Global In Mold Labels Market

Market Size in USD Billion

CAGR :

%

USD

2.79 Billion

USD

3.70 Billion

2024

2032

USD

2.79 Billion

USD

3.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.79 Billion | |

| USD 3.70 Billion | |

|

|

|

|

In-Mold Labels Market Size

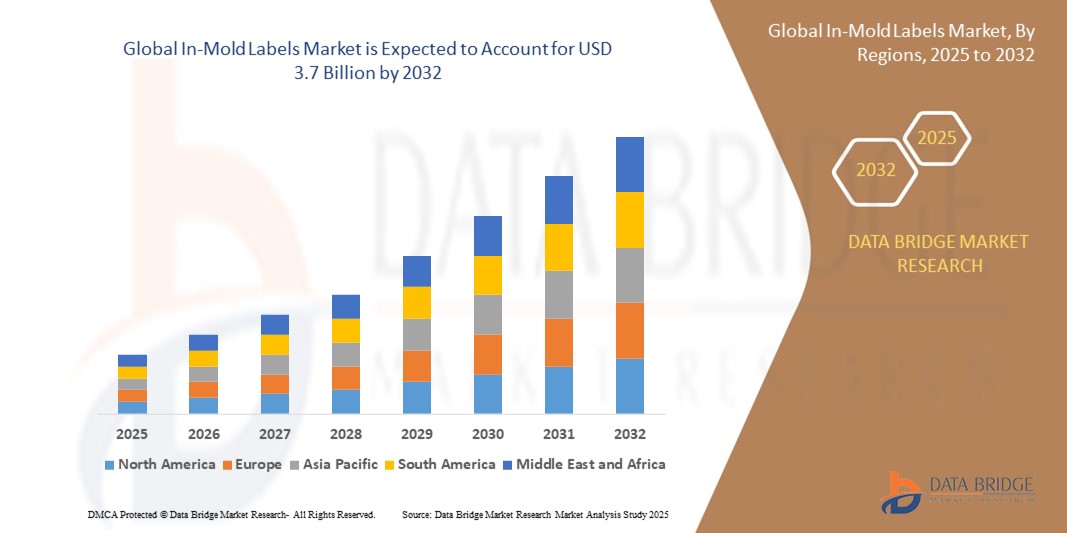

- The Global In-Mold Labels Market size was valued at USD 2.79 billion in 2024 and is expected to reach USD 3.7 billion by 2032, at a CAGR of 5.22% during the forecast period

- The market growth is largely fueled by The rise in inclination toward attractive packaging and increasing demand for aesthetically appealing no-label look and multi-colored prints on consumer products

- Furthermore, the increasing incorporation of in-mold labels in product packaging and the rise in popularity of these labels as they display more information on the product creating positive brand image for a business, thereby driving the In-Mold Labels industry forward.

In-Mold Labels Market Analysis

- In- mold labels are products that are extensively utilized in the packaging industry for the decoration of an object and they are made of material such as polyethylene and ABS resin and polyvinyl chloride.

- These products are manufactured by injection molding, thermoforming and blow molding processes. Several cell phone manufacturers use the technology rather than spray painting because of its wear resistance nature.

- Asia-Pacific dominates the Global In-Mold Labels Market with over 40% market share in 2024, driven by expanding consumer goods, automotive, and personal care industries in China, India, and Southeast Asia, along with robust manufacturing capabilities, favorable trade policies, rising sustainability mandates, and increasing investment in eco-efficient packaging innovations across developing economies.

- Asia-Pacific is the fastest-growing IML region with a projected CAGR of 5.2% (2024–2030), fueled by packaging sector expansion, manufacturing investments, and rising consumer product demand across India, China, and ASEAN countries, alongside favorable trade policies, localization of production, e-commerce growth, and innovation in lightweight, smart labeling solutions.

- In 2024, Polypropylene dominates the in-mold labels market, accounting for over 45% share due to its excellent printability, durability, and recyclability, making it ideal for food, beverage, and consumer goods packaging

Report Scope and In-Mold Labels Market Segmentation

|

Attributes |

In-Mold Labels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

In-Mold Labels Market Trends

“Rising Demand for Sustainable and Smart Labeling Solutions”

- A prominent trend in the Global In-Mold Labels Market is the transition toward sustainable and technologically advanced labeling options. Companies are increasingly adopting recyclable and biodegradable IML films to meet circular economy targets and brand sustainability goals.

For Instance,

- UPM Raflatac and Avery Dennison are developing IML solutions using bio-based resins and recyclable polypropylene, aligning with global packaging sustainability mandates. These solutions are gaining traction in Europe and North America, where eco-labeling regulations are stringent.

- Additionally, smart IML technologies—such as RFID and QR code integration—are growing in popularity to enhance supply chain transparency, product authentication, and consumer engagement.

- Customization is also driving innovation, with brands seeking high-resolution graphics and textured finishes for enhanced shelf appeal. Digital printing and hybrid technologies enable flexible production, supporting short runs and seasonal packaging.

- Industry players like Multi-Color Corporation and CCL Industries are investing in digital IML capabilities to cater to FMCG and automotive clients demanding both aesthetic and functional excellence.

- This evolution reflects a broader shift toward intelligent, sustainable packaging that not only elevates brand visibility but also meets modern compliance and traceability needs.

In-Mold Labels Market Dynamics

Driver

“Boom in Consumer Goods and Brand Differentiation Fueling IML Growth”

- The expanding demand for consumer goods—especially food, beverage, personal care, and household products—is a key driver for the In-Mold Labels Market. IML provides durable, visually appealing, and tamper-proof labeling ideal for high-volume packaged goods.

For instance,

- In March 2024, Coveris Group launched an ultra-thin IML film line for dairy and ready-meal packaging, responding to lightweighting trends and sustainability goals in the food sector.

- Additionally, IML enables seamless label integration during molding, reducing post-processing costs and ensuring label longevity. These attributes are particularly valuable in high-moisture and high-wear environments such as frozen foods and industrial containers.

- As brands seek differentiation on crowded retail shelves, the ability of IML to deliver vivid, scratch-resistant graphics provides a competitive edge. This is further supported by increased automation in injection molding lines, making IML cost-effective at scale.

- The synergy of sustainability, durability, and brand identity is positioning IML as a preferred choice in the evolving global packaging ecosystem.

Restraint/Challenge

“High Capital Investment and Limited Compatibility with Existing Equipment”

- A major restraint in the In-Mold Labels Market is the high initial cost of setting up IML-compatible production lines. Unlike traditional labeling, IML requires specialized injection molding equipment and label feeding systems.

For Instance,

- small and mid-sized packaging firms often hesitate to adopt IML due to the steep capital requirements and training needs, particularly in cost-sensitive markets like Latin America and Southeast Asia.

- Additionally, retrofitting existing lines for IML can be technically complex and may not justify the investment unless large volumes or long production runs are expected.

- The lack of compatibility with various mold designs and product shapes further limits its application in certain packaging segments.

- To address these issues, companies are exploring modular IML systems and hybrid molding-labeling setups. However, achieving cost-efficiency and production flexibility remains a critical challenge for broader adoption.

- Bridging this gap through technological innovation, training support, and scalable solutions will be essential for unlocking the full potential of IML across diverse sectors.

In-Mold Labels Market Scope

The market is segmented on the basis of material, technology, printing technology, printing ink and end use

- By material

On the basis of material, the in-mold labels market is segmented into polypropylene, polyethylene, polyvinyl chloride, ABS resins and others. In 2024, Polypropylene dominates the in-mold labels market, accounting for over 45% share due to its excellent printability, durability, and recyclability, making it ideal for food, beverage, and consumer goods packaging.

In 2024, Polyethylene is the fastest-growing segment, projected to grow at a CAGR of 6.8%, driven by rising demand for flexible, lightweight packaging in personal care and industrial applications requiring high impact resistance.

- By technology

On the basis of technology, the in-mold labels market is segmented into extrusion blow-molding process, injection molding process and thermoforming. Injection molding dominates the in-mold labels market due to its precision, compatibility with complex designs, and high-volume production efficiency, making it ideal for food, beverage, and consumer goods packaging applications.

Thermoforming is the fastest-growing segment due to increasing adoption in lightweight and cost-effective packaging formats, especially for dairy and single-use food containers, driven by efficiency and material savings.

- By printing technology

On the basis of printing technology, the in-mold labels market is segmented into flexographic printing, offset printing, gravure printing, digital printing and others. Flexographic printing leads the market owing to its high-speed production, cost-effectiveness for large-volume runs, and compatibility with various substrates, making it preferred for food and beverage IML applications.

Digital printing is the fastest-growing segment, expanding rapidly due to its ability to offer customization, shorter turnaround times, and cost efficiency for small-batch or seasonal IML packaging production.

- By printing ink

On the basis of printing ink, the in-mold labels market is segmented into UV curable inks, thermal cured inks, water soluble inks and others. UV curable inks dominate the market due to their superior durability, resistance to moisture and abrasion, and fast curing properties, which are essential for long-lasting, high-quality in-mold label finishes.

Water-soluble inks are the fastest-growing segment, driven by increasing demand for sustainable and eco-friendly labeling solutions aligned with environmental regulations and rising consumer preference for green packaging alternatives.

- By end use

On the basis of end use, the in-mold labels market is segmented into personal care, automotive, food and beverage, consumer durables and other. Food and beverage is the leading end-use segment, driven by the demand for durable, tamper-evident, and visually appealing labels in packaged foods, dairy, and beverage containers requiring high-volume labeling.

Personal care is the fastest-growing segment, fueled by increasing demand for premium, aesthetically appealing packaging in cosmetics and hygiene products, supported by branding trends and rising consumer spending on self-care.

In-Mold Labels Market Regional Analysis

- Asia-Pacific dominates the Global In-Mold Labels Market with over 40% market share in 2024, driven by expanding consumer goods, automotive, and personal care industries in China, India, and Southeast Asia, along with robust manufacturing capabilities and rising sustainability mandates.

- Rapid urbanization, rising disposable incomes, and growing demand for durable and visually appealing packaging support regional IML adoption, further boosted by supportive government policies and increased investment in packaging technologies.

- Increasing use of automation and cost-effective manufacturing capacities further enhances Asia-Pacific’s market leadership, as local players and multinationals scale up production and diversify product applications across end-use industries.

U.S. In-Mold Labels Market Insight

In 2025, the U.S. holds around 32% of the North American IML market, supported by advanced injection molding technologies, demand for premium packaging, and sustainable labeling in food, beverage, and healthcare sectors, with strong R&D capabilities, industry-wide automation, rapid innovation cycles, and compliance with strict federal environmental packaging and safety standards.

Europe In-Mold Labels Market Insight

Europe’s IML market is bolstered by strict packaging regulations and eco-labeling requirements. Demand is rising for recyclable and bio-based IML materials, especially in Germany, France, and Italy, driven by environmental sustainability targets, consumer preference for green products, circular economy initiatives, and widespread adoption of automation and smart manufacturing technologies in labeling.

U.K. In-Mold Labels Market Insight

The U.K. IML market is driven by demand for sustainable, high-impact packaging in personal care and food industries. Growth is supported by innovation in digital printing, increasing local production capacities, premium brand differentiation, growing demand for recyclable solutions, regulatory alignment with EU standards, and rapid expansion of e-commerce packaging needs.

Germany In-Mold Labels Market Insight

Germany remains a key player due to its strong industrial base and emphasis on recyclable packaging solutions. Investment in automation and energy-efficient labeling processes enhances IML adoption across sectors including automotive, personal care, and industrial packaging, supported by green technology subsidies, innovation-led manufacturing, and compliance with stringent EU environmental frameworks.

Asia-Pacific In-Mold Labels Market Insight

Asia-Pacific is the fastest-growing IML region with a projected CAGR of 5.2%, fueled by packaging sector expansion, manufacturing investments, and rising consumer product demand across India, China, and ASEAN countries, alongside favorable trade policies, localization of production, e-commerce growth, and innovation in lightweight, smart labeling solutions.

China In-Mold Labels Market Insight

China leads in Asia Pacific with a 38% revenue share in 2025, driven by mass manufacturing, growing consumer goods sector, and government policies favoring eco-friendly packaging. Technological innovation also supports advanced IML use across automotive, personal care, and electronics industries, with rising exports, brand premiumization, and sustainable packaging compliance initiatives expanding further.

India In-Mold Labels Market Insight

India is projected to register the highest CAGR of 23.1%, driven by expanding FMCG and automotive sectors, increasing demand for aesthetic packaging, and government focus on sustainable industrial development and foreign investment, alongside growing domestic manufacturing, Make-in-India incentives, digital printing adoption, and public awareness of sustainable packaging practices.

In-Mold Labels Market Share

The In-Mold Labels industry is primarily led by well-established companies, including:

- CCL Industries (Canada)

- CONSTANTIA (Austria)

- Huhtamaki (Finland)

- COVERIS (Austria)

- Cenveo Corporation (U.S.)

- Fuji Seal International, Inc. (Japan)

- Multi-Color Corporation (U.S.)

- EVCO Plastics (U.S.)

- Innovia Films (United Kingdom)

- AVERY DENNISON CORPORATION (U.S.)

- Serigraph Inc (U.S.)

- Yupo Corporation (Japan)

- TASUS Corporation and the Tsuchiya Global Group Companies (U.S. / Japan)

- Hammer Packaging, Corp. (U.S.)

- Admark Visual Imaging (New Zealand)

Latest Developments in Global In-Mold Labels Market

- In June 2024, CCL Industries introduced advanced in-mold label solutions emphasizing sustainability, recyclability, and customization. These innovations aim to enhance product decoration and durability across various packaging applications, aligning with the growing demand for eco-friendly packaging in industries like food, beverages, and personal care.

- In August 2024, Innovia Films launched RayoForm ELR70, a five-layer semi-cavitated film designed for large-format in-mold labeling containers. Featuring a matte and glossy side, it offers reduced density and optimized anti-static control, enhancing print and molding performance for efficient sheet feeding and molding.

- In March 2024, Mold-Tek Packaging Limited invested in a Durst RSCi 510mm press equipped with priming and varnishing stations. This move aims to transform digital printing for in-mold labels, enabling high-quality, distinctive IML items showcased at Interpack, and reflecting a commitment to advanced printing technologies.

- In September 2023, SABIC partnered with Taghleef Industries, Stephanos Karydakis IML S.A., and Kotronis Packaging to demonstrate the use of certified renewable polypropylene in in-mold labeling applications. This collaboration highlights the potential of renewable polypropylene and supports SABIC's commitment to promoting a circular economy for plastics.

- In April 2023, Multi-Color Corporation announced the acquisition of Turkish in-mold label manufacturer Korsini. This strategic move aims to strengthen MCC's in-mold labeling capabilities, expand its global footprint, and enhance its product portfolio, particularly in Turkey and surrounding regions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global In Mold Labels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global In Mold Labels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global In Mold Labels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.