Global In Station Passenger Information System Market

Market Size in USD Billion

CAGR :

%

USD

37.01 Billion

USD

95.66 Billion

2025

2033

USD

37.01 Billion

USD

95.66 Billion

2025

2033

| 2026 –2033 | |

| USD 37.01 Billion | |

| USD 95.66 Billion | |

|

|

|

|

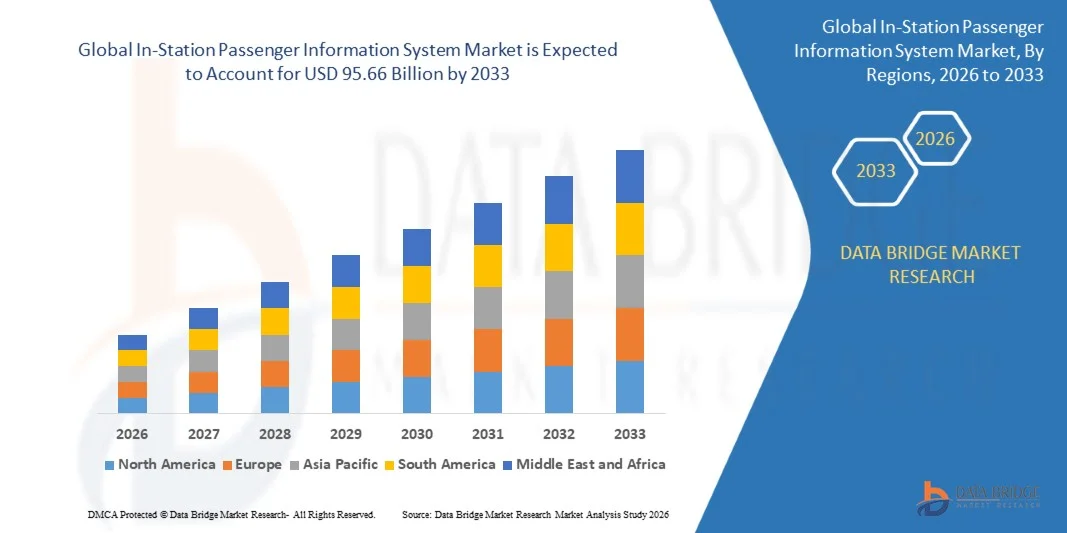

What is the Global In-Station Passenger Information System Market Size and Growth Rate?

- The global in-station passenger information system market size was valued at USD 37.01 Billion in 2025 and is expected to reach USD 95.66 Billion by 2033, at a CAGR of12.60% during the forecast period

- The increasing frequency of passenger journey through public transport has been directly influencing the growth of in-station passenger information system market

- Also, the rising use of smartphones with better connectivity improves the transit experience which is also flourishing the growth of the in-station passenger information system market

What are the Major Takeaways of In-Station Passenger Information System Market?

- The rising demands for real-time, consistent and reliable passenger information as well as ever-increasing implementation of advanced technologies such as big data, cloud and IoT for the development of such systems to enhance the general experience of the passenger are also positively impacting the growth of the market

- Furthermore, the high adoption of such systems amongst the transit agencies leading to the development of passenger satisfaction and comfort are also largely lifting the growth of the in-station passenger information system market

- North America dominated the in-station passenger information system market with a 36.25% revenue share in 2025, driven by large-scale investments in smart transportation infrastructure, widespread modernization of railway stations, metros, and airports, and early adoption of digital passenger communication technologies across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.54% from 2026 to 2033, driven by rapid urbanization, massive railway and metro expansion projects, and rising investments in smart transportation infrastructure across China, Japan, India, South Korea, and Southeast Asia

- The Solutions segment dominated the market with a 46.3% share in 2025, driven by widespread deployment of integrated display hardware, audio announcement systems, networking equipment, and control units across railway stations, metro hubs, and transit terminals

Report Scope and In-Station Passenger Information System Market Segmentation

|

Attributes |

In-Station Passenger Information System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the In-Station Passenger Information System Market?

“Rapid Shift Toward Real-Time, Digital, and Integrated In-Station Passenger Information Platforms”

- The in-station passenger information system market is witnessing strong adoption of real-time digital display systems, network-connected signage, and multimedia platforms that deliver accurate train schedules, service updates, and emergency alerts

- Operators are increasingly deploying IP-based, cloud-integrated, and centrally managed PIS solutions that enable seamless content updates across large station networks

- Rising demand for high-resolution LED/LCD displays, audio-visual integration, and multilingual support is improving passenger experience in metro, rail, and transit hubs

- For instance, companies such as Siemens, Alstom, Huawei, and Thales are enhancing in-station PIS solutions with AI-driven content management, predictive disruption alerts, and remote monitoring capabilities

- Growing focus on smart stations, digital rail infrastructure, and passenger-centric mobility is accelerating adoption of intelligent PIS platforms

- As public transport systems modernize, In-Station Passenger Information Systems will remain critical for real-time communication, operational efficiency, and enhanced passenger satisfaction

What are the Key Drivers of In-Station Passenger Information System Market?

- Rising investments in urban rail, metro expansion, and smart transportation infrastructure are driving demand for advanced in-station information systems

- For instance, during 2024–2025, multiple metro and rail authorities across Europe and Asia-Pacific upgraded legacy announcement boards to digital, networked passenger information displays

- Increasing passenger expectations for real-time updates, service transparency, and improved station experience are accelerating PIS deployment

- Advancements in display technology, connectivity (5G, fiber), cloud software, and centralized control systems are improving system reliability and scalability

- Growing adoption of integrated mobility platforms, multimodal transport hubs, and smart city initiatives is boosting long-term market demand

- Supported by sustained public transport funding and digital transformation initiatives, the In-Station Passenger Information System market is expected to register steady global growth

Which Factor is Challenging the Growth of the In-Station Passenger Information System Market?

- High installation, integration, and maintenance costs of advanced digital PIS solutions limit adoption in smaller stations and developing regions

- For instance, during 2024–2025, rising prices of display panels, networking equipment, and electronic components increased overall system deployment costs

- Integration complexity with legacy rail signaling systems, scheduling software, and station infrastructure poses technical challenges

- Dependence on stable power supply, network connectivity, and cybersecurity readiness increases operational risk

- Budget constraints, long procurement cycles, and regulatory approvals in public transport projects slow system upgrades

- To overcome these challenges, vendors are focusing on modular architectures, cloud-based software, remote diagnostics, and cost-optimized display solutions to improve market penetration

How is the In-Station Passenger Information System Market Segmented?

The market is segmented on the basis of component, mode of transportation, and functional model.

• By Component

On the basis of component, the in-station passenger information system market is segmented into Solutions, Services, and Software. The Solutions segment dominated the market with a 46.3% share in 2025, driven by widespread deployment of integrated display hardware, audio announcement systems, networking equipment, and control units across railway stations, metro hubs, and transit terminals. These solutions provide end-to-end passenger information delivery, including real-time arrival updates, emergency notifications, and service alerts, making them the preferred choice for large-scale infrastructure projects. High reliability, long operational life, and compliance with transport safety standards further support strong adoption.

The Software segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for cloud-based content management platforms, AI-enabled scheduling, predictive disruption alerts, and centralized system monitoring. Increasing focus on smart stations and digital transformation is accelerating software-led upgrades.

• By Mode of Transportation

On the basis of mode of transportation, the in-station passenger information system market is segmented into Railways, Roadways, Airways, and Waterways. The Railways segment dominated the market with a 52.8% share in 2025, owing to extensive deployment of passenger information displays, public address systems, and real-time train scheduling boards across metro, suburban, and long-distance rail networks. Continuous investments in railway modernization, high passenger volumes, and government-backed smart rail initiatives have driven large-scale adoption of advanced in-station PIS solutions.

The Airways segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing airport expansions, rising air passenger traffic, and demand for dynamic gate information, multilingual displays, and real-time flight updates. Growing emphasis on passenger experience, operational efficiency, and integration with airport management systems is accelerating PIS adoption across global airports.

• By Functional Model

On the basis of functional model, the in-station passenger information system market is segmented into Multimedia Displays, Audio Systems, Computing Systems, Networking and Communication Devices, Video Surveillance, Content Management System, and Others. The Multimedia Displays segment dominated the market with a 34.7% share in 2025, driven by extensive use of LED/LCD screens for real-time schedules, platform information, wayfinding, advertisements, and emergency alerts. High visibility, improved readability, and support for dynamic and multilingual content make multimedia displays central to modern station infrastructure.

The Content Management System (CMS) segment is expected to register the fastest CAGR from 2026 to 2033, fueled by growing demand for centralized control, real-time updates, cloud integration, and AI-driven content automation. Increasing system complexity and the need for seamless information synchronization across multiple stations are strengthening CMS adoption globally.

Which Region Holds the Largest Share of the In-Station Passenger Information System Market?

- North America dominated the in-station passenger information system market with a 36.25% revenue share in 2025, driven by large-scale investments in smart transportation infrastructure, widespread modernization of railway stations, metros, and airports, and early adoption of digital passenger communication technologies across the U.S. and Canada. High deployment of real-time display boards, public address systems, centralized control platforms, and integrated networking solutions continues to support strong regional demand across transit hubs

- Leading companies in North America are deploying cloud-connected passenger information platforms, AI-enabled content management systems, and high-resolution multimedia displays, strengthening the region’s leadership in intelligent transit communication solutions

- Strong public funding, mature transport networks, and a high focus on passenger safety, accessibility, and experience further reinforce North America’s market dominance

U.S. In-Station Passenger Information System Market Insight

The U.S. is the largest contributor in North America, supported by continuous upgrades of metro rail systems, commuter rail networks, and airport terminals. Rising adoption of real-time service updates, emergency alert systems, and multilingual passenger information platforms across major cities drives sustained demand. Presence of leading system integrators, strong transit authority budgets, and smart city initiatives further accelerate market growth.

Canada In-Station Passenger Information System Market Insight

Canada contributes significantly due to growing investments in urban transit expansion, modernization of rail corridors, and digital transformation of public transport infrastructure. Increasing adoption of centralized passenger information platforms across metro stations and intercity rail hubs supports steady market growth.

Asia-Pacific In-Station Passenger Information System Market

Asia-Pacific is projected to register the fastest CAGR of 9.54% from 2026 to 2033, driven by rapid urbanization, massive railway and metro expansion projects, and rising investments in smart transportation infrastructure across China, Japan, India, South Korea, and Southeast Asia. Increasing passenger volumes, demand for real-time travel information, and integration of digital displays with mobile and cloud platforms are accelerating system deployment across transit stations.

China In-Station Passenger Information System Market Insight

China leads the Asia-Pacific market due to extensive high-speed rail networks, large-scale metro development, and strong government support for smart mobility. Deployment of advanced multimedia displays and centralized control systems across stations drives widespread adoption.

Japan In-Station Passenger Information System Market Insight

Japan shows steady growth supported by technologically advanced rail networks, emphasis on reliability, and high passenger service standards. Continuous upgrades to digital signage and audio systems support long-term demand.

India In-Station Passenger Information System Market Insight

India is emerging as a high-growth market, driven by metro rail expansion, railway station redevelopment programs, and smart city initiatives. Rising focus on passenger safety and real-time information accelerates adoption.

South Korea In-Station Passenger Information System Market Insight

South Korea benefits from advanced urban transit systems and strong digital infrastructure. Increasing use of high-definition displays, automated announcements, and integrated station management platforms supports sustained market growth.

Which are the Top Companies in In-Station Passenger Information System Market?

The in-station passenger information system industry is primarily led by well-established companies, including:

- Cisco (U.S.)

- Siemens (Germany)

- Huawei Technologies Co., Ltd. (China)

- Hitachi, Ltd. (Japan)

- Alstom (France)

- Advantech Co., Ltd. (Taiwan)

- Cubic Corporation (U.S.)

- Thales Group (France)

- Lunetta (U.S.)

- Teleste Corporation (Finland)

- ST Engineering (Singapore)

- Passio (U.S.)

- Dysten Sp. z o.o. (Poland)

- Televic (Belgium)

- Wabtec Corporation (U.S.)

- r2p GmbH (Germany)

- Indra (Spain)

- Mitsubishi Electric Corporation (Japan)

- ICON Multimedia S.L. (Spain)

- LANCom (Germany)

- Simpleway Europe a.s. (Czech Republic)

What are the Recent Developments in Global In-Station Passenger Information System Market?

- In April 2024, Alstom SA signed a Memorandum of Understanding with Tag i Bergslagen (TiB) to jointly develop next-generation railway technologies through a two-year collaboration led by Alstom’s Innovation Station in Stockholm, with a strong focus on enhancing passenger information systems and other innovative rail solutions. This initiative highlights Alstom’s commitment to sustainable, efficient, and technology-driven railway operations in Europe

- In April 2024, Alstom SA entered into a Memorandum of Understanding with Tag i Bergslagen (TiB) aimed at upgrading railway technologies, including significant improvements to passenger information systems as part of a structured two-year cooperation. This collaboration reinforces Alstom’s strategic focus on digital modernization and passenger-centric rail infrastructure

- In February 2024, Toshiba announced major investments to expand its passenger information display systems portfolio, emphasizing real-time audio-visual communication solutions for rail and metro infrastructure modernization. This move strengthens Toshiba’s position in smart transportation systems and enhances real-time passenger communication capabilities

- In January 2024, Titagarh Railway Systems, based in Kolkata, announced a strategic partnership with Delhi NCR-based Amber Group to advance the design and manufacturing of next-generation passenger information systems for rapidly expanding railway networks. This partnership supports domestic innovation and accelerates deployment of advanced rail communication technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.