Global In Mold Electronics Market

Market Size in USD Million

CAGR :

%

USD

250.00 Million

USD

1,704.71 Million

2024

2032

USD

250.00 Million

USD

1,704.71 Million

2024

2032

| 2025 –2032 | |

| USD 250.00 Million | |

| USD 1,704.71 Million | |

|

|

|

|

In-Mold Electronics Market Size

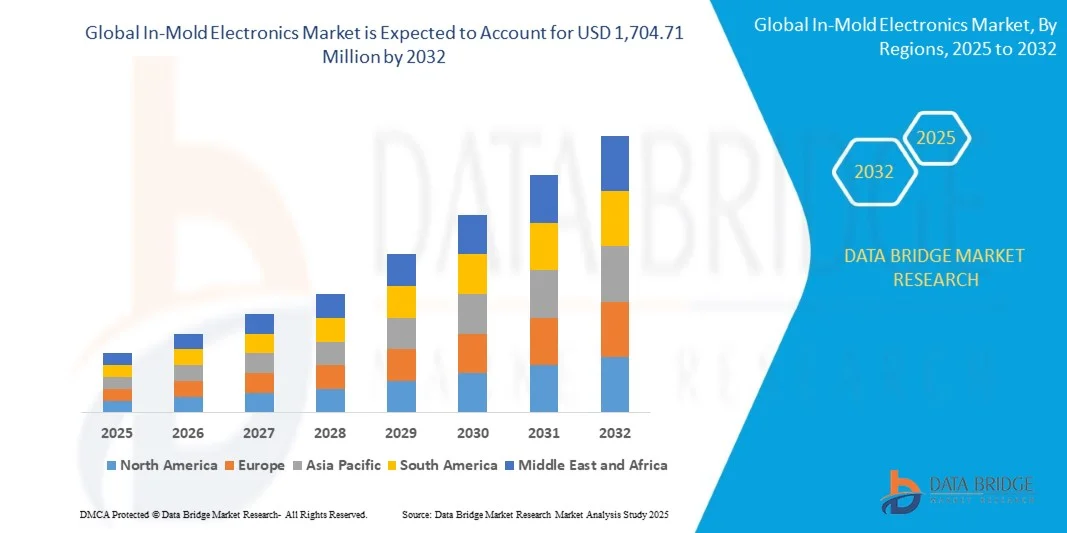

- The global in-mold electronics market size was valued at USD 250.00 million in 2024 and is expected to reach USD 1,704.71 million by 2032, at a CAGR of 27.12% during the forecast period

- The market growth is largely fuelled by the increasing demand for lightweight, compact, and durable electronic components across automotive, consumer electronics, and healthcare applications

- The growing adoption of flexible and printed electronics, coupled with advancements in conductive inks and polymer substrates, is accelerating the integration of in-mold electronics in next-generation smart devices and vehicle interiors

In-Mold Electronics Market Analysis

- The global in-mold electronics market is witnessing robust growth due to rising emphasis on design flexibility, cost efficiency, and sustainability in electronic manufacturing

- The shift toward smart surfaces and integrated control interfaces in automotive and consumer sectors is driving innovation and large-scale commercialization of in-mold electronic technologies

- Asia-Pacific dominated the in-mold electronics (IME) market with the largest revenue share of 41.37% in 2024, driven by rapid industrialization, expanding automotive production, and strong growth in the consumer electronics sector across countries such as China, Japan, and South Korea

- North America region is expected to witness the highest growth rate in the global in-mold electronics market, driven by strong R&D activities, rapid technological integration, and rising demand for lightweight, multifunctional electronic components across industries

- The conductive inks segment held the largest market revenue share in 2024, driven by the increasing use of printed conductive circuits in flexible and lightweight electronic applications. These inks enable seamless integration of electrical pathways within molded surfaces, enhancing performance, design freedom, and product reliability

Report Scope and In-Mold Electronics Market Segmentation

|

Attributes |

In-Mold Electronics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Of Smart And Connected Vehicle Interfaces • Growing Adoption Of Flexible And Printed Electronics |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

In-Mold Electronics Market Trends

“Integration Of In-Mold Electronics In Automotive Interiors”

- The integration of in-mold electronics (IME) in automotive interiors is revolutionizing vehicle design by enabling lightweight, space-efficient, and aesthetically advanced control panels. IME allows the seamless embedding of electronic circuits, sensors, and touch controls into molded plastic surfaces, enhancing both functionality and design flexibility. This is particularly beneficial for modern vehicles prioritizing smart, user-centric interiors. The use of IME helps automakers achieve design uniformity, reduce assembly steps, and minimize wiring, contributing to both cost efficiency and improved ergonomics in interior layouts

- The automotive industry’s growing focus on reducing vehicle weight and component count is driving rapid IME adoption, as it combines mechanical structure and electronics into a single integrated part. This reduces wiring complexity, manufacturing time, and material costs while improving durability and design customization. In addition, IME enables sustainable manufacturing by decreasing the need for separate printed circuit boards and connectors, lowering waste generation and enhancing recyclability in vehicle production

- Increasing demand for advanced infotainment systems, ambient lighting, and integrated control surfaces in electric and luxury vehicles is fuelling IME deployment across dashboards, door panels, and center consoles. Automakers are partnering with material and electronic component suppliers to create high-performance, thermally stable IME solutions. The integration of such technologies enhances driver experience and allows intuitive interaction, supporting the growing trend of digitalized vehicle interiors and connected car ecosystems

- For instance, in 2024, TactoTek collaborated with Hyundai Mobis to develop IME-based smart surfaces for next-generation EV interiors, enabling thinner, energy-efficient control panels with enhanced user interaction and reduced assembly costs. The collaboration focused on improving the resilience and flexibility of integrated circuits under dynamic environmental conditions. This strategic development highlights the increasing industry preference for scalable, sustainable, and design-friendly electronic integration in automotive applications

- While automotive integration presents immense opportunities, challenges remain in ensuring long-term reliability under thermal and mechanical stress. Market players are focusing on developing high-temperature-resistant conductive inks and durable substrates to meet the stringent requirements of automotive environments. The ongoing material research aims to extend product lifespan and maintain stable electrical conductivity, which will be critical for ensuring consistent performance across diverse use cases in automotive, aerospace, and consumer electronics

In-Mold Electronics Market Dynamics

Driver

“Growing Demand For Lightweight And Aesthetic Electronic Components”

- The increasing demand for lightweight, compact, and aesthetically appealing electronic components across industries is a major driver of the in-mold electronics market. IME technology enables the integration of printed circuitry, sensors, and lighting elements directly into 3D surfaces, replacing multiple traditional components with a single molded unit. This not only optimizes design efficiency but also reduces production complexity, offering manufacturers a versatile and cost-effective alternative to conventional assemblies

- This not only enhances design flexibility but also supports sustainable manufacturing by reducing material usage and assembly steps. The technology is especially favored in automotive, consumer electronics, and home appliance applications where sleek design and functionality are key selling points. Furthermore, IME helps manufacturers achieve miniaturization and smart design integration, enabling new possibilities for intuitive, user-centric product interfaces across industries

- Rising adoption of IME panels in infotainment systems, wearable devices, and smart home interfaces underscores the market’s shift toward multifunctional and user-friendly designs. The demand for customizable interfaces is further encouraging manufacturers to adopt IME for enhanced aesthetic appeal and performance efficiency. These products not only provide tactile feedback and lighting integration but also improve device durability, making them suitable for next-generation electronic applications

- For instance, in 2023, Faurecia introduced a new IME-based cockpit design integrating lighting and capacitive touch controls, improving energy efficiency while reducing part count and assembly complexity. The innovation demonstrated IME’s capability to merge functionality with style, appealing to OEMs focused on advanced human–machine interfaces. This move also set a new benchmark for sustainable production practices by reducing resource consumption and component redundancy

- Despite its potential, consistent electrical performance and scalability in high-volume production remain key focus areas. Continuous innovations in conductive materials and advanced molding techniques will be crucial to sustain this growth trajectory. Industry leaders are investing heavily in R&D to enhance manufacturing precision, develop reliable circuit encapsulation methods, and expand IME applications into medical devices, industrial control panels, and wearable technologies

Restraint/Challenge

“High Production Costs And Limited Material Compatibility”

- The high production costs associated with advanced IME manufacturing processes pose a significant restraint to widespread adoption. Specialized conductive inks, high-performance polymers, and complex molding equipment substantially increase overall production expenses, especially for small and mid-scale manufacturers. As a result, cost-sensitive sectors often hesitate to adopt IME despite its design and performance advantages

- Material compatibility challenges between electronic inks, substrates, and molding polymers can impact the durability and functionality of IME products. Maintaining circuit integrity during high-pressure and high-temperature molding processes remains a major technical barrier. Inconsistent adhesion and thermal expansion mismatches can lead to delamination or circuit failure, limiting the reliability of IME applications in harsh environments

- Furthermore, scaling IME technology for mass production while ensuring consistent quality and performance adds to operational complexity. This restricts adoption primarily to premium automotive and electronics segments where cost constraints are less critical. Overcoming this limitation requires investments in process automation, supply chain optimization, and the development of standardized production protocols

- For instance, in 2023, multiple electronic component suppliers in Asia reported delays in IME mass production due to yield loss during molding and circuit integration stages, affecting product timelines and profitability. The setbacks highlighted the pressing need for better production control and precision molding technologies. Companies are now working on predictive analytics and advanced simulation tools to improve yield rates and minimize waste

- Addressing these challenges requires continuous investment in research, process standardization, and material innovation. As automation and hybrid manufacturing solutions advance, production efficiency is expected to improve, gradually reducing costs and expanding IME adoption across broader applications. Long-term, industry collaboration and open innovation platforms will play a crucial role in overcoming technical and economic barriers to IME scalability

In-Mold Electronics Market Scope

The market is segmented on the basis of component, technology, and end use.

• By Component

On the basis of component, the in-mold electronics market is segmented into conductive inks, substrates, films, adhesives, and electronic components. The conductive inks segment held the largest market revenue share in 2024, driven by the increasing use of printed conductive circuits in flexible and lightweight electronic applications. These inks enable seamless integration of electrical pathways within molded surfaces, enhancing performance, design freedom, and product reliability.

The substrates segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising demand for durable and thermally stable base materials that support high-performance printed electronics. Substrates such as polycarbonate and PET are gaining traction due to their compatibility with various printing and molding processes, ensuring flexibility, resilience, and superior electrical insulation in complex 3D structures.

• By Technology

On the basis of technology, the in-mold electronics market is segmented into screen printing, inkjet printing, thermoforming, and injection molding. The screen printing segment held the largest market revenue share in 2024, owing to its widespread use in large-scale production of printed circuitry with high precision and uniformity. Screen printing offers excellent material compatibility and cost efficiency, making it the preferred technique for manufacturing IME panels across automotive and consumer electronics applications.

The injection molding segment is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in integrated molding technologies that enable the seamless combination of structural and electronic functionalities. This process ensures high mechanical strength, design consistency, and reduced assembly steps, contributing to faster production cycles and enhanced product durability in industrial and automotive components.

• By End Use

On the basis of end use, the in-mold electronics market is segmented into automotive, consumer electronics, home appliances, industrial equipment, and others. The automotive segment held the largest market revenue share in 2024, propelled by increasing demand for lightweight, customizable, and energy-efficient control panels in next-generation vehicles. IME technology enables the integration of lighting, sensors, and touch functions into single molded parts, optimizing interior aesthetics and reducing wiring complexity.

The consumer electronics segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising adoption of flexible and compact electronic devices. Growing use of IME in smart wearables, display panels, and connected home devices is driving rapid market expansion. The technology’s ability to combine design flexibility with enhanced functionality is fostering innovation and enabling the development of sleek, high-performance consumer products.

In-Mold Electronics Market Regional Analysis

- Asia-Pacific dominated the in-mold electronics (IME) market with the largest revenue share of 41.37% in 2024, driven by rapid industrialization, expanding automotive production, and strong growth in the consumer electronics sector across countries such as China, Japan, and South Korea

- The region’s manufacturing strength, coupled with increasing investment in advanced materials, printed electronics, and flexible circuit technologies, is significantly accelerating IME adoption

- Furthermore, the rise of electric vehicles, smart home appliances, and digital manufacturing ecosystems is positioning Asia-Pacific as the global hub for in-mold electronics innovation and production

China In-Mold Electronics Market Insight

The China in-mold electronics market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s strong electronics manufacturing infrastructure and growing demand for integrated, cost-effective components. Chinese OEMs and suppliers are rapidly implementing IME solutions in automotive interiors, consumer gadgets, and smart home devices to enhance efficiency and design sophistication. The government’s ongoing smart manufacturing initiatives and the expansion of domestic R&D capabilities are further strengthening market growth. In addition, the country’s leadership in mass production and supply chain scalability continues to attract global IME partnerships and investments.

Japan In-Mold Electronics Market Insight

The Japan in-mold electronics market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s expertise in miniaturization, high-precision electronics, and advanced material science. Japanese automakers and electronics brands are at the forefront of IME innovation, integrating flexible circuits and sensors into dashboards, wearable devices, and control panels. The emphasis on energy efficiency, compact design, and smart user interfaces is fostering IME adoption across consumer and automotive applications. Furthermore, strong collaborations between academic institutions and private manufacturers are accelerating the development of next-generation IME technologies.

North America In-Mold Electronics Market Insight

The North America in-mold electronics market held a substantial share in 2024, driven by early adoption of advanced manufacturing techniques and the presence of key IME innovators. The region’s strong automotive sector, coupled with growing demand for lightweight, integrated control systems, is propelling IME deployment in vehicles and industrial equipment. The U.S. remains a key growth driver, with major OEMs investing in smart surface technologies for next-generation designs. In addition, government emphasis on sustainable, energy-efficient production is supporting continued research in conductive materials and flexible circuits.

U.S. In-Mold Electronics Market Insight

The U.S. in-mold electronics market is anticipated to maintain steady growth from 2025 to 2032, driven by rising demand for compact and energy-efficient components in automotive, aerospace, and consumer electronics applications. American manufacturers are emphasizing localized IME production to enhance supply chain resilience and reduce dependency on imports. The country’s innovation-driven ecosystem supports rapid prototyping and commercialization of new IME materials and processes. In addition, the growing integration of IME in EV interiors and wearable technologies highlights its expanding role in the future of smart, lightweight electronics.

Europe In-Mold Electronics Market Insight

The Europe in-mold electronics market is expected to witness notable growth from 2025 to 2032, supported by stringent environmental standards, sustainability goals, and advanced automotive manufacturing capabilities. European companies are leveraging IME technology to reduce material waste, improve product aesthetics, and enhance design integration. Countries such as Germany, France, and the U.K. are at the forefront of adopting IME in automotive interiors, industrial control panels, and home appliances. Moreover, increasing R&D investments and collaborations between polymer and electronics manufacturers are fostering technological innovation across the region.

Germany In-Mold Electronics Market Insight

The Germany in-mold electronics market is projected to experience strong growth during the forecast period, driven by the country’s leadership in engineering precision, automotive innovation, and industrial automation. German manufacturers are increasingly adopting IME for developing lightweight, multifunctional surfaces that improve efficiency and reduce assembly complexity. The nation’s focus on Industry 4.0 and digital integration is also encouraging the use of IME in smart manufacturing environments. Furthermore, ongoing advancements in conductive inks and thermoforming techniques are enhancing the performance and durability of IME applications across various industries.

U.K. In-Mold Electronics Market Insight

The U.K. in-mold electronics market is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in additive manufacturing and the growing use of smart surfaces in consumer and automotive applications. Increasing investments in R&D for flexible and sustainable electronic components are accelerating IME development across multiple sectors. The rise of electric and connected vehicles is further supporting demand for innovative IME-based interfaces. Moreover, the U.K.’s strategic focus on eco-efficient production and digital transformation aligns with the market’s expansion trajectory.

In-Mold Electronics Market Share

The In-Mold Electronics industry is primarily led by well-established companies, including:

- Butler Technologies, Inc. (U.S.)

- CERADROP (France)

- DuPont de Nemours, Inc. (U.S.)

- Eastprint Incorporated (U.S.)

- GenesInk (France)

- Golden Valley Products, Inc. (U.S.)

- InMold Solution (South Korea)

- Nissha Co., Ltd. (Japan)

- TACTOTEK (Finland)

- TEKRA, LLC. (U.S.)

- YOMURA TECHNOLOGIES, INC. (Taiwan)

Latest Developments in Global In-Mold Electronics Market

- In August 2023, DuPont de Nemours, Inc. completed the acquisition of Spectrum Plastics Group to expand its portfolio in healthcare and wearable electronics. The development aims to enhance DuPont’s capabilities in advanced material science and In-Mold Electronics production by integrating medical-grade substrates and specialty polymers. This strategic move is expected to strengthen DuPont’s position in flexible and printed electronics manufacturing while supporting innovation across high-performance applications. The acquisition also reinforces the company’s competitive edge in delivering durable and miniaturized IME solutions for emerging medical and consumer markets

- In December 2023, TACTOTEK entered into a strategic partnership with Yanfeng to co-develop advanced human-machine interface (HMI) solutions for next-generation automotive interiors. The collaboration focuses on integrating lighting, touch controls, and electronic circuitry into single 3D-molded components using IME technology. This initiative is expected to streamline automotive design, reduce assembly complexity, and enhance the aesthetic and functional appeal of vehicle interiors. The partnership further accelerates IME adoption across the automotive sector by promoting lightweight, sustainable, and digitally interactive interior systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global In Mold Electronics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global In Mold Electronics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global In Mold Electronics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.