthermore, as APAC emerges as a significant market for ICRM devices and systems, the increasing accessibility and affordability of these devices are expanding to a wider patient base.

China Implantable Cardiac Rhythm Management Market Insight

The China implantable cardiac rhythm management market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption in healthcare. China stands as one of the largest markets for advanced medical devices, and ICRM solutions are becoming increasingly popular in hospitals, cardiac centers, and public health initiatives. The push towards improving cardiac care standards and the availability of sophisticated ICRM options, alongside strong domestic manufacturers and increasing investments in healthcare, are key factors propelling the market in China.

India Implantable Cardiac Rhythm Management Market Insight

The India implantable cardiac rhythm management market is anticipated to grow at a noteworthy CAGR of 7.9% from 2025 to 2032, driven by the increasing prevalence of cardiovascular diseases, improving healthcare infrastructure, and rising awareness among the population regarding modern treatment options. In addition, government initiatives aimed at expanding access to cardiac care and increasing healthcare expenditure are encouraging both patients and providers to adopt advanced ICRM solutions. India's growing medical tourism sector, alongside its expanding healthcare facilities, is expected to continue to stimulate market growth.

Implantable Cardiac Rhythm Management Market Share

The implantable cardiac rhythm management industry is primarily led by well-established companies, including:

- Medtronic (U.S.)

- Abbott (U.S.)

- Stryker (U.S.)

- Asahi Kasei Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- Biotronik (Germany)

- Integer Holdings Corporation (U.S.)

- MicroPort Scientific Corporation (China)

- Koninklijke Philips N.V. (Netherlands)

- ZOLL Medical Corporation (U.S.)

- ABIOMED (U.S.)

- Berlin Heart (Germany)

- Jarvik Heart, Inc. (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Defibtech LLC (U.S.)

- Medicalsystem Co., Ltd. (China)

- LivaNova PLC (U.K.)

- 3M (U.S.)

- Mentice AB (Sweden)

Latest Developments in Global Implantable Cardiac Rhythm Management Market

- In January 2025, BIOTRONIK announced the first patient enrollment in the second arm of the BIO-CONDUCT study, an FDA-approved investigational device exemption (IDE) trial examining the use of stylet-driven leads for Conduction System Pacing (CSP). This study aims to further evaluate the use of the investigational BIOTRONIK next-generation Solia CSP S pacing lead when implanted in the left bundle branch area, an emerging technique for more physiologic cardiac tissue activation in patients needing ventricular pacing

- In December 2024, Abbott announced the first-in-world leadless pacing procedures in the left bundle branch area of the heart, representing a significant advancement in leadless pacing technology. This development builds upon the company's commitment to less invasive and more physiological pacing solutions

- In November 2024, Abbott launched its AVEIR VR single-chamber ventricular leadless pacemaker system in India for the treatment of patients with slow heart rhythms. This marks a significant advancement for patient care in India, offering a leadless option with unique mapping capabilities and longer projected battery life.

- In October 2024, Medtronic received FDA approval for its Affera Mapping and Ablation System and Sphere-9 Catheter, marking a new paradigm in electrophysiology. This first-of-its-kind, all-in-one HD-mapping and dual-energy (pulsed field and radiofrequency) ablation catheter is highly anticipated for its innovation and demonstrated safety in treating atrial fibrillation

- In May 2024, Medtronic celebrated 10 years of its Reveal LINQ Insertable Cardiac Monitor (ICM) by adding artificial intelligence (AI) algorithms. This enhancement aims to reduce false alerts and improve the accuracy of cardiac event detection, further advancing long-term heart rhythm monitoring

- In March 2024, BIOTRONIK introduced the world's first and only system CE-approved for Left Bundle Branch Area Pacing (LBBAP). This complete Conduction System Pacing (CSP) solution offers a more physiological approach to pacing, potentially improving outcomes for patients needing ventricular pacing support

- In February 2024, BIOTRONIK announced that it would solely supply its proprietary DX models for new single-chamber ICD implants moving forward. This decision was based on clinical data demonstrating superior diagnostics and decreased complication risk of DX technology compared to traditional high-voltage systems

- In January 2024, Abbott announced the first global procedures in a clinical trial of its Volt Pulsed Field Ablation System, designed to treat patients with abnormal heart rhythms. This system aims to provide a new therapy option for atrial fibrillation using high-energy electrical pulses.

- In July 2023, Abbott received FDA approval for the world's first dual-chamber leadless pacemaker system, the AVEIR DR. This significant milestone expands leadless pacing options for patients requiring dual-chamber therapy, reducing the need for traditional leads and pockets

- In May 2023, Abbott received FDA approval for its Tacti Flex Ablation Catheter for the treatment of abnormal heart rhythm. This device features a flexible tip and contact force technology designed to improve procedural efficiency and patient outcomes during cardiac ablation procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY PRODUCT

16.1 OVERVIEW

16.2 PACEMAKERS

16.2.1 BY TYPE

16.2.1.1. SINGLE CHAMBER

16.2.1.2. DUAL CHMABER

16.2.1.3. BIVENTRICULAR PACEMAKERS

16.2.2 BY COMPATIBILITY

16.2.2.1. MRI COMPATIBLE

16.2.2.2. NON-MRI COMPATIBLE

16.2.3 BY SYTEM TYPE

16.2.3.1. LEADED SYSTEM

16.2.3.1.1. TRANSVENOUS SYSTEMS

16.2.3.1.2. EPICARDIAL SYSTEMS

16.2.3.2. LEADLESS SYSTEMS

16.2.4 BY BRAND

16.2.4.1. MICRA TRANSCATHETER PACING SYSTEM

16.2.4.2. AVEIR (VR) WIRELESS PACEMAKER SYSTEM

16.2.4.3. WISE CRT SYSTEM

16.2.4.4. OTHERS

16.2.5 OTHERS

16.3 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

16.3.1 BY TYPE

16.3.1.1. SUBCUTANEOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATOR (S-ICDS)

16.3.1.1.1. PULSE GENERATOR

16.3.1.1.1.1 TITANIUM

16.3.1.1.1.2 RIGID POLYURETHANE

16.3.1.1.1.3 OTHERS

16.3.1.1.2. LEADS

16.3.1.1.2.1 SOFT POLYURETHANE

16.3.1.1.2.2 SILICONE

16.3.1.1.2.3 OTHERS

16.3.1.1.3. OTHERS

16.3.1.2. TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATOR (T-ICDS)

16.3.1.2.1. BIVENTRICULAR ICDS

16.3.1.2.1.1 PULSE GENERATOR

16.3.1.2.1.1.1. TITANIUM

16.3.1.2.1.1.2. RIGID POLYURETHANE

16.3.1.2.1.1.3. OTHERS

16.3.1.2.1.2 LEADS

16.3.1.2.1.2.1. SOFT POLYURETHANE

16.3.1.2.1.2.2. SILICONE

16.3.1.2.1.2.3. OTHERS

16.3.1.2.1.3 OTHERS

16.3.1.2.2. DUAL-CHAMBER ICDS

16.3.1.2.2.1 PULSE GENERATOR

16.3.1.2.2.1.1. TITANIUM

16.3.1.2.2.1.2. RIGID POLYURETHANE

16.3.1.2.2.1.3. OTHERS

16.3.1.2.2.2 LEADS

16.3.1.2.2.2.1. SOFT POLYURETHANE

16.3.1.2.2.2.2. SILICONE

16.3.1.2.2.2.3. OTHERS

16.3.1.2.2.3 OTHERS

16.3.1.2.3. SINGLE-CHAMBER ICDS

16.3.1.2.3.1 PULSE GENERATOR

16.3.1.2.3.1.1. TITANIUM

16.3.1.2.3.1.2. RIGID POLYURETHANE

16.3.1.2.3.1.3. OTHERS

16.3.1.2.3.2 LEADS

16.3.1.2.3.2.1. SOFT POLYURETHANE

16.3.1.2.3.2.2. SILICONE

16.3.1.2.3.2.3. OTHERS

16.3.1.2.3.3 OTHERS

16.3.2 BY TECHNOLOGY

16.3.2.1. TRADITIONAL

16.3.2.2. SUBCUTANEOUS

16.3.3 OTHERS

16.4 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

16.4.1 BY TYPE

16.4.1.1. CARDIAC RESYNCHRONIZATION THERAPY DEFIBRILLATOR

16.4.1.1.1. MRI COMPATIBLE CRT-P DEVICES

16.4.1.1.2. CONVENTIONAL CRT-P DEVICES

16.4.1.2. CARDIAC RESYNCHRONIZATION THERAPY PACEMAKER

16.4.1.2.1. MRI COMPATIBLE CRT-P DEVICES

16.4.1.2.2. CONVENTIONAL CRT-P DEVICES

16.4.2 BY COMPONENT

16.4.2.1. DEVICE

16.4.2.2. LEAD

16.4.3 OTHERS

16.5 OTHERS

17 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY TECHNOLOGY

17.1 OVERVIEW

17.2 WIRELESS IMPLANTABLE DEVICES

17.3 MRI-COMPATIBLE DEVICES

17.4 CONVENTIONAL DEVICES

17.5 OTHERS

18 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY USAGE

18.1 OVERVIEW

18.2 PERMANENT IMPLANTATION

18.3 TEMPORARY IMPLANTATION

19 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY PROCEDURE

19.1 OVERVIEW

19.2 TRANSVENOUS IMPLANTATION

19.3 SUBCUTANEOUS IMPLANTATION

19.4 EPICARDIAL IMPLANTATION

19.5 OTHERS

20 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY AGE GROUP

20.1 OVERVIEW

20.2 PEDIATRIC

20.3 ADULT

20.4 GERIATRIC

21 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY APPLICATION

21.1 OVERVIEW

21.2 ARRHYTHMIAS

21.2.1 PACEMAKERS

21.2.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

21.2.3 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

21.3 BRADYCARDIA

21.3.1 PACEMAKERS

21.3.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

21.3.3 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

21.4 TACHYCARDIA

21.4.1 PACEMAKERS

21.4.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

21.4.3 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

21.5 HERAT FAILURE

21.5.1 PACEMAKERS

21.5.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

21.5.3 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

21.6 MYOCARDIAL INFARCTION

21.6.1 PACEMAKERS

21.6.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

21.6.3 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

21.7 CORONARY ARTERY DISEASE

21.7.1 PACEMAKERS

21.7.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICD)

21.7.3 CARDIAC RESYNCHRONIZATION THERAPY (CRT)

21.8 OTHER (IF ANY)

22 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 BY TYPE

22.2.2 PUBLIC

22.2.3 PRIVATE

22.2.4 BY LEVEL

22.2.5 TIER 1

22.2.6 TIER 2

22.2.7 TIER 3

22.3 CATH LABS

22.3.1 PUBLIC

22.3.2 PRIVATE

22.4 SPECIALTY CENTERS

22.4.1 PUBLIC

22.4.2 PRIVATE

22.5 AMBULATORY SURGERY CENTERS

22.6 ACADEMIC AND RESEARCH CENTRES

22.7 OTHERS

23 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDER

23.3 RETAIL SALES

23.3.1 ONLINE SALES

23.3.2 OFFLINE SALES

23.3.3 THIRD PARTY DISTRIBUTION

23.4 OTHERS

24 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , BY GEOGRAPHY

24.1 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. ITALY

24.1.2.5. SPAIN

24.1.2.6. RUSSIA

24.1.2.7. TURKEY

24.1.2.8. NETHERLANDS

24.1.2.9. SWITZERLAND

24.1.2.10. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. SAUDI ARABIA

24.1.5.3. UAE

24.1.5.4. EGYPT

24.1.5.5. ISRAEL

24.1.5.6. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

25.6 MERGERS & ACQUISITIONS

25.7 NEW PRODUCT DEVELOPMENT & APPROVALS

25.8 EXPANSIONS

25.9 REGULATORY CHANGES

25.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , SWOT AND DBR ANALYSIS

27 GLOBAL IMPLANTABLE CARDIAC RHYTHM MANAGEMENT MARKET , COMPANY PROFILE

27.1 ABBOTT

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 MEDTRONIC

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 LEPU MEDICAL TECHNOLOGY(BEIJING)CO.,LTD.

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 BIOTRONIK

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 PURPLE MICROPORT

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 MEDICO SRL

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 VITATRON HOLDING B.V.

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 CAIRDAC

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 LIVANOVA PLC + MICROPORT SCIENTIFIC CORPORATION

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 CAMERON HEALTH INC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 SHREE PACETRONIX LTD.

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 DONATELLE

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 MEDIVED INNOVATIONS PVT LTD

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 EBR SYSTEMS, INC.

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

28 RELATED REPORT

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.