Global In Silico Drug Discovery Market

Market Size in USD Billion

CAGR :

%

USD

4,380.97 Billion

USD

12,150.59 Billion

2024

2032

USD

4,380.97 Billion

USD

12,150.59 Billion

2024

2032

| 2025 –2032 | |

| USD 4,380.97 Billion | |

| USD 12,150.59 Billion | |

|

|

|

|

In-Silico Drug Discovery Market Size

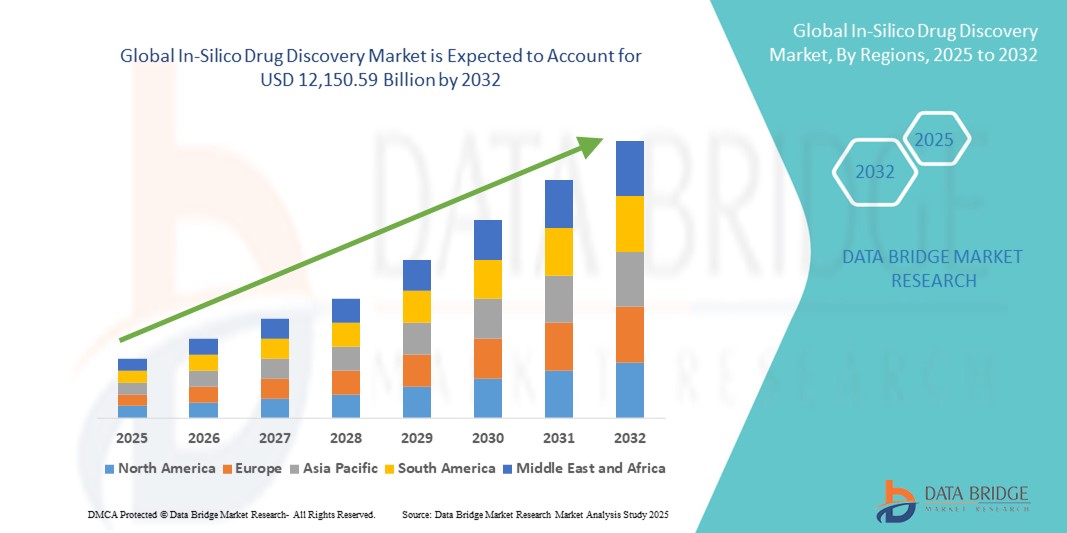

- The global in-silico drug discovery market size was valued at USD 4,380.97 billion in 2024 and is expected to reach USD 12,150.59 billion by 2032, at a CAGR of 13.60% during the forecast period

- The market growth of in-silico drug discovery solutions is largely fueled by the increasing adoption of computational technologies and advanced software platforms in drug research and development. The integration of bioinformatics, molecular modeling, and AI-driven predictive tools is streamlining the drug discovery process, reducing time and cost

- Furthermore, rising demand for efficient, cost-effective, and accurate drug candidate identification and validation is driving the uptake of in-silico drug discovery solutions. These factors are significantly accelerating the adoption of such platforms across pharmaceutical and biotechnology companies, thereby boosting overall industry growth

In-Silico Drug Discovery Market Analysis

- In-Silico drug discovery, which leverages computational methods to accelerate the identification, design, and optimization of potential drug candidates, is becoming a transformative approach in the pharmaceutical industry by reducing development time and costs

- The rising demand for in-silico drug discovery is primarily driven by advancements in artificial intelligence, machine learning, and high-performance computing, alongside the pharmaceutical industry's increasing need for more efficient and cost-effective drug development processes

- North America dominated the in-silico drug discovery market with the largest revenue share of 40.5% in 2024, supported by high adoption of cutting-edge technologies, significant investments in pharmaceutical R&D, and a strong presence of key industry players. The U.S. experienced substantial growth, driven by startups and established firms focusing on AI and advanced computational drug screening platforms

- Asia-Pacific is expected to be the fastest growing region in the in-silico drug discovery market during the forecast period, buoyed by rapid urbanization, expanding healthcare infrastructure, rising disposable incomes, and increasing investment in innovative drug discovery technologies across countries such as China, Japan, and India

- The Software as a Service (SaaS) segment dominated the in-silico drug discovery market with the largest market revenue share of 42.6% in 2024. This dominance is attributed to the flexibility SaaS platforms provide, enabling pharmaceutical companies and research institutions to access computational drug discovery tools without heavy upfront investments in infrastructure

Report Scope and In-Silico Drug Discovery Market Segmentation

|

Attributes |

In-Silico Drug Discovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

In-Silico Drug Discovery Market Trends

Growing Importance of Computational Tools and Automation in Drug Discovery

- A significant and accelerating trend in the global in-silico drug discovery market is the increasing adoption of advanced computational tools, modeling software, and automated workflows. These technologies are enhancing the efficiency and accuracy of drug discovery processes, from target identification to preclinical testing

- For instance, many leading pharmaceutical and biotech companies are leveraging in-silico platforms to simulate molecular interactions, optimize lead compounds, and predict pharmacokinetic properties, thereby reducing reliance on traditional wet-lab experiments

- The integration of high-performance computing and cloud-based platforms allows researchers to perform complex simulations at scale, enabling faster iteration and decision-making in early-stage drug discovery

- Advances in bioinformatics, molecular modeling, and cheminformatics within in-silico platforms provide researchers with actionable insights to prioritize drug candidates, predict off-target effects, and design safer therapeutics

- This trend towards more computational, predictive, and automated drug discovery methods is reshaping the pharmaceutical R&D landscape. Consequently, companies are increasingly investing in scalable, modular, and customizable in-silico solutions that can integrate seamlessly with existing laboratory and research workflows

- The demand for efficient, cost-effective, and high-throughput drug discovery methods is expected to grow rapidly across both large pharmaceutical companies and smaller biotech startups, as organizations seek to accelerate development timelines and reduce R&D costs

In-Silico Drug Discovery Market Dynamics

Driver

Growing Need Due to Rising Demand for Efficient Drug Discovery Solutions

- The increasing prevalence of complex diseases and the urgent need to accelerate drug development are driving significant demand for in-silico drug discovery platforms. These computational solutions allow researchers to model, simulate, and predict drug behavior before moving to costly laboratory experiments

- In 2021, Insilico Medicine used its in-silico discovery platform (Pharma.AI) to identify a novel drug target for IPF and design a small-molecule inhibitor

- Pharmaceutical companies and research institutes are increasingly adopting these platforms to reduce R&D timelines and costs. In-silico platforms offer functionalities such as molecular docking simulations, virtual screening, and predictive pharmacokinetics, making drug discovery more efficient and precise

- The integration of high-throughput computational workflows with advanced bioinformatics tools is enabling faster target identification, lead optimization, and prediction of drug efficacy across multiple therapeutic areas

- The availability of cloud-based platforms and automated simulation workflows is facilitating wider adoption across both large pharmaceutical firms and smaller biotech startups. User-friendly interfaces and scalable solutions are further contributing to market growth

Restraint/Challenge

Concerns Regarding High Initial Costs and Technical Expertise Requirements

- High upfront costs associated with advanced in-silico drug discovery platforms remain a significant challenge, particularly for smaller research organizations, start-ups, and academic institutions with limited budgets. These initial investments can act as a barrier to adopting state-of-the-art computational solutions despite their long-term efficiency benefits

- The complexity of certain computational models and simulation workflows requires specialized knowledge, skilled personnel, and extensive technical training. This creates hurdles for broader implementation, especially in organizations that lack experienced bioinformaticians or computational chemists to operate these platforms effectively

- Developing cost-effective licensing models, intuitive user interfaces, and comprehensive training programs is essential to address these challenges. Simplified workflows and flexible subscription models can encourage wider adoption and enable smaller institutions to leverage advanced in-silico capabilities

- Although the costs of these platforms are gradually decreasing due to technological advancements and competitive offerings, the perceived premium for high-end features may still discourage some organizations. This is particularly true in developing regions or for smaller-scale research setups where budget constraints are more pronounced

- Enhancing affordability, providing robust technical support, and educating stakeholders on the scientific, clinical, and operational advantages of in-silico drug discovery are vital steps to ensure sustained market growth and broader adoption across diverse research and pharmaceutical environments

In-Silico Drug Discovery Market Scope

The market is segmented on the basis of type, type of large molecule, workflow, target therapeutic area, and end user.

- By Type

On the basis of type, the in-silico drug discovery market is segmented into software as a service, consultancy as a service, and software. The software as a service segment dominated the largest market revenue share of 42.6% in 2024. This dominance is attributed to the flexibility SaaS platforms provide, enabling pharmaceutical companies and research institutions to access computational drug discovery tools without heavy upfront investments in infrastructure. SaaS solutions facilitate scalability, remote access, regular software updates, and collaborative workflows, making them highly appealing to organizations seeking efficient and cost-effective computational drug discovery.

The consultancy as a service segment is expected to witness the fastest CAGR of 23.4% from 2025 to 2032. This rapid growth is primarily driven by the increasing trend of outsourcing specialized computational drug discovery tasks to expert consulting firms, allowing organizations to leverage external expertise efficiently. Companies are increasingly relying on consultancy services to gain actionable insights from experienced professionals, accelerate early-stage drug discovery, and streamline the development process, thereby reducing time-to-market for novel drug candidates. The segment benefits from the rising demand for tailored, end-to-end in-silico solutions that can address specific research challenges across therapeutic areas.

- By Type of Large Molecule

On the basis of large molecule, the in-silico drug discovery market is segmented into antibodies, proteins, peptides, nucleic acids, and vectors. The antibodies segment held the largest market revenue share of 38.7% in 2024. Antibody therapeutics remain a major focus in drug development due to their high specificity and efficacy in treating cancer, autoimmune, and infectious diseases. The growing prevalence of monoclonal antibody therapies and increasing clinical trials are propelling the demand for antibody-focused in-silico discovery platforms.

The peptides segment is expected to witness the fastest CAGR of 21.9% from 2025 to 2032, fueled by the growing interest in peptide-based therapeutics across therapeutic areas such as metabolic disorders, oncology, and neurological diseases. The increasing adoption of computational tools for peptide design, optimization, and simulation is enabling researchers to streamline the drug development process, reduce experimental costs, and improve the accuracy of predicting candidate efficacy. These in-silico approaches allow for faster identification of promising peptide candidates while minimizing the risks associated with traditional experimental methods.

- By Workflow

On the basis of workflow, the in-silico drug discovery market is segmented into discovery, target identification, reverse docking, bioinformatics, protein structure prediction, target validation, lead discovery, pharmacophore, library design, preclinical tests, and clinical trials. The discovery segment dominated the market in 2024 with a revenue share of 35.9%, driven by the need to accelerate early-stage drug identification and reduce R&D timelines. Advanced computational discovery platforms enable virtual screening, molecular modeling, and AI-driven predictions, making the discovery phase more efficient and cost-effective.

The lead discovery segment is anticipated to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by the rising adoption of advanced computational techniques such as predictive analytics, molecular docking, and machine learning algorithms. These tools enable researchers to efficiently identify high-potential drug candidates, minimizing the traditional reliance on time-consuming trial-and-error experiments. By leveraging in-silico models, pharmaceutical companies can streamline the progression of promising compounds toward preclinical and clinical development stages, thereby accelerating the overall drug discovery process.

- By Target Therapeutic Area

On the basis of target therapeutic area, the in-silico drug discovery market is segmented into human immunodeficiency virus (HIV), infectious diseases, metabolic disorders, mental disorders, musculoskeletal disorders, neurological disorders, oncological disorders, respiratory disorders, skin disorders, urogenital disorders, autoimmune disorders, blood disorders, cardiovascular disorders, gastrointestinal and digestive disorders, hormonal disorders, and others. The oncological disorders segment dominated with the largest revenue share of 31.5% in 2024, attributed to rising cancer incidence worldwide and the increasing reliance on computational models to design targeted therapies. Immuno-oncology and precision medicine approaches further enhance the importance of in-silico platforms in this area.

The neurological disorders segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by the growing complexity of central nervous system disorders and the increasing demand for computational modeling in drug discovery. In-silico approaches are being extensively used to identify novel therapeutic targets, optimize molecular structures, and predict efficacy and safety profiles in a more efficient and cost-effective manner. These methods help reduce the reliance on traditional experimental techniques, which are often time-consuming and resource-intensive. The rising prevalence of neurological conditions, coupled with the urgent need for effective treatments, is driving the adoption of advanced computational tools

- By End User

On the basis of end user, the in-silico drug discovery market is segmented into contract research organizations, pharmaceutical industry, academic and research institutes, and others. The pharmaceutical industry segment held the largest market revenue share of 39.2% in 2024, driven by the widespread adoption of in-silico drug discovery platforms to streamline the drug development process. These platforms enable pharmaceutical companies to accelerate target identification, optimize lead compounds, and reduce overall R&D costs. In addition, in-silico solutions facilitate enhanced collaboration among global R&D teams, improve data integration, and support predictive modeling for better decision-making.

The contract research organizations segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, driven by the increasing trend of pharmaceutical companies outsourcing computational drug discovery tasks to specialized CROs. This shift allows organizations to access expert knowledge in simulation-based drug design, advanced modeling, and predictive analytics without the need for extensive in-house resources. CROs provide flexible and cost-effective R&D models, enabling faster progression from target identification to lead optimization.

In-Silico Drug Discovery Market Regional Analysis

- North America dominated the in-silico drug discovery market with the largest revenue share of 40.5% in 2024, supported by the high adoption of cutting-edge technologies, substantial investments in pharmaceutical R&D, and a strong presence of key industry players

- The region benefits from advanced computational infrastructure, availability of skilled professionals, and robust regulatory support, which collectively facilitate rapid deployment of in-silico drug discovery platforms

- Furthermore, strong collaborations between industry and academic institutions, as well as increasing funding for precision medicine, have reinforced North America’s dominance in this market

U.S. In-Silico Drug Discovery Market Insight

The U.S. in-silico drug discovery market captured the largest revenue share in North America in 2024, fueled by the expansion of AI-based computational drug discovery platforms and the growing focus on accelerating early-stage drug development. Companies are leveraging advanced modeling, simulation, and bioinformatics tools to enhance lead identification, optimize molecular structures, and reduce the overall drug development timeline. In addition, the integration of high-performance computing and machine learning techniques enables more efficient data analysis, predictive modeling, and virtual screening, further propelling the growth of the U.S. market.

Europe In-Silico Drug Discovery Market Insight

The Europe in-silico drug discovery market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strong investments in pharmaceutical R&D, supportive regulatory frameworks, and the presence of major global biotech and pharmaceutical companies. Increasing emphasis on precision medicine, coupled with technological advancements in computational platforms, is fueling adoption across research institutions and industry players. The region is witnessing steady growth across pharmaceutical and academic sectors, with an increasing focus on early-stage discovery and target validation using in-silico approaches.

U.K. In-Silico Drug Discovery Market Insight

The U.K. in-silico drug discovery market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s robust life sciences ecosystem and growing adoption of computational drug discovery tools. Initiatives to accelerate drug development, government-backed innovation programs, and collaboration between biotech firms and research institutes are enhancing the implementation of AI and in-silico modeling techniques. The increasing demand for cost-effective, predictive drug discovery solutions is further driving market expansion in the U.K.

Germany In-Silico Drug Discovery Market Insight

The Germany in-silico drug discovery market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s advanced pharmaceutical and biotechnology infrastructure. Investments in computational biology, bioinformatics, and AI-driven drug design platforms are increasing, enabling pharmaceutical companies and research institutions to enhance early-stage drug discovery and reduce R&D costs. Germany’s focus on innovation, quality, and efficiency in drug development supports the sustained adoption of in-silico methodologies.

Asia-Pacific In-Silico Drug Discovery Market Insight

The Asia-Pacific in-silico drug discovery market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by rapid urbanization, expanding healthcare infrastructure, and increasing investment in innovative drug discovery technologies across countries such as China, Japan, and India. Rising disposable incomes, growing pharmaceutical R&D activities, and government initiatives promoting digital health and computational drug design are accelerating the adoption of in-silico platforms. The region is also witnessing a surge in biotechnology startups and academic collaborations, which further supports the rapid growth of the market.

Japan In-Silico Drug Discovery Market Insight

The Japan in-silico drug discovery market is witnessing steady growth, driven by the country’s strong technological capabilities, increasing focus on precision medicine, and growing adoption of computational modeling and simulation in pharmaceutical research. The presence of advanced AI and bioinformatics platforms enables the efficient identification of novel drug candidates and accelerates early-stage discovery, particularly in oncology, neurological, and metabolic disorder therapeutics. Supportive government initiatives and high R&D investment further bolster market expansion.

China In-Silico Drug Discovery Market Insight

The China in-silico drug discovery market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding pharmaceutical R&D infrastructure, increasing adoption of AI and computational platforms, and supportive government policies. Rising investments in biotech startups, the growing middle-class population, and enhanced healthcare infrastructure are driving demand for cost-effective and efficient in-silico drug discovery solutions. China’s emphasis on innovation and technology adoption continues to propel the market at a significant pace.

In-Silico Drug Discovery Market Share

The In-Silico Drug Discovery industry is primarily led by well-established companies, including:

- Curia Global Inc. (U.S.)

- Certara (U.S.)

- Charles River Laboratories (U.S.)

- Chemical Computing Group ULC (U.S.)

- GenScript (U.S.)

- Sygnature Discovery (U.K.)

- Abzena Ltd. (U.S.)

- BioNTech SE (Germany)

- Creative Biostructure (U.S.)

- Evotec SE (Germany)

- Nimbus Therapeutics (U.S.)

- Atomwise Inc. (U.S.)

- Schrödinger, Inc. (U.S.)

- Insilico Medicine (U.S.)

Latest Developments in Global In-Silico Drug Discovery Market

- In April 2023, Insilico Medicine announced the successful discovery of a potent, selective, and orally bioavailable small-molecule inhibitor of CDK8 using generative AI. This achievement represented a major advancement in the application of AI-driven drug discovery platforms, showcasing the ability of computational methods to accelerate the identification of promising therapeutic candidates with high precision. The development highlighted the growing role of AI in streamlining early-stage drug design and optimizing molecular properties for clinical viability

- In February 2023, Insilico Medicine received FDA Orphan Drug Designation for its AI-discovered and designed drug targeting idiopathic pulmonary fibrosis (IPF). This recognition underscored the significant potential of AI-based approaches in addressing rare diseases, enabling faster development timelines and demonstrating the platform’s capacity to generate novel therapies for conditions with limited treatment options

- In April 2023, Insilico Medicine presented four novel inhibitors for the treatment of cancer developed through its end-to-end Pharma.AI platform at the American Association for Cancer Research (AACR) conference. This presentation highlighted the platform’s comprehensive capabilities, including target identification, molecular design, and preclinical optimization, emphasizing how AI can accelerate the development of oncology therapeutics

- In November 2023, Insilico Medicine showcased data on AI-designed cancer drugs at three major international cancer conferences: the European Society for Medical Oncology (ESMO) in Madrid, the Society for Immunotherapy of Cancer (SITC) in San Diego, and the San Antonio Breast Cancer Symposium (SABCS). These presentations demonstrated the company’s ability to rapidly generate, validate, and communicate innovative oncology drug candidates, reflecting the growing acceptance of AI-driven approaches in mainstream research communities

- In May 2025, InsilicoTrials expanded its platform with advanced predictive models developed in collaboration with COSBI, aimed at enhancing the accuracy and efficiency of in-silico drug discovery processes. This expansion emphasized the importance of integrating cutting-edge computational techniques to reduce experimental costs, optimize candidate selection, and accelerate the preclinical and clinical pipeline

- In June 2025, InsilicoTrials joined Microsoft’s Startups Pegasus Program to further accelerate digital transformation in healthcare. Through this collaboration, the company aimed to integrate AI-driven solutions into its drug discovery workflows, enhancing computational capabilities, data analysis, and predictive modeling to support more efficient therapeutic development

- In May 2025, Insilico Medicine initiated a pilot project in the United Arab Emirates to discover the first novel oncology drug candidate developed entirely within the country using its proprietary Pharma.AI platform. This initiative highlighted the global expansion of AI-enabled drug discovery and the potential to establish local capabilities for advanced therapeutic development in emerging markets

- In March 2025, Isomorphic Labs, a spin-off from Google’s DeepMind, raised USD 600 million in its first external funding round. The company plans to advance AI-designed drugs into clinical trials by the end of the year, signaling the increasing investment and confidence in AI-driven approaches for accelerating drug discovery and improving the efficiency of pharmaceutical R&D

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.