Global In Store Digital Advertising Display Market

Market Size in USD Billion

CAGR :

%

USD

5.02 Billion

USD

10.42 Billion

2025

2033

USD

5.02 Billion

USD

10.42 Billion

2025

2033

| 2026 –2033 | |

| USD 5.02 Billion | |

| USD 10.42 Billion | |

|

|

|

|

What is the Global In-Store Digital Advertising Display Market Size and Growth Rate?

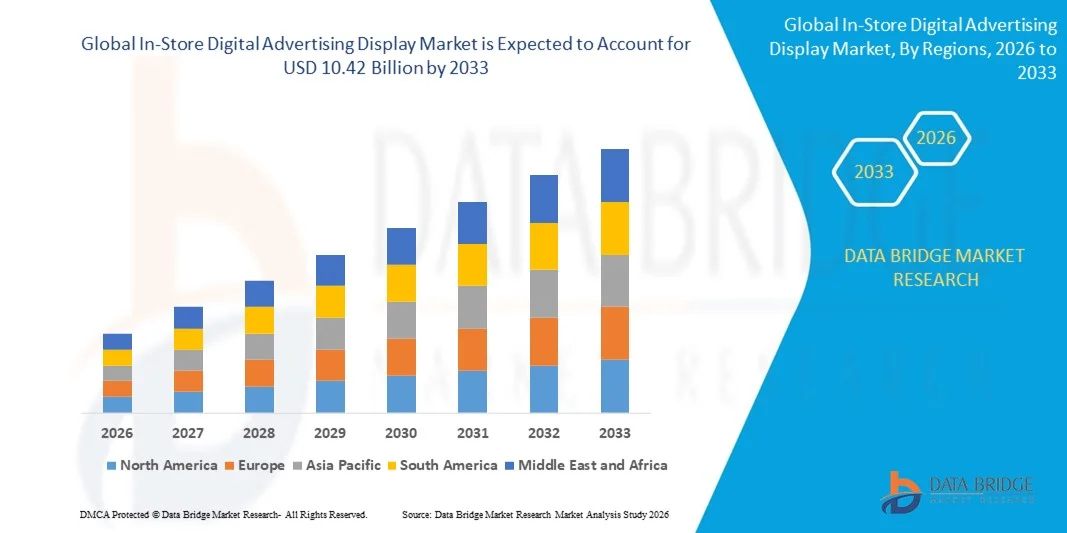

- The global in-store digital advertising display market size was valued at USD 5.02 Billion in 2025 and is expected to reach USD 10.42 Billion by 2033, at a CAGR of9.54% during the forecast period

- Rising demand for high-visibility retail advertising solutions, increasing adoption of interactive digital screens, and rapid penetration of smart retail technologies are accelerating market growth worldwide

- Expansion of omnichannel marketing strategies, growing integration of AI-driven content management, and rising use of dynamic, real-time promotional displays across retail environments further support strong industry expansion

What are the Major Takeaways of In-Store Digital Advertising Display Market?

- Growing need for energy-efficient, high-resolution displays in supermarkets, malls, and QSR outlets continues to boost investment in advanced digital signage systems

- As retailers increasingly prioritize enhanced customer engagement, improved store aesthetics, and data-driven advertising, the market is expected to witness sustained global growth

- North America dominated the in-store digital advertising display market with a 41.12% revenue share in 2025, driven by strong retail modernization, large-scale adoption of digital signage networks, and rapid integration of interactive in-store displays across supermarkets, QSRs, malls, and convenience stores

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by booming retail construction, strong consumer electronics manufacturing, and rapid expansion of modern trade formats across China, Japan, India, South Korea, and Southeast Asia

- The Hardware segment dominated the market with a 54.7% share in 2025, driven by rising deployment of interactive screens, high-brightness displays, digital signage players, sensors, and mounting systems across retail stores, malls, and QSR chains

Report Scope and In-Store Digital Advertising Display Market Segmentation

|

Attributes |

In-Store Digital Advertising Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the In-Store Digital Advertising Display Market?

Rising Adoption of High-Resolution, Energy-Efficient, and Interactive Digital Display Solutions

- The in-store digital advertising display market is experiencing rapid adoption of high-brightness, ultra-HD, and interactive digital displays driven by growing demand for immersive customer engagement across retail, QSRs, malls, and banking environments

- Manufacturers are increasingly introducing 4K/8K displays, touch-enabled panels, AI-powered content management systems (CMS), and sensor-based customer interaction technologies to enhance in-store visibility and targeted messaging

- Rising focus on energy-efficient LED/OLED systems, cloud-connected signage, and real-time content optimization is transforming in-store display deployment across large retail chains

- For instance, companies such as Samsung, LG, Panasonic, BrightSign, and STRATACACHE have launched advanced signage networks featuring dynamic content scheduling, remote management, and analytics-driven customer engagement tools

- Increasing integration of IoT, computer vision, and audience measurement software is enabling retailers to personalize advertising and improve conversion rates

- As retailers adopt more intelligent, automated, and visually rich communication systems, In-Store Digital Advertising Displays will continue to play a central role in real-time promotion, brand reinforcement, and digital customer experience enhancement worldwide

What are the Key Drivers of In-Store Digital Advertising Display Market?

- Growing retail demand for high-impact digital signage to boost customer engagement, reduce perceived wait times, and enhance product visibility is accelerating global adoption

- For instance, in 2025, major brands such as LG, Samsung, and Panasonic expanded their digital signage portfolios with more durable LED displays, modular video walls, and advanced CMS platforms to meet rising demand from hypermarkets, QSRs, and transport hubs

- Increasing expansion of smart retail ecosystems, omnichannel experiences, and DOOH advertising networks is further driving investments in interactive and data-driven display technologies

- Technological advancements in LED/OLED displays, AI-based content analytics, cloud-based device management, and high-resolution imaging continue to improve performance and operational efficiency

- Rising adoption of automated content scheduling, sensor-integrated displays, and 4K/8K signage systems is enhancing real-time advertising precision and customer engagement

- Supported by strong investment in retail digitization, hospitality modernization, and transportation infrastructure, the global In-Store Digital Advertising Display market is poised for robust long-term growth

Which Factor is Challenging the Growth of the In-Store Digital Advertising Display Market?

- High upfront installation costs, including video walls, high-brightness LED screens, and advanced CMS platforms, pose challenges for small retailers and independent stores

- For instance, during 2024–2025, rising prices of semiconductor components, LED modules, and display controllers increased system deployment costs for global manufacturers

- Managing large-scale content networks, multi-location synchronization, and real-time data analytics requires skilled professionals and advanced software capabilities, limiting adoption among small businesses

- Low awareness in emerging markets regarding the ROI benefits, lifespan advantages, and content automation features of digital signage restricts penetration

- Growing competition from alternative marketing formats such as mobile advertising, social media ads, and cost-efficient static signage adds pricing pressure and reduces differentiation

- To overcome these challenges, companies are focusing on modular signage solutions, subscription-based CMS platforms, energy-efficient displays, and simplified plug-and-play systems to enhance global adoption and reduce cost barriers

How is the In-Store Digital Advertising Display Market Segmented?

The market is segmented on the basis of component, product type, technology, resolution, screen size, and end-use.

- By Component

The In-Store Digital Advertising Display market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with a 54.7% share in 2025, driven by rising deployment of interactive screens, high-brightness displays, digital signage players, sensors, and mounting systems across retail stores, malls, and QSR chains. Retailers increasingly prioritize durable, energy-efficient, and visually enhanced display hardware to improve customer engagement and real-time content delivery. Expanding adoption of LED and LCD digital signage, coupled with upgrades in display controllers and connectivity modules, further strengthens hardware leadership.

The Software segment is expected to grow at the fastest CAGR from 2026 to 2033 as retailers embrace advanced CMS platforms, AI-driven content automation, real-time analytics, and cloud-based remote display management. Increasing demand for personalization, targeted advertising, and seamless multi-screen content synchronization will continue to accelerate software adoption across global retail environments.

- By Product Type

The market is segmented into Digital Menu Boards, Video Walls, Digital Posters, Kiosks, Digital Shelf Displays, and Others. The Digital Menu Boards segment dominated the market with a 31.2% share in 2025, driven by rapid digital transformation across QSR chains, restaurants, cafés, and convenience stores. These boards enable dynamic pricing, real-time menu updates, high-visual-impact promotions, and consistent brand messaging. Their low operating cost, ease of integration, and high ROI continue to make them the most widely adopted product type across retail food service environments.

The Digital Shelf Displays segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for electronic shelf labels (ESL), automated price updates, in-aisle promotions, and enhanced shopper analytics. Retailers are increasingly using IoT-enabled shelf displays to deliver real-time product information, improve store efficiency, and support omnichannel retailing strategies.

- By Technology

The market is segmented into LCD, LED, OLED, Projection, and Others. The LCD segment dominated the market with a 46.5% share in 2025, supported by its affordability, high brightness, long operational life, and widespread availability across retail and indoor advertising applications. LCD screens remain the preferred choice for menu boards, posters, and mid-range digital signage due to their superior energy efficiency and cost-effectiveness. Retailers also benefit from continuous improvements in LCD contrast, color depth, and thin-bezel designs.

The LED segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for high-impact, large-format video walls, seamless displays, and ultra-bright signage for both indoor and semi-outdoor environments. Advancements in micro LED, mini LED, and fine-pitch LED technologies are enabling retailers to adopt premium, immersive visual displays to enhance customer engagement.

- By Resolution

The market is segmented into 8K, 4K, FHD, HD, and Lower than HD. The FHD segment dominated the market with a 41.8% share in 2025, owing to its optimal balance between visual clarity, affordability, and content compatibility. Retailers widely use FHD screens for digital posters, menu boards, and small-to-medium digital signage due to sufficient resolution quality for indoor viewing distances. The availability of cost-effective FHD hardware and broad CMS support further boosts adoption.

The 4K segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for ultra-sharp, premium-quality visuals in high-traffic retail zones, malls, and flagship stores. As content creators move toward UHD formats and display prices continue to decline, 4K signage is becoming more accessible for immersive retail advertising and high-precision product promotions.

- By Screen Size

The market is segmented into Below 32 Inches, 32–52 Inches, and Above 52 Inches. The 32–52 Inches segment dominated the market with a 44.1% share in 2025, driven by its widespread use in retail advertising, menu boards, in-store promotions, and wayfinding signage. This screen size range offers the ideal combination of visibility, affordability, and installation flexibility, making it the preferred choice for supermarkets, restaurants, and retail chains.

The Above 52 Inches segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of large-format video walls, interactive displays, and high-impact promotional screens in malls, airports, premium retail stores, and entertainment venues. As LED and UHD display costs decrease, retailers are increasingly opting for larger screens to maximize customer engagement and visual impact.

- By End-Use

The market is segmented into Hypermarkets & Supermarkets, Restaurants & QSRs, Transportation Hubs, Entertainment Venues & Malls, Banking & Financial Institutions, and Others. The Hypermarkets & Supermarkets segment dominated the market with a 33.6% share in 2025, supported by growing adoption of digital shelf labels, in-aisle displays, promotional screens, and interactive product guidance systems. Retailers increasingly depend on digital signage for real-time pricing, customer navigation, and in-store advertising to enhance shopper experience.

The Restaurants & QSRs segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid digital menu board deployments, drive-thru display upgrades, and the need for dynamic, high-impact content. Increasing preference for automated menu updates, AI-driven personalization, and centralized content control is accelerating adoption across global food service chains.

Which Region Holds the Largest Share of the In-Store Digital Advertising Display Market?

- North America dominated the in-store digital advertising display market with a 41.12% revenue share in 2025, driven by strong retail modernization, large-scale adoption of digital signage networks, and rapid integration of interactive in-store displays across supermarkets, QSRs, malls, and convenience stores. High penetration of video walls, digital menu boards, electronic shelf labels, and AI-driven content solutions continues to strengthen demand across the U.S. and Canada

- Leading regional players are expanding high-brightness LED systems, cloud-based CMS platforms, 4K/8K signage displays, and analytics-enabled advertising tools—boosting technological leadership in retail media networks. Continuous investment in omnichannel retailing, programmatic in-store advertising, and digital customer experience solutions further accelerates market expansion

- Strong presence of display manufacturers, software providers, retail media operators, and advanced retail infrastructure reinforces North America’s dominant position

U.S. In-Store Digital Advertising Display Market Insight

The U.S. remains the largest contributor in North America, supported by extensive deployment of digital menu boards, autonomous checkout systems, smart shelves, and immersive promotional screens across hypermarkets, QSR chains, entertainment venues, and airports. Rising adoption of DOOH retail media networks, real-time content automation, and AI-driven shopper analytics continues to drive demand. Strong retail digitization, advanced advertising technologies, and presence of global signage manufacturers strengthen the country’s leadership in in-store digital advertising.

Canada In-Store Digital Advertising Display Market Insight

Canada contributes significantly to regional growth due to rising investments in digital retail transformation, expansion of supermarket chains, and increasing adoption of large-format displays and interactive kiosks. Retailers are integrating cloud-based CMS systems, dynamic pricing displays, and customer engagement tools across stores. Government-backed digital infrastructure programs, high consumer tech adoption, and modernization of transport hubs support sustained market adoption across the country.

Asia-Pacific In-Store Digital Advertising Display Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by booming retail construction, strong consumer electronics manufacturing, and rapid expansion of modern trade formats across China, Japan, India, South Korea, and Southeast Asia. High urbanization, rising disposable incomes, and increasing adoption of digital communication tools in retail spaces fuel strong market growth. Growing demand for LED walls, AI-powered displays, smart shelf labels, and self-service kiosks further boosts regional momentum.

China In-Store Digital Advertising Display Market Insight

China is the largest contributor to Asia-Pacific growth due to rapid retail digitization, strong manufacturing capacity for LED/LCD/OLED displays, and widespread deployment of digital signage across malls, supermarkets, luxury retail, and transportation hubs. Increasing adoption of 4K/8K screens, interactive kiosks, facial-recognition-based advertising, and automated pricing systems continues to strengthen market penetration.

Japan In-Store Digital Advertising Display Market Insight

Japan demonstrates steady adoption supported by advanced retail infrastructure, preference for high-quality displays, and widespread use of digital posters, interactive panels, and smart retail technologies. Strong focus on automation, robotics-driven retail environments, and precision electronics fuels demand for premium signage systems with high reliability and low power consumption.

India In-Store Digital Advertising Display Market Insight

India is emerging as a high-growth market driven by expanding organized retail, increasing mall construction, and rising adoption of digital menu boards, kiosks, and in-aisle promotions. Government-backed digital commerce policies, rapid supermarket expansion, and strong growth in QSR chains accelerate demand for affordable, scalable, cloud-managed signage solutions.

South Korea In-Store Digital Advertising Display Market Insight

South Korea contributes significantly through strong adoption of advanced display technologies, high consumer tech engagement, and rapid deployment of premium digital signage across retail, metro stations, airports, and entertainment venues. Innovation in OLED, microLED, and ultra-high-brightness displays, supported by robust manufacturing capabilities, continues to drive long-term industry growth.

Which are the Top Companies in In-Store Digital Advertising Display Market?

The in-store digital advertising display industry is primarily led by well-established companies, including:

- Daktronics Dr. (U.S.)

- BrightSign, LLC (U.S.)

- Scala (U.S.)

- Lamar Advertising Company (U.S.)

- Leyard Group (China)

- STRATACACHE (U.S.)

- MenuPro Signage (U.S.)

- Hanshow Technology (China)

- Navori SA (Switzerland)

- Mvix (U.S.)

- Displaydata Ltd. (U.K.)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics (South Korea)

- Panasonic Corporation (Japan)

- Barco (Belgium)

What are the Recent Developments in Global In-Store Digital Advertising Display Market?

- In February 2025, Samsung partnered with Cielo to elevate retail advertising and franchise management by integrating Samsung’s VXT display technology with Cielo’s AI-powered digital platform, enabling enhanced marketing efficiency and streamlined operations. In this collaboration, Cielo introduced SmartSigns, a Digital Signage as a Service (DaaS) solution powered by Samsung’s VXT technology, designed to deliver precise, audience-specific messaging at the right moment. In addition, the integration of CieloVision’s KYAI brings real-time analytics and AI-driven advertising intelligence, allowing businesses to gain deeper insights into customer behavior and engagement. This partnership significantly advances the capabilities of modern retail digital signage systems

- In January 2025, LG Electronics USA partnered with BrightSign LLC to launch a new range of ultra-high-definition digital signage displays equipped with BrightSignOS, ensuring superior content delivery and operational performance. In this launch, the UV5N series was introduced featuring LG’s advanced system-on-a-chip multi-core processor, enabling faster processing and enhanced display output. In addition, the displays are built for seamless integration with multiple BrightSign-compatible content management systems, making them suitable for varied screen formats across retail and commercial environments. This collaboration strengthens the digital signage ecosystem with enhanced performance and interoperability

- In March 2024, Hanshow Technology partnered with Pagoda to deploy its advanced electronic shelf labels and comprehensive in-store marketing solutions across Pagoda’s retail network, raising the benchmark for digitalization in fruit retail. In this initiative, the companies committed to expanding their strategic cooperation by focusing on technical innovation, elevated service standards, and diversification of in-store screen applications. In addition, both organizations aim to develop a shared roadmap for long-term, high-quality growth through industry knowledge exchange and enhanced implementation strategies. This partnership sets a strong foundation for accelerated digital transformation in the retail sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global In Store Digital Advertising Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global In Store Digital Advertising Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global In Store Digital Advertising Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.