Global In Store Music Market

Market Size in USD Billion

CAGR :

%

USD

2.27 Billion

USD

3.57 Billion

2024

2032

USD

2.27 Billion

USD

3.57 Billion

2024

2032

| 2025 –2032 | |

| USD 2.27 Billion | |

| USD 3.57 Billion | |

|

|

|

|

In-Store Music Market Size

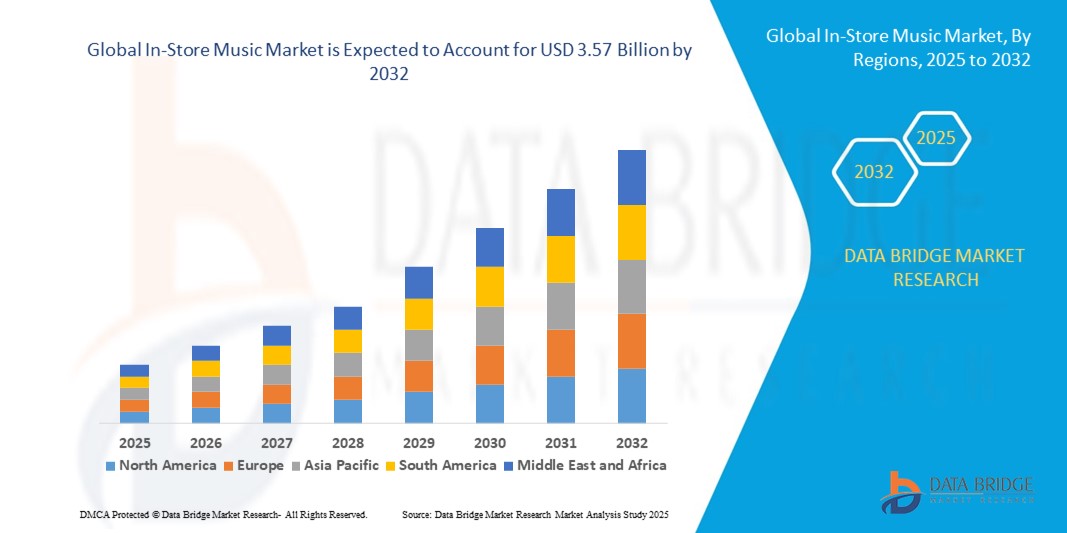

- The global in-store music market size was valued at USD 2.27 billion in 2024 and is expected to reach USD 3.57 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the increasing focus on enhancing customer experience, brand identity, and dwell time in retail spaces, restaurants, shopping malls, and hospitality venues

- Growing adoption of AI-driven music curation, integration of IoT-enabled smart speakers, and licensing services is further supporting market expansion

In-Store Music Market Analysis

- The in-store music market is witnessing strong adoption across retail, hospitality, and fitness sectors, as businesses recognize the role of music in shaping customer engagement and brand perception

- Increasing focus on seamless omnichannel experiences is encouraging retailers to integrate in-store music with broader marketing strategies, enabling a consistent brand identity across physical and digital touchpoints

- North America dominated the in-store music market with the largest revenue share of 38.5% in 2024, driven by the strong presence of retail chains, restaurants, and hospitality businesses focused on enhancing customer experience. The region’s high adoption of cloud-based streaming services and AI-enabled playlist customization has further accelerated growth

- Asia-Pacific region is expected to witness the highest growth rate in the global in-store music market, driven by rising disposable incomes, booming retail and hospitality sectors, and affordable access to cloud-based music streaming solutions

- The streaming media service segment held the largest market revenue share in 2024, driven by the rapid adoption of cloud-based platforms and subscription models that allow businesses to access licensed music libraries. These services provide flexibility, real-time playlist updates, and integration with AI-powered personalization tools, making them the preferred choice for global retail and hospitality brands

Report Scope and In-Store Music Market Segmentation

|

Attributes |

In-Store Music Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Expansion Into Emerging Retail And Hospitality Markets Integration Of AI-Powered Personalized Music Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

In-Store Music Market Trends

Integration Of AI-Powered Personalization In In-Store Music

- The rise of AI-driven personalization is reshaping the in-store music market by allowing retailers and hospitality providers to tailor playlists based on customer demographics, time of day, and shopping behavior. This level of customization enhances the shopping experience, strengthens brand identity, and influences consumer spending patterns

- Growing consumer demand for unique and immersive experiences is accelerating the adoption of smart music platforms that analyze customer data and adapt in real time. These AI tools not only improve ambience but also help businesses increase dwell time and repeat visits, particularly in competitive retail and dining environments

- The affordability and scalability of subscription-based streaming solutions make AI-powered personalization accessible even to small and mid-sized businesses. This allows them to offer curated music experiences without the high costs traditionally associated with licensing and manual playlist management

- For instance, in 2024, several retail chains in the U.S. integrated AI-enabled music platforms that adjusted playlists according to peak hours, seasonal demand, and customer profiles, leading to higher sales conversion rates and improved customer satisfaction

- While AI personalization is driving innovation and customer engagement, its success depends on robust licensing compliance, seamless integration with existing IT infrastructure, and continued investment in user-friendly platforms that cater to diverse business needs

In-Store Music Market Dynamics

Driver

Growing Demand For Enhanced Customer Experience And Brand Differentiation

- Businesses across retail, restaurants, and hospitality are increasingly recognizing in-store music as a critical tool for shaping customer perception and behavior. A well-curated playlist helps create the desired ambience, strengthen brand recall, and differentiate businesses in competitive markets

- Retailers are aware that music directly impacts consumer mood, dwell time, and purchasing intent. This has made in-store music a strategic investment rather than a secondary expense, especially as consumers seek more engaging physical shopping experiences compared to online alternatives

- Industry reports highlight how businesses are moving toward centralized, cloud-based music management platforms that allow multi-location brands to maintain consistent identity while adapting to local preferences

- For instance, in 2023, a leading European fashion retailer deployed a unified in-store music system across 500 outlets, which helped standardize brand experience globally while enabling local playlist adjustments for regional audiences

- While experience-driven demand is a strong market driver, businesses must also address copyright compliance and adopt data-driven strategies to ensure maximum return on investment in music systems

Restraint/Challenge

Complex Licensing Regulations And Rising Copyright Costs

- One of the biggest challenges in the in-store music market is navigating complex licensing requirements, which vary significantly across countries and regions. Businesses must secure multiple performance rights to legally play music, making compliance costly and time-consuming

- Small and mid-sized enterprises often struggle with hidden costs tied to royalties, licensing fees, and regulatory enforcement. In some cases, failure to comply results in fines or legal disputes, discouraging adoption despite the proven benefits of in-store music

- Limited awareness of copyright obligations among small business owners, especially in emerging markets, exacerbates the issue. This creates an uneven playing field where large enterprises can afford licensing while smaller operators may resort to free or unauthorized sources

- For instance, in 2022, several restaurants across Asia-Pacific faced legal action for unauthorized use of music, leading to heavy penalties and loss of reputation, highlighting the importance of compliance in market expansion

- Although streaming services and licensing bodies are working to simplify processes, the industry still needs transparent pricing models, flexible licensing options, and better education for end-users to overcome this restraint and ensure sustainable growth

In-Store Music Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the in-store music market is segmented into streaming media service and audio equipment. The streaming media service segment held the largest market revenue share in 2024, driven by the rapid adoption of cloud-based platforms and subscription models that allow businesses to access licensed music libraries. These services provide flexibility, real-time playlist updates, and integration with AI-powered personalization tools, making them the preferred choice for global retail and hospitality brands.

The audio equipment segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for advanced speakers, sound systems, and hardware that deliver high-quality in-store audio. The rise of smart speakers and IoT-enabled sound devices is further accelerating growth, as businesses seek to enhance ambience and improve customer experiences through reliable equipment solutions.

- By Application

On the basis of application, the in-store music market is segmented into retail stores, cafes & restaurants, leisure places & hotels, and others. The retail stores segment accounted for the largest revenue share in 2024, driven by the growing need to create immersive shopping environments that encourage longer dwell times and higher purchase intent. Retailers are increasingly using music to reinforce brand identity and compete with online channels.

The cafes & restaurants segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising trend of ambience-driven dining experiences. Background music plays a vital role in influencing customer mood, enhancing comfort, and supporting brand loyalty. Quick-service restaurants and boutique cafés are particularly adopting in-store music solutions to attract and retain younger demographics.

In-Store Music Market Regional Analysis

- North America dominated the in-store music market with the largest revenue share of 38.5% in 2024, driven by the strong presence of retail chains, restaurants, and hospitality businesses focused on enhancing customer experience. The region’s high adoption of cloud-based streaming services and AI-enabled playlist customization has further accelerated growth

- Businesses in North America value the ability of in-store music to influence consumer mood, increase dwell time, and strengthen brand identity. The widespread use of licensed streaming services integrated with smart speakers and IoT systems continues to boost adoption

- The region’s high disposable income, advanced digital infrastructure, and strong demand for personalized shopping and dining experiences reinforce its position as a global leader in the in-store music market

U.S. In-Store Music Market Insight

The U.S. in-store music market captured the largest revenue share in 2024 within North America, supported by the rapid digitalization of retail and hospitality sectors. Businesses are prioritizing curated music solutions to drive sales conversion, improve customer satisfaction, and strengthen brand loyalty. The integration of AI-driven music management systems, combined with the popularity of subscription-based licensing platforms, is fueling market growth. Moreover, collaborations with streaming giants and increasing use of music as a marketing tool are expected to further expand the U.S. market.

Europe In-Store Music Market Insight

The Europe in-store music market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the region’s mature retail sector and strong hospitality industry. Businesses are increasingly investing in music as part of their customer engagement strategies, while compliance with strict copyright and licensing regulations fosters demand for legal and structured solutions. The region is experiencing notable adoption across shopping malls, fashion outlets, and hotels, where music is used to enhance ambience and elevate consumer experiences.

U.K. In-Store Music Market Insight

The U.K. in-store music market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of experiential retail and dining. Concerns about customer retention and brand differentiation are motivating businesses to adopt professional in-store music services. The U.K.’s vibrant café culture, strong retail base, and early adoption of digital platforms support the growing demand for curated playlists and cloud-based audio solutions.

Germany In-Store Music Market Insight

The Germany in-store music market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s advanced retail landscape and consumer preference for premium shopping experiences. Businesses are increasingly integrating music into their brand strategy to improve customer satisfaction and loyalty. Germany’s strong regulatory framework for copyright compliance also encourages the adoption of licensed streaming services. Furthermore, the use of smart audio equipment in retail and hospitality outlets is gaining traction, aligning with the country’s focus on innovation and digital adoption.

Asia-Pacific In-Store Music Market Insight

The Asia-Pacific in-store music market is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid urbanization, rising disposable incomes, and expanding retail and hospitality sectors in countries such as China, Japan, and India. The growing popularity of malls, branded retail outlets, and quick-service restaurants is fueling demand for curated in-store music services. Government initiatives supporting digital infrastructure and increasing smartphone penetration further enhance adoption. In addition, the availability of affordable cloud-based music services is helping expand access across mid-sized businesses.

Japan In-Store Music Market Insight

The Japan in-store music market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s tech-driven culture and emphasis on customer-centric experiences. Businesses are adopting AI-enabled music platforms that integrate with IoT devices such as smart speakers and digital signage to deliver immersive environments. The strong demand for convenience stores, boutique outlets, and premium hospitality spaces is propelling adoption. Furthermore, Japan’s aging population is encouraging the use of curated music solutions in healthcare and wellness facilities, expanding the application scope beyond retail and dining.

China In-Store Music Market Insight

The China in-store music market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the expansion of shopping malls, restaurants, and urban leisure centers. With a fast-growing middle class and strong adoption of smart technologies, businesses are increasingly integrating music to improve ambience and attract customers. China’s push towards smart cities, along with the availability of affordable subscription-based music platforms offered by domestic providers, is further fueling market expansion. Local technology firms are also partnering with retailers to develop customized audio solutions, making China one of the most dynamic markets globally.

In-Store Music Market Share

The In-Store Music industry is primarily led by well-established companies, including:

- Mood Media (U.S.)

- SoundCloud (Germany)

- Spotify Technology S.A. (Sweden)

- Pandora Media (U.S.)

- Deezer SA (France)

- Apple Inc. (U.S.)

- Amazon.com, Inc. (U.S.)

- Google LLC (U.S.)

- Sirius XM Holdings Inc. (U.S.)

- iHeartMedia, Inc. (U.S.)

- SoundExchange (U.S.)

- Broadcast Music, Inc. (U.S.)

- American Society of Composers, Authors and Publishers (U.S.)

Latest Developments in Global In-Store Music Market

- In July 2024, Mood Media unveiled "SuperLink," an innovative direct broadcast satellite system tailored specifically for in-store advertising and music services. This state-of-the-art platform enhances Muzak's portfolio of marketing tools by allowing retailers to integrate targeted audio and promotional content seamlessly into their environments. By leveraging satellite technology, SuperLink offers high-quality music programming and advertisements, which can be customized to align with the brand identities and themes of various retail spaces. This move not only modernizes Muzak's service offerings but also empowers businesses to create a more engaging atmosphere for customers, ultimately driving sales and enhancing the overall shopping experience. The launch of SuperLink marks a significant advancement in how retailers can utilize soundscapes strategically in their marketing efforts

- In September 2024, Spotify announced a significant expansion of its AI Playlist feature, extending its availability to new markets including the U.S., Canada, Ireland, and New Zealand. This tool, designed for premium users, utilizes generative artificial intelligence to assist subscribers in creating personalized playlists tailored to their specific preferences. Currently offered in beta, the AI Playlist allows users to formulate playlists based on written prompts; for instance, they can input requests such as "upbeat music for a workout" or "romantic songs for a date night," receiving customized selections in response. Initially launched in the United Kingdom and Australia earlier in the year, this feature aims to enhance user engagement and compete more effectively against rival services by Apple and Amazon, amidst rising competition in the streaming market. As Spotify continues to refine this AI-driven service, the feature promises to offer an increasingly tailored listening experience for its expanding user base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global In Store Music Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global In Store Music Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global In Store Music Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.