Global In Vivo Toxicology Market

Market Size in USD Billion

CAGR :

%

USD

4.95 Billion

USD

7.66 Billion

2024

2032

USD

4.95 Billion

USD

7.66 Billion

2024

2032

| 2025 –2032 | |

| USD 4.95 Billion | |

| USD 7.66 Billion | |

|

|

|

|

In Vivo Toxicology Market Size

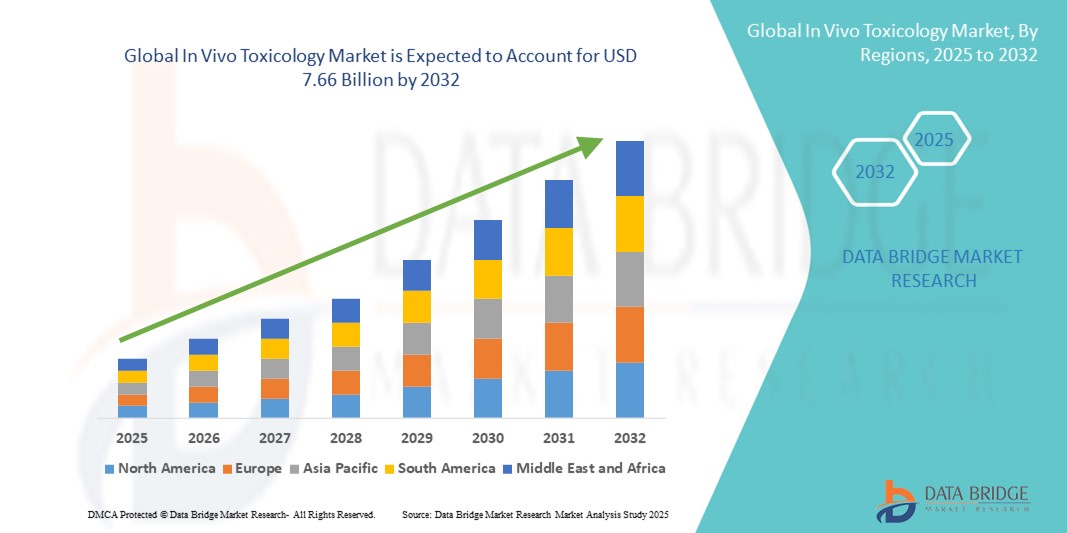

- The global in vivo toxicology market size was valued at USD 4.95 billion in 2024 and is expected to reach USD 7.66 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in preclinical research tools and imaging modalities, leading to enhanced capabilities in both academic and pharmaceutical settings

- Furthermore, rising demand for precise, high-resolution, and reliable imaging solutions for drug discovery, disease characterization, and translational studies is establishing advanced in vivo preclinical brain imaging devices as essential research tools. These converging factors are accelerating the uptake of such imaging platforms, thereby significantly boosting the industry's growth

In Vivo Toxicology Market Analysis

- In vivo toxicology solutions, providing preclinical assessment of drug safety and toxicity, are increasingly vital components of pharmaceutical and biotechnology R&D workflows in both academic and commercial settings due to their ability to deliver reliable, reproducible, and regulatory-compliant safety data

- The escalating demand for advanced preclinical safety assessment tools is primarily fueled by increasing pharmaceutical R&D activities, stricter regulatory requirements, and a rising emphasis on early-stage toxicity evaluation to ensure drug safety and efficacy

- North America dominated the in vivo toxicology market with the largest revenue share of 40.9% in 2024, driven by advanced pharmaceutical and biotechnology R&D infrastructure, high healthcare expenditure, and a strong presence of key industry players. The U.S. experienced substantial growth in In Vivo Toxicology installations, fueled by innovations from established companies and startups focusing on high-throughput and AI-assisted preclinical testing solutions

- Asia-Pacific is expected to be the fastest-growing region in the in vivo toxicology market during the forecast period, due to increasing pharmaceutical investments, expansion of contract research organization (CRO) facilities, and rising focus on domestic drug development programs in countries such as China and India

- The Instruments segment dominated the in vivo toxicology market with a revenue share of 57.4% in 2024, driven by the increasing adoption of high-precision equipment for preclinical toxicology studies. Instruments, including imaging systems, automated dosing devices, and analytical platforms, enable researchers to generate reproducible and high-resolution data, which is critical for evaluating the safety and efficacy of novel compounds

Report Scope and In Vivo Toxicology Market Segmentation

|

Attributes |

In Vivo Toxicology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

In Vivo Toxicology Market Trends

Advancements in Automated and High-Throughput Toxicology Testing

- A significant and accelerating trend in the global in vivo toxicology market is the increasing adoption of automated and high-throughput preclinical testing systems. These technologies are enhancing the efficiency, accuracy, and reproducibility of toxicity studies, allowing researchers to process larger sample sizes and obtain faster, more reliable results

- For instance, modern imaging platforms and automated dosing systems enable simultaneous monitoring of multiple animal models, reducing manual intervention and minimizing experimental variability. Similarly, integrated laboratory information management systems (LIMS) help centralize data collection and analysis, streamlining workflows and improving decision-making

- Advanced software and imaging tools in in vivo toxicology testing facilitate real-time monitoring of physiological and biochemical responses, enabling early detection of adverse effects and enhancing the predictive power of preclinical studies

- The seamless integration of automated imaging, dosing, and analytical platforms allows centralized control over complex toxicology experiments. Through a unified interface, researchers can monitor multiple endpoints, track longitudinal studies, and manage experimental protocols efficiently, improving overall laboratory productivity

- This trend towards more intelligent, precise, and interconnected preclinical testing systems is fundamentally reshaping expectations for drug safety evaluation. Consequently, companies are increasingly developing high-throughput and automated toxicology platforms with capabilities such as real-time imaging, longitudinal monitoring, and integrated data analysis

- The demand for in vivo toxicology solutions that offer automated, high-throughput, and precise data acquisition is growing rapidly across both pharmaceutical and academic research sectors, as stakeholders prioritize efficiency, accuracy, and comprehensive preclinical evaluation

In Vivo Toxicology Market Dynamics

Driver

Growing Need Due to Increasing Drug Safety and Regulatory Compliance Requirements

- The rising emphasis on drug safety, regulatory compliance, and early-stage preclinical testing is a significant driver for the heightened demand for in vivo toxicology studies. Pharmaceutical and biotechnology companies are increasingly prioritizing comprehensive toxicity evaluations to accelerate drug development while ensuring patient safety

- For instance, in April 2024, PerkinElmer expanded its preclinical imaging portfolio with advanced high-throughput systems, enabling more precise and efficient toxicity assessments in animal models. Such strategic advancements by key industry players are expected to drive In Vivo Toxicology market growth in the forecast period

- As research institutions and pharmaceutical companies face increasing regulatory scrutiny, in vivo toxicology platforms offer detailed data on physiological, biochemical, and cellular responses to investigational compounds, providing critical insights for decision-making

- Furthermore, the growing adoption of automated and integrated preclinical testing platforms is facilitating standardized and reproducible toxicology studies. These systems support multi-endpoint monitoring, longitudinal assessments, and enhanced data analysis capabilities, meeting the evolving needs of research organizations

- The demand for efficient, high-throughput, and reliable in vivo toxicology solutions is growing across both pharmaceutical and academic research sectors. The trend toward more sophisticated experimental designs, coupled with the need for faster and more accurate preclinical evaluation, is further accelerating market adoption

Restraint/Challenge

Concerns Regarding High Costs and Operational Complexity

- The relatively high cost of advanced in vivo toxicology systems and the operational complexity associated with some platforms pose significant challenges to broader market adoption. Small or budget-constrained research facilities may find it difficult to invest in cutting-edge imaging and testing solutions

- For instance, high-end preclinical imaging systems equipped with multi-modal capabilities or automated dosing and monitoring features often require substantial capital expenditure, specialized training, and ongoing maintenance, which can limit accessibility in developing regions

- Addressing these challenges through the development of cost-effective platforms, user-friendly interfaces, and comprehensive training programs is crucial for expanding market penetration. Companies are increasingly focusing on creating scalable solutions that balance advanced functionality with affordability

- While prices are gradually decreasing and modular systems are becoming available, the perceived premium of sophisticated in vivo toxicology technologies can still hinder adoption among smaller research groups or early-stage biotech companies

- Overcoming these barriers through enhanced affordability, simplified workflows, and demonstrable ROI will be vital for sustained market growth and wider adoption of in vivo toxicology solutions globally

In Vivo Toxicology Market Scope

The market is segmented on the basis of product, testing type, toxicity endpoints, and testing facility.

- By Product

On the basis of product, the in vivo toxicology market is segmented into consumables and instruments. The instruments segment dominated the market with a revenue share of 57.4% in 2024, driven by the increasing adoption of high-precision equipment for preclinical toxicology studies. Instruments, including imaging systems, automated dosing devices, and analytical platforms, enable researchers to generate reproducible and high-resolution data, which is critical for evaluating the safety and efficacy of novel compounds. Pharmaceutical companies and contract research organizations (CROs) rely heavily on these instruments for longitudinal studies and chronic toxicity assessments. The segment benefits from technological advancements, integration with software-driven analysis, and compatibility with multi-modal platforms, facilitating streamlined workflows. Growing R&D investments, government-funded toxicology programs, and expansion of preclinical research facilities further reinforce the dominance of this segment. High upfront costs are mitigated by the long-term utility and scalability of these instruments, making them essential for advanced toxicology studies.

The consumables segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by recurring demand for high-quality reagents, test kits, animal models, and consumable accessories required for consistent toxicology testing. Consumables are critical for ensuring experimental reproducibility and accuracy in chronic, sub-chronic, and acute toxicity studies. As the number of preclinical trials increases globally, the need for reliable and standardized consumables rises correspondingly. Additionally, rising adoption of in-house testing and outsourcing models drives sustained demand for these products. The segment’s growth is supported by innovations in assay kits, improved storage and handling solutions, and growing awareness of standardized quality standards across laboratories.

- By Testing Type

On the basis of testing type, the in vivo toxicology market is segmented into chronic, sub-chronic, sub-acute, and acute toxicity testing. The chronic toxicity testing segment dominated the market with a revenue share of 45.6% in 2024, owing to its critical role in evaluating long-term safety profiles of drug candidates and chemical compounds. Chronic studies allow researchers to assess cumulative toxicity, organ-specific adverse effects, and potential chronic disease mechanisms over extended periods. Pharmaceutical and biotechnology companies prioritize chronic toxicity studies for regulatory submissions and to identify early safety signals before human trials. The dominance of this segment is reinforced by rising demand for precision toxicology, integration of automated monitoring systems, and government guidelines mandating long-term preclinical evaluations. Chronic testing also supports multi-generational studies in reproductive toxicology and helps refine risk assessment for both small molecules and biologics.

The sub-chronic toxicity testing segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2032, driven by increasing preclinical R&D activities in emerging markets and the need for shorter-duration studies to screen a large number of compounds efficiently. Sub-chronic testing balances study duration and resource allocation while providing meaningful toxicity data for regulatory evaluation. Growing investments in early-stage drug development, combined with advancements in automated monitoring and imaging, are facilitating faster, more accurate sub-chronic assessments. CROs and in-house labs increasingly prefer sub-chronic testing for its cost-effectiveness, reproducibility, and scalability across diverse preclinical models. The adoption of high-throughput preclinical platforms further accelerates growth in this segment.

- By Toxicity Endpoints

On the basis of toxicity endpoints, the in vivo toxicology market is segmented into immunotoxicity, systemic toxicity, carcinogenicity, genotoxicity, developmental and reproductive toxicity (DART), and other endpoints. The Systemic Toxicity segment dominated the market with a revenue share of 48.1% in 2024, due to its importance in evaluating the overall impact of a compound on multiple organ systems. Systemic toxicity studies are critical in identifying dose-limiting toxicities, understanding pharmacokinetics, and ensuring comprehensive safety profiling of drug candidates. This segment is widely adopted in pharmaceutical R&D, CRO services, and regulatory testing labs. The growth is supported by advanced analytical instruments, integration with imaging systems, and increasing use of animal and alternative models to predict human safety. Systemic toxicity assessments also facilitate translational research and help optimize clinical trial design.

The developmental and reproductive toxicity (DART) segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, fueled by increasing regulatory focus on reproductive safety and the growing number of investigational compounds requiring multi-generational toxicity assessment. DART studies enable researchers to evaluate effects on fertility, embryo-fetal development, and postnatal growth, ensuring safer therapeutics for vulnerable populations. Expansion of preclinical research programs, government-funded reproductive studies, and rising adoption of automated and high-throughput DART platforms are key factors driving growth in this segment.

- By Testing Facility

On the basis of testing facility, the in vivo toxicology market is segmented into outsourced testing facilities and in-house testing facilities. The In-House Testing Facilities segment dominated the market with a revenue share of 52.3% in 2024, driven by pharmaceutical and biotechnology companies establishing internal capabilities for better control, confidentiality, and flexibility in preclinical toxicology studies. In-house testing allows faster decision-making, integration of multi-modal platforms, and direct oversight of study protocols and data integrity. Companies benefit from reduced dependence on external providers, improved turnaround times, and enhanced reproducibility. Increasing investment in R&D infrastructure and technological upgrades further reinforces the dominance of this segment.

The outsourced testing facilities segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, due to the growing demand for cost-effective, scalable, and specialized toxicology testing services. Outsourcing is preferred by small and mid-sized companies lacking in-house capabilities, allowing access to advanced instrumentation, regulatory compliance, and experienced personnel. Expansion of global CROs, adoption of multi-site studies, and rising preclinical research volumes are key factors supporting the rapid growth of this segment.

In Vivo Toxicology Market Regional Analysis

- North America dominated the in vivo toxicology market with the largest revenue share of 40.9% in 2024, characterized by advanced pharmaceutical R&D infrastructure, high healthcare expenditure, and a strong presence of key industry players

- In Vivo Toxicology installations, driven by innovations from established companies and startups focusing on AI-assisted and high-throughput preclinical toxicology testing solutions

- Well-established research facilities, regulatory support, and increasing investment in preclinical studies are key factors supporting market growth

U.S. In Vivo Toxicology Market Insight

The U.S. in vivo toxicology market captured the largest revenue share within North America, driven by the widespread adoption of advanced imaging and analytical platforms for toxicity assessment. The country’s strong emphasis on accelerating drug discovery, reducing experimental timelines, and enhancing predictive toxicology models has reinforced its leading position. Integration of multi-modal preclinical imaging, automated dosing systems, and longitudinal monitoring platforms is further supporting the expansion of the market, enabling more precise and efficient preclinical studies.

Europe In Vivo Toxicology Market Insight

The Europe in vivo toxicology market is projected to grow at a substantial CAGR during the forecast period, propelled by stringent regulatory frameworks, increasing pharmaceutical R&D activities, and rising demand for standardized preclinical toxicology testing. Investments in cutting-edge imaging and analytical technologies, along with collaborations between academic institutions and industry, are facilitating the adoption of sophisticated toxicology platforms across research centers, thereby enhancing study accuracy and reproducibility.

U.K. In Vivo Toxicology Market Insight

The U.K. in vivo toxicology market is anticipated to expand at a noteworthy CAGR, supported by growing investment in drug development, adoption of high-throughput preclinical testing systems, and government initiatives promoting safer and faster translational research. Increasing focus on early-stage toxicity assessment and predictive modeling is further driving the demand for advanced in vivo toxicology platforms in both academic and industrial research settings.

Germany In Vivo Toxicology Market Insight

The Germany in vivo toxicology market is expected to grow at a considerable CAGR, fueled by a well-established pharmaceutical sector, rising awareness of digital toxicology solutions, and an emphasis on innovation in preclinical research. The integration of automated, high-resolution imaging systems is becoming increasingly prevalent, enabling precise toxicity studies and supporting both academic and commercial research initiatives.

Asia-Pacific In Vivo Toxicology Market Insight

The Asia-Pacific in vivo toxicology market is expected to be the fastest-growing region during the forecast period, driven by increasing urbanization, rising disposable incomes, and expanding healthcare and research infrastructure, particularly in China, India, and Japan. Growth in government-backed preclinical research initiatives and the development of state-of-the-art testing facilities are key factors accelerating the adoption of advanced toxicology platforms in the region.

Japan In Vivo Toxicology Market Insight

The Japan in vivo toxicology market is gaining momentum due to advanced research infrastructure, rising demand for precision toxicology, and a strong focus on safety and efficacy in drug development. Adoption of automated and high-throughput testing platforms is facilitating more efficient preclinical studies, while the country’s aging population is driving the need for safer and more effective therapeutic solutions.

China In Vivo Toxicology Market Insight

China in vivo toxicology market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid expansion in pharmaceutical and biotechnology research, increasing healthcare investment, and establishment of new preclinical testing facilities. Government initiatives supporting translational research, coupled with rising disposable incomes and growing research capabilities, are boosting the adoption of advanced in vivo toxicology systems across the country.

In Vivo Toxicology Market Share

The in vivo toxicology industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher Corporation (U.S.)

- Charles River Laboratories (U.S.)

- Covance Inc. (U.S.)

- The Jackson Laboratory (U.S.)

- Data Sciences International (U.S.)

- Inotiv (U.S.)

- Eurofins Scientific (Luxembourg)

- PerkinElmer (U.S.)

- SRI International (U.S.)

- Taconic Biosciences, Inc. (U.S.)

- WuXi AppTec (China)

- Merck KGaA (Germany)

- Catalent, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Evotec SE (Germany)

- MATTEK (U.S.)

- XENOMETRIX AG (Switzerland)

- Quest Diagnostics Incorporated (U.S.)

- Jubilant Biosys Limited (India)

Latest Developments in Global In Vivo Toxicology Market

- In June 2021, Covance, a leading contract research organization (CRO), acquired Envigo’s non-clinical contract research services. This strategic acquisition expanded Covance's capabilities in preclinical testing, enhancing its service offerings in the in vivo toxicology sector. The integration aimed to provide clients with comprehensive safety assessment solutions, facilitating more efficient drug development processes

- In August 2024, industry analyses highlighted the role of personalized medicine in driving the in vivo toxicology market. The growing focus on individualized treatments necessitates the development of advanced animal models and tailored safety assessments, thereby propelling market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.