Global Impulse Hydropower Turbine Market

Market Size in USD Billion

CAGR :

%

USD

2.76 Billion

USD

4.34 Billion

2024

2032

USD

2.76 Billion

USD

4.34 Billion

2024

2032

| 2025 –2032 | |

| USD 2.76 Billion | |

| USD 4.34 Billion | |

|

|

|

|

Impulse Hydropower Turbine Market Size

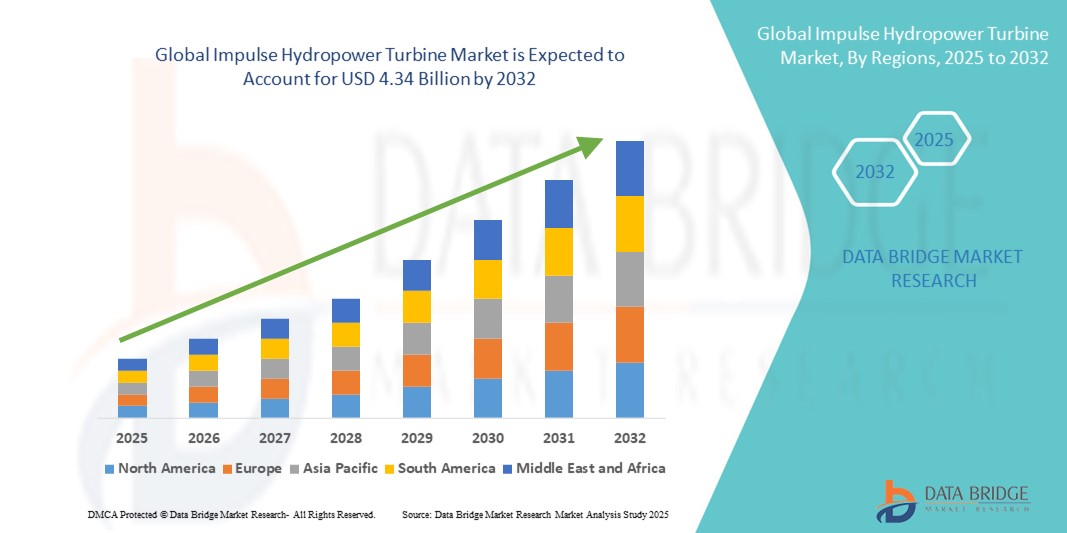

- The global impulse hydropower turbine market size was valued at USD 2.76 billion in 2024 and is expected to reach USD 4.34 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the increasing global emphasis on clean energy generation, especially in mountainous and hilly regions where high-head, low-flow water sources are prevalent. The suitability of impulse turbines such as Pelton and Turgo for small-scale and off-grid hydro projects further strengthens their market demand

- Technological advancements in turbine design, rising investment in micro and mini hydropower systems, and favorable government initiatives toward renewable energy are also contributing to the rapid adoption of impulse turbines in both developing and developed economies

Impulse Hydropower Turbine Market Analysis

- The market is witnessing significant momentum as countries seek to diversify their renewable energy portfolios while reducing dependency on fossil fuels. Impulse turbines are particularly effective in remote terrains and high-altitude zones, making them ideal for small hydropower projects with challenging topographies

- Asia-Pacific holds a substantial market share due to abundant hydropower potential in nations such as China, India, and Nepal. In addition, regions in South America and Africa are increasingly adopting impulse turbines to support rural electrification programs

- Asia-Pacific dominated the impulse hydropower turbine market with the largest revenue share of 41.37% in 2024, driven by a surge in hydropower development projects across countries such as China, India, and Indonesia, along with strong government support for renewable energy initiativesNorth America region is expected to witness the highest growth rate in the global impulse hydropower turbine market, driven by increased focus on low-carbon energy sources, favorable regulatory frameworks, and significant investments in upgrading hydropower capacity to meet peak load demands and support grid flexibility

- The 1–10 M.W. segment dominated the market with the largest revenue share in 2024, driven by its broad adoption across small- and medium-scale hydro projects. These turbines are widely used in decentralized power systems, particularly in remote and rural areas requiring moderate electricity output. The segment’s growth is supported by government initiatives promoting sustainable energy in underserved regions and the relative ease of installation and maintenance associated with this power class

Report Scope and Impulse Hydropower Turbine Market Segmentation

|

Attributes |

Impulse Hydropower Turbine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Micro and Small Hydropower Projects in Remote Areas |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Impulse Hydropower Turbine Market Trends

Rising Adoption of Small-Scale Hydropower Projects in Off-Grid Areas

- The demand for decentralized renewable energy is accelerating the adoption of impulse hydropower turbines, especially in remote and mountainous regions. These turbines are well-suited for high-head, low-flow applications, making them ideal for powering small communities or off-grid infrastructure with limited water availability

- Governments and development agencies are investing in small hydro schemes to improve rural electrification, particularly in developing countries. The simplicity, reliability, and cost-effectiveness of impulse turbines such as Pelton and Turgo designs make them a preferred solution for sustainable energy access. In many cases, these systems are supported through public-private partnerships and subsidy programs

- The modularity and ease of installation of impulse turbines offer flexibility to adapt to varying geographical and hydrological conditions. Their low maintenance needs and long operational life make them an attractive investment for independent power producers and municipalities aiming to reduce carbon footprints

- For instance, in 2023, Nepal launched a series of micro-hydro projects in the Himalayan belt using impulse turbines to electrify over 50 remote villages, reducing dependency on diesel generators and improving community development

- Continued innovation in turbine design, materials, and digital monitoring is expected to enhance performance and efficiency. As demand grows for low-impact, eco-friendly solutions, impulse turbines will play a key role in balancing energy access, environmental conservation, and economic viability

Impulse Hydropower Turbine Market Dynamics

Driver

Growing Focus on Renewable Energy and Off-Grid Power Solutions

• The global transition toward clean energy is driving significant interest in hydropower, particularly small and medium-sized projects using impulse turbines. These turbines enable sustainable electricity generation in remote areas where grid expansion is not economically feasible, contributing to broader energy security and climate goals

• National energy policies are increasingly supportive of micro-hydro initiatives, with tax incentives, feed-in tariffs, and funding mechanisms facilitating project implementation. Countries such as India, Indonesia, and Peru have introduced favorable frameworks that prioritize local energy generation through run-of-river systems

• Impulse turbines offer high efficiency in high-head environments, making them suitable for mountainous terrain where conventional turbines underperform. Their robust design and simple operation lower the cost of operation and maintenance, attracting investments from private and community-based entities

• For instance, in 2024, the Indian Ministry of New and Renewable Energy approved over 150 micro-hydro projects in northeastern states, primarily powered by impulse turbines, to support rural development and reduce fossil fuel usage

• The alignment of policy, technological feasibility, and environmental sustainability is reinforcing the market's upward trajectory. However, ensuring consistent water flow and integrating hybrid systems may be key to enhancing long-term project viability

Restraint/Challenge

Hydrological Dependence and Limited Scalability for Large-Scale Power Generation

• One of the major limitations of impulse hydropower turbines is their reliance on specific hydrological conditions, particularly high-head, low-flow water sources. In regions with seasonal water variability or climate-induced hydrological shifts, energy output becomes inconsistent, posing a challenge for reliable year-round generation

• These turbines are best suited for small to medium installations, limiting their application in large-scale grid-integrated projects. This restricts market expansion into high-demand regions where centralized energy production is necessary. As a result, impulse turbines remain confined to niche applications unless hybridized with other renewables

• Remote or high-altitude project sites often present logistical difficulties during transportation, installation, and servicing of turbine components. These challenges increase initial capital expenditures and extend project timelines, discouraging investment in some regions with poor infrastructure

• For instance, in 2023, developers in the Andean regions of South America cited prolonged delays in impulse turbine installations due to inaccessible terrain and extreme weather conditions, affecting project feasibility and costs

• While impulse turbines offer multiple benefits, addressing their technical limitations, optimizing storage solutions, and strengthening site-specific project planning will be critical for ensuring broader adoption and long-term reliability in diverse geographies

Impulse Hydropower Turbine Market Scope

The market is segmented on the basis of power rating, head type, and installation site.

- By Power Rating

On the basis of power rating, the impulse hydropower turbine market is segmented into <1 M.W., 1–10 M.W., and >10 M.W. The 1–10 M.W. segment dominated the market with the largest revenue share in 2024, driven by its broad adoption across small- and medium-scale hydro projects. These turbines are widely used in decentralized power systems, particularly in remote and rural areas requiring moderate electricity output. The segment’s growth is supported by government initiatives promoting sustainable energy in underserved regions and the relative ease of installation and maintenance associated with this power class.

The <1 M.W. segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for micro-hydropower projects aimed at off-grid electrification. These systems are gaining traction among community-level users and individual operators seeking cost-effective, eco-friendly energy solutions. Their compact design, portability, and suitability for high-head, low-flow conditions make them ideal for small-scale deployments, particularly in developing nations.

- By Head Type

On the basis of head type, the market is segmented into low head turbine, medium head turbine, and high head turbine. The high head turbine segment accounted for the largest market share in 2024, as impulse turbines such as Pelton and Turgo are specifically engineered for high-head, low-flow applications. These systems deliver optimal efficiency in mountainous and hilly terrains where elevation provides sufficient water pressure. The strong compatibility of impulse turbines with high-head environments continues to make them a preferred choice for both new installations and retrofits.

The medium head turbine segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increased development of medium-altitude hydropower projects in emerging economies. Many sites previously deemed unsuitable for conventional turbines are now being explored with improved impulse turbine technology, enhancing electricity access across semi-urban and peri-urban locations.

- By Installation Site

On the basis of installation site, the market is segmented into low hydro power plant, medium hydro power plant, and high hydro power plant. The high hydro power plant segment held the largest market revenue share in 2024, supported by significant investment in large-scale hydro infrastructure in regions with favorable terrain. High elevation areas provide natural advantages for energy generation through impulse turbines, and ongoing government support for utility-scale renewable projects boosts this segment.

The low hydro power plant segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the surge in micro- and mini-hydropower installations. These plants play a vital role in rural electrification programs and are supported by international aid, non-governmental organizations, and private investors focused on sustainable development. Their minimal environmental impact and scalability position them as a viable alternative to fossil fuel-based solutions in remote regions.

Impulse Hydropower Turbine Market Regional Analysis

• Asia-Pacific dominated the impulse hydropower turbine market with the largest revenue share of 41.37% in 2024, driven by a surge in hydropower development projects across countries such as China, India, and Indonesia, along with strong government support for renewable energy initiatives

• The region benefits from abundant mountainous terrains suitable for high-head installations, which are ideal for impulse turbines such as Pelton and Turgo. National policies encouraging rural electrification and low-emission energy generation further support the demand for small and medium hydro power plants equipped with impulse turbines

• In addition, increased investments from both public and private sectors in modernizing existing hydropower stations and developing off-grid power infrastructure are propelling market expansion across emerging economies in Asia-Pacific

China Impulse Hydropower Turbine Market Insight

The China impulse hydropower turbine market held the largest revenue share in Asia-Pacific in 2024, driven by the country’s aggressive push toward clean energy and its position as a global leader in hydropower capacity. China’s mountainous geography offers ideal conditions for high-head hydropower installations, aligning well with the deployment of impulse turbines. The government’s commitment to upgrading legacy hydroelectric plants and integrating smart grid technologies is also fueling demand for modern and efficient turbine solutions.

Japan Impulse Hydropower Turbine Market Insight

The Japan impulse hydropower turbine market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s emphasis on energy security, disaster resilience, and low-carbon energy sources. Japan’s mountainous terrain and numerous small rivers create favorable conditions for high-head micro and small hydropower projects, where impulse turbines such as Pelton and Turgo are commonly used. Government initiatives promoting decentralized power generation, combined with policies encouraging the utilization of untapped small hydro potential in rural and remote areas, are accelerating market growth. In addition, Japan’s advanced manufacturing capabilities and focus on energy efficiency are fostering the adoption of compact and high-performance impulse turbines.

North America Impulse Hydropower Turbine Market Insight

The North America impulse hydropower turbine market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing investments in sustainable energy infrastructure and efforts to repower existing hydro facilities. The United States and Canada are prioritizing the refurbishment of aging hydropower stations to meet new efficiency standards and environmental compliance requirements. The presence of established manufacturers and research institutions further strengthens innovation and deployment of advanced impulse turbine technologies in the region.

U.S. Impulse Hydropower Turbine Market Insight

The U.S. impulse hydropower turbine market is expected to witness the fastest growth rate from 2025 to 2032, driven by regulatory initiatives to decarbonize the energy mix and extend the operational life of existing hydro assets. Federal support for small hydro projects and run-of-river plants is boosting interest in compact, high-efficiency impulse turbines. As utilities seek to meet clean energy mandates and increase grid resilience, investment in modern turbine solutions is likely to grow, particularly in mountainous western states.

Europe Impulse Hydropower Turbine Market Insight

The Europe impulse hydropower turbine market is expected to witness the fastest growth rate from 2025 to 2032, supported by favorable energy transition policies and widespread modernization of hydro facilities. Countries such as Norway, Switzerland, and Austria with ample high-head hydropower resources are leading adoption. The European Union’s climate goals and carbon neutrality ambitions are encouraging investments in both small-scale and pumped storage hydropower, contributing to the demand for high-performance impulse turbines.

Germany Impulse Hydropower Turbine Market Insight

The Germany impulse hydropower turbine market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s push toward sustainable energy solutions and refurbishment of existing renewable energy infrastructure. Germany’s commitment to decentralization and grid efficiency has led to rising interest in small hydroelectric systems, where impulse turbines are particularly suitable. Continued technological innovation and government support for clean energy development are likely to sustain market momentum through the forecast period.

U.K. Impulse Hydropower Turbine Market Insight

The U.K. impulse hydropower turbine market is expected to witness the fastest growth rate from 2025 to 2032, driven by efforts to diversify the renewable energy portfolio and support community-level clean energy initiatives. The UK’s potential for small hydro projects in Scotland and Wales provides opportunities for impulse turbine deployment. Supportive regulatory frameworks and green funding mechanisms are playing a crucial role in encouraging investment in hydropower technologies across the region.

Impulse Hydropower Turbine Market Share

The Impulse Hydropower Turbine industry is primarily led by well-established companies, including:

- FLOVEL Energy Private Limited (India)

- Voith GmbH & Co. KGaA (Germany)

- ANDRITZ (Austria)

- Bharat Heavy Electricals Limited (India)

- AtkinsRéalis (Canada)

- Gilbert Gilkes & Gordon Ltd (U.K.)

- Doosan Corporation (South Korea)

- Hitachi Ltd. (Japan)

- Nordex S.E. (Germany)

- M a v e l, a.s. (Czech Republic)

- General Electric (U.S.)

- Siemens (Spain)

- ABB (Switzerland)

- Kolektor (Slovenia)

- Canyon Hydro (U.S.)

Latest Developments in Global Impulse Hydropower Turbine Market

- In January 2023, the Gerlos 1 power plant successfully completed the trial operation of the first horizontal, six-nozzle Pelton turbine, marking a significant technological milestone. Designed for high-head hydropower plants, the turbine uses high-velocity water jets to drive the Pelton runner, improving efficiency and energy output. This development sets a new industry benchmark for high-performance turbine configurations, potentially influencing future hydropower installations in similar terrains

- In February 2023, GE Energy announced a USD 20 million investment to establish a state-of-the-art impulse hydropower turbine manufacturing facility in South Carolina. This expansion aims to strengthen GE Energy’s production capabilities while addressing the rising global demand for renewable energy infrastructure. The move is expected to enhance local job creation, accelerate turbine delivery timelines, and solidify GE’s position in the clean energy market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.